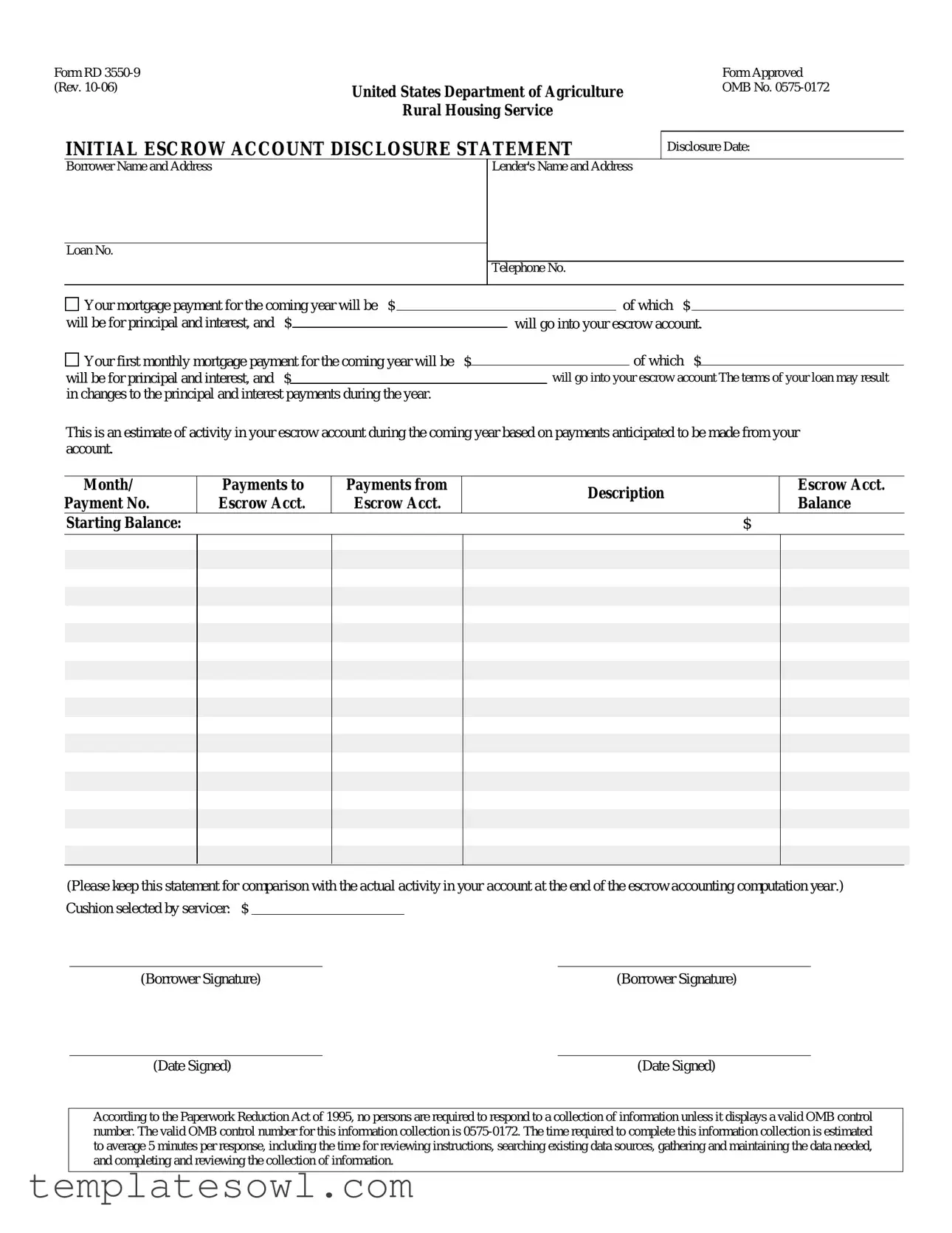

Fill Out Your Escrow Disclosure Form

When navigating the world of home financing, understanding the Escrow Disclosure form is crucial for borrowers. This essential document provides a snapshot of how much of your monthly mortgage payment is earmarked for principal and interest versus contributions to your escrow account. By outlining the anticipated payments into and out of this account, the form helps borrowers prepare for the upcoming year’s financial responsibilities. It includes important information such as the borrower’s name and address, the lender’s contact details, as well as a distinct loan number for easy reference. Each month, your mortgage payment may change based on varying principal and interest rates, and this form estimates the activity likely to occur in your escrow account over the year. Starting balance information and a cushion amount selected by the servicing company allow for clear budgeting and planning. Ultimately, retaining this document for the end of the escrow accounting computation year can enhance your understanding of your financial commitments. With all of these details presented in a straightforward manner, the Escrow Disclosure form serves as a vital tool in managing your mortgage and ensuring you are well-informed about your financial obligations.

Escrow Disclosure Example

Form RD

(Rev.

Rural Housing Service

INITIAL ESCROW ACCOUNT DISCLOSURE STATEMENT

Form Approved

OMB No.

Disclosure Date:

Borrower Name and Address

Lender's Name and Address

Loan No.

Telephone No.

Your mortgage payment for the coming year will be $ |

|

|

|

of which $ |

|

|

||||

will be for principal and interest, and |

$ |

|

|

will go into your escrow account. |

||||||

|

|

|||||||||

Your first monthly mortgage payment for the coming year will be $ |

|

|

|

of which $ |

|

|||||

|

|

|

|

|

|

|||||

will be for principal and interest, and |

$ |

|

|

|

|

will go into your escrow account The terms of your loan may result |

||||

in changes to the principal and interest payments during the year. |

|

|

|

|

|

|

||||

This is an estimate of activity in your escrow account during the coming year based on payments anticipated to be made from your account.

Month/ |

Payments to |

Payments from |

Description |

|

Escrow Acct. |

|

Payment No. |

Escrow Acct. |

Escrow Acct. |

|

Balance |

||

|

|

