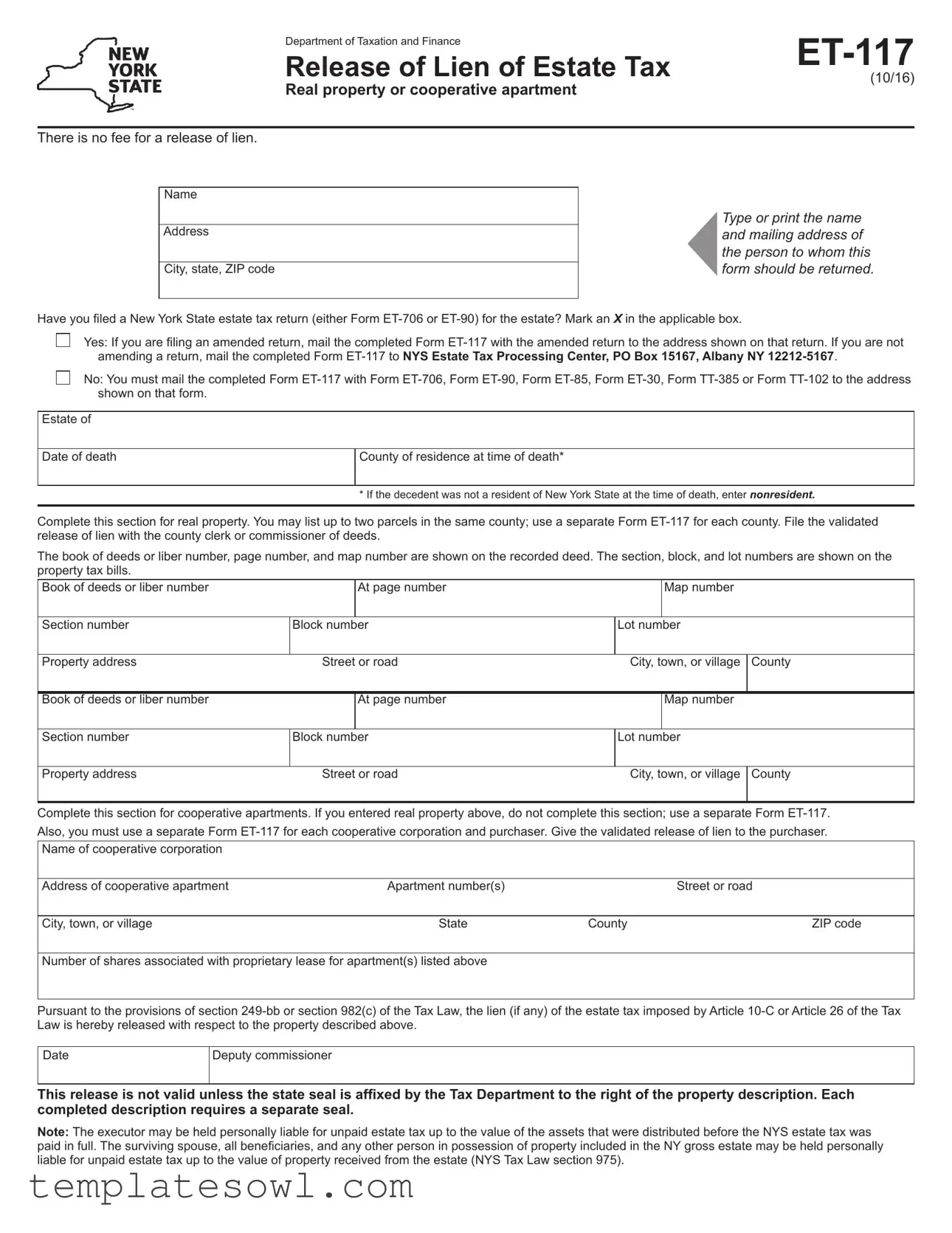

Fill Out Your Et 117 Form

The ET-117 form is an important document issued by the Department of Taxation and Finance for the purpose of releasing a lien associated with estate taxes on real property or cooperative apartments in New York State. This form is required when an estate tax return has been filed, either the ET-706 or the ET-90. Importantly, there is no fee associated with obtaining a release of lien. When completing the form, essential details must be provided, such as the name and address of the person to whom the completed form should be returned, along with information about the estate, including its date of death and county of residence. The form also contains sections for listing details about the properties involved, whether they are parcels of real estate or shares in cooperative apartments. For those dealing with multiple properties, it's necessary to file separate ET-117 forms for each county. Executors must take care, as they could be held personally liable for any unpaid estate taxes associated with the assets distributed prior to full payment. Ultimately, the processing of the ET-117 form serves to clarify tax obligations and facilitate the smooth transfer of property ownership.

Et 117 Example

Department of Taxation and Finance |

||

Release of Lien of Estate Tax |

||

(10/16) |

||

|

Real property or cooperative apartment

There is no fee for a release of lien.

Name

Address

City, state, ZIP code

Type or print the name and mailing address of the person to whom this form should be returned.

Have you iled a New York State estate tax return (either Form

Yes: If you are iling an amended return, mail the completed Form

No: You must mail the completed Form

Estate of

Date of death

County of residence at time of death*

* If the decedent was not a resident of New York State at the time of death, enter NONRESIDENT.

Complete this section for real property. You may list up to two parcels in the same county; use a separate Form

The book of deeds or liber number, page number, and map number are shown on the recorded deed. The section, block, and lot numbers are shown on the property tax bills.

Book of deeds or liber number |

|

At page number |

|

Map number |

|

|

|

|

|

|

|

Section number |

Block number |

Lot number |

|

||

|

|

|

|

|

|

Property address |

Street or road |

City, town, or village |

County |

||

|

|

|

|

|

|

Book of deeds or liber number |

|

At page number |

|

Map number |

|

|

|

|

|

|

|

