Fill Out Your Farm Lease Agreement 669 Form

A Farm Lease Agreement is a vital tool for establishing clear expectations and responsibilities between a landlord and a tenant in agricultural settings. The Farm Lease Agreement 669 form serves as a structured template to facilitate this agreement, encompassing key components that outline the terms of the rental arrangement. It begins by documenting essential information such as the date of the agreement, the identities of the contracting parties, and a detailed description of the property involved. The form specifies the timeframe, indicating when the lease will commence and when it will terminate, while also suggesting that tenants should communicate with landlords prior to lease expiration to discuss renewing terms. Key provisions of land use and expectations regarding cropping practices are included to ensure both parties are aligned on agricultural goals. With provisions for the calculation and payment schedule of rent – displayed clearly to avoid confusion – and detailed responsibilities for both the landlord and tenant, the form aims to protect each party’s interests. It further lays out rights of entry, conditions for maintenance and improvements, and procedures for addressing disputes or claims. In short, Farm Lease Agreement 669 serves as a comprehensive guide, ensuring that both landlords and tenants can navigate their relationship and responsibilities effectively.

Farm Lease Agreement 669 Example

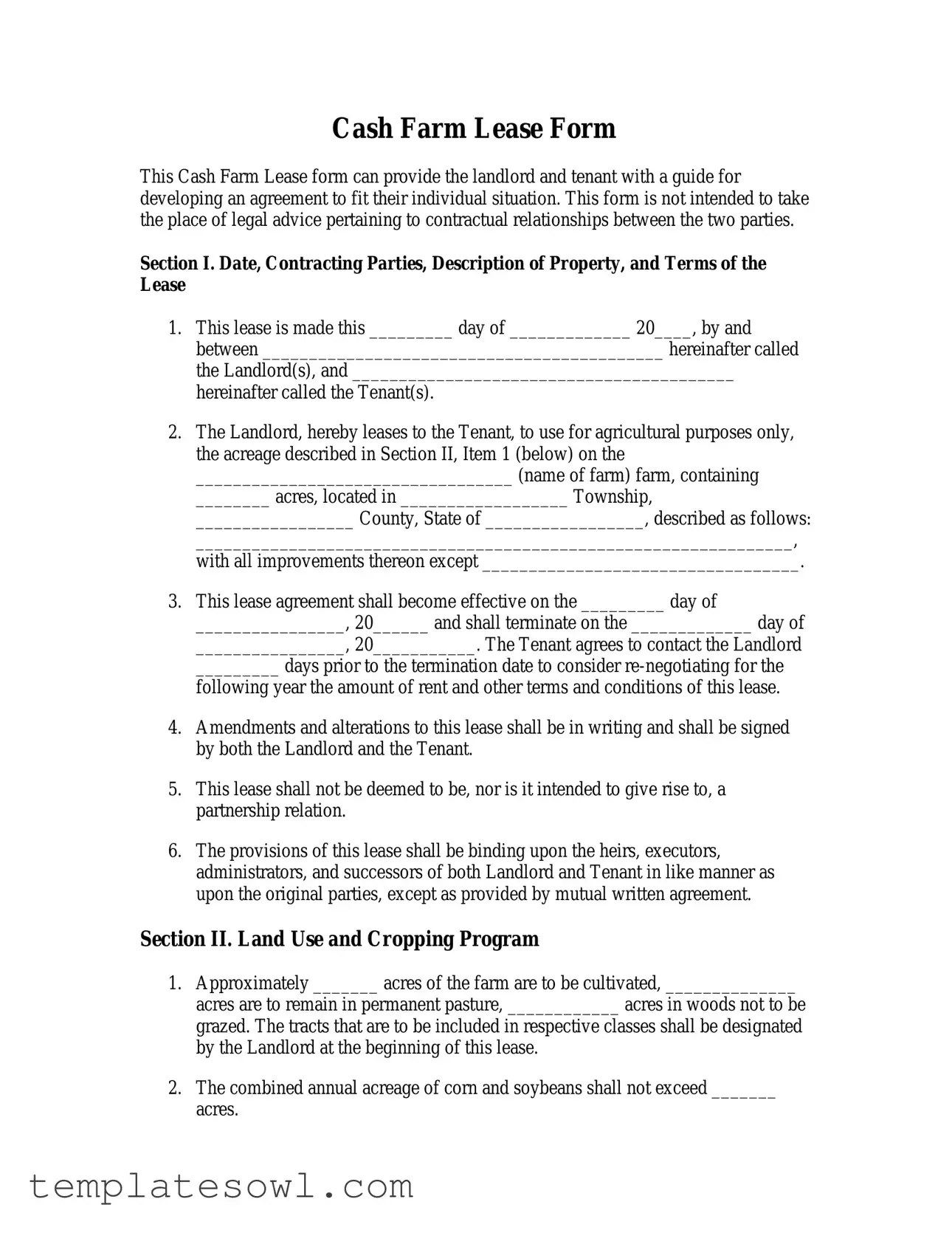

Cash Farm Lease Form

This Cash Farm Lease form can provide the landlord and tenant with a guide for developing an agreement to fit their individual situation. This form is not intended to take the place of legal advice pertaining to contractual relationships between the two parties.

Section I. Date, Contracting Parties, Description of Property, and Terms of the Lease

1.This lease is made this _________ day of _____________ 20____, by and between ___________________________________________ hereinafter called the Landlord(s), and _________________________________________

hereinafter called the Tenant(s).

2.The Landlord, hereby leases to the Tenant, to use for agricultural purposes only, the acreage described in Section II, Item 1 (below) on the

__________________________________ (name of farm) farm, containing

________ acres, located in __________________ Township,

_________________ County, State of _________________, described as follows:

________________________________________________________________, with all improvements thereon except __________________________________.

3.This lease agreement shall become effective on the _________ day of

