Fill Out Your Executor Deed Form

The Executor Deed form serves as a crucial legal document in the administration of an estate following the death of an individual. This form is utilized by the executor of a will to transfer real estate owned by the deceased to a specified recipient, ensuring that the wishes of the deceased are honored in accordance with the terms laid out in the will. Generally, the form requires the executor to affirm their authority through letters testamentary issued by a court. These letters grant the executor the legal power to act on behalf of the estate. The deed must include the names and addresses of both the grantor, who is the executor, and the grantee, the person receiving the property. Furthermore, it specifies the legal description of the property being conveyed along with important details, such as tax obligations and any other pertinent restrictions. Additionally, the form must be notarized to validate the transaction, thereby protecting all parties involved. While the Executor Deed facilitates the transfer of property, it is essential for individuals to seek legal advice when completing this document, as improper use may lead to legal complications.

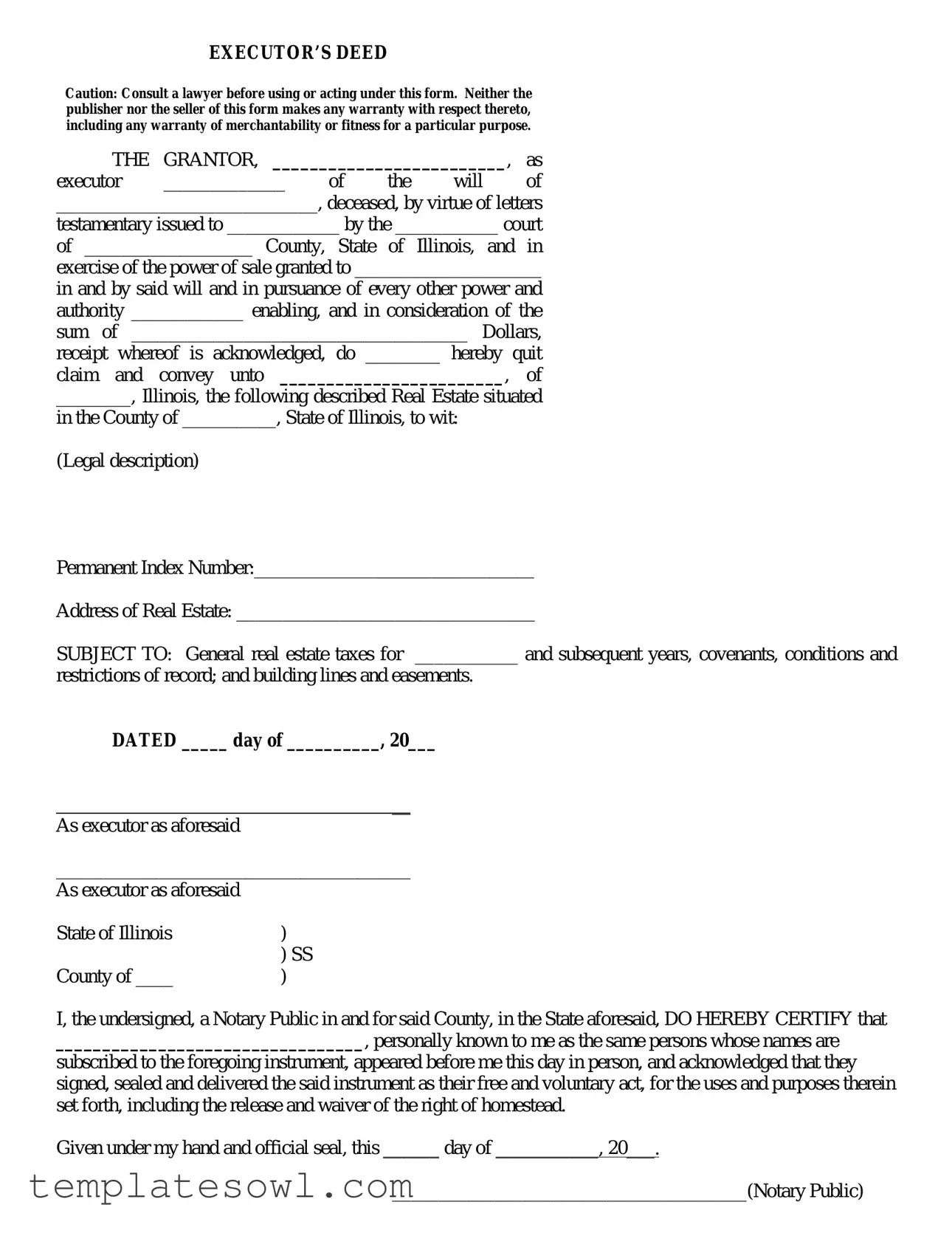

Executor Deed Example

EXECUTOR’S DEED

Caution: Consult a lawyer before using or acting under this form. Neither the publisher nor the seller of this form makes any warranty with respect thereto, including any warranty of merchantability or fitness for a particular purpose.