Section number |

Block number |

Lot number |

|

||

|

|

|

|

||

Property address |

Street or road |

City, town, or village |

County |

||

|

|

|

|

|

|

Complete this section for cooperative apartments. If you entered real property above, do not complete this section; use a separate Form

Name of cooperative corporation

Address of cooperative apartment |

Apartment number(s) |

|

Street or road |

|

|

|

|

City, town, or village |

State |

County |

ZIP code |

|

|

|

|

Number of shares associated with proprietary lease for apartment(s) listed above |

|

|

|

Pursuant to the provisions of section

Date

Deputy commissioner

This release is not valid unless the state seal is afixed by the Tax Department to the right of the property description. Each completed description requires a separate seal.

Note: The executor may be held personally liable for unpaid estate tax up to the value of the assets that were distributed before the NYS estate tax was paid in full. The surviving spouse, all beneiciaries, and any other person in possession of property included in the NY gross estate may be held personally

liable for unpaid estate tax up to the value of property received from the estate (NYS Tax Law section 975).

Form Characteristics

| Fact Name | Details |

|---|---|

| Form Title | ET-117 Release of Lien of Estate Tax |

| Governing Department | New York State Department of Taxation and Finance |

| Form Purpose | This form releases the lien of estate tax on real property or cooperative apartments. |

| No Fee | There is no fee associated with the release of lien. |

| Filing Requirements | If you’re not amending a return, submit Form ET-117 to the NYS Estate Tax Processing Center. |

| Estate Tax Returns | You must have filed a New York State estate tax return (Form ET-706 or ET-90) to use this form. |

| Property Listings | Up to two parcels can be listed on one form, but separate forms are required per county. |

| Cooperative Apartments | A separate Form ET-117 must be used for each cooperative corporation and purchaser. |

| Executor Liability | The executor may be personally liable for unpaid estate taxes if assets were distributed before payment. |

Guidelines on Utilizing Et 117

Filling out Form ET-117 is a necessary step for the release of any estate tax lien related to real property or cooperative apartments. Once you complete the form, ensure you send it to the appropriate address based on your situation. Follow the steps carefully to avoid any delays in processing your request.

