Fill Out Your Evidence Of Insurance Form

When it comes to securing life insurance coverage, the Evidence of Insurance form plays a critical role in the process. This form requires careful completion by both employers and employees to ensure the proper information is gathered for insurance requests. Employers begin by providing their details—like name, policy number, and contact information—while also filling out the employee's specifics, which include their name, date of hire, and earnings. Additionally, the form requests essential coverage amounts for life insurance, enabling employees to decide on basic or supplemental coverage for themselves and their spouses, as well as optional coverage for children. Gathering medical information is another important part of this document; applicants must answer a series of health-related questions accurately. Completing the form in full and submitting it to The Hartford within 30 days of signing is essential to avoid delays in processing, ensuring that employees receive the benefits they are entitled to without unnecessary setbacks. Proper comprehension and execution of this form can pave the way for peace of mind regarding life insurance coverage.

Evidence Of Insurance Example

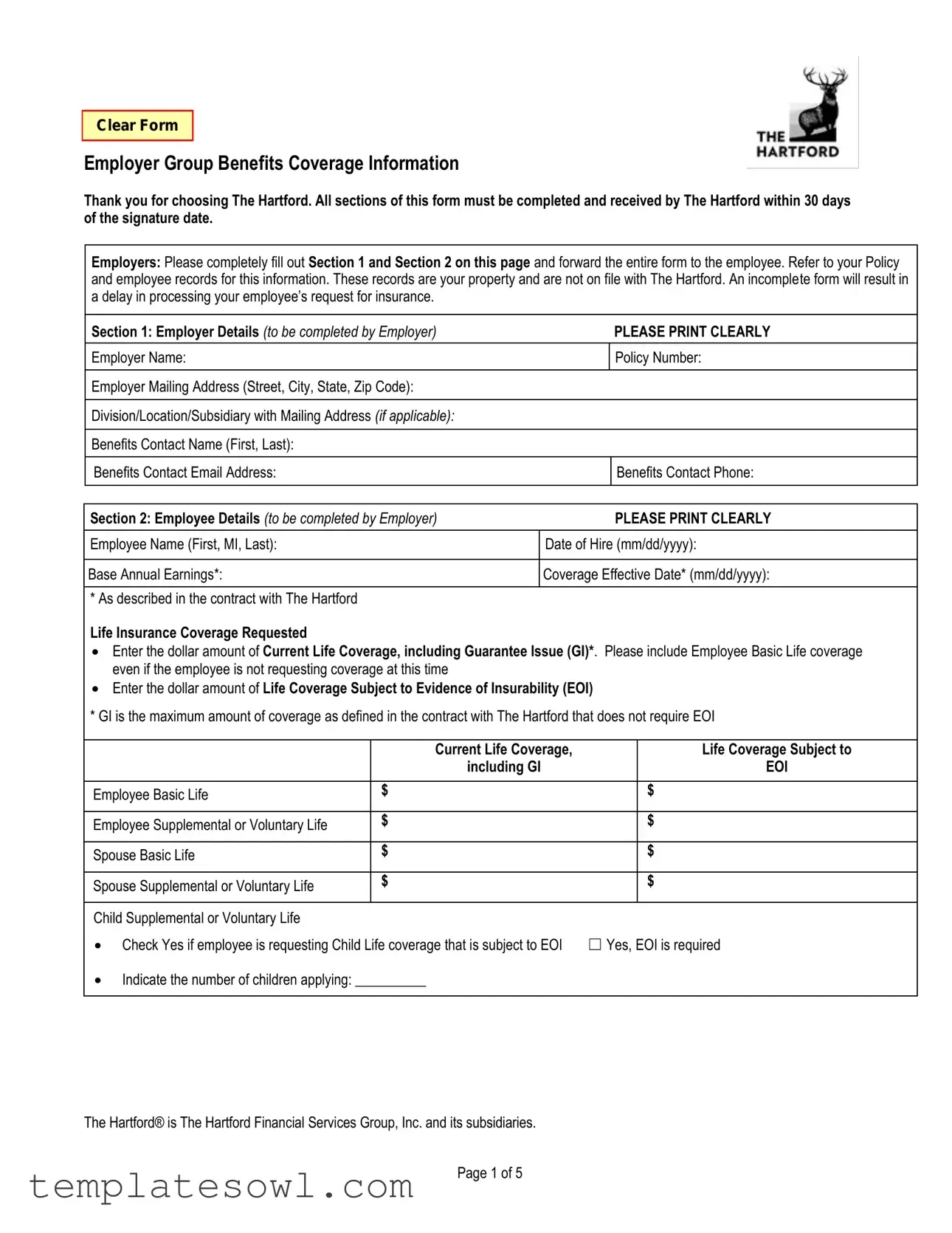

Clear Form

Employer Group Benefits Coverage Information

Thank you for choosing The Hartford. All sections of this form must be completed and received by The Hartford within 30 days of the signature date.