|||||

Starting Balance: |

|

|

|

$ |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(Please keep this statement for comparison with the actual activity in your account at the end of the escrow accounting computation year.)

Cushion selected by servicer: $

(Borrower Signature)

(Date Signed)

(Borrower Signature)

(Date Signed)

According to the Paperwork Reduction Act of 1995, no persons are required to respond to a collection of information unless it displays a valid OMB control number. The valid OMB control number for this information collection is

Form Characteristics

| Fact Name | Detail |

|---|---|

| Form Identification | The Escrow Disclosure form is officially known as Form RD 3550-9, approved by the United States Department of Agriculture (USDA) Rural Housing Service. |

| Purpose | This form provides borrowers with a detailed estimate of their escrow account activities for the coming year, including anticipated payments and balances. |

| Governing Law | The form is governed by the regulations set forth by the USDA Rural Development program and should comply with the guidelines established under the Paperwork Reduction Act of 1995. |

| Disclosure Date | Each form must clearly state the disclosure date to ensure that borrowers are informed about the timing of the provided estimates. |

| Estimated Time for Completion | Completing the Escrow Disclosure form is estimated to take about 5 minutes on average, including various preparatory tasks. |

| Importance of Retention | Borrowers are advised to retain a copy of this statement for comparison with the actual activity in the escrow account at the end of the accounting computation year. |

Guidelines on Utilizing Escrow Disclosure

After understanding the need to complete the Escrow Disclosure form, you can proceed by filling it out accurately. This document provides essential information about the escrow account associated with your mortgage loan, detailing payments and other relevant financial figures. Follow the steps below to ensure proper completion.

- Locate the form titled Initial Escrow Account Disclosure Statement (Form RD 3550-9).

- Fill in the Disclosure Date at the top of the form.

- Enter your Borrower Name and Address in the designated area.

- Provide the Lender's Name and Address as prompted.

- Insert the Loan Number next to the relevant label.

- Include the Telephone Number where you can be contacted.

