Fill Out Your Fannie Mae 194 Form

The Fannie Mae 194 form is a critical tool for homeowners facing financial difficulties and potential foreclosure. This form serves as a hardship affidavit, allowing borrowers to communicate specific struggles that affect their ability to make mortgage payments. Within its pages, borrowers provide personal details, such as names, dates of birth, and property information, including the address and loan number. One of the essential components of the Fannie Mae 194 form is the section where borrowers can check off the factors contributing to their financial hardship. These factors may include reduced household income, excessive monthly debt payments, rising expenses, and insufficient cash reserves. Additionally, borrowers must acknowledge their understanding of the implications of providing this information, which includes the possibility of an investigation into their statements and the need for supporting documentation. The form emphasizes the importance of honesty and underscores the need for timely responses to the servicer’s inquiries. Ultimately, the Fannie Mae 194 form is designed to help navigatethe foreclosure prevention process and explore alternative solutions for those in distress.

Fannie Mae 194 Example

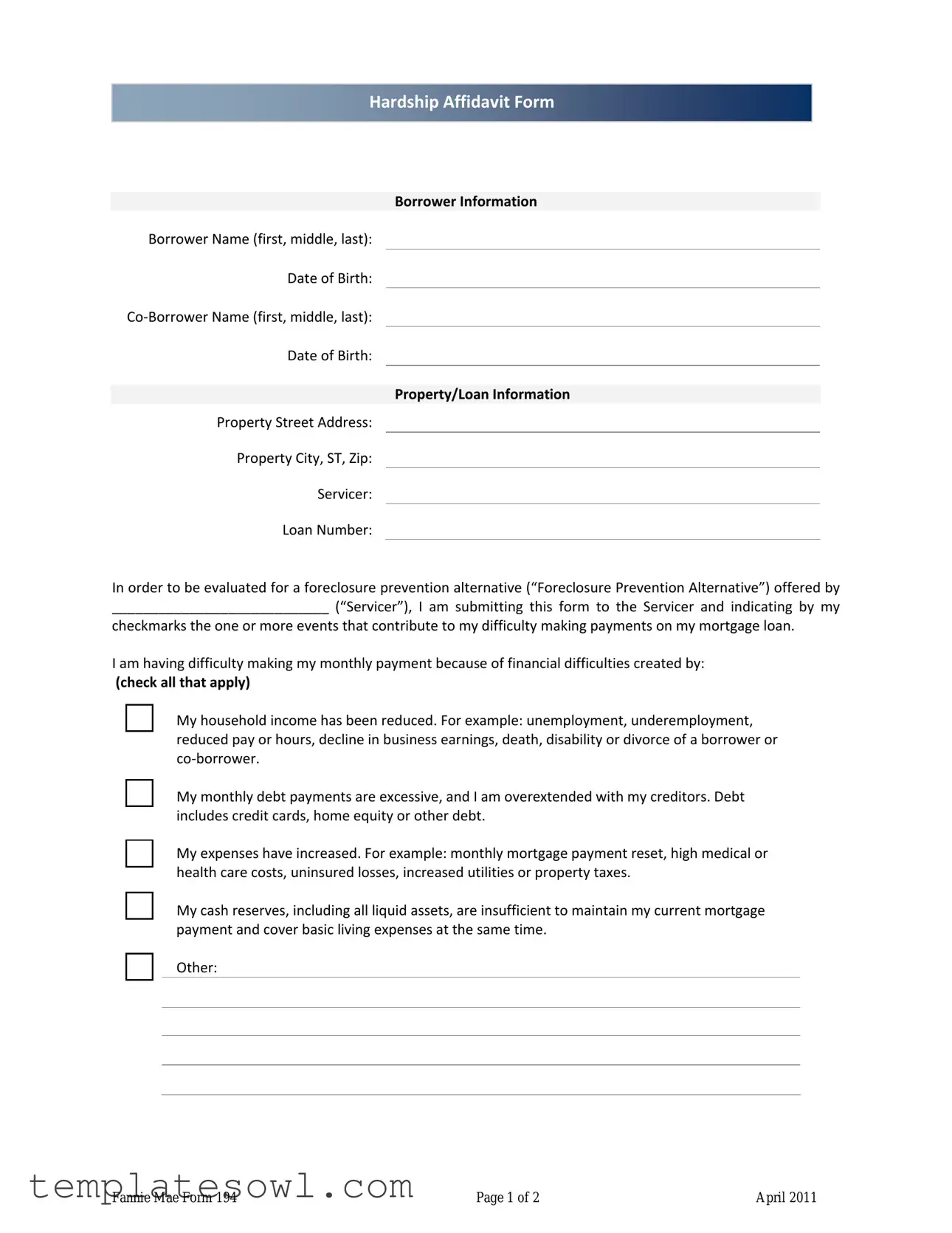

Hardship Affidavit Form

Borrower Information

Borrower Name (first, middle, last):

