Fill Out Your Fe 6 Claim For Death Benefits Form

The Claim for Death Benefits form, known as the FE 6, is an essential document under the Federal Employees' Group Life Insurance (FEGLI) Program, designed for individuals seeking to claim life insurance benefits upon the death of a federal employee, annuitant, or compensationer. This form lays out the hierarchy for distributing the life insurance proceeds, which can include beneficiaries designated by the insured, legal spouses, children, parents, as well as estate executors and next of kin, as defined by applicable laws. If no beneficiary has been named, the order of payment established by the law ensures that family members receive the benefits in a systematic manner. Furthermore, it provides clear instructions for completing the form, emphasizing the necessity for accuracy and thoroughness in documenting pertinent details such as the insured's personal information, marital history, and relationships with survivors. Claimants are informed about the submission process, and the form also specifies options for receiving payment—either through a Total Control Account, which functions like a checking account, or as a direct check. Additionally, necessary documentation, including a certified death certificate and any relevant financial authorizations, must accompany the claim to facilitate a smooth processing experience. As a whole, the FE 6 Claim form serves as a comprehensive guide for beneficiaries, ensuring their understanding of the claims procedure and the distribution of benefits they are entitled to following such a significant loss.

Fe 6 Claim For Death Benefits Example

Claim for Death Benefits

Federal Employees’ Group Life Insurance (FEGLI) Program (To file an Option

Who receives the FEGLI life insurance benefits?

The law states that FEGLI benefits will be paid in the following manner:

If the deceased did not assign ownership and there is no valid court order on file with the employing agency or the Office of Personnel Management (OPM) (if retired), then the Office of Federal Employees' Group Life Insurance (OFEGLI) (an administrative office of MetLife) will pay:

•First, to the beneficiary(ies) the insured validly designated

•Second, if none, to the insured's widow or widower

•Third, if none of the above, to the insured's child or children and descendants of any deceased children (a court will usually appoint a guardian to receive payment for a minor child)

•Fourth, if none of the above, to the insured's parents in equal shares, or the entire amount to the surviving parent

•Fifth, if none of the above, to the

•Sixth, if none of the above, to the insured's other next of kin, entitled under the laws of the state where the insured lived

If the insured did not assign ownership and there is a valid court order on file with the agency or the U.S. Office of Personnel Management (OPM), as appropriate, OFEGLI will pay benefits according to the court order.

If the insured assigned ownership of his/her life insurance to someone else (generally by filing an RI

•First, to the beneficiary(ies) the assignee(s) validly designated

•Second, if none, to the assignee(s)

Completing this form

Please complete this Claim for Death Benefits form by following the instructions on the form. Only use this form for the death of a Federal employee, annuitant, or compensationer. If you are filing a claim for a dependent, use form

If you have not previously notified the employing agency or OPM (if retired) of the death, please contact the appropriate office. The easiest way to report the death of a Federal retiree is online at: www.opm.gov/reportdeath

or you can report the death by calling OPM at

Decide

You have the following options to receive your life insurance proceeds:

•A Total Control Account® in your name (you may select this option if your benefits are $5,000 or greater), or

•A check that we mail to you

Please read About the Total Control Account (Page 2) for details. Indicate your choice on Page 5 when completing the claim form. If you do not choose an option and your benefits are $5,000 or greater, a MetLife Total Control Account will be established in your name and your payment will be deposited on your behalf.

Return

A. Check off the items you’re sending with this claim form

Death Certificate. We require a certified copy of the death certificate with the cause and manner of death. The funeral director taking care of the funeral arrangements or your state bureau of vital statistics can usually provide a copy of the death certificate. We only require one death certificate - if you're aware of another claimant who's sending one, you don't have to send it.

If you signed a document with a funeral home that authorizes us to make a payment directly to them, a copy of that document.

If the insured was an active employee and died in an accident, and you’re making an accidental death benefit claim, proof of the accident - police reports and other supporting documents.

If you are filing this claim on behalf of the estate, a copy of the appointment papers issued by the court.

If a trust is designated, a statement that the trust is still in effect and you are authorized to act under the trust, and a copy of the trust document. If you are not the original trustee, a copy of the page naming you as successor trustee.

