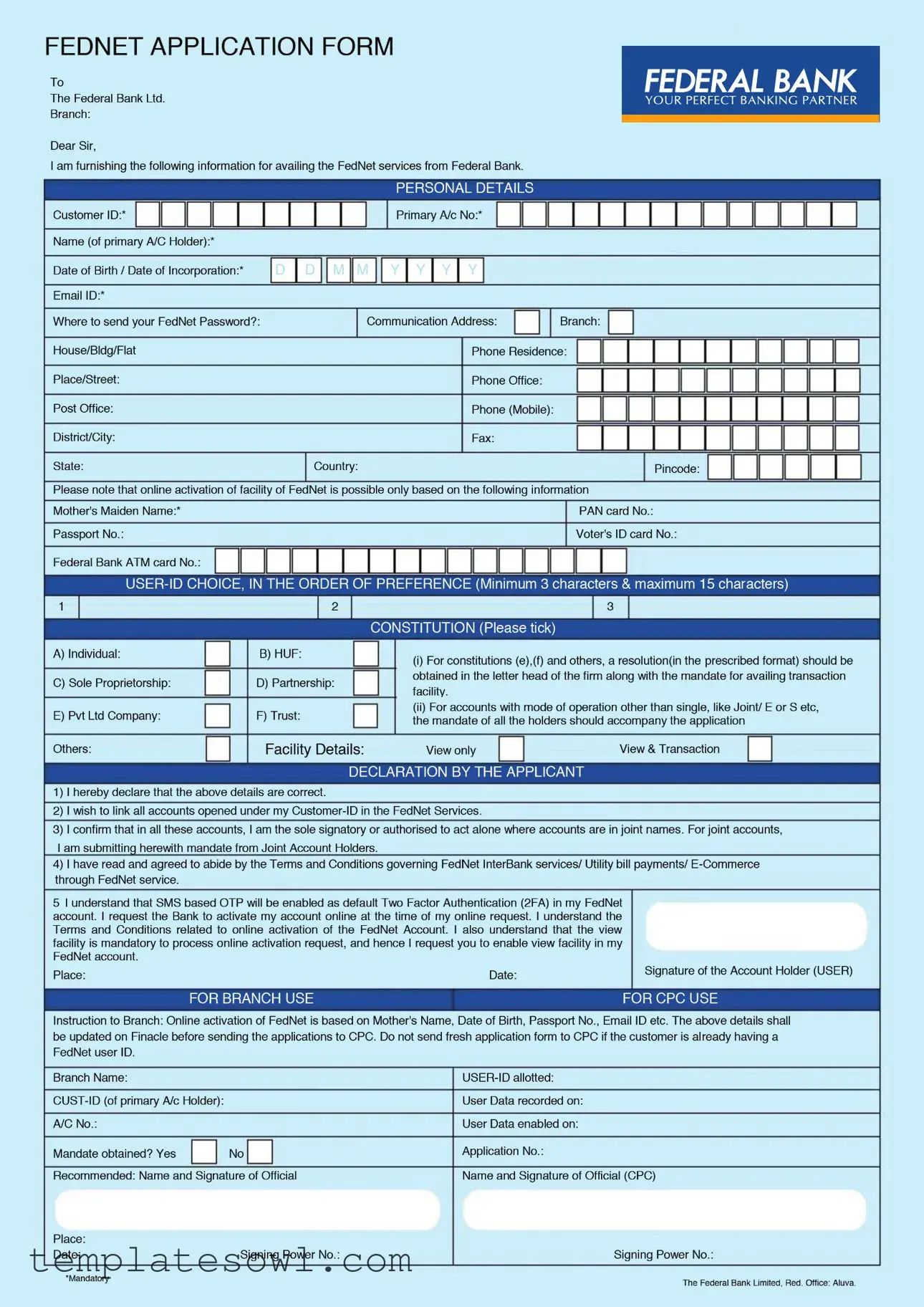

Fill Out Your Fednet Application Form

The Fednet Application form plays a crucial role for individuals and organizations seeking to utilize the FedNet Internet Banking Service offered by the Federal Bank. The form includes sections tailored for different types of applicants, such as individuals with joint accounts, trusts, societies, and companies. It outlines the authority granted to a designated user to access and manage accounts linked to a Customer-ID. Applicants must provide personal details and signatures, affirming their understanding of terms including the use of SMS-based OTP for Two Factor Authentication. The application is designed to ensure that all parties involved understand the terms and responsibilities associated with using FedNet, emphasizing security measures like maintaining the confidentiality of User-IDs and passwords. Furthermore, it details the procedure for fund transfers, utility bill payments, and online transactions, clarifying that users must comply with the stipulated conditions to avoid unauthorized transactions. Importantly, the application reinforces the bank's right to amend terms and the need for users to remain informed about updates, thereby cultivating a secure and efficient banking experience.