Employers: Please completely fill out Section 1 and Section 2 on this page and forward the entire form to the employee. Refer to your Policy and employee records for this information. These records are your property and are not on file with The Hartford. An incomplete form will result in a delay in processing your employee’s request for insurance.

Section 1: Employer Details (to be completed by Employer) |

PLEASE PRINT CLEARLY |

|

|

Employer Name: |

Policy Number: |

|

|

|

|

|

|

Employer Mailing Address (Street, City, State, Zip Code): |

|

|

|

|

|

|

|

Division/Location/Subsidiary with Mailing Address (if applicable): |

|

|

|

|

|

|

|

Benefits Contact Name (First, Last): |

|

|

|

|

|

|

|

Benefits Contact Email Address: |

Benefits Contact Phone: ( |

) |

- |

|

|

|

|

Section 2: Employee Details (to be completed by Employer) |

PLEASE PRINT CLEARLY |

|

|

|

|

|

|

|

|

Employee Name (First, MI, Last): |

Date of Hire (mm/dd/yyyy): |

/ |

/ |

|

|

|

|

|

|

Base Annual Earnings*: |

Coverage Effective Date* (mm/dd/yyyy): |

/ |

/ |

|

|

|

|

|

|

* As described in the contract with The Hartford |

|

|

|

|

Life Insurance Coverage Requested

Enter the dollar amount of Current Life Coverage, including Guarantee Issue (GI)*. Please include Employee Basic Life coverage even if the employee is not requesting coverage at this time

Enter the dollar amount of Life Coverage Subject to Evidence of Insurability (EOI)

* GI is the maximum amount of coverage as defined in the contract with The Hartford that does not require EOI

|

Current Life Coverage, |

|

Life Coverage Subject to |

|

including GI |

|

EOI |

|

|

|

|

Employee Basic Life |

$ |

|

$ |

|

|

|

|

Employee Supplemental or Voluntary Life |

$ |

|

$ |

|

|

|

|

|

|

|

|

Spouse Basic Life |

$ |

|

$ |

|

|

|

|

|

|

|

|

Spouse Supplemental or Voluntary Life |

$ |

|

$ |

|

|

|

|

|

|

|

|

Child Supplemental or Voluntary Life |

|

|

|

Check Yes if employee is requesting Child Life coverage that is subject to EOI |

☐ Yes, EOI is required |

||

Indicate the number of children applying: __________ |

|

|

|

The Hartford® is The Hartford Financial Services Group, Inc. and its subsidiaries.

