Fill Out Your Fannie Mae Income Worksheet Form

The Fannie Mae Income Worksheet, known as Form 1084, serves as a key tool for borrowers who are self-employed and seeking to secure a loan. This comprehensive form guides users through a cash flow analysis to evaluate the income available for qualifying purposes. It incorporates various sections that capture different income streams, including wages, interest, dividends, and various business revenues reported across multiple IRS forms such as 1040, 1065, and 1120S. By meticulously detailing income from self-employment, sole proprietorships, and even farming, the worksheet helps lenders assess the borrower's financial stability. Each line item, from net profits to nonrecurring losses, allows for an in-depth review of income history and future expectations. Additionally, specific areas highlight how income distributions are validated through documentation such as Schedule K-1, ensuring that all claims of income are substantiated while adhering to Fannie Mae’s guidelines. This structured approach is essential for accurately determining the amount of stable and continuous income that can support a loan application.

Fannie Mae Income Worksheet Example

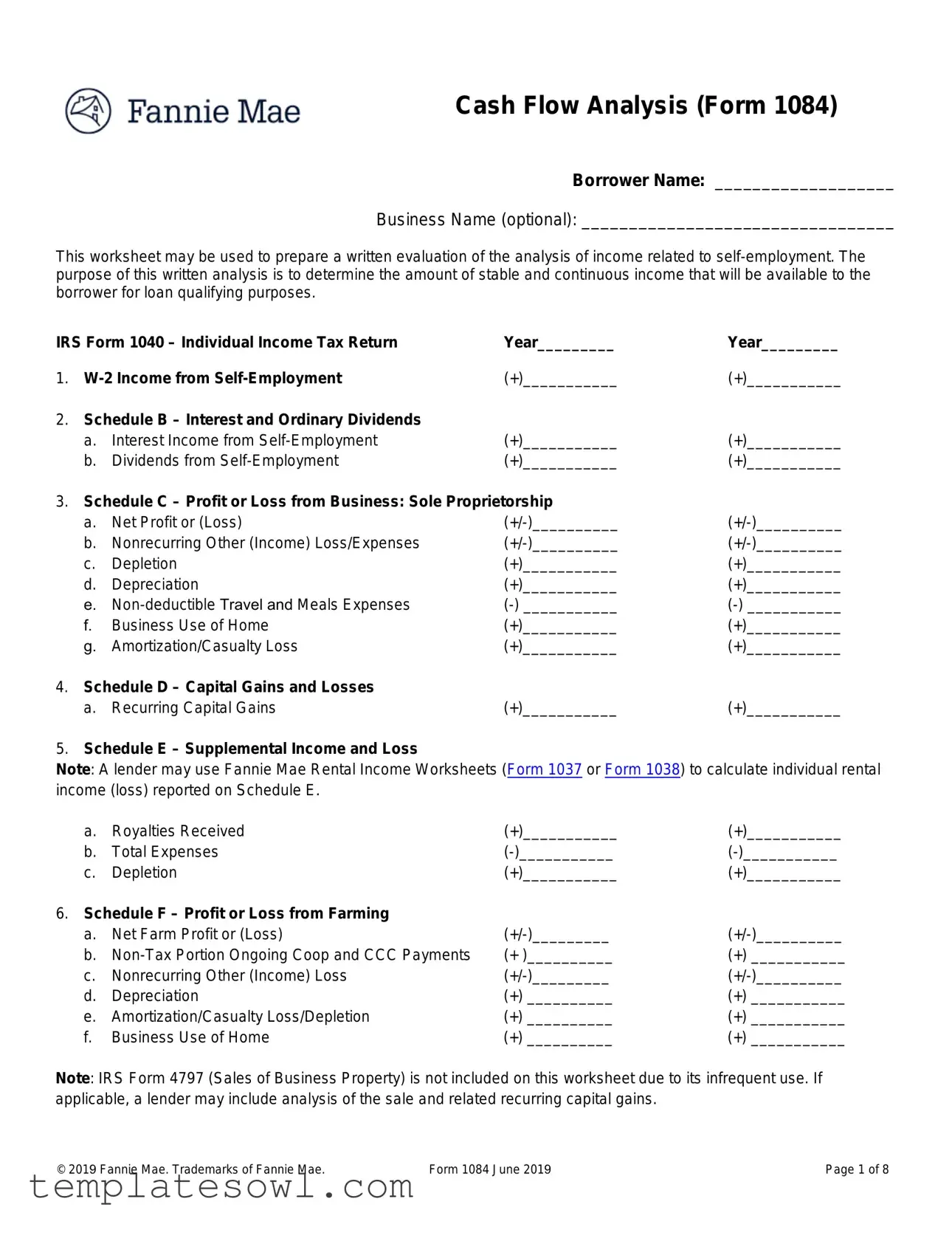

Cash Flow Analysis (Form 1084)