If you have a Power of Attorney, a copy of the appointment papers naming you as the

B. Submission instructions

Return this claim form and the necessary documents to:

OFEGLI |

Overnight Address: OFEGLI |

PO Box 6080 |

10 E.D. Preate Drive |

Scranton, PA |

Moosic, PA 18507 |

Do NOT use previous editions |

Page 1 |

If a certified death certificate has already been submitted, you may fax your claim form to OFEGLI at:

Form

Revised December 2016

Claim for Death Benefits

Federal Employees’ Group Life Insurance Program

About the Total Control Account

A convenient place for you to hold the proceeds from your claim while you decide what to do with the money.

How the account works

The Total Control Account (TCA) is a draft account that works like a checking account:

•When your account is open, MetLife1 will send you a package which includes additional details about the TCA. We pay the full amount owed to you by placing your proceeds into the TCA and providing you a book of drafts. You can use the drafts like you would use checks.

•You can use a single draft to access the entire proceeds or you may write several drafts for smaller amounts (minimum amount $250). There are no limits on the number of drafts you may write, up to the full available balance in your account. Processing time is similar to check processing. If there is no activity on your account for a period of time (typically three years, but this may vary by state), state regulations may require that we contact you at the address we have on file. If we aren't able to reach you, we may be required to close your account and transfer the funds to the state.

•You earn interest on the money in your account from the date your account is open.

•We’ll send you an account statement each month when there is activity in your account. If you have no activity, we’ll send you a statement once every three months.

•You can name a beneficiary for your account. We’ll include a beneficiary form in the package we send you when we open your account.

Interest rates and guarantees

The interest rate on your account is set weekly, and will never fall below the minimum guaranteed rate stated in your TCA package, or the rate established by one of the following indices: the prior week’s Money Fund Report Averages™/Government

No monthly maintenance fees

There are no monthly maintenance or service fees on your TCA, no charges for making withdrawals or writing drafts, and no cost for ordering additional drafts. You may be charged for special services or an overdrawn TCA, and the current fees (subject to change) for those are: draft copy $2; stop payment $10; wire transfer $10; overdrawn TCA $15; overnight delivery service $25.

Other important information

•Your Total Control Account is backed by the financial strength of MetLife. The assets backing the funds are held in MetLife’s general account and are subject to MetLife’s creditors. In addition, while the funds in your account are not insured by the FDIC, they are guaranteed by your state insurance guarantee association.

The coverage limits vary by state. Please contact the National Organization of Life and Health Insurance Guaranty Associations (www.NOLHGA.com or

•We may limit or suspend your access to the funds in your account if we suspect fraud or if there was an error in opening your account.

•We use the services of The Bank of New York Mellon, 701 Market Street, Philadelphia, PA 19106, for Total Control Account recordkeeping and draft clearing.

•A TCA generally is not available if your claim is less than $5,000, you reside in a foreign country, or if the claimant is a corporation or similar entity.

•MetLife may receive investment earnings from operating the Total Control Account. The performance results of any investments we make do not affect the interest rate we pay you.

•To learn more about TCA, please call us at

Total Control Account ® is a registered service mark of Metropolitan Life Insurance Company.

1“MetLife” means Metropolitan Life Insurance Company

Do NOT use previous editions |

Page 2 |

Form |

|

|

Revised December 2016 |

Claim for Death Benefits

Federal Employees’ Group Life Insurance Program

Part A. Information about the insured

1. Insured's full name (Last) (First) (Middle)

2.Date of birth (mm/dd/yyyy)

3.Date of death (mm/dd/yyyy)

4. Social Security number or FEGLI Claim number

5. Legal Residence at time of death (City and State)

6. Department or agency in which last employed, including bureau or division

7. Location of last employment (City, State, ZIP Code)

8. At the time of death, was the insured retired under any Federal civilian retirement system?

Yes

No

Unknown |

If “Yes”, provide the Claim number |

|

|

|

(CSA/CSF/CSI) |

9. At the time of death, was the insured receiving Federal Worker’s Compensation benefits?

Yes

No

Unknown |

If “Yes”, provide the effective |

|

date of Federal Worker’s |

||

|

||

|

Compensation Benefits |

Part B. Information about the insured's marriages

|

1. How many times was the |

2. Give the name of each spouse |

3. How did the marriage end? |

4. When did the marriage end? |

|

|

insured married? Include |

(include ALL marriages) |

(Check one in each case) |

(mm/dd/yyyy) |

|

|

yourself if you were |

|

|

|

|

|

married to the insured at |

|

|

|

|

|

the time of death. |

|

|

|

|

|

|

|

|

|

|

|

|

|

Death |

Divorce |

|

|

|

|

|

|

|

|

No data needed |

|

Death |

Divorce |

|

|

|

|

|

|

|

|

No data needed |

|

Death |

Divorce |

|

|

|

|

|

|

|

|

No data needed |

|

Death |

Divorce |

|

|

|

|

|

|

|

|

|

|

|

|

|

Part C. Information about your marriages

(Complete only if you are the insured's widow or widower)

