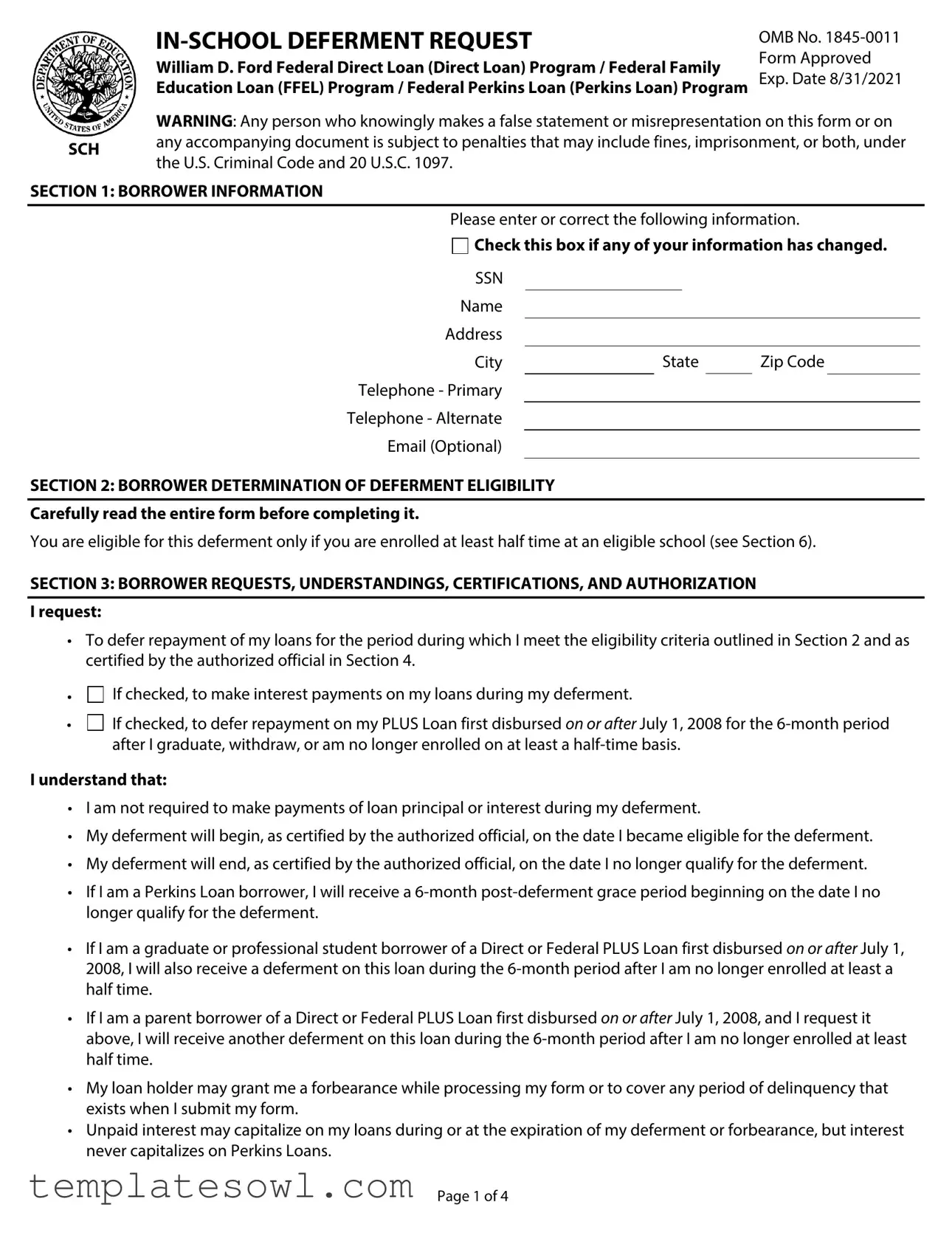

Fill Out Your Fedloan Servicing Deferment Form

The Fedloan Servicing Deferment form is a crucial document for borrowers seeking to temporarily postpone their student loan payments. It is designed for those enrolled at least half-time in an eligible educational institution. This form requires personal information such as the borrower's name, Social Security number, contact details, and a declaration of their enrollment status. Section 2 outlines eligibility requirements, while Section 3 details the specific requests and certifications a borrower must acknowledge. This section includes options for interest payments during the deferment period and explains how the deferment period begins and ends, especially for PLUS Loans and Perkins Loans. Moreover, the form emphasizes the importance of accurate and truthful information, as providing false statements can lead to severe consequences under federal law. Additionally, borrowers are required to obtain certification from an authorized official at their school regarding their enrollment status, which supports their deferment eligibility. Clear instructions are provided to assist in the completion of the form and to guide borrowers on where to submit it. Understanding these aspects is essential for borrowers to navigate their deferment options effectively.

Fedloan Servicing Deferment Example

OMB No. |

||

William D. Ford Federal Direct Loan (Direct Loan) Program / Federal Family |

Form Approved |

|

Exp. Date 8/31/2021 |

||

Education Loan (FFEL) Program / Federal Perkins Loan (Perkins Loan) Program |

WARNING: Any person who knowingly makes a false statement or misrepresentation on this form or on

SCH any accompanying document is subject to penalties that may include fines, imprisonment, or both, under the U.S. Criminal Code and 20 U.S.C. 1097.

SECTION 1: BORROWER INFORMATION

Please enter or correct the following information.

Check this box if any of your information has changed.

Check this box if any of your information has changed.

SSN |

|

|

|

|

|

|

|

Name |

|

|

|

|

|

|

|

Address |

|

|

|

|

|

|

|

City |

|

|

State |

|

Zip Code |

|

|

Telephone - Primary |

|

|

|

|

|

|

|

Telephone - Alternate |

|

|

|

|