Fednet Application Example

FEDNET

|

(Applicable for accounts of individuals having more than one operator) |

Name of Joint Account Holders (other than User): |

|

1 |

|

2 |

|

3 |

|

We authorise |

................................................................................ (USER*) to avail of the FedNet service in respect of all accounts linked to |

his/her

Signature of Joint Account Holders (other than user)

1 |

2 |

3 |

FEDNET MANDATE- Trust / Society / Associations / Partnership / Company & Others (Non INDIVIDUALS )

(In the case of partnership firms to be signed by all partners. In the case of Trusts to be signed by all Trustees,

In the case of Society to be signed by all members, In the case of Company to be signed by Authorised officials of the Company)

We have read and understood the terms and conditions of FedNet - Internet Banking Service of the Federal Bank Limited and we applied for opening an

account in the name of |

*Company / Firm / Trust with you. |

We hereby declare that Shri. / Smt |

is authorised to operate the said FedNet account singly on behalf of |

the Company / Firm / Trust and to avail of the related FedNet service and to do any transactions through FedNet representing the Company / Firm / Trust.

We hereby also declare that all his acts, transactions, instructions shall be binding on the Company / Firm / Trust and ourselves individually (in the case of partnership firm) and we shall remain liable to honour the same.

We undertake to ratify and confirm all and whatever the user does or causes to do through FedNet - Internet Banking Service. I/We understand that SMS based OTP will be enabled as default Two Factor Authentication (2FA) in our FedNet account.

We hereby declare that the authority hereby given is in conformity with the Memorandum and Articles of Association/Board Resolution/Partnership Deed / Trust Deed of the Company / Partnership / Trust.

This authority shall continue to be in force until we revoke it by a prior notice in writing and delivered to you. Dated |

day of |

............20 |

|

|

NAMES AND SIGNATURES |

|

|

1 |

2 |

|

3 |

Terms and Conditions governing the use of FedNet - the Internet banking Service of The Federal bank Ltd.

1. Definitions: In this document the following words and phrases have the meaning set opposite them unless the context indicates otherwise • BANK refers to The Federal Bank Ltd, a banking company incorporated

in India under the Companies Act 1956 and having its registered office at Federal Towers, Bank Junction, Aluva 683101, Kerala, India and having branches/offices all over India. The term includes the successors

and assigns of The Federal Bank Ltd. FedNet is the trade name of BANK’s Internet Banking Service, which provides access to ac |

count information, Utility Bill Payment, |

||

as advised by the BANK from time to time to the BANK’s customers through the Internet. The words FedNet and FedNet Service are used interchangeably in this documen |

t. USER refers to a customer of the BANK |

||

authorized to use FedNet for availing any of the above services of the Bank• FedNet ACCOUN |

T refers to the User’s Savings and/or Current Account and/or any other type of account so designated by the Bank |

||

to be eligible account (s) for operations through the use of FedNet. One of these accounts will be designated as Primary Account. All other accounts (if any) of the USER will be called Secondary Account(s). The USER should be either the account holder and sole signatory or authorized to act alone when there is more than one signatory. An account in the name of a minor or an account in which a minor or an account, in which a minor is a joint account holder, is not eligible to be a FedNet account PERSONAL INFORMATION refers to the information about the USER obtained in connection with the FedNet service. TERMS refer to Terms and Conditions for use of FedNet as specified in this document. In this document, all references to the USER being referred in masculine gender will also include the feminine gender.

2.Applicability of TERMS: These TERMS form the contract between the USER and the BANK. By applying for FedNet and accessing the service the USER acknowledges and accepts these TERMS. These TERMS will be in addition to and not in derogation of the terms and conditions relating to any account of the customer.

3.Application for FedNet: The BANK may offer FedNet to selected customers at its discretion through its identified branches. The customer would need to be a current Internet user or have legal access to the Internet and knowledge of how the Internet works. Interest in the use of FedNet may be registered online through the BANK’s web site. The BANK will forward the FedNet application form, a copy of these terms and

conditions and the brochure explaining the service to the person who has registered his interest. Alternatively, the customer can download the application form from BANK’s web site www.federalbank.co.in, ll up the form and forward it to any of the branches in which he maintains his account. The acceptance of the registration and the acknowledgement thereof does not automatically imply the acceptance of application for FedNet. The BANK will advise from time to time the Internet software such as Browsers, which are required for using FedNet. There will be no obligation on the BANK to support all the versions of this Internet software.