________________, 20______ and shall terminate on the _____________ day of

________________, 20___________. The Tenant agrees to contact the Landlord

_________ days prior to the termination date to consider

4.Amendments and alterations to this lease shall be in writing and shall be signed by both the Landlord and the Tenant.

5.This lease shall not be deemed to be, nor is it intended to give rise to, a partnership relation.

6.The provisions of this lease shall be binding upon the heirs, executors, administrators, and successors of both Landlord and Tenant in like manner as upon the original parties, except as provided by mutual written agreement.

Section II. Land Use and Cropping Program

1.Approximately _______ acres of the farm are to be cultivated, ______________

acres are to remain in permanent pasture, ____________ acres in woods not to be grazed. The tracts that are to be included in respective classes shall be designated by the Landlord at the beginning of this lease.

2.The combined annual acreage of corn and soybeans shall not exceed _______

acres.

3.The extent of participation in government programs will be discussed and decided upon on an annual basis. The course of action agreed upon shall be placed in writing and signed by both parties. A copy of the course of action so agreed upon shall be made available to each party.

4.No permanent pasture shall be plowed without the written consent of the Landlord.

Section III. Amount of Rent and Time of Payment

1.The Tenant shall pay to the Landlord the sum of $_____________ annual rent for the entire acreage referred to in Section I, calculated as follows:

_____ acres of tillable land @ $______ per acre |

$________ |

_____ acres of |

$________ |

Building rent for: dwelling |

$________ |

grain bins |

$________ |

other ________________ |

$________ |

Total annual cash rent |

$________ |

The annual cash rent shall be paid as follows:

$______________ on or before __________________, 20_______

$______________ on or before __________________, 20_______

$______________ on or before __________________, 20_______

If rent is not paid when due, the Tenant agrees to pay interest on the amount of unpaid rent at the rate of _____ percent per annum from the due date until paid.

Section IV. The Landlord Agrees to:

1.Furnish the land and the fixed improvements referred to in Section I.

2.Pay all taxes and the assessments against the real estate and all taxes on the Landlord's personal property on the farm.

3.Furnish materials and labor for mutually agreed upon repairs, improvements, and construction of buildings, drains, and fences on the farm. To pay for materials purchased by the Tenant for purposes of repair and maintenance in an amount not to exceed $_________ in any one year, except as otherwise agreed upon. Reimbursement shall be made within ________ days after the Tenant submits the bill.