1. Date of marriage (mm/dd/yyyy)

2. Place of marriage (City and State)

3. Marriage was performed by:

Clergy or Justice of the Peace

Other (specify)

4.Were you divorced from the insured at the time of death?

Yes |

No |

5. If you were divorced from the insured, give the date (mm/dd/yyyy) and place of divorce

6. How many times were you |

7. Give the name of each spouse |

8. How did the marriage end? |

9. When did the marriage end? |

||

married? Include the |

(include ALL marriages) |

(Check one in each case) |

(mm/dd/yyyy) |

||

insured if you were |

|

|

|

|

|

married at the time of |

|

|

|

|

|

death. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Death |

Divorce |

|

|

|

|

|

|

|

No data needed |

|

Death |

Divorce |

|

|

|

|

|

|

|

|

No data needed |

|

Death |

Divorce |

|

|

|

|

|

|

|

|

No data needed |

|

Death |

Divorce |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Do NOT use previous editions |

Page 3 |

Form |

|

|

Revised December 2016 |

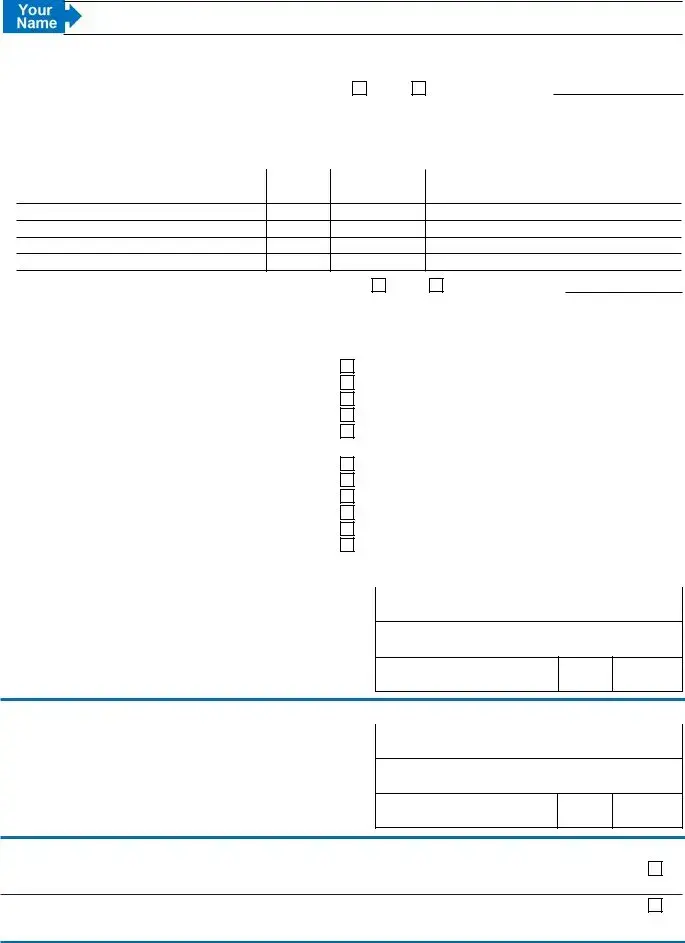

Part D. Information about the insured's next of kin

(Everyone must complete Part D unless you are the insured's widow or widower)

1. Did the insured have any living children on the date of his/her death?

Yes

No* If Yes, how many

Please list the insured's living children below. Note that

*(a) If the insured has no children, list the insured's parents; if one or both parents died before the insured, provide their name(s) and date(s) of death.

(b)If the insured has no children, and both parents died before the insured, list the next of kin who may be capable of inheriting from the insured (brothers, sisters, descendants of deceased brothers, sisters,etc.). Additional sheets can be used if needed.

