Fill Out Your Fannie 1084 Form

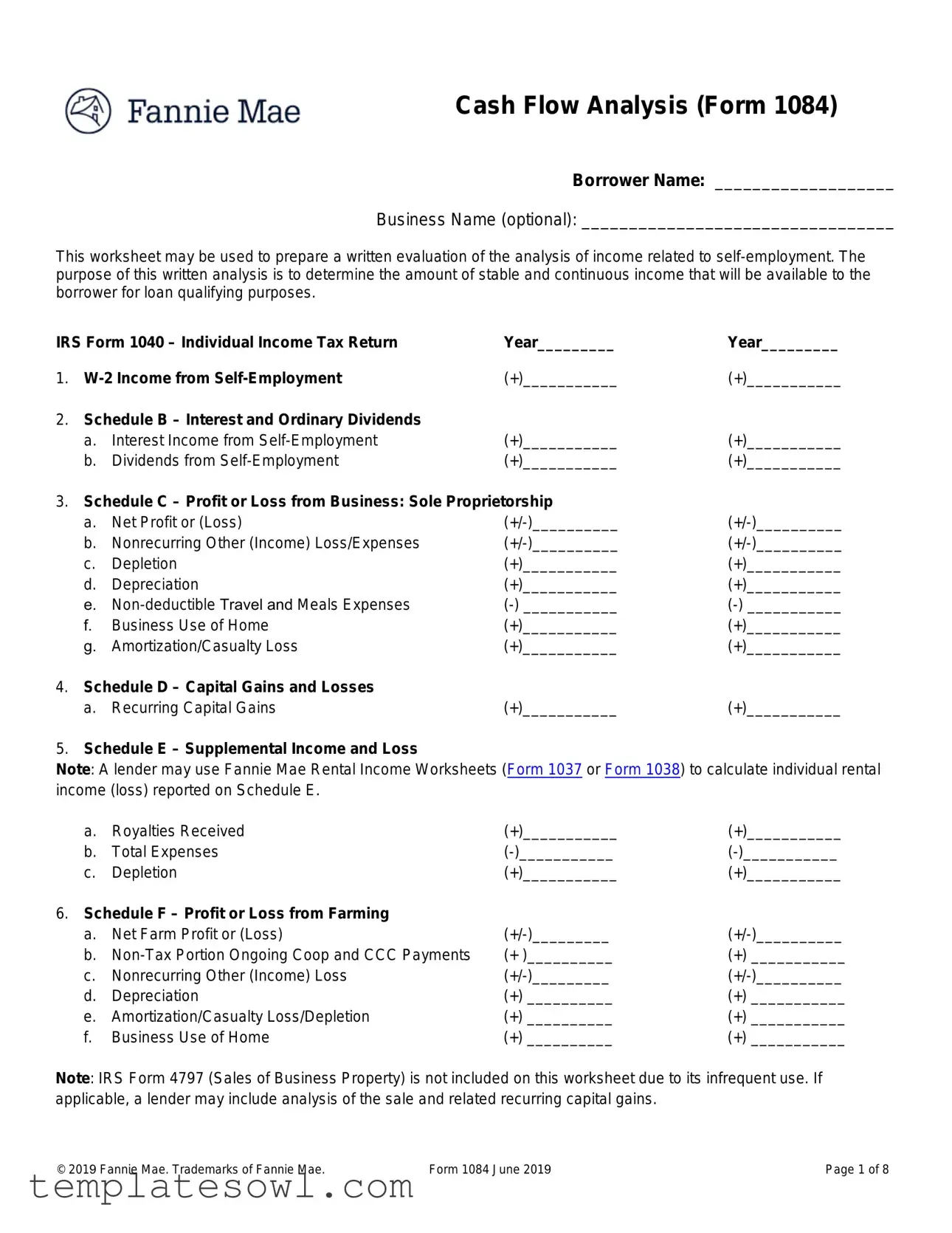

The Fannie Mae Form 1084, also known as the Cash Flow Analysis form, plays an essential role in the loan qualification process for self-employed individuals. This comprehensive worksheet assists lenders in evaluating the income generated from self-employment, helpfully identifying stable and continuous streams of income that borrowers can rely on. The form encompasses various components, including W-2 income, profits from sole proprietorships, capital gains, and rental income, facilitating a thorough assessment of an applicant's financial status. Integrating IRS forms such as the 1040 and supplemental documents like Schedule K-1, the 1084 ensures that all income sources are accurately represented. By examining not just the net profit or loss from business activities but also factors like nonrecurring income and business use of home expenses, this document provides a holistic view of the borrower’s cash flow. Ultimately, it is designed to empower self-employed individuals by clearly outlining their financial outlook and assisting lenders in making informed lending decisions.

