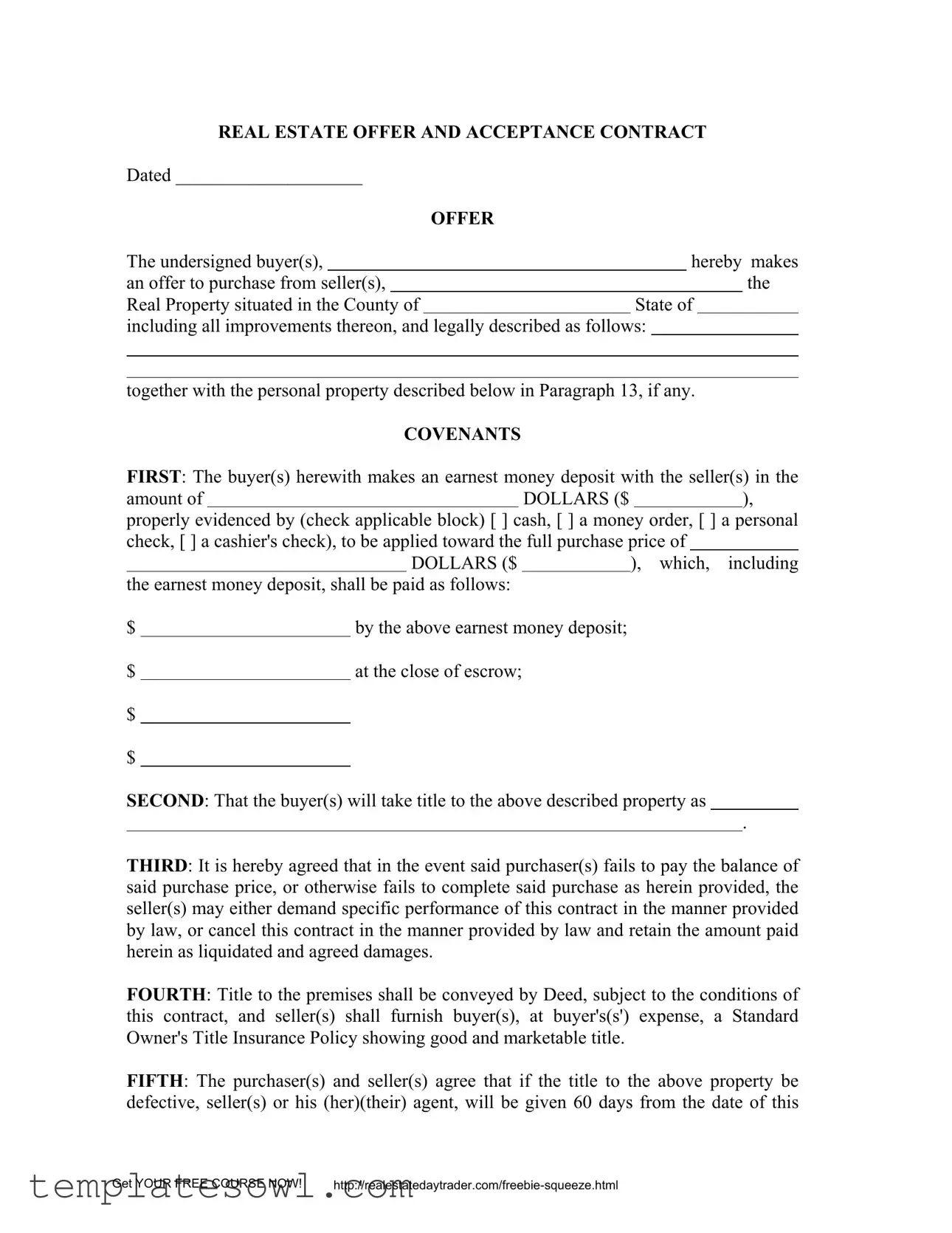

Fill Out Your Estate Acceptance Form

The Estate Acceptance form is a crucial document that facilitates real estate transactions between buyers and sellers by formalizing their agreement. It starts with the buyer's offer to purchase property, specifying the location and details of the real estate involved. An earnest money deposit is included, demonstrating the buyer's commitment, and the amount is typically indicated, along with acceptable methods of payment. The form outlines the terms of the purchase, including the breakdown of payment obligations and conditions for title transfer. Additionally, it contains provisions for addressing potential title defects and sets timelines for corrections or refunds, ensuring legal protection for both parties. Key elements such as inspection rights, escrow arrangements, and conditions for contract enforceability are also addressed. By establishing clear deadlines for acceptance and closing, the Estate Acceptance form provides a framework that helps manage expectations and responsibilities, ultimately aiding in a smooth transaction process.

