Fill Out Your Employees Provident Fund Form

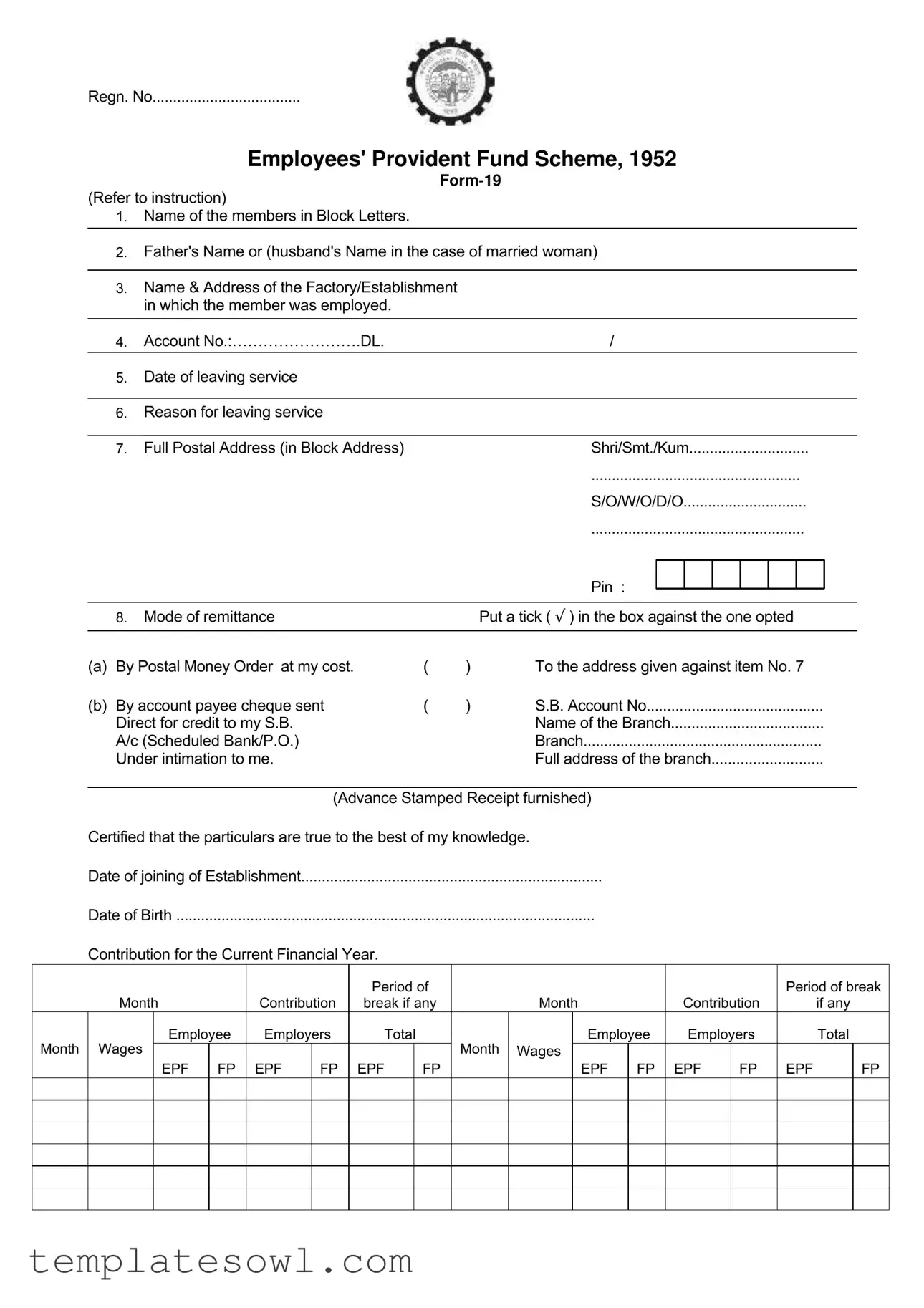

The Employees Provident Fund form is an essential document for individuals seeking to claim their provident fund benefits after leaving employment. This form, known as Form-19, is structured to collect vital personal information such as the member's name, father's or husband’s name, and the details of the factory or establishment where they were employed. One significant section of the form includes the account number and the date of leaving service, which are crucial for processing the claim. Additionally, claimants must provide their full postal address and indicate their preferred method of remittance, selecting from options like postal money order or an account payee cheque. The form also requires a declaration of the contributions made during the current financial year, which must be certified by the employer. Furthermore, to ensure a smooth processing experience, individuals must verify that they have submitted the claim application after a two-month waiting period if they remain unemployed. Understanding each section of this form and filling it out accurately is essential for members to efficiently access their hard-earned provident fund savings.

