Fill Out Your Fedex Commercial Invoice Form

The FedEx Commercial Invoice form is a crucial document for businesses engaging in international shipping. It serves multiple purposes, including providing a detailed account of the goods being shipped, their value, and the parties involved in the transaction. This form includes essential information, such as the sender's and recipient's names and addresses, a description of the items being shipped, their quantities, and values. Furthermore, it outlines the terms of sale and delivery, which helps ensure compliance with customs regulations. By accurately completing this form, businesses can avoid potential delays and penalties during customs processing. The form's significance extends beyond mere compliance; it also plays a vital role in ensuring that goods are correctly classified and valued, safeguarding both sender and recipient. Additionally, it provides a record that can be essential for tracking shipments and resolving disputes. Accurate completion of the FedEx Commercial Invoice is not just a requirement; it is a best practice that enhances the efficiency of international trade.

Fedex Commercial Invoice Example

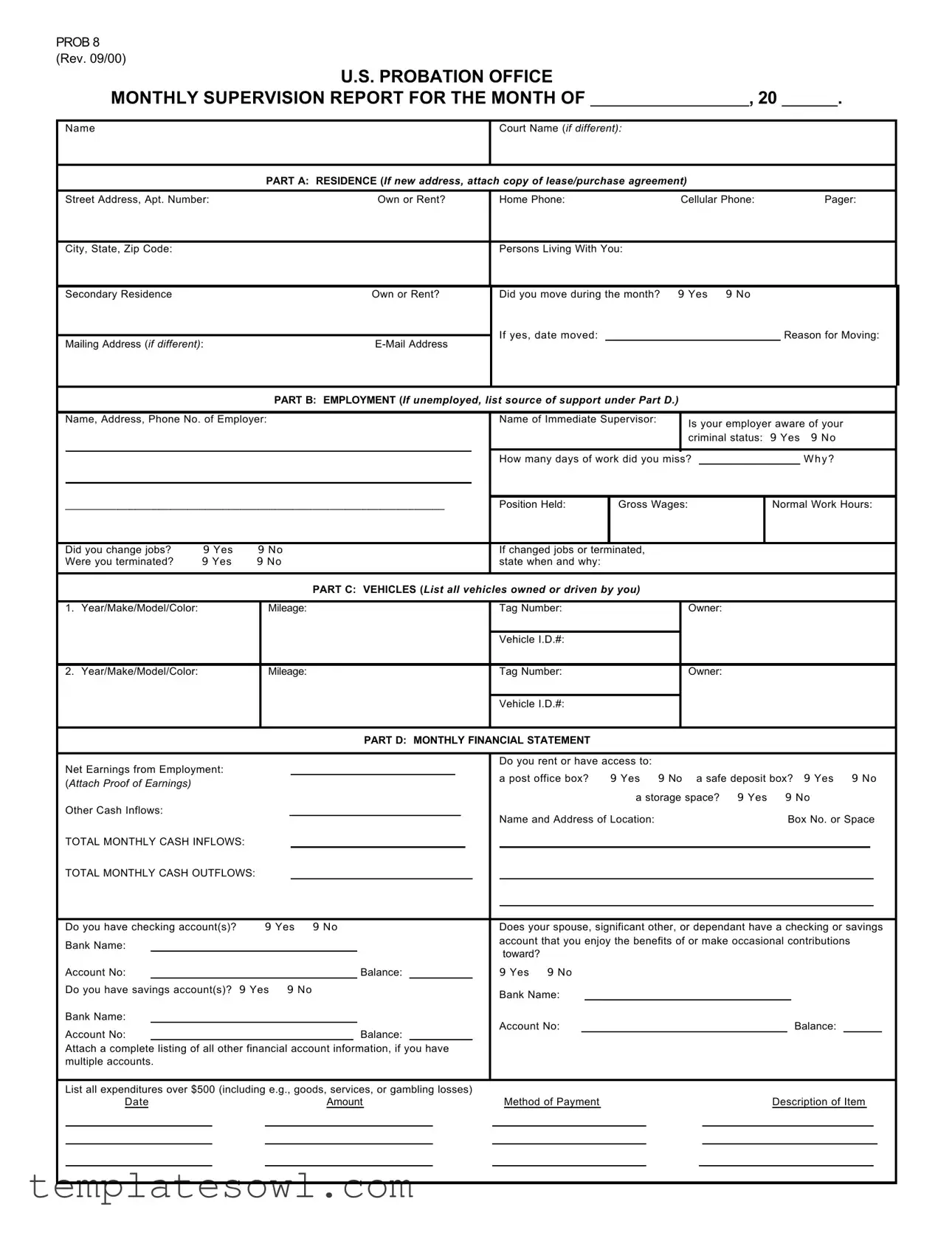

PROB 8 |

|

|

(Rev. 09/00) |

|

|

U.S. PROBATION OFFICE |

|

|

MONTHLY SUPERVISION REPORT FOR THE MONTH OF |

, 20 |

. |

Name

Court Name (if different):

PART A: RESIDENCE (If new address, attach copy of lease/purchase agreement)

Street Address, Apt. Number: |

Own or Rent? |

Home Phone: |

Cellular Phone: |

Pager: |

|

|

|

|

|

|

|

City, State, Zip Code: |

|

Persons Living With You: |

|

|

|

|

|

|

|

|

|

Secondary Residence |

Own or Rent? |

Did you move during the month? |

9 Yes 9 No |

|

|

|

|

If yes, date moved: |

|

Reason for Moving: |

|

Mailing Address (if different): |

|

||||

|

|

|

|

||

|

|

|

|

|

|

PART B: EMPLOYMENT (If unemployed, list source of support under Part D.)

|

Name, Address, Phone No. of Employer: |

|

Name of Immediate Supervisor: |

|

Is your employer aware of your |

|||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

criminal status: |

9 Yes |

9 No |

||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

How many days of work did you miss? |

|

|

|

Why? |

||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

_________________________________________________________________ |

|

|

|

|

|

Position Held: |

Gross Wages: |

|

|

|

|

Normal Work Hours: |

||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

Did you change jobs? |

9 Yes |

9 No |

|

If changed jobs or terminated, |

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||

|

Were you terminated? |

9 Yes |

9 No |

|