- In the section detailing your mortgage payment for the coming year, fill in the total amount.

- Specify how much of this payment will be allocated for principal and interest.

- Indicate the portion that is intended for the escrow account.

- Enter the amount for your first monthly mortgage payment for the upcoming year.

- Again, break down this payment into principal and interest and the amount for the escrow account.

- Note any potential changes in principal and interest payments that could occur throughout the year.

- In the escrow account activity section, document the anticipated payments to and payments from the escrow account for each month.

- Calculate and enter the Starting Balance for your escrow account.

- Indicate the Cushion selected by servicer in the relevant box.

- Sign and date the form in the provided signature areas.

Keep this statement for future reference, as it allows you to compare the estimated activity with the actual transactions in your account at the end of the escrow accounting computation year.

What You Should Know About This Form

What is the Escrow Disclosure form?

The Escrow Disclosure form, specifically Form RD 3550-9, is a financial document provided by the United States Department of Agriculture (USDA) Rural Housing Service. It outlines the expected activity in your escrow account over the upcoming year, including how much of your monthly mortgage payment will be allocated to escrow. This ensures that borrowers understand what part of their payments will go towards property taxes, insurance, and other related expenses.

Why is receiving this form important?

This form is crucial because it helps you plan your finances by providing clarity on your monthly payment breakdown. Knowing how much will be set aside in escrow can aid in budgeting for other costs related to homeownership, allowing for a more informed financial decision-making process.

What does the term "escrow account" mean?

An escrow account is a special account where money is held on behalf of the borrower to cover specific expenses, such as property taxes and homeowners insurance. When these bills come due, the lender uses funds from this account to pay them on your behalf. This can prevent the burden of large lump-sum payments and helps ensure these essential expenses are paid on time.

What details are included in the Escrow Disclosure form?

The form includes your name, the lender's information, the loan number, and a breakdown of your monthly mortgage payment. It details how much of that payment will contribute to your principal and interest and how much will go into your escrow account. Additionally, it provides an estimate of what will be paid from the escrow account throughout the year and the starting balance.

How will my monthly payment change over the year?

Your initial monthly mortgage payment will likely change due to fluctuations in property taxes or insurance premiums. The form indicates that your payments may be adjusted based on the actual amounts due, meaning the lender might require higher payments in the future if costs rise.

What is the "cushion" mentioned in the form?

The cushion is an amount that lenders may keep in the escrow account as a safeguard against potential increases in property taxes or insurance costs. This cushion ensures there are sufficient funds to cover these expenses without the need for immediate additional payments from you, preventing unexpected financial strain.

Should I keep the Escrow Disclosure form?

Yes, it is important to retain this document for future reference. Keeping it will allow you to compare the estimated activity in your escrow account with the actual transactions at the end of the escrow accounting computation year. This can help ensure everything aligns with your expectations and identify any discrepancies.

What happens if there is a shortage in my escrow account?

If there is a shortage in your escrow account, the lender may require you to make up the difference through a one-time payment or by increasing your monthly payments. It is essential to stay informed about your account to avoid unexpected costs later on.

Can I get a refund if there is a surplus in my escrow account?

Yes, if there is a surplus in your escrow account at the end of the year, the lender is typically required to refund any excess amount back to you. This often occurs after the annual escrow analysis, which reviews the account's activity and balances out payments to ensure accuracy.

How long does it take to complete the Escrow Disclosure form?

Completing the Escrow Disclosure form typically takes around five minutes. This includes reviewing the instructions, gathering any necessary data, and finalizing the document. It is designed to be a straightforward process to ensure you receive the essential information effectively.

Common mistakes

Filling out the Escrow Disclosure form is a crucial step when securing a mortgage, yet many borrowers make common mistakes that can lead to confusion and complications down the line. One frequent error is providing incomplete or incorrect personal information. It may seem trivial, but details like the borrower’s name, address, and loan number must be accurate. Inaccuracies can delay processing and lead to issues with the mortgage itself.