Estate Acceptance Example

REAL ESTATE OFFER AND ACCEPTANCE CONTRACT

Dated ____________________ |

|

|

|

|

|

||

|

|

|

OFFER |

||||

The undersigned buyer(s), |

|

|

|

hereby makes |

|||

an offer to purchase from seller(s), |

|

|

|

|

|

the |

|

Real Property situated in the County of |

|

State of |

|

||||

including all improvements thereon, and legally described as follows:

together with the personal property described below in Paragraph 13, if any.

COVENANTS

FIRST: The buyer(s) herewith makes an earnest money deposit with the seller(s) in the

amount ofDOLLARS ($ ),

properly evidenced by (check applicable block) [ ] cash, [ ] a money order, [ ] a personal check, [ ] a cashier's check), to be applied toward the full purchase price of

|

|

|

DOLLARS ($ |

|

), which, including |

the earnest money deposit, shall be paid as follows: |

|

||||

$ |

|

by the above earnest money deposit; |

|

||

$ |

|

at the close of escrow; |

|

||

$ |

|

|

|

|

|

$ |

|

|

|

|

|

SECOND: That the buyer(s) will take title to the above described property as

.

THIRD: It is hereby agreed that in the event said purchaser(s) fails to pay the balance of said purchase price, or otherwise fails to complete said purchase as herein provided, the seller(s) may either demand specific performance of this contract in the manner provided by law, or cancel this contract in the manner provided by law and retain the amount paid herein as liquidated and agreed damages.

FOURTH: Title to the premises shall be conveyed by Deed, subject to the conditions of this contract, and seller(s) shall furnish buyer(s), at buyer's(s') expense, a Standard Owner's Title Insurance Policy showing good and marketable title.

FIFTH: The purchaser(s) and seller(s) agree that if the title to the above property be defective, seller(s) or his (her)(their) agent, will be given 60 days from the date of this

Get YOUR FREE COURSE NOW! |

contract to perfect the same. If said title cannot be perfected within said time limit, the earnest money deposit herein receipted shall, upon the demand of the purchaser(s), be returned to the purchaser(s) and this contract cancelled. Purchaser(s) may, however, elect to accept title to said premises subject to any defects which are not so cured.

SIXTH: It is understood and agreed that the buyer(s) is(are) of legal age and that said

property has been inspected by the buyer(s) or the buyer's(s') duly authorized agent: that the same is, and has been, purchased by the buyer(s) as the result of said inspection and not upon any representation made by the seller(s), or any selling agent, or any agent for the seller(s), and the buyer(s) hereby expressly waives any and all claims for damages occasioned by any representation made by any person whomsoever other than as contained in this agreement, and the seller(s) or his(her)(their) agent shall not be responsible or liable for any inducement, promise, representation, agreement, condition or stipulation not specifically set forth herein.

SEVENTH: This contract shall become binding only when executed by the purchaser(s) and by the seller(s), and shall be in force and effect from that date of such execution.

EIGHTH: Time is declared to be the essence of this contract.

NINTH: Upon the seller's(s') acceptance of this contract, the earnest money deposit shall be deposited with an Escrow Agent simultaneously with the execution of the Escrow Instructions to fulfill the terms of this contract. The execution of the Escrow Instructions shall not exceed a period of 10 days from the date of acceptance by the parties. Said Escrow Instructions shall not conflict with the terms and conditions hereof, and shall be prepared upon said Escrow Agent's ordinary form.

TENTH: The seller(s) agrees to deliver, or cause to be delivered to Escrow Agent, all instruments necessary and required to carry out and complete the terms of this contract.

ELEVENTH: The proration of Taxes, Insurance, Rents, Assessments, etc. shall be at the close of Escrow, unless otherwise agreed upon as follows:

TWELFTH: Closing of Escrow shall be on or before |

|

, 20 |

,subject to any extensions set forth in the Escrow Instructions and the cancellation provisions thereof, with possession of the premises to be delivered to

buyer(s) on or before |

|

, 20 |

|

. |

THIRTEENTH: The following personal property is included with the premises

FOURTEENTH: The seller(s) acceptance of this contract must be made on or before

,20 , otherwise the buyer's(s') offer is withdrawn and

voided, unless the buyer(s) agrees in writing to extend such acceptance date.

Get YOUR FREE COURSE NOW! |

FIFTEENTH: (Other)

IN WITNESS WHEREOF, the buyer(s) executes this Contractual Offer to purchase the above described property on the terms and conditions herein stated, and acknowledges receipt of a copy of this contract and the attached addendum, if any.