|

|

|

Email (Optional) |

|

|

|

|

|

|

|

SECTION 2: BORROWER DETERMINATION OF DEFERMENT ELIGIBILITY

Carefully read the entire form before completing it.

You are eligible for this deferment only if you are enrolled at least half time at an eligible school (see Section 6).

SECTION 3: BORROWER REQUESTS, UNDERSTANDINGS, CERTIFICATIONS, AND AUTHORIZATION

Irequest:

•To defer repayment of my loans for the period during which I meet the eligibility criteria outlined in Section 2 and as certified by the authorized official in Section 4.

•

•

If checked, to make interest payments on my loans during my deferment.

If checked, to defer repayment on my PLUS Loan first disbursed on or after July 1, 2008 for the

I understand that:

•I am not required to make payments of loan principal or interest during my deferment.

•My deferment will begin, as certified by the authorized official, on the date I became eligible for the deferment.

•My deferment will end, as certified by the authorized official, on the date I no longer qualify for the deferment.

•If I am a Perkins Loan borrower, I will receive a

•If I am a graduate or professional student borrower of a Direct or Federal PLUS Loan first disbursed on or after July 1, 2008, I will also receive a deferment on this loan during the

•If I am a parent borrower of a Direct or Federal PLUS Loan first disbursed on or after July 1, 2008, and I request it above, I will receive another deferment on this loan during the

•My loan holder may grant me a forbearance while processing my form or to cover any period of delinquency that exists when I submit my form.

•Unpaid interest may capitalize on my loans during or at the expiration of my deferment or forbearance, but interest never capitalizes on Perkins Loans.

Page 1 of 4

Borrower NameBorrower SSN

SECTION 3: BORROWER REQUESTS, UNDERSTANDINGS, CERTIFICATIONS, AND AUTHORIZATION (CONTINUED)

I certify that:

•The information I have provided on this form is true and correct.

•I will provide additional documentation to my loan holder, as required, to support my deferment eligibility.

•I will notify my loan holder immediately when my eligibility for the deferment ends.

•I have read, understand, and meet the eligibility requirements in Section 2.