- Begin by entering the name of the person whom the form should be returned to in the designated area.

- Fill in the address, including city, state, and ZIP code for the person receiving the form.

- Indicate whether you have filed a New York State estate tax return by marking an X in the appropriate box. Select "Yes" if you have filed Form ET-706 or ET-90, or "No" if not.

- If "Yes" is selected and you are filing an amended return, prepare to mail the completed Form ET-117 along with the amended return to the address shown on the return.

- If "No" is selected, gather the required forms (ET-706, ET-90, ET-85, ET-30, TT-385, or TT-102) and ensure Form ET-117 is submitted together with one of those forms.

- Provide details related to the estate, including the date of death and the county of residence at the time of death. If the decedent was a non-resident, indicate "NONRESIDENT."

- For real property, complete the relevant sections including book of deeds or liber number, page number, map number, section, block, and lot number. Include the property address as well.

- If applicable, fill out the section for cooperative apartments. Provide the name of the cooperative corporation, address of the apartment, and apartment number(s).

- Provide information about the number of shares associated with the proprietary lease for the apartments listed.

- Sign and date the form at the end, ensuring that it includes a validation seal from the Tax Department by the deputy commissioner.

After completing Form ET-117, review it for accuracy before mailing. Keep copies of all submitted documents for your records. Timely submission will help ensure a smoother process in obtaining your release of lien.

What You Should Know About This Form

What is the ET-117 form?

The ET-117 form, known as the Release of Lien of Estate Tax, is a document used in New York State to release any lien that may have been placed on real property or cooperative apartments due to unpaid estate taxes. This release indicates that any estate tax obligations associated with the designated property have been satisfied.

Who needs to complete the ET-117 form?

The ET-117 form should be completed by the executor of the estate or an authorized representative. It is necessary if there has been a New York State estate tax return filed for the estate. This includes situations where an estate tax return needs to be amended. If there are properties or cooperative apartments tied to an estate, this form becomes important for ensuring that liens are cleared from those holdings.

Is there a fee associated with filing the ET-117 form?

No, there is no fee required for filing the ET-117 form. This can provide relief to those managing the estate by avoiding additional costs during an already complex process.

What documents must be submitted along with the ET-117 form?

If you have filed a New York State estate tax return, the ET-117 can be mailed alone or alongside an amended return. If you have not filed a return, you must send the completed ET-117 form along with other estate tax forms, such as Form ET-706, Form ET-90, Form ET-85, Form ET-30, Form TT-385, or Form TT-102.

What information is required about the deceased?

The form requires certain details about the deceased, including the date of death and the county of residence at the time of death. If the decedent was not a resident of New York State, you should indicate "NONRESIDENT."

How many properties can be listed on one ET-117 form?

You may list up to two parcels of real property in the same county on a single ET-117 form. If you have properties in different counties, you need to complete separate forms for each county to ensure accurate processing.

What should I do with the validated release of lien?

Once you receive the validated release of lien, it is essential to file it with the county clerk or commissioner of deeds. This will officialize the release in public records, ensuring that there are no lingering legal claims against the property or cooperative apartment.

What if the property is a cooperative apartment?

If the property in question is a cooperative apartment, you will need to fill out the appropriate sections specific to this type of property. Remember to use a separate ET-117 form for each cooperative corporation and its associated properties. The validated release of lien must be provided to the purchaser of the cooperative apartment.

What are the consequences of not paying estate tax?

If estate taxes are not paid in full, the executor may be held personally liable for any unpaid amounts, up to the value of the assets distributed. Additionally, surviving spouses, beneficiaries, and anyone in possession of property included in the gross estate may also be held personally liable for any unpaid estate tax. It is important to keep this in mind while managing estate transactions.

Common mistakes

When filling out the ET-117 form, one common mistake is forgetting to indicate whether a New York State estate tax return has been filed. This section requires a clear answer marked with an "X" in the applicable box. Skipping this step may lead to delays in processing your request.