Borrower Name: ___________________

Business Name (optional): _________________________________

This worksheet may be used to prepare a written evaluation of the analysis of income related to

IRS Form 1040 – Individual Income Tax Return |

Year_________ |

Year_________ |

||

1. |

(+)___________ |

(+)___________ |

||

2. |

Schedule B – Interest and Ordinary Dividends |

|

|

|

|

a. |

Interest Income from |

(+)___________ |

(+)___________ |

|

b. |

Dividends from |

(+)___________ |

(+)___________ |

3.Schedule C – Profit or Loss from Business: Sole Proprietorship

a. Net Profit or (Loss) |

|||

b. Nonrecurring Other (Income) Loss/Expenses |

|||

c. |

Depletion |

(+)___________ |

(+)___________ |

d. |

Depreciation |

(+)___________ |

(+)___________ |

e. |

|||

f. |

Business Use of Home |

(+)___________ |

(+)___________ |

g. |

Amortization/Casualty Loss |

(+)___________ |

(+)___________ |

4.Schedule D – Capital Gains and Losses

a. Recurring Capital Gains |

(+)___________ |

(+)___________ |

5.Schedule E – Supplemental Income and Loss

Note: A lender may use Fannie Mae Rental Income Worksheets (Form 1037 or Form 1038) to calculate individual rental income (loss) reported on Schedule E.

a. |

Royalties Received |

(+)___________ |

(+)___________ |

b. |

Total Expenses |

||

c. |

Depletion |

(+)___________ |

(+)___________ |

6.Schedule F – Profit or Loss from Farming

a. Net Farm Profit or (Loss) |

|||

b. |

(+ )__________ |

(+) ___________ |

|

c. Nonrecurring Other (Income) Loss |

|||

d. |

Depreciation |

(+) __________ |

(+) ___________ |

e. |

Amortization/Casualty Loss/Depletion |

(+) __________ |

(+) ___________ |

f. |

Business Use of Home |

(+) __________ |

(+) ___________ |

Note: IRS Form 4797 (Sales of Business Property) is not included on this worksheet due to its infrequent use. If applicable, a lender may include analysis of the sale and related recurring capital gains.

© 2019 Fannie Mae. Trademarks of Fannie Mae. |

Form 1084 June 2019 |

Page 1 of 8 |

Partnership or S Corporation

A

the income was actually distributed to the borrower, or

the business has adequate liquidity to support the withdrawal of earnings. If the Schedule

Note: See the Instructions for additional guidance on documenting access to income and business liquidity.

IRS Form 1065 - Partnership |

Income |

|

|

|

7. Schedule |

– Partner’s Share of Income |

Year__________ |

Year__________ |

|

a. |

Ordinary Income (Loss) |

|||

b. Net Rental Real Estate; Other Net Income (Loss) |

||||

c. |

Guaranteed Payments to Partner |

(+)____________ |

(+) ___________ |

|

8.Form 1065 - Adjustments to Business Cash Flow

a. Ordinary (Income) Loss from Other Partnerships |

|||

b. Nonrecurring Other (Income) Loss |

|||

c. |

Depreciation |

(+) __________ |

(+) ___________ |

d. |

Depletion |

(+) __________ |

(+) ___________ |

e. |

Amortization/Casualty Loss |

(+) __________ |

(+) ___________ |

f. Mortgages or Notes Payable in Less than 1 Year |

|||

g. |

|||

h. |

Subtotal |

____________ |

_____________ |

i. |

Total Form 1065 |

____________ |

_____________ |

|

(Subtotal multiplied by % of ownership) |

||

IRS Form 1120S – S Corporation Earnings |

Year__________ |

Year__________ |

9.Schedule

a. |

Ordinary Income (Loss) |

||

b. |

Net Rental Real Estate; Other Net Rental Income (Loss) |

||

10.Form 1120S - Adjustments to Business Cash Flow

a. Nonrecurring Other (Income) Loss |

|||

b. |

Depreciation |

(+)__________ |

(+)___________ |

c. |

Depletion |

(+)__________ |

(+)___________ |

d. |

Amortization/Casualty Loss |

(+)__________ |

(+)___________ |

e. Mortgages or Notes Payable in Less than 1 Year |

|||

f. |

|||

g. |

Subtotal |

____________ |

_____________ |

h. |

Total Form 1120S |

|

|

|

(Subtotal multiplied by % of ownership) |

____________ |

_____________ |

© 2019 Fannie Mae. Trademarks of Fannie Mae. |

Form 1084 June 2019 |

Page 2 of 8 |

IRS Form 1120 – Regular Corporation

Corporation earnings may be used when the borrower(s) own 100% of the corporation.

