Fill Out Your Federal Loan Economic Hardship Request Form

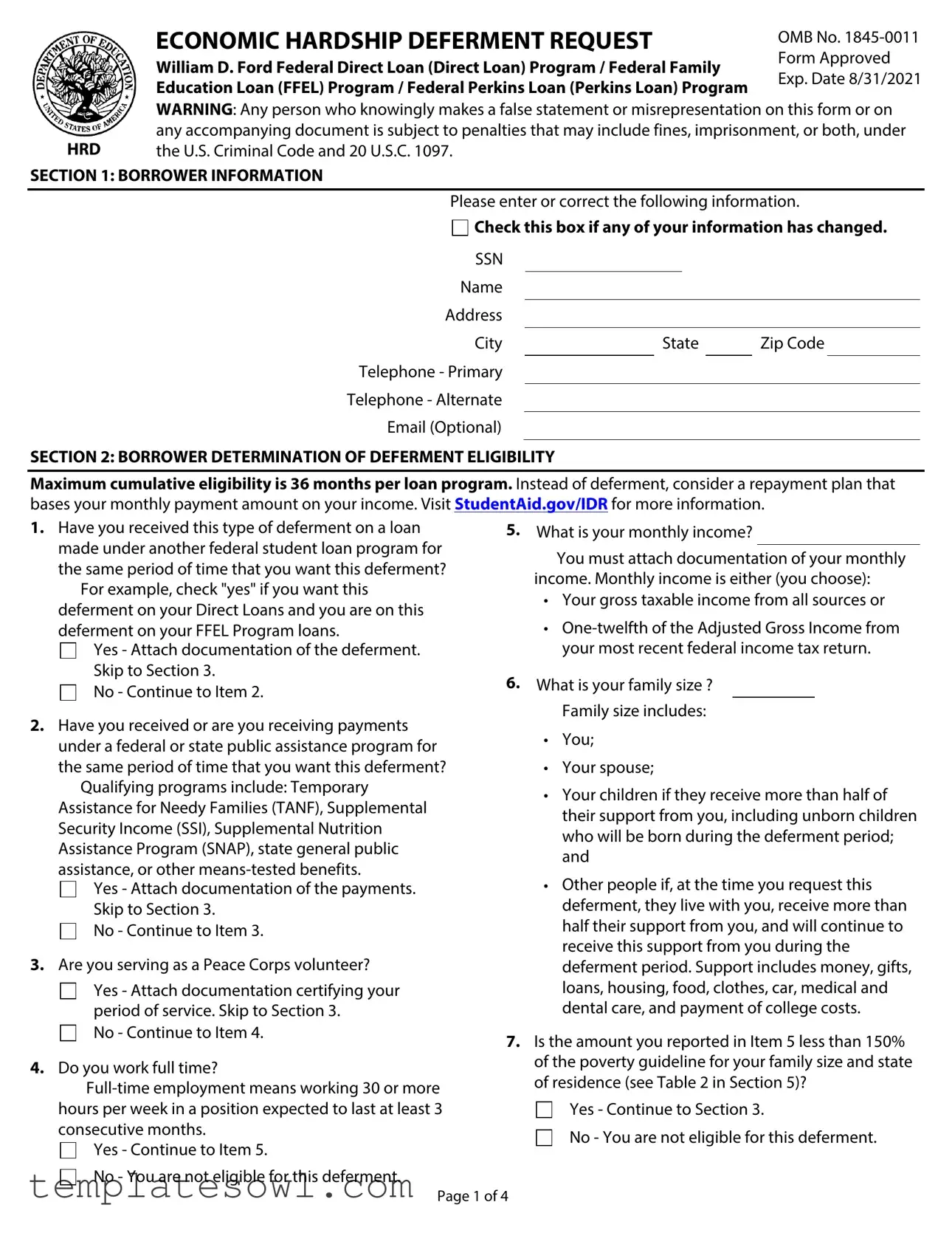

The Federal Loan Economic Hardship Request form plays a crucial role for borrowers facing financial difficulties in managing their federal student loan repayments. This form allows eligible individuals to temporarily postpone their loan payments during times of economic hardship, providing necessary relief. Each borrower begins by filling out their personal information, which includes essential details such as their name, Social Security number, and contact information. The form contains a series of questions designed to assess the borrower's eligibility for deferment, particularly focusing on their income and family size. For instance, borrowers must disclose whether they are employed full-time, though exceptions exist for those serving as Peace Corps volunteers or receiving public assistance. Furthermore, it’s important to note that there is a maximum duration for deferment, capped at 36 months, and borrowers are encouraged to consider alternative repayment plans based on their income. The process also includes sections where borrowers verify their understanding of the terms and authorizations needed for the loan holder to process their request. Beyond its functional components, the form highlights the seriousness of reporting accurate information, emphasizing that false statements could lead to legal consequences. Overall, this request form stands as an important resource designed to ease the financial burdens on borrowers, allowing them temporary relief while navigating their economic challenges.