Fannie 1084 Example

Cash Flow Analysis (Form 1084)

Borrower Name: ___________________

Business Name (optional): _________________________________

This worksheet may be used to prepare a written evaluation of the analysis of income related to

IRS Form 1040 – Individual Income Tax Return |

Year_________ |

Year_________ |

||

1. |

(+)___________ |

(+)___________ |

||

2. |

Schedule B – Interest and Ordinary Dividends |

|

|

|

|

a. |

Interest Income from |

(+)___________ |

(+)___________ |

|

b. |

Dividends from |

(+)___________ |

(+)___________ |

3.Schedule C – Profit or Loss from Business: Sole Proprietorship

a. Net Profit or (Loss) |

|||

b. Nonrecurring Other (Income) Loss/Expenses |

|||

c. |

Depletion |

(+)___________ |

(+)___________ |

d. |

Depreciation |

(+)___________ |

(+)___________ |

e. |

|||

f. |

Business Use of Home |

(+)___________ |

(+)___________ |

g. |

Amortization/Casualty Loss |

(+)___________ |

(+)___________ |

4.Schedule D – Capital Gains and Losses

a. Recurring Capital Gains |

(+)___________ |

(+)___________ |

5.Schedule E – Supplemental Income and Loss

Note: A lender may use Fannie Mae Rental Income Worksheets (Form 1037 or Form 1038) to calculate individual rental income (loss) reported on Schedule E.

a. |

Royalties Received |

(+)___________ |

(+)___________ |

b. |

Total Expenses |

||

c. |

Depletion |

(+)___________ |

(+)___________ |

6.Schedule F – Profit or Loss from Farming

a. Net Farm Profit or (Loss) |

|||

b. |

(+ )__________ |

(+) ___________ |

|

c. Nonrecurring Other (Income) Loss |

|||

d. |

Depreciation |

(+) __________ |

(+) ___________ |

e. |

Amortization/Casualty Loss/Depletion |

(+) __________ |

(+) ___________ |

f. |

Business Use of Home |

(+) __________ |

(+) ___________ |

Note: IRS Form 4797 (Sales of Business Property) is not included on this worksheet due to its infrequent use. If applicable, a lender may include analysis of the sale and related recurring capital gains.

© 2019 Fannie Mae. Trademarks of Fannie Mae. |

Form 1084 June 2019 |

Page 1 of 8 |

Partnership or S Corporation

A

the income was actually distributed to the borrower, or

the business has adequate liquidity to support the withdrawal of earnings. If the Schedule

Note: See the Instructions for additional guidance on documenting access to income and business liquidity.