4.Furnish _______ % of the limestone used on the farm, together with ______ % of hauling and spreading costs. If the Tenant hauls and/or spreads the limestone furnished by the Landlord, the Landlord shall pay the Tenant the customary rate per ton for such work as agreed upon in writing before the work is done.

5.Replace or repair as promptly as possible the dwelling or any other building or equipment regularly used by the Tenant that may be destroyed or damaged by fire, flood, or other cause beyond the control of the Tenant and, until such replacement or repair is made, to compensate the tenant as follows:

_______________________________________________________________

________________________________________________________________

6.Other responsibilities of the Landlord:

Let the Tenant make minor improvements of a temporary or removable nature, which do not mar the condition or appearance of the farm, at the Tenant's expense. The Landlord further agrees to let the Tenant remove such improvements at any time this lease is in effect or within ________ days thereafter, provided the Tenant leaves in good condition that part of the farm from which such improvements are removed. The Tenant shall have no right to compensation for improvements that are not removed except as mutually agreed.

7.Reimburse the Tenant at the termination of this lease for field work done and for other crop costs incurred for crops to be harvested during the following year. Unless otherwise agreed, current custom rates for the operations involved will be used as a basis of settlement.

Section V. The Tenant Agrees to:

1.Follow the farming practices that are generally recommended for and that are best adapted to this type of farm and for this locality unless other practices are agreed upon.

2.Furnish all labor, power, machinery, and movable equipment and all related operation and maintenance expenses to operate the farm except as follows:

__________________________________________________________

3.Furnish all labor for minor repair and the minor improvement of buildings, fences, and drains with the material to be furnished by the Landlord. The buildings, fences, and other improvements on the farm are to be kept in as good condition as they are at the beginning of the lease, or in as good condition as they may be put in by the Landlord during the term of the lease; ordinary wear, depreciation, or unavoidable destruction excepted.

4.Keep livestock out of the fields when the soil is soft, and protect sod crops, especially new seedings, from too close grazing that might impair the following year's crop.

5.Follow NRCS and/or FSA recommendations and fulfill all other requirements necessary to maintain the rights of current and future tenants of this farm to participate in federal farm programs. Planted acreages and yields of crops shall be reported as required by FSA.

6.Store and use pesticides, fertilizers, and other chemicals, and dispose of containers in accordance with state and federal regulations and recommendations. Furnish the Landlord a written field by field record of the amount, kinds, and dates of applications of pesticides and fertilizers.

7.Store no motor vehicles, tractors, fuel, and chemicals on the farm in violation of restrictions in the Landlord's insurance policies.

8.Apply fertilizer as follows:

|

Corn |

Soybeans |

___________ |

Potash (K2O) no less than |

_______lb/a |

________lb/a |

_________lb/a |

Phosphate (P2O5) no less than |

_______lb/a |

________lb/a |

_________lb/a |

Nitrogen (N) no more than |

_______lb/a |

________lb/a |

_________lb/a |

9.Neither assign this lease to any person or persons nor sublet any part of the real estate for any purpose without the written consent of the Landlord.

10.Not to: a) erect or permit to be erected on the farm any permanent structure, b) incur any expense to the Landlord for such purposes, or c) add electrical wiring, plumbing, or heating to any building without written consent of the Landlord.

11.Control soil erosion according to a conservation plan approved by NRCS; keep in good repair all terraces, open ditches, inlets and outlets of tile drains; preserve all established watercourses or ditches including grassed waterways; and refrain from any operation or practice that will injure such structures.

12.When leaving the farm, to pay the Landlord reasonable compensation for any damages to the farm for which the Tenant is responsible. Any decrease in value due to ordinary wear and depreciation or damage outside the control of the Tenant is exempted.

13.Yield peaceable possession of the farm at the termination of this lease.

Section VI. Rights and Privileges

1.The Landlord or anyone designated by him shall have the right of entry at any mutually convenient time to inspect the property and/or the farming methods being used.