Date of Birth:

Co‐Borrower Name (first, middle, last):

Date of Birth:

Property/Loan Information

Property Street Address:

Property City, ST, Zip:

Servicer:

Loan Number:

In order to be evaluated for a foreclosure prevention alternative (“Foreclosure Prevention Alternative”) offered by

____________________________ (“Servicer”), I am submitting this form to the Servicer and indicating by my

checkmarks the one or more events that contribute to my difficulty making payments on my mortgage loan.

I am having difficulty making my monthly payment because of financial difficulties created by:

(check all that apply)

My household income has been reduced. For example: unemployment, underemployment, reduced pay or hours, decline in business earnings, death, disability or divorce of a borrower or co‐borrower.

My monthly debt payments are excessive, and I am overextended with my creditors. Debt includes credit cards, home equity or other debt.

My expenses have increased. For example: monthly mortgage payment reset, high medical or health care costs, uninsured losses, increased utilities or property taxes.

My cash reserves, including all liquid assets, are insufficient to maintain my current mortgage payment and cover basic living expenses at the same time.

Other:

Fannie Mae Form 194 |

Page 1 of 2 |

April 2011 |

Hardship Affidavit Form

Borrower/Co‐Borrower Acknowledgement and Agreement

1.I certify that all of the information in this Hardship Affidavit is truthful and the event(s) identified above has/have contributed to my need for a Foreclosure Prevention Alternative relating to my mortgage loan.

2.I understand and acknowledge the Servicer may investigate the accuracy of my statements, may require me to provide supporting documentation, and that knowingly submitting false information may violate Federal law.

3.I understand the Servicer may pull a current credit report on all borrowers obligated on the note relating to my mortgage loan.

4.I understand that if I have intentionally defaulted on my existing mortgage, engaged in fraud or misrepresented any fact(s) in connection with this Hardship Affidavit, or if I do not provide all of the required documentation, the Servicer may cancel a Foreclosure Prevention Alternative and may pursue foreclosure on my home.

5.I certify that I have not received a condemnation notice on my property.

6.I certify that I am willing to provide all requested documents and to respond to all Servicer communication in a timely manner. I understand that time is of the essence.

7.I understand that the Servicer may use this information to evaluate my eligibility for a Foreclosure Prevention Alternative, but the Servicer is not obligated to offer me assistance based solely on the representations in this Hardship Affidavit.

8.I understand that the Servicer may collect and record personal information, including, but not limited to, my name, address, telephone number, social security number, credit score, income, payment history, and information about account balances and activity. I understand and consent to the disclosure of my personal information and the terms of any Foreclosure Prevention Alternative offered by the Servicer to any investor, insurer, guarantor or servicer that owns, insures, guarantees or services my first lien or subordinate lien (if applicable) mortgage loan(s).

_________________________ ___________ |

_________________________ ____________ |

||

Borrower Signature |

Date |

Co‐Borrower Signature |

Date |

Fannie Mae Form 194 |

Page 2 of 2 |

April 2011 |

Form Characteristics

| Fact Name | Detail |

|---|---|

| Purpose | The Fannie Mae 194 form serves as a Hardship Affidavit for borrowers facing financial difficulties. |

| Submission Requirement | This form must be submitted to the servicer to evaluate eligibility for foreclosure prevention alternatives. |

| Borrower Information | The form collects essential information, such as the borrowers' names and dates of birth. |

| Property Details | Borrowers must provide the property’s street address, city, state, and zip code. |

| Debt Disclosure | Borrowers indicate whether they have excessive monthly debt payments as a contributing factor to their hardship. |

| Document Verification | By signing the form, borrowers confirm the accuracy of the information and agree to potential investigation by the servicer. |

| Potential Consequences | Submitting false information can lead to legal penalties and may jeopardize foreclosure prevention options. |

| Eligibility Criteria | Completing the form does not guarantee assistance; eligibility is determined by the servicer's assessment. |

| State-Specific Laws | Each state may have its own relevant foreclosure and loan modification laws that govern the process. |

| Data Privacy | Borrowers consent to the collection and potential sharing of personal information related to their loan. |

Guidelines on Utilizing Fannie Mae 194

Filling out the Fannie Mae 194 form is crucial for borrowers facing financial hardship. The process involves providing personal and property information, as well as detailing the circumstances contributing to your payment difficulties. Follow these steps carefully to complete the form accurately.