Federal Loan Economic Hardship Request Example

|

ECONOMIC HARDSHIP DEFERMENT REQUEST |

|

|

|

OMB No. |

|||

|

William D. Ford Federal Direct Loan (Direct Loan) Program / Federal Family |

Form Approved |

||||||

|

Exp. Date 8/31/2021 |

|||||||

|

Education Loan (FFEL) Program / Federal Perkins Loan (Perkins Loan) Program |

|||||||

|

|

|

|

|||||

|

WARNING: Any person who knowingly makes a false statement or misrepresentation on this form or on |

|||||||

HRD |

any accompanying document is subject to penalties that may include fines, imprisonment, or both, under |

|||||||

the U.S. Criminal Code and 20 U.S.C. 1097. |

|

|

|

|

|

|

||

SECTION 1: BORROWER INFORMATION |

|

|

|

|

|

|

||

|

|

|

|

|

|

|

||

|

Please enter or correct the following information. |

|||||||

|

Check this box if any of your information has changed. |

|||||||

|

SSN |

|

|

|

|

|

|

|

|

Name |

|

|

|

|

|

|

|

|

Address |

|

|

|

|

|

|

|

|

City |

|

State |

|

Zip Code |

|

|

|

|

Telephone - Primary |

|

|

|

|

|

|

|

Telephone - Alternate

Email (Optional)

SECTION 2: BORROWER DETERMINATION OF DEFERMENT ELIGIBILITY

Maximum cumulative eligibility is 36 months per loan program. Instead of deferment, consider a repayment plan that bases your monthly payment amount on your income. Visit StudentAid.gov/IDR for more information.

1. Have you received this type of deferment on a loan |

5. |

What is your monthly income? |

|||||

made under another federal student loan program for |

|

|

|

|

|

|

|

|

|

You must attach documentation of your monthly |

|||||

the same period of time that you want this deferment? |

|

|

|||||

|

income. Monthly income is either (you choose): |

||||||

For example, check "yes" if you want this |

|

||||||

|

• Your gross taxable income from all sources or |

||||||

deferment on your Direct Loans and you are on this |

|

||||||

|

• |

||||||

deferment on your FFEL Program loans. |

|

||||||

Yes - Attach documentation of the deferment. |

|

|

your most recent federal income tax return. |

||||

Skip to Section 3. |

6. |

What is your family size ? |

|||||

No - Continue to Item 2. |

|||||||

|

|

|

|

|

|

||

2. Have you received or are you receiving payments |

|

|

Family size includes: |

||||

|

• |

You; |

|||||

under a federal or state public assistance program for |

|

||||||

|

|

|

|

|

|

||

the same period of time that you want this deferment? |

|

• |

Your spouse; |

||||

Qualifying programs include: Temporary |

|

• Your children if they receive more than half of |

|||||

Assistance for Needy Families (TANF), Supplemental |

|

||||||

|

|

their support from you, including unborn children |

|||||

Security Income (SSI), Supplemental Nutrition |

|

|

|||||

|

|

who will be born during the deferment period; |

|||||

Assistance Program (SNAP), state general public |

|

|

|||||

|

|

and |

|||||

assistance, or other |

|

|

|||||

|

• Other people if, at the time you request this |

||||||

Yes - Attach documentation of the payments. |

|

||||||

Skip to Section 3. |

|

|

deferment, they live with you, receive more than |

||||

No - Continue to Item 3. |

|

|

half their support from you, and will continue to |

||||

3. Are you serving as a Peace Corps volunteer? |

|

|

receive this support from you during the |

||||

|

|

deferment period. Support includes money, gifts, |

|||||

Yes - Attach documentation certifying your |

|

|

loans, housing, food, clothes, car, medical and |

||||

period of service. Skip to Section 3. |

|

|

dental care, and payment of college costs. |

||||

No - Continue to Item 4. |

7. Is the amount you reported in Item 5 less than 150% |

||||||

|

|||||||

4. Do you work full time? |

|

of the poverty guideline for your family size and state |

|||||

|

of residence (see Table 2 in Section 5)? |

||||||

|

|||||||

|

|

|

|

|

|

||

hours per week in a position expected to last at least 3 |

|

|

Yes - Continue to Section 3. |

||||

consecutive months. |

|

|

No - You are not eligible for this deferment. |

||||

Yes - Continue to Item 5. |

|

|

|||||

|

|

|

|

|

|

||

No - You are not eligible for this deferment. |

|

|

|

|

|

|

|

Page 1 of 4

Borrower Name |

|

Borrower SSN |

|

|

|

SECTION 3: BORROWER REQUESTS, UNDERSTANDINGS, CERTIFICATIONS, AND AUTHORIZATION

Irequest:

•To defer repayment of my loans for the period during which I have an economic hardship, as described in Section 2.