11. Form 1120 – Regular Corporation |

Year_________ |

Year_________ |

|

|

|

||

a. |

Taxable Income |

____________ |

_____________ |

b. |

Total Tax |

||

c. |

Nonrecurring (Gains) Losses |

||

d. Nonrecurring Other (Income) Loss |

|||

e. |

Depreciation |

(+)__________ |

(+)___________ |

f. |

Depletion |

(+)__________ |

(+)___________ |

g. |

Amortization/Casualty Loss |

(+)__________ |

(+)___________ |

h. Net Operating Loss and Special Deductions |

(+)__________ |

(+)___________ |

|

i. Mortgages or Notes Payable in Less than 1 Year |

|||

j. |

|||

k. |

Subtotal |

____________ |

_____________ |

l. Less: Dividends Paid to Borrower |

|||

m. Total Form 1120 |

____________ |

_____________ |

|

© 2019 Fannie Mae. Trademarks of Fannie Mae. |

Form 1084 June 2019 |

Page 3 of 8 |

CASH FLOW ANALYSIS (Fannie Mae Form 1084)

Instructions

Guidance for documenting access to income and business liquidity

If the Schedule

If the Schedule

IRS Form 1040 – Individual Income Tax Return

1.

2.Schedule B – Interest and Ordinary Dividends

Line 2a - Interest Income from

Line 2b - Dividends from

3.Schedule C – Profit or Loss from Business: Sole Proprietorship

Line 3a - Net Profit or Loss: Record the net profit or (loss) reported on Schedule C.

Line 3b - Nonrecurring Other (Income) Loss/ Expense: Other income reported on Schedule C represents income that is not directly related to business receipts. Deduct other income unless the income is determined to be recurring. If the income is determined to be recurring, no adjustment is required. Other loss may be added back when it is determined that the loss will not continue.

Line 3c - Depletion: Add back the amount of the depletion deduction reported on Schedule C.

Line 3d - Depreciation: Add back the amount of the depreciation deduction reported on Schedule C. Vehicle depreciation included as part of the standard mileage deduction may be added back by multiplying the business miles driven by the depreciation factor for the respective year.

Line 3e -

Line 3f - Business Use of Home: Add back the expenses deducted for the business use of home.

© 2019 Fannie Mae. Trademarks of Fannie Mae. |

Form 1084 June 2019 |

Page 4 of 8 |

Line 3g - Amortization/Casualty Loss: Add back the expense deducted for amortization along with the expense associated with

4.Schedule D – Capital Gains and Losses

Line 4a - Recurring Capital Gains: Identify the amount of recurring capital gains. Schedule D may report business capital gains passed through to the borrower on Schedule

Note: Business capital losses identified on Schedule D do not have to be considered when calculating income or liabilities, even if the losses are recurring.

5.Schedule E – Supplemental Income and Loss

Note: Use Fannie Mae Rental Income Worksheets (Form 1037 or Form 1038) to evaluate individual rental income (loss) reported on Schedule E. Refer to Selling Guide,

Partnerships and S corporation income (loss) reported on Schedule E is addressed below.

Line 5a - Royalties Received: Include royalty income which meets eligibility standards.

Line 5b - Total Expenses: Deduct the expenses related to royalty income used in qualifying the borrower.

Line 5c - Depletion: Add back the amount of the depletion deduction related to royalty income used in qualifying the borrower.

6.Schedule F – Profit or Loss from Farming

Line 6a - Net Farm Profit or (Loss): Record the net farm profit or (loss) reported on Schedule F.

Line 6b -

Line 6c - Nonrecurring Other (Income) Loss: Other income reported on Schedule F represents income received by a farmer that was not obtained through farm operations. Deduct other income unless the income is determined to be recurring. If the income is determined to be recurring, no adjustment is required. Other loss may be added back when it is determined that the loss will not continue.