IRS Form 1065 - Partnership |

Income |

|

|

|

7. Schedule |

– Partner’s Share of Income |

Year__________ |

Year__________ |

|

a. |

Ordinary Income (Loss) |

|||

b. Net Rental Real Estate; Other Net Income (Loss) |

||||

c. |

Guaranteed Payments to Partner |

(+)____________ |

(+) ___________ |

|

8.Form 1065 - Adjustments to Business Cash Flow

a. Ordinary (Income) Loss from Other Partnerships |

|||

b. Nonrecurring Other (Income) Loss |

|||

c. |

Depreciation |

(+) __________ |

(+) ___________ |

d. |

Depletion |

(+) __________ |

(+) ___________ |

e. |

Amortization/Casualty Loss |

(+) __________ |

(+) ___________ |

f. Mortgages or Notes Payable in Less than 1 Year |

|||

g. |

|||

h. |

Subtotal |

____________ |

_____________ |

i. |

Total Form 1065 |

____________ |

_____________ |

|

(Subtotal multiplied by % of ownership) |

||

IRS Form 1120S – S Corporation Earnings |

Year__________ |

Year__________ |

9.Schedule

a. |

Ordinary Income (Loss) |

||

b. |

Net Rental Real Estate; Other Net Rental Income (Loss) |

||

10.Form 1120S - Adjustments to Business Cash Flow

a. Nonrecurring Other (Income) Loss |

|||

b. |

Depreciation |

(+)__________ |

(+)___________ |

c. |

Depletion |

(+)__________ |

(+)___________ |

d. |

Amortization/Casualty Loss |

(+)__________ |

(+)___________ |

e. Mortgages or Notes Payable in Less than 1 Year |

|||

f. |

|||

g. |

Subtotal |

____________ |

_____________ |

h. |

Total Form 1120S |

|

|

|

(Subtotal multiplied by % of ownership) |

____________ |

_____________ |

© 2019 Fannie Mae. Trademarks of Fannie Mae. |

Form 1084 June 2019 |

Page 2 of 8 |

IRS Form 1120 – Regular Corporation

Corporation earnings may be used when the borrower(s) own 100% of the corporation.

11. Form 1120 – Regular Corporation |

Year_________ |

Year_________ |

|

|

|

||

a. |

Taxable Income |

____________ |

_____________ |

b. |

Total Tax |

||

c. |

Nonrecurring (Gains) Losses |

||

d. Nonrecurring Other (Income) Loss |

|||

e. |

Depreciation |

(+)__________ |

(+)___________ |

f. |

Depletion |

(+)__________ |

(+)___________ |

g. |

Amortization/Casualty Loss |

(+)__________ |

(+)___________ |

h. Net Operating Loss and Special Deductions |

(+)__________ |

(+)___________ |

|

i. Mortgages or Notes Payable in Less than 1 Year |

|||

j. |

|||

k. |

Subtotal |

____________ |

_____________ |

l. Less: Dividends Paid to Borrower |

|||

m. Total Form 1120 |

____________ |

_____________ |

|

© 2019 Fannie Mae. Trademarks of Fannie Mae. |

Form 1084 June 2019 |

Page 3 of 8 |

CASH FLOW ANALYSIS (Fannie Mae Form 1084)

Instructions

Guidance for documenting access to income and business liquidity

If the Schedule

If the Schedule

IRS Form 1040 – Individual Income Tax Return

1.

2.Schedule B – Interest and Ordinary Dividends

Line 2a - Interest Income from

Line 2b - Dividends from

3.Schedule C – Profit or Loss from Business: Sole Proprietorship

Line 3a - Net Profit or Loss: Record the net profit or (loss) reported on Schedule C.

Line 3b - Nonrecurring Other (Income) Loss/ Expense: Other income reported on Schedule C represents income that is not directly related to business receipts. Deduct other income unless the income is determined to be recurring. If the income is determined to be recurring, no adjustment is required. Other loss may be added back when it is determined that the loss will not continue.

Line 3c - Depletion: Add back the amount of the depletion deduction reported on Schedule C.

Line 3d - Depreciation: Add back the amount of the depreciation deduction reported on Schedule C. Vehicle depreciation included as part of the standard mileage deduction may be added back by multiplying the business miles driven by the depreciation factor for the respective year.

Line 3e -

Line 3f - Business Use of Home: Add back the expenses deducted for the business use of home.

© 2019 Fannie Mae. Trademarks of Fannie Mae. |

Form 1084 June 2019 |

Page 4 of 8 |

Line 3g - Amortization/Casualty Loss: Add back the expense deducted for amortization along with the expense associated with

4.Schedule D – Capital Gains and Losses

Line 4a - Recurring Capital Gains: Identify the amount of recurring capital gains. Schedule D may report business capital gains passed through to the borrower on Schedule

Note: Business capital losses identified on Schedule D do not have to be considered when calculating income or liabilities, even if the losses are recurring.

5.Schedule E – Supplemental Income and Loss

Note: Use Fannie Mae Rental Income Worksheets (Form 1037 or Form 1038) to evaluate individual rental income (loss) reported on Schedule E. Refer to Selling Guide,

Partnerships and S corporation income (loss) reported on Schedule E is addressed below.

Line 5a - Royalties Received: Include royalty income which meets eligibility standards.

Line 5b - Total Expenses: Deduct the expenses related to royalty income used in qualifying the borrower.

Line 5c - Depletion: Add back the amount of the depletion deduction related to royalty income used in qualifying the borrower.

