Fill Out Your Equal Housing Form

The Equal Housing form is a crucial document used in the rental application process to ensure fairness and transparency in housing opportunities. This form allows prospective tenants to provide essential personal and financial information, such as their name, contact details, anticipated move-in date, rental amount, and security deposit. Along with basic applicant details, it includes sections for residential history over the past three years, outlining current and previous addresses, reasons for leaving, and landlord contact information. Applicants must also disclose their credit history, addressing issues like bankruptcies and evictions, which help landlords assess creditworthiness. The employment section requires tenants to present their job status, employer details, and salary information. Additional sections allow for listing references, banking details, and any pertinent information that may assist the landlord in evaluating the application. The document concludes with an authorization for the landlord to conduct background checks, ensuring an informed selection process that aligns with fair housing practices.

Equal Housing Example

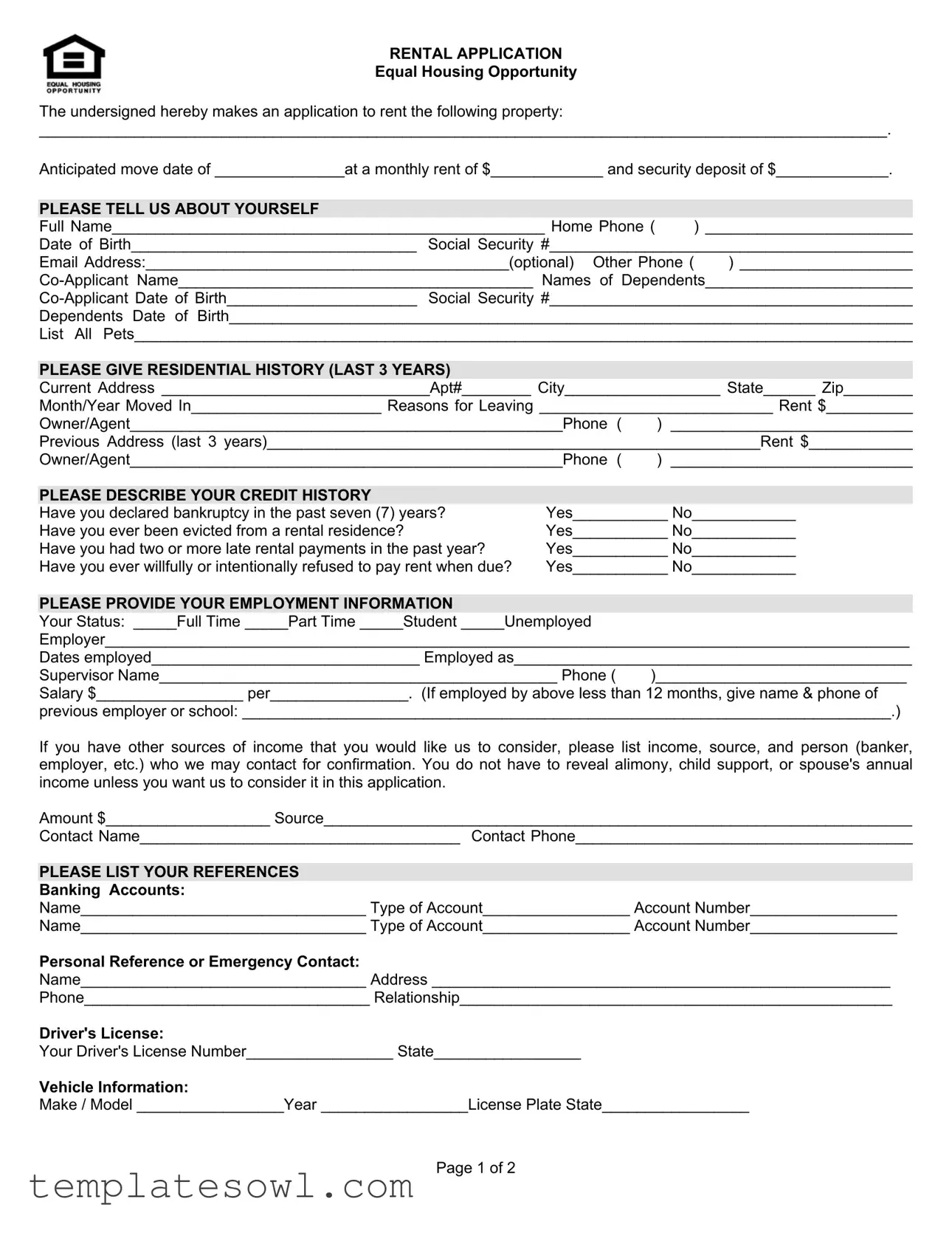

RENTAL APPLICATION

Equal Housing Opportunity

The undersigned hereby makes an application to rent the following property:

__________________________________________________________________________________________________.

Anticipated move date of _______________at a monthly rent of $_____________ and security deposit of $_____________.

PLEASE TELL US ABOUT YOURSELF |

|

|

Full Name__________________________________________________ Home Phone ( |

) ________________________ |

|

Date of Birth_________________________________ Social Security #__________________________________________ |

||

Email Address:__________________________________________(optional) Other Phone ( |

) ____________________ |

|

Dependents Date of Birth_______________________________________________________________________________

List All Pets__________________________________________________________________________________________

PLEASE GIVE RESIDENTIAL HISTORY (LAST 3 YEARS)

Current Address _______________________________Apt#________ City__________________ State______ Zip________

Month/Year Moved In______________________ Reasons for Leaving ___________________________ Rent $__________

Owner/Agent__________________________________________________Phone ( ) ____________________________

Previous Address (last 3 years)_________________________________________________________Rent $____________

Owner/Agent__________________________________________________Phone ( |

) ____________________________ |

|

|

|

|

PLEASE DESCRIBE YOUR CREDIT HISTORY |

|

|

Have you declared bankruptcy in the past seven (7) years? |

Yes___________ No____________ |

|

Have you ever been evicted from a rental residence? |

Yes___________ No____________ |

|

Have you had two or more late rental payments in the past year? |

Yes___________ No____________ |

|

Have you ever willfully or intentionally refused to pay rent when due? |

Yes___________ No____________ |

|

PLEASE PROVIDE YOUR EMPLOYMENT INFORMATION

