Fill Out Your Erm 14 Form

The ERM-14 form, known as the Request for Ownership Information, plays an important role for businesses in relation to their workers' compensation insurance policies. Completing this form allows employers to report any changes in ownership or business structure that may affect their insurance premiums. It is crucial for policyholders to communicate these changes to their insurance carriers within a 90-day timeframe to avoid potential complications. The form requires basic contact information and details about the nature of the ownership change, including whether it pertains to a sale, merger, or formation of a new entity. For each change, specific details must be provided, helping to ensure clear and accurate reporting. Additionally, the ERM-14 form allows for flexibility in presentation; ownership information can be documented in narrative format if submitted on the employer’s letterhead, provided it is signed by a key individual within the organization. Understanding how to accurately fill out the ERM-14 is essential for maintaining compliance and ensuring that businesses remain protected under their insurance policies.

Erm 14 Example

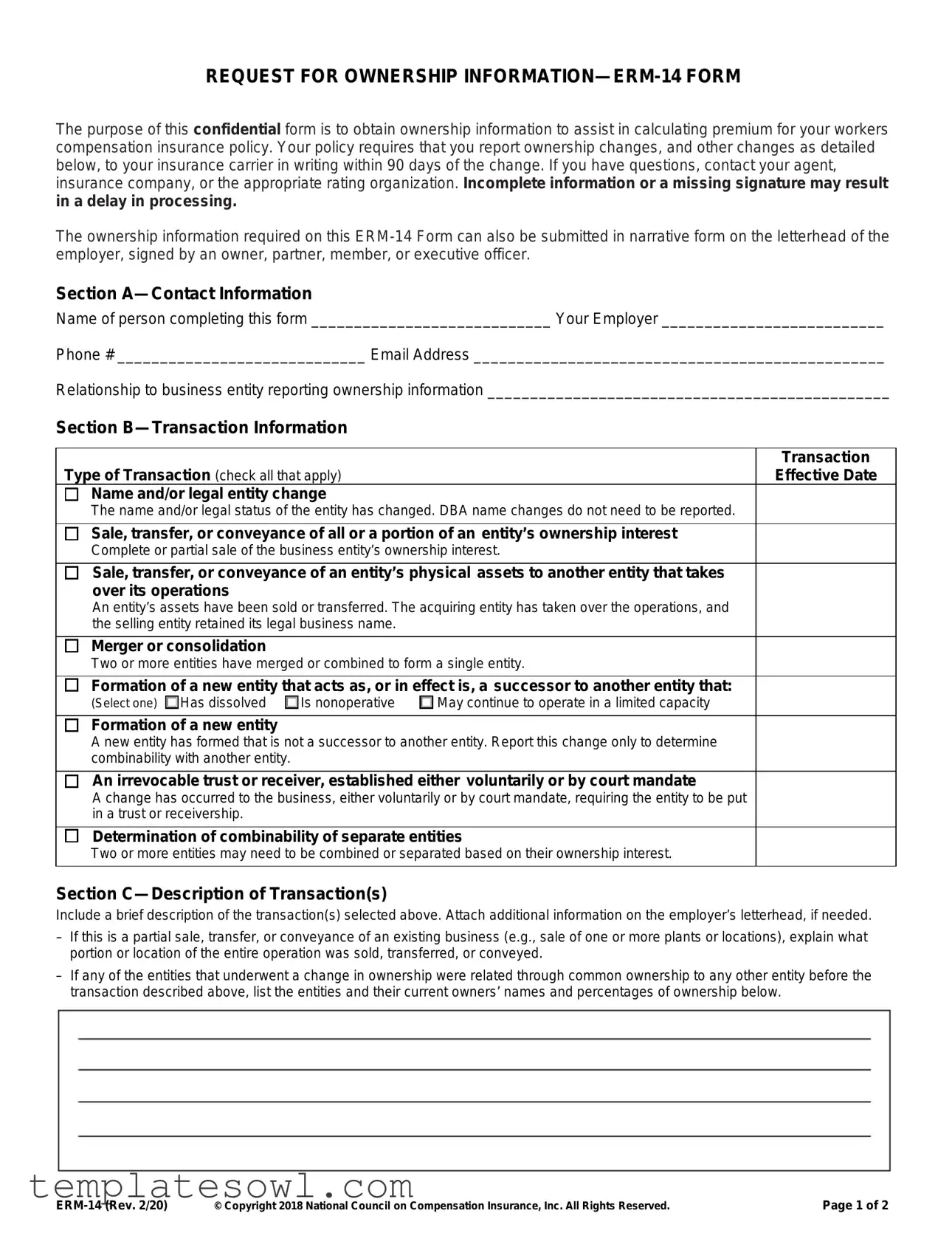

REQUEST FOR OWNERSHIP

The purpose of this confidential form is to obtain ownership information to assist in calculating premium for your workers compensation insurance policy. Your policy requires that you report ownership changes, and other changes as detailed below, to your insurance carrier in writing within 90 days of the change. If you have questions, contact your agent, insurance company, or the appropriate rating organization. Incomplete information or a missing signature may result in a delay in processing.

The ownership information required on this

Section

Name of person completing this form ____________________________ Your Employer __________________________

Phone # _____________________________ Email Address ________________________________________________

Relationship to business entity reporting ownership information _______________________________________________

Section

