Fill Out Your Export Decleration Form

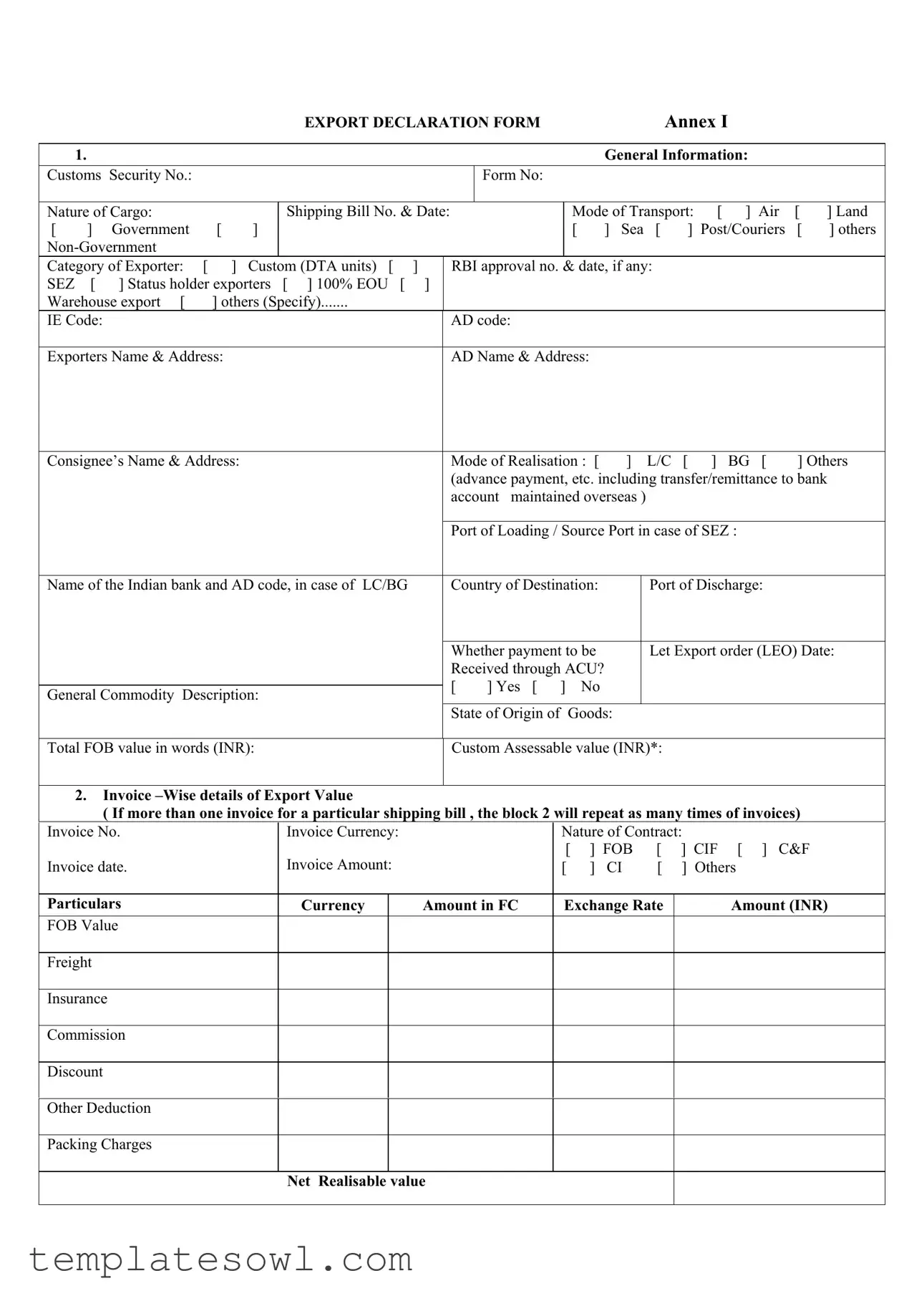

The Export Declaration Form is a vital document used by exporters to report shipments of goods leaving a country. This comprehensive form captures essential information required for customs clearance and regulatory compliance. Key sections include general information such as customs security numbers, shipping bill details, and the mode of transport, which can vary from air to sea. Furthermore, the form delineates the exporter’s category—whether they are a customs or government entity, and highlights specifics like the Importer-Exporter Code (IEC) and Authorized Dealer (AD) code. Importantly, it includes details about the consignee, the country of destination, and relevant financial information such as total FOB value and invoice amounts. Each invoice related to the exported goods must be clearly detailed, capturing currency, nature of the contract, and net realizable value. The declaration section affirms the authenticity of the information provided, mandating the exporter to ensure proper repatriation of funds in line with regulatory requirements. Finally, a designated space allows for the approval by customs or SEZ officials, completing the validation process necessary for the export operation. This form not only secures compliance but also facilitates smooth international trade transactions.

