Fill Out Your Eyemed Claim Form

When it comes to managing your eye care expenses, knowing how to navigate the EyeMed Out-Of-Network Claim Form can make a significant difference. This form serves as your pathway to reimbursement when you choose to visit a vision care provider who is not part of the EyeMed network. Before you fill it out, it's essential to check your benefits information to confirm that your plan includes coverage for out-of-network services. Once you’ve chosen your provider, ensure that you pay for the services upfront, as EyeMed will reimburse you later according to your plan design. To avoid delays, complete all sections of the form, and attach the required itemized paid receipts that detail the services and charges. If you're submitting for a secondary insurance benefit, include your Explanation of Benefits as well. A few additional steps are worth noting: if the reimbursement is directed to someone other than yourself, you'll need to provide verification of payment, and it's crucial to sign the form to confirm the accuracy of your claims. Adhering to these guidelines will help streamline your claim process and secure your deserved reimbursement.

Eyemed Claim Example

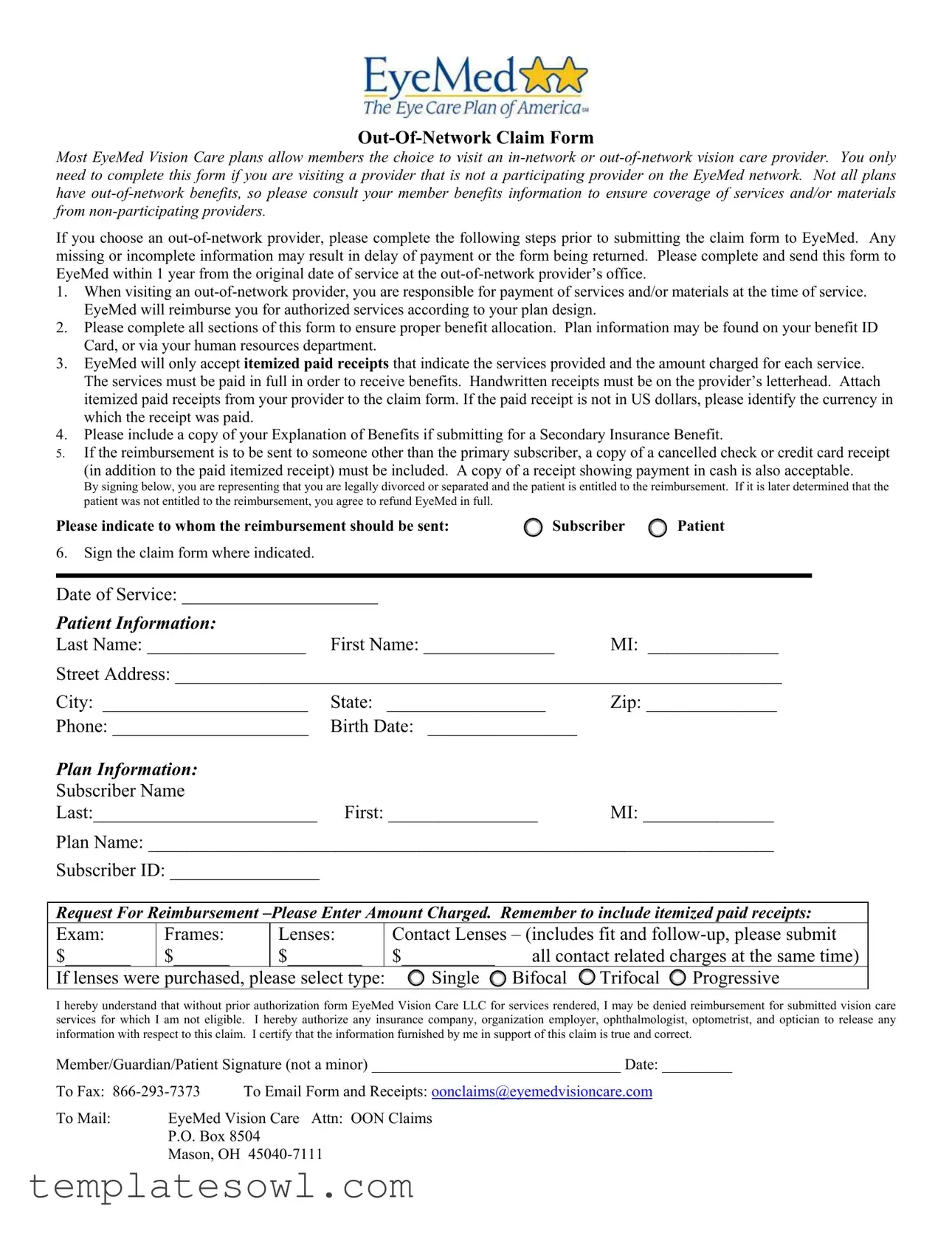

Most EyeMed Vision Care plans allow members the choice to visit an

If you choose an

1.When visiting an

2.Please complete all sections of this form to ensure proper benefit allocation. Plan information may be found on your benefit ID Card, or via your human resources department.

3.EyeMed will only accept itemized paid receipts that indicate the services provided and the amount charged for each service. The services must be paid in full in order to receive benefits. Handwritten receipts must be on the provider’s letterhead. Attach itemized paid receipts from your provider to the claim form. If the paid receipt is not in US dollars, please identify the currency in which the receipt was paid.

4.Please include a copy of your Explanation of Benefits if submitting for a Secondary Insurance Benefit.

5.If the reimbursement is to be sent to someone other than the primary subscriber, a copy of a cancelled check or credit card receipt

(in addition to the paid itemized receipt) must be included. A copy of a receipt showing payment in cash is also acceptable.

By signing below, you are representing that you are legally divorced or separated and the patient is entitled to the reimbursement. If it is later determined that the patient was not entitled to the reimbursement, you agree to refund EyeMed in full.

Please indicate to whom the reimbursement should be sent: |

Subscriber |

Patient |

