Fill Out Your Employer Information Form

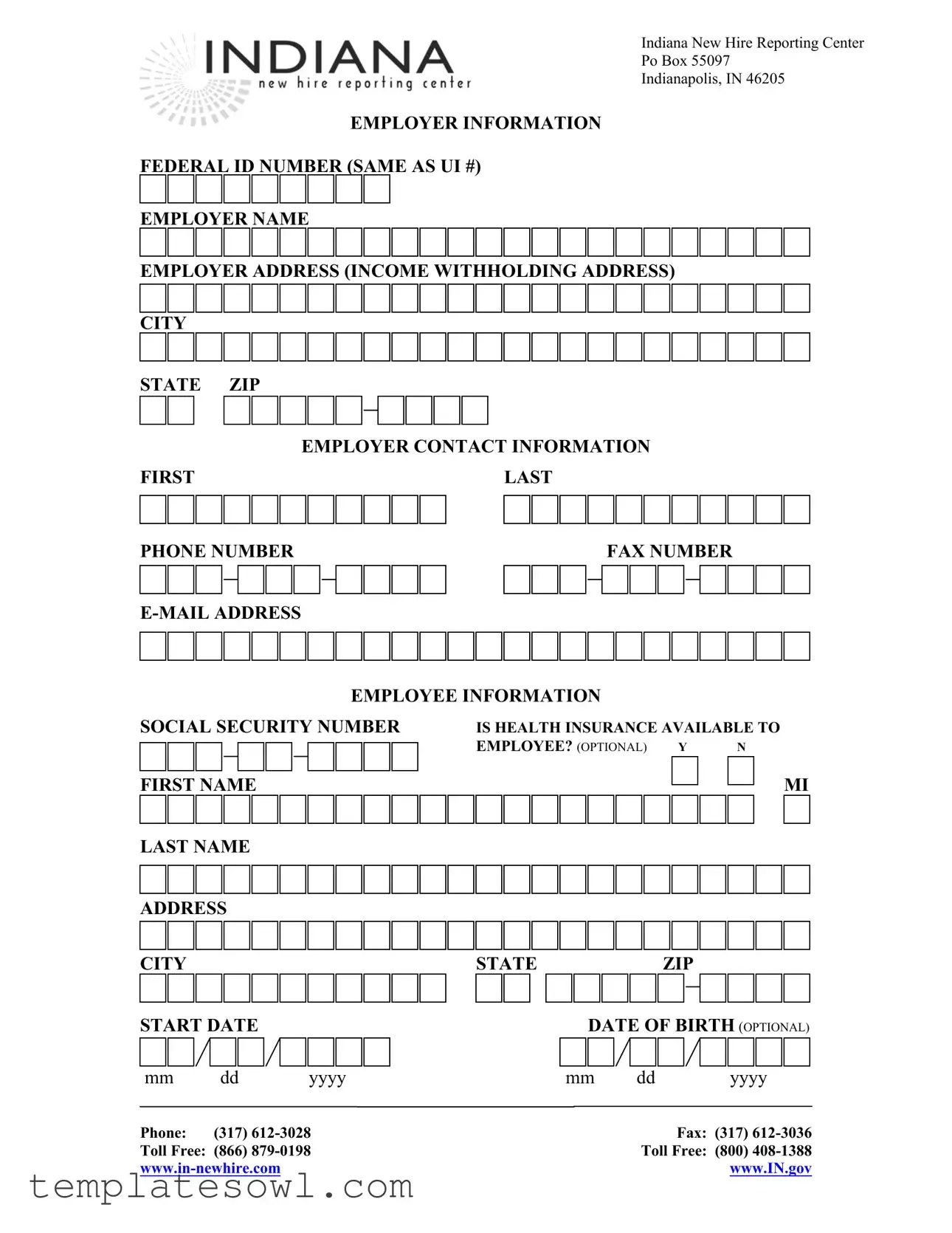

The Employer Information form serves as a vital tool for employers in Indiana, ensuring that crucial information is communicated to the state's New Hire Reporting Center. At the heart of this form lies the employer's federal identification number, which is essential for tracking tax and unemployment insurance obligations. Alongside this identifier, employers must provide their name and complete address, which includes the income withholding address. This is important not only for accurate documentation but also for ensuring that correspondence is directed correctly. Contact information for the employer is equally vital, with spaces allocated for the first and last names of individuals responsible for this documentation, along with their phone number, fax number, and email address. Additionally, the form collects essential details about the new employee, including their Social Security number, full name, and address, ensuring compliance with state and federal regulations. Employers are also asked whether health insurance is available to the employee, though this inquiry is optional. The start date of employment and, optionally, the employee's date of birth are also requested, further aiding in the accurate recording of new hires. This structured approach not only facilitates efficient processing but also supports the enforcement of child support orders and other important state initiatives.

Employer Information Example

Indiana New Hire Reporting Center

Po Box 55097

Indianapolis, IN 46205

EMPLOYER INFORMATION

FEDERAL ID NUMBER (SAME AS UI #)

EMPLOYER NAME

EMPLOYER ADDRESS (INCOME WITHHOLDING ADDRESS)

CITY

STATE ZIP

|

EMPLOYER CONTACT INFORMATION |

FIRST |

LAST |

PHONE NUMBER |

FAX NUMBER |

|

EMPLOYEE INFORMATION

SOCIAL SECURITY NUMBER |

IS HEALTH INSURANCE AVAILABLE TO |

|

|

EMPLOYEE? (OPTIONAL) Y |

N |

FIRST NAME

MI

LAST NAME |

|

|

|

|

ADDRESS |

|

|

|

|

CITY |

|

|

STATE |

ZIP |

START DATE |

|

DATE OF BIRTH (OPTIONAL) |

||

mm |

dd |

yyyy |

mm dd |

yyyy |

Phone: |

(317) |

Fax: |

(317) |

|

Toll Free: (866) |

Toll Free: |

(800) |

||

|

www.IN.gov |

|||

Form Characteristics

| Fact Name | Details |

|---|---|

| Purpose | The Employer Information form is used for new hire reporting in Indiana. |

| Governing Law | This form is governed by Indiana Code 22-4-18-1, which outlines new hire reporting requirements. |

| Required Fields | Employers must provide their federal ID number, name, address, and contact information. |

