Fill Out Your Fafsa Signature Page Form

The FAFSA Signature Page form plays a crucial role in securing financial aid for students pursuing higher education. This form is not just a simple piece of paperwork; it serves as a certification of your commitment to using federal and state financial aid responsibly. By signing it, you confirm that you plan to use these funds solely for educational costs and that you meet certain eligibility requirements. This includes not being in default on federal loans and making satisfactory arrangements to repay any grants received. The form also holds you accountable for providing truthful information, which must be verifiable through tax documents if requested. If you choose to sign electronically, a personal identification number (PIN) will be your safeguard for authenticity. Importantly, misrepresentation can lead to severe penalties, so honesty is key. Completing this form requires information about both you and your parents if their financial details are included on your application, ensuring a comprehensive look at your financial background. Whether you’re the student or a parent signing on behalf of the student, understanding the requirements and implications of this form is a critical step in the application process for financial aid.

Fafsa Signature Page Example

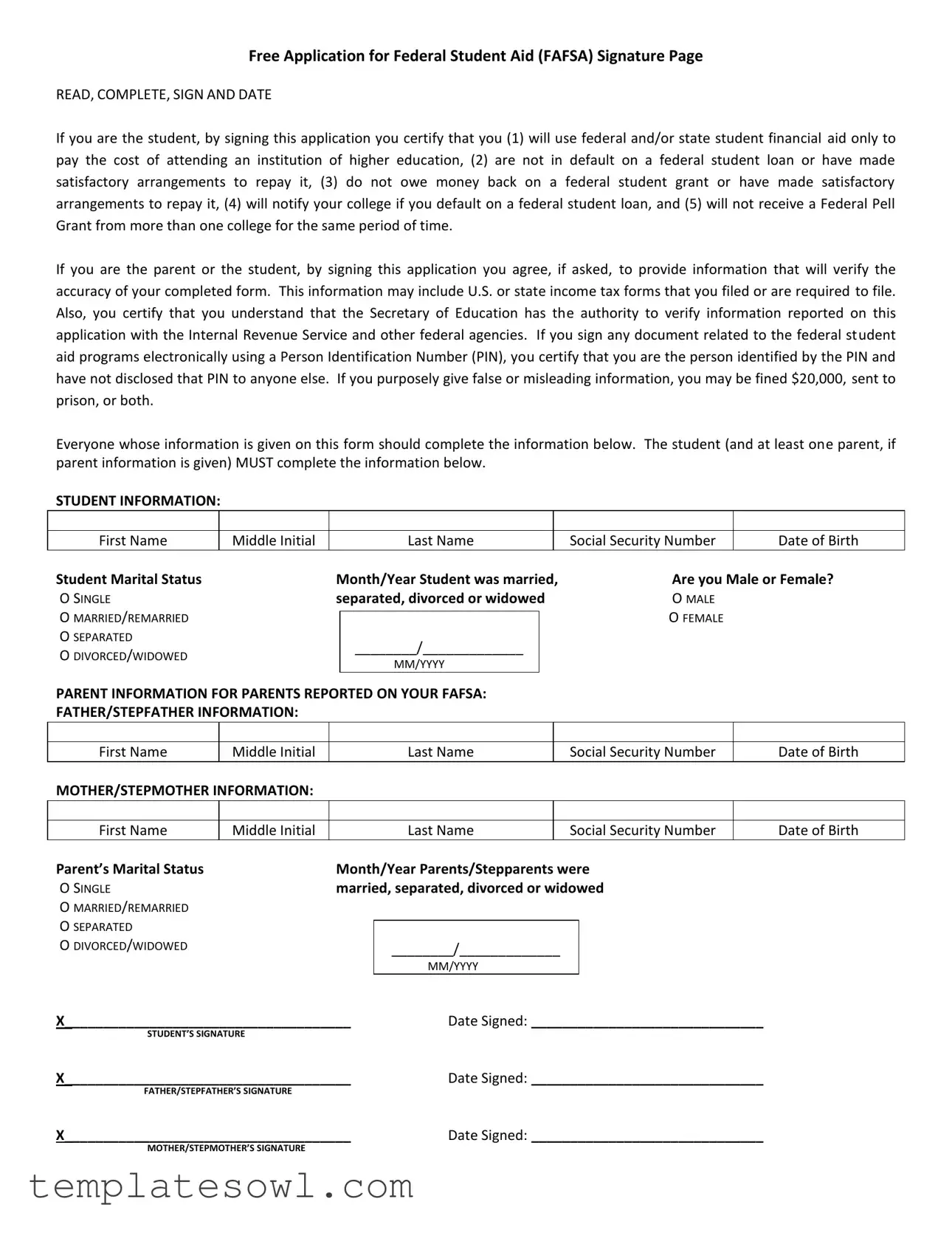

Free Application for Federal Student Aid (FAFSA) Signature Page

READ, COMPLETE, SIGN AND DATE

If you are the student, by signing this application you certify that you (1) will use federal and/or state student financial aid only to pay the cost of attending an institution of higher education, (2) are not in default on a federal student loan or have made satisfactory arrangements to repay it, (3) do not owe money back on a federal student grant or have made satisfactory arrangements to repay it, (4) will notify your college if you default on a federal student loan, and (5) will not receive a Federal Pell Grant from more than one college for the same period of time.

If you are the parent or the student, by signing this application you agree, if asked, to provide information that will verify the accuracy of your completed form. This information may include U.S. or state income tax forms that you filed or are required to file. Also, you certify that you understand that the Secretary of Education has the authority to verify information reported on this application with the Internal Revenue Service and other federal agencies. If you sign any document related to the federal student aid programs electronically using a Person Identification Number (PIN), you certify that you are the person identified by the PIN and have not disclosed that PIN to anyone else. If you purposely give false or misleading information, you may be fined $20,000, sent to prison, or both.