6.Sign the claim form where indicated.

Date of Service: _____________________ |

|

Patient Information: |

|

Last Name: _________________ First Name: ______________ |

MI: ______________ |

Street Address: _________________________________________________________________

City: ______________________ |

State: _________________ |

Zip: ______________ |

Phone: _____________________ |

Birth Date: ________________ |

|

Plan Information: |

|

|

Subscriber Name |

|

|

Last:________________________ |

First: ________________ |

MI: ______________ |

Plan Name: ___________________________________________________________________

Subscriber ID: ________________

Request For Reimbursement

Exam: |

Frames: |

Lenses: |

|

Contact Lenses – (includes fit and |

|||

$_______ |

$______ |

$________ |

|

$__________ |

all contact related charges at the same time) |

||

If lenses were purchased, please SELECT type: |

Single |

Bifocal |

Trifocal |

Progressive |

|||

I hereby understand that without prior authorization form EyeMed Vision Care LLC for services rendered, I may be denied reimbursement for submitted vision care services for which I am not eligible. I hereby authorize any insurance company, organization employer, ophthalmologist, optometrist, and optician to release any information with respect to this claim. I certify that the information furnished by me in support of this claim is true and correct.

Member/Guardian/Patient Signature (not a minor) ________________________________ Date: _________

To Fax: |

To Email Form and Receipts: oonclaims@eyemedvisioncare.com |

|

To Mail: |

EyeMed Vision Care Attn: OON Claims |

|

|

P.O. Box 8504 |

|

|

Mason, OH |

|

Fraud Warning Statements

Arizona: For your protection Arizona law requires the following statement to appear on this form. Any person who knowingly presents a false or fraudulent claim for payment of a loss is subject to criminal and civil penalties.

Alaska: A person who knowingly and with intent to injure, defraud, or deceive an insurance company files a claim containing false, incomplete, or misleading information may be prosecuted under state law.

Arkansas: Any person who knowingly presents a false or fraudulent claim for payment of a loss or benefit or knowingly presents false information in an application for insurance is guilty of a crime and may be subject to fines and confinement in prison.

California: For your protection California law requires the following to appear on this form: Any person who knowingly presents false or fraudulent claim for the payment of a loss is guilty of a crime and may be subject to fines and confinement in state prison.