4.FedNet Service: The BANK shall endeavour to provide to the USER through FedNet, services such as enquiry about the balance in his FedNet account(s), details about transactions, Statement of Account,

Request for issue of

prescribed by the Bank from time to time, request for issue of Demand Drafts to self or to third parties subject to the ceiling if any prescribed by the Bank from time to time, standing instructions as to operations in the account, stop payment instructions, utility bill payment through Internet, payment instructions under

a particular service shall be advised through email, web page of the BANK or written communication• The Bank shall take all r easonable efforts to carryout the instructions given by the User as expeditiously as

possible and the Bank shall not be held liable for any omission or delay in carrying out all or any of the said instructions due to circumstances beyond the reasonable control of the Bank. The BANK shall take reasonable care to ensure the security of and prevent unauthorised access to the FedNet SERVICE using technology reasonably available to the BANK. The USER shall not use or permit to use FedNet or any related services for any illegal or improper purposes.

5.FedNet Access: The USER would be allotted a FedNet

adopt such other means of authentication including but not limited to digital certication and/or smart cards• The USER shal |

l not attempt or permit others to attempt accessing the account information stored in the |

computers of the BANK through any means other than the FedNet service. |

|

6.Password: The USER must: Keep the

a mix of alphabets, numbers and special characters which must not relate to any readily accessible personal data such as the USER’s name, address, telephone number, |

driver license etc. or easily guessable |

|

|

combination of letters and numbers. Keep the |

|

||

computer unattended whilst accessing FedNet• If the USER forgets the FedNet User |

|||

password and/or the replacement of FedNet |

|

||

7. Joint Accounts: The FedNet SERVICE will be available in case of joint accounts only if the mode of operation is indicated as ‘either or survivor’ or 'anyone or survivor’. For these joint accounts one FedNet User |

- |

||

Id will be issued to one of the joint account holders. The other joint account holder(s) shall expressly agree with this arrangement and give their consent on the application from for use of FedNet. In case of any |

|

||

of the joint account holder(s) gives stop payment instructions in respect of operations through the use of FedNet (or in writing), on any of the FedNet accounts held jointly by them, the FedNet SERVICE will be discontinued for the USER.

8.Minimum Balance and Charges: The USER shall maintain, at all times such minimum balance in FedNet account(s) as the BANK may stipulate from time to time. The Bank may, at its discretion, levy penal charges for

account, and also be published on the Web site of the BANK. Any further change in the fees shall be notied on the BANK’s Web site 15 days in advance of the changes t aking effect. The USER authorizes the BANK to recover all charges related to FedNet as determined by the BANK from time to time by debiting one of the USER’s FedNet accounts. The BANK may withdraw the FedNet facility, if at any time the

amount of deposit falls short of the required minimum as aforesaid and/or if the service charges remain unpaid, without giving any further notice to the USER and/or without incurring any liability or responsibility whatsoever by reason of such withdrawal.

9.Funds Transfer/ Issuing Demand Draft: The USER shall not use or attempt to use FedNet for funds transfer/ Issuing Demand Draft - as and when the facility is made available without sufficient funds in the relative

FedNet account or without a |

ctions/Issuing Demand Draft received through FedNet |

|

provided there are sucient funds available in the USER’s account. |

|

|

10. Authority to the Bank: Banking transactions in the USER’s FedNet account(s) are permitted through FedNet only after authentication of the User |

||

account holder, if any) grants express authority to the BANK for carrying out the banking transactions performed by him through FedNet. The BANK shall have no obligation to verify the authenticity of any transaction received from the USER through FedNet or purporting to have been sent by the USER via FedNet other than by means of verification of the

that is produced by the USER at the time of operation of FedNet is a record of the operation of the Internet access and shall not be construed as the BANK’s record of the relat ive transactions. The BANK’s own

records of transactions maintained through computer systems or otherwise shall be accepted as conclusive and binding for all purposes unless any discrepancy is pointed out within a week from the date of making

the data available through FedNet• All transactions arising from the use of FedNet, to operate a joint account, shall be bind |

ing on all the joint account holders, jointly and severally. |

11.Accuracy of Information: The USER is responsible for the correctness of information supplied to the BANK through the use of FedNet or through any other means such as electronic mail or written communication. The BANK accepts no liability for the consequences arising out of erroneous information supplied by the USER. If the USER suspects that there is an error in the information supplied to the BANK by him, he

shall advise the BANK as soon as possible. The Bank will endeavor to correct the error wherever possible on a ‘best eorts’ basis. If the USER notices an error in the account inform ation supplied to him through

FedNet or by the use of any of the FedNet services, he shall advise the BANK as soon as possible. The BANK will endeavor to correct the error promptly and adjust any interest or charges arising out the error.