Your Status: _____Full Time _____Part Time _____Student _____Unemployed

Employer_____________________________________________________________________________________________

Dates employed_______________________________ Employed as______________________________________________

Supervisor Name______________________________________________ Phone ( )_____________________________

Salary $_________________ per________________. (If employed by above less than 12 months, give name & phone of

previous employer or school: ___________________________________________________________________________.)

If you have other sources of income that you would like us to consider, please list income, source, and person (banker, employer, etc.) who we may contact for confirmation. You do not have to reveal alimony, child support, or spouse's annual income unless you want us to consider it in this application.

Amount $___________________ Source____________________________________________________________________

Contact Name_____________________________________ Contact Phone_______________________________________

PLEASE LIST YOUR REFERENCES

Banking Accounts:

Name_________________________________ Type of Account_________________ Account Number_________________

Name_________________________________ Type of Account_________________ Account Number_________________

Personal Reference or Emergency Contact:

Name_________________________________ Address _____________________________________________________

Phone_________________________________ Relationship__________________________________________________

Driver's License:

Your Driver's License Number_________________ State_________________

Vehicle Information:

Make / Model _________________Year _________________License Plate State_________________

Page 1 of 2

ADDITIONAL INFORMATION:

Please give any additional information that might help owner/management evaluate this application?

___________________________________________________________________________________________________

___________________________________________________________________________________________________

___________________________________________________________________________________________________

___________________________________________________________________________________________________

___________________________________________________________________________________________________

___________________________________________________________________________________________________

Where may we reach you to discuss this application?

Day Phone # ( |

) ___________________________ Night Phone # ( |

)____________________________ |

I hereby apply to lease the above described premises for the term and upon the set conditions above set forth and agree that the rental is to be payable the first day of each month in advance. As an inducement to the owner of the property and to the agent to accept this application, I warrant that all statements above set forth are true; however, should any statement made above be a misrepresentation or not a true statement of facts, all of the deposit will be retained to offset the agent's cost, time, and effort in processing my application.