Employees Provident Fund Example

Regn. No....................................

Employees' Provident Fund Scheme, 1952

(Refer to instruction)

1.Name of the members in Block Letters.

2.Father's Name or (husband's Name in the case of married woman)

3.Name & Address of the Factory/Establishment in which the member was employed.

4. Account No.:…………………….DL. |

/ |

5.Date of leaving service

6.Reason for leaving service

7. |

Full Postal Address (in Block Address) |

Shri/Smt./Kum |

|||||||

|

|

................................................... |

|

||||||

|

|

S/O/W/O/D/O |

|||||||

|

|

.................................................... |

|

||||||

|

|

Pin : |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

8. |

Mode of remittance |

Put a tick ( Ö ) in the box against the one opted |

|

||||||

|

|

|

|

|

|

|

|

|

|

(a)By Postal Money Order at my cost.

(b)By account payee cheque sent Direct for credit to my S.B. A/c (Scheduled Bank/P.O.) Under intimation to me.

( |

) |

To the address given against item No. 7 |

( |

) |

S.B. Account No |

|

|

Name of the Branch |

|

|

Branch |

|

|

Full address of the branch |

(Advance Stamped Receipt furnished)

Certified that the particulars are true to the best of my knowledge.

Date of joining of Establishment.........................................................................

Date of Birth ......................................................................................................

Contribution for the Current Financial Year.

|

|

|

|

|

|

Period of |

|

|

|

|

|

|

Period of break |

||||

|

Month |

|

Contribution |

break if any |

|

Month |

|

Contribution |

|

if any |

|||||||

|

|

Employee |

Employers |

Total |

|

|

|

Employee |

Employers |

|

Total |

||||||

Month |

Wages |

|

|

|

|

|

|

|

Month |

Wages |

|

|

|

|

|

|

|

|

|

EPF |

FP |

EPF |

FP |

EPF |

|

FP |

|

|

EPF |

FP |

EPF |

FP |

EPF |

|

FP |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

( information to be furnished by the Employer if the Claim Form is Attested by the Employer)

Certified that the above contributions have been included in the regular monthly remittances.

The Applicant has signed/Thumb impressed before me.

............ .....................................................

Signature of Left/Right hand thumb impression of the member

Date......................................

Designation & Seal

Encl.

Declaration of

Note:- In the case of submission of application for settlement under clause (s) of

Date |

Signature or Left / Right hand thumb impression of the member |

|

|

ADVANCE STAMPED RECEIPT (To be furnished only in case of 8 (b) above)

Received a sum of Rs. ....................(Rupees .......................................................... .......................... from

Regional Provident Fund Commissioner /

by deposit in my Savings Bank account towards the settlement of my Provident Fund Account.

The space should be left blank which shall be filled in by Regional Provident Fund Commissioner/Officer

Affix 1/- Rupee

Revenue

Stamp

Signature orLeft / Right hand thumb impression of the member

(For the use of Commissioner's Office)

A/C Settled in part/Full Entered in F.

|

Clerk |

Section Supervisor |

M.O./Cheque |

||

Account No. |

Section |

|

¼in

M.O. Commission (if any)

Net Amount to be paid by M.0……………………………Date………………..