2.The Tenant shall have the right of entry for _______ days after the termination of the lease for the purpose of harvesting spring seeded crops. The Landlord or his designated agent shall have the right of entry to plant fall crops following harvest of the current year's crops.

3.If this lease is terminated before the Tenant shall have obtained the benefits from any other labor or expense he may have made in operating the farm, according to contract or agreement with the Landlord during the current lease year, the Landlord shall reimburse the Tenant for such labor and expense. The Tenant shall present, in writing to the Landlord, his claim for such reimbursement at least

_______ days before the termination of this lease.

4.Transfer of ownership of this farm shall be subject to the provisions of this lease.

Section VII. Enforcement of Agreements and Arbitration

1.Failure of either the Landlord or the Tenant to comply with the agreement set forth in this lease shall make that person liable for damages to the other party. Any claim by either party for such damages shall be presented, in writing to the other party, at least _______ days before the termination of this lease.

2.The provisions of this lease shall be binding on the heirs, executors, administrators, and assigns of the party or parties involved.

3.Any disagreements between the Landlord and the Tenant shall be referred to a board of three disinterested persons, one of whom shall be appointed by the Landlord, one by the Tenant, and the third by the two thus appointed. The decision of these three shall be considered binding by the parties to this lease unless a sum exceeding $________ is involved. Any cost for such arbitration shall be shared equally between the two parties of this lease.

Section VIII. Other Agreements and Provisions

_________________________________________________________________

_________________________________________________________________

_________________________________________________________________

_________________________________________________________________

_________________________________________________________________

_________________________________________________________________

_________________________________________________________________

_________________________________________________________________

Section IX. Signatures

_____________________________________ |

_______________________________________ |

||

(Tenant) |

(Date) |

(Landlord) |

(Date) |

____________________________________________ |

|

||

(Witness of Notary Public) |

|

(Date) |

|

Section XR1. Annual Renewal for Crop Year 20_____

1.Annual rent for crop year 20_____. shall be $____________.payable on the same dates and in the same proportion as specified in Section II.

2.All other agreements in the attached lease are hereby renewed for crop year

20_____. |

|

|

|

_____________________________ |

________________________________ |

||

(Tenant) |

(Date) |

(Landlord) |

(Date) |

Section XR2. Annual Renewal for Crop Year 20_____

1.Annual rent for crop year 20_____. shall be $____________.payable on the same dates and in the same proportion as specified in Section II.

2.All other agreements in the attached lease are hereby renewed for crop year 20_____.

_____________________________ |

________________________________ |

||

(Tenant) |

(Date) |

(Landlord) |

(Date) |

Section XR3. Annual Renewal for Crop Year 20_____

1.Annual rent for crop year 20_____. shall be $____________.payable on the same dates and in the same proportion as specified in Section II.

2.All other agreements in the attached lease are hereby renewed for crop year 20_____.

_____________________________ |

________________________________ |

||

(Tenant) |

(Date) |

(Landlord) |

(Date) |

Section XR4. Annual Renewal for Crop Year 20_____

1.Annual rent for crop year 20_____. shall be $____________.payable on the same dates and in the same proportion as specified in Section II.

2.All other agreements in the attached lease are hereby renewed for crop year 20_____.

_____________________________ |

________________________________ |

||

(Tenant) |

(Date) |

(Landlord) |

(Date) |

Section XR5. Annual Renewal for Crop Year 20_____

1.Annual rent for crop year 20_____. shall be $____________.payable on the same dates and in the same proportion as specified in Section II.

2.All other agreements in the attached lease are hereby renewed for crop year 20_____.

_____________________________ |

________________________________ |

||

(Tenant) |

(Date) |

(Landlord) |

(Date) |

Rev 2/02

It is the policy of the Purdue University Cooperative Extension Service, David C. Petritz, Director, Purdue University that all persons shall have equal opportunity and access to its programs and facilities without regard to race, color, sex, religion, national origin, age, or disability.

Purdue University is an Affirmative Action employer.

*Prepared by Agricultural Economists Craig L. Dobbins and J.H. Atkinson. This form was developed to provide an example that illustrates the items often included in a written lease. The reader should consult with appropriate legal council before finalizing their lease agreement.