- Gather personal information: Collect your name, date of birth, co-borrower's name, and their date of birth.

- Enter property and loan details: Write down the property street address, city, state, and ZIP code, along with the name of your loan servicer and loan number.

- Indicate financial hardship: Check all applicable boxes that represent your financial difficulties. Options include reduced income, excessive debt payments, increased expenses, and insufficient cash reserves.

- Complete the acknowledgement section: Read the statements carefully, ensuring that you understand each one regarding the accuracy of your information, credit report, and potential consequences of misrepresentation.

- Sign and date the form: Both the borrower and co-borrower should sign and date the form to certify the information provided is true.

After completing the form, submit it to the servicer promptly. Be prepared to provide additional documentation if requested and respond to any communication from the servicer in a timely manner. This will help facilitate the review process for potential foreclosure prevention alternatives.

What You Should Know About This Form

What is the purpose of the Fannie Mae 194 form?

The Fannie Mae 194 form, known as the Hardship Affidavit, is designed for borrowers facing financial difficulties that affect their ability to make mortgage payments. By completing this form, borrowers can formally communicate their situation to the servicer of their loan. This document may help initiate discussions around alternatives to foreclosure, such as loan modifications or repayment plans.

What information do I need to provide on the Fannie Mae 194 form?

Borrowers must fill in critical personal details, including their names, dates of birth, and property information. Additionally, the form requires specific checkboxes to indicate the hardships affecting their ability to pay. These may include reduced household income, excessive debt, increased expenses, and insufficient cash reserves. Clear and truthful disclosures are essential for the servicer to assess the situation accurately.

What happens after I submit the Fannie Mae 194 form?

Upon submission, the servicer will review the information provided to determine eligibility for potential foreclosure prevention alternatives. They may also conduct an investigation into the accuracy of the statements and require supplementary documentation. Depending on the findings, the servicer will communicate the available options to the borrower.

Is there a deadline for submitting the Fannie Mae 194 form?

While there isn't a strict universal deadline, it is crucial to submit the form as soon as possible when difficulties arise. Time delays could negatively impact the likelihood of being offered assistance. The servicer emphasizes that timely responses are vital, as they can expedite the evaluation process and afford the borrower access to available relief options.

What should I do if my circumstances change after submitting the form?

If borrowers experience any changes in their situation, such as improved financial stability or further hardships, they should notify the servicer immediately. Keeping the servicer updated ensures that they can provide the most relevant support and assess all the alternatives available to the borrower under the new conditions.

What are the risks of providing false information on the Fannie Mae 194 form?

Submitting inaccurate or misleading information can have severe consequences. If the servicer discovers fraudulent claims, they may revoke any foreclosure alternatives and proceed with foreclosure. Moreover, knowingly providing false information could violate federal law, potentially leading to further legal repercussions for the borrower.

Can I get assistance with filling out the Fannie Mae 194 form?

Yes, borrowers seeking assistance can reach out to housing counselors, legal aid organizations, or mortgage servicers for guidance. These resources can help clarify the requirements of the form and ensure that all necessary information is accurately submitted. Proper assistance can significantly increase the chances of a successful outcome.

Common mistakes

When filling out the Fannie Mae 194 form, it's common for individuals to make mistakes that can delay the process or complicate their situation. One significant error occurs when people fail to provide complete and accurate borrower information. Missing dates of birth or names can lead to confusion and delays in processing. It’s essential to double-check this section and ensure that all names are spelled correctly and that the dates are accurate.

Another frequent mistake involves inadequately describing the financial hardships. If you check a box stating that your household income has been reduced, be sure to provide a clear explanation of how this reduction occurred. General statements may not suffice. Supporting details will strengthen your case for assistance. Take the time to articulate your situation fully.

Some individuals also overlook the importance of providing supporting documentation. The form mentions that the servicer may require this documentation to verify your claims. Failing to submit necessary documentation, like pay stubs or medical bills, can undermine your request. Always attach relevant documents that support the hardships you are experiencing.