THE GRANTOR, _________________________, as

executor _____________ of the will of

____________________________, deceased, by virtue of letters

testamentary issued to ____________ by the ___________ court

of __________________ County, State of Illinois, and in

exercise of the power of sale granted to ____________________

in and by said will and in pursuance of every other power and authority ____________ enabling, and in consideration of the

sum of ____________________________________ Dollars,

receipt whereof is acknowledged, do ________ hereby quit

claim and convey unto ________________________, of

________, Illinois, the following described Real Estate situated

in the County of __________, State of Illinois, to wit:

(Legal description)

Permanent Index Number:______________________________

Address of Real Estate: ________________________________

SUBJECT TO: General real estate taxes for ___________ and subsequent years, covenants, conditions and

restrictions of record; and building lines and easements.

DATED _____ day of __________, 20___

__

As executor as aforesaid

______________________________________

As executor as aforesaid

State of Illinois |

) |

|

) SS |

County of ____ |

) |

I, the undersigned, a Notary Public in and for said County, in the State aforesaid, DO HEREBY CERTIFY that

_________________________________, personally known to me as the same persons whose names are

subscribed to the foregoing instrument, appeared before me this day in person, and acknowledged that they signed, sealed and delivered the said instrument as their free and voluntary act, for the uses and purposes therein set forth, including the release and waiver of the right of homestead.

Given under my hand and official seal, this ______ day of ___________, 20___.

______________________________________(Notary Public)

This instrument was prepared by:

MAIL RECORDED INSTRUMENT TO:

SEND SUBSEQUENT TAX BILLS TO:

Form Characteristics

| Fact Title | Description |

|---|---|

| Purpose of the Executor Deed | The Executor Deed is used to transfer real estate from a deceased person’s estate to a designated beneficiary, as specified in the will. |

| Authority to Act | An executor must possess letters testamentary issued by the court, which grants them the authority to administer the estate and execute the deed. |

| Governing Law | This form complies with Illinois state law, particularly the Illinois Probate Act, which outlines the processes involved in estate administration. |

| Tax Considerations | The deed is subject to general real estate taxes, which continue to apply to the property after the transfer is made. |

| Notary Requirement | A notary public must witness the execution of the deed, confirming the identity of the executor and the voluntary nature of their signature. |

Guidelines on Utilizing Executor Deed

Completing the Executor Deed form is a crucial step in managing and transferring property as outlined in a deceased person's will. After filling out this form accurately, it should be signed, notarized, and then recorded with the appropriate county office to ensure the deed is legally binding. Here are the steps to effectively fill out the Executor Deed form:

- Identify the Grantor: Write your name as the executor of the will.

- Specify the Will Details: Enter the name of the deceased and the court that issued the letters testamentary.

- Indicate the Grantor’s Authority: Fill in the name of the person to whom the power of sale has been granted, as stipulated in the will.

- Consideration Amount: Fill in the total sum being exchanged, acknowledging receipt.

- Real Estate Description: Provide the name of the person receiving the property and their address in Illinois.

- Legal Description: Include the legal description of the property along with its Permanent Index Number.

- Obligations: State any relevant conditions such as taxes or restrictions.

- Date the Document: Write the date the deed is being executed, ensuring it’s in the correct day/month/year format.

- Executor’s Signature: Sign the document as the executor.

- Notary Section: After signing, coordinate with a Notary Public to complete the certification process, ensuring all signatures are properly acknowledged.

- Document Submission: Decide where to send the recorded instrument and subsequent tax bills, noting addresses if necessary.

Once all sections are completed and verified, proceed to make copies for your records before submitting the form for recording. Keeping a record of this crucial document is essential for future reference and clarity in property matters.

What You Should Know About This Form

What is an Executor Deed?

An Executor Deed is a legal document used by an executor of an estate to transfer ownership of real estate from a deceased person to a buyer or heir. This deed is essential in fulfilling the executor's duties after a person passes away, allowing for the distribution of that person's assets according to their will.

Who is considered an executor?

An executor is someone appointed in a will to manage the deceased person's estate. This individual is responsible for settling debts, distributing assets, and ensuring that the deceased's wishes, as outlined in the will, are carried out. An executor may be a family member, a friend, or a professional such as an attorney.