Export Decleration Example

|

|

|

|

|

EXPORT DECLARATION FORM |

|

|

|

|

|

Annex I |

|

|

|

|

||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

1. |

|

|

|

|

|

|

|

|

|

|

|

|

|

General Information: |

|

|

|

|||||

Customs Security No.: |

|

|

|

|

|

|

|

Form No: |

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

Nature of Cargo: |

|

|

Shipping Bill No. & Date: |

|

|

|

Mode of Transport: |

[ |

] |

Air |

[ |

] Land |

|||||||||||

[ |

] |

Government |

[ |

] |

|

|

|

|

|

|

|

|

[ |

|

] Sea |

[ |

] |

Post/Couriers |

[ |

] others |

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

Category of Exporter: |

[ ] |

Custom (DTA units) [ |

] |

|

RBI approval no. & date, if any: |

|

|

|

|

|

|

||||||||||||

SEZ |

[ |

] Status holder exporters [ ] 100% EOU |

[ |

] |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

Warehouse export [ |

] others (Specify) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

IE Code: |

|

|

|

|

|

|

|

AD code: |

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

Exporters Name & Address: |

|

|

|

|

|

AD Name & Address: |

|

|

|

|

|

|

|

|

|

||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||

Consignee’s Name & Address: |

|

|

|

|

|

Mode of Realisation : [ |

] |

|

L/C |

[ |

] |

BG |

[ |

] Others |

|||||||||

|

|

|

|

|

|

|

|

|

(advance payment, etc. including transfer/remittance to bank |

||||||||||||||

|

|

|

|

|

|

|

|

|

account maintained overseas ) |

|

|

|

|

|

|

|

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||

|

|

|

|

|

|

|

|

|

Port of Loading / Source Port in case of SEZ : |

|

|

|

|||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||

Name of the Indian bank and AD code, in case of LC/BG |

|

Country of Destination: |

|

|

Port of Discharge: |

|

|

||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||

|

|

|

|

|

|

|

|

|

Whether payment to be |

|

|

Let Export order (LEO) Date: |

|||||||||||

|

|

|

|

|

|

|

|

|

Received through ACU? |

|

|

|

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

[ |

] Yes [ |

] |

No |

|

|

|

|

|

|

|

|

|

||

General Commodity Description: |

|

|

|

|

|

|

|

|

|

|

|

||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

|

|

|

|

|

|

|

|

|

State of Origin of |

|

Goods: |

|

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

Total FOB value in words (INR): |

|

|

Custom Assessable value (INR)*: |

|

|

|

|

|

|

||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

2. Invoice |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

|

( If more than one invoice for a particular shipping bill , the block 2 will repeat as many times of invoices) |

|

|||||||||||||||||||||

Invoice No. |

|

|

Invoice Currency: |

|

|

|

|

|

Nature of Contract: |

|

|

|

|

|

|||||||||

|

|

|

|

|

|

|

|

|

|

|

|

[ |

] FOB |

[ |

] CIF |

[ |

] C&F |

|

|||||

Invoice date. |

|

|

Invoice Amount: |

|

|

|

|

|

[ |

] |

CI |

[ |

] |

Others |

|

|

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

Particulars |

|

|

Currency |

|

|

Amount in FC |

|

|

Exchange Rate |

|

|

Amount (INR) |

|||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

FOB Value |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Freight |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Insurance |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

Commission |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Discount |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

Other Deduction |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

Packing Charges |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

Net Realisable value |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

EXPORT DECLARATION FORM- Cont.