|

(For use in Cash Section) |

|

Paid by inclusion in Cheque No |

............................ |

date |

vide Cash Book (Bank) Account No.3 Debit Item No |

||

HC |

|

AC / RC |

|

|

|

|

Remarks |

|

Form Characteristics

| Fact Name | Fact Description |

|---|---|

| Regulation Year | The Employees' Provident Fund Scheme was established in 1952. |

| Member Details | The form requires the member's name in block letters for clear identification. |

| Parental Information | Married women must provide either their father's or husband's name. |

| Employer's Details | It is necessary to include the name and address of the factory or establishment where employed. |

| Account Number | The member must provide their Provident Fund account number in the designated section. |

| Leaving Date | The form requires the date when the member last worked at the establishment. |

| Reason for Leaving | Members must specify the reason for leaving their previous job. |

| Remittance Option | Members can choose to receive payment by postal money order or account payee cheque. |

| Certification Requirement | A certification by the employer is needed to validate the member's contributions to the account. |

Guidelines on Utilizing Employees Provident Fund

Filling out the Employees Provident Fund form involves providing accurate and complete information to ensure the processing of your request goes smoothly. Follow the steps below to complete the form properly.

- Write your Name in block letters at the top of the form.

- Input your Father's Name or Husband's Name if you are a married woman.

- Provide the Name & Address of the factory or establishment where you were employed.

- Fill in your Account Number.

- Enter your Date of Leaving Service.

- State the Reason for Leaving Service.

- Write your Full Postal Address in block letters, including PIN code.

- Select your preferred Mode of Remittance by ticking the appropriate box. Choose between:

- By Postal Money Order at my cost.

- By account payee cheque sent directly for credit to my bank account.

- If you selected the second option, fill in the details such as S.B. Account Number, Name of the Branch, and the Full Address of the Branch.

- Provide the Date of Joining the Establishment and your Date of Birth.

- List the Contributions for the Current Financial Year along with any breaks, detailing both Employee and Employer contributions for each month.

- Obtain the Employer's Certification verifying that your contributions have been included in monthly remittances. Have the employer sign and put their seal on the form.

- Sign the declaration affirming that the particulars provided are true to the best of your knowledge.

- If opting for a direct bank transfer, complete the Advance Stamped Receipt section.

- Finally, submit the completed form along with any required attachments to the designated authority.

What You Should Know About This Form

What is the Employees Provident Fund form and who needs to fill it out?

The Employees Provident Fund form is a document required for individuals seeking to claim their provident fund benefits after leaving their employment. Anyone who has contributed to the Employees' Provident Fund (EPF) during their employment is eligible to fill out this form. This includes both employees and employers who need to ensure that the necessary contributions and details are accurately provided.

What information is required on the form?

The form requires detailed information including your full name, father’s name or husband’s name if applicable, the name and address of the factory or establishment where you were employed, your EPF account number, and the date of leaving service. Additionally, you must provide the reason for leaving, your full postal address, and your mode of remittance preferences, such as by postal money order or account payee cheque.

How should the mode of remittance be indicated?

You need to indicate your preferred mode of remittance by placing a tick (Ö) in the appropriate box on the form. You can choose from options like receiving funds via postal money order at your cost or having an account payee cheque sent directly to your bank account. Make sure to provide the full address of your chosen branch if selecting the latter option.

What is the importance of the employer's certification?

The certification from your employer is crucial as it confirms that the details provided, notably regarding your contributions, are accurate. This includes verifying that the amounts specified for employee and employer contributions for the current financial year have been included in regular monthly remittances. Without this certification, the processing of your claim may be delayed or denied.

When should the form be submitted?

The claim form should be submitted after a waiting period of two months from the date of leaving service, provided you remain unemployed in an establishment covered by the EPF Act. This ensures that all claims are accurately processed and helps the authorities verify your employment status during this time.

Common mistakes

When filling out the Employees Provident Fund (EPF) form, individuals often make several common mistakes that can delay their application or result in rejection. Understanding these errors can help in ensuring that the form is completed correctly and efficiently.

One frequent mistake is incorrect spelling or formatting of personal names. The form requires the member's name and respective father's or husband’s name to be written in block letters. Neglecting this requirement may lead to confusion or difficulties in processing the claim.

Another common error involves the failure to complete the full postal address accurately. Missing details such as the postal code can hinder communication from the EPF office. It is essential to provide a complete address to facilitate prompt remittance and notifications.

Many individuals overlook the section where they specify the reason for leaving service. Leaving this field blank or providing vague information can delay the processing of the application. Clear and precise reasons are necessary to validate the claim and ensure that all regulations are met.