Name

Age

Relationship to the

insured

Full address

2. Did the insured have any children who died before his/her date of death?

Yes

No If Yes, how many

Please list any children who died before the insured. If any of the children who died before also have children (descendants), list them below as well and indicate the parent who was the insured's child. Additional sheets can be used if needed.

Name |

Age |

Relationship to the |

Full address |

||

|

|

insured |

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Child |

|

|

|

|

|

Descendant |

|

|

|

|

|

Child |

|

|

|

|

|

Descendant |

|

|

|

|

|

Child |

|

|

|

|

|

Descendant |

|

|

|

|

|

|

|

|

|

|

|

Child |

|

|

|

|

|

Descendant |

|

|

|

|

|

Child |

|

|

|

|

|

Descendant |

|

|

|

|

|

Child |

|

|

|

|

|

Descendant |

|

Complete item 3 only if any of the persons listed above are under age 18

3.If the court appointed a guardian for the estate of any minor children above, give the name and address of the guardian and attach a copy of the court appointment papers. Natural parentage or custody as a result of a divorce do not constitute guardianship.

Name

Address (number, street, apt. no.)

City

State

ZIP Code

Part E. Information about the insured's estate (Complete if the insured's estate is entitled)

If the court appointed an executor or administrator to settle the insured's estate, give his/her name and address and attach a copy of the court appointment papers.

Name

Address (number, street, apt. no.)

City

State

ZIP Code

Part F. Additional information

Have you signed a document with a funeral home that authorizes us to make a payment directly to them? |

|

Yes |

This document is usually referred to as a funeral home assignment. (If yes, please send us a copy of the document with this claim form.) |

|

|

Are you claiming accidental death benefits (did the insured die solely through violent, external, and accidental means)? If “Yes”, submit |

|

Yes |

|

||

coroner's and police reports, news clippings, and any other available reports concerning the accident. OFEGLI cannot consider a claim |

|

|

for such benefits if the insured separated or retired before the accident. |

|

|

No

No

Do NOT use previous editions |

Page 4 |

Form |

|

|

Revised December 2016 |

Claim for Death Benefits

Federal Employees’ Group Life Insurance Program

Part G: Select a method to receive your payment

Please SELECT ONE method of settlement in order to receive your payment. By selecting below, you confirm that you have read the enclosed materials on both FEGLI payment options.

Total Control Account (TCA)

Check

FEGLI death benefits are not subject to Federal income tax, but the interest that OFEGLI pays on those benefits is subject to such tax. OFEGLI will report all interest payments to the Internal Revenue Service (IRS).

Part H - Information about you

Please note: If you are completing this claim on behalf of someone else (such as a minor), complete all of Part H with that person's information, and not yours. Sign your own name "on behalf of" the other person.

Name (please print)

Relationship to the insured

Date of birth

Address (number, street, apartment number)

City |

|

|

State |

ZIP |

|

|

|

|

|

Social Security number |

or |

Estate/Trust/Tax ID Number |

||

Daytime Telephone number

Email address

Under penalties of perjury, I certify:

1.That the number shown as my Social Security Number in "Part H: Information about you" is my correct taxpayer identification number, and

2.That I am NOT subject to backup withholding because: (a) I have not been notified by the Internal Revenue Service (IRS) that I am subject to backup withholding as a result of a failure to report all interest and dividends, or (b) I am exempt from backup withholding, or (c) the IRS has notified me that I am no longer subject to backup withholding, and

3.I am a U.S. citizen, resident alien, or other U.S. person*, and

4.I am not subject to Foreign Account Tax Compliance Act (FATCA) reporting because I am a U.S. person* and the account is located within the United States.

(Please note: You must cross out Item 2 above if the IRS has notified you that you are currently subject to backup withholding because you

failed to report all interest or dividend income on your tax return.)

*If you are not a U.S. Citizen, a U.S. resident alien or other U.S. person for tax purposes, please cross out Item 3 above, and complete form

The Internal Revenue Service does not require your consent to any provision of this document other than the certifications required to avoid backup withholding.