Another frequent error involves incomplete or incorrect personal information. It is crucial to provide the full name and mailing address where the completed form should be sent. Failing to ensure that this information is accurate can result in significant setbacks, as important documents may be misrouted or delayed.

Many individuals also mistakenly attempt to list more than one parcel of real property or cooperative apartment without using separate forms. The ET-117 form only allows for the listing of up to two parcels in the same county. To comply with the requirements, it is essential to utilize a separate form for each additional parcel or county.

Additionally, some people do not verify the completeness of property description information. All sections related to property must be filled out accurately. This includes the book of deeds, page number, and lot number among others. Inaccuracies in this section can cause complications in releasing the lien.

Finally, individuals may overlook the need for the state seal. The release is invalid without this crucial detail affixed by the Tax Department. Remember that each completed property description requires a separate seal. Failing to secure this can invalidate the entire form and create further obstacles in the process.

Documents used along the form

When dealing with estate tax matters in New York, the ET-117 Release of Lien of Estate Tax form is just one of several important documents. Each document plays a crucial role in ensuring compliance and clarity in the estate settlement process. Below is a list of additional forms and documents that are commonly used alongside the ET-117 to facilitate the proper handling of estate taxes.

- Form ET-706: This is the New York State Estate Tax Return. Executors of estates are required to file this form if the estate meets certain value thresholds, detailing the estate's assets and liabilities.

- Form ET-90: Used for small estates, this form serves as a simplified Estate Tax Return for estates with a lesser value, allowing for easier processing.

- Form ET-85: This form is utilized to request a determination of the New York State estate tax liability, providing clarity on what the tax obligation will be before the estate is settled.

- Form ET-30: Designed for voluntary disclosures, this form allows executors to report any previously unreported estate tax liabilities to the state, often leading to reduced penalties.

- Form TT-385: This is a transfer tax return, which is filed for transfers of property from the decedent's estate, ensuring any applicable transfer taxes are properly addressed.

- Form TT-102: Similar to the TT-385, this form is another type of transfer tax return that is specifically used for documenting and paying the relevant taxes associated with property transfers.

- Validated Release of Lien: After filing the ET-117, this document must be filed with the county clerk to officially release any liens placed on the estate's property due to unpaid estate taxes.

- Deed of Distribution: This is a legal document to transfer ownership of specific assets or property from the estate to the heirs or beneficiaries, ensuring that the estate is settled according to the decedent’s wishes.

In conclusion, understanding the variety of forms used in conjunction with the ET-117 can significantly simplify the estate administration process. By carefully completing and submitting these documents, executors can ensure compliance with state laws and facilitate a smoother transition of assets to beneficiaries. Each form serves a unique purpose, reflecting the diverse aspects of estate management and taxation in New York State.

Similar forms

- ET-706: New York State Estate Tax Return - This form is filed by the executor of an estate to report and pay the estate tax imposed on the decedent's estate. Like the ET-117, it deals with estate tax but is primarily used to assess the tax due rather than to release a lien.

- ET-90: New York State Estate Tax Return for Non-Residents - Similar to the ET-706, this form is specifically for non-residents of New York who need to file an estate tax return. The ET-117 is needed for later processing when a lien is released after tax obligations are satisfied.

- ET-85: Extension to File New York State Estate Tax Return - This document allows an executor additional time to file the estate tax return. Once the taxes are settled, the ET-117 may be filed to release any existing lien from the estate.

- ET-30: New York State Estate Tax Amendment - This form is utilized when an amended return is necessary. Similar to the ET-117, it requires careful attention to the estate’s tax obligations before a lien can be released.

- TT-385: New York State Tax Clearance Request for Estate Transfer - This request is made to ensure all taxes are cleared before an estate is transferred. The ET-117 is used afterward to release any associated liens once the tax matters are resolved.

- TT-102: Tax Clearance Application - Used to verify that all taxes owed on an estate have been paid. The ET-117 follows this process by allowing a release of lien when taxes are confirmed paid.

