Fill Out Your Family Chore Chart Form

The Family Chore Chart serves as a foundational tool to help families instill financial responsibility and life skills in their tweens. Designed to accompany an allowance system, this chart allows parents to outline specific chores and tasks, ensuring that children earn their keep through contributions to household maintenance. It encourages financial discussions within the family, guiding tweens through the decision-making process around saving and spending. A built-in incentive structure might include bonuses for completing tasks like shoveling snow or raking leaves, reinforcing the idea that effort is rewarded. These chores can also be tied to a regular allowance day, promoting budgeting and anticipation. Additionally, the chart promotes goal-setting by allowing tweens to track their progress towards financial objectives, such as saving for a new video game or guitar lessons. Enlisting a cool adult figure, like a babysitter or coach, can also make financial lessons more relatable, creating a bridge between parents' advice and real-world application for the kids. Through diverse resources—like books and websites focused on money management—this form nurtures a proactive approach to financial literacy, preparing children for sound financial habits in their future.

Family Chore Chart Example

M ney Talks To Tweens

ney Talks To Tweens

and their families

Brought to you by your local bank and the ABA Education Foundation

Quick Tips to Help

Your Tween

Save Money!

1 If your tween has spending money, have him write a list of the things he’d like to purchase. Prioritize the list and discuss the choices, even research the lowest prices.

2 Help your tween earn extra money by suggesting he start a paper route or a

3 Set up an automatic savings plan for college or other expenses for your child. Putting away $5 a week over 18 years is $4680 — even more with interest earned if the money is in a bank account.

4 Have your tween wait at least

48 hours before buying an impulse purchase. If he still wants to buy the video game or CD a couple of days or a week later, you can be confident about it too.

It’s Pay Day!