•That my deferment begin on:

• |

If checked, to make interest |

payments on my |

loans during my deferment. |

I understand that:

•I am not required to make payments of loan principal or interest during my deferment.

•My deferment will begin on the later of the date I became eligible or the date that I requested.

•My deferment will end on the earlier of the date that I exhaust my maximum eligibility, the certified deferment end date, or when I am no longer eligible for the deferment for another reason.

•If I am a Perkins Loan borrower, I will receive a

•Unless I am a Peace Corps volunteer, my deferment will be granted in increments of 1 year. If I continue to be eligible for an Economic Hardship Deferment after 1 year, I may reapply, subject to the cumulative maximum.

•My loan holder may grant me a forbearance while processing my form or to cover any period of delinquency that exists when I submit my form.

•Unpaid interest may capitalize on my loans during or at the expiration of my deferment or forbearance, but interest never capitalizes on Perkins Loans.

I certify that:

•The information I have provided on this form is true and correct.

•I will provide additional documentation to my loan holder, as required, to support my deferment eligibility.

•I will notify my loan holder immediately when my eligibility for the deferment ends.

•I have read, understand, and meet the eligibility requirements in Section 2.

I authorize the entity to which I submit this request and its agents to contact me regarding my request or my loans at any cellular telephone number that I provide now or in the future using automated telephone dialing equipment or artificial or prerecorded voice or text messages.

Borrower's Signature |

|

Date |

SECTION 4: INSTRUCTIONS FOR COMPLETING THE DEFERMENT REQUEST

Type or print using dark ink. Enter dates as

SECTION 5: DEFINITIONS

The William D. Ford Federal Direct Loan (Direct |

The Federal Family Education Loan (FFEL) Program |

|

Loan) Program includes Federal Direct Stafford/Ford |

includes Federal Stafford Loans, Federal PLUS Loans, Federal |

|

(Direct Subsidized) Loans, Federal Direct Unsubsidized |

Consolidation Loans, and Federal Supplemental Loans for |

|

Stafford/Ford (Direct Unsubsidized) Loans, Federal |

Students (SLS). |

|

Direct PLUS (Direct PLUS) Loans, and Federal Direct |

The Federal Perkins Loan (Perkins Loan) Program |

|

Consolidation (Direct Consolidation) Loans. |

||

includes Federal Perkins Loans, National Direct Student Loans |

||

|

||

|

(NDSL), and National Defense Student Loans (Defense Loans). |

Page 2 of 4

SECTION 5: DEFINITIONS (CONTINUED)