Buyer |

|

Buyer |

|

|

|

|

|

Address |

|

Address |

|

|

|

|

|

City/State/Zip |

|

|

City/State/Zip |

|

ACCEPTANCE |

||

|

(When Not Using a Broker) |

||

The undersigned seller(s) accepts the offer of the above named buyer(s) to purchase the premises herein described and agrees to sell the same to said buyer(s) upon the aforesaid terms and conditions.

Seller

Address

City/State/Zip

Get YOUR FREE COURSE NOW! |

Form Characteristics

| Fact Name | Description |

|---|---|

| Purpose of the Form | The Estate Acceptance form serves to establish a legally binding agreement between buyers and sellers regarding the sale of real estate property. |

| Earnest Money | This agreement requires buyers to make an earnest money deposit, which indicates serious intent to purchase. This deposit is applied toward the overall purchase price. |

| Title Transfer | The seller is responsible for providing a Standard Owner's Title Insurance Policy, ensuring that the title is good and marketable before the transfer of ownership. |

| Contract Binding | The contract becomes binding only when signed by both the buyer(s) and the seller(s), underscoring the importance of mutual consent in real estate transactions. |

| Defective Title Resolution | If a defect in title is found, the seller has 60 days to remedy the issue. Buyers can withdraw from the contract and receive their earnest money back if the issue remains unresolved. |

Guidelines on Utilizing Estate Acceptance

Once you have gathered all necessary information, you can proceed to complete the Estate Acceptance form. It is crucial to ensure that every section is filled out accurately to avoid any potential disputes or misunderstandings later on in the process.

- Fill in the date at the top of the form, where indicated.

- Provide the names of the buyer(s) making the offer.

- Detail the property being purchased, including the location and the legal description.

- Indicate the earnest money deposit amount and the type of payment (cash, money order, personal check, or cashier's check).

- Outline how the remaining purchase price will be paid, including amounts and timelines.

- Specify how the title to the property will be taken by the buyer(s).

- Understand and acknowledge the conditions regarding defective titles as outlined in the form.

- Confirm that the buyer(s) are of legal age and that they have inspected the property.

- Sign and date the form where indicated, ensuring all buyer(s) provide their signatures.

- Provide the seller(s) with the completed form for acceptance, including their names and contact information.

- The seller(s) will then indicate acceptance by signing and dating the form.

- Ensure all parties receive a copy of the fully executed contract for their records.

What You Should Know About This Form

What is the purpose of the Estate Acceptance form?

The Estate Acceptance form serves as a legally binding agreement between a buyer and a seller for the purchase of real property. This document outlines the terms of the offer, including the purchase price, payment methods, and relevant contingencies related to the sale.

How does the earnest money deposit work?

The earnest money deposit is a sum of money offered by the buyer to demonstrate their serious intent to purchase the property. It is typically a small percentage of the total price and is held by the seller or an escrow agent. This deposit can be applied toward the purchase price at closing but may be forfeited if the buyer fails to follow through with the purchase without a valid reason.

What happens if the buyer fails to complete the purchase?

If the buyer fails to pay the balance of the purchase price or does not complete the purchase for any reason, the seller has options. The seller can either seek specific performance, meaning they can compel the buyer to go through with the purchase, or they can cancel the contract and retain the earnest money deposit as agreed damages.

What assurances does the buyer receive regarding the title of the property?

The seller agrees to provide a Standard Owner's Title Insurance Policy which demonstrates that the title to the property is clear. If there are any defects or issues with the title, the seller has 60 days to fix these problems. If they fail to do so, the buyer can choose to either receive their earnest money back or take the property with the existing defects.

Can a buyer waive their right to claims based on representations made during the sale?

Yes. The buyer explicitly waives any claims for damages based on representations made by the seller, their agents, or anyone else during the sale process, unless those claims are clearly stated in the contract. This means the buyer is taking responsibility to ensure the property meets their expectations through their own inspections.

When does the contract become effective?

The contract becomes binding once it has been signed by both the buyer and the seller. Until both parties have executed the document, there is no obligation on either side to proceed with the transactions outlined in the form.

What are the timing requirements associated with this contract?

Time is considered crucial in this agreement. The earnest money must be deposited within ten days of the seller's acceptance of the contract. Additionally, the closing of escrow must occur by a specific date mentioned in the contract, unless both parties agree to an extension.

How are the various costs like taxes and insurance handled?

Costs such as taxes, insurance, rents, and other assessments will be prorated at the time of closing unless the parties agree otherwise. This means that the seller and buyer will share these costs based on how long each party has ownership during the relevant time period.