Form Characteristics

| Fact Name | Description |

|---|---|

| Purpose | This Cash Farm Lease Agreement serves as a guide for landlords and tenants in forming an agricultural lease tailored to their needs. |

| Effective Date | The lease becomes effective on a specific date provided and will terminate on another agreed-upon date, requiring tenants to notify landlords prior to renegotiation. |

| Amendments | Any changes to the lease must be documented in writing and signed by both parties to be valid. |

| Governing Law | This lease complies with applicable state laws, which can vary, so consulting local regulations is advisable. |

Guidelines on Utilizing Farm Lease Agreement 669

To successfully fill out the Farm Lease Agreement 669 form, it's important to provide accurate and complete information. This process involves various details related to the parties involved, the property description, terms of the lease, land use, rental amounts, and the responsibilities of both the landlord and tenant. Following the steps below will help ensure that the lease agreement meets both parties' needs.

- On the first line, fill in the date of the agreement.

- Identify the landlord's name and write it clearly after "by and between".

- Identify the tenant’s name and write it after "hereinafter called the Tenant(s)".

- In Section II, specify the name of the farm and the amount of acreage being leased for agricultural use.

- Describe the location of the farm, including township, county, and state.

- Note any exceptions to improvements on the property.

- Fill in the effective date of the lease and the termination date.

- Indicate the days' notice the tenant must give the landlord before the termination date for lease renewal discussions.

- Detail the land use, including how many acres will be cultivated, in permanent pasture, and in woods.

- Specify the maximum allowable acres for corn and soybeans annually.

- Discuss participation in government programs; record the agreement in writing after discussion.

- In the payment section, list the total annual rent and how it will be calculated, breaking it down by tillable and non-tillable land, as well as any building rent.

- Detail the payment schedule, including due dates and amounts.

- Fill out the landlord's responsibilities, including tax payment and maintenance provisions.

- Clarify any responsibilities of the tenant regarding farm operations and land condition.

- Outline the rights and privileges for both parties regarding property inspection and access after lease termination.

- Finally, sign and date the agreement where indicated to confirm both parties accept the terms.

What You Should Know About This Form

What is the purpose of the Farm Lease Agreement 669 form?

The Farm Lease Agreement 669 form serves as a guideline for landlords and tenants to create a lease that fits their specific needs. It outlines the terms of the lease, including property description, rental amounts, and responsibilities of both parties. While it provides a structured approach, it is always advisable for both parties to consult legal professionals for legal advice related to their agreement.

What are the key sections included in the Farm Lease Agreement 669?

The Farm Lease Agreement 669 contains several key sections. These include details about the contracting parties and property in Section I, which establishes the basic terms of the lease. Section II discusses land use and cropping programs, while Section III outlines the rent amount and payment schedule. Sections IV and V detail the responsibilities of both the landlord and tenant. Lastly, Sections VI and VII cover rights, privileges, and enforcement of agreements.

How is the rent amount determined and paid?

The rent amount is calculated based on the total acreage being leased. Different rates may apply to tillable and non-tillable land. The annual cash rent is specified and can include charges for buildings, equipment, or other structures. Payments are scheduled throughout the year, with specific due dates outlined in the lease. If rent is not paid on time, interest may accrue on the unpaid amount.

What obligations does the landlord have in this agreement?

The landlord is responsible for providing the land and fixed improvements, paying necessary taxes, and offering support for repairs and maintenance as specified in the lease. The landlord must also replace or repair significant structures damaged beyond the tenant's control and reimburse the tenant for agreed-upon expenses related to farm operations. These obligations help ensure that the tenant can effectively farm the land throughout the lease term.

Can a tenant make improvements to the leased property?

Yes, the tenant can make minor improvements to the property. However, these improvements must not damage the farm's condition or appearance. Any major installations or alterations require written consent from the landlord. The tenant retains the right to remove temporary improvements when the lease ends, provided they restore the affected areas to good condition.

