Fill Out Your Fcmb Client Ativation Form

The FCMB Client Activation Form for Wholesale Internet Banking is a comprehensive document designed to facilitate a seamless onboarding process for businesses looking to utilize banking services. It begins with a detailed company profile section that captures essential information such as the company's name, address, registration number, and contact details. The form progresses to outline the various products and services available, allowing clients to select features like cash management, trade finance, and reporting options that best suit their needs. Billing information follows, detailing set-up fees, monthly charges, and transaction fees, accompanied by the account numbers associated with each service. To ensure secure access to the platform, the form includes a section for customer administration, where details about user roles and contact representatives are recorded. Importantly, clients must acknowledge their understanding of the terms and conditions, confirming that they will maintain accurate information at all times. The form concludes with sections for authorized signatures, allowing for verification and acceptance of the banking services. Overall, the FCMB Client Activation Form is essential for businesses to access the bank's comprehensive suite of wholesale internet banking services efficiently.

Fcmb Client Ativation Example

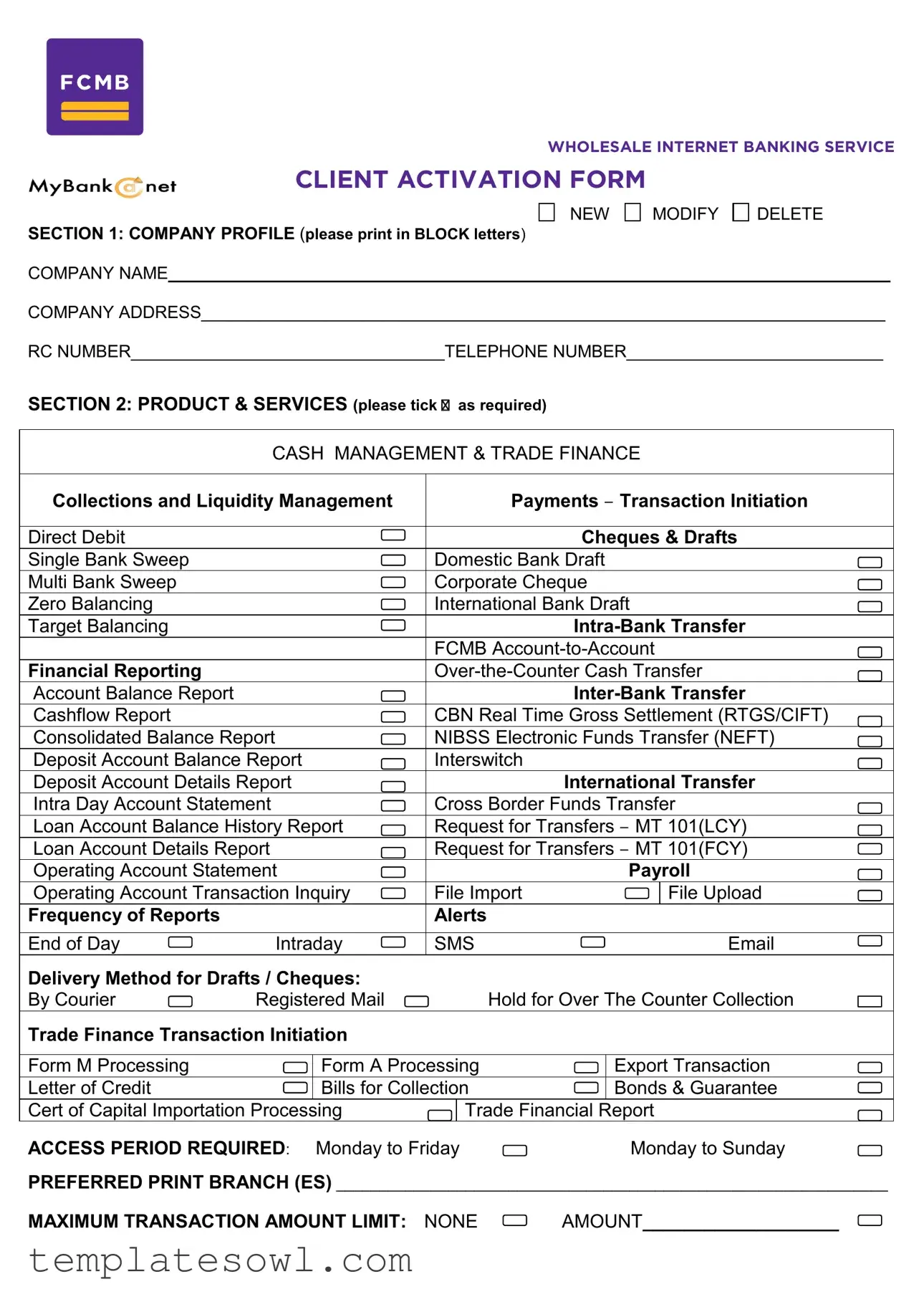

WHOLESALE INTERNET BANKING SERVICE

CLIENT ACTIVATION FORM

NEW

SECTION 1: COMPANY PROFILE (please print in BLOCK letters)

MODIFY  DELETE

DELETE

COMPANY NAME____________________________________________________________________________

COMPANY ADDRESS________________________________________________________________________

RC NUMBER_________________________________TELEPHONE NUMBER___________________________

SECTION 2: PRODUCT & SERVICES (please tick as required)

CASH MANAGEMENT & TRADE FINANCE

Collections and Liquidity Management |

Payments – Transaction Initiation |

|||

|

|

|

|

|

Direct Debit |

|

|

Cheques & Drafts |

|

Single Bank Sweep |

|

Domestic Bank Draft |

||

Multi Bank Sweep |

|

Corporate Cheque |

||

Zero Balancing |

|

International Bank Draft |

||

Target Balancing |

|

|

||

|

|

FCMB |

||

Financial Reporting |

|

|||

Account Balance Report |

|

|

||

Cashflow Report |

|

CBN Real Time Gross Settlement (RTGS/CIFT) |

||

Consolidated Balance Report |