What must the seller do after accepting the offer?

Once the seller accepts the offer, they are required to deliver all necessary documents to an escrow agent to finalize the transaction. This may include the deed and other relevant instruments to ensure the terms of the contract are completed properly.

Common mistakes

When completing the Estate Acceptance form, individuals often overlook various critical details. One common mistake is leaving the purchase price blank. This section is essential, as it fully communicates the terms of the offer and must specify the total amount being proposed. Without this, the contract may be seen as incomplete and may not hold up in negotiations or legal scrutiny.

Another frequent error is failing to accurately fill in the earnest money deposit amount. This amount represents the buyer's good faith commitment to purchase. If it’s too low or incorrectly listed, it can lead to misunderstandings or even the rejection of the offer. Ensuring this amount matches what was discussed is key.

Buyers sometimes neglect to provide a clear manner of taking title to the property. This section determines how ownership will be held, whether individually or jointly. Missing or vague information can lead to complications in ownership rights later on.

Inaccurate property descriptions also pose a challenge. Buyers often skip confirming that the legal description of the property is correct. This can create significant issues in the transfer of title or disputes over property boundaries.

Another mistake involves the acceptance dates. Both buyers and sellers must clearly state the date by which acceptance must occur. If this is left blank or incorrectly dated, it may lead to confusion over the offer's validity.

Buyers also tend to overlook the inspection clause. They may fail to indicate whether the property has been inspected, or they may not include any contingencies. This waiver of inspection rights can lead to future disputes regarding property conditions.

Often, the section outlining personal property included in the sale is neglected. This could lead to misunderstandings about what is part of the purchase. Any items that are to be included need to be explicitly listed to avoid conflict later on.

Finally, ensure that both parties sign and date the form properly. Without signatures, the contract holds no legal weight. A missing signature can invalidate the entire agreement, rendering months of negotiation useless.

Documents used along the form

The Estate Acceptance form is commonly accompanied by several other important documents that facilitate the real estate transaction process. These documents help ensure clarity, legality, and smooth progression between parties involved. Here is a list of ten frequently used forms and documents that accompany the Estate Acceptance form.

- Purchase Agreement: This is a legally binding contract outlining the terms of sale, including purchase price, contingencies, and any conditions to finalize the sale.

- Earnest Money Deposit Receipt: This receipt confirms the buyer’s earnest money deposit, assuring the seller of the buyer's commitment to proceed with the purchase.

- Escrow Instructions: These directives provide detailed guidance to the escrow agent on how to handle the transaction process, including when to release funds and documents.

- Disclosure Statements: Sellers usually provide these to inform potential buyers about any known issues or defects regarding the property, ensuring transparency.

- Title Insurance Policy: This document protects the buyer and lender from any claims against the property after the purchase is completed, ensuring clear ownership.

- Deed of Trust: This is a security instrument used to secure the loan on the property, establishing the lender's interest in case of default by the borrower.

- Closing Statement: This statement summarizes all financial aspects of the transaction, including fees, deposits, and the final amount to be paid at closing.

- Repair Addendum: If repairs are needed on the property, this document outlines the agreed-upon conditions regarding those repairs before closing the deal.

- Property Listing Agreement: This is an agreement between the seller and the real estate agent, detailing the terms under which the agent will market the property for sale.

- Final Walkthrough Checklist: This checklist helps the buyer ensure that the property is in the expected condition before officially closing the sale.

Understanding these documents is essential for both buyers and sellers. They play a crucial role in protecting the interests of all parties and ensuring a smooth transaction. Clarity regarding these forms helps mitigate disputes and fosters successful real estate dealings.

Similar forms

-

Purchase Agreement: Like the Estate Acceptance form, a purchase agreement outlines the terms under which a buyer agrees to purchase real estate. Both documents require a clear expression of the offer and acceptance, along with specified conditions and terms of sale.

-

Letter of Intent: A letter of intent expresses the intention of a buyer to make an offer. Similar to the Estate Acceptance form, it outlines the basic terms and serves as a precursor to a formal contract, although it may not be legally binding.

-

Lease Agreement: This document details the terms of renting property, including rental amounts and conditions of occupancy. The structure of negotiation in a lease can mirror that of the Estate Acceptance form, incorporating elements like earnest money and responsibilities of parties.

-

Option to Purchase Agreement: This gives a potential buyer an option to purchase the property at a specified price within a certain timeframe. Similar to the Estate Acceptance form, it establishes conditions and terms relevant to the potential sale.