Another mistake is neglecting to review the estimated payments. Borrowers often gloss over the section detailing monthly payments allocated to principal, interest, and escrow. Understanding these figures is vital. Misinterpreting or overlooking them can result in unexpected financial burdens, leaving borrowers unprepared for the costs ahead.

In addition, failing to acknowledge the potential changes in payment amounts is a significant oversight. The Escrow Disclosure form mentions that the loan terms may alter principal and interest payments. However, many individuals overlook this statement. Remaining aware of how these adjustments can affect overall payments is essential for effective financial planning.

Keeping the statement for comparison with actual escrow account activity is another commonly missed step. After signing the form, it’s easy to tuck it away and forget about it. However, this document is a valuable reference. It allows borrowers to track actual payments against anticipated ones, aiding in financial management and forecasting.

Borrowers also frequently misunderstand the significance of the cushion selected by the servicer. The cushion is an amount held in the escrow account for unforeseen expenses. Not grasping its importance can lead to financial shortfalls, particularly if unexpected bills arise. Knowing how much cushion is appropriate can prevent stress and anxiety later.

Signature errors are another common pitfall. It is imperative to complete all necessary signature fields and dates accurately. Any missing signature or incorrect date can hinder the processing of the loan, complicating the timeline and causing additional frustration.

Moreover, many borrowers ignore the instructions provided with the form. These instructions often contain critical information on how to fill out the form accurately and what to expect afterward. Skipping this step can lead to misunderstandings and errors that could have been easily avoided.

Lastly, waiting until the last minute to complete the form can create unnecessary pressure. Procrastination can lead to rushed decisions and errors. It’s wise for borrowers to take their time, review, and double-check the form before submission. By avoiding these mistakes, individuals can greatly enhance their chances of a smooth escrow account experience.

Documents used along the form

When engaging in real estate transactions, various forms and documents accompany the Escrow Disclosure form to ensure clarity and protection for all parties involved. Understanding these documents can help you navigate the process with confidence.

- Loan Estimate (LE): This document provides potential borrowers with a summary of key loan terms and estimated closing costs. It helps borrowers compare different loan offers and understand their financial commitments prior to finalizing the loan.

- Closing Disclosure (CD): The Closing Disclosure outlines the final terms of your loan and includes detailed information about the loan's costs. It is provided to borrowers at least three days before the closing meeting, enabling them to review all terms and ensure everything aligns with what they agreed upon.

- Purchase Agreement: This contract between the buyer and seller outlines the terms of the sale, including the purchase price, contingencies, and important dates. It serves as the foundation for the real estate transaction and is crucial for the escrow process.

- Title Report: The title report details the current ownership of the property and any claims or liens against it. This document is essential for ensuring that the seller has the right to sell the property and that it can be transferred without issues.

- Property Insurance Policy: This document provides evidence of insurance coverage for the property. Lenders typically require proof of insurance to safeguard against potential damages that could affect the property’s value and the loan's security.

- Escrow Agreement: This agreement outlines the roles and responsibilities of the escrow agent, as well as the conditions under which funds and documents will be exchanged. It ensures all parties understand the process and what is required to complete the transaction.

By familiarizing yourself with these documents, you can better prepare for the various stages of the real estate transaction. This understanding can foster a smoother experience and give you peace of mind as you navigate the steps ahead.

Similar forms

The Escrow Disclosure form serves an important role in informing borrowers about their escrow accounts in relation to their mortgage loans. Several other documents also share similar functions or purposes in the realm of mortgage and loan disclosures. Below are seven documents that are comparable to the Escrow Disclosure form, each highlighted for their unique aspects.

- Good Faith Estimate (GFE): The GFE provides borrowers with an estimate of the costs associated with a mortgage loan. Like the Escrow Disclosure, it is designed to enhance borrower awareness about potential financial obligations over time.

- Loan Estimate (LE): Following the Dodd-Frank Act, the LE has replaced the GFE for most loan applications. It contains similar details, including loan terms and projected costs, making it a crucial document in loan transactions.