state when and why: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

PART C: VEHICLES (List all vehicles owned or driven by you) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

1. |

Year/Make/Model/Color: |

|

|

|

|

Mileage: |

|

Tag Number: |

|

|

|

Owner: |

|

|

|

|

|

|

|

|

|

|||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Vehicle I.D.#: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

2. |

Year/Make/Model/Color: |

|

|

|

|

Mileage: |

|

Tag Number: |

|

|

|

Owner: |

|

|

|

|

|

|

|

|

|

|||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Vehicle I.D.#: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

PART D: MONTHLY FINANCIAL STATEMENT |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

Net Earnings from Employment: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Do you rent or have access to: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

a post office box? |

9 Yes 9 No |

a safe deposit box? |

9 Yes 9 No |

||||||||||||||||||||

|

(Attach Proof of Earnings) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

a storage space? 9 Yes |

9 No |

||||||||||||||

|

Other Cash Inflows: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Name and Address of Location: |

|

|

|

|

|

Box No. or Space |

||||||||||||||

|

TOTAL MONTHLY CASH INFLOWS: |

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||

|

TOTAL MONTHLY CASH OUTFLOWS: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Do you have checking account(s)? |

|

|

9 Yes 9 No |

|

Does your spouse, significant other, or dependant have a checking or savings |

||||||||||||||||||||||||||||||||

|

Bank Name: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

account that you enjoy the benefits of or make occasional contributions |

||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

toward? |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

Account No: |

|

|

|

|

|

|

|

|

|

Balance: |

|

|

|

9 Yes 9 No |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

|

Do you have savings account(s)? |

9 Yes 9 No |

|

Bank Name: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

Bank Name: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Account No: |

|

|

|

|

|

|

|

|

|

Balance: |

|||||||||

|

Account No: |

|

|

|

|

|

|

|

|

|

Balance: |

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||

|

Attach a complete listing of all other financial account information, if you have |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||

|

multiple accounts. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

List all expenditures over $500 (including e.g., goods, services, or gambling losses) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||