Type of Transaction (check all that apply) |

Transaction |

Effective Date |

Name and/or legal entity change

The name and/or legal status of the entity has changed. DBA name changes do not need to be reported.

Sale, transfer, or conveyance of all or a portion of an entity’s ownership interest

Complete or partial sale of the business entity’s ownership interest.

Sale, transfer, or conveyance of an entity’s physical assets to another entity that takes over its operations

An entity’s assets have been sold or transferred. The acquiring entity has taken over the operations, and the selling entity retained its legal business name.

Merger or consolidation

Two or more entities have merged or combined to form a single entity.

Formation of a new entity that acts as, or in effect is, a successor to another entity that:

(Select one) |

Has dissolved |

Is nonoperative |

May continue to operate in a limited capacity |

Formation of a new entity

A new entity has formed that is not a successor to another entity. Report this change only to determine combinability with another entity.

An irrevocable trust or receiver, established either voluntarily or by court mandate

A change has occurred to the business, either voluntarily or by court mandate, requiring the entity to be put in a trust or receivership.

Determination of combinability of separate entities

Two or more entities may need to be combined or separated based on their ownership interest.

Section

Include a brief description of the transaction(s) selected above. Attach additional information on the employer’s letterhead, if needed.

–If this is a partial sale, transfer, or conveyance of an existing business (e.g., sale of one or more plants or locations), explain what portion or location of the entire operation was sold, transferred, or conveyed.

–If any of the entities that underwent a change in ownership were related through common ownership to any other entity before the transaction described above, list the entities and their current owners’ names and percentages of ownership below.

© Copyright 2018 National Council on Compensation Insurance, Inc. All Rights Reserved. |