I authorize the entity to which I submit this request and its agents to contact me regarding my request or my loans at any cellular telephone number that I provide now or in the future using automated telephone dialing equipment or artificial or prerecorded voice or text messages.

Borrower's Signature |

|

Date |

SECTION 4: AUTHORIZED OFFICIAL'S CERTIFICATION |

|

|

Note: As an alternative to completing this section, you may attach separate documentation from an authorized official that includes all of the information requested below or have your school report your enrollment to the National Student Loan Data System (NSLDS) at nsldsfap.ed.gov.

•The student is/was enrolled at the school below:

Full time

Full time

At least half time, but less than full time

At least half time, but less than full time

•Is the student enrolled at the school below as a regular student?

Yes

Yes

No

No

•The student's enrollment status begins/began on:

•The student's enrollment status ends/ended on:

•The student is expected to complete his/her program requirements on:

I certify, to the best of my knowledge and belief, that the information that I have provided in this section is accurate.

Name of School |

|

|

|

|

OPEID |

|

|

|

|||||

Address |

|

City |

|

|

State |

|

|

Zip Code |

|

||||

Official's Name/Title |

|

|

|

Telephone |

|

|

|

|

|||||

Official's Signature |

|

|

|

|

Date |

|

|

|

|

||||

SECTION 5: INSTRUCTIONS FOR COMPLETING THE DEFERMENT REQUEST

Type or print using dark ink. Enter dates as

Page 2 of 4

SECTION 6: DEFINITIONS

|

The William D. Ford Federal Direct Loan (Direct Loan) |

A deferment is a period during which you are entitled to |

||||||||

Program includes Federal Direct Stafford/Ford (Direct |

postpone repayment of your loans. Interest is not generally |

|||||||||

Subsidized) Loans, Federal Direct Unsubsidized Stafford/ |

charged to you during a deferment on your subsidized loans. |

|||||||||

Ford (Direct Unsubsidized) Loans, Federal Direct PLUS |

Interest is always charged to you during a deferment on your |

|||||||||

(Direct PLUS) Loans, and Federal Direct Consolidation |

unsubsidized loans. On loans made under the Perkins Loan |

|||||||||

(Direct Consolidation) Loans. |

|

|

Program, all deferments are followed by a |

|||||||

|

The Federal Family Education Loan (FFEL) Program |

grace period of 6 months, during which time you are not |

||||||||

|

required to make payments. |

|

|

|

||||||

includes Federal Stafford Loans, Federal PLUS Loans, Federal |

|

|

|

|||||||

An eligible school is a school that has been approved by |

||||||||||

Consolidation Loans, and Federal Supplemental Loans for |

||||||||||

Students (SLS). |

|

|

the Department to participate in the Department's Federal |

|||||||

|

The Federal Perkins Loan (Perkins Loan) Program |

Student Aid programs, even if the school does not participate |

||||||||

includes Federal Perkins Loans, National Direct Student |

in those programs. |

|

|

|

|

|||||

Loans (NDSL), and National Defense Student Loans (Defense |

A forbearance is a period during which you are permitted |

|||||||||

Loans). |

|

|

||||||||

|

|

to postpone making payments temporarily, allowed an |

||||||||

|

An authorized official who may complete Section 4 is |

|||||||||

|

extension of time for making payments, or temporarily |

|||||||||

an official of the school where you are/were enrolled. |

allowed to make smaller payments than scheduled. |

|||||||||

|

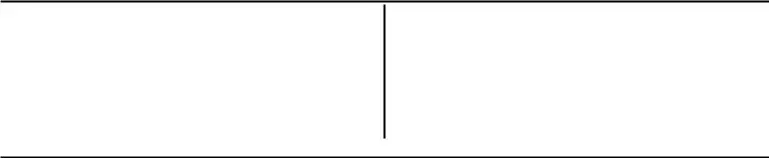

Capitalization is the addition of unpaid interest to the |

The holder of your Direct Loans is the Department. The |

||||||||

principal balance of your loan. Capitalization causes more |

holder of your FFEL Program loans may be a lender, guaranty |

|||||||||

interest to accrue over the life of your loan and may cause |

agency, secondary market, or the Department. The holder of |

|||||||||

your monthly payment amount to increase. Interest never |

your Perkins Loans is an institution of higher education or the |

|||||||||

capitalizes on Perkins Loans. Table 1 (below) provides an |

Department. Your loan holder may use a servicer to handle |

|||||||||

example of the monthly payments and the total amount |

billing and other communications related to your loans. |

|||||||||

repaid for a $30,000 unsubsidized loan. The example loan |