Additionally, applicants often incorrectly complete the contributions section, either by omitting information or entering inaccurate figures. This section is crucial as it summarizes the financial contributions made by both the employee and employer. Any discrepancies could lead to complications in the withdrawal process.

Another common mistake is neglecting to properly select the preferred mode of remittance. The form allows applicants to choose between a postal money order or a direct transfer to their savings bank account. Failing to mark their choice or marking more than one option can create confusion for the processing staff.

Applicants sometimes fail to obtain the necessary certification from their employer. The form includes a section for the employer's signature or stamp. Without this, the application may be deemed incomplete, resulting in delays. Ensuring that all required signatures are in place is vital for a smooth process.

Finally, many individuals forget to attach the advance stamped receipt when opting for payment by cheque. This oversight can prevent the funds from being processed or lead to unnecessary delays in payment. Each step of the application process is important, and skipping any part can lead to problems.

By being aware of these common mistakes, applicants can increase the likelihood of a successful and timely claim process for their provident fund. Careful attention to detail in completing the form is of utmost importance.

Documents used along the form

The Employees Provident Fund (EPF) form is an essential document used for managing employee funds upon leaving a job. However, there are several other forms and documents that often accompany this form to ensure a smooth and compliant process. Understanding these documents can help you navigate your EPF claims more effectively.

- Form 10C: This form is used to claim a pension under the Employees’ Pension Scheme. It allows you to access the pension benefits accumulated during your employment, making it crucial for those eligible for pension payouts.

- Form 51: This declaration is for the purpose of notifying the EPF authorities about any changes in your employment status, ensuring that your account reflects accurate information.

- Form 19U: Used for a withdrawal benefit when you haven't completed the minimum service period required for the full EPF settlement. It ensures you receive whatever amount you've contributed up to that point.

- Nomination Form: This form allows you to designate beneficiaries who will receive your EPF dues in case of your demise. Keeping this updated is crucial for safeguarding your loved ones financially.

- Bank Account Statement: Often required when claiming funds, this document shows your current banking details and ensures that the transfer of your provident fund is directed into your correct bank account.

- Termination Letter: This letter, provided by the employer, formally documents the end of your employment. It may be necessary to accompany your EPF claim to validate your reason for leaving.

- Form 28: This is a request for transfer of funds from one EPF account to another. It's especially useful if you're moving to a new employer and want to consolidate your savings.

- Form 11: This form is used by employers to declare every employee's EPF membership. It's essential for new hires to ensure compliance from the very beginning of their employment.

- Employment Certificate: A letter from your previous employer validating your time of employment and contributions can help reinforce your claims during the EPF withdrawal process.

By familiarizing yourself with these supporting documents, you can expedite your claims and ensure a smoother transition after leaving your job. Each piece of documentation plays a part in confirming your eligibility and securing your benefits. Being well-prepared can make the process much less daunting.

Similar forms

-

W-2 Form: The W-2 form is an annual wage statement issued by employers to their employees. Like the Employees Provident Fund form, it collects similar personal information, including name, address, and the amount contributed. Both documents are used for financial record-keeping and reporting purposes.

-

1099 Form: The 1099 form is utilized to report various types of income other than wages. Similar to the Employees Provident Fund form, it includes payer information and recipient details. Both require accurate information for proper processing and compliance with tax regulations.

-

Retirement Account Withdrawal Form: This form is used when withdrawing funds from retirement accounts like IRAs. It shares similarities with the Employees Provident Fund form, requiring personal details, account information, and the reason for withdrawal. Both facilitate the process of accessing retirement funds.

-

Direct Deposit Authorization Form: This form allows employees to set up direct deposit for their paychecks. Similar to the Employees Provident Fund form, it gathers personal identification and banking details to ensure accurate fund transfers and financial transactions.

-

Unemployment Benefits Application: Individuals applying for unemployment benefits must complete this application. Like the Employees Provident Fund form, it involves providing personal information, dates of employment, and reasons for job termination, thereby aiding in the determination of eligibility for assistance.

-

Health Insurance Claims Form: This form is used to file a claim for health care expenses. It collects personal details and involves reporting on previous employment and services received, much like the information gathered in the Employees Provident Fund form.