I hereby deposit $_______________ as earnest money to be refunded to me if this application is not accepted in three (3)

business banking days. Upon acceptance, this deposit shall be retained as part of the security deposit. When so approved and accepted, I agree to execute a lease for ___________ months before possession is given and to pay the balance of the

security deposit prior to the move in date. If the application is not approved or accepted by the owner or agent, the deposit will be refunded, the application hereby waiving any claim for damages by reason of

The above information, to the best of my knowledge, is true and correct.

Please sign: X__________________________________ |

_________________ |

Signature of Applicant |

Date |

AUTHORIZATION

Release of Information

I authorize an investigation of my credit, tenant history, banking and employment for the purposes of renting a house, apartment, or condominium from this owner/manager.

_____________________________________________

Name (please print)

Please sign: X__________________________________ |

_________________ |

Signature of Applicant |

Date |

APPLICANT: PLEASE DO NOT WRITE BELOW (FOR OFFICE USE ONLY)

Deposit of $__________________ Received by ____________________________ Date_______________

OFFICE NOTES:

Page 2 of 2

Form Characteristics

| Fact Name | Fact Description |

|---|---|

| Purpose | The Equal Housing form is used to assess applicants for rental properties. |

| Applicant Information | It collects personal details, including full name, contact information, and Social Security number. |

| Residential History | Applicants must provide their residential history for the past three years, including current address and reasons for leaving. |

| Credit History | The form requests information about the applicant's credit history, including any bankruptcies or evictions. |

| Employment Information | Employment status, employer details, job title, and salary are required sections of the form. |

| References | Applicants are asked to provide banking information and personal references for verification. |

| Deposit Terms | A monetary deposit is required as earnest money, refundable if the application is rejected. |

| Authorization | Applicants must authorize an investigation into their credit and tenant history. |

| Equal Housing Laws | The form adheres to the Fair Housing Act (42 U.S.C. § 3601 et seq.), which prohibits discrimination in housing. |

| Signature Requirement | Applicants must sign the form, affirming the truthfulness of the provided information. |

Guidelines on Utilizing Equal Housing

Completing the Equal Housing Opportunity rental application is a straightforward process that involves providing personal, residential, and employment information. After submitting the form, the landlord or property manager will review your details, which may lead to further discussion or a rental agreement.

- Begin by filling in the property details you wish to rent, including the address, anticipated move date, monthly rent, and required security deposit.

- Next, provide your personal information, including your full name, home phone number, date of birth, social security number, email address (optional), and any additional phone numbers.

- If applicable, include co-applicant details, such as their name, social security number, date of birth, and the dates of birth for any dependents.

- List all pets, detailing their types and any relevant characteristics.

- Provide your residential history for the last three years by filling in your current address and previous addresses, including rent amounts and contact information for owners or agents.

- Respond to the credit history questions honestly, indicating whether you have declared bankruptcy, been evicted, had late payments, or refused to pay rent in the past.

- Detail your employment status, employer’s name, job title, supervisor's contact information, and salary, including additional income sources if applicable.

- List any banking accounts, personal references or emergency contacts, and provide your driver’s license number and vehicle information.

- Provide any additional information that may assist the owner or management in evaluating your application.

- Indicate a daytime and nighttime phone number where you can be contacted.

- Sign the application to verify that all provided information is accurate and complete.

- Complete the authorization section to allow the landlord or property manager to conduct a background check, including credit and tenant history.

What You Should Know About This Form

1. What is the purpose of the Equal Housing Opportunity form?

The Equal Housing Opportunity form is designed to promote fair housing practices. It ensures that all individuals seeking to rent a property are treated equally, without discrimination based on race, color, religion, sex, national origin, familial status, or disability. By completing this form, applicants provide essential information required for the rental application process while affirming their understanding of these principles.

2. What information do I need to provide on this form?

When filling out the form, you will need to provide personal details, including your full name, contact information, date of birth, and Social Security number. Additionally, you must outline your residential history for the last three years, provide your employment information, and disclose any credit history relevant to your rental application. Including details about co-applicants and dependents is also required, along with references and any additional information that could support your application.