12.Liability of the USER and the BANK: The USER shall be liable for some or all loss from unauthorized transactions in the FedNet accounts if he has breached the TERMS or contributed or caused the loss by

negligent actions such as the following: Keeping a written or electronic record of FedNet password• Disclosing or failin g to take all reasonable steps to prevent disclosure of the FedNet

anyone including BANK staff and/or failing to advise the BANK of such disclosure within reasonable time. Not advising the BANK in a reasonable time about unauthorized access to or erroneous transactions in

the FedNet accounts• The BANK shall not be liable for any unauthorized transactions occurring through the use of FedNet which can be attributed to the fraudulent or negligent conduct of the USER• The BANK

shall in no circumstances be held liable to the USER if FedNet access is not available in the desired manner for reasons including but not limited to natural calamity, floods, fire and other natural disasters, legal restraints, faults in the telecommunication network or Internet or network failure, software or hardware error or any other reason beyond the control of the BANK. Under no circumstances shall the BANK be liable for any damages whatsoever whether such damages are direct, indirect, incidental consequential and irrespective of whether any claim is based on loss of revenue, investment, production, goodwill, profit, interruption of business or any other loss of any character or nature whatsoever and whether sustained by the USER or any other person.

13.Indemnity: The USER shall indemnify and hold the BANK harmless against any loss suffered by the BANK, its customers or a third party or any claim or action brought by a third party which is any way the result of the improper use of the FedNet by the USER and due to other factors beyond the control of the Bank.

14.Disclosure of the PERSONAL INFORMATION: The USER agrees that the BANK or its contractors may hold and process his PERSONAL INFORMATION on computer or otherwise in connection with FedNet

services as well as for statistical analysis and credit scoring. The USER also agrees that the BANK may disclose, in strict confidence, to other institutions, such PERSONAL INFORMATION as may be reasonably

necessary for reasons inclusive of, but not limited to, the following: For participation in any telecommunication or electronic clearing network • In compliance with a legal directive • For credit rat ing by recognized credit scoring agencies for fraud prevention purposes

15. Bank’s Lien: The BANK shall have the right of

or in any other account, whether in single name or joint name(s), to the extent of all outstanding dues, whatsoever, arising as a result of the FedNet SERVICE extended to and/or used by the USER.

16.Proprietary Rights: The USER acknowledges that the software underlying the FedNet SERVICE as well as other Internet related software which are required for accessing FedNet are the legal property of the respective vendors. The permission given by the Bank to access FedNet will not convey any proprietary or ownership rights in the above software. The USER shall not attempt to modify, translate, disassemble,

17.Change of Terms and Conditions: The Bank has the absolute discretion to amend or supplement any of the TERMS at any time and will endeavour to give prior notice of fifteen days for such changes wherever feasible except for changes to interest rates and/or other variations that are subject to market changes. The Bank may introduce new services within FedNet from time to time. The existence and availability of the new functions will be notified to USER as and when they become available. The changed terms and conditions applicable to the new FedNet services shall be continued to the USER. By using these new services, the USER agrees to be bound by the Terms and Conditions applicable.

18.Non Transferability: The grant of facility of FedNet to a USER is not transferable under any circumstances and shall be used only by the USER.

19.Termination of FedNet Service: The User may request for termination of the FedNet facility any time by giving a written notice of at least 15 days to the Bank. The User shall remain responsible for any transactions

made on his FedNet account(s) through FedNet prior to the time of such cancellation of the FedNet Service• The BANK |

may withdraw the FedNet facility anytime provided the USER is given reasonable notice |

|

under the circumstances. If the FedNet service is withdrawn by the BANK for a reason other than the breach of the terms and conditions by the USER, the Bank’s liability s |

hall be restricted to the return of the |

|

annual charges, if any, recovered from the USER for the period in question• The closure of all FedNet accounts of the USER wi |

ll automatically terminate the FedNet service• The Bank may suspend or terminate |

|

FedNet facilities without prior notice if the USER has breached these terms and conditions or the Bank learns of the death, bankruptcy or lack of legal capacity of the USER.

20.Notices: Notices under these Terms and Conditions may be given by the BANK and the USER, electronically to the mail box of either party. Such notices will be regarded as being in writing• In writing by delivering

them by hand or by sending them by post to the last address given by the USER and in the case of the BANK to the address mentioned below: The Federal Bank Limited, FedNet Services, Registered Office: Aluva, Kerala, India 683 101. In addition, the BANK may also publish notices of general nature, which are applicable to all USERS of FedNet on its web site. Such notices will have the same effect as a notice served individually to each USER.

21.Governing Law: These terms and conditions and/or the operations in the accounts of the USER maintained by the BANK and/or the use of the services provided through FedNet shall be governed by the laws of the Republic of India and no other nation. The BANK accepts no liability whatsoever, direct or indirect, for

22.General: The clause headings in this agreement are only for convenience and do not affect the meaning of the relative clause Terms & Conditions

23.Online activation: The online activation of the account requires input of personal information related to the account holder and a token sent to the user in addition to the

The user shall exercise necessary precautions in keeping the personal details, password and token condential• The disclosur |

e of all of the informations required for online activation only can dilute the security |

of the Fednet system. The user should excercise utmost caution in keeping his email secure and any unauthorised access will cause the token being available to third party/hackers etc. |

|

Place: |

|

Date: |

Signature of Account Holder (User) |

24.Offline activation also is possible if the signed acknowledgement is sent to the Bank. I understand that the FedNet account is provided to me with the view facility and any one with access to the user Id and password will be able to view the account details. The USER shall not assign this agreement to anybody else. The BANK may

Additional Terms and Conditions for the Utility bill Payment Service

1.The user authorises the bank to make payment of Utility Bills raised upon him by any company offering Utility Services (hereinafter referred to as billing company) where the Bank is entered into a collection arrangement, through FedNet Service provided by the Bank, under debit to his accounts, on receiving payment instructions from him.