Line 6d - Depreciation: Add back the amount of the depreciation deduction reported on Schedule F.

Line 6e - Amortization/Casualty Loss/Depletion: Add back the expense deducted for amortization/depletion along with the expense associated with

Line 6f - Business Use of Home: Add back the expenses deducted for the business use of home.

© 2019 Fannie Mae. Trademarks of Fannie Mae. |

Form 1084 June 2019 |

Page 5 of 8 |

Partnership or S Corporation

IRS Form 1065 – Partnership Income

7.Schedule

Line 7a - Ordinary Income (Loss): Record the amount of ordinary income (loss) reported to the borrower in Box 1 of Schedule

Line 7b - Net Rental Real Estate; Other Net Income (Loss): Record the amount of net rental real estate; other net income (loss) reported to the borrower in Box 2 and/or 3 of Schedule

Line 7c - Guaranteed Payments to Partner: Add guaranteed payments to partner when the borrower has a two- year history of receipt.

8.Adjustments to Business Cash Flow – Form 1065

When business tax returns are obtained by the lender, the following adjustments to business cash flow should be made.

Line 8a - Ordinary income (loss) from other Partnerships: In order to consider ordinary income from other partnerships, the lender must obtain additional documentation to confirm the income passed through from the other partnership to the borrower’s business meets partnership income eligibility standards. Deduct ordinary income passed through to the borrower’s business from other partnerships unless this additional action is taken. Losses passed through to the borrower’s business may be added back when the lender determines

Line 8b - Nonrecurring Other (Income) Loss: Other income reported on Form 1065 generally represents income that is not directly related to business receipts. Deduct other income unless the income is determined to be recurring. If the income is determined to be recurring, no adjustment is required. Other loss may be added back when it is determined that the loss will not continue.

Line 8c - Depreciation: Add back the amount of the depreciation deduction reported on Form 1065 and/or on Form 8825.

Line 8d - Depletion: Add back the amount of the depletion deduction reported on Form 1065.

Line 8e - Amortization/Casualty Loss: Add back the expense deducted for amortization/depletion along with the expense associated with

Line 8f - Mortgage or Notes Payable in Less than 1 Year: Subtract the amount of mortgage or note obligations payable in less than one year, as reported in Schedule L of Form 1120S, end of year column. This deduction is not required for lines of credit or if there is evidence that these obligations roll over regularly and/or the business has sufficient liquid assets to cover them.

Line 8g -

Line 8h - Subtotal: Total lines 8a – 8g.

Line 8i - Form 1065 Total: To arrive at the borrower’s proportionate share of adjustments to business cash flow, multiply the subtotal (line 8h) by the borrower’s percentage of ownership (the borrower’s ending percentage of capital ownership as reported on the Schedule

© 2019 Fannie Mae. Trademarks of Fannie Mae. |

Form 1084 June 2019 |

Page 6 of 8 |

IRS Form 1120S – S Corporation Earnings

9.Schedule

Line 9a - Ordinary Income (Loss): Record the amount of ordinary income (loss) reported to the borrower in Box 1 of Schedule

Line 9b - Net Rental Real Estate; Other Net Income (Loss): Record the amount of net rental real estate; other net income (loss) reported to the borrower in Box 2 and/or 3 of Schedule

10.Adjustments to Business Cash Flow – Form 1120S

When business tax returns are obtained by the lender, the following adjustments to business cash flow should be made.

Line 10a - Nonrecurring Other (Income) Loss: Other income reported on Form 1120S generally represents income that is not directly related to business receipts. Deduct other income unless the income is determined to be recurring. If the income is determined to be recurring, no adjustment is required. Other loss may be added back when it is determined that the loss will not continue.

Line 10b - Depreciation: Add back the amount of the depreciation deduction reported on Form 1120S and/or or Form 8825.

Line 10c - Depletion: Add back the amount of the depletion deduction reported on Form 1120S.

Line 10d - Amortization/Casualty Loss: Add back the expense deducted for amortization/depletion along with the expense associated with

Line 10e - Mortgage or Notes Payable in Less than 1 Year: Subtract the amount of mortgage or note obligations payable in less than one year, as reported in Schedule L of Form 1120S, end of year column. This deduction is not required for lines of credit or if there is evidence that these obligations rollover regularly and/or the business has sufficient liquid assets to cover them.

Line 10f -

Line 10g - Subtotal: Total lines 10a – 10f.