3. How is my application evaluated?

Your application will be evaluated based on the information you provide regarding your rental history, credit status, and employment situation. Owners and property managers will review these details to assess your financial stability and reliability as a tenant. Further, they may conduct a background check, which includes investigations into your credit, tenant history, and personal references, to make a well-informed decision.

4. What happens if my application is not accepted?

If your application is not accepted, any earnest money you submitted must be refunded, provided that the owner or agent has not incurred any costs due to your application processing. However, if any of the information you provided is found to be false, the property owner may retain your deposit to cover their expenses. It's crucial to ensure that all the information you submit is accurate and truthful.

5. Is there a deposit required when applying?

Yes, a deposit is typically required when submitting your application. This deposit, sometimes termed as earnest money, signifies your intent to rent the property. If your application is approved, this deposit will be applied toward your security deposit. If your application is not accepted, the deposit will be refunded to you within the specified time frame, provided there were no issues with the application.

Common mistakes

Applying for housing can be an intricate process, and filling out the Equal Housing form is no exception. Many applicants make common mistakes that could jeopardize their chances of securing a rental. Understanding these pitfalls is crucial for a smoother experience. Here are six mistakes to watch out for.

1. Incomplete Information is one of the most prevalent errors made on the form. Often, applicants neglect to fill in all required fields, which can raise red flags for landlords or property management. Missing information, such as Social Security numbers or dates of birth, can lead to delays or denials. It is essential to review the form carefully to ensure every section is fully completed.

2. Failing to Disclose Issues can create bigger problems later on. This includes omitting past evictions, bankruptcies, or late payments. Even if it seems minor, disclosing all relevant history is critical. Attempting to hide these issues may appear as a lack of transparency, causing the landlord to question the applicant's integrity.

3. Insufficient Employment Information can also be detrimental. Providing vague employment details or failing to list a reliable contact can lead to skepticism about stability and reliability. All applicants should include their current employment status and substantial income sources. This supports their ability to meet rental obligations and can strengthen their application.

4. Lack of References is another significant misstep. Applicants should provide both personal and professional references to help landlords gauge character and reliability. Neglecting to include references limits verification opportunities and creates doubts about the applicant's credibility.

5. Miscommunication of Financial Information can complicate matters as well. When stating income, it is vital to clarify whether it is gross or net. Inconsistent figures can raise concerns and lead to misunderstandings with potential landlords. Complete and precise financial details can enhance one’s application.

6. Ignoring the Fine Print may have near-fatal implications for applicants. Some individuals fail to read the terms regarding deposits and application processing times thoroughly. Not understanding what the initial deposit entails, or the possibility of losing it due to misrepresentation, can lead to financial loss and increased stress.

In conclusion, being meticulous when filling out the Equal Housing form is essential. Avoiding these common mistakes can substantively improve an applicant's chances of securing a rental property. A thoughtful and thorough approach can pave the way for a successful housing application.

Documents used along the form

When applying for rental properties, several documents often accompany the Equal Housing form to provide a comprehensive view of a tenant's background. Below are four key forms that are commonly used in conjunction with the rental application.

- Lease Agreement: This is a formal contract outlining the terms and conditions between the tenant and the landlord. It specifies the rental period, payment amount, security deposit, and other rules regarding property use.

- Credit Report Authorization: This document gives landlords permission to check a tenant's credit history. It helps landlords evaluate the applicant's financial responsibility and ability to pay rent on time.

- Rental History Verification: This form requests information from previous landlords regarding a potential tenant's payment history and behavior during their lease period. It helps confirm details provided in the rental application.

- Income Verification: This document is used to confirm a tenant's income through pay stubs, tax returns, or employment letters. It is crucial for assessing whether the applicant can afford the rent.

Having these forms ready can streamline the rental application process and help in making informed decisions. Being organized and thorough will benefit both applicants and landlords alike.

Similar forms

Lease Agreement: Similar to the Equal Housing form, a lease agreement outlines the terms and conditions of renting a property, including rent amount, security deposit, duration, and responsibilities of both the tenant and landlord.

Rental Application Addendum: This document provides additional questions or information requirements for rental applicants, similar to the Equal Housing form’s information about the applicant’s residential and employment history.