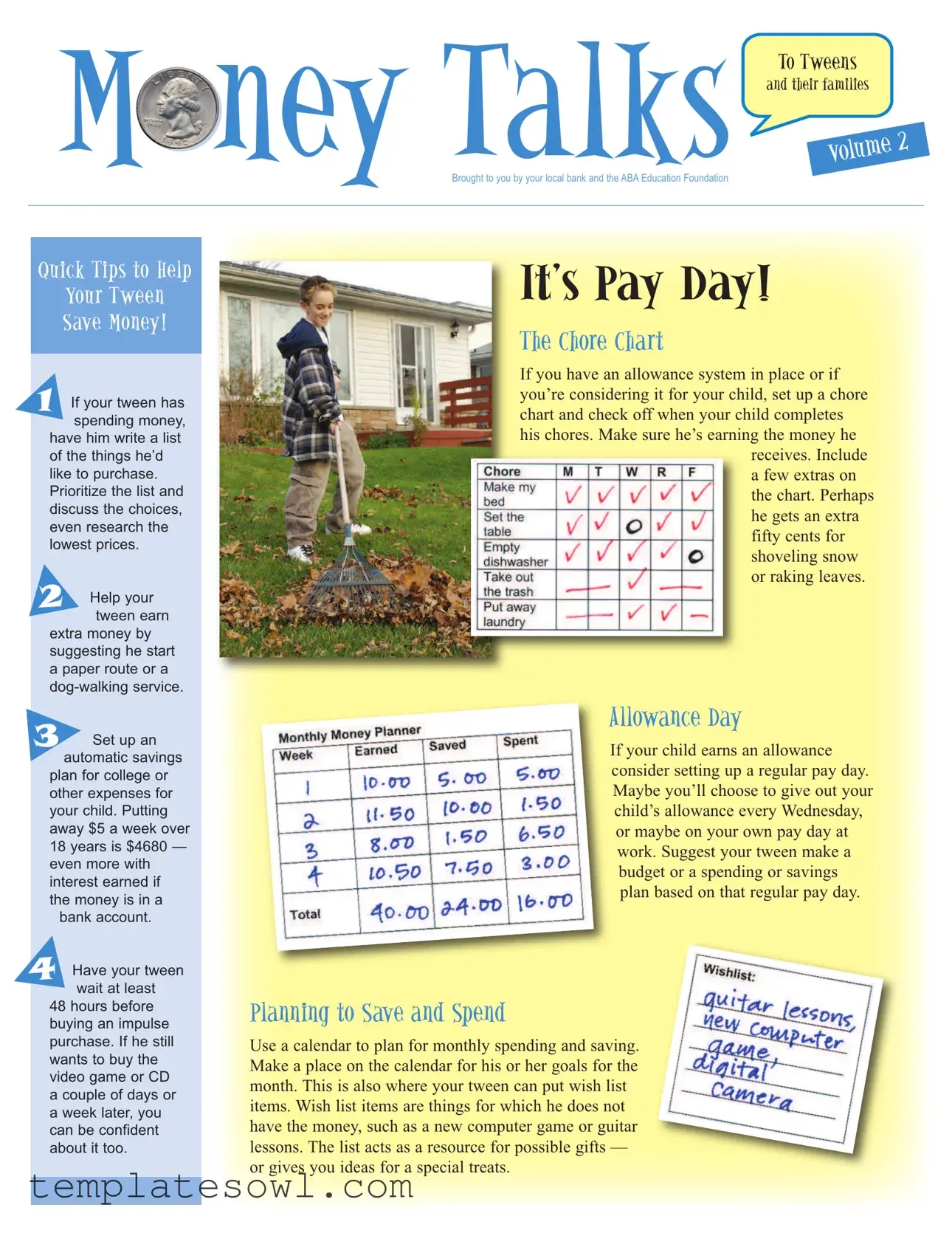

The Chore Chart

If you have an allowance system in place or if you’re considering it for your child, set up a chore chart and check off when your child completes his chores. Make sure he’s earning the money he

receives. Include a few extras on the chart. Perhaps he gets an extra fifty cents for shoveling snow or raking leaves.

Allowance Day

If your child earns an allowance consider setting up a regular pay day. Maybe you’ll choose to give out your child’s allowance everyWednesday, or maybe on your own pay day at work. Suggest your tween make a budget or a spending or savings plan based on that regular pay day.

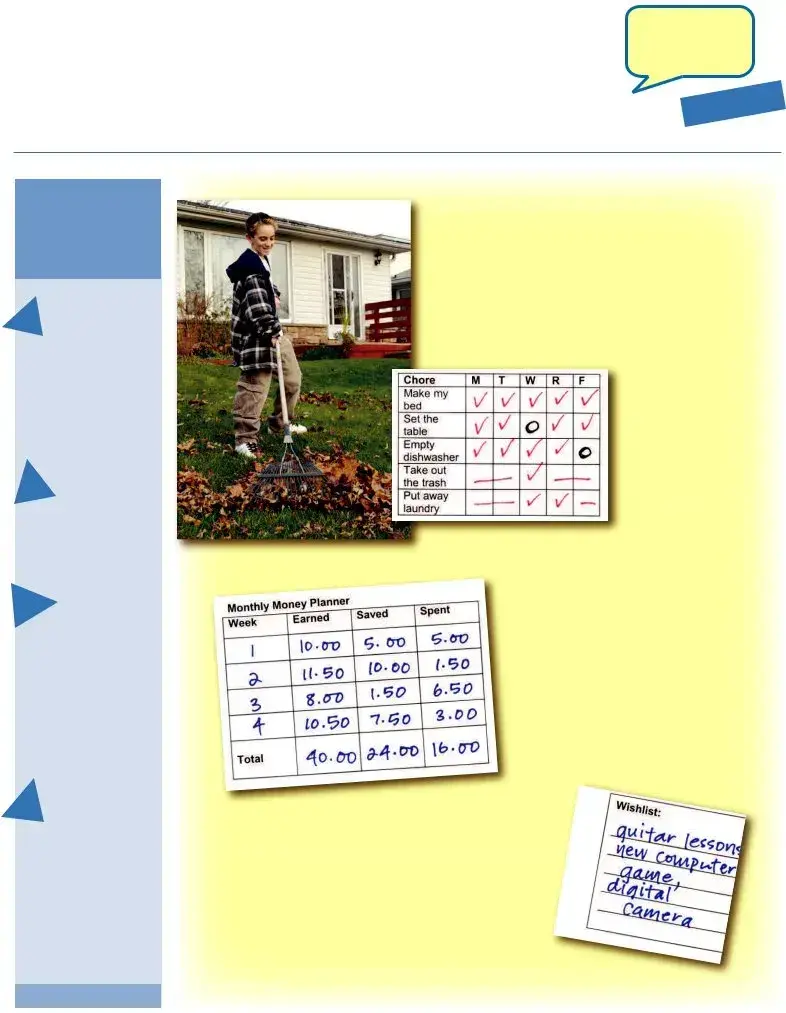

Planning to Save and Spend

Use a calendar to plan for monthly spending and saving. Make a place on the calendar for his or her goals for the month.This is also where your tween can put wish list items.Wish list items are things for which he does not have the money, such as a new computer game or guitar lessons.The list acts as a resource for possible gifts — or gives you ideas for a special treats.