Common mistakes

Filling out the Farm Lease Agreement 669 form can seem straightforward, but there are common mistakes that can complicate the leasing process. One such mistake is incomplete information. When parties fail to fill in critical areas such as the date, names, and property description, it can lead to confusion about the agreement's legitimacy and the responsibilities of each party. It's essential to ensure that all blanks are carefully filled out to avoid future disputes.

Another frequent oversight is neglecting to detail the terms of rent and payment schedules. Incomplete or unclear payment terms can create misunderstandings between the landlord and tenant. If the specific amounts owed and the due dates are not clearly indicated, either party may have a valid reason to dispute the terms. Clarity in this section can also establish a solid foundation for the financial relationship between both parties.

A third common mistake involves overlooking the amendment process. When modifications are needed, it is crucial that all changes be documented in writing, with signatures from both parties. Failing to do this can render verbal agreements unenforceable. This oversight can leave one party feeling at a disadvantage if issues arise concerning agreed-upon alterations to the lease.

Lastly, not addressing responsibilities related to land use can lead to significant problems. Failing to clearly outline what portions of the land are designated for various purposes—such as cultivation, pasturing, or maintaining woods—could result in disputes over land and resources. It is vital for both the landlord and tenant to agree on land use practices at the start of the lease to ensure that both parties are on the same page regarding expectations and obligations.

Documents used along the form

The Farm Lease Agreement 669 form establishes the essential terms of the leasing contract between a landlord and tenant for farming purposes. Various other forms and documents are often used in conjunction with the Farm Lease Agreement to clarify details, outline expectations, and ensure compliance with regulations. Below is a list of these common documents, each with a brief description.

- Farm Management Plan: This document outlines the management strategies for the farm, including crop rotation, soil conservation practices, and resource management. It serves as a guide for both parties to ensure sustainable farming practices are followed.

- Livestock Lease Agreement: If the tenant plans to raise animals, this agreement specifies conditions for animal care, feeding practices, and liability considerations. It is crucial for maintaining animal welfare and responsibility.

- Insurance Policies: These documents provide coverage details for the farm and its operations. Both landlord and tenant may need to secure appropriate liability and property insurance to protect against unforeseen events.

- Crop Sharing Agreement: This document outlines the distribution of crop yields between the landlord and tenant when crops are shared instead of a fixed rental payment. It defines share percentages and responsibilities for costs and labor.

- Field Application Records: Records of pesticide, fertilizer, and herbicide applications are essential for compliance with agricultural regulations. This document also helps maintain the safety and health of the land and surrounding environment.

- State and Federal Program Compliance Forms: These forms help ensure that the farm meets government standards to qualify for various agricultural programs and subsidies, protecting both parties from potential legal issues.

- Repair and Maintenance Agreement: An agreement detailing both parties' responsibilities for maintaining the farm's buildings and equipment. Clear expectations can prevent disputes over upkeep tasks.

- Termination Notice: A written statement provided by either party to formally notify the other of the decision to end the lease. This ensures both parties are aware of their rights and must follow established timelines.

- Sublease Agreement: Should the tenant wish to sublet any part of the leased land, this agreement specifies conditions and requirements. It ensures the landlord's approval and prevents unauthorized rentals.

- Property Condition Report: A document that records the state of the property at the beginning and end of the lease. It helps prevent disputes regarding damages or necessary repairs when the lease concludes.

Utilizing these forms and documents alongside the Farm Lease Agreement 669 can help promote clear communication and understanding between the landlord and tenant. This collaborative approach can create a more effective and harmonious leasing relationship, ultimately benefiting both parties.

Similar forms

- Cash Farm Lease Form: Similar to the Farm Lease Agreement 669, the Cash Farm Lease Form outlines the relationship between landlords and tenants, focusing on rental amounts, terms, and property usage. It serves as a guide for establishing customized agreements based on individual needs.

- Crop Share Lease Agreement: This agreement involves sharing crop yields between the landlord and tenant instead of a fixed cash rent. Like the Farm Lease Agreement, it specifies property use and responsibilities pertaining to maintenance and improvements.

- Rental Agreement for Agricultural Property: This document governs the lease terms for agricultural properties. It covers duration, payment terms, and obligations of both parties, similar to the layout of the Farm Lease Agreement 669.