| Employee Information | The form collects essential employee details, including Social Security number and start date. |

| Contact Information | For assistance, employers can call the Indiana New Hire Reporting Center at (317) 612-3028. |

Guidelines on Utilizing Employer Information

Filling out the Employer Information form is an important step for ensuring accurate records and compliance. This process requires careful attention to detail to provide the necessary information regarding your business and employees.

- Locate the Employer Information form.

- Fill in the Federal ID Number, which is the same as the Unemployment Insurance number.

- Enter the Employer Name.

- Provide the Employer Address, including the street address, City, State, and ZIP Code.

- Complete the Employer Contact Information section. This includes the First Name and Last Name of the contact person.

- Fill in the Phone Number, Fax Number, and E-Mail Address for the contact person.

- In the Employee Information section, enter the employee's Social Security Number.

- Indicate whether Health Insurance is available to the employee by selecting Yes or No.

- Provide the employee's First Name, Middle Initial, and Last Name.

- Fill out the employee's Address, City, State, and ZIP Code.

- Enter the employee’s Start Date in the format mm/dd/yyyy.

- If applicable, provide the employee's Date of Birth in the format mm/dd/yyyy.

Once you have completed the form, review it for accuracy. Ensure that all fields are filled out completely before submitting it. If you have any questions, you may contact the employer information center at the provided phone numbers.

What You Should Know About This Form

What is the purpose of the Employer Information form?

The Employer Information form is primarily used for new hire reporting in the state of Indiana. Employers are required to submit this information to help ensure compliance with state and federal regulations. The data collected assists in tracking employment and supports various state programs, including child support enforcement.

What information must be provided on the form?

The form requires several key pieces of information. Employers need to fill in their Federal ID Number, which is the same as their Unemployment Insurance number. Additionally, the employer's name, address, and contact information must be included. This section is critical for communication and record-keeping purposes. Employee details, such as the Social Security Number, start date, and whether health insurance is available, are also essential. The form collects both employer and employee contact information to facilitate any follow-up if required.