Page 1 of 2 |

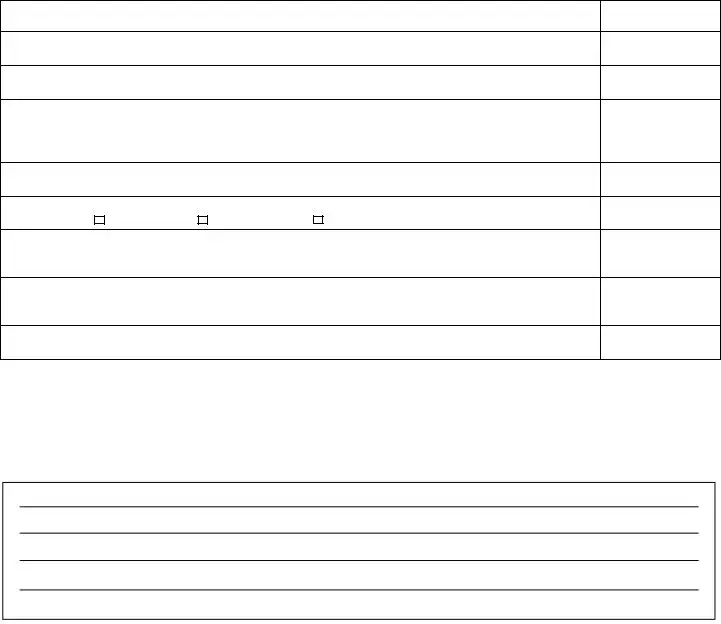

Section

Copies of this page may be submitted for transactions with more than three entities.

|

|

Entity 1 |

Entity 2 |

Entity 3 |

|

|

Entity before the change or |

Entity after the change or |

Entity after a merger or |

|

Entity Information |

to determine combinability |

to determine combinability |

consolidation or to determine |

|

|

with another entity |

with another entity |

combinability with another entity |

1. |

Name of Business |

|

|

|

|

Provide the legal name of the |

|

|

|

|

business entity. |

|

|

|

|

|

|

|

|

2. |

Primary Address |

|

|

|

|

(Street, City, State, Zip) |

|

|

|

|

|

|

|

|

3. |

Legal Status |

|

|

|

|

(See examples in item 4 below) |

|

|

|

|

|

|

|

|

4. |

Ownership |

|

|

|

|

List names of individual owners, |

|

|

|

|

partners, etc. and percentages of |

|

|

|

|

ownership (if applicable). |

|

|

|

|

Ownership should total 100%. |

|

|

|

– Sole Proprietorship: Owner |

|

|

|

|

– Corporation: Owner(s) and |

|

|

|

|

|

percentages of ownership |

|

|

|

– General Partnership: |

|

|

|

|

|

Partners and percentages of |

|

|

|

|

ownership |

|

|

|

– Limited Partnership: |

|

|

|

|

|

General partners and |

|

|

|

|

percentages of ownership |

|

|

|

– Limited Liability Company: |

|

|

|

|

|

Members and percentages of |

|

|

|

|

ownership |

|

|

|

– Revocable Trust: Grantor(s) |

|

|

|

|

– Irrevocable Trust: Trustee(s) |

|

|

|

|

– Other: If no voting stock, list |

|

|

|

|

|

members of board of directors or |

|

|

|

|

comparable governing body |

|

|

|

|

|

|

|

|

5. |

FEIN |

|

|

|

|

|

|

|

|

6. |

Risk ID Number |

|

|

|

|

|

|

|

|

7. |

Policy Number |

|

|

|

|

|

|

|

|

8. |

Policy Effective Date |

|

|

|

|

|

|

|

|

9. |

Contact Name |

|

|

|

|

|

|

|

|

10. Contact Phone/Email |

|

|

|

|

|

|

|

|

|

Section

This is to certify that the information contained on this form is complete and correct.

_________________________________________________ |

_________________________ |

________________________________ |

Signature of Owner, Partner, Member, or Executive Officer Title |

Business Name |

|

_________________________________________________ |

_________________________ |

|

Print name of above signature |

Date |

|

© Copyright 2018 National Council on Compensation Insurance, Inc. All Rights Reserved. |

Page 2 of 2 |

Form Characteristics

| Fact Name | Fact Description |

|---|---|

| Purpose | The ERM-14 Form is used to request ownership information necessary for calculating premiums for workers' compensation insurance policies. |

| Reporting Changes | Policyholders must report any ownership changes in writing to their insurance carrier within 90 days following the change. |

| Completeness Requirement | Incomplete information or a lack of signature can delay the processing of the form. |

| Alternative Submission | Ownership information can also be submitted in a narrative format on the employer’s letterhead if signed by an authorized person. |

| Transaction Types | The form allows for various types of transactions to be reported, including mergers, sales, and legal entity changes. |

| Governing Laws | The ERM-14 Form complies with state-specific regulations regarding worker’s compensation insurance reporting, which varies by state. |

Guidelines on Utilizing Erm 14

The ERM-14 form is an important document for reporting ownership changes related to your workers' compensation insurance policy. Accurately completing this form ensures that your insurance provider has the most up-to-date information, allowing for the correct premium calculations. Below are the step-by-step instructions to help guide you through the process of filling it out.