Colorado: It is unlawful to knowingly provide false, incomplete, or misleading facts or information to an insurance company for the purpose of defrauding or attempting to defraud the company. Penalties may include imprisonment, fines, denial of insurance and civil damages. Any insurance company or agent of an insurance company who knowingly provides false, incomplete or misleading facts or information to a policyholder or claimant for the purpose of defrauding or attempting to defraud a policyholder or claimant with regard to a settlement or award payable from insurance proceeds shall be reported to the Colorado Department of Insurance within the department of regulatory agencies.

District of Columbia: WARNING: It is a crime to provide false or misleading information to an insurer for the purpose of defrauding the insurer or any other person. Penalties include imprisonment and/or fines. In addition, an insurer may deny insurance benefits if false information materially related to a claim was provided by the applicant.

Florida: Any person who knowingly and with intent to injure, defraud, or deceive any insurer files a statement of claim or an application containing any false, incomplete or misleading information is guilty of a felony of the third degree.

Hawaii: For your protection, Hawaii law requires you to be informed that presenting a fraudulent claim for payment of a loss or benefit is a crime punishable by fines or imprisonment, or both.

Idaho: Any person who knowingly and with intent to defraud or deceive any insurance company, files a statement or claim containing a false, incomplete or misleading information is guilty of a felony.

Indiana: A person who knowingly and with intent to defraud an insurer files a statement of claim containing any false, incomplete or misleading information commits a felony.

Kentucky: Any person who knowingly and with intent to defraud any insurance company or other person files an application or claim for insurance containing any materially false information or conceals, for the purpose of misleading, information concerning any fact material thereto commits a fraudulent act, which is a crime.

Maine: It is a crime to knowingly provide false, incomplete or misleading information to an insurance company for the purpose of defrauding the company. Penalties may include imprisonment, fines or a denial of insurance benefits.

Minnesota: A person who files a claim with intent to defraud or helps commit a fraud against an insurer is guilty of a crime.

New Hampshire: Any person who, with a purpose to injure, defraud or deceive any insurance company, files a statement of claim containing any false, incomplete or misleading information is subject to prosecution and punishment for insurance fraud, as provided in § 638.20.

New Jersey: Any person who knowingly files a statement of claim containing any false or misleading information is subject to criminal and civil penalties.

New Mexico: Any person who knowingly presents a false or fraudulent claim for payment of a loss or benefit or knowingly presents false information in an application for insurance is guilty of a crime and may be subject to civil fines and criminal penalties.

New York: Any person who knowingly and with intent to defraud insurance company or other person files an application for insurance or statement of claim containing any materially false information or conceals for the purpose of misleading, information concerning any fact material thereto, commits a fraudulent act, which is a crime and shall also be subject to a civil penalty not to exceed $5,000 and the stated value of the claim for each such violation.

Ohio: Any person who, with intent to defraud, or knowing that he is facilitating a fraud against an insurer, submits an application or false claim containing a false or deceptive statement is guilty of insurance fraud.

Oklahoma: WARNING: Any person who knowingly and with intent to injure, defraud, or deceive any insurer makes any claim for the proceeds of an insurance policy containing any false, incomplete or misleading information is guilty of a felony.

Texas: Any person who knowingly presents a false or fraudulent claim for the payment of a loss is guilty of a crime and may be subject to fines and confinement in state prison.

Virginia: It is a crime to knowingly provide false, incomplete or misleading information to an insurance company for the purpose of defrauding the company. Penalties include imprisonment, fines and denial of insurance benefits.

Form Characteristics

| Fact Name | Fact Description |

|---|---|

| Claim Submission Deadline | Members must submit the EyeMed Claim form within one year from the original date of service. |

| Out-of-Network Payment Responsibility | Members are responsible for payment to the out-of-network provider at the time of service and will be reimbursed by EyeMed for authorized services. |

| Itemized Receipt Requirement | EyeMed accepts only itemized paid receipts showing services provided and amounts charged, verified receipts must be attached to the claim form. |

| Fraud Warning by State | The claim form includes specific fraud warnings based on state laws, which outline potential penalties for submitting false claims. |

Guidelines on Utilizing Eyemed Claim

Filling out the EyeMed Claim form is crucial when you have received vision care services from a provider outside of the EyeMed network. To ensure a smooth claims process, it’s important to provide complete and accurate information. Follow the steps outlined below to fill out the form correctly and submit it in a timely manner.