|

|

Date |

|

|

|

|

|

|

Amount |

|

Method of Payment |

|

|

|

|

|

|

|

Description of Item |

|||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

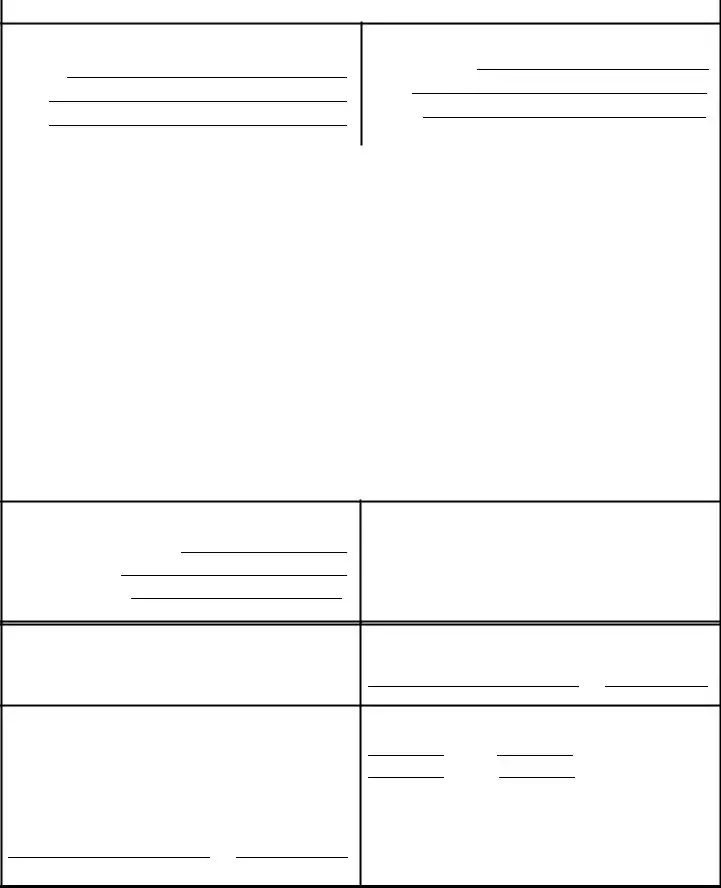

PROB 8 |

|

(09/00) |

Page 2 |

|

|

|

PART E: COMPLIANCE WITH CONDITIONS OF SUPERVISION DURING THE PAST MONTH |

Were you questioned by any law enforcement officers?

9 Yes |

9 No |

If yes, date:

Agency:

Reason:

Were you arrested or named as a defendant in any criminal case? 9 Yes 9 No

If yes, when and where?

Charges:

Disposition:

(Attach copy of citation, receipt, charges, disposition, etc.)

Were any pending charges disposed of during the month? |

|

|

|

|

Was anyone in your household arrested or questioned by law enforcement? |

||||||||||||||||||||

|

|

|

|

|

9 Yes |

9 |

No |

|

|

|

|

|

|

|

|

|

|

9 Yes |

9 No |

|

|

|

|

||

If yes, date: |

|

|

|

|

|

|

|

|

If yes, whom? |

|

|

|

|

|

|

||||||||||

Court: |

|

|

|

|

|

|

|

|

Reason: |

|

|

|

|

|

|

||||||||||

Disposition: |

|

|

|

|

|

|

|

Disposition: |

|

|

|

|

|

||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Do you have any contact with anyone having a criminal record? |

|

|

|

|

Do you possess or have access to a firearm? |

|

|

|

|

||||||||||||||||

|

|

|

|

|

9 Yes |

9 |

No |

|

|

|

|

|

|

|

|

|

|

9 Yes |

9 No |

|

|

|

|

||

If yes, whom? |

|

|

|

|

|

|

|

If yes, why? |

|

|

|

|

|

|

|

|

|||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Did you possess or use any illegal drugs? |

|

|

|

|

|

|

|

Did you travel outside the district without permission? |

|

|

|

|

|||||||||||||

|

|

|

|

|

9 Yes |

9 |

No |

|

|

|

|

|

|

|

|

|

|

9 Yes |

9 No |

|

|

|

|

||

If yes, type of drug: |

|

|

|

|

|

|

|

If yes, when and where? |

|

|

|

|

|

||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Do you have a special assessment, restitution, or fine? |

9 Yes |

9 No |

|

If yes, amount paid during the month: |

|

|

|

|

|||||||||||||||||

Special Assessment: |

|

|

|

|

|

Restitution: |

|

|

Fine: |

|

____ |

|

|

||||||||||||

NOTE: ALL PAYMENTS TO BE MADE BY MONEY ORDER (POSTAL OR BANK) OR CASHIER’S CHECK ONLY.