Page 1 of 5

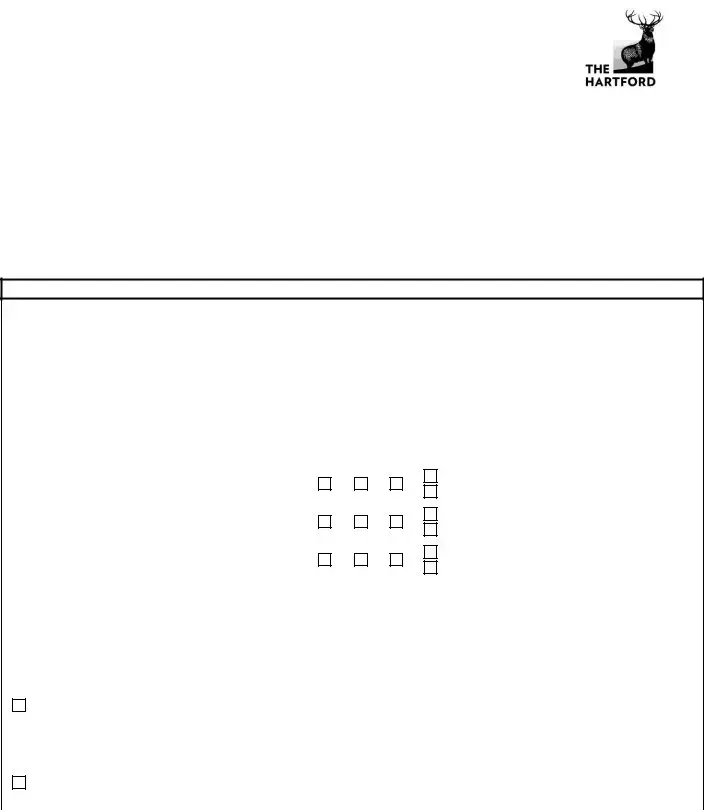

EVIDENCE OF INSURABILITY

HARTFORD LIFE AND ACCIDENT INSURANCE COMPANY

One Hartford Plaza, Hartford, CT 06155

Applicant Information

●If there are more than three Applicants, please provide the information on a separate sheet of paper.

Abbreviations: Employee = EE Spouse = SP Child = CH

First Name |

Last Name |

Social Security |

|

|

|

|

|

Height |

Weight |

Date of Birth |

|

|

|

Number |

EE |

SP |

CH |

|

Gender |

(ft./in.) |

(lbs.) |

(mm/dd/yyyy) |

|

|

|

|

|

|

|

|

|

|

If currently |

|

|

|

|

|

|

|

|

|

|

|

pregnant, |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(check one) |

|

pre- |

|

|

|||

|

|

|

|

|

pregnancy |

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

weight |

|

|

|

|

|

|

|

|

|

Male |

|

|

|

|

|

|

|

|

|

|

|

Female |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Male |

|

|

|

|

|

|

|

|

|

|

|

Female |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Male |

|

|

|

|

|

|

|

|

|

|

|

Female |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

EE Address: |

|

|

|

|

Day Time Phone: |

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Evening Phone: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Email Address: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

SP Address: |

|

|

|

|

Day Time Phone: |

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

same as EE |

|

|

|

|

|

Evening Phone: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Email Address: |

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

||

CH Address: |

|

|

|

|

Day Time Phone: |

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Evening Phone: |

|

|

|

|

|

same as EE |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Email Address: |

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

The Hartford® is The Hartford Financial Services Group, Inc. and its subsidiaries.

Form |

Page 2 of 5 |

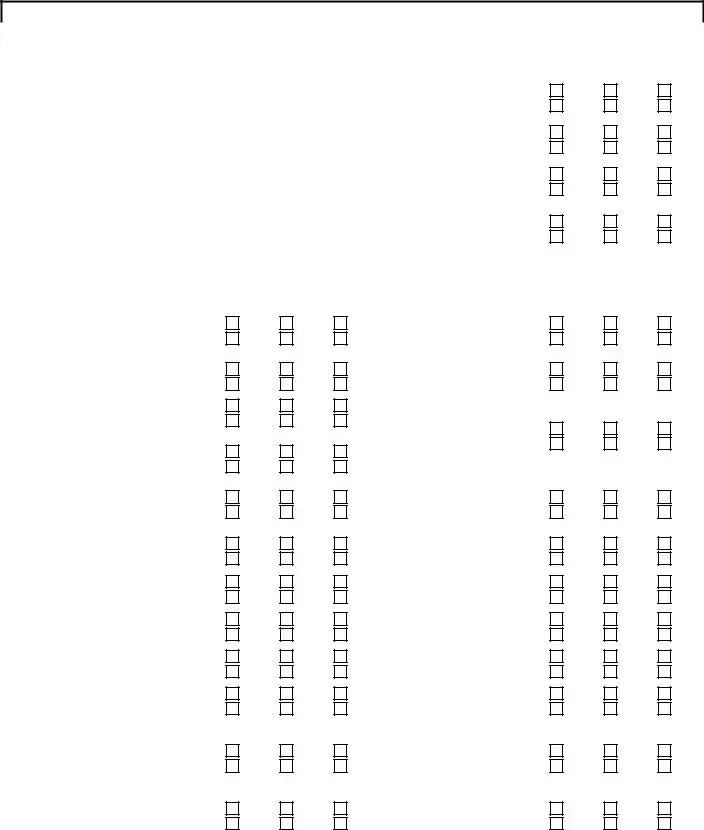

Medical Information

Each Applicant must answer each of the following questions to the best of their knowledge and |

|

|

|

|||||

belief. A Legal Guardian is required to answer each of the questions for minor children. If you have |

EE |

SP |

CH |

|||||

more than 1 child, specify which child(ren) the answer applies to on a separate sheet of paper. |

||||||||

|

|

|

||||||

|

|

|

|

|

|

|

|

|

Within the past 5 years, have you been diagnosed with or treated by a licensed medical physician for |

