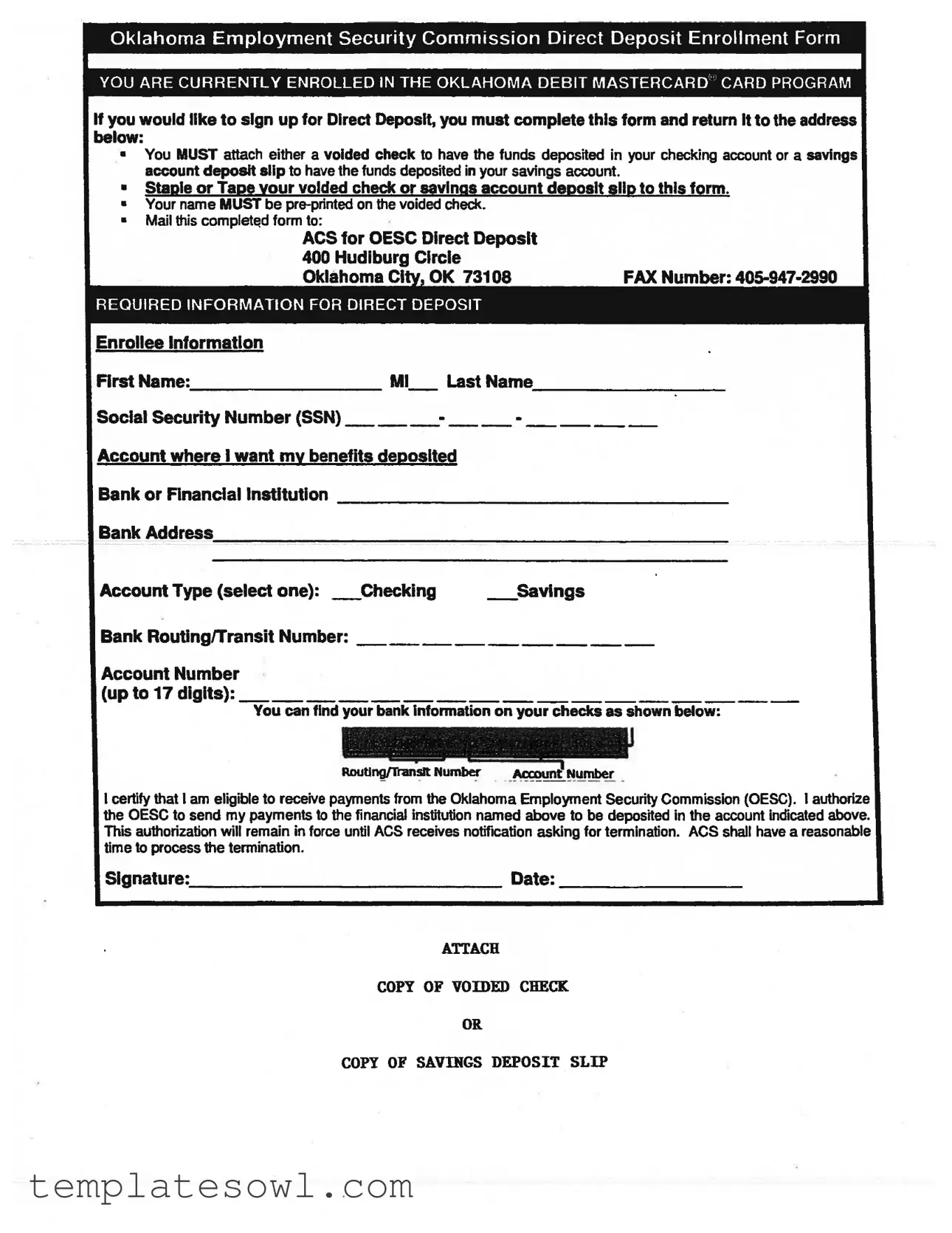

Fill Out Your Employment Oklahoma Form

The Oklahoma Employment Security Commission's Direct Deposit Enrollment Form is an essential tool for individuals looking to streamline their benefit payments. Currently, many Oklahomans are enrolled in the Oklahoma Debit Mastercard program, but switching to direct deposit can enhance convenience and security. This form allows beneficiaries to authorize the direct transfer of their payments into either a checking or savings account. To complete the enrollment, users must provide personal information, including their name, Social Security number, and bank details. Additionally, attaching a voided check or a savings deposit slip is required. It’s crucial that the voided check has the name pre-printed on it to avoid any processing issues. Once the form is filled out, sending it to ACS for OESC at the specified address ensures it’s properly processed. This direct deposit option not only saves time but also helps reduce the likelihood of lost checks and ensures timely access to funds.