Line 10h - Form 1120S Total: To arrive at the borrower’s proportionate share of adjustments to business cash flow, multiply the subtotal (line 10g) by the borrower’s percentage of stock for tax year reported on the Schedule

IRS Form 1120 – Regular Corporation

11.Regular Corporation – Form 1120

When business tax returns are obtained by the lender, the following adjustments to business cash flow should be made.

Line 11a - Taxable Income: Record the taxable income reported by the business on the first page of Form 1120.

Line 11b - Total Tax: Deduct the corporation‘s tax liability identified on page 1 of Form 1120.

Line 11c - Nonrecurring Other (Gains) Losses: Deduct gains unless it is determined that the gains are likely to continue. Losses may be added back when it can be determined that the loss is a

© 2019 Fannie Mae. Trademarks of Fannie Mae. |

Form 1084 June 2019 |

Page 7 of 8 |

Line 11d - Nonrecurring Other (Income) Loss: Other income reported on Form 1120 generally represents income that is not directly related to business receipts. Deduct other income unless the income is determined to be recurring. If the income is determined to be recurring, no adjustment is required. Other loss may be added back when it is determined that the loss will not continue.

Line 11e - Depreciation: Add back the amount of the depreciation deduction reported on Form 1120.

Line 11f - Depletion: Add back the amount of the depletion deduction reported on Form 1120S.

Line 11g - Amortization/Casualty Loss: Add back the expense deducted for amortization/depletion along with the expense associated with

Line 11h - Net Operating Loss and Special Deductions: Add back the full amount of the deduction related to net operating loss and/or special deductions.

Line 11i - Mortgage or Notes Payable in Less than 1 Year: Subtract the amount of mortgage or note obligations payable in less than one year, as reported in Schedule L of Form 1120S, end of year column. This deduction is not required for lines of credit or if there is evidence that these obligations roll over regularly and/or the business has sufficient liquid assets to cover them.

Line 11j -

Line 11k - Subtotal: Total lines 11a – 11j.

Line 11l - Dividends Paid to Borrower: Dividends paid to stockholders are reported on Schedule

Line 11m - Form 1120 Total: Subtract 11l from 11k to determine the adjustments to business tax flow that may be considered when the borrower(s) own 100% of the corporation and the business has adequate liquidity to support the withdrawal of earnings.

© 2019 Fannie Mae. Trademarks of Fannie Mae. |

Form 1084 June 2019 |

Page 8 of 8 |

Form Characteristics

| Fact Name | Description |

|---|---|

| Purpose | The Fannie Mae Income Worksheet (Form 1084) helps evaluate income from self-employment for loan qualifications. |

| Income Sources | The form allows for various income sources, including wages, business profits, and royalties, among others. |

| Documentation Requirement | Details such as IRS forms (1040, 1065, etc.) and Schedule K-1 must verify income distribution for partnership or S Corporation earnings. |

| Usage Note | Lenders may use forms like 1037 or 1038 to calculate specific rental income reported on Schedule E. |

Guidelines on Utilizing Fannie Mae Income Worksheet

Completing the Fannie Mae Income Worksheet Form (Form 1084) can provide clarity on self-employment income for loan qualifying purposes. By assessing various income sources and deductions, this form helps to showcase a borrower's financial situation objectively. It's crucial to proceed carefully through the details, ensuring accurate reporting for all relevant income streams and expenses. Here's a step-by-step guide to assist in filling out this important form.

- Begin by entering your name and, if applicable, the business name at the top of the form.

- Complete the section for IRS Form 1040: Individual Income Tax Return by filling in the relevant years.

- For W-2 Income from Self-Employment, input any income earned from self-employment for both specified years.

- In Schedule B, record interest and dividend income. Include the amounts for both years under the respective categories.

- Proceed to Schedule C: Profit or Loss from Business. Provide the net profit or loss, including adjustments for nonrecurring items, depletion, depreciation, and business-use expenses. Deduct any non-deductible travel and meals expenses as necessary.

- Move on to Schedule D: Capital Gains and Losses, listing recurring capital gains for both years.

- On Schedule E: Supplemental Income and Loss, detail royalties received, total expenses, and depletion for applicable income sources.

- Next, fill out Schedule F: Profit or Loss from Farming. Complete the net profit or loss and make adjustments for any non-taxable income, other income or losses, depreciation, and business-use expenses.