Everyone whose information is given on this form should complete the information below. The student (and at least one parent, if parent information is given) MUST complete the information below.

STUDENT INFORMATION:

First Name

Middle Initial

Last Name

Social Security Number

Date of Birth

Student Marital Status |

|

Month/Year Student was married, |

|

Are you Male or Female? |

|||||||

O SINGLE |

|

separated, divorced or widowed |

|

O MALE |

|

||||||

O MARRIED/REMARRIED |

|

|

|

|

|

|

|

|

O FEMALE |

|

|

|

|

|

|

|

|

|

|

||||

O SEPARATED |

|

|

|

________/_____________ |

|

|

|

|

|

|

|

O DIVORCED/WIDOWED |

|

|

|

|

|

|

|

|

|

||

|

|

|

|

MM/YYYY |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

PARENT INFORMATION FOR PARENTS REPORTED ON YOUR FAFSA: |

|

|

|

|

|||||||

FATHER/STEPFATHER INFORMATION: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

First Name |

Middle Initial |

|

|

|

Last Name |

|

Social Security Number |

|

Date of Birth |

||

MOTHER/STEPMOTHER INFORMATION: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

First Name |

Middle Initial |

|

|

|

Last Name |

|

Social Security Number |

|

Date of Birth |

||

Parent’s Marital Status |

|

Month/Year Parents/Stepparents were |

|

||||||||

O SINGLE |

|

married, separated, divorced or widowed |

|

||||||||

O MARRIED/REMARRIED |

|

|

|

|

|

|

|

|

|

|

|

O SEPARATED |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

O DIVORCED/WIDOWED |

|

|

|

|

________/_____________ |

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

MM/YYYY |

|

|

|

|

||

X_____________________________________ |

|

Date Signed: ______________________________ |

|

||||||||

STUDENT’S SIGNATURE |

|

|

|

|

|

|

|

|

|

|

|

X_____________________________________ |

|

Date Signed: ______________________________ |

|

||||||||

FATHER/STEPFATHER’S SIGNATURE |

|

|

|

|

|

|

|

|

|

|

|

X_____________________________________ |

|

Date Signed: ______________________________ |

|

||||||||

MOTHER/STEPMOTHER’S SIGNATURE

Form Characteristics

| Fact Name | Details |

|---|---|

| Purpose | The FAFSA Signature Page certifies that the applicant agrees to use financial aid responsibly. |