- Contact Information: Fill in your name, employer name, phone number, email address, and your relationship to the business.

- Transaction Information: Check all applicable boxes to indicate the type of transaction you are reporting. Be sure to include the effective date of the transaction.

- Description of Transaction(s): Provide a brief description of the selected transaction(s). Explain if this is a partial sale, transfer, or if related entities were involved. Include details on ownership where necessary.

- Business Entity Information: For each entity involved, provide the legal name, primary address, legal status, ownership details, FEIN, risk ID number, policy number, policy effective date, and contact information.

- Certification: Sign and print your name, include your title and the business name, and date your signature to certify the information is complete and correct.

Once you've completed the form, review it carefully to ensure all information is accurate. If needed, attach any additional documents that could provide further clarification or support for your submission. Submitting this form promptly will help avoid potential delays in processing and ensure your records are kept up to date.

What You Should Know About This Form

What is the purpose of the ERM-14 form?

The ERM-14 form, known as the Request for Ownership Information, is designed to gather essential ownership details. This information supports the calculation of premiums for your workers' compensation insurance policy. It's important to communicate any changes in ownership to your insurance carrier within 90 days to ensure that your policy remains accurate and compliant.

Who needs to fill out the ERM-14 form?

The form should be completed by individuals who have a significant relationship with the business, such as an owner, partner, member, or executive officer. This person is responsible for providing accurate and complete information regarding any changes to the business ownership.

What types of transactions does the ERM-14 form cover?

The ERM-14 form covers several types of ownership transactions including name changes, sales or transfers of ownership interests, mergers, the formation of new entities, and changes resulting from trusts or receiverships. Each type of transaction has its specific implications that can affect your insurance policy, making it crucial to report them accurately.

What happens if I don’t report ownership changes on time?

Failing to report ownership changes within the 90-day window may lead to complications, such as premium adjustments or policy coverage issues. Incomplete submissions can also delay processing, which may impact your business's compliance with workers' compensation requirements.

Can I submit ownership information in another format?

Yes, if preferred, the ownership information can be submitted in narrative form on the employer’s letterhead. This submission must be signed by an authorized individual, such as an owner or executive officer, detailing the ownership changes in lieu of using the ERM-14 form.

What must be included in Section D of the form?

Section D requires detailed business entity information about the ownership structure before and after the change. This includes the legal name of the business, primary address, legal status, ownership percentages, FEIN, risk ID number, and policy details. Ensure the ownership percentages total 100% for accuracy.

Is it necessary to attach additional documentation?

Additional documentation may be necessary, especially if detailing complex transactions such as partial sales or multiple entities. Providing extra information on the employer's letterhead can help clarify the changes and support the accuracy of the submitted ownership information.

How do I confirm that the information provided is accurate?

To confirm accuracy, the form requires a certification section where an owner, partner, or executive officer must sign and date the document. This signature attests to the validity of the information presented on the ERM-14 form, ensuring that the details about ownership changes are indeed correct.

Common mistakes

Filling out the ERM-14 form can be daunting, and mistakes happen frequently. One common error is the failure to provide complete contact information. When the person completing the form does not include their name, employer, phone number, or email address, it leads to confusion. This information is crucial for communication with the insurance carrier.

Another frequent mistake is neglecting to indicate the type of transaction accurately. This section requires checking all applicable options. If all relevant transactions are not clearly marked, it may result in delays or complications in processing the form.