Yes |

Yes |

Yes |

|||||

Acquired Immune Deficiency Syndrome (AIDS) or AIDS Related Complex (ARC)? |

||||||||

No |

No |

No |

||||||

|

|

|

|

|

|

|

|

|

Are you currently pregnant? |

|

|

|

|

Yes |

Yes |

Yes |

|

|

|

|

|

|

||||

|

|

|

|

|

No |

No |

No |

|

|

|

|

|

|

|

|

|

|

Within the past 5 years, with the exception of a past pregnancy, have you lost time from work for more than |

Yes |

Yes |

Yes |

|||||

10 consecutive work days due to a disability, injury, or sickness? |

|

|

||||||

|

|

No |

No |

No |

||||

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

Within the past 5 years, have you used any controlled substances, with the exception of those taken as |

Yes |

Yes |

Yes |

|||||

prescribed by your physician, been diagnosed or treated for drug or alcohol abuse (excluding support |

||||||||

No |

No |

No |

||||||

groups), or been convicted of operating a motor vehicle while under the influence of drugs or alcohol? |

||||||||

|

|

|

||||||

|

|

|

|

|

|

|

|

|

Within the past 5 years, have you been diagnosed with or treated by a licensed member of the medical profession for: |

|

|

||||||

|

|

|

|

|

|

|

|

|

|

EE |

SP |

CH |

|

EE |

SP |

CH |

|

Heart Disease |

Yes |

Yes |

Yes |

Disease, injury or surgery of |

Yes |

Yes |

Yes |

|

(Do not check “Yes” if you only have High |

Joint, Ligaments, Knee, Back, |

|||||||

No |

No |

No |

No |

No |

No |

|||

Blood Pressure or a Heart Murmur) |

or Neck (including Arthritis) |

|||||||

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

Yes |

Yes |

Yes |

Muscular Dystrophy |

Yes |

Yes |

Yes |

||

Heart Attack |

No |

No |

No |

No |

No |

No |

||

|

||||||||

|

|

|

|

|

|

|

|

|

High Blood Pressure |

Yes |

Yes |

Yes |

|

|

|

|

|

|

No |

No |

No |

Hepatitis (Do not check “Yes” |

Yes |

Yes |

Yes |

|

If you checked “Yes” to High Blood |

|

|

|

|||||

|

|

|

for Hepatitis A) or Cirrhosis |

No |

No |

No |

||

Pressure, have you had a change in |

Yes |

Yes |

Yes |

|||||

|

|

|

|

|||||

medication within the last 6 months? |

No |

No |

No |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Blocked Arteries (Arteriosclerosis, |