References to “your loan holder” on this form mean either |

|||||||||

has a 6% interest rate and the example deferment or |

your loan holder or your servicer. |

|

|

|||||||

forbearance lasts for 12 months and begins when the loan |

A regular student is a person who is enrolled or accepted |

|||||||||

entered repayment. The example compares the effects of |

||||||||||

for enrollment at an institution for the purpose of obtaining a |

||||||||||

paying the interest as it accrues or allowing it to capitalize. |

||||||||||

degree, certificate, or other recognized educational credential |

||||||||||

|

A |

|||||||||

|

offered by the institution. |

|

|

|

||||||

borrowers on a Direct or Federal Consolidation Loan or a |

A subsidized loan is a Direct Subsidized Loan, a Direct |

|||||||||

Federal PLUS Loan. Both borrowers are equally responsible |

||||||||||

Subsidized Consolidation Loan, a Federal Subsidized Stafford |

||||||||||

for repaying the full amount of the loan. |

|

|||||||||

|

Loan, portions of some Federal Consolidation Loans, a Federal |

|||||||||

|

|

|

|

|||||||

|

|

|

|

Perkins Loan, an NDSL, and a Defense Loan. |

|

|

||||

|

|

|

|

An unsubsidized loan is a Direct Unsubsidized Loan, a |

||||||

|

|

|

|

Direct Unsubsidized Consolidation Loan, a Direct PLUS Loan, a |

||||||

|

|

|

|

Federal Unsubsidized Stafford Loan, a Federal PLUS Loan, a |

||||||

|

|

|

|

Federal SLS, and portions of some Federal Consolidation |

||||||

|

|

|

|

Loans. |

|

|

|

|

||

Table 1. Capitalization Chart |

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

Treatment of Interest with |

Loan |

Capitalized |

Outstanding |

|

Monthly |

Number of |

Total |

||

|

Deferment/Forbearance |

Amount |

Interest |

Principal |

|

Payment |

Payments |

Repaid |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Interest is paid |

$30,000 |

$0 |

$30,000 |

|

$333 |

120 |

$41,767 |

|

|

|

|

|

|

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

Interest is capitalized at the |

$30,000 |

$1,800 |

$31,800 |

|

$353 |

120 |

$42,365 |

|

|

|

end |

|

|

|||||||

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

Interest is capitalized |

$30,000 |

$1,841 |

$31,841 |

|

$354 |

120 |

$42,420 |

|

|

|

quarterly and at the end |

|

|

|||||||

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

Page 3 of 4

SECTION 7: WHERE TO SEND THE COMPLETED DEFERMENT REQUEST

Return the completed form and any documentation to: |

If you need help completing this form, call: |

(If no address is shown, return to your loan holder.) |

(If no phone number is shown, call your loan holder.) |

SECTION 8: IMPORTANT NOTICES

Privacy Act Notice. The Privacy Act of 1974 (5 U.S.C. |

|

To assist program administrators with tracking refunds |

|

552a) requires that the following notice be provided to you: |

and cancellations, disclosures may be made to guaranty |

||

The authorities for collecting the requested information |

agencies, to financial and educational institutions, or to |

||

federal or state agencies. To provide a standardized method |

|||

from and about you are §421 et seq., §451 et seq., or §461 |

|||

for educational institutions to efficiently submit student |

|||

et. seq. of the Higher Education Act of 1965, as amended (20 |

|||

enrollment statuses, disclosures may be made to guaranty |

|||

U.S.C. 1071 et seq., 20 U.S.C. 1087a et seq., or 20 U.S.C. |

|

||

|

agencies or to financial and educational institutions. To |

||

1087aa et seq.) and the authorities for collecting and using |

|||

counsel you in repayment efforts, disclosures may be made |

|||

your Social Security Number (SSN) are §§428B(f) and 484(a) |

|||

to guaranty agencies, to financial and educational |

|||

(4) of the HEA (20 U.S.C. |

|

||

|

institutions, or to federal, state, or local agencies. |

||

U.S.C. 7701(b). Participating in the William D. Ford Federal |

|||

|

|||

Direct Loan (Direct Loan) Program, Federal Family Education |

In the event of litigation, we may send records to the |

||

Loan (FFEL) Program, or Federal Perkins Loan (Perkins Loan) |

Department of Justice, a court, adjudicative body, counsel, |

||

Program and giving us your SSN are voluntary, but you must |

party, or witness if the disclosure is relevant and necessary |

||