How can I submit the Employer Information form?

You can submit the Employer Information form via mail or fax. The mailing address is the Indiana New Hire Reporting Center, P.O. Box 55097, Indianapolis, IN 46205. If you prefer to fax the information, you can do so using the fax number (317) 612-3036. Ensure that all information is accurate and complete to avoid any delays in processing.

What should I do if I make a mistake on the form?

If you notice an error after submitting the form, it is important to correct it as soon as possible. You can submit a new form with the accurate information, clearly indicating that it is an update. Make sure to note the changes and the reason for the updated submission to help streamline the process. Keeping detailed records of submissions is always a good practice to assist with any future discrepancies.

Common mistakes

Filling out the Employer Information form can seem straightforward, but many people make common mistakes. One frequent error is forgetting to include the Federal ID Number, which is crucial. This number is often used for various tax and legal purposes. Leaving it blank could delay processing of the form, causing unnecessary complications.

Another common mistake is not providing a complete employer name. An incomplete name might lead to confusion, making it hard for the recipient to identify your business. Always double-check to ensure that the name matches official records.

Next, many people fail to provide a precise employer address. When this information is missing or incorrect, it can create trouble for any correspondence or regulatory compliance. Your business's physical location is important for processing and record-keeping.

Sometimes, the city, state, and ZIP code fields are filled out incorrectly or left blank. This mistake is simple to make but highly impactful. Ensure that all parts of the address are correct to avoid delays.

Some also overlook the need for employer contact information. Providing an accurate first and last name, phone number, and email address is essential for communication. If the form needs clarification, it helps if there is a reliable contact person listed.

In addition, people often skip the optional question regarding health insurance availability. While this is not required, it is useful information. Future employees appreciate understanding the benefits offered, which can aid in recruitment efforts.

Another mistake involves not filling out the employee information section completely. Omitting important details like the social security number or start date can lead to errors in documentation and payroll, potentially affecting the employee's employment status.

Finally, failing to proofread the form before submission is a common pitfall. Simple typos or missing information could cause significant delays. Always take a moment to review everything carefully to ensure accuracy and clarity.

Documents used along the form

The Employer Information form serves as a foundational document for employers to provide critical data to various government agencies and facilitate compliance with regulations. Alongside this form, several other documents often accompany it to ensure a comprehensive understanding of the employment relationship and the employer's obligations. Below is a list of related forms and documents frequently utilized in conjunction with the Employer Information form.

- Employee Eligibility Verification (Form I-9): This form is used to verify the identity and employment authorization of individuals hired for employment in the United States. All employees must complete this form, which helps employers comply with federal immigration laws.

- Wage and Tax Statement (Form W-2): Issued at the end of each year, this form reports an employee's annual wages and the amount of taxes withheld from their paychecks. It is essential for employees when filing their income tax returns.

- State Employment Tax Registration: This document registers an employer with the appropriate state agencies for unemployment insurance and other employment taxes. Each state has its own requirements and forms, which help in the proper collection of taxes.

- Notice of Employee Rights: Employers often provide a notice outlining employees' rights under the Family and Medical Leave Act (FMLA) and other relevant laws. This document promotes awareness and compliance among both employers and employees.

- Health Insurance Offer Form: If an employer offers health insurance, this form details the specifics of the health benefits available to employees. It ensures that employees understand their options and responsibilities regarding health coverage.

- Direct Deposit Authorization Form: Employees complete this form to authorize their employer to deposit their wages directly into their bank accounts. This arrangement streamlines payroll processing and enhances convenience for employees.

- Job Description Document: This internal document outlines the roles, responsibilities, and qualifications required for specific positions within the organization. It helps both employers and employees understand job expectations clearly.

- Employee Handbook: An employee handbook is a critical resource that outlines company policies, procedures, and expectations. It serves as a guide for employees to understand their rights, responsibilities, and the organization’s culture.

Together, these documents not only support the information provided in the Employer Information form but also foster a more informed and compliant workplace environment. Each document plays a vital role in promoting clarity and accountability within the employment relationship.