|

NIBSS Electronic Funds Transfer (NEFT) |

||

Deposit Account Balance Report |

Interswitch |

|

|

|

Deposit Account Details Report |

|

International Transfer |

||

Intra Day Account Statement |

|

Cross Border Funds Transfer |

||

Loan Account Balance History Report |

Request for Transfers – MT 101(LCY) |

|||

Loan Account Details Report |

|

Request for Transfers – MT 101(FCY) |

||

Operating Account Statement |

|

Payroll |

||

Operating Account Transaction Inquiry |

File Import |

|

File Upload |

|

Frequency of Reports |

|

Alerts |

|

|

|

|

|

|

|

End of Day |

Intraday |

SMS |

|

|

Delivery Method for Drafts / Cheques: |

|

|

|

|

||

By Courier |

Registered Mail |

|

|

Hold for Over The Counter Collection |

||

Trade Finance Transaction Initiation |

|

|

|

|

||

|

|

|

|

|

|

|

Form M Processing |

|

Form A Processing |

|

Export Transaction |

||

Letter of Credit |

|

Bills for Collection |

|

Bonds & Guarantee |

||

Cert of Capital Importation Processing |

|

Trade Financial Report |

||||

ACCESS PERIOD REQUIRED: Monday to Friday |

|

Monday to Sunday |

||||

PREFERRED PRINT BRANCH (ES) ________________________________________________________________ |

||||||

MAXIMUM TRANSACTION AMOUNT LIMIT: |

NONE |

AMOUNT___________________ |

||||

WHOLESALE INTERNET BANKING SERVICE

CLIENT ACTIVATION FORM

SECTION 3: BILLING INFORMATION (Please indicate account number(s) & currency as appropriate)

Service Item (s) |

Monthly Access Charge |

Transaction Charges |

|

Amount (=N) |

=N= 20,000 |

=N= 10,000 |

Based on payment gateway |

Billing A/C |

|

|

|

SECTION 4: ACCOUNT NUMBERS

S/N |

ACCOUNT NUMBER |

|

|

BANK/ |

|

|

STATE/ |

|

CURRENCY |

|

|

ACCT |

|

|

DAILY |

|

|

|

|

|

|

|

|

|

|

|

|||||||

|

|

|

|

BRANCH |

|

|

COUNTRY |

|

|

|

|

TYPE |

|

|

AMT LIMIT |

|

|

|

|

|

|

|

|||||||||||

1 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

2 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

3 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

4 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

5 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

6 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

7 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

*Please state the default Collections Pool Account________________________________________________________