provide the requested information, including your SSN, to |

to the litigation. If this information, either alone or with |

||

participate. |

|

other information, indicates a potential violation of law, we |

|

The principal purposes for collecting the information on |

may send it to the appropriate authority for action. We may |

||

send information to members of Congress if you ask them |

|||

this form, including your SSN, are to verify your identity, to |

|||

to help you with federal student aid questions. In |

|||

determine your eligibility to receive a loan or a benefit on a |

|||

circumstances involving employment complaints, |

|||

loan (such as a deferment, forbearance, discharge, or |

|

||

|

grievances, or disciplinary actions, we may disclose relevant |

||

forgiveness) under the Direct Loan, FFEL, or Federal Perkins |

|||

records to adjudicate or investigate the issues. If provided |

|||

Loan Programs, to permit the servicing of your loans, and, if |

|||

for by a collective bargaining agreement, we may disclose |

|||

it becomes necessary, to locate you and to collect and |

|

||

|

records to a labor organization recognized under 5 U.S.C. |

||

report on your loans if your loans become delinquent or |

|

||

|

Chapter 71. Disclosures may be made to our contractors for |

||

default. We also use your SSN as an account identifier and to |

|||

the purpose of performing any programmatic function that |

|||

permit you to access your account information |

|

||

|

requires disclosure of records. Before making any such |

||

electronically. |

|

||

|

disclosure, we will require the contractor to maintain Privacy |

||

The information in your file may be disclosed, on a case- |

|||

Act safeguards. Disclosures may also be made to qualified |

|||

|

|||

|

researchers under Privacy Act safeguards. |

||

third parties as authorized under routine uses in the |

|

||

|

Paperwork Reduction Notice. According to the |

||

appropriate systems of records notices. The routine uses of |

|||

Paperwork Reduction Act of 1995, no persons are required |

|||

this information include, but are not limited to, its disclosure |

|||

to respond to a collection of information unless such |

|||

to federal, state, or local agencies, to private parties such as |

|||

collection displays a valid OMB control number. The valid |

|||

relatives, present and former employers, business and |

|

||

|

OMB control number for this information collection is |

||

personal associates, to consumer reporting agencies, to |

|

||

|

|||

financial and educational institutions, and to guaranty |

|

||

|

information is estimated to average 10 minutes per |

||

agencies in order to verify your identity, to determine your |

|||

response, including time for reviewing instructions, |

|||

eligibility to receive a loan or a benefit on a loan, to permit |

|||

searching existing data sources, gathering and maintaining |

|||

the servicing or collection of your loans, to enforce the |

|

||

|

the data needed, and completing and reviewing the |

||

terms of the loans, to investigate possible fraud and to verify |

|||

collection of information. The obligation to respond to this |

|||

compliance with federal student financial aid program |

|

||

|

collection is required to obtain a benefit in accordance with |

||

regulations, or to locate you if you become delinquent in |

|

||

|

34 CFR 674.34, 674.35, 674.36, 674.37, 682.210, or 685.204. |

||

your loan payments or if you default. To provide default rate |

|||

If you have comments or concerns regarding the |

|||

calculations, disclosures may be made to guaranty agencies, |

|||

status of your individual submission of this form, please |

|||

to financial and educational institutions, or to state |

|

||

|

contact your loan holder directly (see Section 7). |

||

agencies. To provide financial aid history information, |

|

||

|

|

||

disclosures may be made to educational institutions. |

Page 4 of 4 |

||

Form Characteristics

| Fact Name | Fact Description |

|---|---|

| Eligibility Criteria | To qualify for deferment, students must be enrolled at least half-time at an eligible educational institution. |

| Loan Types Covered | The form applies to Direct Loans, FFEL Loans, and Perkins Loans. |