- When working on income from partnerships or S corporations, obtain the Schedule K-1 and include ordinary income, rental income, and guaranteed payments for verification.

- For additional business cash flow adjustments, fill in details from Forms 1065, 1120S, or 1120 where necessary, ensuring to capture all relevant income and adjustments.

- Finally, total your calculated amounts where indicated, ensuring all inputs are accurate and verifiable to present a comprehensive view of your income analysis.

What You Should Know About This Form

What is the purpose of the Fannie Mae Income Worksheet form?

The Fannie Mae Income Worksheet, Form 1084, is primarily used to assess and document the income of a self-employed borrower. This worksheet provides a detailed cash flow analysis to help lenders determine the stable and continuous income available for loan qualification. It gathers important financial details from various tax forms and schedules.

How should I fill out the cash flow analysis section?

In the cash flow analysis section, you need to include various sources of income from your tax returns. This includes wages, interest, dividends, and profits from your business shown on Schedule C. Make sure to accurately report both income and expenses, as they all contribute to understanding your financial situation comprehensively.

What should I include from my IRS tax returns?

You should gather information from several IRS tax forms, including Form 1040, Schedule B for interest and dividends, Schedule C for sole proprietorship profits or losses, Schedule D for capital gains, and others based on your situation. Each section requires specific income details that reflect your earnings from self-employment and any business activities.

What is the significance of Schedule K-1?

Schedule K-1 is crucial when you're involved with a partnership or S corporation. It documents your share of the earnings, which can only be considered for loan qualification if there's proof that the income was actually distributed to you or if the business has enough liquidity to support this withdrawal. Proper documentation ensures you receive consideration for these earnings in your loan application.

How do I handle non-recurring income or losses?

When you encounter non-recurring income or losses, assess whether they will continue. If the income is stable and likely to recur, no adjustment is needed. However, if it is a one-time event, you should generally deduct that income or add back losses only if they won't occur again. It’s vital to evaluate these items carefully to reflect your true financial position.

How can I verify my W-2 income from self-employment?

To verify W-2 income from self-employment, you should match the Employer Identification Number (EIN) on your W-2 with the EIN associated with your business. Additionally, when submitting your business tax returns, cross-reference any reported compensation of officers with your W-2 to ensure consistency in reported income.

What expenses can be added back when calculating cash flow?

Certain expenses, like depreciation, depletion, and some non-deductible travel and meals expenses, can be added back to your income. These deductions lower taxable income but do not necessarily represent cash flow out of your pocket. Ensure you are aware of which expenses qualify to achieve an accurate representation of your cash flow situation.

Is rental income analyzed differently?

Yes, rental income is evaluated separately. Use the Fannie Mae Rental Income Worksheets (Forms 1037 or 1038) specifically designed for this purpose. These forms help calculate individual rental income or losses reported on Schedule E. Be sure to gather all necessary documentation to support your rental income claims when applying for a loan.

What if I have both S corporation and partnership income?

If you have income from both an S corporation and a partnership, you need to fill out the related sections for each in the worksheet

Common mistakes

Completing the Fannie Mae Income Worksheet can seem daunting, especially for self-employed borrowers. Yet, avoiding straightforward errors can dramatically streamline the process and enhance approval chances. One common mistake is failing to accurately report W-2 income from self-employment. Many individuals may overlook the importance of confirming that their W-2 aligns with their business's Employer Identification Number (EIN). This cross-referencing is vital. Without it, lenders might deem the income unverifiable, leaving an applicant with a skewed income profile.

Another frequent misstep involves the misclassification of nonrecurring income. Borrowers sometimes mistakenly add such income to their overall cash flow when it is not stable or predictable. This can skew the findings and lead lenders to question the authenticity of reported earnings. It's crucial for borrowers to dissect their income sources, ensuring that only consistent, verifiable income is represented on the worksheet. The distinction between nonrecurring and recurring income is significant, and accuracy here is key to a favorable assessment.

Furthermore, many people neglect to consider the impact of depreciation and amortization deductions. While these deductions can reduce taxable income significantly, they must be handled correctly on the worksheet. Borrowers should add back any depreciation or amortization amounts deducted on tax returns, as these figures can improve cash flow analysis when calculating qualifying income. Failing to do so could present an incorrect picture of financial stability.

Lastly, individuals often forget to account for non-deductible travel and meals expenses. Because these expenses often get excluded from tax reporting, it’s necessary to explicitly identify and deduct them from business cash flow to maintain an accurate representation of available income. Clarity is essential, and omitting this detail can lead to an overestimation of disposable income, which is a red flag for lenders.