Missing or incomplete descriptions of the transactions selected is a major pitfall as well. Section C asks for brief descriptions that clarify the nature of the changes. If this part is overlooked or filled out vaguely, questions will inevitably arise, prolonging the review process.

A misunderstanding of ownership information is also common. Many fail to provide names and percentages that add up to 100%. The ownership breakdown needs to be specific, whether it’s an LLC, corporation, or partnership. Not accounting for all owners can lead to significant discrepancies.

Section D includes critical data about the business entity, which must be accurate. Ignoring vital details such as legal status, FEIN, and risk ID numbers can result in more severe complications later. Double-checking this information is necessary to prevent oversight.

Another mistake occurs in the certification section. A missing signature or an unverified date can lead to the form being deemed invalid. It’s essential for the owner, partner, or executive officer to sign and date the document to avoid administrative hurdles.

Moreover, failing to submit attachments when needed is a common error. If the transaction is complex or involves multiple entities, additional documentation may be required. Neglecting to attach supporting copies can hinder the processing of your request.

People sometimes overlook the policy requirements regarding notification of changes. The form specifies that any changes must be reported in writing within 90 days. Delayed submission could result in penalties or affect insurance coverage.

Finally, some individuals may assume that DBA name changes need reporting. This is a misconception. The ERM-14 form does not require DBA name changes to be reported. Misinterpretation of such details can lead to unnecessary paperwork and delays.

Documents used along the form

The ERM-14 form is essential for communicating changes in ownership, particularly regarding workers' compensation insurance policies. Alongside this form, various other documents may be required to provide comprehensive information about ownership changes and business transactions. Below is a brief overview of these related documents.

- Ownership Change Notification: This document formally notifies the insurance carrier of any change in ownership. It includes details about the previous and new owners, ensuring that the insurer has accurate records.

- Business Sale Agreement: This agreement outlines the terms of the sale of a business or its assets. It details the parties involved, sale price, and conditions, serving as a binding contract to protect both buyer and seller.

- Asset Transfer Agreement: Similar to a sale agreement, this document focuses specifically on the transfer of physical assets rather than ownership. This includes any machinery, inventory, or property involved in the transaction.

- Articles of Incorporation: If a new entity is formed, this legal document must be filed with the state. It officially establishes the business as a corporation and includes key information such as its name, purpose, and ownership structure.

- Operating Agreement: This document governs the management structure and operational guidelines of a Limited Liability Company (LLC). It outlines the roles of members and how decisions are made, thus guiding the new entity's internal operations.

- Trust Documents: If the business is placed in a trust, documentation detailing the trust’s terms and conditions is necessary. These documents clarify the trustee's powers and responsibilities regarding the assets held in trust.

- Combinability Determination Report: This report is used when assessing whether separate entities should be combined for insurance purposes. It outlines ownership interests and helps determine risks associated with the entities involved.

Having the correct forms and documents ready is crucial for a smooth transition during ownership changes. This ensures compliance with insurance requirements and minimizes potential delays in coverage or processing. Be sure to contact your insurance carrier or legal advisor with any questions regarding these documents.

Similar forms

The ERM-14 Form plays a crucial role in providing ownership information for workers' compensation insurance policies. It is not an isolated document; rather, it shares similarities with several other important forms. Here are four documents that are akin to the ERM-14 form, highlighting how they relate.

- Business Ownership Change Notification Form: Like the ERM-14, this form is designed to inform the relevant authorities about changes in business ownership. It requires detailed information about the nature of the ownership change, ensuring that all parties involved are updated efficiently and accurately.

- Certificate of Incorporation: This document is essential for businesses that have recently changed their legal entity status. Similar to the ERM-14, it requires specific details about ownership and operational changes, thereby maintaining accurate records for both legal and insurance purposes.

- Annual Ownership Report: Much like the ERM-14, this report compiles the ownership structure of a business annually, detailing any changes that may have occurred throughout the year. Ensuring accuracy in reporting can affect risk assessments and insurance premiums.