| Eligibility | Only students attending an institution of higher education can apply for federal and state aid. |

| Loan Default | Applicants must not be in default on any federal student loans or must have made repayment arrangements. |

| Grant Repayment | Applicants should not owe money for federal grants unless arrangements for repayment have been made. |

| Verification | Applicants agree to provide verification information, including tax forms, upon request. |

| Electronic Signature | Using a Personal Identification Number (PIN) confirms the identity of the signer. |

| Penalties | Providing false information can result in fines up to $20,000 or imprisonment. |

| Completion Requirement | The student and at least one parent must complete the signature section. |

| Governing Laws | Federal laws, including the Higher Education Act, govern the FAFSA process and its enforcement. |

Guidelines on Utilizing Fafsa Signature Page

Completing the FAFSA Signature Page form is an important step in the financial aid application process. After filling out the main FAFSA form, you must provide signatures to certify that all information is true and accurate. Ensure you have all necessary information at hand to complete this page appropriately.

- Visit the FAFSA Signature Page form online or print a copy if you prefer to fill it out by hand.

- Locate the section for Student Information at the top of the page.

- Enter the student's first name, middle initial, and last name in the corresponding fields.

- Provide the student's Social Security Number in the designated area.

- Fill in the date of birth of the student, using the format Month/Day/Year.

- Select the student’s marital status from the provided options: SINGLE, MARRIED/REMARRIED, SEPARATED, DIVORCED/WIDOWED.

- If applicable, enter the month and year of when the student was married or separated.

- Indicate the student's gender by selecting either MALE or FEMALE.

- Find the section labeled Parent Information for Parents Reported on Your FAFSA.

- For the father/stepfather, enter the required information including first name, middle initial, last name, Social Security Number, and date of birth.

- Repeat the process for the mother/stepmother, filling in the same types of details as for the father/stepfather.

- Choose the parents' marital status from the available options: SINGLE, MARRIED/REMARRIED, SEPARATED, DIVORCED/WIDOWED.

- Enter the month and year that the parents or stepparents were married, separated, or divorced if applicable.

- Both the student and at least one parent must sign the form in the designated areas.

- Date each signature by entering the corresponding date in the provided lines.

What You Should Know About This Form

What is the FAFSA Signature Page?

The FAFSA Signature Page is a crucial component of the Free Application for Federal Student Aid (FAFSA). It serves as a certification that the information submitted in the FAFSA is accurate and complete. By signing this page, students and their parents agree to abide by the rules for receiving federal and state financial aid.

Why do I need to sign the FAFSA Signature Page?

Your signature on the FAFSA Signature Page confirms your understanding of the terms and conditions of federal student aid. It ensures that you will use the funds solely for educational expenses and that you are not in default on any federal loans. Signing this page is required for your application to be processed and considered for financial aid.

Who needs to sign the FAFSA Signature Page?

The student must sign the FAFSA Signature Page. If parent information is included in the FAFSA, at least one parent or stepparent must also sign. This requirement ensures that both the student and the parent understand and agree to the financial obligations associated with receiving aid.

What happens if I don’t sign the FAFSA Signature Page?

If the FAFSA Signature Page is not signed, your application cannot be processed. This means you may miss out on vital financial aid opportunities that could help cover college costs. It is essential to ensure all necessary signatures are obtained as soon as possible.

Can I submit the FAFSA Signature Page electronically?

Yes, you can submit the FAFSA Signature Page electronically using a Personal Identification Number (PIN). The PIN acts as your signature and verifies your identity. When using a PIN, never share it with anyone else to maintain the integrity of your application.