Employment Oklahoma Example

Form Characteristics

| Fact Name | Details |

|---|---|

| Governing Agency | The form is governed by the Oklahoma Employment Security Commission (OESC). |

| Purpose | This form allows individuals to enroll in Direct Deposit for their benefits. |

| Eligibility | Individuals must certify their eligibility to receive payments from the OESC. |

| Required Attachments | A voided check or a savings account deposit slip must be attached to the form. |

| Personal Information | Enrollees must provide their first name, middle initial, last name, Social Security Number, and contact information. |

| Account Information | Applicants need to specify the bank name, address, account type, routing number, and account number. |

| Mailing Address | Completed forms must be mailed to ACS for OESC Direct Deposit, 400 Hudiburg Circle, Oklahoma City, OK 73108. |

| Authorization Duration | The authorization for Direct Deposit remains in effect until terminated by the enrollee. |

Guidelines on Utilizing Employment Oklahoma

To complete the Employment Oklahoma form, follow the steps outlined below carefully. Ensure all necessary information is accurate before submitting the form. Gather any required documents beforehand to streamline the process.

- Obtain the Oklahoma Employment Security Commission Direct Deposit Enrollment Form.

- Fill in your personal information:

- First Name

- Middle Initial (optional)

- Last Name

- Social Security Number (SSN)

- Fax Number

- Specify the name of the Bank or Financial Institution where you want your benefits deposited.

- Enter the Bank Address.

- Select your Account Type by checking either Checking or Savings.

- Locate your Bank Routing/Transit Number and write it in the designated field.

- Fill in your Account Number, which can be up to 17 digits long.

- Certify your eligibility by reading the statement provided and signing in the designated space.

- Indicate the date beside your signature.

- Attach a voided check (for checking accounts) or a savings account deposit slip (for savings accounts) to the form. Ensure your name is pre-printed on the voided check.

- Mail the completed form along with the attachment to:

ACS for OESC Direct Deposit

400 Hudiburg Circle

Oklahoma City, OK 73108

What You Should Know About This Form

What is the purpose of the Oklahoma Employment Security Commission Direct Deposit Enrollment Form?

This form is designed for individuals who wish to receive their unemployment benefits through direct deposit. Instead of receiving a debit card, enrollees can have their payments directly deposited into their bank account, providing quicker access to funds.

How do I submit the form?

To submit the form, complete all required fields and attach either a voided check or a savings account deposit slip. Make sure your name is pre-printed on the check or slip. Once completed, mail the form along with the attachment to the designated address: ACS for OESC Direct Deposit, 400 Hudiburg Circle, Oklahoma City, OK 73108.

What information do I need to provide on the form?

You will need to provide your first name, middle initial, last name, and Social Security Number. Additionally, include the name and address of your bank or financial institution, specify the type of account (checking or savings), and provide the bank routing number and your account number.

What if I want to switch my direct deposit account later?

If you decide to change your account for direct deposit, you will need to complete a new direct deposit enrollment form. The Oklahoma Employment Security Commission will process this request, but it may take some time. Until the new information is processed, expect your benefits to continue being deposited into your previous account.

What happens if I do not attach a voided check or deposit slip?

The form will likely be considered incomplete. It is mandatory to attach a voided check or a savings account deposit slip to verify your banking information. If this documentation is missing, your direct deposit request may be delayed or rejected.

How can I confirm my direct deposit enrollment?

Is there a fee for using direct deposit?

No, there are typically no fees associated with enrolling in the direct deposit program for benefits. However, it is advisable to check with your financial institution for any potential charges or policies related to direct deposits.

Can I use a bank account that is not in my name for direct deposit?