|

Capitalization is the addition of unpaid interest to |

|

A forbearance is a period during which you are permitted |

||||||||||||||

the principal balance of your loan. Capitalization causes |

|

to postpone making payments temporarily, allowed an |

|||||||||||||||

more interest to accrue over the life of your loan and |

|

extension of time for making payments, or temporarily |

|||||||||||||||

may cause your monthly payment amount to increase. |

|

allowed to make smaller payments than scheduled. |

|||||||||||||||

Interest never capitalizes on Perkins Loans. |

|

|

|

The holder of your Direct Loans is the Department. The |

|||||||||||||

|

Table 1 (below) provides an example of the monthly |

|

holder of your FFEL Program loans may be a lender, guaranty |

||||||||||||||

payments and the total amount repaid for a $30,000 |

|

agency, secondary market, or the Department. The holder of |

|||||||||||||||

unsubsidized loan. The example loan has a 6% interest |

|

your Perkins Loans is an institution of higher education or the |

|||||||||||||||

rate and the example deferment or forbearance lasts for |

|

Department. Your loan holder may use a servicer to handle |

|||||||||||||||

12 months and begins when the loan entered |

|

billing and other communications related to your loans. |

|||||||||||||||

repayment. The example compares the effects of paying |

|

References to “your loan holder” on this form mean either |

|||||||||||||||

the interest as it accrues or allowing it to capitalize. |

|

your loan holder or your servicer. |

|

|

|||||||||||||

|

A |

|

A subsidized loan is a Direct Subsidized Loan, a Direct |

||||||||||||||

joint borrowers on a Direct or Federal Consolidation |

|

||||||||||||||||

|

Subsidized Consolidation Loan, a Federal Subsidized Stafford |

||||||||||||||||

Loan or a Federal PLUS Loan. Both |

|

||||||||||||||||

|

Loan, portions of some Federal Consolidation Loans, a Federal |

||||||||||||||||

responsible for repayment the full amount of the loan. |

|

||||||||||||||||

|

Perkins Loan, an NDSL, and a Defense Loan. |

|

|

||||||||||||||

|

A deferment is a period during which you are |

|

|

|

|||||||||||||

|

|

An unsubsidized loan is a Direct Unsubsidized Loan, a |

|||||||||||||||

entitled to postpone repayment of your loans. Interest is |

|

||||||||||||||||

|

Direct Unsubsidized Consolidation Loan, a Direct PLUS Loan, a |

||||||||||||||||

not generally charged to you during a deferment on |

|

||||||||||||||||

|

Federal Unsubsidized Stafford Loan, a Federal PLUS Loan, a |

||||||||||||||||

your subsidized loans. Interest is always charged to you |

|

||||||||||||||||

|

Federal SLS, and portions of some Federal Consolidation |

||||||||||||||||

during a deferment on your unsubsidized loans. On |

|

||||||||||||||||

|

Loans. |

|

|

|

|

|

|

|

|

|

|||||||

loans made under the Perkins Loan Program, all |

|

|

|

|

|

|

|

|

|

|

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

||||||

deferments are followed by a |

|

|

|

|

|

|

|

|

|

|

|

|

|||||

period of 6 months, during which time you are not |

|

|

|

|

|

|

|

|

|

|

|

|

|||||

required to make payments. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

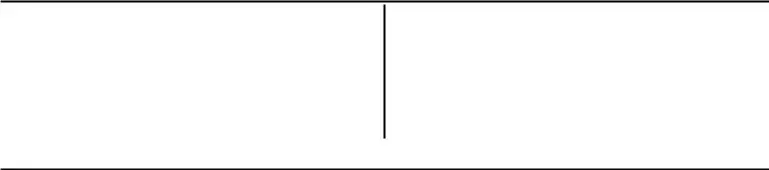

Table 1. Capitalization Chart |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

Treatment of Interest with |

Loan |

Capitalized |

Outstanding |

|

Monthly |

Number of |

Total |

|||||||||

|

Deferment/Forbearance |

Amount |

Interest |

|

Principal |

|

Payment |

Payments |

Repaid |

|

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Interest is paid |

$30,000 |

$0 |

|

|

$30,000 |

|

|

$333 |

120 |

$41,767 |

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Interest is capitalized at the |

$30,000 |

$1,800 |

|

$31,800 |

|

|

$353 |

120 |

$42,365 |

|

||||||

|

end |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Interest is capitalized |

$30,000 |

$1,841 |

|

$31,841 |

|

|

$354 |

120 |

$42,420 |

|

||||||

|

quarterly and at the end |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

Table 2. 150% of the Poverty Guidelines for 2019 (Monthly) |

|

|

|||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

Family Size |

|

Alaska |

|

Hawaii |

|

|

All Others |

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

|

|

|

|

1 |

|

$1,950.00 |

|

$1,797.50 |

$1,561.25 |

|

|

|

|||||

|

|

|

|

2 |

|

$2,641.25 |

|

$2,432.50 |

$2,113.75 |

|

|

|

|||||

|

|

|

|

3 |

|

$3,332.50 |

|

$3,067.50 |

$2,666.25 |

|

|

|

|||||

|

|

|

|

4 |

|

$4,023.75 |

|

$3,702.50 |

|

$3,218.75 |

|

|

|

||||

|

|

|

|

5 |

|

$4,715.00 |

|

$4,337.50 |

|

$3,771.25 |

|

|

|

||||

|

|

|

|

6 |

|

$5,406.25 |

|

$4,972.50 |

|

$4,323.75 |

|

|

|

||||

|

|

|

|

7 |

|

$6,097.50 |

|

$5,607.50 |

|

$4,876.25 |

|

|

|

||||

|

|

|

|

8 |

|

$6,788.75 |

|

$6,242.50 |

|

$5,428.75 |

|

|

|

||||

|

|

|

Each additional |

|

$691.25 |

|

$635.00 |

|

$552.50 |

|

|

|

|||||

|

|

|

person, add |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||

|

If you do not live in the United States, use the poverty guideline amount in |

|

|

||||||||||||||

|

|

|

|

the column labeled "All Others". |

|

|

|

|

|

|

|

||||||

Page 3 of 4

SECTION 6: WHERE TO SEND THE COMPLETED DEFERMENT REQUEST

Return the completed form and any documentation to: (If no address is shown, return to your loan holder.)