3.Applicable for Export under FPO/Couriers Name of the post Office:

Number & date of Parcel receipts :

Stamp & Signature of Authorised Dealer

4.Declaration by the Exporters (All types of exports)

I /We hereby declare that I/we @am/are the seller/consignor of the goods in respect of which this declaration is made and that the particulars given above are true and that the value to be received from the buyer represents the export value contracted and declared above. I/We undertake that I/we will deliver to the authorised dealer bank named above the foreign exchange representing the full

value of the goods exported as above on or before |

(i.e. within the period of realisation stipulated by RBI from time to |

|

time ) in the manner specified in the Regulations made under the Foreign Exchange Management Act, 1999. |

||

I/We |

@ am/are not in the Caution List of the Reserve Bank of India. |

|

Date: |

|

(Signature of Exporter) |

5.Space for use of the competent authority (i.e. Custom/SEZ) on behalf of Ministry concerned:

Certified, on the basis of above declaration by the Custom/SEZ unit, that the Goods described above and the export value declared by the exporter in this form is as per the corresponding invoice/gist of invoices submitted and declared by the Unit.

Date:

(Signature of Designated/Authorised officials of Custom /SEZ )

@ Strike out whichever is not applicable.

*Unit declared Value in case of exports affected from SEZs

Form Characteristics

| Fact Name | Description |

|---|---|

| Purpose | The Export Declaration Form is used to declare goods being exported from the country, ensuring compliance with customs regulations. |

| Information Required | Details such as customs security number, nature of cargo, invoice amount, and consignee’s name must be filled out to process the export. |

| Mode of Transport | Exporters must indicate the mode of transport, which can include air, land, sea, or postal services. |

| Bank Involvement | If payment is via Letter of Credit or Bank Guarantee, the name of the Indian bank and associated details must be provided. |

| Declaration of Accuracy | The exporter must declare the accuracy of the information provided and commit to remitting foreign exchange for the exported goods. |

| Applicable Laws | This form must comply with the regulations stipulated under the Foreign Exchange Management Act (FEMA) and any state-specific laws. |

| Multiple Invoices | If there are multiple invoices associated with a shipment, the form allows for repetition of invoice-wise details in a structured manner. |

| Authorized Dealer Signature | A stamp and signature from an Authorized Dealer is required to validate the declaration before export processing occurs. |

| Counter-Verification | The form includes space for customs or SEZ authorities to certify that the declared information matches the submitted invoice details. |

Guidelines on Utilizing Export Decleration

Filling out the Export Declaration form is crucial for ensuring compliance with regulations and helps streamline the export process. Once completed, this form will need to be submitted to the appropriate authorities. Below are clear steps to guide you through the process of completing the form accurately.

- Start with Section 1, where you will provide General Information:

- Customs Security No.

- Form No.

- Nature of Cargo

- Shipping Bill No. and Date

- Select Mode of Transport:

- Air

- Land

- Government

- Sea

- Post/Couriers

- Others

- Identify the Category of Exporter:

- Custom (DTA units)

- SEZ

- Status holder exporters

- 100% EOU

- Warehouse export

- Others (Specify)

- Fill in the IE Code and AD code.

- Provide details of the Exporter’s Name & Address as well as the AD Name & Address.

- List the Consignee’s Name & Address.

- Indicate the Mode of Realisation:

- L/C

- BG

- Others (advance payment, etc.)

- Complete the fields for Port of Loading, Country of Destination, and Port of Discharge.

- State whether payment is received through ACU and fill in all General Commodity Descriptions.

- In Section 2, provide Invoice-wise details of Export Value for each invoice:

- Invoice No.

- Invoice Currency

- Nature of Contract (FOB, CIF, C&F, CI, etc.)

- Invoice Amount

- Detail particulars about the value breakdown (FOB Value, Freight, Insurance, Commission, etc.)

- Section 3 requires post office details if applicable and must include the stamp and signature of the Authorized Dealer.

- In Section 4, make the declaration:

- State your name as the seller/consignor.

- Confirm the particulars are true.

- Affirm that you will deliver foreign exchange representing the entire value of goods exported.

- Sign and date the declaration to finalize your submission.

- If required, leave space for the competent authority's use in Section 5.

Once you complete these steps, your Export Declaration form will be ready for submission. It’s always a good idea to double-check for accuracy to avoid delays in the export process.

What You Should Know About This Form

What is the purpose of the Export Declaration Form?

The Export Declaration Form serves as a primary document for exporters in India to declare the details of goods being exported. It ensures compliance with customs regulations and helps in monitoring foreign exchange transactions. The form provides essential information about the cargo, mode of transport, and payment terms, facilitating the smooth processing of exports.

Who is required to fill out the Export Declaration Form?

Any individual or organization involved in exporting goods from India must complete the Export Declaration Form. This includes manufacturers, traders, and other participants in the export process. Different categories of exporters, such as Custom, RBI-approved, and 100% EOU, must accurately fill out the form to meet regulatory requirements.