- Begin by indicating your Date of Service in the designated space.

- Provide the Patient Information:

- Last Name

- First Name

- Middle Initial

- Full Street Address

- City and State

- Zip Code

- Phone Number

- Birth Date

- Complete the Plan Information:

- Subscriber's Last Name

- Subscriber's First Name

- Subscriber's Middle Initial

- Plan Name

- Subscriber ID

- Fill in the Request for Reimbursement section, entering the amount charged for each of the following:

- Exam

- Frames

- Lenses

- Contact Lenses

- If applicable, indicate the type of lenses purchased:

- Single

- Bifocal

- Trifocal

- Progressive

- Attach all itemized paid receipts from the provider. Make sure these indicate the services provided and the amounts charged. If the payment was not made in US dollars, specify the currency.

- If you are submitting for Secondary Insurance Benefits, include a copy of your Explanation of Benefits.

- If the reimbursement should be sent to someone other than the primary subscriber, enclose a copy of a cancelled check or credit card receipt, along with the itemized receipt. A cash payment receipt is also acceptable.

- Sign the claim form in the designated area and fill in the date of signature.

- Submit the completed form and receipts by one of the following methods:

- Fax to: 866-293-7373

- Email to: oonclaims@eyemedvisioncare.com

- Mail to: EyeMed Vision Care, Attn: OON Claims, P.O. Box 8504, Mason, OH 45040-7111

Ensure all steps are followed carefully and all necessary documents attached to avoid delays in processing your claim. Timely submission is crucial, as claims should be sent within one year of the service date.

What You Should Know About This Form

1. What is the purpose of the EyeMed Claim Form?

The EyeMed Claim Form is intended for members who visit an out-of-network vision care provider. It allows you to request reimbursement for the services and materials received from providers not associated with the EyeMed network. Not all EyeMed plans include out-of-network benefits, so it’s important to check your plan details before using this form.

2. How do I complete the EyeMed Claim Form?

To complete the claim form, fill in all required sections with accurate information, including patient details, date of service, and the amounts charged for each service. You'll need to attach itemized receipts from your provider and ensure that they show payment in full. Any handwritten receipts must be on the provider's letterhead.

3. Where should I send the completed claim form?

You can submit the completed claim form and receipts by mailing them to EyeMed Vision Care, Attn: OON Claims, P.O. Box 8504, Mason, OH 45040-7111. Alternatively, you can fax the form to 866-293-7373 or email it to oonclaims@eyemedvisioncare.com.

4. What information needs to be included with the claim form?

When submitting the claim form, include itemized paid receipts that detail the services provided and charges. If applicable, also attach a copy of your Explanation of Benefits if you are claiming for a secondary insurance benefit. If the reimbursement should go to someone other than the primary subscriber, additional evidence of payment, such as a cancelled check or credit card receipt, must be provided.

5. How long do I have to submit my claim?

You must submit your claim to EyeMed within 1 year from the date of service. Late submissions may lead to denial of your claim. Ensure that all necessary information is included to avoid delays in processing.

6. What happens if I do not provide accurate information?

If you fail to include all required information, your claim may be delayed or returned. It's essential to carefully fill out every section of the claim form and include all necessary receipts to prevent any issues with processing your request for reimbursement.

7. Can I claim for services not previously authorized by EyeMed?

Reimbursement for services that have not received prior authorization from EyeMed may be denied. Therefore, it’s advisable to check with EyeMed before receiving such services to understand your eligibility for reimbursement based on your specific plan.

Common mistakes

When completing the EyeMed Claim Form, many individuals overlook important details that can delay reimbursement. One common mistake is failing to complete all sections of the form. Omitting any part of the required information can lead to processing delays or even rejection of the claim.