If you need help completing this form, call:

(If no phone number is shown, call your loan holder.)

SECTION 7: IMPORTANT NOTICES

Privacy Act Notice. The Privacy Act of 1974 (5 U.S.C. 552a) |

To assist program administrators with tracking refunds |

|

requires that the following notice be provided to you: |

and cancellations, disclosures may be made to guaranty |

|

The authorities for collecting the requested information |

agencies, to financial and educational institutions, or to |

|

federal or state agencies. To provide a standardized method |

||

from and about you are §421 et seq., §451 et seq., or §461 et |

||

for educational institutions to efficiently submit student |

||

seq. of the Higher Education Act of 1965, as amended (20 |

||

enrollment statuses, disclosures may be made to guaranty |

||

U.S.C. 1071 et seq., 20 U.S.C. 1087a et seq., or 20 U.S.C. 1087aa |

||

agencies or to financial and educational institutions. To |

||

et seq.) and the authorities for collecting and using your Social |

||

counsel you in repayment efforts, disclosures may be made |

||

Security Number (SSN) are §§428B(f) and 484(a)(4) of the HEA |

||

to guaranty agencies, to financial and educational |

||

(20 U.S.C. |

||

institutions, or to federal, state, or local agencies. |

||

Participating in the William D. Ford Federal Direct Loan (Direct |

||

|

||

Loan) Program, Federal Family Education Loan (FFEL) |

In the event of litigation, we may send records to the |

|

Program, or Federal Perkins Loan (Perkins Loan) Program and |

Department of Justice, a court, adjudicative body, counsel, |

|

giving us your SSN are voluntary, but you must provide the |

party, or witness if the disclosure is relevant and necessary |

|

requested information, including your SSN, to participate. |

to the litigation. If this information, either alone or with |

|

The principal purposes for collecting the information on |

other information, indicates a potential violation of law, we |

|

may send it to the appropriate authority for action. We may |

||

this form, including your SSN, are to verify your identity, to |

||

send information to members of Congress if you ask them |

||

determine your eligibility to receive a loan or a benefit on a |

||

to help you with federal student aid questions. In |

||

loan (such as a deferment, forbearance, discharge, or |

||

circumstances involving employment complaints, |

||

forgiveness) under the Direct Loan, FFEL, or Federal Perkins |

||

grievances, or disciplinary actions, we may disclose relevant |

||

Loan Programs, to permit the servicing of your loans, and, if it |

||

records to adjudicate or investigate the issues. If provided |

||

becomes necessary, to locate you and to collect and report on |

||

for by a collective bargaining agreement, we may disclose |

||

your loans if your loans become delinquent or default. We also |

||

records to a labor organization recognized under 5 U.S.C. |

||

use your SSN as an account identifier and to permit you to |

||

Chapter 71. Disclosures may be made to our contractors for |

||

access your account information electronically. |

||

the purpose of performing any programmatic function that |

||

The information in your file may be disclosed, on a case- |

||

requires disclosure of records. Before making any such |

||

disclosure, we will require the contractor to maintain Privacy |

||

parties as authorized under routine uses in the appropriate |

||

Act safeguards. Disclosures may also be made to qualified |

||

systems of records notices. The routine uses of this |

||

researchers under Privacy Act safeguards. |

||

information include, but are not limited to, its disclosure to |

||

Paperwork Reduction Notice. According to the |

||

federal, state, or local agencies, to private parties such as |

||

Paperwork Reduction Act of 1995, no persons are required |

||

relatives, present and former employers, business and |

||

to respond to a collection of information unless such |

||

personal associates, to consumer reporting agencies, to |

||

collection displays a valid OMB control number. The valid |

||

financial and educational institutions, and to guaranty |

||

OMB control number for this information collection is |

||

agencies in order to verify your identity, to determine your |

||

eligibility to receive a loan or a benefit on a loan, to permit the |

||

information is estimated to average 10 minutes per |

||

servicing or collection of your loans, to enforce the terms of |

||

response, including time for reviewing instructions, |

||

the loans, to investigate possible fraud and to verify |

||

searching existing data sources, gathering and maintaining |

||

compliance with federal student financial aid program |

||

the data needed, and completing and reviewing the |

||

regulations, or to locate you if you become delinquent in your |

||

collection of information. The obligation to respond to this |

||

loan payments or if you default. To provide default rate |

||

collection is required to obtain a benefit in accordance with |

||

calculations, disclosures may be made to guaranty agencies, |

||

34 CFR 674.34, 674.35, 674.36, 674.37, 682.210, or 685.204. |

||

to financial and educational institutions, or to state agencies. |

||

If you have comments or concerns regarding the |

||

To provide financial aid history information, disclosures may |

||

status of your individual submission of this form, please |

||

be made to educational institutions. |

||

contact your loan holder directly (see Section 6). |

||

|

Page 4 of 4

Form Characteristics

| Fact Name | Description |

|---|---|

| Form Purpose | The Economic Hardship Deferment Request form allows borrowers to postpone loan payments during periods of economic hardship. |