Documents used along the form

The Fannie Mae Income Worksheet is an essential tool for evaluating self-employment income. However, it is commonly accompanied by other forms and documents that provide additional information. These documents help lenders gain a more comprehensive understanding of a borrower's financial situation and ability to repay a loan. Below is a list of forms that are often used alongside the Fannie Mae Income Worksheet.

- IRS Form 1040 – Individual Income Tax Return: This is the standard form used by individuals to file their annual income tax returns. It includes information on income, deductions, and tax liability, providing a complete view of the taxpayer's financial picture.

- Schedule C – Profit or Loss from Business: This schedule is attached to IRS Form 1040 to report income and expenses from a sole proprietorship. It details profits or losses and is crucial for assessing self-employment income.

- Schedule E – Supplemental Income and Loss: Used to report income or loss from rental real estate, partnerships, S corporations, estates, and trusts. This form helps to outline additional income sources beyond regular employment.

- Schedule K-1: This form documents the earnings of partners in a partnership or shareholders in an S corporation. It verifies the distribution of income to individuals and is important for confirming income from business entities.

- IRS Form 1065 – Partnership Income: This form reports the income, deductions, gains, and losses of a partnership. It is vital when a borrower is a partner and their income is dependent on partnership distributions.

- IRS Form 1120S – S Corporation Earnings: This form is used by S corporations to report income. It's significant when S corporation shareholders are attempting to qualify for loans based on their share of the corporation's income.

- IRS Form 1120 – Regular Corporation: This returns income, deductions, and taxes for corporations. For borrowers who own a regular corporation, this form provides necessary documentation of their business earnings.

Each of these forms plays a crucial role in providing a clearer picture of a borrower's income, allowing for a more informed decision during the loan application process. Collectively, they contribute to a thorough assessment of financial stability and capacity for repayment.

Similar forms

The Fannie Mae Income Worksheet (Form 1084) is one of several documents used to evaluate income for lending purposes. Here are ten other documents it is similar to:

- IRS Form 1040 - Individual Income Tax Return: Like the Income Worksheet, the 1040 is used to report personal income. Borrowers need to summarize their income sources, including wages and business profits, as with the Fannie Mae form.

- Schedule C - Profit or Loss from Business: This schedule details income and expenses from self-employment. It aligns with the Income Worksheet's objective of assessing the borrower’s business earnings.

- IRS Form 1065 - Partnership Return: Similar to the Income Worksheet, this form reflects the income from partnerships, enabling lenders to see how much the borrower earns from these ventures.

- Schedule K-1 (Form 1065) - Partner’s Share of Income: This schedule provides the borrower’s income distribution from partnerships, contributing to a comprehensive cash flow analysis like the one in the Fannie Mae form.

- IRS Form 1120S - S Corporation Return: Similar in purpose, it reveals S Corporation earnings. It helps to assess income from corporations in which the borrower has an ownership stake.

- Schedule K-1 (Form 1120S) - Shareholder’s Share of Income: This is akin to the Schedule K-1 for partnerships, offering a detailed look at income distributed to shareholders, useful for personal cash flow assessments.

- Schedule E - Supplemental Income and Loss: This schedule notes additional income sources, such as rental income, paralleling the Income Worksheet's focus on various streams of income.

- Schedule D - Capital Gains and Losses: It identifies capital transactions affecting income. This aligns with the Fannie Mae form in calculating overall income from investments.

- IRS Form 1120 - Corporation Tax Return: This form outlines taxable income for corporations. If a borrower owns a corporation, this helps establish income for evaluation purposes, like the Income Worksheet.

- Cash Flow Analysis Form - A general cash flow analysis form requires similar information on income and liabilities. It is used alongside the Income Worksheet to ensure comprehensive income reviews.

Dos and Don'ts

When filling out the Fannie Mae Income Worksheet, follow these tips to ensure accuracy and completeness.

- Double-check your income sources. Make sure to accurately report all forms of income, including W-2, Schedule C, and any self-employment income.

- Use the right documents. Gather all necessary tax documents, such as IRS Form 1040 and Schedules K-1, to support your income claims.

- Clarify nonrecurring income. Identify and clearly mark any income that is nonrecurring to avoid confusion during the loan review process.

- Be consistent. Ensure that your reported income aligns with what is reflected in your tax returns.