Tenant Background Check Authorization: This form authorizes landlords to conduct background checks on potential tenants, focusing on credit and rental history, akin to the section in the Equal Housing form about credit history inquiries.

Fair Housing Poster: This poster informs tenants of their rights under fair housing laws, ensuring equal treatment in housing, just like the Equal Housing Opportunity notice promotes non-discrimination.

Pet Policy Agreement: Similar to the pet disclosure in the Equal Housing form, this document outlines the pet-related rules and additional deposits that may be required by landlords.

Security Deposit Receipt: This receipt acknowledges the amount and terms of the security deposit taken from tenants, paralleling the security deposit section in the Equal Housing form.

Lead-Based Paint Disclosure: Required for older properties, this document informs tenants of potential lead hazards, similar to how the Equal Housing form informs applicants of housing rights.

Move-In Checklist: This checklist records the condition of the rental unit at move-in, serving a similar purpose as the Equal Housing form in documenting crucial tenant information.

Rental Payment Agreement: This agreement specifies the expectations for rental payments, much like the Equal Housing form emphasizes payment terms for tenants.

Tenancy Agreement: This is a broader document that defines the landlord-tenant relationship, encompassing rights and responsibilities, much like what is covered in the Equal Housing form.

Dos and Don'ts

When filling out the Equal Housing form for a rental application, it is important to approach the process thoughtfully. This ensures that you provide the necessary information while adhering to the requirements set forth. Below are some guidelines on what you should and shouldn't do.

- Do be honest and accurate when providing your personal information. Misrepresenting or omitting details could affect your application negatively.

- Do provide complete information regarding your rental history. This includes past addresses, the names of landlords, and the reasons for leaving each residence.

- Do include all required contacts for verifying your employment and rental history. Incorporating these details will help expedite the application process.

- Do clearly communicate any special circumstances in the additional information section. If there are any unique aspects of your situation that could impact your application, mentioning them might be helpful.

- Don't leave any sections blank unless they are specifically marked as optional. Omissions can lead to delays or the rejection of your application.

- Don't provide misleading information regarding your credit history or income. Doing so can have serious consequences down the line, including being denied a lease.

By following these guidelines, you can improve your chances of a successful rental application while ensuring transparency in the process.

Misconceptions

Here are some common misconceptions about the Equal Housing form. Understanding these can help clarify expectations when applying for rental properties.

- Everyone qualifies for housing under the Equal Housing form. This is misleading. While the form promotes fair housing practices, each application is evaluated based on the applicant's rental and financial history.

- The Equal Housing form guarantees acceptance. Submission of the form does not guarantee that an application will be approved. Other factors, such as credit history and income verification, play significant roles in the decision-making process.

- All rental applications require the same information. Rental applications can differ significantly. Some may require more or less information based on the property owner or management company's policies.

- The Equal Housing form is only for low-income individuals. This is not true. The form is meant to ensure fair treatment for everyone, regardless of income level, race, or background.

- You cannot be denied housing based on a criminal record. While the Equal Housing form promotes non-discrimination, landlords may consider past criminal behavior during their screening process in accordance with state laws.

- Submitting the form is all you need to do. Completing the form is just one step in the application process. It often needs to be accompanied by additional documentation, such as proof of income and references.

Key takeaways

Key Takeaways for Filling Out and Using the Equal Housing Form:

- Complete all sections of the application accurately. Include your full name, contact information, and personal details.

- Provide complete residential history for the last three years. This helps the property owner assess your past rental behavior.

- Disclose any negative credit history, such as bankruptcies or evictions. Full transparency can prevent future complications.

- List your employment information clearly, including your job status and income. The owner needs this to evaluate your financial stability.

- Include references appropriately. Banking information and personal contacts add credibility to your application.

- Deposit the requested amount as earnest money to show your commitment. Ensure you understand if it is refundable.

- Read the authorization section carefully. You consent to background checks, so ensure you’re comfortable with the information shared.

Browse Other Templates

Nurse Notes - Document the management of chronic conditions observed.

How Long Do You Have to File a Report for a Crash With the Dmv If Law Enforcement Isn’t Involved? - Write down the exact name of the insurance company for all covered parties.