WHOLESALE INTERNET BANKING SERVICE

CLIENT ACTIVATION FORM

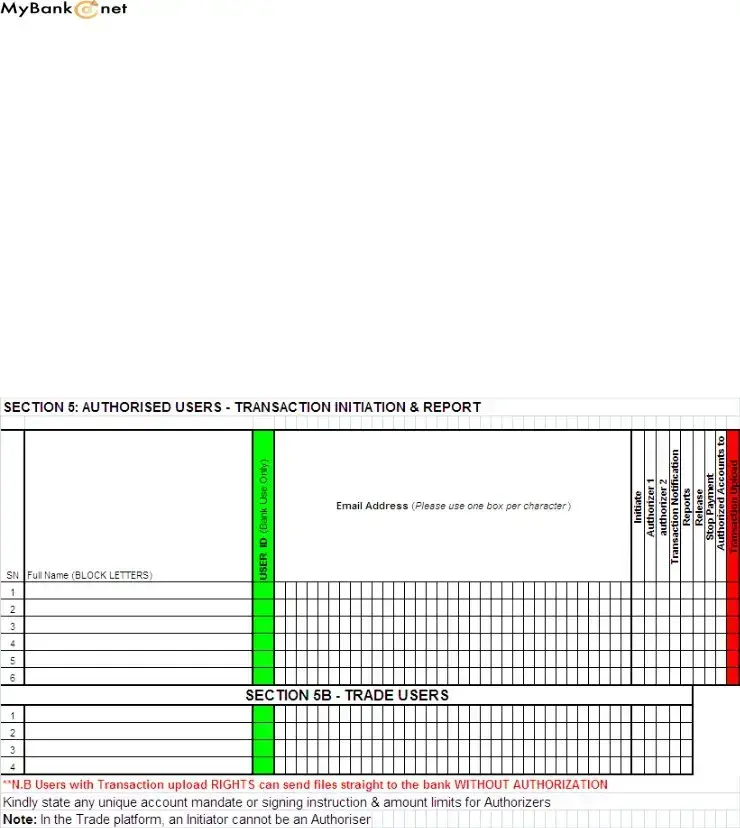

SECTION 6: CUSTOMER ADMINISTRATION (for User ID & Password Reset with your Organisation)

SN |

Administrator User |

Role |

Email Address |

Mobile # |

Signature |

User ID |

|

Name |

|

|

|

|

( Bank Use |

|

|

|

|

|

|

Only) |

1 |

|

Maker |

|

|

|

|

2 |

|

Checker |

|

|

|

|

3 |

|

|

|

|

|

|

4 |

|

Back |

|

|

|

|

Please indicate the number of pages of addendums completed (if any) __________________________

Virtual Card Number________________________________Expiry Date_______________________

I/WE acknowledge that my/our use of the service(s) required will be governed by the relevant terms and conditions applicable to such service(s) as indicated in this form. I/WE hereby certify that the information provided above is true and accurate at all times and, that we will notify you of the inaccuracy of such information and forthwith provide to you the

______________________________________________ |

________________________________________ |

Authorised Signature, Company Stamp and Date |

Authorised Signature, Company Stamp and Date |

__________________________________________________ |

____________________________________________ |

Name and Title |

Name and Title |

SECTION 7: CONTACT REPRESENTATIVE DETAILS

Cash Management - Contact Person

___________________________________________________________________________________________________

First Name |

Last Name |

Title____________________________________________LandLine Number______________________________________ |

|

Trade - Contact Person________________________________________________________________________________ |

|

First Name |

Last Name |

Title____________________________________________ Landline Number_____________________________________ |

|

Mobile Number________________________________ |

|

WHOLESALE INTERNET BANKING SERVICE

CLIENT ACTIVATION FORM

SECTION 8: AUTHORIZERED SIGNATURE SPECIMENS FOR CORPORATE CHEQUES (Please print in black ink)

S/N |

NAME |

SIGNATURE |

S/N |

NAME |

SIGNATURE |

1 |

|

|

4 |

|

|

|

|

|

|

|

|

2 |

|

|

5 |

|

|

|

|

|

|

|

|

3 |

|

|

6 |

|

|

|

|

|

|

|

|

SECTION 8: FOR BANK USE ONLY

SIGNATURE VERIFIED BY:

*CSO NAME____________________________STAFF ID_______________________ DATE_______________________

*ACCOUNT OFFICER CODE______________________

INFORMTION VERIFIED:

BDM / RM SIGNATURE / DATE ______________________ PRODUCT & CHANNELS

DATE RECEIVED _________________________________ DATE SENT TO AMU _______________________________

BUSINESS DEV.MANAGER _________________________ CONTACT NUMBER _______________________________

RELATIONSHIP MANAGER _________________________ CONTACT NUMBER_________________________________

CLIENT ACCESS MANAGER _______________________ CONTACT NUMBER _______________________________

CLIENT TYPE ____________________________________ CLIENT SEGMENT _________________________________

MyBank@Net GROUP ID __________________________ TRADE

WHOLESALE INTERNET BANKING SERVICE

CLIENT ACTIVATION FORM

REMARKS: _______________________________________________ _________________________________________

OBSERVED CLIENT SPECIFICATIONS

- INTERNET LINK (Upload/Download )

-INTERNET BROWSER

-INTERNET SERVICE PROVIDER

-MAIN MEMORY OF KEY SYSTEM

-PROCESSOR SPEED OF KEY SYSTEM

SET- UP COMPLETED |

YES |

|

NO |

|

|

|

|

CLIENT TRAINING COMPLETED |

YES |

|

NO |

DATE

DATE

Form Characteristics

| Fact Name | Description |

|---|---|

| Purpose | The FCMB Client Activation Form is designed to facilitate the onboarding of companies for wholesale internet banking services. |

| Sections | The form consists of several sections, including company profile, product and services selection, billing information, and account numbers. |

| Fees | A set-up fee of ₦20,000 and a monthly access charge of ₦10,000 apply for using the services associated with this form. |

| Authorized Signatures | The form requires authorized signatures and company stamps from representatives of the company to validate the activation process. |

| Governing Terms | The use of services is governed by the Master Client Access Agreement and related documentation, ensuring clarity and compliance. |

Guidelines on Utilizing Fcmb Client Ativation

Filling out the FCMB Client Activation Form is the first step toward accessing a variety of banking services tailored to your company's needs. Once you complete the form, you will submit it to your bank representative for further processing. Ensure that all information provided is accurate to avoid any delays in the activation process.

- Company Profile: Begin by entering your company name and address in block letters. Provide your RC number and telephone number.

- Product & Services: Tick the boxes next to the services your company requires under the Cash Management & Trade Finance section.

- Access Period: Indicate your desired access period by selecting either Monday to Friday or Monday to Sunday.

- Preferred Print Branch(es): Fill in the details of the branches where you want printed communications sent.

- Maximum Transaction Amount Limit: Specify if there is no limit or provide a set amount.

- Billing Information: List account numbers along with the currency type and ensure the billing information is correctly filled, including the service item charges.

- Account Numbers: Enter the account numbers along with the respective bank, state, currency type, and any amount limit.

- Customer Administration: Fill in the names, roles, email addresses, and mobile numbers of your administrators as applicable.

- Authorized Signatures: Provide signatures as required in this section along with company stamps and dates.

- Contact Representative Details: Include the contact details for both the Cash Management and Trade representatives.

- Authorized Signature Specimens: Print names and signatures of authorized personnel for corporate cheques.

- For Bank Use Only: Leave this section blank, as it is intended for bank representatives to fill out after submitting your form.

What You Should Know About This Form

What is the FCMB Client Activation Form used for?

The FCMB Client Activation Form is designed for businesses wishing to enroll in Wholesale Internet Banking Services offered by FCMB. By filling out this form, companies can access a range of banking services such as cash management, payments, and trade finance, enabling better financial control and improved transaction efficiency.

What information is required in the Company Profile section?

In the Company Profile section, businesses need to provide their official company name, address, registration number (RC Number), and telephone number. This information helps the bank verify the identity of the business and establish a formal relationship.

How do I specify the products and services I want to use?

The form includes a checklist where you can tick the services your company wishes to utilize. Options range from cash management to international transfers, depending on your business needs. Make sure to review the list carefully and select all pertinent services.