2.The User shall furnish the required information as specified by the billing company and other essential data pertaining to the Bills so as to identify the same. In the case of any change in the identification details the user shall be responsible to communicate such changes as registered with the billing company to the Bank within the time specified by the Bank.

3.The user has no objection whatsoever to the billing company providing the billing details to the Bank.

4.All billing and payment details will be prepared by electronic means and the information contained will be extracted from the system maintained by the Billing Company and the Bank respectively. While the Bank will take all reasonable steps to ensure the accuracy of the statements, the Bank is not liable for any error. The user shall hold the Bank not liable against any loss, damages etc. that may be incurred / suffered by the user if the information turns out to be inaccurate/incorrect.

5.Any disputes on bill details will be settled directly with the billing company and the Bank’s responsibility is restricted to providing of information only.

6.The User shall not hold the Bank liable for such transactions that are carried out on their instructions done in good faith not carrying out such instructions where the Bank has reason to believe that the instructions are not genuine or are otherwise improper, unclear, vague for any loss or damage incurred or suffered by the user due to any error, defect, delay failure or interruption in providing the bill payment services arising from or caused by any reason whatsoever withdrawing/suspending the facility wholly/partially without prior notice to the user.

7.The record of the instructions given and transactions with the Bank kept either in electronic form or otherwise shall be binding on him and the same shall be conclusive proof for all purposes and can be used as evidence in any proceedings.

8.The user agree that all transactions those necessitate processing by the Bank / Billing company will be carried out only during business hours and the value dates, if any will be within the operating hours/ days decided by the Billing Company/ Bank.

9.The user shall be liable to pay service charges to the Bank, as fixed by the Bank from time to time for the Bill payment services availed by the User and the Bank can debit such charges to the account of the customer at its discretion.

10.The User shall ensure that there would be sufficient funds/ clear balance or

11.In the event of an account being overdrawn the Bank reserves the right to set off this amount against credit lying in any of the accounts of the User without giving prior notice to the User.

12.The User shall indemnify and keep the Bank indemnified from and against all actions, claims, demands, proceedings, cost, charges and expenses whatsoever which the Bank may at any time incur, sustain, suffer or put to as a consequence or by reason of or arising out of providing the user the Bill payment facility or by reason the Bank in good faith refuse to take or omit to take action on the instructions of the User.

13.The Bank can terminate the Bill payment services granted without prior notice on occurrence of any of the following events: Non compliance of the terms and conditions set for. Non compliance of any other

agreement entered into with the Bank• Death, insolvency and Bankruptcy of the User• Any other cause arising out of operation |

of law. |

14.The Bank is at liberty to withdraw at any time the Bill Payment Facility or any service rendered to the User, in respect of any or all the accounts without assigning any reason whatsoever, without giving the User any prior notice. The User shall give the Bank 15 days notice in writing and obtain an acknowledgment thereof in order to terminate Bill Payment Services availed by him.

Additional Terms and Conditions for E Commerce Facility

1.The User authorises the Bank for making payment / transfer funds from any of his accounts towards the purchase price of products / services ordered by the User through Internet, favouring various merchants / shoppers / service providers, as approved by the Bank

2.The Bank would from time to time be identifying website where User could use this additional feature of making acquisitions / purchase of products and services and making payment for the same through accounts maintained with the bank by giving instructions for such payment through the Internet. The websites on which USER may place any order and in respect of which he can request the Bank to make payments would be solely and exclusively from the list of designated websites identified by the Bank from time to time. The list of websites in respect of which he can utilize this facility shall be displayed on the web site of the Bank from time to time. The User shall update himself as to the websites available prior to making any purchase / acquisition on the website.

3.The User shall ensure that upon placing the order with the merchant on the designated websites he notes all the details of his orders placed accurately, including the customer order number and price payable.

4.All orders placed by the USER on website are orders between the User and the Merchant supplying the products and services. The Bank shall not at any time be deemed to be a supplier of the products or party to such contract at any times whatsoever.

5.The Bank is merely providing a facility for making payments for the orders placed by the USER on such websites and are not in any manner associated with or part of the actual transaction of sale of the products and services. The User shall make all such independent enquiries, as he may deem fit in respect of the products and services offered by the Companies and Merchants on the websites.

6.The User confirms that he is not placing the order with the Companies / Merchants on the websites based on any representation or statement of the Bank and the User shall place any order on the designated web site, he shall do it out of his own volition and shall not in any manner hold the Bank responsible for any deficiency, defect, delay in delivery, quality and merchantability of the products and services.