- Pasture Lease Agreement: This type of lease focuses on renting land for grazing livestock. It is similar to the Farm Lease Agreement as it also details specific terms of use, responsibilities, and payment arrangements between tenant and landlord.

- Farming Partnership Agreement: In this agreement, two or more parties collaborate in farming operations. While it involves shared decision-making and profits, it also shares some structural similarities with the Farm Lease Agreement regarding responsibilities and obligations.

- Custom Farming Agreement: This document articulates the terms under which one party farms land for another, focusing on services rendered rather than rental income. It encompasses similar aspects that define responsibilities and compensation, akin to the Farm Lease Agreement 669.

- Farm Management Agreement: This agreement outlines the relationship where one party manages the farming operations on behalf of the landowner. Like the Farm Lease Agreement, it establishes duties, payment structures, and duration, tailored to both sides' needs.

Dos and Don'ts

When filling out the Farm Lease Agreement 669 form, following some key guidelines can enhance clarity and ensure compliance. Below are nine important dos and don’ts to keep in mind:

- Do complete all sections of the form accurately to avoid confusion later.

- Do clearly define the terms of the lease, including the start and end dates.

- Do specify the acreage details, including the types of land usage and any restrictions.

- Do ensure that both parties sign all amendments or alterations to the lease.

- Do keep written records of verbal agreements for reference.

- Don't leave blanks in important sections; if information is not applicable, indicate this clearly.

- Don't assume that oral agreements stand; always confirm in writing.

- Don't alter any terms without the consent of both parties and without putting it in writing.

- Don't violate any local regulations regarding land use, as these could impact the lease.

Misconceptions

Understanding the Farm Lease Agreement 669 form is essential for both landlords and tenants. However, several misconceptions often arise regarding this form. Here are four common misunderstandings and clarifications for each:

- The lease automatically favors either the landlord or the tenant. Many believe that a standard lease inherently benefits one party over another. In reality, the Farm Lease Agreement 669 is designed to outline the responsibilities and rights of both parties fairly. It provides a framework that can be tailored to the specific needs of the landlord and tenant.

- Oral agreements can replace written terms. Some might think that verbal agreements or understandings can override the content of the written lease. However, the Farm Lease Agreement clearly states that any amendments must be in writing and signed by both parties. This ensures clarity and reduces potential disputes.

- The rent amount is fixed and cannot be renegotiated. A misconception exists that once the rent is determined in the lease, it cannot be changed. In fact, the lease allows for renegotiation of rent and other terms before the termination date. This adaptive approach ensures both parties can address changing circumstances, such as market conditions or agricultural yields.

- The lease duration is unchangeable. People often assume that the duration of the lease is set in stone. However, this form stipulates that the lease becomes effective on a specific date and can be extended or modified through mutual agreement. This flexibility allows both parties to adapt to evolving situations.

Key takeaways

Here are key takeaways regarding the Farm Lease Agreement 669 form. Understanding these aspects can help both landlords and tenants navigate the leasing process effectively.

- The agreement should clearly state the names of both the landlord and tenant, along with the date of execution.

- Details about the property must include a specific description, the acreage involved, and any improvements or exceptions.

- Clear start and end dates for the lease are essential. The tenant should notify the landlord in advance if renegotiation is desired.

- All amendments must be in writing and signed by both parties to be considered valid.

- Land use must be clearly defined, including the types of agricultural practices and any restrictions on cropping.

- Specify the rent amount based on the type of land and ensure the payment terms are outlined, including deadlines and potential interest on late payments.

- The landlord is responsible for providing the land and making necessary repairs, while the tenant is responsible for regular operational expenses.

- The tenant must adhere to agricultural best practices and maintain the property in good condition throughout the lease term.

- Both parties should understand their rights regarding property inspections and access after the lease ends.

- Disputes should be documented in writing, and the lease terms are binding on both parties and their successors.

Browse Other Templates

California Coe Benefits - Returning discharge papers will usually not be needed again unless requested.

Health Care Proxy Form - It is recommended to review your proxy periodically to ensure it reflects your current wishes.