Do you have community service work to perform?

9 Yes |

9 No |

Number of hours completed this month:

Number of hours missed:

Balance of hours remaining:

Do you have drug, alcohol, or mental health aftercare? 9 Yes 9 No

If yes, did you miss any sessions during this month? 9 Yes 9 No

Did you fail to respond to phone recorder instructions?

|

9 Yes |

9 No |

If yes, why? |

|

|

WARNING: ANY FALSE STATEMENTS MAY RESULT IN REVOCATION OF PROBATION, SUPERVISED RELEASE, OR PAROLE, IN ADDITION TO 5 YEARS IMPRISONMENT, A $250,000 FINE, OR BOTH.

(18 U.S.C. § 1001)

I CERTIFY THAT ALL INFORMATION FURNISHED IS COMPLETE AND CORRECT.

SIGNATURE |

DATE |

REMARKS:

RECEIVED

MailOC

HCCC

RETURN TO:

U.S. Probation Officer |

Date |

Form Characteristics

| Fact Name | Fact Details |

|---|---|

| Purpose of the Form | The FedEx Commercial Invoice is a key document used in international shipping to declare the nature and value of goods shipped. |

| Required Information | The form requires details such as shipping and billing address, item description, quantity, and value for customs processing. |

| Governing Authority | Regulations for the Commercial Invoice are governed by U.S. Customs and Border Protection laws. |

| Payment of Duties | Correct completion of this form is essential as it determines the duty and taxes owed upon importation of goods. |

Guidelines on Utilizing Fedex Commercial Invoice

Completing the FedEx Commercial Invoice form is an important step in ensuring that your shipment adheres to international shipping requirements. This guide will help you accurately fill out the form, which can prevent delays and ensure smooth customs clearance.

- Locate the Form: Obtain a copy of the FedEx Commercial Invoice either online or at a FedEx location.

- Shipping Details: In the top section, fill in the seller's name, address, and contact information. This includes the company name, street address, city, state, and zip code.

- Recipient Information: Next, provide the recipient's name and full address, including any company names if applicable. Ensure that the address is complete and accurate.

- Description of Goods: List each item being shipped. Include a detailed description for every product, along with the corresponding quantity, value, and currency.

- Country of Origin: Specify the country where each item was manufactured or produced.

- Shipping Charges: Fill in the total value of shipping and handling charges, if applicable.

- Reason for Export: Clearly state the reason for exporting the items. Common reasons include sale, gift, or sample.

- Signature: Sign and date the form at the bottom, confirming the accuracy of the information provided.

- Attach Other Documents: If necessary, include any relevant documents, such as export licenses or certificates of origin.

- Review: Before submitting, carefully review all information for accuracy and completeness. Make any necessary corrections.

What You Should Know About This Form

What is the purpose of a FedEx Commercial Invoice?

The FedEx Commercial Invoice serves as a key document for international shipping. It outlines the details of the shipment, including the nature of the goods, their value, and any applicable customs information. This document is essential for customs clearance and helps ensure that your package is processed quickly upon arrival in another country.

Who needs to fill out the FedEx Commercial Invoice?

Anyone sending goods internationally, whether individuals or businesses, is required to fill out a FedEx Commercial Invoice. This applies to commercial shipments, personal gifts, and any items sold or traded across borders. Accurate completion of the invoice is crucial to prevent delays or additional charges during the shipping process.

What information is required on the Commercial Invoice?

The Commercial Invoice must include several important details. This includes the shipper's information (name, address, and contact), recipient's information, a description of the goods, the value of each item, and any applicable harmonized system codes. Additionally, it is necessary to declare if the shipment contains any restricted or controlled items.

How do I estimate the value of the goods on the Commercial Invoice?

The value of the goods should reflect their fair market value. If you are selling items, use the selling price. For gifts or personal items, estimate their worth based on similar products. Ensure this value is accurate, as misrepresenting it can lead to fines or confiscation by customs authorities.

Where should I place the Commercial Invoice?

The Commercial Invoice should be attached to the outside of your package in a clear plastic pouch or sleeve. This makes it easily accessible for customs inspections. If you're using FedEx services, the shipping label and invoice can be placed on the same side of the package to facilitate easy scanning and review.