- Understand your business structure. If you are a partner or shareholder, know the rules regarding documentation for income withdrawal from the business.

- Don't rush through the process. Filling out the form correctly takes time. Avoid rushing to prevent errors.

- Don't omit any income sources. Failing to report all income can lead to loan application issues down the road.

- Don't ignore discrepancies. If your income from different sources doesn't add up, take the time to resolve these inconsistencies before submitting.

- Don't forget to check for updates. Stay informed about any changes to Fannie Mae guidelines or requirements for filling out the worksheet.

- Don't use outdated tax documents. Always use the most recent tax filings to ensure your information is current.

Misconceptions

Understanding the Fannie Mae Income Worksheet form is essential for accurately assessing income for self-employed borrowers. However, several misconceptions can lead to confusion. Below are eight common misconceptions along with clarifications.

- Self-employment income is automatically accepted. Many assume that all self-employment income qualifies without scrutiny. In reality, lenders require documentation and a stable income history to determine qualification.

- The worksheet is only for full-time self-employed individuals. This worksheet can be used by anyone reporting self-employment income, regardless of full-time or part-time status. Part-time self-employed individuals can benefit from the evaluation process as well.

- Non-deductible expenses do not affect cash flow analysis. Some believe that non-deductible expenses are irrelevant to cash flow calculations. In truth, these expenses must be accounted for when analyzing cash flow, as they can impact overall income used for loan qualifications.

- Only net profit from Schedule C is considered. A common issue is the belief that only the net profit from Schedule C matters. However, other sources of income, like capital gains and rental income, are also important when assessing overall financial health.

- This form is only for individual borrowers. There is a misconception that the worksheet applies solely to individual borrowers. In reality, it is also useful for partnerships and S corporations, provided the documentation is correctly submitted.

- All income listed on the worksheet is automatically verifiable. Many individuals think that if income is recorded on the worksheet, it must be verifiable. However, documentation such as IRS forms and schedules is necessary to support all claims of income.

- The worksheet simplifies the process without further documentation. Some people believe that using the worksheet alone streamlines the entire process. While it organizes financial data, lenders will still require additional documentation for a complete assessment.

- Business owners can withdraw any amount of income. There is a significant misunderstanding regarding the access to income for business owners. Just because a business is profitable does not guarantee that owners can access that income unless they provide evidence of business liquidity and proper documentation.

Addressing these misconceptions can lead to a clearer understanding of how to utilize the Fannie Mae Income Worksheet form effectively, ultimately aiding borrowers in their pursuit of financing.

Key takeaways

Ensure you accurately provide your name and the optional business name at the top of the Fannie Mae Income Worksheet. This basic information is crucial for identification.

The worksheet assists in evaluating income generated from self-employment. Its primary goal is to determine what portion of your income is stable and can be relied upon when qualifying for a loan.

Gather essential documentation, including your IRS Form 1040, which outlines your individual income. This will serve as the starting point for filling out the worksheet.

Report all W-2 income accurately. Clearly state your self-employment income from W-2s and ensure it matches the Employer Identification Number (EIN) on your business tax returns.

Use Schedule C (Profit or Loss from Business) to capture your net profit or loss. It’s important to distinguish between recurring and nonrecurring income to provide a clear picture of your business earnings.

Watch out for deductions related to depreciation, depletion, and amortization. These can significantly affect the net income calculated, so account for them thoughtfully.

Rental income should be evaluated using Fannie Mae Rental Income Worksheets. This ensures adherence to guidelines when reporting any rental activity on the Income Worksheet.

In cases of partnerships or S Corporations, only include income if documentation, such as Schedule K-1, confirms that distributions were made to you. This safeguards against counting non-distributed income.

Lastly, consistency is key. Ensure the income reported aligns with your historical earnings and business health to satisfy lenders’ scrutiny regarding stability and access to necessary funds.

Browse Other Templates

Repossession Affidavit Arizona - This form is integral to ensuring all repossession actions are documented properly.

Pathos Ethos Logos - PATHOS: The strong emotional imagery evokes a sense of loss and dire circumstances, compelling audiences to acknowledge community suffering more productively.

Oklahoma Angler Permit Form,Oklahoma Fishing Registration Form,Oklahoma Wildlife Fishing Application,Fishing License Request Form for Oklahoma,Oklahoma Sport Fishing Application,Oklahoma Recreational Fishing License Form,Oklahoma Fishing Rights Regis - Some licenses may grant access to special events or fishing tournaments.