Yes |

Yes |

Yes |

Amyotrophic Lateral Sclerosis |

Yes |

Yes |

Yes |

|

Atherosclerosis, Aneurysm, or Deep Vein |

(ALS) or Multiple Sclerosis |

|||||||

No |

No |

No |

No |

No |

No |

|||

Blood Clot) |

(MS) |

|||||||

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

Stroke or transient ischemic attack (TIA) |

Yes |

Yes |

Yes |

Alzheimer’s or Parkinson’s |

Yes |

Yes |

Yes |

|

No |

No |

No |

Disease |

No |

No |

No |

||

|

||||||||

|

|

|

|

|

|

|

|

|

Chronic Obstructive Pulmonary Disease |

Yes |

Yes |

Yes |

Paralysis |

Yes |

Yes |

Yes |

|

(COPD) or Emphysema |

No |

No |

No |

No |

No |

No |

||

|

||||||||

|

|

|

|

|

|

|

|

|

Diabetes |

Yes |

Yes |

Yes |

Major Organ Transplant |

Yes |

Yes |

Yes |

|

No |

No |

No |

No |

No |

No |

|||

|

|

|||||||

|

|

|

|

|

|

|

|

|

Depression |

Yes |

Yes |

Yes |

Chronic Fatigue Syndrome or |

Yes |

Yes |

Yes |

|

No |

No |

No |

Fibromyalgia |

No |

No |

No |

||

|

||||||||

|

|

|

|

|

|

|

|

|

Sleep Apnea |

Yes |

Yes |

Yes |

Narcolepsy |

Yes |

Yes |

Yes |

|

No |

No |

No |

No |

No |

No |

|||

|

|

|||||||

|

|

|

|

|

|

|

|

|

Cancer (Do not check “Yes” for Basal |

|

|

|

|

|

|

|

|

Cell Carcinoma only) |

Yes |

Yes |

Yes |

Ulcerative Colitis or Crohn’s |

Yes |

Yes |

Yes |

|

|

||||||||

If “Yes”, Date of Diagnosis: |

No |

No |

No |

Disease |

No |

No |

No |

|

|

|

|

|

|

|

|

||

_______________________________ |

|

|

|

|

|

|

|

|

Psychotic, Psychiatric, Personality, or Bi- |

Yes |

Yes |

Yes |

Kidney Failure or Dialysis |

Yes |

Yes |

Yes |

|

Polar Disorder |

No |

No |

No |

No |

No |

No |

||

|

||||||||

|

|

|

|

|

|

|

|

|

The Hartford® is The Hartford Financial Services Group, Inc. and its subsidiaries.

Form |

Page 3 of 5 |

Notice

To the best of your knowledge, you are required to notify Hartford Life and Accident Insurance Company in writing of any changes in your medical condition between the date you sign this form and the date the coverage is approved.

In order to complete the evaluation of this application, Hartford Life and Accident Insurance Company may contact you, through the mail or over the telephone:

1.to clarify any information contained on this form;

2.to obtain any information missing from this form;

3.to ask additional questions of you or your physician about the information that you have provided; or

4.to request a paramedical exam.

We may also use information about you obtained from other sources, including our claim files, evidence of insurability applications you have previously submitted to us, copies of medical records which you have authorized us to review, and information obtained from MIB, Inc. Only information that is relevant to determining Evidence of Insurability for the coverage which you are currently requesting will be considered.

Authorization

I, an undersigned applicant, authorize Hartford Life and Accident Insurance Company, together with its affiliates, (“Company”) to contact me, during the evaluation of this application, through the mail, secure

1.to clarify any information contained on this form;

2.to obtain any information missing from this form; or

3.to request a paramedical exam.

In the event that I cannot be reached via telephone, I authorize a representative of the Company to leave a voice message identifying his or her name, the Company name, and a return phone number, indicating that he or she is calling to obtain information necessary to complete my recent application for insurance. The message will also contain an underwriting ID number and the hours during which I may reach a representative of the Company by telephone.

❒Yes, you may leave a message as indicated above. |

❒No, please do not leave a message. |

In addition to the information that I have provided on this application, I authorize the Company to use information about me obtained from Company claim files, insurance applications and medical information I or my physician(s) have previously submitted to the Company. I further authorize my employer, any health or benefits plan, physician, medical professional, hospital, clinic, laboratory, MIB Group, Inc. (MIB, Inc), pharmacy or pharmacy benefits manager that possesses my protected personal health information (“PHI”), including copies of records concerning physical or mental illness, diagnosis, prognosis, prescription information, care or treatment provided to me (but excluding HIV and genetic testing), to furnish such protected health information to the Company or its representative. The Company may only use information disclosed under this authorization that is relevant to underwrite this or any other insurance application to the Company during the period that the Authorization is valid (as described below), at any time to aid in the detection of fraud, and for internal research purposes.

I authorize the Company to disclose the “PHI” in its files to its reinsurer(s) and affiliates, other insurance companies and their affiliates, other persons, representatives and/or organizations performing functions on behalf of the Company and their affiliates, my employer, or as required by law, including any mandated reporting to state agencies. I understand that I may request details about any of the information gathered about me that relates to this application and that such requested information and the identity of the source of the information shall be released to me or, in the case of medical information, to a licensed medical professional of my choice.

I/We authorize Hartford Life and Accident Insurance Company, or its reinsurers, to make a brief report of my/our personal health information to Medical Information Bureau.

I agree that a photocopy of this authorization is valid as the original and I understand that I or my authorized representative is entitled to receive a copy of this authorization upon request.

This authorization shall be valid for

I have received and read a copy of the Notice of Insurance Information Practices.

The Hartford® is The Hartford Financial Services Group, Inc. and its subsidiaries.

Form |

Page 4 of 5 |

Fraud

For your protection, California law requires the following to appear on this form: The falsity of any statement in the application for any policy shall not bar the right to recovery under the policy unless such false statement was made with the actual intent to deceive or unless it materially affected either the acceptance of the risk or the hazard assumed by the insurer.