- Form RP-5217: Real Property Transfer Report - This form must be filed when real property is transferred. Similar to the ET-117, it addresses property transactions but involves more comprehensive reporting about the property itself.

- Form C-700: Application for a Certificate of Status - This application is for obtaining proof that a taxpayer is compliant with tax laws. Once obligations are met, the ET-117 may be filed to show the release of any associated liens on the estate.

Dos and Don'ts

When completing the ET-117 form for the release of lien of estate tax, there are important guidelines to follow. Here’s a list of things you should and shouldn’t do:

- Do provide accurate information regarding the decedent’s details, including the estate name and date of death.

- Do ensure you have filed a New York State estate tax return (either Form ET-706 or ET-90) before submitting the ET-117 form.

- Do mail the completed Form ET-117 to the appropriate address, depending on whether you are filing an amended return or not.

- Do fill out the real property section correctly, including parcel details if applicable.

- Do submit a separate ET-117 for each cooperative apartment or each county where real property is located.

- Don't leave any sections of the form blank; complete every required field to avoid delays.

- Don't forget to obtain the validated release of lien before the state seal is affixed to the form.

Following these guidelines will help ensure a smooth process in obtaining the release of lien for estate tax matters.

Misconceptions

Understanding the ET-117 form can be challenging. Here are nine common misconceptions about this form, along with clarifications.

- There is a fee for submitting the ET-117 form. Many people believe that a fee applies. In reality, there is no fee for the release of lien associated with this form.

- The ET-117 form can only be filed once. Some individuals think the form can only be used once per estate. In fact, multiple forms can be filed, especially when dealing with different properties in separate counties.

- You can file the ET-117 without an estate tax return. It is a misconception that the ET-117 can be submitted without filing the relevant estate tax return first. If you have not filed either Form ET-706 or ET-90, you must submit the ET-117 along with those forms.

- The form is only for real property. While the form does relate to real property or a cooperative apartment, many think it can only be used for one type. The ET-117 can address both scenarios.

- The release of lien is automatically valid once submitted. Some may assume that simply submitting the form will instantly validate it. However, a state seal must be affixed for the release to be considered valid.

- The executor is not liable for unpaid estate tax. It is commonly misunderstood that the executor is shielded from liability. Executors may be held personally liable for unpaid estate taxes if distributions were made before all taxes were satisfied.

- Every beneficiary is exempt from tax liability. Some beneficiaries believe they hold no accountability for unpaid estate taxes. In reality, beneficiaries can be liable for unpaid taxes up to the value of the property they received from the estate.

- You do not need to specify parcel details when filing. There is a misconception that specific parcel information is optional. Detailed property information is crucial for the processing of the ET-117 form.

- Only one signature is required for multiple properties. Some may think a single signature suffices when multiple properties are involved. Each property requires a separate description and seal on its corresponding ET-117 form.

Clarifying these misconceptions can help individuals navigate the process associated with the ET-117 form more effectively.

Key takeaways

Here are key takeaways regarding the completion and use of the ET-117 form:

- No fee is required for filing the ET-117 form to release a lien on estate tax.

- Check the applicable box on whether a New York State estate tax return has been filed. If filing an amended return, send the ET-117 with the amended return.

- For estates not filing an amended return, submit the ET-117 directly to the NYS Estate Tax Processing Center.

- Each county requires a separate ET-117 for real property; list up to two parcels on the form for the same county.

- Cooperative apartments also need a separate ET-117. Each cooperative corporation and purchaser requires its own form.

Ensure all necessary details are filled accurately to avoid delays in processing.

Browse Other Templates

Txdmv Forms - The application must be signed and dated by the applicant before submission.

Combat Fitness Evaluation Sheet,Army Physical Readiness Test Scorecard,ACFT Performance Record,Soldier Fitness Assessment Form,Military Fitness Assessment Sheet,Army Endurance and Strength Evaluation,Soldier Performance Metrics Form,Physical Fitness - This form must be signed by a supervising officer for validation.