Why is it important to consult a lawyer before using an Executor Deed?

Consulting a lawyer is crucial because they can provide guidance tailored to your specific situation. They will help ensure that the deed meets legal requirements and that the transfer of property is executed correctly. By avoiding legal pitfalls, you can protect the interests of all parties involved.

What information is required on the Executor Deed?

The Executor Deed requires detailed information, including the names of the grantor (the executor) and the grantee (the buyer), the deceased person's details, and a legal description of the property being transferred. It should also include a statement about the consideration, or payment, for the property.

What does "quit claim" mean in an Executor Deed?

"Quit claim" refers to a type of conveyance where the grantor transfers their interest in the property without guaranteeing that the title is free and clear of claims. In this context, the executor is relinquishing their rights to the property based on the deceased's will, but without making any promises about the property's title status.

What are the tax implications of using an Executor Deed?

When real estate is transferred via an Executor Deed, the estate may still be responsible for any outstanding taxes on the property. Additionally, the new owner might need to file property tax information with the local authorities. Consulting a tax professional can help clarify any tax responsibilities that may arise from the transaction.

How is an Executor Deed executed and notarized?

To properly execute an Executor Deed, the executor must sign the document and have it notarized. This process involves a Notary Public witnessing the executor's signature and certifying the deed, providing an official seal. This step is vital for the deed's legal recognition.

Can the Executor Deed be challenged?

Yes, an Executor Deed can be challenged in court, especially if there are claims of improper execution, questions about the will's validity, or disputes among heirs. If concerns arise, it’s advisable to seek legal assistance to navigate potential challenges effectively.

What happens if the deceased person had no will?

If there was no will, the estate is considered "intestate." In this case, state laws will dictate how the property is distributed among heirs. Usually, a court would appoint an administrator to manage the estate and transfer the property using a different type of deed, often called an "Administrator's Deed." Again, consulting an attorney is wise in these scenarios.

Common mistakes

Filling out an Executor Deed form can be a straightforward process, but mistakes often occur. One common error is failing to completely and accurately fill in the grantor's information. The grantor, who is acting as executor of the estate, must be clearly identified. Missing or incorrect names can lead to complications in the validity of the deed.

Another mistake is neglecting the legal description of the property. The property must be described with precision to avoid any ambiguity. For instance, a vague description can result in disputes later on. Always ensure you have the complete and correct legal description, including the Permanent Index Number and the property address.

People sometimes forget to acknowledge the receipt of the sale amount. This acknowledgment is crucial. It serves as a legal confirmation that the agreed-upon funds were exchanged. Without it, the deed may not hold up under scrutiny, and that could create issues for both the executor and the buyer.

Moreover, executors may fail to explicitly list any encumbrances or conditions related to the property. It's essential to include details about any outstanding taxes, easements, or restrictions that may affect the sale. Providing incomplete information may mislead potential buyers and cause legal disputes.

In addition, many executors overlook the need for proper notarization. The notary public must certify the executor's signature. Missing this step can render the deed invalid. Take the time to ensure that every signature is notarized correctly and all parties are present when signing the document.

Finally, some individuals neglect to consult a lawyer before completing the deed. Not seeking legal advice can lead to unintentional errors. Given the importance of the Executor Deed, it's wise to have professional guidance to ensure compliance with state laws.

Documents used along the form

The Executor Deed is an important document used in the process of transferring real estate ownership after someone's death. It may accompany several other forms and documents, each serving a unique purpose for the estate's administration. Below is a list of commonly used documents with a brief description of each.

- Will: This legal document outlines how a deceased person's assets should be distributed. It includes details on beneficiaries and may appoint an executor, the person responsible for managing the estate.

- Letters Testamentary: Issued by a probate court, this document authorizes the executor to act on behalf of the estate and carry out the provisions in the will.

- Affidavit of Heirship: This sworn statement identifies heirs of the deceased, useful when there is no will or when assets need to be claimed by heirs without going through probate.

- Receipt of Payment: A document acknowledging that the executor has received payment for the transfer of property, confirming the transaction details for all parties involved.

- Notice to Creditors: A formal announcement published to inform creditors of the deceased about the estate proceedings, allowing them to make claims against the estate for any debts owed.

- Estate Inventory: A detailed list of the deceased person's assets and debts, which the executor must compile and submit to the court to provide a clear picture of the estate's value.