What if I make a mistake on the FAFSA Signature Page?

If you realize that you’ve made a mistake after signing, do not panic. You can update your FAFSA online at any time. It’s recommended to make corrections as soon as possible to prevent delays in processing your financial aid.

What should I do if I am not eligible to use the FAFSA Signature Page?

If you are not eligible to sign the FAFSA Signature Page, perhaps due to being a dependent student with no parent signature, you may need to provide additional documentation or seek assistance from your school’s financial aid office. They can guide you on alternative options available to you.

How do I know if my FAFSA Signature Page has been received?

What are the penalties for providing false information on the FAFSA Signature Page?

Providing false or misleading information can lead to serious consequences, including fines of up to $20,000, imprisonment, or both. It's critical to ensure all information given on the FAFSA and the Signature Page is accurate to avoid such penalties.

Common mistakes

When filling out the FAFSA Signature Page, one common mistake is overlooking the importance of accurate naming conventions. Students often miswrite their own names or the names of their parents or stepparents. This can lead to confusion regarding eligibility. It's essential to ensure that names match those on official documents, such as Social Security cards and driver’s licenses.

Another frequent error occurs with the Social Security Number. Some individuals mistakenly input incorrect digits, which may result in delays or even rejections of financial aid applications. It’s crucial to double-check each digit before submission. Remember, the Social Security Number is sensitive, and accuracy here is vital for verifying your identity.

Additionally, people often forget to sign and date the form properly. Both the student and at least one parent must provide their signatures, and each signature must be accompanied by the date. Incomplete or unsigned forms cannot be processed, which could jeopardize financial aid opportunities. Each party involved should take care to review the form thoroughly.

Lastly, misunderstanding the terms and certifications can create issues. For instance, failing to recognize the implications of falsely reporting information can have serious consequences, including penalties. The signer should read the certification statements closely and ensure they fully understand the commitments and obligations they are agreeing to by signing.

Documents used along the form

When completing the FAFSA Signature Page, there are several other documents that you may need to use alongside it. Each of these documents plays a crucial role in helping to secure financial aid for higher education. Below are some forms that are often required in connection with the FAFSA.

- Free Application for Federal Student Aid (FAFSA): This is the primary form that students fill out to apply for federal financial aid. It collects information about the student’s and their family's financial situation to determine eligibility for grants, loans, and work-study programs.

- IRS Tax Return Transcripts: Often needed to verify the income reported on the FAFSA, these transcripts can show your adjusted gross income, which helps assess your financial status. Tax transcripts provide a reliable third-party verification of your reported income.

- Verification Worksheet: If your FAFSA is selected for verification, you might be required to fill out this worksheet. It gathers additional details to confirm the information provided in your FAFSA, including details about household size and income.

- Parent’s Tax Returns: If the FAFSA includes parental information, parents may need to provide their own tax returns. These documents are essential for verifying the family's financial information and ensuring the accuracy of the FAFSA data.

These documents work together with the FAFSA Signature Page to create a complete application for financial aid. Ensuring that all information is accurate and complete can improve your chances of receiving the aid you need for your education. Always check the specific requirements that apply to you or your situation, as they can vary based on individual circumstances.

Similar forms

The FAFSA Signature Page plays an important role in the application process for federal student aid. Its function is similar to several other documents, often requiring personal information and confirmation of eligibility. The following list highlights six documents that share similarities with the FAFSA Signature Page:

- Tax Return Signature Page: Like the FAFSA, this document requires a signature to certify that the information is accurate and complete. It reflects the individual's financial situation, which is critical for assessing eligibility for financial assistance.

- Loan Application Signature Page: This document often demands a signature to confirm acceptance of loan terms and the accuracy of information provided. Just as with FAFSA, it also indicates compliance with repayment obligations.

- Financial Aid Agreement:** This agreement outlines the terms of financial aid offered by an institution. An individual's signature is necessary to acknowledge acceptance and understanding of the conditions, similar to the FAFSA form.