-

Sales Contract: A sales contract is often used in real estate transactions, detailing the rights and obligations of both parties. The contract must include all essential terms, akin to those found in the Estate Acceptance form.

-

Real Estate Listing Agreement: This agreement between a seller and a real estate agent lays out the terms under which the agent will act on behalf of the seller. The Estate Acceptance form similarly sets forth specific terms regarding the sale of real estate.

-

Escrow Agreement: This document outlines the terms under which an escrow agent will hold funds during a transaction. Like the Estate Acceptance form, it requires detailed instructions that must be followed for transactions to proceed smoothly.

-

Deed: The deed is the legal document that conveys property title from seller to buyer. While primarily focused on the transfer of ownership, it is tied to the terms arising from the Estate Acceptance form regarding the completion of a sale.

-

Title Search Report: This document provides information about the property’s title and any liens. Similar to the Estate Acceptance form, it plays a crucial role in ensuring that the terms related to title clearance are met before completion of the sale.

-

Disclosure Statement: This form provides essential information about the property’s condition and potential issues. It complements the Estate Acceptance form by ensuring that parties disclose pertinent facts before finalizing the sale.

Dos and Don'ts

When filling out the Estate Acceptance form, attention to detail is crucial. Here’s a straightforward guide outlining what to do and what to avoid.

- Do: Read the entire form thoroughly before filling it out. Understanding every section is essential.

- Do: Provide accurate and complete information. Ensure that your names, addresses, and the property details are correct.

- Do: Include a clearly defined earnest money deposit. Specify the amount and method of payment clearly.

- Do: Double-check the dates mentioned in the form. Incorrect dates can lead to misunderstandings.

- Don't: Leave any blanks unless indicated. Every section needs to be addressed to avoid delays.

- Don't: Misrepresent your financial situation. Full honesty will help avoid issues later in the process.

- Don't: Sign without consulting a trusted advisor or attorney. Guidance can prevent costly mistakes.

- Don't: Rush through the process. Taking your time will ensure accuracy and reduce future complications.

By following these guidelines, you position yourself for a smoother real estate transaction. Remember, a well-filled form lays the foundation for a successful agreement.

Misconceptions

When dealing with the Estate Acceptance form, several misconceptions can lead to confusion. It's crucial to clarify these points so that all parties involved understand their rights and obligations clearly.

- It's only a preliminary document. Many believe the Estate Acceptance form serves only as a preliminary agreement. In reality, it is a binding contract once both buyer and seller sign it.

- Earnest money guarantees the sale. Some think that providing an earnest money deposit guarantees the sale. However, this deposit is actually a show of good faith and does not automatically ensure that the transaction will proceed.

- The seller can take their time to respond. A common error is assuming the seller has unlimited time to accept the offer. The seller must accept within the specified time frame, or the buyer's offer may be considered void.

- Buyers can demand changes after acceptance. Once the seller accepts the offer, it's assumed that all terms are agreed upon. Buyers cannot unilaterally change the terms of the contract without the seller's consent.

- Title insurance is optional. Some believe that obtaining title insurance is optional in the transaction. However, the seller is typically obligated to provide a Standard Owner's Title Insurance Policy as part of the deal.

- The buyer can back out at any point. A misconception exists that buyers can back out of the agreement simply by changing their minds. While there may be provisions for this, buyers often have limited grounds for withdrawing after signing the contract.

- All communications must be formal. Lastly, there is a belief that all communications regarding the contract must be formal. While written documentation is crucial, questions or discussions can often occur informally to clarify terms before any formal actions are taken.

Understanding these misconceptions helps facilitate smoother transactions and better communication between buyers and sellers.

Key takeaways

Here are five key takeaways about filling out and using the Estate Acceptance form:

- Understand the Offer: The buyer makes an offer including an earnest money deposit, which is an amount paid upfront to demonstrate commitment to the purchase.

- Title Information: Buyers must specify how they will take title to the property. This could affect ownership rights and future transactions.

- Inspection Acknowledgment: Buyers should conduct an inspection of the property and acknowledge that they are purchasing it based on their findings, not any representations made by the seller.

- Time Constraints: The contract includes strict timelines for acceptance and execution, emphasizing the importance of adhering to these deadlines.

- Closing Process: The contract outlines the closing procedures, including what is required from both the seller and buyer to finalize the sale.

Browse Other Templates

How to Get Your Transcript - Keep in mind that student records are confidential and require your authorization.

How to Write a Contract for Rental Property - Tenants should keep copies of all correspondence regarding the lease.

What Do You Need to Change Your Address at the Dmv - It can be completed online or sent by mail to the DMV.