- Final Accounting: This document summarizes all financial transactions related to the estate, detailing income, expenses, distributions to beneficiaries, and ensuring transparency in the administration process.

Using these forms and documents effectively can simplify the process of estate administration. Each item has its own importance and helps ensure that all legal and financial matters are handled appropriately throughout the transition of property and assets.

Similar forms

The Executor Deed form is similar to several other legal documents in function and purpose. Below is a list of eight documents that share similarities with the Executor Deed:

- Quitclaim Deed: Both documents transfer real estate interests. The Executor Deed is specific to transfers made by an executor, while a quitclaim deed can be used by anyone to convey property without warranties.

- Warranty Deed: Similar to the Executor Deed in that it transfers ownership of real estate, but a warranty deed offers guarantees about the title, unlike the more limited assurances in an executor's deed.

- Special Administrator’s Deed: This document is used when a special administrator sells property before the estate is fully settled, similar to how an executor's deed functions in managing estate assets.

- Trustee’s Deed: Both are used to transfer property. A trustee’s deed conveys property held in a trust, while the Executor Deed pertains to property of a decedent’s estate.

- Affidavit of Heirship: This document identifies heirs to an estate and can serve as support for claims on property, much like the contribution made by the executor in determining rightful ownership.

- Bill of Sale: While primarily for personal property, both documents convey ownership. The Executor Deed focuses on real estate of a deceased person, whereas a bill of sale typically handles movable property.

- Power of Attorney: This document grants authority to act on behalf of another, similar to how an executor acts for the deceased in managing estate transactions through an executor's deed.

- Deed in Lieu of Foreclosure: This instrument allows a homeowner to transfer property to a lender to avoid foreclosure, similar in its effect of transferring ownership, though it does not involve an executor.

Dos and Don'ts

When filling out the Executor Deed form, it is important to follow certain guidelines to ensure accuracy and compliance. Here are key do's and don'ts to consider:

- Do confirm the identity of the grantor as the executor of the will.

- Do include the correct court and county information as stated in the letters testamentary.

- Do ensure the legal description of the real estate is complete and accurate.

- Don't leave out the permanent index number, as it is essential for property identification.

- Don't forget to acknowledge the receipt of payment in the document.

- Don't sign the deed without having the document notarized, as this is a necessary step for validity.

Misconceptions

Misconceptions about the Executor Deed Form

- Anyone can use the Executor Deed form. This is incorrect. Only the actual executor of the estate can utilize this form, as they have the legal authority provided by the will and the court.

- The Executor Deed automatically transfers ownership. While it allows for the transfer of property, it does not guarantee that ownership is effective without appropriate legal procedures and verification.

- Executor Deed eliminates the need for a will. This is a common misunderstanding. The Executor Deed is a tool used in the administration of a will but does not replace the will itself.

- Only lawyers can prepare an Executor Deed. Although having a lawyer is advisable for complex situations, an executor familiar with the process can complete the form, provided they understand the requirements.

- Executor Deed does not need notarization. This is false. The document must be notarized to verify the identity of the executor and the authenticity of the signatures.

- Filling out the Executor Deed is straightforward with no complexities. While the form might seem simple, it can involve important details and legal considerations that may require careful attention.

- The Executor Deed releases all liabilities. This is misleading. While it transfers property, it does not absolve the executor from responsibilities tied to the estate's debts or obligations.

- Executor Deeds can be reversed at any time. Once executed and delivered, reversing an Executor Deed can be complicated and typically requires legal action or consent from the beneficiaries.

Key takeaways

Here are important points to remember when filling out and using the Executor Deed form:

- Consult a Lawyer: It is crucial to seek legal advice before using this form to ensure compliance with local laws and specific circumstances.

- Understand Your Role: The executor must have legal authority through letters testamentary issued by the probate court to execute this deed.

- Accurate Information: All sections of the form must be filled out with precise details, including the grantor’s name, the deceased's name, and the specific legal description of the property.

- Financial Considerations: Clearly state the consideration amount being received for the transfer. This should reflect the actual transaction.

- Legal Description: Include the permanent index number and the detailed legal description of the property to avoid confusion regarding the transfer.

- Notarization Required: The deed must be signed in front of a notary public to confirm the identities of the parties involved and their voluntary agreement.

- Subject to Conditions: The deed will include specific conditions such as existing taxes, covenants, and easements, which may affect the property's use.

Browse Other Templates

What Happens When You Declare Cash at Customs - This report contributes to transparency in financial dealings worldwide.

Cease and Desist Letter to Neighbor - This form serves as a clear notification to individuals that they are prohibited from entering a specific property.