6.Schedule F – Profit or Loss from Farming

Line 6a - Net Farm Profit or (Loss): Record the net farm profit or (loss) reported on Schedule F.

Line 6b -

Line 6c - Nonrecurring Other (Income) Loss: Other income reported on Schedule F represents income received by a farmer that was not obtained through farm operations. Deduct other income unless the income is determined to be recurring. If the income is determined to be recurring, no adjustment is required. Other loss may be added back when it is determined that the loss will not continue.

Line 6d - Depreciation: Add back the amount of the depreciation deduction reported on Schedule F.

Line 6e - Amortization/Casualty Loss/Depletion: Add back the expense deducted for amortization/depletion along with the expense associated with

Line 6f - Business Use of Home: Add back the expenses deducted for the business use of home.

© 2019 Fannie Mae. Trademarks of Fannie Mae. |

Form 1084 June 2019 |

Page 5 of 8 |

Partnership or S Corporation

IRS Form 1065 – Partnership Income

7.Schedule

Line 7a - Ordinary Income (Loss): Record the amount of ordinary income (loss) reported to the borrower in Box 1 of Schedule

Line 7b - Net Rental Real Estate; Other Net Income (Loss): Record the amount of net rental real estate; other net income (loss) reported to the borrower in Box 2 and/or 3 of Schedule

Line 7c - Guaranteed Payments to Partner: Add guaranteed payments to partner when the borrower has a two- year history of receipt.

8.Adjustments to Business Cash Flow – Form 1065

When business tax returns are obtained by the lender, the following adjustments to business cash flow should be made.

Line 8a - Ordinary income (loss) from other Partnerships: In order to consider ordinary income from other partnerships, the lender must obtain additional documentation to confirm the income passed through from the other partnership to the borrower’s business meets partnership income eligibility standards. Deduct ordinary income passed through to the borrower’s business from other partnerships unless this additional action is taken. Losses passed through to the borrower’s business may be added back when the lender determines

Line 8b - Nonrecurring Other (Income) Loss: Other income reported on Form 1065 generally represents income that is not directly related to business receipts. Deduct other income unless the income is determined to be recurring. If the income is determined to be recurring, no adjustment is required. Other loss may be added back when it is determined that the loss will not continue.

Line 8c - Depreciation: Add back the amount of the depreciation deduction reported on Form 1065 and/or on Form 8825.

Line 8d - Depletion: Add back the amount of the depletion deduction reported on Form 1065.

Line 8e - Amortization/Casualty Loss: Add back the expense deducted for amortization/depletion along with the expense associated with

Line 8f - Mortgage or Notes Payable in Less than 1 Year: Subtract the amount of mortgage or note obligations payable in less than one year, as reported in Schedule L of Form 1120S, end of year column. This deduction is not required for lines of credit or if there is evidence that these obligations roll over regularly and/or the business has sufficient liquid assets to cover them.

Line 8g -

Line 8h - Subtotal: Total lines 8a – 8g.

Line 8i - Form 1065 Total: To arrive at the borrower’s proportionate share of adjustments to business cash flow, multiply the subtotal (line 8h) by the borrower’s percentage of ownership (the borrower’s ending percentage of capital ownership as reported on the Schedule

© 2019 Fannie Mae. Trademarks of Fannie Mae. |

Form 1084 June 2019 |

Page 6 of 8 |

IRS Form 1120S – S Corporation Earnings

9.Schedule

Line 9a - Ordinary Income (Loss): Record the amount of ordinary income (loss) reported to the borrower in Box 1 of Schedule

Line 9b - Net Rental Real Estate; Other Net Income (Loss): Record the amount of net rental real estate; other net income (loss) reported to the borrower in Box 2 and/or 3 of Schedule

10.Adjustments to Business Cash Flow – Form 1120S

When business tax returns are obtained by the lender, the following adjustments to business cash flow should be made.

Line 10a - Nonrecurring Other (Income) Loss: Other income reported on Form 1120S generally represents income that is not directly related to business receipts. Deduct other income unless the income is determined to be recurring. If the income is determined to be recurring, no adjustment is required. Other loss may be added back when it is determined that the loss will not continue.

Line 10b - Depreciation: Add back the amount of the depreciation deduction reported on Form 1120S and/or or Form 8825.