Certification

I hereby represent that I have reviewed the above questions and that all statements and answers contained herein are full, complete, and true to the best of my knowledge and belief. For residents of Virginia only: I have read, or had read to me, the completed application, and I realize that any false statement or misrepresentation in the application may result in loss of coverage under the policy.

This application will be made a part of the Policy.

|

/ |

/ |

|

|

/ |

/ |

||

Employee Signature |

|

Date Signed |

|

Spouse Signature |

|

Date Signed |

||

|

/ |

/ |

|

Child Signature |

|

Date Signed |

|

(Parent/Legal Guardian of the Child is |

|

|

|

required to sign when submitting

dependent Evidence of Insurability on a

minor child.)

Please mail the completed Employer Group Benefits Coverage Information page and Evidence of Insurability application to:

The Hartford

Group Medical Underwriting

P.O. Box 2999

Hartford, CT

If you have any questions or concerns, please call The Hartford Customer Service Department

Friday, 8:00 a.m. to 6:00 p.m., Eastern Time, or email us at medical.uw@thehartford.com.

The Hartford® is The Hartford Financial Services Group, Inc. and its subsidiaries.

Form |

Page 5 of 5 |

Form Characteristics

| Fact Name | Details |

|---|---|

| Submission Deadline | This form must be fully completed and submitted to The Hartford within 30 days of the signature date. |

| Required Sections | Sections 1 and 2 need to be filled out by employers and must be clearly printed. |

| Employer Responsibilities | Employers must provide accurate information from their policy and employee records. |

| Impact of Incompleteness | Failure to complete the form accurately will delay the processing of the insurance request. |

| Medical Questions | Applicants must answer all medical questions to the best of their knowledge for each covered individual. |

| California Governing Law | California law requires that false statements in insurance applications must be made with intent to deceive to affect recovery. |

| Authorization Details | Applicants authorize The Hartford to collect information relevant to their insurance application. |

| Contact Information | For questions, applicants can contact The Hartford Customer Service, available Monday to Friday from 8:00 a.m. to 6:00 p.m. ET. |

Guidelines on Utilizing Evidence Of Insurance

Once you have the Evidence of Insurance form ready, the next step is to ensure all required sections are filled out accurately and completely. This is crucial for avoiding delays in processing the insurance request. Below are the steps to guide you through filling out the form.

- Print the form clearly to avoid any misunderstandings.

- In Section 1, fill in the following employer details:

- Employer Name: Enter the full name of the employer.

- Policy Number: Input the relevant policy number from your records.

- Employer Mailing Address: Provide the street, city, state, and zip code.

- If applicable, enter the Division/Location/Subsidiary: Fill in any additional mailing address information.

- Benefits Contact Name: Type the first and last name of the benefits contact person.

- Benefits Contact Email Address: Include a valid email address for communication.

- Benefits Contact Phone: List a reachable phone number.

- Move to Section 2, which includes employee details. Fill in:

- Employee Name: Enter the first name, middle initial, and last name of the employee.

- Date of Hire: Specify the hire date using the format mm/dd/yyyy.

- Base Annual Earnings: State the employee's annual earnings.

- Coverage Effective Date: Indicate the date the coverage is to start.

- Next, detail the coverage requested:

- Enter the dollar amount for Current Life Coverage: Include any Guarantee Issue amounts.

- Input the dollar amount of Life Coverage Subject to Evidence of Insurability:

- List coverage amounts for Employee Basic Life.

- Provide amounts for Employee Supplemental Life.

- Include Spouse Basic Life and Supplemental Life amounts.

- State Child Supplemental or Voluntary Life amounts.

- If applicable, check 'Yes' for Child Life coverage subject to EOI and indicate the number of children applying.

- In the Applicant Information section, complete the following for each applicant:

- First and last names.

- Social Security numbers.

- Height and weight.

- Date of birth.

- Gender.

- If pregnant, mark the appropriate box.

- Complete the Medical Information section, answering each question for all applicants.

- Review all entries for accuracy.

- Have the employee and their spouse, if applicable, sign and date where indicated.

- Mail the completed form as directed at the bottom of the document.

What You Should Know About This Form

What is the Evidence of Insurance form and why is it important?

The Evidence of Insurance form is a essential document for employees applying for life insurance coverage through their employer's plan. This form ensures that all necessary details regarding both the employer and employee are correctly documented. Timely completion and submission of this form are crucial, as it must be received by The Hartford within 30 days of the signature date. An incomplete form can significantly delay the processing of the insurance request, so careful attention is needed in filling it out.