Enlist Someone Cool

Enlist Someone Cool

Parents,guardiansandgrandparentsknowthattothetweenintheirlife,adults

If all of your talking about the importance ofsavingandplanningforthefuturedoesn’t seemtobesinkinginwithyourtween spender,enlistsomeoneheorshethinksis cool.Maybeit’syourdaughter’sbabysitter, alifeguardatthepool,oryourson’ssoccer coach.Asksomeonewithwhomyourchild hasaconnection.

Encouragethatspecialpersoninyour child’slifetodiscussafewbasicmessages aboutsavingandbudgeting.Perhapsyour daughter’sbabysitterwillshareherstoryof savingforherschooltrip.Yourson’ssoccer coachmighthaveagreatstoryabouthowhe

madeextramoneydoingneighbors’chores.Thelifeguardatthepoolmightbe abletoshareacautionarystoryabouthowsheblewlastyear’ssummerwages onatriptothebeach,whenhewassupposedtousehissavingsforadown paymentonacar.WhetherthetalesarebasedonwhattodoorwhatNOTto do,theywillbeinstructive.

Check Out These Books!

Visit your local library or bookstore …

Earning Money: How

Economics Works

By Patricia J. Murphy

This book details how to earn money, either by

requesting an allowance or starting a

Money Sense for Kids

By Hollis Page Harman

This book introduces different types of U.S. currency, an explanation of the complicated path

that money takes from the mint to banks to the consumer, how to earn money and how to make it grow by investing in stocks and bonds. Clear,

Click Your Mouse Here

http://pbskids.org/dontbuyit

(Corporation for Public Broadcasting and Public Broadcasting Service)

Yet another site developed specifically for tweens, Don’t Buy It: Get Media Smart is a media literacy Web site for young people that encourages users to think critically about media and become smart consumers. Activities on the site are designed to provide users with some of the skills and knowledge needed to question, analyze, interpret and evaluate media messages.

www.plasticforkdiaries.com (Maryland Public Television)

This Web site especially for tweens follows six middle school students as they experience

The ABA Education Foundation, a

© 2007 American Bankers Association Education Foundation, Washington, DC. Permission to reprint granted.

Form Characteristics

| Fact Title | Description |

|---|---|

| Purpose | The Family Chore Chart helps families encourage tweens to save money and manage their finances effectively. |

| Allowance System | It supports setting up an allowance system based on completed chores for fair earnings. |

| Savings Plan | Families are guided to establish automatic savings plans for future expenses, such as college. |

| Impulse Purchases | The chart promotes waiting 48 hours before making impulse purchases, allowing for thoughtful decision-making. |

| Involvement of Adults | It encourages engaging “cool” adults, like coaches or babysitters, to reinforce money management lessons. |

| Recommended Resources | Various books and websites offer additional finance education and practical advice for tweens and families. |

Guidelines on Utilizing Family Chore Chart

Completing the Family Chore Chart is an excellent way to help your tween develop responsibility while earning money. The steps are straightforward, ensuring the process is enjoyable and educational. Follow the instructions below to effectively fill out the chart.

- Start with a blank chart. You can draw one on paper or use a digital tool.

- At the top of the chart, write down your child’s name to personalize it.

- List all chores your tween is responsible for. Consider including daily tasks like making the bed, as well as weekly chores like vacuuming.

- Assign a monetary value to each chore. Be fair and consider how long each task takes to complete.

- Make space for additional rewards, such as extra earnings for tasks like shoveling snow or washing the car.

- Include a section for notes. This can track completed chores or other reminders.

- Decide on a regular payday. This can be weekly, bi-weekly, or whatever works best for your family.

- Encourage your tween to review the chart regularly and check off completed chores. This practice helps reinforce accountability.

- Discuss any changes or adjustments in chores or payouts as needed, keeping the dialogue open and constructive.

What You Should Know About This Form

What is the purpose of the Family Chore Chart?

The Family Chore Chart is designed to help organize household responsibilities and teach tweens about earning money through completing chores. By using this chart, families can create a structured allowance system that encourages children to contribute to the household while learning valuable lessons about money management.

How does the chore chart help with allowance management?

The chart allows parents to track which chores have been completed by their children, making it easier to determine if an allowance is justified. Chores can be assigned specific values, and extra tasks can provide additional earning opportunities. This system encourages consistency and accountability for both parents and children.

What are some ideas for extra tasks on the chore chart?

In addition to regular chores, families can include extra tasks such as shoveling snow, raking leaves, or washing the family car. These tasks can be valued at a set amount, providing children with the chance to earn extra money for special purchases while instilling a strong work ethic.