-

Loan Application Form: When applying for a personal or business loan, this form is required. It often asks for similar personal information and employment history as the Employees Provident Fund form, crucial for assessing the applicant's ability to repay the loan.

Dos and Don'ts

When filling out the Employees Provident Fund form, it is crucial to ensure accuracy and completeness. Follow these important guidelines:

- Do: Write in clear and legible block letters, especially for your name and address.

- Do: Include your father's name if you are unmarried or your husband's name if you are married.

- Do: Make sure to provide the correct name and address of the factory or establishment.

- Do: Indicate the correct Account Number, if applicable, to avoid delays.

- Do: Check off the preferred mode of remittance accurately; ensure you follow through with the option you select.

- Do: Confirm that all the information is true to the best of your knowledge before signing the form.

- Do: Attach any required declarations, such as proof of non-employment.

- Don't: Leave any section blank unless it does not apply to you.

- Don't: Use initials or abbreviations when filling out your name or address.

- Don't: Forget to date your application and provide your signature or thumb impression.

- Don't: Submit the claim immediately upon leaving service; wait for the necessary two-month period if required.

- Don't: Alter any details once the form is filled out; mistakes should be corrected as instructed.

- Don't: Ignore instructions related to the submission process; follow them closely for smooth processing.

- Don't: Assume that all applications are processed at the same speed; plan your finances accordingly.

Misconceptions

There are many misconceptions surrounding the Employees Provident Fund (EPF) form. Below are eight common misunderstandings and explanations to clarify them:

- EPF Forms Are Only for Withdrawals: Some believe that EPF forms are exclusively for claiming funds after leaving service. In reality, they can also be used to transfer balances when changing jobs or updating personal information.

- Employers Must Complete the Form: It is a common misconception that only employers have the authority to complete the EPF form. While employer verification is required, the employee initiates the process by filling out their details.

- No Contribution Means No Claim: Many people think that if there have been breaks in employment, they cannot claim their EPF balance. However, as long as there are contributions made at any time during employment, a claim is still valid.

- EPF Claims Are Always Paid in Full: Some assume that the amount claimed will always be paid in full. Claims may be partial if the employee has not completed the necessary contribution period or if dues exist.

- It’s Mandatory to Wait Two Months to Claim: The belief exists that everyone must wait two months before processing claims. This rule only applies if the member remains unemployed after leaving service.

- Handwritten Corrections are Acceptable: Many think that they can correct errors on the EPF form by hand. This is inaccurate — corrections should be made neat and formal, ideally by starting a new form.

- Advance Stamped Receipt Is Optional: Some believe that providing an Advance Stamped Receipt is not necessary. However, if claiming via cheque, furnishing this receipt is mandatory for processing the claim.

- Only Certain Types of Employment Are Eligible: Lastly, there’s a misconception that only specific jobs qualify for EPF. All employees in establishments covered under the EPF Act are eligible, regardless of industry.

Key takeaways

Here are some key takeaways regarding the Employees Provident Fund form:

- Accurate Information: Fill in your name and father's or husband's name correctly, using block letters.

- Employment Details: Provide the name and address of the factory or establishment where you were employed.

- Account Numbers: Include your Provident Fund account number to ensure accurate processing.

- Date of Leaving: Clearly state the date you left your job and the reason for departure.

- Postal Address: Enter your full postal address in block letters to avoid any delivery errors.

- Payment Method: Choose your preferred mode of remittance and tick the appropriate box.

- Certification: Make sure to certify that the information you provided is true and accurate.

- Declaration of Non-Employment: If necessary, submit a declaration confirming you have not found new employment.

- Timing: Submit your application for settlement after two months from your last employment date, if you're still unemployed.

By keeping these guidelines in mind, you can ensure a smoother process in managing your Employees Provident Fund claims.

Browse Other Templates

How to Change Your Doctor With Medicaid Online - Take the next step in your healthcare by changing your primary provider.

Mission Papers - Consultations between home and away bishops are required if the candidate has lived elsewhere.

Incident Response Planning Phase 1 (preparation) Calls For: - It provides guidance on reporting multiple vehicles involved.