What happens if I forget to include a Commercial Invoice?

If you fail to include a Commercial Invoice, your shipment could face significant delays. Customs officials may hold the package until the necessary documentation is provided. In some cases, the package may even be returned to the sender or refused entry into the destination country.

Can I use a Commercial Invoice for multiple items?

Yes, a single FedEx Commercial Invoice can be used for multiple items within the same shipment. Ensure you detail each item accurately, including its value and description. However, if the items vary significantly in terms of customs regulations or values, it may be advisable to use separate invoices for clarity and compliance.

Common mistakes

Filling out the FedEx Commercial Invoice form correctly is essential for smooth shipping processes. One common mistake is incomplete information. Omitting key details, such as the shipper's address or the recipient's contact information, can cause delays. Always ensure that every required field is filled out.

Another frequent error is the misclassification of goods. Some people underestimate the importance of accurately describing the items being shipped. Misclassifications can lead to fines or the return of goods. Hence, be precise when detailing item descriptions, including their values.

People also often forget to list the correct quantity of each item. Whether you’re sending a single item or multiple, it’s vital to accurately state how many of each item is being shipped. Missing quantities can result in misunderstandings or disagreements about the expected shipment contents.

In addition, not including the correct Harmonized System (HS) Codes can further complicate the shipping process. These codes help customs identify goods and apply proper tariffs or duties. Without the correct codes, shipments may be delayed at customs or even rejected.

Another mistake is failing to sign the form. The Commercial Invoice requires a signature to validate the information provided. Not signing it can render the document incomplete, potentially causing issues down the line.

Many individuals neglect to double-check the currency being used for the total value of the goods. Ensure that the currency is correctly specified, especially if shipping internationally. Different currencies can result in confusion and additional fees.

Finally, many people overlook the importance of keeping a copy of the completed Commercial Invoice. This document serves as proof of the transaction and may be needed for future reference. Keeping a copy can be invaluable if questions arise later regarding the shipment.

Documents used along the form

The FedEx Commercial Invoice form is a crucial document for international shipping. It provides essential details about the goods being shipped, including descriptions, quantities, and values. However, other forms and documents are often needed to ensure compliance with customs regulations and to facilitate smooth shipping processes. Here are four common documents used alongside the FedEx Commercial Invoice.

- Shipper's Letter of Instruction (SLI): This document provides instructions from the shipper to the carrier. It outlines how the shipment should be handled and any specific requests or important details regarding the shipment.

- Bill of Lading (BOL): The BOL serves as a contract between the shipper and the carrier. It details the shipment, confirms receipt of goods, and outlines the terms of transportation.

- Certificate of Origin: This document verifies the origin of the goods being shipped. It's often required by customs to determine applicable tariffs and trade regulations based on the country of origin.

- Export License: An export license may be necessary for certain goods being sent to specific countries. It ensures that the shipment complies with export regulations and restrictions that may be in place for national security or trade reasons.

Each of these documents plays a significant role in the shipping process. They not only facilitate the smooth movement of goods but also help ensure compliance with legal and regulatory requirements. Understanding these documents can make international shipping more efficient and less prone to delays.

Similar forms

- Commercial Invoice: Similar in purpose, the commercial invoice provides details about the goods being shipped internationally, including descriptions, quantities, and prices. The FedEx Commercial Invoice also serves as a legal document for customs clearance.

- Proforma Invoice: This document is a preliminary bill of sale sent to buyers in advance of a shipment or delivery of goods. Like the FedEx Commercial Invoice, it outlines the expected costs but is not a demand for payment.

- Bill of Lading: Serving as a contract between the shipper and carrier, the bill of lading details the specifics of the goods being transported. It functions similarly to the FedEx Invoice by documenting the shipping terms and responsibilities.

- Packing List: This document includes a detailed list of items included in the shipment. It complements the FedEx Commercial Invoice by helping customs officials verify cargo contents.

- Certificate of Origin: Often required by international customs, this document certifies the country of origin of the goods. Similar to the FedEx Commercial Invoice, it aids in the tariff assessment process.

- Shipping Manifest: This is a comprehensive document which lists all items on board a shipment. Like the FedEx Commercial Invoice, it provides vital information for logistics handling and customs inspection.