7.A User shall ensure that he does not in any manner release any confidential data including the Password to the merchants and suppliers during his access to the various websites of the merchants and the User shall indemnify the Bank from any loss that may be caused to the Bank by any breach of this covenant.

8.While communicating payment instructions to the Bank the User shall provide such details as the Bank may require in respect of the payments to be made including details in respect of the site on which the purchase order was placed and the relevant customer order number. The User shall indemnify the Bank from any loss caused from any inaccuracies in this regard.

9.The Bank may for any reason whatsoever refuse to honour his instructions to make payment to the merchants / companies, in such circumstances as the Bank may deem fit and the User shall not hold the Bank responsible for any failure to process payment instructions by reason of the services being temporarily unavailable or there being an overload on the server or for any other technical or any other reason whatsoever.

10. The Bank shall not be responsible for in the event of the Merchant / Company failing to refund any monies at the request of the User and the User’s sole and exclusive recourse shall be against th |

e Merchant / |

Company only. |

|

11.In the event of any dispute with the Merchant / Company the Bank shall not be made as a party to dispute or any proceedings.

12.The Bank may at any time alter the mode and the manner of making payments and User shall be bound by the same.

13.The Bank may from time to time and for any reason discontinue the services offered in respect of particular sites and in such event Bank may refuse to make payments for products purchased from such sites. The User shall update himself on a regular basis as to the details of the websites on which the services offered by the Bank could be utilized and shall not require the Bank to make any payments for products purchased from websites other than the websites identified by the Bank

14.The Bank may specify limits from time to time on the number of transactions the user may enter into a particular period. The aggregate payments that the User may make on transactions in a particular period.

15.The User shall abide by and with all such limits that may be placed by the Bank from time to time and the User shall not hold the Bank responsible for refusing to honour instruction in violation of the said limits placed by the Bank.

16.In the event of any misuse of the password or any other identification details or in the event of any fraudulent use of the account through the Internet, the User shall be solely and exclusively responsible for all loss caused thereby and the Bank shall not be made liable for any such losses or claims.

17.The USER shall not hold the Bank liable for such transactions that are carried out on their instructions done in good faith not carrying out such instructions where the Bank has reason to believe that the instructions

are not genuine or are otherwise improper, unclear, vague• For any loss or damage incurred or suered by the user due to any |

error, defect failure or interruption in providing the services arising from or caused |

by any reason whatsoever withdrawing / suspending the facility wholly / partially without prior notice to the user. |

|

18.The record of the instructions given and transactions with the Bank kept either in electronic form or otherwise shall be binding on him and the same shall be conclusive proof for all purposes and can be used as evidence in any proceedings.

19.The user shall be liable to pay service charges to the Bank, as fixed by the Bank from time to time for the services availed by the User and the Bank can debit such charges to the account of the User at its discretion.

20.The User shall ensure that there would be sufficient funds / cleared balance or

21.In the event of an account being overdrawn the Bank reserves the right to set off this amount against credit lying in any of the accounts of the User without giving prior notice to the User.

22.The User shall indemnify and keep the Bank indemnified from and against all actions, claims, demands, proceedings, cost, charges and expenses whatsoever which the Bank may at any time incur, sustain, suffer or put to as a consequence or by reason of or arising out of providing the user the facility or by reason the Bank in good faith refuse to take or omit to take action on the instructions of the User.

Place: |

|

Date: |

Signature of Account Holder (User) |

You can also download this application and Terms & Conditions from our website: www.federalbank.co.in

Form Characteristics

| Fact Name | Details |

|---|---|

| Application Purpose | The FedNet Application Form is designed for individuals or entities seeking to register for the FedNet Internet Banking Service provided by the Federal Bank Limited. |

| Joint Account Processing | In cases of joint accounts, authorization is required from all joint holders, emphasizing a collective responsibility in managing the account. |

| Governing Law | The use of the FedNet service is governed by the laws of the Republic of India, ensuring all operations comply with Indian banking regulations. |

| Two Factor Authentication | SMS-based One Time Passwords (OTP) serve as the default Two Factor Authentication (2FA), enhancing security for user transactions. |

| Termination of Service | Eitherthe user or the bank may terminate the FedNet service with a prior written notice of at least 15 days, with certain conditions applied regarding ongoing transactions. |

Guidelines on Utilizing Fednet Application

Filling out the FedNet Application form involves a straightforward process to ensure that all necessary information is provided accurately. This application is vital for those who wish to use the FedNet Internet Banking Service, whether as an individual or on behalf of a trust, society, association, or company. Below are the steps to complete the application successfully.

- Download the FedNet Application form from the Federal Bank website or obtain a physical copy from a branch.

- Carefully read the instructions and the terms and conditions included with the form.