Line 10c - Depletion: Add back the amount of the depletion deduction reported on Form 1120S.

Line 10d - Amortization/Casualty Loss: Add back the expense deducted for amortization/depletion along with the expense associated with

Line 10e - Mortgage or Notes Payable in Less than 1 Year: Subtract the amount of mortgage or note obligations payable in less than one year, as reported in Schedule L of Form 1120S, end of year column. This deduction is not required for lines of credit or if there is evidence that these obligations rollover regularly and/or the business has sufficient liquid assets to cover them.

Line 10f -

Line 10g - Subtotal: Total lines 10a – 10f.

Line 10h - Form 1120S Total: To arrive at the borrower’s proportionate share of adjustments to business cash flow, multiply the subtotal (line 10g) by the borrower’s percentage of stock for tax year reported on the Schedule

IRS Form 1120 – Regular Corporation

11.Regular Corporation – Form 1120

When business tax returns are obtained by the lender, the following adjustments to business cash flow should be made.

Line 11a - Taxable Income: Record the taxable income reported by the business on the first page of Form 1120.

Line 11b - Total Tax: Deduct the corporation‘s tax liability identified on page 1 of Form 1120.

Line 11c - Nonrecurring Other (Gains) Losses: Deduct gains unless it is determined that the gains are likely to continue. Losses may be added back when it can be determined that the loss is a

© 2019 Fannie Mae. Trademarks of Fannie Mae. |

Form 1084 June 2019 |

Page 7 of 8 |

Line 11d - Nonrecurring Other (Income) Loss: Other income reported on Form 1120 generally represents income that is not directly related to business receipts. Deduct other income unless the income is determined to be recurring. If the income is determined to be recurring, no adjustment is required. Other loss may be added back when it is determined that the loss will not continue.

Line 11e - Depreciation: Add back the amount of the depreciation deduction reported on Form 1120.

Line 11f - Depletion: Add back the amount of the depletion deduction reported on Form 1120S.

Line 11g - Amortization/Casualty Loss: Add back the expense deducted for amortization/depletion along with the expense associated with

Line 11h - Net Operating Loss and Special Deductions: Add back the full amount of the deduction related to net operating loss and/or special deductions.

Line 11i - Mortgage or Notes Payable in Less than 1 Year: Subtract the amount of mortgage or note obligations payable in less than one year, as reported in Schedule L of Form 1120S, end of year column. This deduction is not required for lines of credit or if there is evidence that these obligations roll over regularly and/or the business has sufficient liquid assets to cover them.

Line 11j -

Line 11k - Subtotal: Total lines 11a – 11j.

Line 11l - Dividends Paid to Borrower: Dividends paid to stockholders are reported on Schedule

Line 11m - Form 1120 Total: Subtract 11l from 11k to determine the adjustments to business tax flow that may be considered when the borrower(s) own 100% of the corporation and the business has adequate liquidity to support the withdrawal of earnings.

© 2019 Fannie Mae. Trademarks of Fannie Mae. |

Form 1084 June 2019 |

Page 8 of 8 |

Form Characteristics

| Fact Name | Description |

|---|---|

| Purpose | The Fannie Mae Form 1084 is used for analyzing cash flow related to self-employment. It aids in determining the stable income available for loan qualifying purposes. |

| Documentation Requirement | Documentation, such as IRS Form 1040 and Schedule K-1, is essential for verifying income. Without proper documentation, lenders may require proof of business liquidity. |

| Inclusions | This form includes various income sources like W-2 income, Schedule C profits, rental income from Schedule E, and also profits or losses from farming via Schedule F. |

| State-specific Forms | While the Form 1084 is standardized, different states may have additional regulations based on local laws. Ensure compliance with local requirements during submission. |

| S Corporations | Income from Partnership or S Corporation can be included only if documented that the earnings were distributed to the borrower. Use Schedule K-1 for verification. |

| Frequency of Use | Though it's a vital tool, not all lenders use Form 1084 regularly. Certain lenders may prefer alternative income verification methods instead. |

| Updates | The latest version of the form was released in June 2019. Keep an eye out for any revisions that may affect how income is reported or analyzed. |

Guidelines on Utilizing Fannie 1084

Filling out the Fannie 1084 form is an essential step in assessing income related to self-employment for loan qualifying purposes. The form requires specific financial details from various tax documents to ensure accurate analysis of stable and continuous income.