Additionally, people sometimes underestimate the importance of signing and dating the form correctly. An unsigned form or one with an incomplete signature can render the submission invalid. Ensure that both borrower and co-borrower sign and date the document appropriately to avoid unnecessary complications.

Another pitfall is neglecting to communicate promptly with the servicer. Once the Hardship Affidavit has been submitted, the servicer may reach out for additional information. Ignoring these communications or delaying your responses can result in the cancellation of potential assistance. Being responsive is crucial for your success in navigating this process.

Finally, some individuals misunderstand the implications of misrepresenting information on the form. Knowingly providing false information can lead to serious consequences, including legal issues. It's crucial to be truthful about your financial situation. Integrity in your disclosures is not only ethical but also essential to securing the help you need.

Documents used along the form

When dealing with a Hardship Affidavit, such as the Fannie Mae 194 form, borrowers often encounter a series of corresponding documents and forms that aid in the overall evaluation process. Understanding these additional documents can provide clarity and enhance the efforts made towards securing a foreclosure prevention alternative.

- Loan Modification Request Form: This form initiates a borrower's request to modify existing loan terms. It typically outlines the proposed changes, such as interest rates or payment schedules, that could make the loan more manageable.

- Authorization to Release Information: Borrowers sign this document to authorize lenders or servicers to collect necessary information from third parties, like employers or banks, which supports their claims of financial hardship.

- Property Listing Agreement: This document is used if a borrower decides to sell the property. It legally obligates an agent to represent the borrower in selling their home, often required in situations where foreclosure seems likely.

- Borrower Financial Statement: This provides a detailed account of a borrower's financial status, including income, expenses, debts, and assets. The information guides lenders in assessing the borrower’s financial situation.

- Hardship Letter: A written explanation from the borrower that outlines the specific circumstances leading to financial difficulties. This personal account can supplement the formal Hardship Affidavit.

- Credit Counseling Certificate: Often obtained through a counseling agency, this document verifies that a borrower has received guidance regarding their financial situation and potential solutions for distress.

- Trial Payment Plan Agreement: This outlines the terms of a temporary payment plan that may be established while reviewing a borrower’s loan modification or foreclosure alternatives.

- Debt Validation Request: Borrowers may use this form to formally request validation of their debts from creditors, ensuring that all claimed debts are legitimate and accurate.

- Bank Statements: These statements provide evidence of a borrower’s financial situation, illustrating income deposits and expenditures that help substantiate claims made in the hardship affidavit.

- Tax Returns: Previous years’ tax returns are often required to verify income levels and financial stability, highlighting the borrower’s capacity to repay the loan.

Gathering these documents can be essential in navigating the complexities of loan modification or foreclosure prevention. Each of these forms serves a unique purpose and contributes to a comprehensive understanding of a borrower’s circumstances. By preparing these materials, borrowers enhance their chances for favorable outcomes during their negotiations with lenders or servicers.

Similar forms

The Fannie Mae 194 form, known as the Hardship Affidavit, is designed for borrowers facing difficulties in making mortgage payments. Similar forms exist to address different financial situations and document hardships. Below is a list of ten documents that share similarities with the Fannie Mae 194 form, along with a brief explanation for each.

- Mortgage Assistance Application: This document is used when borrowers apply for assistance programs and requires detailed information about their financial status and the reasons for requesting assistance.

- Loan Modification Request Form: Borrowers submit this form to request changes to their loan terms due to financial hardship, often requiring similar personal and financial information as the Fannie Mae 194 form.

- Forbearance Agreement: Like the Fannie Mae 194, this document outlines an arrangement where a lender permits a temporary reduction or pause of mortgage payments due to hardship.

- Hardship Letter: Borrowers often write this letter to explain their situation in detail, similar to how the Fannie Mae 194 form identifies specific financial difficulties affecting their ability to pay.

- Bankruptcy Petition: This legal document includes essential information about a borrower's financial state, including debts and assets, much like the financial disclosures found in the Fannie Mae 194.

- Debt Consolidation Application: Borrowers use this application to seek a consolidation of debts when overwhelmed by payments, paralleling the need for assistance outlined in the Fannie Mae 194.

- State Housing Finance Agency Assistance Forms: Various states provide specific forms to help borrowers apply for state-funded assistance, often mirroring the financial disclosures required in the Fannie Mae 194.

- Financial Hardship Declaration: This document is submitted by individuals or business owners outlining the specific circumstances that led to their financial strain, similar to the events listed in the Fannie Mae 194.