What information needs to be included in the Export Declaration Form?

The form requires various details, including the exporter’s name and address, consignee’s name and address, shipping bill number and date, mode of transport, and commodity description. Additionally, financial information such as the total FOB value and invoice-wise details should be provided. Accurate representation of all these details is crucial for compliance with customs authorities.

What happens if the Export Declaration Form is not filled correctly?

Incorrect or incomplete information on the Export Declaration Form can lead to delays in processing the export shipment. Customs officials may reject the export, resulting in additional fines or penalties. In certain cases, persistent inaccuracies could affect the exporter’s credibility and lead to increased scrutiny in future transactions.

What is the significance of the declaration made by the exporter at the end of the form?

The declaration signifies that the exporter confirms the correctness of the provided information and acknowledges that they are the seller of the goods. This legal assertion is important for safeguarding compliance with the Foreign Exchange Management Act. It also indicates the exporter’s responsibility to remit the foreign exchange value to the bank as per the regulations.

What should exporters do if they have further questions or need assistance with the Export Declaration Form?

If exporters have questions about filling out the Export Declaration Form or need assistance, they should contact their authorized dealer bank or a customs consultant. Additionally, they can reach out to the local customs office for specific guidance. Ensuring clarity on the process will help avoid potential compliance issues.

Common mistakes

Filling out the Export Declaration form is a crucial step for anyone engaged in exporting goods. However, many individuals encounter challenges that can lead to mistakes. One common error is failing to provide the correct Customs Security Number and Form Number. These identifiers are essential for tracking and processing shipments. When these numbers are incorrect or missing, it can cause delays that impact the timely delivery of goods. Thorough attention to these sections can prevent unnecessary complications.

Another frequent mistake involves the Category of Exporter. It’s imperative that exporters accurately select their appropriate classification, whether as Custom, SEZ, 100% EOU, or another designation. Inaccurate selection can lead to compliance issues, which may result in penalties or even the rejection of the export application. Therefore, reviewing the definitions associated with each category is essential for correct categorization.

Error in the Invoice Details is also a prevalent issue. Exporters often misuse the invoice number or fail to include the invoice date correctly. Inconsistencies in the invoice information can result in differences between declared and actual export values, leading to disputes with customs authorities. To avoid this, cross-checking invoice records with the information on the Export Declaration form is highly recommended.

Finally, another major mistake occurs in the Declaration by the Exporter section. Exporters may neglect to sign the form or inadvertently leave out necessary declarations regarding their status with the Reserve Bank of India. This section is a binding commitment to the accuracy of the information submitted. Omissions or inaccuracies here can lead to serious legal repercussions. Therefore, ensuring that this declaration is complete and accurately reflects the exporter’s situation is crucial.

Documents used along the form

When exporting goods, several documents accompany the Export Declaration form to ensure compliance with legal and regulatory requirements. Each document plays a crucial role in facilitating a smooth export process and helps in tracking and managing the shipment. Below are additional forms that are typically required.

- Commercial Invoice: This document serves as a bill for the goods being sold. It details the products being shipped, the value of the goods, payment terms, and the seller's and buyer's information. The commercial invoice is essential for customs clearance and for the buyer to process payment.

- Packing List: The packing list outlines the items included in the shipment. It specifies quantities, weights, dimensions, and packaging details. This document helps customs officials and freight forwarders confirm that all items accounted for match what is stated in the commercial invoice.

- Bill of Lading: Issued by the carrier, this document serves as a receipt of the goods and proof of the contract of carriage. It details the terms and conditions of the transport and is necessary for the buyer to claim ownership of the goods upon arrival at the destination.

- Export License: Depending on the nature of the goods being exported, an export license may be required. This document grants permission from the government to send specific goods to specific countries. It ensures that the export complies with national security and economic regulations.

Completing and submitting these forms accurately and promptly is vital for ensuring a successful export process. Each document not only fulfills regulatory obligations but also protects your interests throughout the transaction.

Similar forms

-

Commercial Invoice: This document provides details about the transaction between the seller and buyer. It includes descriptions of the goods, prices, and terms of sale, similar to the detailed cargo descriptions in the Export Declaration form.

-

Bill of Lading: The Bill of Lading serves as a contract between the exporter and carrier, similar to the mode of transport section of the Export Declaration form. It outlines the method of shipping and receiving details.

