Fill Out Your Fedex Payroll Direct Deposit Form

When navigating the FedEx Payroll Direct Deposit form, employees are empowered to streamline their paycheck processing by choosing how their earnings are deposited into their bank accounts. This form is designed to cater to a variety of banking scenarios, offering options for both new setups and alterations to existing direct deposits. Users need to specify their branch details, account types, and the preferred deposit amounts, whether they wish to receive the full net paycheck or a specific sum. Importantly, the form also underscores the necessity for clear communication with the company regarding any changes or terminations in direct deposit agreements. Acknowledging potential processing delays and the importance of verifying deposits further enhances employee understanding of the direct deposit process. Signature authorization on this form reflects a commitment to these terms and conditions, and a copy of a voided check is requested to ensure correct account setup. With straightforward instructions and provisions, this form supports efficient payroll management while ensuring employees are informed about their financial arrangements.

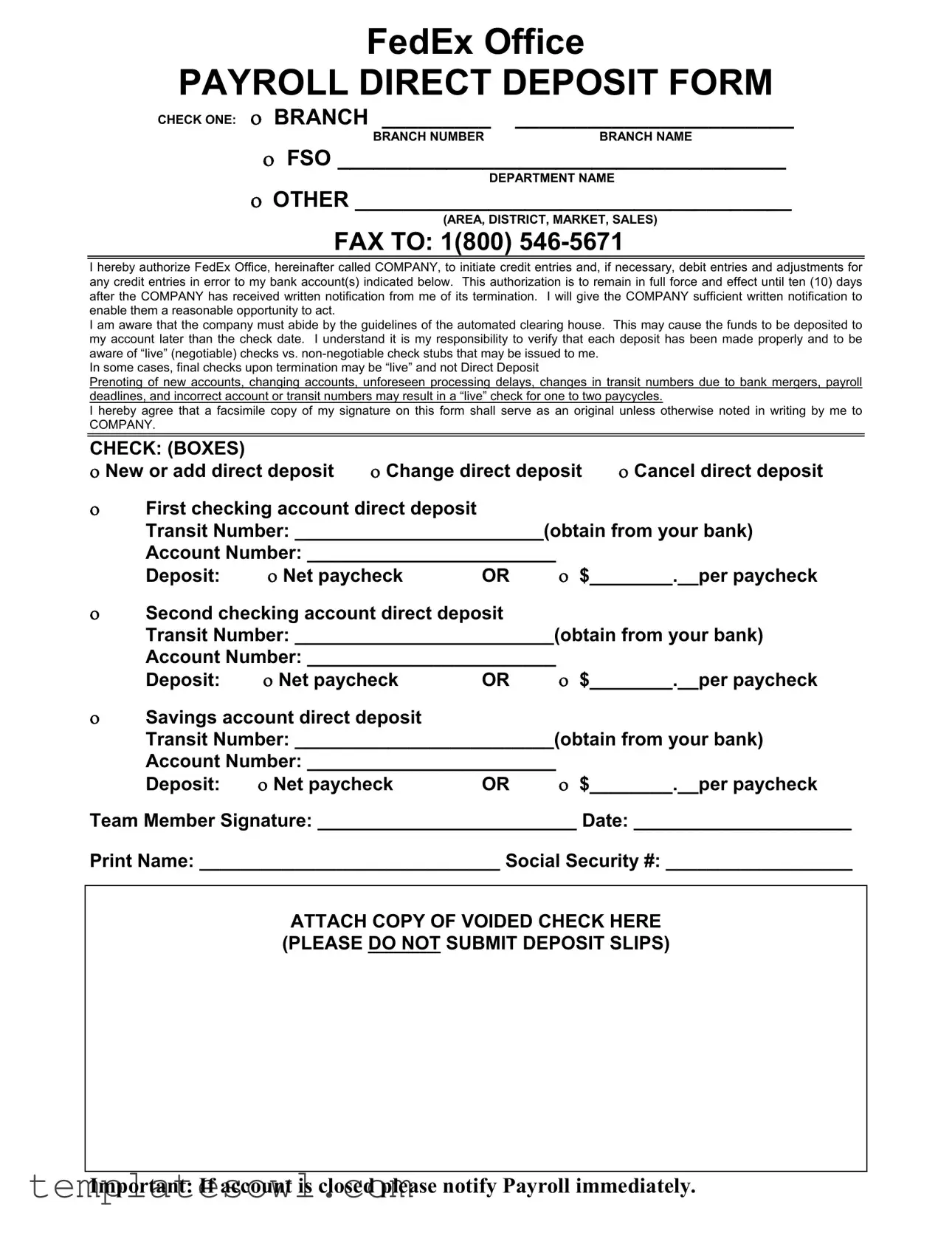

Fedex Payroll Direct Deposit Example

FedEx Office

PAYROLL DIRECT DEPOSIT FORM

CHECK ONE: ο BRANCH _________ |

_______________________ |

BRANCH NUMBER |

BRANCH NAME |

οFSO _____________________________________

DEPARTMENT NAME

οOTHER ____________________________________

(AREA, DISTRICT, MARKET, SALES)