Another frequent error involves the submission of receipts. EyeMed only accepts itemized paid receipts that clearly indicate the services provided and the amount charged for each. Receipts that lack this information will not be sufficient for reimbursement. Additionally, it is crucial that these receipts are paid in full. Handwritten receipts must also be submitted on the provider’s letterhead, which many claimants might forget.

Some individuals neglect to check the currency of their receipts when submitting expenses for services paid outside the United States. If the payment was made in a currency other than U.S. dollars, the claimant must identify that currency. Failing to do so can complicate the reimbursement process and lengthen the time for resolution.

Another common oversight is the requirement related to secondary insurance benefits. If filing for reimbursement from a secondary insurance provider, a copy of the Explanation of Benefits is needed. Many claimants mistakenly skip this step, which can also result in delays.

Furthermore, if reimbursement is to be directed to someone other than the primary subscriber, additional documentation is necessary. Claimants must provide a copy of a canceled check or a credit card receipt, in addition to the required itemized receipt. Sometimes, claimants either forget to include these documents or fail to understand the need for them.

Finally, a clear and legible signature on the claim form is essential. Some individuals may overlook signing the document before submission, which essentially invalidates the claim. Without a valid signature, EyeMed cannot process the request, leading to further delays for the claimant.

Documents used along the form

When submitting an EyeMed Claim Form for out-of-network services, several other documents may be required to ensure a smooth processing experience. Each document plays a specific role in validating the claim and ensuring that the information provided is complete and accurate. Here are some commonly used forms and documents that work in conjunction with the EyeMed Claim Form:

- Itemized Paid Receipt: This is a detailed receipt from the out-of-network provider showing the services rendered and their respective costs. EyeMed requires this receipt to confirm what was billed and ensure that the services were paid in full.

- Explanation of Benefits (EOB): If you have a secondary insurance provider, including a copy of their EOB is essential when submitting your claim. This document outlines what was covered and the amounts paid by that insurance, aiding in the reimbursement process.

- Benefit ID Card: Your benefit ID card contains vital information, such as your member ID and plan details. This card should be referenced or included to help EyeMed quickly identify your coverage and benefits.

- Cancellation Check or Credit Card Receipt: If the reimbursement needs to go to someone other than the primary subscriber, a copy of a canceled check or a credit card receipt is necessary to prove payment. This ensures that the correct party receives the reimbursement.

- Statement of Agreement: In some cases, providing a signed agreement indicating who is authorized to receive the reimbursement is advised. This helps avoid any disputes regarding payment distribution.

- Out-of-Network Coverage List: A document indicating the services covered under your specific out-of-network benefits can be helpful. It outlines what EyeMed may reimburse you for, ensuring claims align with your plan.

- Claim Reference Number: If you have been issued a claim reference number from EyeMed or any previous correspondence, including it with your submission helps track your claim efficiently.

By preparing these documents in advance, you can facilitate the claims process and reduce the likelihood of delays. Always ensure that all forms are filled out accurately and completely to avoid complications. Proper documentation not only aids in faster reimbursement but also helps maintain transparency and clarity throughout the process.

Similar forms

Health Insurance Claim Form: Similar to the EyeMed Claim form, this document is used to request reimbursement for healthcare services. It requires personal and provider information, itemized receipts, and details regarding the service to ensure proper processing.

Dental Claim Form: Like the EyeMed form, this document captures necessary information about dental treatments and the cost associated. Patients must submit receipts and a breakdown of services rendered for reimbursement purposes.

Vision Care Insurance Reimbursement Form: This form serves the same purpose as the EyeMed Claim form but may be specific to different vision insurance providers. It collects details of the service, costs, and requires itemized billing receipts.

Out-of-Network Reimbursement Request: This document is closely aligned with the EyeMed Claim form, specifically for receiving funds for services from non-participating providers. It includes sections for service details, proof of payment, and personal information.

Flexible Spending Account (FSA) Claim Form: Similar functionality allows for reimbursement for eligible medical expenses. This form also requires itemized receipts and details about the services to be refunded.

Health Savings Account (HSA) Claim Form: Much like the EyeMed Claim form, this document is used to submit claims for eligible healthcare expenses incurred, requiring proof of payment and detailed service information.