- Begin filling out the form by providing personal details such as your name, address, and mobile number.

- Fill in your Customer-ID, which is required for linking your existing accounts to FedNet.

- If applicable, list the names of additional joint account holders under the relevant section.

- Clearly identify who the designated user of the FedNet service will be.

- Confirm your understanding of SMS based OTP for Two Factor Authentication by checking the appropriate box or section.

- Sign the form under the designated section to authorize the application.

- If you are acting on behalf of a company or trust, ensure all authorized signatories have also signed where required.

- Submit the completed application form at any Federal Bank branch along with any necessary identification documents.

What You Should Know About This Form

What is the FedNet Application form used for?

The FedNet Application form is used to set up an Internet banking service provided by The Federal Bank Limited. Customers can apply for access to their bank accounts online, allowing them to manage their finances conveniently from anywhere with internet access.

Who can fill out the FedNet Application form?

Individuals, trusts, societies, associations, partnerships, and companies can fill out the FedNet Application form. For joint accounts, all account holders must provide their signatures and consent. In the case of non-individual entities, it is necessary that authorized officials or all partners sign the form as required.

What information do I need to provide in the application?

The application requires personal information, including the name of the user, joint account holders, and specific account details. It is important to provide accurate information to ensure effective setup and management of the FedNet service.

What is the default authentication process for FedNet?

As part of the security measures, an SMS-based One Time Password (OTP) will be enabled as the default Two Factor Authentication (2FA) for all accounts linked to FedNet. This provides an additional layer of security for online transactions.

Can I change my password after the initial setup?

Yes, users are required to change the password provided by the bank upon their first access to FedNet. Additionally, they are encouraged to change their password frequently thereafter to maintain account security.

Are there any charges associated with using FedNet?

Yes, the bank may impose service charges related to the use of FedNet, including potential penalties for non-maintenance of a required minimum balance. Customers will be informed of these charges at the time of account opening and any future changes will be communicated on the bank's website 15 days in advance.

What should I do if I suspect unauthorized access to my FedNet account?

If you suspect unauthorized access, it is critical to notify the bank immediately. Taking swift action can help safeguard your account, and the bank will assist in rectifying any issues arising from unauthorized activities.

Is it possible to place restrictions on the use of FedNet for joint accounts?

Yes, the FedNet service will only be accessible for joint accounts if the operation mode is designated as ‘either or survivor’ or ‘anyone or survivor’. Restrictions can be put in place if any joint account holder issues stop payment instructions.

How can I terminate my FedNet service?

To terminate your FedNet service, you must provide a written notice to the bank at least 15 days prior to the desired termination date. This notice ensures that you are no longer responsible for transactions made after the cancellation period.

Common mistakes

Filling out the FedNet Application form requires careful attention to detail. One common mistake involves incomplete personal information. Users should ensure that all required fields, including name, address, and contact information, are fully filled out. Leaving any section blank could lead to processing delays or rejection of the application.

Another frequent issue is providing inaccurate account details. When entering account numbers, it is essential to double-check that the numbers are correct. Using wrong account information may result in complications and could hinder services being set up properly.

Many applicants fail to sign the application where required. Neglecting to provide a signature can render the request invalid and cause unnecessary delays. It is crucial to check that every designated signature line is signed appropriately.

In addition, not reading the terms and conditions before submitting the application can lead to misunderstandings about the service. Users are encouraged to familiarize themselves with the terms to ensure they understand their rights and obligations. Ignoring this aspect might lead to issues down the line.

Another aspect that applicants might overlook is the minimum balance requirement. Ensuring that the specified minimum amount is maintained at all times is necessary to avoid penalties. If this requirement is not clearly understood, it might lead to account restrictions or fees.

Some individuals mistakenly assume that the application will be automatically accepted once submitted. In reality, applications are subject to review, and missing documentation or errors can result in rejection. Users should thus follow up and confirm that their application has been processed successfully.

Providing outdated identification documents can also pose a problem. Users must submit current and valid forms of ID as required. Failing to present relevant and timely identification may delay or derail the application process.

In addition, users often forget to indicate the mode of operation for joint accounts. Clearly specifying if the account will operate under "either or survivor" terms is essential for proper processing, as ambiguity can lead to complications later.

Another common mistake involves users not being proactive about confirming their application status. It is beneficial to contact customer service or check online to ensure that their application has been received and is being processed. Ignoring this step could lead to unnecessary delays.

Lastly, neglecting to keep a copy of the completed application can be a significant oversight. Retaining a record of the submission provides a backup in case any issues arise later on. A copy serves as proof of what was submitted and the date it was sent.

Documents used along the form

If you're looking to apply for the FedNet service, you're not alone. Many find it beneficial to have a few supplementary forms and documents on hand to ensure a smooth application process. Below is a list of commonly used documents alongside the FedNet Application form, each serving a specific purpose to enhance your account management experience.