What are the billing charges mentioned in the form?

The form outlines several financial charges, including a set-up fee of ₦20,000 and a monthly access charge of ₦10,000. Additionally, there may be transaction charges based on the payment gateway used, which varies according to the transactions processed. Make sure to factor these costs into your budget.

What is the purpose of the Customer Administration section?

The Customer Administration section is designed for the management of user access to the banking services. Your organization can list administrators and their roles here, making it easier to control who has permission to initiate transactions, check balances, or access reports.

What do I need to include for Authorized Signature Specimens?

This section requires the signatures of individuals authorized to sign corporate cheques on behalf of the business. Companies must print the names and signatures of these authorized representatives, ensuring that the bank knows who can legally operate on the company’s accounts.

Are there any legal acknowledgments required in the form?

Yes, the form includes several acknowledgments confirming that the information provided is true and accurate. Businesses must agree to the terms outlined in the Master Client Access Agreement and acknowledge that the bank reserves the right to modify these terms at any time.

How can I ensure my form is accurately completed before submission?

Before sending in your form, review all sections to confirm that all necessary information has been included and is accurate. Double-check the selections made in the products and services section and ensure that all authorized signatures are obtained. If you have addendums, be sure to indicate the number of pages completed. Taking these steps will help prevent delays in processing your request.

Common mistakes

Completing the Fcmb Client Activation form can be straightforward, but it is essential to avoid common errors that could delay the process. One frequent mistake individuals make is failing to provide complete information in the Company Profile section. Essential details, such as the company address and telephone number, must be filled out accurately. Incomplete or incorrect information can lead to confusion and delays in service activation.

Another common error pertains to the Product & Services section. Applicants often forget to check the necessary boxes for the services they require. Omitting this step can result in inadequate access to essential banking features. It is crucial to carefully review this section and ensure all relevant services are selected before submission.

The Billing Information section also poses challenges for some applicants. Incorrect or missing details about the account number and billing amounts can cause problems during the billing process. Double-checking this information is vital to avoid unnecessary complications and ensure smooth transactions.

When filling out the Account Numbers section, individuals might overlook the importance of providing accurate currency and account type information. Failing to do so can lead to confusion later, especially when executing transactions. It is important to verify that all entries are correct and correspond to the respective accounts.

Another area where applicants often falter is in the Customer Administration section. Providing incorrect user IDs or emails for administrators can hinder access to banking services. Each user needs to be listed accurately to maintain secure and smooth operations within the company's banking activities.

Lastly, many people neglect to review the Authorized Signature Specimens section. Signatures must match the bank's records precisely. Inconsistencies can lead to headaches during transactions and may cause delays in account operations. Taking care to confirm these details will help ensure that banking processes continue without any interruptions.

Documents used along the form

When completing the FCMB Client Activation Form, several other documents may also be needed. These documents help to streamline the activation process and provide necessary information to support the client's request. Below is a list of forms commonly associated with this activation that might be required.

- Business Registration Certificate: This certificate proves that the business is legally registered with the appropriate government authority. It is often necessary for validating the company's identity.

- Tax Identification Number (TIN): This number is issued by tax authorities and is essential for tax-related matters. Businesses need it for tax compliance and transactions.

- Corporate Resolution: This document outlines the decisions made by the company's board regarding the activation of internet banking services. It often includes names of authorized signatories.

- Identification Documents: Personal identification, such as a driver's license or passport, for the authorized representatives may be required to verify their identities.

- Proof of Address: Recent utility bills or bank statements can serve as proof of the company’s registered address. They help confirm that the business operates at that location.

- Financial Statements: A recent balance sheet and income statement may be needed to give the bank a clear picture of the company's financial health.

- Client Agreement: This agreement outlines the terms and conditions of the banking services being activated. Clients must read and accept these terms as part of the activation process.

- Access Control List: This list outlines which users within the organization can access internet banking services, ensuring security and proper access management.

- Client Training Acknowledgment: Evidence that the client has undergone training regarding the use of the internet banking services may be necessary to ensure proper usage and security.

Having these documents ready can facilitate a smoother activation process for the FCMB internet banking services. Gather all required items before submitting the client activation form for the best results.