Supplemental Insurance Claim Form: Similar in nature, this document allows users to claim expenses from supplemental insurance plans. It necessitates providing detailed service descriptions and receipts to substantiate the claim.

Medicare Claim Form (CMS-1500): This form is universally used for medical claims made to Medicare. Like the EyeMed form, it requires detailed information about patient services, provider data, and costs incurred.

Auto Insurance Medical Claims Form: This document serves to claim medical expenses incurred from an auto accident. Similar to the EyeMed Claim form, it collects necessary details about medical services and proof of payment for reimbursement.

Workers' Compensation Claim Form: This form aligns closely with the EyeMed Claim form in that it seeks reimbursement for medical costs incurred due to work-related injuries, requiring documentation of services rendered and payment details.

Dos and Don'ts

When filling out the EyeMed Claim form, following the right steps is essential for a smooth reimbursement process. Here are five things you should do and avoid:

- Do complete all sections of the form. Ensure every required part is filled out to prevent delays.

- Do attach itemized paid receipts from your provider. Receipts must clearly show the services provided and the amounts charged.

- Do indicate the reimbursement recipient. Specify whether the reimbursement goes to the subscriber or the patient.

- Do sign the claim form. Your signature confirms the information provided is accurate and truthful.

- Do submit your claim within one year of the service. This is crucial to ensure eligibility for reimbursement.

- Don’t submit handwritten receipts that are not on the provider’s letterhead. EyeMed requires formal documentation.

- Don’t forget to include currency information if receipts are not in US dollars. Clarity is important.

- Don’t skip attaching a copy of your Explanation of Benefits for secondary insurance claims. This documentation is necessary.

- Don’t leave out your plan information. This might include your subscriber ID and plan name.

- Don’t ignore the importance of accuracy. Incorrect or incomplete forms can lead to rejected claims or delays in payment.

Misconceptions

Misconception 1: You don’t need to pay upfront when visiting an out-of-network provider.

This is incorrect. When you choose an out-of-network provider, you are responsible for paying for services and materials at the time of your appointment. EyeMed will reimburse you later according to your plan.

Misconception 2: Any receipt will work for the claim submission.

This isn’t true. Only itemized paid receipts that clearly state the services provided and the amounts charged will be accepted. Make sure to check that the receipt includes this vital information.

Misconception 3: It doesn’t matter if the claim form is filled out completely.

Incomplete forms can lead to payment delays or even rejection of the claim. Be sure to fill out all sections of the form accurately to ensure proper processing.

Misconception 4: You have unlimited time to submit your claim.

Actually, claims must be submitted within one year from the original service date. Mark your calendar to ensure you don’t forget!

Misconception 5: You can submit a handwritten receipt from any provider.

A handwritten receipt must be on the provider’s letterhead and should include all necessary details. Otherwise, it may not be accepted.

Misconception 6: It’s okay to submit claims without including the Explanation of Benefits if you have secondary insurance.

This is false. If you are submitting for a Secondary Insurance Benefit, you must include a copy of your Explanation of Benefits for proper processing.

Misconception 7: You can send your claim forms through any method.

There are specific submission methods: by fax, email, or regular mail, which must be followed. Make sure to choose the correct method to avoid delays.

Key takeaways

When filling out the EyeMed Claim Form for out-of-network services, there are several important points to remember:

- Timely Submission: Submit the completed claim form to EyeMed within 1 year from the original date of service. Delays may hinder reimbursement.

- Payment Responsibility: Pay for all services at the time of your visit. EyeMed will reimburse you according to your plan's specific guidelines.

- Complete Information: Ensure all sections of the form are filled out, as missing information can cause delays or rejections.

- Documentation Requirements: Attach itemized receipts showing the services received and payment made. Receipts must be in US dollars, or the currency should be specified.

Following these key steps can help ensure a smoother claims process and quicker reimbursements.

Browse Other Templates

Legal Guardianship Illinois - Instructions detail various conditions under which the appointment becomes effective.

Bmo Harris Payment - Provide the account numbers for each checking account you wish to use.