FAX TO: 1(800)

I hereby authorize FedEx Office, hereinafter called COMPANY, to initiate credit entries and, if necessary, debit entries and adjustments for any credit entries in error to my bank account(s) indicated below. This authorization is to remain in full force and effect until ten (10) days after the COMPANY has received written notification from me of its termination. I will give the COMPANY sufficient written notification to enable them a reasonable opportunity to act.

I am aware that the company must abide by the guidelines of the automated clearing house. This may cause the funds to be deposited to my account later than the check date. I understand it is my responsibility to verify that each deposit has been made properly and to be aware of “live” (negotiable) checks vs.

In some cases, final checks upon termination may be “live” and not Direct Deposit

Prenoting of new accounts, changing accounts, unforeseen processing delays, changes in transit numbers due to bank mergers, payroll deadlines, and incorrect account or transit numbers may result in a “live” check for one to two paycycles.

I hereby agree that a facsimile copy of my signature on this form shall serve as an original unless otherwise noted in writing by me to

COMPANY.

CHECK: (BOXES) |

|

|

ο New or add direct deposit |

ο Change direct deposit |

ο Cancel direct deposit |

οFirst checking account direct deposit

Transit Number: ________________________(obtain from your bank)

Account Number: ________________________

Deposit: |

ο Net paycheck |

OR |

ο $________.__per paycheck |

οSecond checking account direct deposit

Transit Number: _________________________(obtain from your bank)

Account Number: ________________________

Deposit: |

ο Net paycheck |

OR |

ο $________.__per paycheck |

οSavings account direct deposit

Transit Number: _________________________(obtain from your bank)

Account Number: ________________________

Deposit: ο Net paycheck OR ο $________.__per paycheck

Team Member Signature: _________________________ Date: _____________________

Print Name: _____________________________ Social Security #: __________________

ATTACH COPY OF VOIDED CHECK HERE (PLEASE DO NOT SUBMIT DEPOSIT SLIPS)

Important: If account is closed please notify Payroll immediately.

Form Characteristics

| Fact Name | Description |

|---|---|

| Authorization | Employees authorize FedEx Office to initiate credit and debit entries to their designated bank accounts. |

| Notification Period | The authorization remains effective until ten days after FedEx Office receives written notification of termination from the employee. |

| Processing Delays | There may be processing delays due to various factors such as bank mergers, payroll deadlines, or incorrect account information. |

| Facsimile Signatures | A facsimile copy of the employee's signature is considered an original unless stated otherwise in writing. |

| Checking Accounts | Employees can elect to deposit their net paycheck or a specified amount into one or more checking accounts. |

| Savings Account Options | Direct deposits can also be arranged for savings accounts, following the same options for net pay or specified amounts. |

| Important Notifications | Employees must notify Payroll immediately if their bank account is closed to avoid payment issues. |

Guidelines on Utilizing Fedex Payroll Direct Deposit

Filling out the FedEx Payroll Direct Deposit form is a straightforward process. You will need to provide accurate bank account details to ensure your paycheck is deposited correctly. Follow these steps carefully to complete the form successfully.

- Select the appropriate option: Check one of the boxes indicating whether you are adding a new direct deposit, changing your direct deposit, or canceling your direct deposit.

- Fill in your branch information: Write the branch name and branch number as required.

- Complete the department name: Enter your department name or any relevant area information in the space provided.

- Provide the bank account details:

- For your first checking account, fill in the transit number (contact your bank for this) and your account number.

- Choose how much of your paycheck to deposit: select "Net paycheck" or specify a dollar amount.

- If applicable, add a second checking account by repeating the above step.

- For a savings account, again fill in the transit number and account number. Specify the deposit amount in the same manner.

- Sign and date the form: Provide your signature, date of completion, and print your name clearly.

- Provide your Social Security number: Write your Social Security number in the designated space.

- Attach documentation: Include a copy of a voided check with the form. Do not submit deposit slips.

After completing the form, fax it to the appropriate number indicated on the document. Make sure to keep a copy for your records, and notify Payroll immediately if you encounter any issues or changes regarding your bank account.