- Consumer Credit Counseling Intake Form: Similar in nature, this form collects detailed financial information and reasons for seeking credit counseling as borrowers express in the Fannie Mae 194.

- Short Sale Agreement Documents: When seeking a short sale, borrowers must provide documentation explaining their financial hardship, akin to the sections in the Fannie Mae 194 that address hardship events.

Dos and Don'ts

When filling out the Fannie Mae 194 form, it is crucial to approach the process carefully. Here are six essential do's and don'ts to ensure you complete the form correctly.

- Do ensure accuracy. Double-check all information before submission. Incorrect details can complicate your evaluation.

- Do provide supporting documentation. If the form requests documentation, gather and submit it promptly. This will aid your case.

- Do be honest. Misrepresenting your situation can lead to serious legal consequences. Always present truthful information.

- Do respond to the servicer quickly. Timely communication can make a significant difference in your application process.

- Don’t skip any sections. Complete every part of the form, even if you feel some information is minor. Omissions may delay your request.

- Don’t ignore deadlines. Be aware of any timelines related to the submission process. Late submissions can undermine your chances for assistance.

Misconceptions

When it comes to the Fannie Mae 194 form, there are several misconceptions that can create confusion for borrowers facing financial difficulty. Understanding these misbeliefs is crucial when navigating the foreclosure prevention process. Here’s a list addressing common misconceptions:

- My signature guarantees that I will receive assistance. Many believe that signing the form automatically means they will obtain a Foreclosure Prevention Alternative. In reality, submission does not guarantee approval, as the servicer must evaluate eligibility.

- Providing false information is harmless. Some may think that embellishing personal information won’t cause any issues. However, knowingly providing false information can violate federal law and may lead to severe consequences.

- All financial difficulties qualify me for assistance. While the form lists various hardship reasons, not all financial issues meet the criteria for a Foreclosure Prevention Alternative. Each case is reviewed on its own merits.

- I won’t need to provide any documentation. It's a common misconception that just submitting the form is enough. Servicers can and often will require documentation to verify the claims made on the Hardship Affidavit.

- The servicer is obligated to help me. Some borrowers assume that the servicer must offer assistance if they provide the Hardship Affidavit. However, the servicer has discretion and is not mandated to provide an option based solely on the affidavit.

- I can ignore communication from the servicer. It's a misunderstanding to think that responding to the servicer isn't urgent. Prompt communication is essential, as delays can negatively impact the outcome of a request for assistance.

- My credit score won’t be affected. Many believe that filling out the Hardship Affidavit won’t impact their credit. In truth, servicers often pull credit reports, which means credit can be affected depending on the situation.

- I don’t need to worry about personal information being shared. Some assume that their personal details remain private. However, the servicer may share this information with investors and insurers involved in the loan process.

- Once submitted, my hardship isn’t reviewed again. It’s incorrect to think that a once-submitted affidavit is final. Servicers can re-evaluate cases as new information comes to light or circumstances change.

- I can take my time with this process. The idea that there’s no urgency in submitting the Hardship Affidavit can lead to dire results. Time is critical in these situations, and acting swiftly can greatly affect the outcome.

Understanding these misconceptions can empower borrowers to navigate their financial challenges more effectively. It’s important to approach the process with clarity and readiness to provide honest, accurate information.

Key takeaways

When filling out and using the Fannie Mae 194 form, it's essential to keep several key points in mind. Understanding these takeaways can help ensure an effective submission process.

- Accurate Personal Information: Ensure all borrower and co-borrower information is complete and correct. This includes names, dates of birth, and contact details.

- Clear Explanation of Hardship: Clearly indicate the specific financial difficulties impacting your ability to make mortgage payments. Check all relevant boxes related to the hardship.

- Truthfulness and Documentation: Certify that the information provided is accurate. Be prepared to supply supporting documents if the servicer requests them, as honesty is crucial.

- Timely Communication: Respond promptly to any requests from the servicer. The process may hinge on timely exchanges of information.

- Understanding Consequences: Acknowledge that providing false information can lead to severe consequences, including the potential for foreclosure.

By adhering to these key takeaways, borrowers can navigate the process more effectively and improve their chances of obtaining a Foreclosure Prevention Alternative.

Browse Other Templates

Custodian Job Duties - Sample exams like this can boost confidence before the actual test day.

How to Write a Landscaping Contract - Temporary holds on accounts may incur re-initiation fees as needed.