Who is responsible for completing the form?

The completion of the Evidence of Insurance form involves both the employer and the employee. Employers are required to fill out Sections 1 and 2 with their details and then forward the entire form to the employee. This section includes the employer's name, policy number, and contact information. The employee must then provide personal information, including their name, date of hire, and earnings. Each party plays a critical role in ensuring that the form is accurately filled and submitted.

What happens if the form is submitted incomplete?

If the form is not fully completed, it will result in delays in processing the employee's request for insurance coverage. Incomplete forms do not allow The Hartford to process the application swiftly, which can lead to unnecessary stress for the employee. Therefore, it is essential for both employers and employees to carefully review all sections before submission to avoid any mishaps.

How can I ensure my information is kept secure and private?

Your personal information is treated with the utmost care. The Hartford employs strict privacy and security measures in handling the Evidence of Insurance form and related health information. Authorizations included in the form allow for the collection of relevant information while protecting your privacy. You have the right to inquire about any personal information used in the underwriting process, which promotes transparency and trust in handling your health records.

Common mistakes

Filling out the Evidence of Insurance form can seem straightforward, but many people make common mistakes that can lead to delays in processing. One frequent mistake is leaving sections incomplete. Each part of the form must be filled out in full. If any section is missing information, it can hold up your application.

Another mistake is failing to print clearly. If handwriting is hard to read, it may cause misinformation or confusion. It's essential to use clear and legible writing when completing the form. Additionally, people often skip providing the correct policy number or employer details, which are vital for The Hartford to process the application efficiently.

Many applicants mistakenly believe that the coverage requested does not need to include all required details. Both current life coverage and life coverage subject to Evidence of Insurability must be listed accurately. Neglecting to include spouse and child coverage can also create unnecessary complications.

Moreover, some applicants overlook the medical information questions. Each question needs a truthful and complete answer. If you fail to adequately respond, it may lead to complications later on. Be mindful that certain conditions must be addressed carefully. For example, saying "no" when there have been prior health issues may affect your coverage.

Another common error is not checking the correct boxes. If you are applying for Child Life coverage, ensure that you indicate that it is required. This small step can prevent delays in the application process. It's also important to be careful when providing contact information. Missing phone numbers or email addresses can impede communication between you and The Hartford.

Sometimes, applicants forget to sign the form. Unsigned applications cannot be processed. Double-check to make sure that all required signatures are included for every applicant on the form. Finally, failing to send the completed form to the right address is another mistake people make. Ensure that you send everything to the specified P.O. Box for The Hartford to avoid any unnecessary delays.

By paying attention to these common issues, you can help ensure that your Evidence of Insurance form is processed quickly and correctly. Taking the time to review your application can save you from future headaches.

Documents used along the form

Along with the Evidence of Insurance form, there are several key documents that play an important role in the insurance process. Each of these documents has its own purpose and can help ensure that everything goes smoothly when obtaining coverage. Here's a quick overview of other forms you might encounter.

- Employer Group Benefits Application – This document collects basic information about the employer and their benefit offerings. It’s essential for determining employee eligibility and coverage options.

- Enrollment Form – This form is completed by the employee to enroll in specific benefit plans. It specifies which coverages the employee is opting for and helps track their selections.

- Benefit Summary Plan Description – This document outlines the details of the insurance plans available to employees. It includes information on coverage limits, exclusions, and claims processes.

- Authorization for Release of Health Information – Employees may need to sign this form to allow the insurance provider to access their health records, making the underwriting process more efficient.

- Claim Form – When a claim needs to be filed, this form is crucial. It captures details about the incident or injury for which reimbursement is being sought.

- Dependent Eligibility Verification Form – If dependents are included in a coverage plan, this form verifies their eligibility and relationship to the employee.

- Waiver of Coverage Form – Employees who choose not to enroll in available benefits must submit this form. It confirms their decision and protects the employer from future claims.

- COBRA Notification – This document informs employees about their rights to continue coverage after leaving employment. It’s important for understanding options post-employment.

- Medical History Form – Employees might need to provide detailed medical history to assess eligibility for certain types of coverage. This form helps underwriters evaluate risk more accurately.

- Benefit Adjustment Request Form – If employees wish to adjust their coverage levels, this form is used to submit requests for changes in insurance benefits.

Understanding these forms can streamline the insurance process and help avoid unnecessary delays. Whether you’re an employer or an employee, being familiar with this paperwork ensures that everyone is on the same page regarding insurance coverage and benefits.