- Identification Documents: This typically includes a government-issued ID like a driver’s license or passport. These documents help confirm your identity and are essential to safeguard your account from unauthorized access.

- Proof of Residence: A recent utility bill or bank statement showing your current address is commonly required. This helps the bank verify your residence, which is crucial for compliance with regulatory standards.

- Joint Account Holder Agreement: If your FedNet application involves multiple account holders, this agreement is necessary. It outlines each party's authority and responsibility concerning account operations, ensuring clarity and minimizing disputes.

- Corporate Resolution (if applicable): For business accounts, a corporate resolution confirms that specific individuals are authorized to manage and operate the FedNet account. This document is vital for maintaining organizational integrity and compliance.

- Tax Identification Number (TIN): This number is required for businesses and helps the bank report taxes accurately. It is a standard requirement for maintaining your account in good standing.

- Account Mandate Form: This form is often needed for specifying how the account should be operated, especially for partnerships or trust accounts. It lays out the operational rules shared among account holders.

Having these documents ready can help streamline the process and enhance your banking experience with FedNet. As you prepare your application, remember that clear communication with your bank can make a significant difference in ensuring everything goes smoothly. Your financial well-being and security are the top priority, so take the time to gather the necessary paperwork.

Similar forms

-

Power of Attorney (POA): This document allows one person to act on behalf of another for legal or financial matters. Like the Fednet Application form, it requires explicit permissions for the authorized person to manage the account or perform transactions.

-

Joint Account Agreement: This agreement outlines the relationship between co-owners of a bank account. Similar to the Fednet Application, it clarifies how transactions are approved and managed between multiple account holders.

-

Internet Banking Authorization Form: Similar to the Fednet form, this document grants specific users access to a bank account via online banking services, detailing rights and responsibilities in using the system securely.

-

Business Partnership Agreement: This agreement formalizes terms between business partners, allowing certain individuals to act on behalf of the partnership, much like the Fednet form designates a user to manage accounts on behalf of a group.

Dos and Don'ts

- Do: Read all instructions carefully before starting your application.

- Do: Provide accurate and complete personal information to avoid delays.

- Do: Sign and date the application where required to validate your request.

- Do: Use black or blue ink when filling out the form for better clarity.

- Do: Double-check that all necessary documents are attached with the application.

- Don’t: Leave any mandatory fields blank—this could result in rejection.

- Don’t: Use nicknames or aliases; use your legal name as it appears on official documents.

- Don’t: Forget to revoke any previous authorizations if they no longer apply.

- Don’t: Provide misleading information; this can have serious legal repercussions.

- Don’t: Submit the application without ensuring all signatures are in place.

Misconceptions

Misconceptions about the FedNet Application Form

- All users must sign the application form. Not every user needs to sign the form. In cases involving joint accounts, only one user can be designated to operate the account through FedNet, provided the other account holders consent to this arrangement.

- FedNet accounts are available to anyone. Accessibility to FedNet is restricted to users who either hold a primary account or are authorized to operate the account. Additionally, accounts in the name of minors are not eligible.

- Submitting the application guarantees approval. While submitting the application form is essential, approval is not automatic. The bank retains the discretion to accept or deny applications based on their criteria.

- Two Factor Authentication (2FA) is optional. The inclusion of SMS-based OTP as default 2FA is automatic. Users should prepare for this security measure to protect their accounts.

- Users are protected against all unauthorized transactions. Users have certain responsibilities. If a loss occurs due to the user not maintaining password confidentiality or failing to notify the bank of any unauthorized access, they can be held liable for the losses.

Key takeaways

Understanding the FedNet Application Form: Filling out the FedNet Application Form is critical for users seeking to access the Internet Banking Service offered by The Federal Bank. Here are key takeaways to ensure a smooth application process and service usage.

- Joint Account Holders: If you are a joint holder, all parties must authorize one individual as the primary user for the FedNet services. Ensure you fill in and sign as required.

- Two-Factor Authentication: By default, SMS-based OTP will be set as Two-Factor Authentication for your FedNet account. Be ready to receive this for secure access.

- Accurate Information: Double-check that all personal and account information is correct when filling out the form. Errors can lead to processing issues or delays.

- Minimum Balance Requirements: Be aware of any minimum balance requirements in your FedNet account to avoid penalties and ensure continuous service.

- Authorization of User: The user must be either the sole signatory or the person authorized to act on behalf of joint signatories. Miscommunication here can cause access issues.

- Terms and Conditions: Familiarize yourself with the terms governing the FedNet service. This understanding is crucial for complying with the application and accessing services.

Following these guidelines can facilitate a seamless experience when utilizing the FedNet Internet Banking Service. Ensure your information is precise, and stay informed about service requirements and responsibilities.

Browse Other Templates

Movers Contract Template - A signed Release of Liability confirms acknowledgment of terms.

Federal Courts - Customize your court layouts to reflect your team’s unique style.