| Certification Requirement | An authorized official from the educational institution must certify the student's enrollment status. |

| Consequences of False Information | Submitting false information may lead to penalties including fines or imprisonment under U.S. law. |

| Post-Deferment Grace Period | Perkins Loan borrowers receive a 6-month grace period after the deferment period ends. |

| State Laws and Regulations | The government follows federal guidelines, but check local state laws for any additional regulations. |

Guidelines on Utilizing Fedloan Servicing Deferment

Completing the Fedloan Servicing Deferment form requires careful attention to detail. After submitting the form, your loan holder will review your request. They will determine your eligibility for deferment based on the information you provide and any required documentation. To ensure a smooth process, follow the instructions outlined below.

- Begin by entering your borrower information in Section 1. Fill in your Social Security Number, name, address, city, state, zip code, primary and alternate telephone numbers, and email (if you choose).

- In Section 2, make sure to read the deferment eligibility criteria. Confirm your enrollment status at your school, ensuring it is at least half-time.

- Proceed to Section 3 to make your requests. Indicate if you wish to defer repayment and whether you will make interest payments during the deferment period. Also, specify if you wish to extend the deferment for any PLUS loans.

- Carefully read the understandings and certifications listed. Ensure you understand your responsibilities and the details associated with the deferment.

- Sign and date the form at the bottom of Section 3 to certify the information is accurate and true.

- In Section 4, have an authorized official from your school fill out their portion to confirm your enrollment status. This includes the expected start and end dates of your enrollment.

- Once all sections are complete, refer to Section 5 for instructions. Type or print clearly using dark ink, and include your name and account number on any supplementary documentation.

- If you have loans serviced by different holders, prepare a separate form for each.

- After reviewing the entire form for accuracy, return it along with any required documentation to the address provided in Section 7.

What You Should Know About This Form

What is the purpose of the Fedloan Servicing Deferment form?

The Fedloan Servicing Deferment form allows borrowers to request a temporary pause in loan repayment while they meet particular eligibility criteria, such as being enrolled at least half-time in an eligible school. By completing this form, borrowers can defer both the principal and interest payments on certain types of loans, helping to alleviate financial stress during periods of education or other qualifying circumstances.

Who is eligible to apply for deferment using this form?

Eligibility for deferment requires borrowers to be enrolled at least half-time in an eligible school. This means that the institution must be approved to participate in federal student aid programs. Additionally, borrowers must sign and submit the form to confirm their eligibility status. Eligibility varies based on the type of loan, so it is essential to read the guidelines outlined in Section 2 of the form carefully.

What information is required to fill out the deferment request form?

Several key pieces of information are necessary to complete the deferment request form. Borrowers must provide their Social Security number, name, address, and contact details. In addition, they need to indicate their enrollment status and provide details about the school they are attending. It is also crucial to check for any changes in personal information before submitting the form, by marking the appropriate box provided.

What happens after submitting the deferment request form?

Once the deferment request form is submitted, the borrower’s loan holder will review the application. If approved, the loan holder will grant deferment from the date eligibility criteria are met until the borrower no longer qualifies. Borrowers may be eligible for a grace period after this time, specifically for Perkins Loan borrowers, which offers an additional six months before payments must resume. If there are any delays or issues with the processing of the form, the loan holder may grant a temporary forbearance to manage any existing delinquency.