- Closing Disclosure (CD): The CD outlines the final terms of the loan and all associated costs. It is akin to the Escrow Disclosure in that it aims to provide transparency to the borrower regarding financial responsibilities before closing the loan.

- Monthly Mortgage Statement: This statement informs the borrower of their mortgage payment details, including principal, interest, and escrow contributions. It serves as a continuation of the information provided in the Escrow Disclosure.

- Annual Escrow Account Disclosure Statement: Similar to the Escrow Disclosure, this annual document provides borrowers with a summary of the activity in their escrow account during the preceding year, ensuring continued transparency regarding funds.

- Private Mortgage Insurance Disclosure (PMI Disclosure): If applicable, this document informs borrowers about the cost of PMI and how it may affect their overall payment obligations. It parallels the Escrow Disclosure by focusing on additional monthly payments related to the loan.

- Truth in Lending Act (TILA) Disclosure: This disclosure provides essential information about loan terms and costs. It relates closely to the Escrow Disclosure in enhancing borrower understanding regarding the total cost of borrowing.

Dos and Don'ts

When filling out the Escrow Disclosure form, there are several important actions to consider. Below is a list of things you should and shouldn't do to ensure accurate completion.

- Do carefully review all instructions provided with the form.

- Do verify the accuracy of the information before submission.

- Do keep a copy of the completed form for your records.

- Do indicate all required amounts clearly and accurately.

- Don't rush through the process. Take your time to avoid mistakes.

- Don't leave any fields incomplete if they require a response.

Misconceptions

Here are some common misconceptions about the Escrow Disclosure form:

- It is only for new homeowners. Many believe the Escrow Disclosure is just for people buying a home. In reality, it applies to anyone with an escrow account, including current homeowners refinancing their loans.

- It guarantees that escrow payments will not change. Some think the initial disclosure means their payments will stay the same for the life of the loan. Changes in expenses can lead to adjustments, and the form provides only an estimate for the coming year.

- Escrow accounts are optional. While it may seem like homeowners can choose whether to have an escrow account, many lenders require it as part of the loan agreement to ensure property taxes and insurance are paid on time.

- Only property taxes go into escrow accounts. Many believe that escrow is solely for property taxes. However, escrow can also include homeowners insurance, mortgage insurance, and sometimes private assessments.

- All lenders use the same Escrow Disclosure form. People often assume that every lender must use the same format. Different lenders may have their own forms, although the information required is similar.

- Escrow accounts do not earn interest. There is a misconception that escrow accounts are non-interest-bearing. In fact, some states require interest to be paid to homeowners on their escrow balance.

- The escrow cushion is unnecessary. Some homeowners feel that having a cushion in the escrow account is not important. However, it helps cover any unexpected increases in costs, ensuring there are enough funds to cover payments.

- Once signed, the Escrow Disclosure is final. Finally, some believe that signing the form locks in the amounts forever. Adjustments can occur, and homeowners receive annual statements summarizing the escrow activity.

Key takeaways

Filling out and using the Escrow Disclosure form is an important step in managing your mortgage. Here are key takeaways to keep in mind:

- Understand the Structure: The form outlines your expected mortgage payments, detailing how much will be allocated to principal, interest, and your escrow account.

- Keep for Reference: Retain this statement for your records. It allows you to compare estimated escrow account activity with actual figures at the end of the year.

- Review Changes: Be aware that the terms of your loan may lead to changes in principal and interest payments, affecting overall payment amounts.

- Monthly Breakdown: The form includes a month-by-month summary of anticipated payments into and out of your escrow account, which aids in budgeting.

- Cushion Information: The escrow account may include a cushion. This extra amount is set aside to cover possible fluctuations and should be understood as part of your overall payment strategy.

Browse Other Templates

California Contractors License Bond - It establishes a legal framework for contractor accountability.

What Is Trophon Used for - Regular check-ups can help maintain device functionality.