Similar forms

- Certificate of Insurance: Similar to the Evidence of Insurance form, this document provides proof of insurance coverage. It details the policy benefits, coverage limits, and can be presented to service providers, akin to how the Evidence of Insurance form conveys employee life insurance coverage.

- Insurance Policy Document: This comprehensive document outlines the terms and conditions of an insurance policy. Like the Evidence of Insurance form, it serves as an official record of coverage details but is broader in scope regarding benefits and exclusions.

- Beneficiary Designation Form: This form allows policyholders to name beneficiaries for their insurance. Similar to the Evidence of Insurance form, it plays a crucial role in the management of an insurance policy, particularly in life insurance contexts.

- Claim Form: This document is used to request payment or benefits from an insurance policy. It shares similarities with the Evidence of Insurance form in that both require accurate and complete information to ensure timely processing.

- Enrollment Form: Used in the initial process of obtaining insurance, this form captures essential data about the policyholder and dependents. Like the Evidence of Insurance form, it necessitates accurate information to establish coverage.

- Coverage Confirmation Letter: Issued by the insurance company to confirm active coverage, this letter reflects similar information found in the Evidence of Insurance form but in a more formalized letter format.

- Policy Renewal Notice: This document informs policyholders of upcoming renewals and any changes to policy coverage. While it serves a different function, it maintains the connection of providing essential coverage information.

- Dependent Enrollment Form: This form is used to add dependents to an insurance policy. Similar to the Evidence of Insurance form, it requires details about the dependents and is crucial for maintaining accurate coverage records.

Dos and Don'ts

When filling out the Evidence Of Insurance form, keep the following guidelines in mind:

- Do print clearly and use black or blue ink to ensure readability.

- Do complete all sections, including employer and employee details.

- Do double-check the policy number and contact information for accuracy.

- Do submit the form within 30 days of the signature date to avoid processing delays.

- Don't leave any fields blank; incomplete forms will result in further delays.

- Don't provide false or misleading information, as this could jeopardize coverage.

- Don't ignore additional paperwork for more than three applicants; include separate sheets if necessary.

- Don't neglect to sign and date the form, as it is essential for validation.

Misconceptions

Here are some common misconceptions about the Evidence of Insurance form:

- It is optional to complete all sections of the form. All sections of the Evidence of Insurance form must be filled out completely. Incomplete forms will delay processing.

- The employer's information is not necessary. Employers must provide accurate details in Section 1 to ensure the employee's insurance request is addressed properly.

- The form can be submitted at any time. The form must be submitted within 30 days of the signature date. Late submissions may complicate or void the insurance request.

- Medical information is not required for all applicants. Each applicant listed on the form, including children, must answer the medical questions thoroughly.

- Changes in medical conditions do not need to be reported. Any changes in medical conditions must be reported in writing between signing the form and approval of coverage.

- Signature is not required from all applicants. Each applicant, including minors represented by a legal guardian, must provide a signature to validate the application.

Key takeaways

Understanding the Evidence of Insurance form is essential for smooth processing of insurance requests. Here are some key points to keep in mind:

- Complete All Sections: Every section of the form must be filled out in its entirety. Leaving any part incomplete can lead to delays in processing.

- Timely Submission: The completed form should be submitted to The Hartford within 30 days of the signature date. Late submissions may complicate your coverage request.

- Employer Responsibilities: Employers are responsible for filling out Sections 1 and 2 accurately. This includes details like the policy number and employee information.

- Employee Verification: Employers should forward the completed form to the employee. Employees must verify that all information is accurate before submission.

- Medical Information Importance: Each applicant needs to answer medical questions honestly. Providing false information can result in denial of coverage.

- Child Coverage Details: If life coverage for children is being requested, ensure that the number of children applying is indicated. EOI may be required for Child Life coverage.

- Authorization Required: An authorization section allows The Hartford to collect additional medical information, if needed. Make sure all applicants understand what they are consenting to.

- Contact Information: The form requires accurate contact details for benefits representatives and applicants. Mismatched or incorrect information can hinder communication about the application.

By keeping these takeaways in mind, you can ensure a smoother process when completing and submitting your Evidence of Insurance form.

Browse Other Templates

Tn Enhanced Carry Permit Class Online - The form is essential for evaluating both individual and team performance.

California Sales Tax Exemption - Failure to comply with exemption rules may lead to tax liabilities.