Are there any consequences if I do not notify my loan holder when my deferment eligibility ends?

Failing to notify the loan holder when your eligibility for deferment ends can have financial implications. If the borrower does not inform the loan holder of changes in enrollment status, payments may resume without prior warning, potentially leading to missed payments and, consequently, negative impacts on credit scores. It is important to be proactive and communicate any changes in status as soon as possible to avoid complications with loan repayment and credit standing.

Common mistakes

Filling out the Fedloan Servicing Deferment form accurately is essential to ensure that your request is processed smoothly. However, many borrowers make common mistakes that can lead to delays or even denials of their deferment requests. Here are several mistakes to watch out for.

One prevalent mistake is neglecting to verify personal information. It’s vital to ensure that your Social Security Number, name, address, and contact details are correct. Any inaccuracies can create confusion and lead to processing problems. Staying attentive to these details can save time and frustration later.

Another error involves failing to read the eligibility criteria. The form specifies that borrowers must be enrolled at least half-time at an eligible school. Yet, some individuals may not fully understand or adhere to this requirement, inadvertently applying for deferment when they are not eligible. Carefully reviewing Section 2 can clarify whether you qualify.

Some borrowers also forget to check the necessary boxes in the authorization section. These boxes indicate whether you wish to make interest payments or defer repayment on specific loans. Neglecting to check the appropriate options can lead to misunderstandings about the terms of your deferment.

Moreover, individuals often overlook the importance of obtaining and submitting the authorized official’s certification. An authorized official must verify your enrollment status. Failure to complete Section 4 or attach the appropriate documentation could result in delays, as the loan holder requires this confirmation to process your deferment.

Equally important is the presentation of additional documentation. Borrowers may be unaware that they might need to provide further proof of eligibility. Submitting incomplete information can stall your deferment request. Always check what documentation is required to accompany your application.

Additionally, people sometimes misinterpret the instructions regarding dates. Listing incorrect dates, such as the start or end of your enrollment, can lead to complications. Dates must be entered as specified in the instructions to avoid errors that could jeopardize your application.

Lastly, many individuals do not return the completed form to the correct address. Double-checking this detail is crucial. Sending the form to the wrong loan holder can create significant delays, impacting your financial situation. Always ensure you know where to send the form as indicated in Section 7.

By being aware of these common errors, borrowers can fill out the Fedloan Servicing Deferment form with greater accuracy, ensuring a smoother process for deferment approval.

Documents used along the form

When applying for a deferment using the FedLoan Servicing Deferment form, you may encounter several additional documents that are critical to support your request. These documents help establish your eligibility for deferment and ensure that all necessary information is provided. Below is a list of commonly used documents alongside the deferment form.

- In-School Notification: This document confirms your enrollment status at an eligible educational institution. It may be provided directly by your school or through the National Student Loan Data System (NSLDS), verifying that you are enrolled at least half-time.

- Income Documentation: If applying for a deferment based on financial hardship, you may need to submit your recent income tax returns or recent pay stubs to prove your financial situation.

- Certification from Authorized Official: An official from your school can complete a portion of the deferment form to certify your enrollment status, or you may submit separate documentation that includes this information.

- Loan Statements: Current loan statements may be required to provide your lender with details about your outstanding balances, interest rates, and payment history.

- Forbearance Request Form: If you are not eligible for deferment, you might consider requesting forbearance, which allows you to temporarily postpone payments. Submission of a different form is necessary for this process.

- Application for Financial Aid: A completed Free Application for Federal Student Aid (FAFSA) can be helpful, especially if your deferment is tied to financial circumstances that warrant aid considerations.

- Previous Deferment Request Documentation: If you’ve previously applied for a deferment, providing any prior decisions or supporting documentation may be useful for review.

- Contact Information for Previous Schools: If you've transferred from another school recently, you may need to include contact information for those institutions to verify your educational history.