What You Should Know About This Form

What is the purpose of the FedEx Payroll Direct Deposit form?

The FedEx Payroll Direct Deposit form allows employees to authorize FedEx to deposit their pay directly into their bank accounts. This service ensures timely and secure payment without the need for physical checks. Employees can choose to deposit their net paycheck or a specified amount into one or multiple accounts.

How do I fill out the FedEx Payroll Direct Deposit form?

To complete the form, you need to check the appropriate boxes that indicate your choice of action: whether it is a new deposit, a change, or a cancellation. Then, provide the branch number and name, department name, and your selected bank account details, including transit and account numbers. Make sure to attach a copy of a voided check and sign and date the form before submission.

Where do I send the completed form?

The completed form should be faxed to 1(800) 546-5671. It is important to ensure that the form is submitted to the correct number to avoid any processing delays.

What happens if I need to change my bank account information?

If you need to change your bank account information, you must submit a new Payroll Direct Deposit form with the updated details. This new authorization will replace your previous registration. Ensure you allow enough processing time, as changes may result in receiving a physical check for one to two pay cycles due to unforeseen delays.

Will my direct deposit take effect immediately?

Direct deposits do not go into effect immediately upon submitting the form. It typically takes at least one payroll cycle for the changes to be processed. In some cases, if there are any issues with bank information or processing, it could result in receiving a physical check until everything is settled.

What information do I need from my bank to complete the form?

You will need the transit number and account number from your bank. This information is crucial for ensuring that the funds are deposited into the correct account. It is advisable to verify these numbers with your bank to avoid any errors that could delay your payment.

What should I do if my account is closed?

If your bank account is closed, you should notify the Payroll department immediately to prevent any issues with your pay deposits. Submit a new Payroll Direct Deposit form with your updated banking information at the same time to ensure a smooth transition.

Common mistakes

Filling out the FedEx Payroll Direct Deposit form is a straightforward process, but several mistakes can hinder its effectiveness. One common error occurs when individuals forget to check the appropriate box indicating the type of direct deposit request they are submitting. This oversight leaves the payroll department unsure whether to initiate a new deposit, change an existing one, or cancel a deposit altogether. Clear instructions are provided, yet the importance of this step is often underestimated.

A second mistake arises from inaccurate account and transit numbers. Many people neglect to double-check these numbers with their bank, leading to potential delays or misdirected funds. A single digit error can result in significant complications. This not only affects timely access to funds but may also require additional time to resolve the issue, thereby increasing frustration for everyone involved.

Another frequent misconception involves the completion of the deposit amount section. Some individuals mistakenly leave this section blank or fail to specify whether they want their entire paycheck directly deposited or only a portion of it. This can cause confusion for payroll staff, leading to incomplete transactions. Clarity in this area helps ensure that the desired amount is processed correctly without unnecessary interruptions.

Lastly, many people overlook the requirement for a voided check. Instead, they might mistakenly submit a deposit slip, which is not acceptable per the instructions. Failing to attach the correct documentation can result in delays or even rejection of the direct deposit request, creating unnecessary hassle. Paying attention to these details is crucial for a smooth payroll process.

Documents used along the form

The FedEx Payroll Direct Deposit Form is an essential document that facilitates quick and efficient payment processing for employees. Along with this form, several additional documents often play a crucial role in ensuring smooth payroll operations. Here are five forms and documents commonly used in conjunction with the Direct Deposit Form:

- Voided Check: This document provides your bank account details, including the account number and transit (routing) number. A voided check must be attached to the Direct Deposit Form, as it confirms the account where your paycheck will be deposited.

- W-4 Form: This form is used to determine the amount of federal income tax withholding from your pay. Completing the W-4 accurately ensures that the right amount is deducted, avoiding surprises during tax season.

- State Tax Withholding Form: Similar to the W-4, this form relates to your state taxes. It allows you to provide the necessary information for state-level tax deductions, which vary based on where you live and work.

- Employment Eligibility Verification (I-9): The I-9 form verifies your identity and eligibility to work in the United States. Completing this form is essential for compliance with federal law and must be submitted shortly after you start employment.

- Direct Deposit Pre-Notification Letter: In some cases, this letter notifies employees about upcoming changes to direct deposit accounts or banking information. It ensures that employees are aware of any potential disruptions in their pay deposits.

Understanding these additional forms can simplify the payroll process and minimize any potential issues. Being prepared with the necessary documentation helps ensure that your payments are timely and accurate, putting your mind at ease regarding your finances.