| Forms Covered | This form applies to the William D. Ford Federal Direct Loan Program, Federal Family Education Loan Program, and Federal Perkins Loan Program. |

| Maximum Eligibility | Borrowers may qualify for a maximum of 36 months of deferment across all programs, combined. |

| Impact of Deferment | While a borrower is in deferment, they are not required to make principal or interest payments on their subsidized loans. |

| Income Documentation | Borrowers must attach documentation that confirms their monthly income, using either gross taxable income or Adjusted Gross Income from their tax return. |

| Family Size Consideration | Family size is relevant for determining eligibility and includes the borrower, spouse, children, and others living with the borrower who rely on them for support. |

| State Guidelines Reference | The form requires borrowers to meet specific income thresholds, such as 150% of the poverty guidelines, which vary by state. |

| Reapplication Requirement | If a borrower still meets eligibility requirements after one year, they must reapply for deferment. |

| Submitting the Form | Those who want to submit a deferment request must send their completed form and necessary documents to the designated loan holder. |

| Privacy and Disclosures | Information provided may be shared with federal or state agencies and other entities to verify identity and determine eligibility. |

Guidelines on Utilizing Federal Loan Economic Hardship Request

After gathering your personal information and determining your eligibility, the next step involves filling out the Federal Loan Economic Hardship Request form. Completing this form accurately is essential for seeking deferment on your student loans based on your current financial situation. Follow these steps carefully to ensure your request is processed smoothly.

- Provide your Borrower Information in Section 1. Enter your Social Security Number, name, address, city, state, zip code, and both primary and alternate telephone numbers. An optional email address can also be included.

- Check the box if any of your personal information has changed.

- Move to Section 2. Answer each question regarding your eligibility for deferment, starting with item 1. Indicate whether you have received a similar deferment on another federal student loan. If yes, attach the required documentation and skip to Section 3.

- If you answered no to item 1, proceed to item 2. Indicate whether you receive public assistance payments and provide documentation if applicable.

- If you answered no to item 2, move to item 3 and confirm whether you are a Peace Corps volunteer. Attach certification of your service if applicable.

- If you answered no to item 3, continue to item 4 where you will answer if you work full-time. If yes, go to item 5.

- In item 5, report your monthly income. Ensure to attach documentation supporting your reported income.

- Next, state your family size in item 6. This should include everyone who qualifies according to the instructions.

- In item 7, indicate if your reported income is less than 150% of the poverty guideline for your family size and residence. If yes, continue to Section 3.

- If you answered no to item 7, unfortunately, you are not eligible for deferment.

- In Section 3, make your requests and affirm your understanding of the terms by checking the required boxes. Sign and date the form at the bottom.

- Follow the instructions in Section 4. Type or print using dark ink and properly format the date as month-day-year (mm-dd-yyyy).

- Ensure your name and account number are on any required documents you submit along with the form.

- Prepare to return the completed form. Go to Section 6 to find the address where you need to submit the form and any documentation.

- If you have any questions while completing the form, contact your loan holder for assistance as detailed in Section 6.

What You Should Know About This Form

What is the Federal Loan Economic Hardship Request form?

The Federal Loan Economic Hardship Request form is used by borrowers to apply for a deferment on their federal student loans. This deferment allows individuals facing financial difficulties to temporarily postpone their loan payments without affecting their credit score. It's important for borrowers to provide accurate information about their situation when filling out the form.

Who can apply for economic hardship deferment?

Borrowers who meet certain criteria may be eligible for economic hardship deferment. This includes individuals who have low income, are receiving public assistance, or are Peace Corps volunteers. To qualify, borrowers must provide documentation of their situation, including proof of income or assistance received from government programs.

How long can deferment last?

The maximum cumulative eligibility for economic hardship deferment is 36 months. Borrowers can apply for deferment in increments of one year. If they continue to qualify after one year, they may reapply while keeping track of the total time used. It's crucial to stay informed about when the deferment period will end, so borrowers can avoid any potential issues with repayments.