Gathering these documents can significantly enhance your request for deferment. Making sure everything is in order is essential, as it facilitates a smoother approval process. Should you have any questions or need assistance with your deferment application, don’t hesitate to reach out for help.

Similar forms

- In-School Deferment Request Form: Similar in purpose, this form is used to apply for deferment while enrolled in school. It requires borrower information, eligibility certification, and authorization, just like the Fedloan Servicing Deferment form.

- Request for Forbearance: This document is used when a borrower requests a temporary postponement of payments due to financial hardship. Like the deferment form, it requires evidence of eligibility and borrower consent.

- Loan Repayment Plan Selection: This form helps borrowers choose a repayment strategy for their student loans. It includes borrower information and requires a declaration of intent, similar to the use of information on the deferment form.

- Loan Consolidation Application: When a borrower consolidates multiple loans into one, this form collects borrower details and loans being consolidated. It parallels the deferment form in requiring detailed borrower information and consent.

- Income-Driven Repayment Plan Application: This document allows borrowers to apply for a repayment plan based on their income. It shares the need for borrower information and certifications about circumstances, similar to the deferment request.

- Graduate/Post-Graduate Deferment Application: This form is specifically for graduates or post-graduates seeking deferment due to continued education. It includes many of the same sections on eligibility and certifications as the Fedloan Servicing Deferment form.

Dos and Don'ts

- Do read the entire form carefully before filling it out.

- Do provide accurate information in the borrower information section.

- Do ensure you meet the eligibility criteria stated in Section 2.

- Do include any required documentation when submitting the form.

- Don't submit the form without checking for any errors or omissions.

- Don't forget to notify your loan holder if your eligibility changes.

- Don't assume your deferment will be granted without proper documentation.

- Don't return the form to the wrong address; verify the submission details in Section 7.

Misconceptions

When it comes to the Fedloan Servicing Deferment form, several misconceptions frequently arise. Understanding the reality behind these myths can help borrowers navigate the deferment process more effectively. Here are four common misconceptions:

- All borrowers qualify for deferment automatically. Many people believe that as soon as they enroll in school, their loans will be automatically deferred. In reality, eligibility for deferment depends on various criteria, including enrollment status. Borrowers must be enrolled at least half-time at an eligible school to qualify.

- Interest does not accrue during deferment. There is a misconception that interest is never charged during deferment. While it is true that interest does not accumulate on subsidized loans during deferment, it can accrue on unsubsidized loans. Knowing the type of loan you have is crucial for understanding potential costs.

- Submitting the deferment form is a one-time task. Some borrowers think that once their deferment request is approved, they do not need to take further action. However, it is essential to notify the loan holder promptly if eligibility for the deferment changes, as failing to do so can lead to complications and potential penalties.

- A deferment guarantees that payments will remain unchanged. Many believe that obtaining a deferment protects them from any future payment increases. This is not always the case, especially when interest accrues during a deferment on certain types of loans, leading to capitalization. Understanding how deferment impacts the overall loan balance and payment obligations is vital.

By clarifying these misconceptions, borrowers can make informed decisions about their loans and ensures that they manage their financial futures with confidence. Always read the specifics of your loan agreement and consult with a loan servicer for personalized guidance.

Key takeaways

- Eligibility Criteria: Borrowers must verify they are enrolled at least half-time at an eligible institution to qualify for the deferment.

- Complete and Accurate Information: It is essential to provide accurate personal information. Any changes must be noted to ensure proper processing.

- Documentation and Notification: Additional documentation may be required to support deferment eligibility. Borrowers should inform their loan holder immediately when their eligibility ends.

- Interest Considerations: While the borrower may defer payments, interest may still accrue on certain loans, particularly unsubsidized ones, which could lead to capitalization.

Browse Other Templates

Register Car in Illinois - The VSD 350 form for Used Vehicle Warranty is available in packages of 50.

Nyc Doe Uft - This form serves as an official record for claims submitted to the UFT Welfare Fund.

Child Custody Affidavit Examples - This affidavit highlights the irrevocability of the relinquishment after a specific period.