How can parents encourage their tweens to save money?

Parents can emphasize the importance of saving by setting up automatic savings plans or encouraging their tweens to wait before making impulse purchases. Discussing financial goals, utilizing a calendar for planning monthly spending, and collaborating on a savings plan can also help reinforce these concepts.

Who can help reinforce the lessons in money management?

Parents can enlist individuals whom tweens consider "cool," like babysitters or coaches, to discuss smart money management. These conversations can offer relatable insights and personal stories that resonate with children, making them more likely to absorb important financial lessons.

What resources are available for further learning about money management?

Families can explore books like "Earning Money: How Economics Works" by Patricia J. Murphy and "Money Sense for Kids" by Hollis Page Harman. Additionally, various websites provide engaging materials designed specifically for tweens, such as the PBS site about media literacy and budget management strategies.

Common mistakes

Filling out the Family Chore Chart can seem straightforward, but many families make common mistakes that can lead to confusion. One mistake to avoid is skipping the instructions. It’s important to read through all the sections carefully to understand how to fill it out correctly.

Another frequent error is not involving the child in the process. When parents do all the work, the child may not feel ownership over the chores. This can lead to resistance or lack of motivation. Allow your tween to contribute in deciding which chores they want to take on. It creates a sense of responsibility.

People often forget to update the chore chart regularly. If tasks are not checked off consistently, it can create misunderstandings about what chores have been completed. Set a routine for checking and updating the chart together to keep everyone informed.

Including too many chores at once is another mistake. It can overwhelm the child and lead to frustration. Focus on a few essential tasks initially, and then gradually add more as they become comfortable. This approach helps build confidence.

Furthermore, it's easy to overlook the importance of rewards. Not setting clear rewards for completed chores may diminish enthusiasm. Be sure to establish a system that recognizes their hard work, whether it's an allowance or extra privileges.

Some families neglect to hold discussions about the value of chores and allowances. Have conversations about why completing chores is important and how it ties into financial literacy. Understanding the reasons behind chores can motivate children to engage more actively.

Finally, forgetting to personalize the chart can lead to a lack of interest. Every child is different, and a one-size-fits-all approach may not work. Tailor the chart to fit your child’s interests and hobbies. A personalized touch makes the chores feel relevant and engaging.

Documents used along the form

The Family Chore Chart form is an excellent tool for teaching young people about responsibility and money management. In conjunction with this form, there are several documents and resources that can enhance financial literacy and promote productive habits within the family. Below is a list of related documents that families may find beneficial.

- Allowance Agreement: A written agreement that outlines how much allowance a child will receive, when it will be disbursed, and under what conditions. This document helps children understand the value of money and the link between chores and earnings.

- Budget Planner: A simple worksheet where families can assess income and expenditures. By tracking spending habits, children can start to grasp how to manage their money effectively.

- Chore Guidelines: A list of chores and expectations for each family member. This document provides clarity and sets standards for what needs to be accomplished, making it easier to complete tasks and understand their worth in terms of allowance.

- Goal Setting Worksheet: A tool for children to articulate short-term and long-term financial goals. Whether it's saving for a new video game or a trip, this worksheet encourages forward-thinking and planning.

- Money Management Booklet: A collection of tips and advice on various money topics aimed at children and tweens. This resource can include information on saving, spending, and smart financial decisions.

- Savings Tracker: A visual document to record savings progress towards specific goals. This can motivate children as they see their savings grow over time, reinforcing the benefits of delayed gratification.

- Spending Diary: A log that encourages children to note their daily purchases. Keeping track of spending helps them understand their habits and can inform better financial choices in the future.

- Family Financial Meeting Notes: Records from regular family discussions about finances, including budgets, savings goals, and allowance adjustments. These notes promote open communication and collective decision-making regarding finances.

- Educational Resource List: A compilation of books, websites, and tools that help reinforce financial literacy. This list serves as a go-to guide for exploring new financial topics that interest young people.

These complementary forms and documents serve to enrich the experience of using the Family Chore Chart. Together, they promote a comprehensive approach to financial education and encourage valuable life skills in the younger generation.

Similar forms

- Chore Tracker: Similar to the Family Chore Chart, a Chore Tracker helps parents assign and monitor tasks for their children. It ensures that children are aware of specific responsibilities and can track their completion over time.

- Allowance Agreement: This document outlines the conditions under which a child receives their allowance. Like the Chore Chart, it helps parents reinforce the connection between chores performed and money earned.

- Weekly Planner: A Weekly Planner functions similarly by allowing families to plan their chores and financial activities for the week. It helps organize tasks and encourages accountability.