Direct deposit must be made to an account that is in your name. Enrolling with an account that is not yours could lead to complications, including the denial of benefits. Always ensure the account matches your legal name as it appears on your Social Security card.

What is the contact information if I have questions about the form?

If you have questions regarding the Oklahoma Employment Security Commission Direct Deposit Enrollment Form, you can reach the OESC at their website or call their customer service. Additional assistance can also be provided at the fax number listed: 405-947-2990.

Common mistakes

Completing the Oklahoma Employment Security Commission's Direct Deposit Enrollment Form can be a straightforward process; however, many individuals make mistakes that may delay their benefits. One common error is neglecting to attach the required documentation. Without a voided check or a savings account deposit slip, the form may be deemed incomplete, resulting in processing delays.

Another mistake often seen is failing to ensure that the name on the voided check matches the name on the form. It is crucial that the individual's name is pre-printed on the voided check. If there is a mismatch, the bank may refuse to process the deposit, further complicating the situation.

Many people overlook the need to fill in all required fields accurately. Fields such as first name, last name, Social Security Number, and account details are essential. Leaving any of these fields blank can lead to rejection of the form, which can unnecessarily prolong the receipt of funds.

Providing incorrect bank account information happens frequently as well. Account and routing numbers must be accurate; even a single digit's error can lead to funds being deposited into the wrong account. It is advisable to double-check these numbers or consult with the bank for verification before submitting the form.

Additionally, some individuals mistakenly select the wrong account type. Whether it is checking or savings, this designation significantly affects where the benefits are deposited. Selecting the incorrect account type can lead to lost funds.

Moreover, neglecting to sign and date the form can render it invalid. A completed form requires both a signature and a date to confirm the individual's agreement with the terms stated in the form.

Another issue arises when individuals fail to send the form to the correct address. It is essential to mail the completed form to the specific address provided on the document to ensure timely processing by the appropriate department.

Some submitters forget to use adequate means to attach their voided check or deposit slip. Stapling or taping these documents securely to the form is advised to prevent them from becoming detached during transit.

An often-overlooked requirement is not including the full account number, which is up to 17 digits. Omitting any digits can cause further complications in depositing funds swiftly into the correct account.

Lastly, users might overlook the importance of keeping a copy of the form for personal records. Retaining this documentation can provide a reference if any follow-up is necessary, ensuring that individuals can quickly address any discrepancies that may arise.

Documents used along the form

When applying for employment benefits in Oklahoma, various additional forms and documents help facilitate the process. Each contributes to ensuring that all necessary information is collected and verified effectively. Below are some of the most commonly used documents in conjunction with the Employment Oklahoma form.

- Oklahoma Unemployment Insurance Application: This document serves as the initial application for unemployment benefits. It collects essential information about the applicant’s work history, reason for unemployment, and personal details.

- W-2 Forms: These tax documents summarize an employee's earnings and the taxes withheld by an employer for a given year. Applicants are often required to submit their W-2 forms to verify income.

- Pay Stubs: Recent pay stubs can demonstrate your past income and employment status. They may be requested to assess eligibility for benefits.

- Identity Verification: This document typically includes a government-issued ID or another form of identification to confirm the applicant's identity.

- Work Search Log: A record of efforts made to seek new employment might be required. It details the places and methods through which individuals applied for jobs.

- Eligibility Review Form: This form is used to determine ongoing eligibility for benefits. Regular reviews may be necessary to ensure compliance with program requirements.

- Authorization for Release of Information: This consent form allows the Oklahoma Employment Security Commission to obtain necessary information from previous employers to verify the details provided by the applicant.

- Appeal Request Form: In cases of denied claims, applicants may need to submit this form to request a review of their case. It outlines the reasons for the appeal and any supporting points.

- Direct Deposit Enrollment Form: This document allows applicants to opt for direct deposit of their unemployment benefits into their bank accounts, ensuring quicker access to funds.

Utilizing these forms will help streamline the application process for unemployment benefits in Oklahoma. Ensuring that all required documentation is submitted accurately and promptly can significantly improve the efficiency of receiving benefits.