- Begin by entering the borrower name and the business name (if applicable) at the top of the form.

- In the section for IRS Form 1040, write the years for the income under consideration.

- For W-2 Income from Self-Employment, enter the amounts for the designated years.

- In the Schedule B section, record interest and dividends from self-employment for both years.

- Under Schedule C, provide values for net profit or loss, nonrecurring other income or expenses, depletion, depreciation, non-deductible travel and meals expenses, business use of home, and amortization/casualty loss.

- For Schedule D, enter the amounts for recurring capital gains.

- In the Schedule E section, detail royalties received, total expenses related to royalty income, and depletion.

- For Schedule F, record the net farm profit or loss, ongoing cooperative payments if applicable, and any depreciation or amortization relevant to the farm income.

- If applicable, fill in information for IRS Form 1065 or Form 1120S for Partnership or S Corporation income, and complete the respective cash flow adjustments.

- Address the Form 1120 information for regular corporations if relevant, entering taxable income and related values.

- Review and ensure all calculations account for necessary adjustments.

What You Should Know About This Form

What is the Fannie 1084 form used for?

The Fannie 1084 form, also known as the Cash Flow Analysis form, is designed to evaluate the income related to self-employment for loan qualification purposes. It helps lenders assess the stability and continuity of income that can be available to borrowers who are self-employed.

Who can use the Fannie 1084 form?

This form is specifically for self-employed borrowers. It is useful for individuals who earn income from a business, partnership, or corporation. Borrowers must fill in their income details as reported on various IRS forms, such as 1040, 1065, and 1120S.

What kind of income can be reported on this form?

Borrowers can report several types of income on the Fannie 1084 form. This includes W-2 income, dividends, interest, profits or losses from a sole proprietorship, farming income, and royalties. Each type of income has specific lines on the form for accurate reporting.

How does the form assess income stability?

The form assesses income stability by analyzing past earnings and any adjustments that might apply. By reviewing income from multiple years and making proper deductions or additions, lenders can determine whether the reported income is stable enough to qualify for a loan.

What is a Schedule K-1 and why is it important?

A Schedule K-1 reports a partner's or shareholder's share of income, deductions, and credits from a partnership or S corporation. It is crucial because lenders need this documentation to verify the income distribution to the borrower. They must confirm that income was actually received before considering it in the cash flow analysis.

Can losses be reported on the Fannie 1084 form?

Yes, self-employed borrowers can report losses on the form. If losses can be documented and are expected to be nonrecurring, they may be considered in the cash flow analysis. However, lenders typically focus more on consistent income when evaluating loan applications.

Are there expenses that must be deducted from reported income?

Yes, certain non-deductible expenses, like travel and entertainment costs, must be subtracted from reported income. It's important to identify these expenses clearly to present an accurate picture of net income.

What if my business income fluctuates widely?

If business income fluctuates, the lender may want to see several years of income statements to understand the overall trend. It's essential to provide a clear explanation of any irregularities to help lenders evaluate eligibility fairly.

How does this form relate to other IRS forms?

The Fannie 1084 form complements various IRS forms like the 1040, 1065, and 1120S. Borrowers need to reference these forms to fill out the Fannie 1084 accurately. Each provides context and verification for the income reported, ensuring robust documentation for lenders.

What common mistakes should be avoided when completing the form?

Common mistakes include failing to provide proper documentation, ignoring nonrecurring income or losses, or incorrectly adding back depreciation. It's crucial to check all entries against the supporting IRS forms to avoid inconsistencies that could delay the loan approval process.

Common mistakes

Filling out the Fannie Mae Form 1084 can be a daunting task. Many borrowers encounter common mistakes that can adversely affect their loan applications. One significant mistake is failing to accurately report all self-employment income. Some individuals overlook income sources from Schedule C, Schedule E, or other relevant forms. Each source of income should be documented thoroughly to provide a clear picture of the borrower’s financial situation.

Another frequent error is neglecting to include depreciation and depletion adjustments. These deductions can sometimes lead to inaccuracies in cash flow analysis. Borrowers often either forget to add back these amounts or miscalculate them. Since these figures impact the overall calculation of stable income, it is crucial to double-check their inclusion and accuracy.