Similar forms

- W-2 Form: Like the Employer Information form, the W-2 form records an employee’s information for tax purposes. It includes details such as the employee’s name, Social Security number, and earning details, establishing a connection to the employer.

- I-9 Form: The I-9 form verifies an employee’s identity and eligibility to work in the U.S. It also gathers essential information like name and Social Security number, similar to the Employer Information form.

- 941 Form: The 941 form reports payroll taxes withheld from employees. It features employer details and shows the relationship between the employer and employee, similar to the structure of the Employer Information form.

- Employee Handbook: An employee handbook outlines company policies while also including details about the company and its employees. It serves as a comprehensive guide, reflecting some of the data collected in the Employer Information form.

- Payroll Records: Payroll records document employee earnings and hours worked. These records contain both employer and employee information, much like the data gathered in the Employer Information form.

- Health Insurance Enrollment Form: This form collects information on employees, including their eligibility for health insurance. It parallels the Employer Information form by gathering data about employees and their benefits.

Dos and Don'ts

When filling out the Employer Information form, attention to detail is crucial. Adhering to the following guidelines can help ensure a smooth process. Here are nine things you should and shouldn't do:

- Do double-check your Federal ID number to avoid submission errors.

- Don't leave fields blank if the information is applicable and necessary.

- Do provide a complete and accurate employer name as it appears in official records.

- Don't use abbreviations when filling out the employer address; write it out fully.

- Do include a working phone number for the employer contact information.

- Don't forget to include an email address for easier communication.

- Do carefully enter the start date and ensure it reflects the employee's actual start date.

- Don't neglect to indicate whether health insurance is available to the employee.

- Do review your entries before submitting the form to confirm all information is accurate.

By following these guidelines, you can contribute to an efficient reporting process and minimize any potential complications.

Misconceptions

Many people have misunderstandings about the Employer Information form. Here are seven common misconceptions explained:

- This form is only for large businesses. Many think only big companies need to fill it out. In reality, any employer who hires employees must complete this form, regardless of size.

- The federal ID number is different from the UI number. Some believe these are separate. However, they are the same, so there's no need to look for different numbers.

- Health insurance information is mandatory. While it's important to provide benefits information, indicating the availability of health insurance is optional on the form.

- Only the employer needs to fill out the form. Many overlook that employee information must also be provided. Both employer and employee details are crucial for proper reporting.

- The form is only for reporting new hires. Some think it serves only that purpose. In reality, it also aids in tracking and reporting employment for tax purposes.

- Once submitted, the information can't be changed. This is incorrect. Employers can update their information as needed, but it's best to keep it accurate from the start.

- You don't need to worry about deadlines. Some believe there's no rush. However, timely submission is essential to avoid penalties and ensure compliance.

Understanding these points can help you navigate the Employer Information form more effectively and avoid common pitfalls.

Key takeaways

When filling out the Employer Information form, keep these key takeaways in mind:

- Provide the correct Federal ID Number, which is the same as your Unemployment Insurance (UI) number.

- Include your complete Employer Name as it is registered.

- List your Employer Address accurately, as this is used for income withholding purposes.

- Make sure to fill in the City, State, and ZIP code for the employer address.

- For Employer Contact Information, provide the first and last names of the contact person, along with phone and fax numbers.

- Do not forget to enter a valid E-mail Address for any necessary communication.

- Gather all necessary Employee Information, including the Social Security Number.

- Indicate whether Health Insurance is available to the employee, choosing either 'Yes' or 'No'.

- List the employee’s Start Date and Date of Birth where applicable.

Remember to double-check all entries for accuracy to avoid any delays in processing.

Browse Other Templates

Nz Arrival Card - Information collection for food importers is mandated under the Food Act 2014.

Loan Payoff Request - The form is important for facilitating timely transactions in property sales or loans.

Decedent's Estate Hearing Notification,Notice of Estate Administration Hearing,Probate Status Report Notice,Hearing Reminder for Decedent's Estate,Notice of Trust Proceedings,Hearing Announcement for Estate Matters,Decedent Trust Notification Form,Es - Included in the DE-120 form are the details of the hearing for a decedent's estate.