- Financial Goals Worksheet: This sheet encourages children to set and track savings goals. Just like the Chore Chart, it promotes proactive planning and responsibility toward money management.

- Budgeting Worksheet: A Budgeting Worksheet helps children learn to allocate their allowance or earnings among spending, saving, and giving. Its purpose aligns with the philosophy of teaching financial responsibility present in the Chore Chart.

- Task List: A general Task List can be similar to the Family Chore Chart in that it organizes tasks that need completing. Both documents aim to clarify responsibilities in the household.

- Reward Chart: A Reward Chart can serve the same purpose as the Family Chore Chart by incentivizing children to complete chores with rewards. This enhances motivation for households using an allowance system.

- Shopping List: While primarily used for purchasing, a Shopping List encourages children to prioritize their spending similar to how the Chore Chart prioritizes chores. It promotes conscious decision-making regarding finances.

- Goal Setting Sheet: This document allows children to outline personal financial aspirations. It complements the Chore Chart by encouraging them to think about the bigger picture beyond everyday tasks, such as savings and expenditures.

Dos and Don'ts

When filling out the Family Chore Chart form, consider the following dos and don’ts to ensure a smooth experience.

- Do set clear expectations for the chores assigned to each family member.

- Do involve your tween in the process of creating the chart. This increases their commitment.

- Do acknowledge and reward completed chores promptly to encourage continued participation.

- Do be flexible in assigning additional chores when needed, such as seasonal tasks.

- Do use a calendar to schedule when each chore should be completed to help manage time effectively.

- Don't set unrealistic or overly complicated chores that may discourage your child.

- Don't forget to review the chart regularly to keep everyone accountable.

- Don't ignore your tween's input on their chores; their involvement can lead to increased responsibility.

- Don't let discrepancies go unaddressed; ensure fair compensation for tasks completed.

Misconceptions

Many families consider using a Family Chore Chart to help manage household responsibilities and teach financial skills. However, several misconceptions often cloud its effectiveness. Below are some common misunderstandings about the Family Chore Chart form.

- Chore charts are only for young children. Many believe chore charts lose their value once a child reaches a certain age. In fact, tweens and teens can also benefit from this structured approach, as it helps instill responsibility and accountability.

- All chores should have a monetary reward. Some parents think every chore must come with a payment. While it's good to reward certain tasks, it's also beneficial to have chores that are simply part of contributing to the family.

- Chore charts lead to entitlement. Some worry that using a chore chart will make children feel entitled to money for every task. In reality, it teaches them that work is rewarded and encourages hard work and saving habits.

- Using a chore chart means I have to track everything meticulously. While tracking can be beneficial, it doesn't have to be overly complicated. A simple system can still yield positive results without excessive monitoring.

- Chore charts are too strict and don't allow for flexibility. Many assume chore charts offer no room for adjustment. In truth, they can be tailored to fit family needs and schedules, fostering a collaborative environment.

- Only parents should decide the chores. Some believe that the adult perspective dominates the chore chart process. Involving children in choosing and assigning chores can promote buy-in and make them more invested in completing the tasks.

- Chore charts are just a phase. Many families think chore charts are temporary solutions that won't last. A well-implemented chore chart can evolve over time, adapting guidelines to suit different ages and responsibilities.

- Implementing a chore chart is too time-consuming. Some assume that the setup and maintenance require a significant time investment. However, once established, it often runs smoothly and requires only occasional updates.

Understanding these misconceptions can help families make better use of chore charts. With the right approach, they can be an effective tool for managing household duties and teaching valuable life skills.

Key takeaways

Here are key takeaways for effectively using the Family Chore Chart form:

- Create a clear system. Establish how chores will be tracked and how much each one is worth to give your tween a sense of achievement.

- Encourage personal finance discussions. Talk about budgeting and savings every time you review the chore chart. It reinforces the connection between work and money.

- Implement regular allowance payments. Choose specific days for allowance disbursement to help your tween anticipate and manage their finances better.

- Set short and long-term goals. Use a calendar to help your tween plan for both immediate purchases and future savings.

- Seek outside perspective. Ask someone your tween finds cool to reinforce financial lessons, making the message more relatable.

- Include fun incentives. Add bonus opportunities on the chore chart for extra tasks to encourage responsibility and a sense of earning.

Browse Other Templates

Da Form 6 - Clear documentation fosters accountability among personnel.

Will the Va Pay My Wife to Be My Caregiver - Assistance with filling out the form can be obtained through various VA resources.

Qualified Income Trust Form - Monthly monitoring of your income and deposits into the QIT is crucial for compliance.