What information do I need to provide on the form?

On the form, borrowers need to enter their personal information, such as their name, Social Security Number, and contact details. They must also answer several questions regarding their employment status, family size, and monthly income. Providing accurate information is essential, as it helps determine eligibility for the deferment.

What documentation is required?

Borrowers are required to attach appropriate documentation that supports their claims of economic hardship. This may include proof of income, such as pay stubs or tax returns, or documentation showing participation in government assistance programs. Proper documentation is vital for processing the request efficiently.

What happens to interest during the deferment period?

During the deferment period, borrowers are not required to make payments on their subsidized loans, and interest generally does not accrue. However, for unsubsidized loans, interest does accrue, and it may be added to the loan balance at the end of the deferment. Borrowers should consider this when deciding whether to apply for deferment.

How do I submit the Economic Hardship Request form?

Once completed, borrowers should submit the Economic Hardship Request form and any related documentation to their loan holder. If there are loans with different holders, separate requests must be sent to each one. It's important to ensure that everything is filled out correctly before sending the form, as errors could delay processing.

Common mistakes

Filling out the Federal Loan Economic Hardship Request form can seem daunting, but avoiding common mistakes can make the process smoother. Here are nine mistakes people frequently make that you should be aware of.

1. Incomplete Borrower Information: Many individuals fail to provide complete personal information, such as their Social Security Number (SSN) or correct address. Missing this important data can delay the processing of the request or even lead to a denial.

2. Not Checking for Changes: Some borrowers overlook the necessity to check a box if their information has changed. If any of your details differ from what is on file, it’s crucial to indicate this, as discrepancies can cause complications.

3. Ignoring Documentation Requirements: Supporting documentation is vital. The form asks for evidence of your monthly income and recent deferments or public assistance payments. Failing to attach the necessary documents can result in automatic rejection.

4. Incorrect Family Size Calculation: Borrowers often miscalculate their family size. It’s important to accurately report everyone who qualifies under the guidelines provided. Incorrect family size may lead to an ineligibility finding.

5. Misunderstanding Income Requirements: Understanding the income thresholds set by the poverty guidelines can be tricky. Some applicants mistakenly assume their income qualifies without confirming against the specific table provided in the form.

6. Not Indicating Full-Time Employment: Failing to clarify your employment status can have drastic consequences. If you do not work full-time but claim eligibility for deferment based on employment, it can lead to denial of the request.

7. Signature and Date Omission: A simple yet critical mistake is forgetting to sign and date the form. Without a signature, the application is incomplete and cannot be processed at all.

8. Submitting Multiple Requests for Different Loans: When borrowers have several loans from different holders, each requires a separate request. Submitting just one form for multiple loans can hinder the deferment process and lead to rejections.

9. Delaying Submission: Last but not least, delays in submitting the form can impact eligibility for deferment. Promptly returning the completed documents ensures you remain covered under economic hardship provisions.

By paying attention to these common pitfalls, borrowers can navigate the Economic Hardship Request form with increased accuracy and confidence, ensuring a smoother experience.

Documents used along the form

When applying for a Federal Loan Economic Hardship Request, several additional documents may enhance your application. Each of these forms supports your request by providing necessary evidence of your financial situation. Below are five common documents that you might need to submit alongside the request form.

- Income Documentation: This could include pay stubs, tax returns, or bank statements to validate your monthly income. This document demonstrates financial need and helps determine eligibility for the deferment.

- Proof of Public Assistance: Documentation from state or federal public assistance programs, such as TANF or SSI, can clarify your financial status. This verifies that you are receiving aid, which can strengthen your request.

- Certification of Peace Corps Service: If you are a Peace Corps volunteer, you must include confirmation of your service. This document supports your application by outlining your commitment and current living conditions.

- Family Size Declaration: A statement detailing the number of individuals living in your household can be crucial. This information plays a role in calculating income eligibility based on family size and local poverty guidelines.

- Loan Deferment History: If you've had previous deferments under any federal program, including documentation of those deferments may be important. It shows a consistent history and can aid in your current request.

Make sure to gather all relevant documents before submitting your Economic Hardship Request to avoid delays. Each piece of information contributes to a clearer understanding of your financial situation and increases the likelihood of approval.

Similar forms

The Federal Loan Economic Hardship Request form is similar to several other documents used in the context of student loans and financial assistance. Below are nine similar documents, explaining how each relates to the Economic Hardship Request form:

- Income-Driven Repayment Plan Application: This document determines eligibility for repayment plans based on income, similar to how the Economic Hardship Request assesses financial status for loan deferment.