Similar forms

- Bank Account Authorization Form: Like the FedEx Payroll Direct Deposit form, a Bank Account Authorization Form is designed to facilitate electronic direct deposit. It grants permission to the designated entity to deposit funds directly into the account holder's bank account. Both documents require account details and maintain a continuous authorization until revoked.

- W-4 Form: The W-4 form, used by employees to detail their tax withholding preferences, shares similarities with the direct deposit form in that both require personal information and must be submitted to the employer. Each form plays a crucial role in ensuring the employee receives their accurate payment or refund, as intended.

- Change of Address Form: Much like the FedEx Payroll Direct Deposit form, the Change of Address Form is essential for keeping personal records up-to-date with an employer. Both documents require action from the employee to ensure that any changes are communicated effectively and recorded accurately in the company's system.

- Employment Verification Form: An Employment Verification Form confirms details about an employee's status and compensation. Similar to the FedEx Payroll Direct Deposit form, this document serves to ensure that accurate and pertinent information is communicated to financial institutions or other requesting entities.

Dos and Don'ts

When completing the FedEx Payroll Direct Deposit form, it's essential to follow certain guidelines to ensure accuracy and efficiency. Here is a list of do's and don'ts:

- Do fill in all required fields neatly and legibly.

- Do use the correct transit and account numbers obtained directly from your bank.

- Do indicate whether you are setting up, changing, or canceling a direct deposit.

- Do attach a copy of a voided check; avoid submitting deposit slips.

- Do sign and date the form at the bottom.

- Don’t forget to update the Payroll department if you close your account.

- Don’t submit the form without verifying all information for accuracy.

- Don’t leave any section blank that is required; this can cause processing delays.

- Don’t assume the direct deposit will start immediately; processing may take time.

- Don’t forget to keep a copy of the completed form for your records.

Misconceptions

Understanding the FedEx Payroll Direct Deposit form is essential for team members. Unfortunately, there are several misconceptions that can lead to confusion. Here are nine of the most common misconceptions explained:

- Direct Deposit is Instantaneous: Many believe that once they submit the form, their direct deposit will begin immediately. In reality, it may take one or two pay cycles before the change is reflected in your paycheck.

- Only One Account Can Be Used: Some assume they can deposit their paycheck into only one account. In fact, the form allows for multiple accounts, including checking and savings accounts, as specified.

- All Errors Will Be Instantly Corrected: A common belief is that any error in account numbers will be immediately rectified. However, errors can lead to delays, and it often requires a written notification to correct any issues.

- Live Checks Are a Thing of the Past: Many think that with direct deposit, there will never be a live check issued. This is not true; in cases of processing delays or errors, live checks may still be issued temporarily.

- You Don’t Need to Verify Deposits: There is a misconception that once the direct deposit is set up, verification is no longer necessary. However, it is crucial to check your bank account to ensure each deposit is made correctly.

- Only Employees Can Submit the Form: There's a belief that only employees can fill out and submit the form. Flexibility is provided, allowing a designated representative to submit the form when necessary.

- No Notification Before Changes: Some team members think they can change accounts without notifying the company. However, it is essential to provide sufficient written notification before making any changes.

- Faxing Will Always Be Successful: Many rely solely on faxing the form, believing it will always be received. Faxes can fail; thus, confirming receipt or following up is advisable.

- Account Information Can Be Mixed Up: Verifying account and transit numbers is often overlooked. Any mistakes in these numbers can lead to funds being sent to an incorrect account.

Being aware of these misconceptions can greatly improve the direct deposit experience for team members. Staying informed helps ensure a smooth payroll process.

Key takeaways

When filling out the FedEx Payroll Direct Deposit form, consider the following key takeaways:

- Authorization Requirement: You must authorize FedEx Office to make deposits to your bank account. This includes agreeing to potential debit entries for errors.

- Notification for Changes: If you wish to terminate this authorization, provide written notification at least ten days in advance to allow for processing.

- Verification Responsibility: It is important that you verify each deposit to ensure it has been made properly and be aware of the distinction between live checks and non-negotiable stubs.

- Potential Payment Delays: Be mindful that changes, such as opening new accounts or incorrect information, may lead to temporary delays or the issuance of live checks.

- Signature Validity: A facsimile of your signature on the form is considered valid unless you indicate otherwise in writing.

For a smooth direct deposit experience, ensure that you fill out the form completely and accurately.

Browse Other Templates

Is Property Tax Based on Purchase Price - The form discusses options for filing complaints based on denied tax exemptions.

Nyc Doing Business Data Form - This form must be filled out by city agencies before initiating transactions.

Hpd Section 8 Apartments Listings - Filing this form correctly is crucial for maintaining your eligibility in the Section 8 program.