Signature If you are completing this claim on behalf of someone else sign your own name "on behalf of" the other person. |

Today's Date |

Warning - If you knowingly and willfully make any materially false, fictitious, or fraudulent statement or representation on this form, or conceal a material fact related to the requests for information on this form, you may be subject to a monetary fine or imprisonment for not more than five years, or both under 18 U.S.C. 100

Please return pages 3 through 5 to OFEGLI

Do NOT use previous editions |

Page 5 |

Form |

|

|

Revised December 2016 |

Form Characteristics

| Fact Name | Fact Detail |

|---|---|

| Primary Purpose | This form is used to claim death benefits from the Federal Employees’ Group Life Insurance (FEGLI) Program. |

| Beneficiary Hierarchy | If the insured did not assign ownership and there’s no court order, benefits are paid first to designated beneficiaries, then to the widow/widower, children, parents, executor, or next of kin. |

| Claimant Requirements | Each claimant or beneficiary must complete their own form for the benefits to be processed. |

| Required Documentation | A certified death certificate is mandatory, alongside additional documents based on specific circumstances, such as accident documentation or proof of executor status. |

| Payment Options | Claimants can choose either a Total Control Account® or a check to receive their proceeds. A TCA may not be available for claims below $5,000. |

| Governance | This form and the FEGLI Program are governed by federal laws, including those administered by the Office of Personnel Management (OPM). |

Guidelines on Utilizing Fe 6 Claim For Death Benefits

To file a Claim for Death Benefits using the FE-6 form, follow these steps carefully to ensure accurate completion and timely processing by the Office of Federal Employees' Group Life Insurance (OFEGLI).

- Gather necessary documents, including a certified copy of the death certificate and any relevant paperwork concerning the insured's estate, marriage, or trust, if applicable.

- Complete Part A with information about the insured, including their full name, date of birth, date of death, Social Security number, and details regarding their last employment.

- Fill out Part B if applicable, providing details about the insured’s marriages, including names, dates, and end of marriages.

- If you are the insured's widow or widower, complete Part C, detailing your marriage to the insured, including the date, place, and whether you were divorced at the time of death.

- In Part D, provide information about the insured's next of kin. This includes listing living children, parents, siblings, or descendants of deceased siblings as necessary.

- Complete Part E if the insured's estate is entitled to benefits, providing the name and address of the appointed executor or administrator along with the relevant court documents.

- For Part F, indicate whether you have signed a document with a funeral home authorizing direct payment and note if you are claiming accidental death benefits.

- In Part G, select your method of receiving payment. Choose between a Total Control Account (TCA) or a check.

- Complete Part H with your information, ensuring to provide your full name, relationship to the insured, address, and social security number.

- Sign and date the form, confirming the accuracy of the information provided. Return the completed form and all required documents via mail or fax, as appropriate.

After submitting the completed claim form and documents, OFEGLI will review the information. They will process the claim accordingly and inform you of the next steps via the contact information provided. Ensure to keep copies of all documents submitted for your records.

What You Should Know About This Form

What is the purpose of the FE 6 Claim For Death Benefits form?

The FE 6 Claim For Death Benefits form is used to request the payment of life insurance benefits from the Federal Employees’ Group Life Insurance (FEGLI) Program. This form should be completed if a federal employee, annuitant, or compensationer has passed away and you are seeking the benefits owed to the named beneficiaries. For claims regarding dependent benefits, a different form, FE-6 DEP, should be used.

Who is eligible to receive the FEGLI benefits?

FEGLI benefits are paid according to specific priority rules outlined in the law. Payments go first to any designated beneficiaries. If none exist, the benefits will be paid to a spouse, children, parents, or a court-appointed executor of the estate, in that order. If a valid court order regarding the distribution of benefits is on file, payments will follow that order instead. If ownership has been assigned to another party, the benefits go to that assignee or their designated beneficiaries.

What information must be included in the form?

When completing the FE 6 form, provide detailed information about the deceased, including their full name, birth date, date of death, and Social Security number. You will also need to include information about your relationship to the insured, any marriage history, and the next of kin. It is crucial to fill in all requested portions to ensure a smooth processing of your claim.

What documents are required to submit with the claim form?

You must submit a certified copy of the death certificate with your claim. If applicable, include additional documents such as funeral home assignment paperwork, proof of accidental death, court appointment papers for an estate claim, or a Power of Attorney. It is only necessary to submit one death certificate unless multiple claimants are involved.

How can I submit the completed claim form?

To submit your completed claim form, send it along with any necessary documents to the Office of Federal Employees' Group Life Insurance (OFEGLI). You can mail it to either the overnight address or the PO Box listed in the claims instructions. If a certified death certificate has been previously sent to OFEGLI, you may also choose to fax your claim form instead.