- Customs Declaration: Required for international shipping, this document informs customs officials of the specifics of imports or exports, echoing the information conveyed in the FedEx Commercial Invoice.

- Export License: This may be required for certain goods to be shipped abroad, confirming that export regulations are met. The purpose aligns with ensuring compliance in documentation like the FedEx Commercial Invoice.

- Sales Agreement: While primarily a contract between buyer and seller, it lays out terms of sale that can mirror some elements of the FedEx Commercial Invoice, specifically the role of pricing and product descriptions in the transaction.

Dos and Don'ts

When filling out the FedEx Commercial Invoice form, it is essential to ensure accuracy and completeness. To help you navigate the process, here are five things you should do, and five things you should avoid.

- Do: Provide complete and accurate descriptions of all items being shipped.

- Do: Include the correct value for each item. This helps with customs clearance.

- Do: Use clear and legible handwriting or type the form to avoid misunderstandings.

- Do: Ensure that the shipping and recipient addresses are correct.

- Do: Sign and date the form at the end to validate your information.

- Don't: Leave any fields blank. Even if an item does not apply, use "N/A" to indicate it.

- Don't: Estimate item values; always report the actual prices.

- Don't: Forget to include any required documents, such as licenses or permits for restricted items.

- Don't: Use vague descriptions of the items; be specific to avoid delays.

- Don't: Submit the invoice without reviewing it for errors or omissions.

Taking these steps will help ensure a smooth shipping experience and improve the chances of timely delivery. Simple mistakes can lead to significant delays, so attention to detail is paramount.

Misconceptions

Here are four common misconceptions about the FedEx Commercial Invoice form, along with explanations for each:

- It's only for international shipments. Many believe that the FedEx Commercial Invoice is necessary exclusively for international shipments. While it is crucial for customs clearance when sending items overseas, it can also be used during domestic shipments if the contents require detailed declarations, such as in certain business transactions.

- It is the same as a regular invoice. Some people confuse the FedEx Commercial Invoice with a standard invoice. However, a commercial invoice serves a different purpose. It provides details regarding the shipment for customs, including its value and description, whereas regular invoices usually pertain to billing and payment for services or goods.

- Filling it out is optional. Many think that submitting a Commercial Invoice is optional. This is not the case. For international shipments, it is mandatory to provide a properly completed Commercial Invoice. Failure to do so can result in delays or additional fees at customs.

- Once it’s submitted, no changes can be made. There is a misconception that once the Commercial Invoice is submitted, it cannot be altered. In reality, if an error is found or changes need to be made, it's possible to update the information before the package reaches customs. Timely action can help avoid complications.

Key takeaways

Filling out and using the FedEx Commercial Invoice form correctly is crucial for efficient shipping and customs clearance. Here are nine key takeaways:

- Accurate Information: Ensure all information provided on the invoice is precise. Errors could delay shipment or lead to additional fees.

- Item Description: Clearly describe each item being shipped. Use specific terms that align with industry standards.

- Value Declaration: Declare a correct value for all items. This value is used for duty assessment and insurance coverage.

- Country of Origin: Indicate the country of origin for each item. Customs officials require this information to determine trade agreements and tariffs.

- Sender and Recipient Details: Provide complete names and addresses for both the sender and recipient. Incomplete information can result in delivery issues.

- Shipping Terms: Specify the shipping terms, such as FOB (Free On Board) or CIF (Cost, Insurance, and Freight). Understanding these terms helps both parties manage costs effectively.

- Commercial Invoice Number: Include an invoice number for tracking purposes. This adds organization and helps in referencing the invoice if needed.

- Multiple Copies: Prepare multiple copies of the invoice. Besides the one included with the shipment, keep copies for your records and the consignee.

- Sign and Date: Remember to sign and date the invoice. This step certifies the accuracy of the information provided and is a necessary requirement.

By adhering to these guidelines, you can streamline the shipping process and avoid complications.

Browse Other Templates

Army Promotion Points Worksheet - Commands utilize the DA 3355 to tailor counseling sessions based on individual Soldier performance data.

Favn Rabies Antibody Test Hawaii - Timeliness and accuracy are critical in completing the FAVN Report Form for successful processing.

Flashcard Maker Free - The form ensures that each flashcard is easy to read and understand at a glance.