-

Export License: For certain regulated goods, an export license is required. This parallels the Export Declaration form's requirement for customs security and other export compliance requirements.

-

Packing List: The packing list details the contents of each package. It is akin to the invoice-wise details section in the Export Declaration form, as both provide a breakdown of the goods being exported.

-

Customs Declaration Form: This form is submitted to customs authorities and is similar to the Export Declaration form. Both declare the nature of the goods and ensure compliance with export regulations.

-

Certificate of Origin: This document certifies the country of origin of the goods. It relates to the Export Declaration form’s information on the state of origin, ensuring proper tariff applications.

-

Proforma Invoice: Issued prior to shipment, it outlines the expected prices and terms. This is similar to the invoice details section of the Export Declaration form, as it establishes the basis for the sale.

-

Airway Bill (for air transport): This document serves a similar function to the Bill of Lading but is specific to air transport. It contains transport details important for customs similar to the shipping details in the Export Declaration form.

Dos and Don'ts

When filling out the Export Declaration form, careful attention is crucial. Below are ten important do's and don'ts to guide you through the process to ensure accuracy and compliance.

- Do provide accurate details for the Customs Security No. and Form No.

- Do clearly indicate the Mode of Transport used for the shipment.

- Do specify the Nature of Cargo to avoid misunderstandings.

- Do ensure the Exporter's Name and Address are correct and complete.

- Do indicate the Country of Destination and Port of Discharge accurately.

- Don't leave any required fields blank; each section is essential for processing.

- Don't underestimate the importance of the Invoice details; verify all amounts and dates.

- Don't make unapproved alterations to the form; use the official template as provided.

- Don't delay submission; adhere to the timelines set for export declarations.

- Don't forget to retain a copy of the completed form for your records.

By following these guidelines, you will enhance the accuracy of your Export Declaration form, facilitating a smoother export process.

Misconceptions

- Misconception 1: The Export Declaration Form is only necessary for government exports.

- Misconception 2: Filling out the form is straightforward and does not require prior knowledge.

- Misconception 3: Once submitted, the export declaration cannot be modified.

- Misconception 4: The Export Declaration Form only serves one purpose.

This is not accurate. While government exports definitely require an Export Declaration Form, all exporters—including private businesses—must complete this form for their shipments. It ensures compliance with customs regulations for any type of export.

Many people find that the form can be complex and detail-oriented. Each section asks for specific information about the cargo, mode of transport, and financial details. A lack of understanding can lead to mistakes, which could cause delays or penalties.

This is incorrect. You can amend the information on your export declaration even after submission, as long as you follow the proper procedure. Mistakes or changes in shipment details can be accurately reflected through amendments to ensure your records remain correct.

This form serves multiple functions. It not only acts as a record for customs but also plays a role in verifying the shipment details for banks and financial purposes. Understanding its multifaceted uses can help exporters navigate the process more effectively.

Key takeaways

Here are key takeaways for filling out and using the Export Declaration form:

- General Information is crucial; ensure all sections, including Customs Security Number and Shipping Bill Number, are accurately filled.

- Indicate the Mode of Transport correctly. Options include Air, Land, Sea, and Post/Couriers.

- The Category of Exporter must be selected; options include SEZ, Status holder exporters, and 100% Export Oriented Units.

- Accurate IE Code and AD Code are required for customs clearance.

- List the Complete Address of both the exporter and the consignee.

- Provide details about the Country of Destination and Port of Discharge for the cargo.

- Fill in the Commodity Description clearly and comprehensively to avoid misunderstandings.

- Invoice-wise details need to be filled out for each invoice related to the shipping bill.

- If applicable, ensure to include the name of the post office and parcel receipts when using couriers.

- A Declaration by the exporter is necessary, confirming the truthfulness of the information provided.

Proper completion of this form is essential for compliance with regulations related to customs and foreign exchange management. This helps in facilitating smooth international transactions.

Browse Other Templates

Register Car in Ma - Completing Form MVU-26 allows individuals to potentially avoid sales or use tax on family vehicle transfers.

Equipment Operator Qualification Document,Operator Skills Validation Form,Heavy Machinery Certification Record,Non-Aircraft Equipment Proficiency Record,Vehicle Operator Competency Assessment,Driver Capability and Experience Sheet,Qualified Equipment - Completion of the DA 348 is mandatory for all equipment operators within the system.

Remodeling Contract Example - States that the builder may assign the contract to another party without homeowner consent.