Similar forms

- Account Opening Form: Similar to the FCMB Client Activation form, the account opening form collects essential details about a client, including company name, address, and preferred services. Both documents require verification of information and authorized signatures.

- Service Agreement: This document outlines the terms and conditions of services provided, much like how the FCMB form delineates the use and governance of services. Both documents emphasize the necessity for clients to acknowledge and adhere to stipulated terms.

- Client Profile Form: Just as the FCMB form captures critical information about a company, the client profile form serves a similar purpose in profiling a client's business needs and preferences.

- Electronic Services Authorization Form: This form allows clients to authorize a financial institution to conduct electronic transactions. The FCMB Client Activation form also seeks consent for transaction services, emphasizing user authorization.

- Bank Account Change Request Form: This document facilitates updates to existing account information and instructions, paralleling how the FCMB form allows for modifications or updates in client details and services.

- ACH Enrollment Form: Similarly, the ACH enrollment form is necessary for clients wishing to enroll in electronic payment services, echoing the electronic services component found in the FCMB Client Activation form.

- Loan Application Form: This form requests detailed information about a client's financial situation and requirements for a loan, analogous to how the FCMB form collects relevant service information to tailor offerings to client needs.

- Corporate Credit Card Application: This application requests company details and user information for corporate credit cards and is similar in structure and purpose to the FCMB Client Activation form in securing approval and service provision.

Dos and Don'ts

Things You Should Do:

- Use block letters when filling in the company profile section.

- Accurately provide all requested information, including company name and RC number.

- Indicate your preferred products and services by checking the appropriate boxes.

Things You Shouldn't Do:

- Do not leave any required fields blank.

- Avoid using abbreviations or informal language in your responses.

- Never forget to sign and stamp the form where indicated.

Misconceptions

-

Misconception 1: The form is only for new clients.

In reality, existing clients can also use this form to modify or update their account information or services. The options to modify or delete company details ensure that the form caters to both new and ongoing clients.

-

Misconception 2: All fields on the form are mandatory.

While many fields need completion, not all of them are required. Clients can complete the sections relevant to their specific services, avoiding unnecessary stress about filling out every single line.

-

Misconception 3: The activation process is instant.

The form needs to go through verification processes after submission. This means clients should expect some time before their activation is fully processed and services are available.

-

Misconception 4: The form is complicated and hard to understand.

The FCMB Client Activation form is structured in a straightforward manner with clear sections for company profile, product selection, and billing information. This organization facilitates easy navigation through the information required.

-

Misconception 5: There are hidden fees when activating services.

All applicable fees, including set-up and monthly charges, are clearly stated in the billing information section. Transparency regarding costs is maintained throughout the activation process.

-

Misconception 6: The activation form is only for cash management services.

The form actually encompasses a variety of services including trade finance and account management. Clients can select from multiple options to customize their banking experience.

Key takeaways

Filling out the FCMB Client Activation Form is a crucial step for businesses wishing to engage with their banking services. Here are key takeaways to ensure accurate completion and effective use of the form:

- The Company Profile section requires precise information, including the company name, address, and registration number. Ensure all details are printed in block letters for clarity.

- In the Product & Services section, select the services your business requires by ticking the appropriate boxes. This helps the bank understand your specific needs.

- Billing information is essential for transparency. Specify the account numbers and currency for each service item, noting any setup fees and monthly charges that apply.

- The Account Numbers section must be filled out meticulously. Include details like the account type, limit, and corresponding bank or branch for each account.

- Designate a Customer Administration team, assigning specific roles, such as Maker and Checker, for managing user IDs and password resets. Ensure accurate email and mobile information is provided.

- Authorized signatures are required on the form. Be sure to use black ink to maintain visibility and clarity when submitting the form.

- Verify all content before submission. Properly filled forms expedite processing and enhance communication between your company and the bank.

Browse Other Templates

Sick Leave Documentation,Patient Illness Report,Medical Absence Form,Individual Health Declaration,Sick Note Submission,Injury Notification Form,Duty Status Change Request,Medical Leave Record,Health and Wellness Slip,Unit Commander Medical Report - Service members should fill out the DD 689 promptly after illness or injury.

Military Dd Forms - Pickup and destination addresses for the shipment are essential details in the DD 1299.

Michigan Liquor License Application - The form addresses the presence of illegal spirits and advertising.