- Forbearance Request Form: A forbearance request allows borrowers to temporarily pause payments due to financial difficulties, akin to the deferred payments allowed under the Economic Hardship Request.

- Temporary Unemployment Deferment Form: This form specifically caters to individuals who are currently unemployed, providing similar relief from payments as the Economic Hardship Request for those facing economic hardship.

- Direct Consolidation Loan Application: This application allows borrowers to combine multiple loans into one for easier management. Both documents aim to assist borrowers in better managing financial challenges.

- Perkins Loan Cancellation Application: This document requests cancellation of Perkins Loans due to specific circumstances, much like how the Economic Hardship Request seeks to alleviate loan repayment under challenging conditions.

- Student Loan Status Report: Often required to assess a borrower’s financial situation, this document may supplement the Economic Hardship Request by providing detailed financial information about the borrower's circumstances.

- Financial Aid Appeal Letter: This letter is used by students to request additional financial aid based on unexpected financial challenges, similar to how the Economic Hardship Request seeks assistance due to financial distress.

- Loan Rehabilitation Application: This application allows borrowers in default to rehabilitate their loans and return to good standing, showcasing a proactive approach to resolving financial hardship, similar to seeking deferment.

- Hardship Withdrawal Form: Used in academic settings, this form permits students to withdraw due to personal hardships, paralleling the Economic Hardship Request’s goal of providing relief from loan payments based on personal adversity.

Each of these documents serves the purpose of assisting borrowers in navigating financial challenges related to their student loans, whether through deferment, consolidation, or other forms of relief.

Dos and Don'ts

When filling out the Federal Loan Economic Hardship Request form, there are several important considerations to keep in mind. Below is a list of things to do and not do to ensure the process goes smoothly.

- Do ensure that all personal information is complete and accurate.

- Don't leave any sections blank unless instructed.

- Do attach all necessary documentation to support your claims.

- Don't provide false information or misrepresent facts on the form.

- Do follow the instructions for completing the form carefully.

- Don't submit the form without reviewing it for errors.

- Do send the completed form to the appropriate address as listed in the instructions.

- Don't assume that additional documentation is not necessary without confirming eligibility requirements.

- Do keep a copy of the completed form for your records.

By adhering to these guidelines, individuals can enhance their chances of successful submission and avoid common pitfalls.

Misconceptions

-

The form guarantees automatic deferment.

Many individuals believe that submitting the Economic Hardship Deferment Request form will result in automatic deferment of their loans. However, this is incorrect. Eligibility for deferment is contingent upon meeting specific criteria outlined in the form. Each request is evaluated based on the information provided, and borrowers may need to submit additional documentation to prove their eligibility.

-

Documentation is not required to submit the form.

A common misconception is that borrowers can submit the form without any supporting documents. In fact, the form requires attaching proof of income and proof of any assistance received through means-tested programs. Failure to provide this documentation could result in denial of the deferment request.

-

Deferment can last indefinitely.

Some borrowers think that once they qualify for deferment, they can enjoy it without limits. This is misleading. The maximum cumulative eligibility for the Economic Hardship Deferment is 36 months per loan program. After reaching this limit, borrowers must either switch to another repayment plan or resume payments.

-

All types of loans are eligible for deferment.

This form is specifically designed for certain federal loan programs: Direct Loans, FFEL Program Loans, and Perkins Loans. Borrowers with private loans or other non-qualifying loans cannot use this form for deferment. It is essential for borrowers to check the eligibility of their specific loans before applying.

Key takeaways

When filling out and using the Federal Loan Economic Hardship Request form, keep the following key points in mind:

- Understand Eligibility: Review your eligibility thoroughly. You can only receive a maximum of 36 months of deferment under this program. If you received deferment on another federal student loan for the same time period, it may affect your eligibility.

- Document Your Income: You need to provide clear documentation of your monthly income. Attach either your gross taxable income or one-twelfth of your Adjusted Gross Income from your most recent tax return. This step is crucial for processing your request.

- Be Aware of Capitalization: Interest may capitalize during the deferment period, which means it gets added to your loan balance. This can increase the total amount you will owe later, so consider making interest payments if you can.

- Submit Each Loan Separately: If you have loans held by different servicers, you must submit separate deferment requests for each one. Ensure that you follow the instructions carefully and send any required documentation to the correct address.

Browse Other Templates

California Bbs - Ensure compliance with all documentation to avoid delays in licensure.

How to Prepare a Balance Sheet - Applicants should ensure accuracy to avoid complications or delays.

Academy of Art University Transcript - Submission methods include in-person, mail, or electronic payment options.