What options do I have for receiving my death benefits?

You have two primary options for receiving your benefits. One option is to open a Total Control Account (TCA), which allows you to access the funds like a checking account. The other option is to receive a check mailed directly to you. If you do not select a preferred method and your benefits qualify for a TCA, that account will be established automatically.

Common mistakes

Filling out the FE-6 Claim for Death Benefits form can be a challenging task during a difficult time. Even small mistakes can delay the processing of benefits. Here are eight common mistakes to avoid when completing this important form.

First, many people overlook the requirement to provide a certified copy of the death certificate. The form explicitly states that this is necessary, and it must include the cause and manner of death. Failing to submit this crucial document can lead to significant delays.

Second, it’s essential to accurately complete all parts of the form, especially Part A, which includes details such as the insured's full name and social security number. Incomplete or incorrect information could result in the claim being rejected or needing further verification.

Another frequent error involves the submission of documents. Claimants often forget to check off items they are sending with the claim form. This simple act ensures that the Office of Federal Employees' Group Life Insurance (OFEGLI) receives all necessary paperwork and avoids unnecessary follow-ups.

The choice of the payment method should not be taken lightly. Some people neglect to select a settlement option. If you do not indicate whether you prefer a Total Control Account or a check, a TCA will be established automatically, which may not align with your preferences.

Additionally, section Part C contains questions about marriages related to the insured. Many claimants fail to provide complete details about all marriages, including divorces. It is critical to disclose all relevant information, as this could affect the distribution of benefits.

Furthermore, claimants also tend to mistake the need for additional documents when making a claim for accidental death benefits. If applicable, it’s important to provide all supporting documents, such as police reports and coroner’s reports, to ensure the claim can be processed as quickly as possible.

Another common misunderstanding involves the reporting of next of kin details. The form requires information about the insured's living children or other relatives. Make sure to list all eligible beneficiaries accurately, as omitting this can complicate benefit distribution.

Lastly, individuals frequently fail to include their own information accurately in Part H. Make sure that you fill out the claimant’s information correctly, and sign appropriately. This may seem minor, but it is essential for the authenticity and validity of the claim.

By staying mindful of these mistakes while filling out the FE-6 form, you can help expedite the claims process and ensure that beneficiaries receive their entitled benefits without unnecessary delays.

Documents used along the form

When filing a claim using the FE 6 Claim For Death Benefits form, there are several other documents that are commonly required. These documents serve to support the claim and to ensure that the benefits are disbursed properly. Below are some essential forms and documents that may be utilized alongside the FE 6 form.

- Death Certificate: This is a critical document that provides official confirmation of the death of the insured. A certified copy is required and must include the cause and manner of death, which can typically be obtained from the funeral director or the state bureau of vital statistics.

- Funeral Home Assignment Document: If there is a specific arrangement made with a funeral home that allows direct payment for services, a copy of this document must be submitted. This ensures that the funds are allocated accordingly.

- Proof of Accident (if applicable): In cases where the claim is for an accidental death benefit, supporting evidence such as police reports and other relevant documentation proving the accident must be included. This is necessary for the assessment of the claim.

- Appointment Papers: If the claim is submitted on behalf of the estate of the deceased, a copy of the court appointment papers must be provided. This shows that the claimant is authorized to act on behalf of the estate.

- Trust Documents (if applicable): If a trust is designated as the beneficiary, documents proving the trust's validity and current status must be included. This might involve a statement confirming that the trust remains in effect and the claimant's authority to act under the trust.

Including these additional documents along with the FE 6 form can help streamline the claims process and reduce delays. It ensures that all necessary information is available for the Office of Federal Employees' Group Life Insurance to process the claim in a timely manner.

Similar forms

- Life Insurance Claim Form: Similar to the FE 6 form, this document is used by individuals to claim insurance benefits upon the death of the insured. It outlines necessary beneficiary information and may require certified death certificates too.

- Social Security Administration (SSA) Death Benefit Application: This form allows survivors to request a one-time death benefit. Like the FE 6 form, it confirms the death and necessitates proof, such as a death certificate.

- Death Certificate: While not a claim form, this official document is essential across various benefits claims, including the FE 6. It verifies the date and cause of death, required by insurance providers and government agencies.