Similar forms

The Oklahoma Employment Security Commission Direct Deposit Enrollment Form is quite similar to other documents that deal with direct deposit or financial transactions. Here’s a list of nine similar documents and how they compare:

- Direct Deposit Authorization Form: This form allows employees to authorize their employer to deposit wages directly into their bank account, similar to how the Oklahoma form allows for benefits to be directly deposited.

- IRS Form W-4: Also known as the Employee's Withholding Certificate, this form is filled out by employees to inform the employer about tax withholding. Both require personal information and account details.

- Bank Account Application: When opening a new bank account, this document collects essential personal and account information, just like the enrollment form gathers information for direct deposit.

- Wire Transfer Request Form: This form enables individuals to request the transfer of funds from one bank account to another, sharing similarities in authorization and account verification.

- Automatic Payment Authorization Form: This document enables individuals to set up automatic payments for bills, requiring similar bank information as needed for the direct deposit form.

- Payroll Deduction Authorization Form: Employers use this document to collect authorizations for payroll deductions, including contributions to retirement accounts, mirroring the authorization nature of the direct deposit form.

- Medicare or Medicaid Enrollment Application: Similar in that individuals must provide personal details and banking information to enroll in these benefit programs for direct deposits.

- Loan Application Form: This form collects detailed personal and financial information to evaluate the creditworthiness of the applicant, akin to the financial information required for direct deposit.

- Social Security Benefits Application: This document requires individuals to provide personal and banking details to receive payments, just like the Oklahoma direct deposit form.

Dos and Don'ts

Filling out the Oklahoma Employment Security Commission Direct Deposit Enrollment Form is an important step in ensuring your benefits are received in a timely manner. Here are seven essential dos and don’ts to keep in mind:

- Do ensure your name is pre-printed on the voided check or savings deposit slip.

- Do attach the required voided check or savings account deposit slip securely to the form.

- Do double-check your bank account information for accuracy, including the routing number and account number.

- Do mail your completed form to the correct address to avoid delays in processing.

- Don't forget to sign and date the form before submission.

- Don't include any unnecessary information that does not pertain to your direct deposit enrollment.

- Don't delay in sending the form, as this could postpone your payments.

Misconceptions

Here are 10 misconceptions about the Employment Oklahoma form and clarifications for each:

- You can use any generic check or slip. Only a voided check or a savings account deposit slip with your name pre-printed is acceptable.

- Submitting the form is optional. You must complete and submit the form to set up Direct Deposit.

- You don't need to attach anything. It's mandatory to attach a voided check or a savings account deposit slip to the form.

- Your name can be handwritten on the check. The name must be pre-printed; a handwritten name will not be accepted.

- The form can be mailed anywhere. It specifically must be mailed to the ACS for OESC Direct Deposit at the provided address.

- Checking and savings account deposits are identical processes. You need to select the account type—either checking or savings—on the form.

- The routing number is optional. The routing number is required and can be found on your checks.

- Only your Social Security Number is needed. You must fill out additional information, including bank details and contact information.

- You can change the account at any time without notification. You must notify ACS to process any changes to your Direct Deposit account.

- Direct Deposit setup is immediate. There is processing time after submission, so it may take time for the changes to take effect.

Key takeaways

- Eligibility Requirement: Before filling out the Employment Oklahoma form, ensure that you are eligible to receive payments from the Oklahoma Employment Security Commission (OESC).

- Attachment of Documentation: You must attach a voided check (for checking accounts) or a savings account deposit slip to the form. This documentation is essential for processing your direct deposit.

- Personal Information: Fill in all required fields accurately, including your name, Social Security Number, and financial institution details. Ensure that your name appears on the voided check.

- Submission Process: After completing the form and securing the necessary attachments, mail it to ACS for OESC Direct Deposit at the address provided: 400 Hudiburg Circle, Oklahoma City, OK 73108.

Browse Other Templates

Form Uia 1718 - If you believe your wages were incorrectly calculated, fill out the UIA 1718 form.

California Apartment Association - Emergency contact details allow for quick communication when needed.

Business Information Update,Corporate Status Report,California Corporate Disclosure,Statement of Corporate Details,Annual Business Information Form,Corporate Data Submission,California Corporation Status Statement,Company Information Declaration,Lega - Using the online filing service can streamline the process and reduce paperwork.