- Merger Agreement: This document outlines the specifics of a merger between two or more entities. Similar to the ERM-14, it requires comprehensive ownership details and the implications of the merger, making it critical for accurate insurance policy evaluations.

Each of these documents serves its unique purpose but ultimately contributes to the broader goal of maintaining transparent ownership information necessary for effective risk management and insurance coverage.

Dos and Don'ts

When filling out the ERM-14 form, accuracy and clarity are vital. Follow these essential tips to ensure your submission is successful.

- DO: Clearly print your name and the name of the employer in the appropriate sections.

- DO: Check all applicable transaction types to convey the complete ownership change.

- DO: Provide full and accurate contact information, including phone number and email address.

- DO: Attach any additional information on the employer’s letterhead if necessary.

- DO: Ensure the signature is from an authorized owner or executive officer to validate the form.

- DON'T: Leave any section blank; incomplete information can delay processing.

- DON'T: Report only DBA name changes as they do not need to be included.

- DON'T: Ignore the 90-day notification requirement for ownership changes.

- DON'T: Use abbreviations or shorthand that may confuse the reviewer.

- DON'T: Forget to double-check for errors before submission, as inaccuracies can lead to complications.

By adhering to these guidelines, you will facilitate a smooth processing of your ownership information request, ensuring compliance with the necessary regulations.

Misconceptions

Here are 10 misconceptions about the ERM-14 form along with clarifications to assist with proper understanding:

- The ERM-14 is unnecessary if there are no changes. The ERM-14 must be submitted whenever there are ownership changes or other significant transactions affecting the business, even if you believe they are minor.

- All name changes require a new ERM-14 submission. Only legal name or entity changes must be reported. DBA (Doing Business As) name changes do not need to be included on the form.

- Any transfer of assets doesn’t require reporting. The sale, transfer, or conveyance of business assets affecting its operations must be reported through the ERM-14.

- You need to file the ERM-14 form for every business activity. The form must only be completed for specific types of transactions listed on the form, not for every business decision.

- A simple letter is not enough to report changes. While you can provide ownership information in a narrative form on company letterhead, it still must meet requirements outlined in the ERM-14.

- Signature of any employee is sufficient. The form must be signed by an owner, partner, member, or executive officer to validate the information.

- Past ownership information can be omitted if it’s outdated. Accurate ownership details are critical, and prior ownership should be disclosed if relevant to the current transaction.

- Reports can be submitted at any time post-transaction. Changes must be reported within 90 days of the transaction occurring to ensure compliance.

- You cannot provide additional context or information. Attach additional documentation or explanations if needed to clarify ownership changes or transactions.

- The ERM-14 form affects every business equally. The need and implications of the form can vary widely between businesses based on their structure and changes in ownership.

Understanding these misconceptions can aid in compliance and ensure proper reporting of ownership changes and related transactions.

Key takeaways

Filling out the ERM-14 Form correctly is crucial for your workers' compensation insurance policy. Here are some key takeaways to keep in mind:

- Timeliness is Essential: Ensure you report any ownership changes within 90 days to avoid potential issues with your insurance coverage.

- Complete and Accurate Information: Missing details or signatures can lead to processing delays. Double-check every section before submission.

- Types of Transactions Matter: Familiarize yourself with the different types of ownership transactions listed on the form, such as mergers, sales, and formations of new entities.

- Narrative Format Allowed: If you prefer, you can provide ownership information in narrative form on your business letterhead, signed by an authorized individual.

- Certification Required: A signature from an owner, partner, member, or executive officer is necessary to certify the information is correct. Don’t skip this important step!

Browse Other Templates

Companies House Register a Charge - Marines will have access to established fitness resources online.

Boy Scout Pack Vs Troop - The application aims to foster youth leadership and personal development.

State Farm Change of Beneficiary Form - You may wish to consult with a financial advisor when making beneficiary designations to ensure they align with your overall financial strategy.