- Will: A last will is a legal document that may dictate the distribution of a deceased’s assets, similar to how the FE 6 form determines benefit allocation. It is crucial for estate management after death.

- Probate Petition: This document is filed with the court to initiate the probate process for a deceased person’s estate, akin to how the claimant must submit the FE 6 for life insurance claims.

- Power of Attorney Documentation: When someone is acting on behalf of the beneficiary, this form legally empowers them to sign the FE 6. It shares a purpose of representation with the claim form.

- Funeral Home Assignment: This is an authorization allowing direct payment from the insurance benefit to funeral services, paralleling the way the FE 6 form requests similar information for beneficiaries.

- Estate Claim Form: For claims against the deceased’s estate, this form tracks assets and debts. It has similarities with the FE 6 in that both require information about the deceased's beneficiaries.

- State Death Benefit Claim Forms: Many states provide their own death benefit packets that require similar information, such as beneficiary details and proof of death, just like the federal FE 6 form.

Dos and Don'ts

Filling out the FE 6 Claim For Death Benefits form can be a daunting task during an emotional time. Here’s a helpful list to guide you through the process, highlighting what you should and shouldn't do.

- Do read the instructions carefully before you begin.

- Do gather all necessary documents, such as the death certificate and any relevant court papers.

- Do make sure all information is complete and accurate to avoid delays.

- Do file claims for every beneficiary individually; each needs their own form.

- Don't leave any sections blank; if a question doesn't apply, indicate that clearly.

- Don't forget to include your own identification information.

- Don't mix up the form for death benefits with that for dependent claims; use the correct forms.

- Don't hesitate to call OFEGLI at 1-800-633-4542 if you have questions.

By following these guidelines, you’ll help ensure that the claim process goes smoothly.

Misconceptions

- Misconception 1: Only the insured's spouse can receive benefits.

- Misconception 2: A death certificate is unnecessary to file a claim.

- Misconception 3: Only one claim form is needed per family.

- Misconception 4: Claims can be submitted without notifying the employing agency.

- Misconception 5: The Total Control Account (TCA) is mandatory for all benefit payments.

- Misconception 6: All claim forms are the same, and previous editions can still be used.

- Misconception 7: Benefits are taxable as income.

- Misconception 8: Reporting the death can be done only by the immediate family members.

- Misconception 9: There are no consequences for submitting a fraudulent claim.

This belief ignores the order of beneficiaries as outlined in the FEGLI program. Benefits can also go to designated beneficiaries, children, parents, and even a court-appointed executor if no other beneficiaries exist.

A certified death certificate is a vital requirement for processing a claim. It must include the cause and manner of death to validate the claim.

Each claimant or beneficiary must complete their own claim form. This requirement ensures that all parties have the opportunity to provide necessary information and documentation.

Claimants must notify the appropriate agency about the insured's death before submitting a claim. This process helps ensure that all benefits are processed correctly and in a timely manner.

Choosing to set up a TCA is optional. Claimants can also opt for a direct check payment if they prefer that method of receiving funds.

This assertion is incorrect. Claimants must use the most current edition of the form to ensure their claims are processed without delays.

FEGLI death benefits are not subject to federal income tax. However, any interest earned on those benefits may be taxable, and claimants should consult tax advisors for clarity.

While immediate family members can report the death, any individual aware of the occurrence may contact the employing agency or OPM to report it.

This belief is false. Submitters who knowingly provide false information on the claim form may face severe legal penalties, including monetary fines and potential imprisonment.

Key takeaways

Key Takeaways for Completing the FE-6 Claim for Death Benefits Form:

- Ensure you provide a certified copy of the death certificate with your claim. This is required for processing.

- Each claimant or beneficiary must complete their own FE-6 form to ensure proper processing and avoid delays.

- Select your method of payment carefully. You can choose a Total Control Account or a check for benefits over $5,000.

- If the insured had multiple marriages, provide complete details about each, as this could affect the distribution of benefits.

Browse Other Templates

Life Insurance Change Request Form,Universal Change Notification Form,Beneficiary Update Request Form,Life Policy Modification Form,Ownership Transfer Form,Contact Information Update Form,Coverage Adjustment Request Form,Insurance Account Modificatio - No changes in beneficiary due to divorce are valid without submitting the decree.

Arp Accessories - It is critical to correct any personal information before the form is officially processed.