Additionally, many individuals misunderstand the importance of the Schedule K-1 documentation. This form verifies income distributions from partnerships or S corporations. If the borrower fails to provide adequate proof of these distributions, their income may be disqualified. It’s essential to ensure that any Schedule K-1 included shows a stable history of distributions to support the reported income.

Furthermore, mistakes can arise from incorrectly identifying tax-exempt income. Certain types of income, such as specific agricultural payments, may not be fully taxable and must be added back to the cash flow calculation. If borrowers do not recognize these distinctions, it could skew the analysis of their financial health.

Many borrowers also miss the opportunity to include legitimate business expenses that could enhance their cash flow position. Commonly, they might overlook adding back non-deductible travel and entertainment expenses. Identifying these expenses accurately can contribute to a more favorable representation of the borrower’s financial standing.

Moreover, reporting errors in capital gains from Schedule D can lead to complications. Borrowers sometimes fail to differentiate between recurring capital gains and non-recurring gains. This distinction is crucial for a proper income analysis. Including only recurring gains can avoid inflating the borrower’s income.

Lastly, another prevalent mistake is poor documentation of ongoing income. If borrowers don’t demonstrate a stable history of income through verified records, lenders may question the reliability of the proposed income figures. To minimize this risk, it is essential to ensure that all financial documentation is organized and accurately reflects income continuity over time.

Documents used along the form

The Fannie 1084 form is essential for borrowers who are self-employed, as it helps analyze income for loan qualification. However, it is often used in conjunction with other important forms and documents that provide a comprehensive view of a borrower's financial situation. Below is a list of common documents that complement the Fannie 1084 form.

- IRS Form 1040 – This is the standard individual income tax return form. It provides details about the borrower's income, including wages, interest, and dividends, crucial for validating financial claims.

- Schedule C – This report outlines profits or losses from a sole proprietorship. It is vital for understanding self-employment income and any applicable deductions.

- Schedule K-1 – Used for partnerships or S corporations, this form details each partner's share of income, deductions, and credits. It is necessary for confirming distributed earnings to self-employed borrowers.

- IRS Form 1065 – This form is for partnership income reporting. It summarizes the total income, losses, and deductions of a partnership and is crucial for understanding the borrower's stakes in business income.

- IRS Form 1120S – This form reports income for S corporations. It provides income and deduction details crucial for assessing the financial health of the corporation when the borrower has ownership.

- Schedule E – This is used to report supplemental income or loss. It can include rents, royalties, and partnership income which may further impact the cash flow analysis.

- Schedule D – This document lists capital gains and losses. It is necessary for an accurate assessment of recurring gains or losses which affect net income calculations for the borrower.

Each of these forms plays a significant role in the comprehensive analysis of a self-employed borrower's income. Proper completion and review of these documents ensure an accurate understanding of the borrower's financial situation, facilitating the loan qualification process effectively.

Similar forms

- IRS Form 1040 – Individual Income Tax Return: The Fannie 1084 form assesses income related to self-employment similar to how Form 1040 summarizes an individual’s overall income. Both forms evaluate income sources like wages, dividends, and business profits to establish a borrower’s financial status.

- Schedule C – Profit or Loss from Business: Form 1084 incorporates elements from Schedule C, which details the profits or losses of a sole proprietorship. Both documents analyze net income and adjustments for non-recurring expenses, providing insight into the borrower's ongoing earning potential.

- Schedule E – Supplemental Income and Loss: Like the Fannie 1084 form, Schedule E assesses various income streams from partnerships, rental properties, and royalties. Both documents aim to accurately reflect a borrower’s diverse income sources for loan qualification.

- IRS Form 1065 - Partnership Income: Both the Fannie 1084 and Form 1065 capture income from partnerships. Form 1084 reviews the borrower’s share of income to determine its impact on cash flow, considering the documentation needed, such as Schedule K-1.

- IRS Form 1120S – S Corporation Earnings: Similar to the Fannie 1084 form, Form 1120S details S corporation earnings. Both analyze shareholders' income to ascertain its stability and relevance for cash flow analysis, a critical aspect of the loan qualification process.