- College Admission Application Signature Page: Often included with college applications, this page requires a signature to affirm that all provided information is accurate and honest, mirroring the integrity requirements found in FAFSA.

- Grant Application Signature Page: When applying for various grants, applicants must sign to verify their eligibility and confirm the completeness of the application. This aligns with the verification process seen in the FAFSA Signature Page.

- Housing Application Signature Page: Similar to FAFSA, this document includes a signature to confirm that the applicant has read and agrees to the terms regarding housing assistance, confirming the accuracy of their statements.

Each of these documents plays a vital role in ensuring that the information provided is truthful and that the applicant understands their obligations within various programs.

Dos and Don'ts

When filling out the FAFSA Signature Page form, ensure that you follow these guidelines to avoid potential issues.

- Do read the instructions carefully. Make sure you understand what is required before you start filling it out.

- Do sign and date the form accurately. Both the student and at least one parent should provide their signatures and the correct date.

- Do keep a copy of the completed form. This will help you reference the information in case you need it later.

- Do seek help if needed. Reach out to school counselors or financial aid offices if you have questions.

- Do provide honest information. The penalties for false information can be serious and may include fines or imprisonment.

- Don't leave any required fields blank. Ensure all necessary information is filled out completely to avoid processing delays.

- Don't use a PIN that belongs to someone else. This could lead to issues with verifying your identity.

- Don't forget to notify the school of any changes. If your financial situation changes, it's important to inform them as soon as possible.

- Don't rush through the form. Taking your time ensures accuracy and thoroughness.

- Don't ignore deadlines. Make sure to submit your FAFSA by the required date to maximize your financial aid opportunities.

Misconceptions

Understanding the FAFSA Signature Page can help avoid common misunderstandings. Here are four misconceptions about this important form:

- Misconception 1: Only the student needs to sign the FAFSA Signature Page.

Many believe that only the student’s signature is required. However, if parent information is included on the FAFSA, at least one parent must also sign.

- Misconception 2: The FAFSA Signature Page is optional.

This is false. The signature page is essential for the application to be processed. Without the required signatures, the FAFSA will be incomplete.

- Misconception 3: Signing the FAFSA means you are committing to repay the aid.

Some think that signing indicates an agreement to repay loans. In reality, signing certifies that the information is accurate and that aid will be used appropriately, not that repayment is guaranteed.

- Misconception 4: Using an electronic signature is less secure than a written one.

The electronic signature process is designed to be secure. If you use your Personal Identification Number (PIN) correctly, it provides a valid and secure way to sign the FAFSA.

Key takeaways

When filling out and using the FAFSA Signature Page form, consider the following key takeaways:

- Understand the responsibilities: By signing the FAFSA, both students and parents certify their willingness to comply with specific regulations related to federal and state financial aid. This includes agreeing to use financial aid solely for educational expenses and notifying the college of any defaults on federal loans.

- Provide accurate information: It is crucial to ensure that all provided information is accurate. Any false or misleading information can lead to severe penalties, including fines or imprisonment.

- Ensure all required signatures: The FAFSA Signature Page mandates that the student and at least one parent sign the document. Both signatures must be dated, emphasizing the importance of finalizing this process before submission.

- Be aware of the verification process: Signers agree to provide verifying documents if requested, such as income tax forms. The U.S. Department of Education possesses the authority to verify details with other federal agencies, highlighting the need for honesty in your submissions.

Browse Other Templates

Universal Claim Form Pharmacy - The NCPDP Billing Form is used for submitting pharmacy claims to insurance providers.

Species Development Form,Evolutionary Change Worksheet,New Species Inquiry Sheet,Geographic Isolation Analysis,Speciation Exploration Form,Adaptation Assessment Worksheet,Isolated Species Investigation,Evolutionary Theory Questionnaire,Galapagos Spec - Evolutionary changes can occur due to both adaptation and random genetic drift.

How Many Nots Points Added for Not Stopping - A requester identification label is included on the form to ensure proper handling and delivery.