Dos and Don'ts

When filling out the Fannie 1084 form, attention to detail is crucial. Here is a list of recommended practices and pitfalls to avoid.

- Double-check your numbers. Ensure that all calculations from your tax returns are accurate before submission.

- Provide complete documentation. Include all necessary forms like Schedule K-1, Schedule C, and any supporting documents verifying income sources.

- Be clear about your income sources. Differentiate between stable income and one-time earnings to provide a realistic income assessment.

- Consult the instructions. Referring to the guidelines specific to the 1084 form can help avoid common mistakes.

- Avoid incomplete forms. Leaving any sections blank or unclear can lead to delays in processing your application.

- Do not misrepresent your income. Ensure that all income reported reflects actual earnings, as inaccuracies can have serious consequences.

Following these guidelines can help streamline the process and increase your chances of approval. A thorough and accurate submission can make a considerable difference in obtaining the financing you need.

Misconceptions

- Misconception 1: The Fannie 1084 form is only for self-employed individuals.

- Misconception 2: Only taxable income is considered in the analysis.

- Misconception 3: Depreciation cannot be added back to income calculations.

- Misconception 4: You cannot include capital gains in your income assessment.

- Misconception 5: All business expenses should be deducted from income.

- Misconception 6: Partnership income is automatically considered valid.

- Misconception 7: All forms of income must be treated equally.

- Misconception 8: Completing the Fannie 1084 form is a simple task.

- Misconception 9: Only recent tax returns are necessary for completion.

- Misconception 10: The Fannie 1084 is only for mortgage applications.

This form is designed for those in self-employment but can also include income from partnerships and S corporations. It provides a comprehensive cash flow analysis for various business structures.

The Fannie 1084 form takes into account both taxable and non-taxable income sources, such as certain federal agriculture program payments, ensuring a more complete income picture.

Actually, depreciation is added back when assessing a borrower's cash flow. This adjustment recognizes that depreciation is a non-cash expense, which does not affect the actual cash available.

Recurring capital gains may indeed be included in income calculations, but it is crucial that these gains are consistent rather than sporadic. One-time transactions are excluded.

While many expenses are deducted, certain non-deductible expenses, such as a portion of travel and entertainment, are rather identified and subtracted from the overall cash flow.

For partnership income to be included, it must be backed by specific documentation, such as a Schedule K-1, showing actual distributions to the borrower.

Income types vary significantly in their assessment. For instance, rental income should follow specific guidelines outlined in different forms and may require additional calculations.

This form requires careful consideration and accurate calculations of various income types. Data must be meticulously documented to ensure correct evaluations for loan purposes.

The analysis may require looking at multiple years of tax returns. A thorough history provides valuable insights into income stability and consistency, which are crucial for loan qualification.

While often associated with mortgage lending, this form can also serve as a valuable tool in various financial evaluations, including planning and business assessments.

Key takeaways

Here are some key takeaways regarding the completion and use of the Fannie 1084 form:

- The Fannie 1084 form is primarily used to evaluate income from self-employment for loan qualification purposes.

- Accurate income reporting is crucial; it necessitates the careful compilation of relevant tax documents including IRS Form 1040, Schedule C, and others.

- When filling out the form, include details from W-2 income, self-employment income, and any dividends or interest from the business.

- It is important to document the stability and continuity of income over time, which may involve referencing multiple years of tax returns.

- Specific line items allow for adjustments, such as adding back depreciation or nonrecurring losses, which can alter the cash flow analysis.

- Partnership or S Corporation income can only be considered when the borrower documents that the income is distributed to them and the business can support this withdrawal.

- Lenders often accept the Schedule K-1 as sufficient documentation to prove income distribution from Partnerships or S Corporations.

- Income from farming or royalties must be carefully evaluated, and non-taxable payments can often be added back to cash flow if they are expected to continue.

- Utilizing IRS Form 1065 or Form 1120S along with the 1084 form can provide a more complete financial picture.

- In cases of inadequate documentation, lenders are required to verify that the business possesses adequate liquidity to support income withdrawals.

Browse Other Templates

Ihsaa Physical Form 2023-24 - Overall, the PPE is a vital tool for ensuring Indiana's student-athletes are fit and ready to take on the challenges of sports.

Kinship Chart Template - The diagram emphasizes the importance of patrilineal descent in Zaza society.