Fill Out Your Fee Worksheet Form

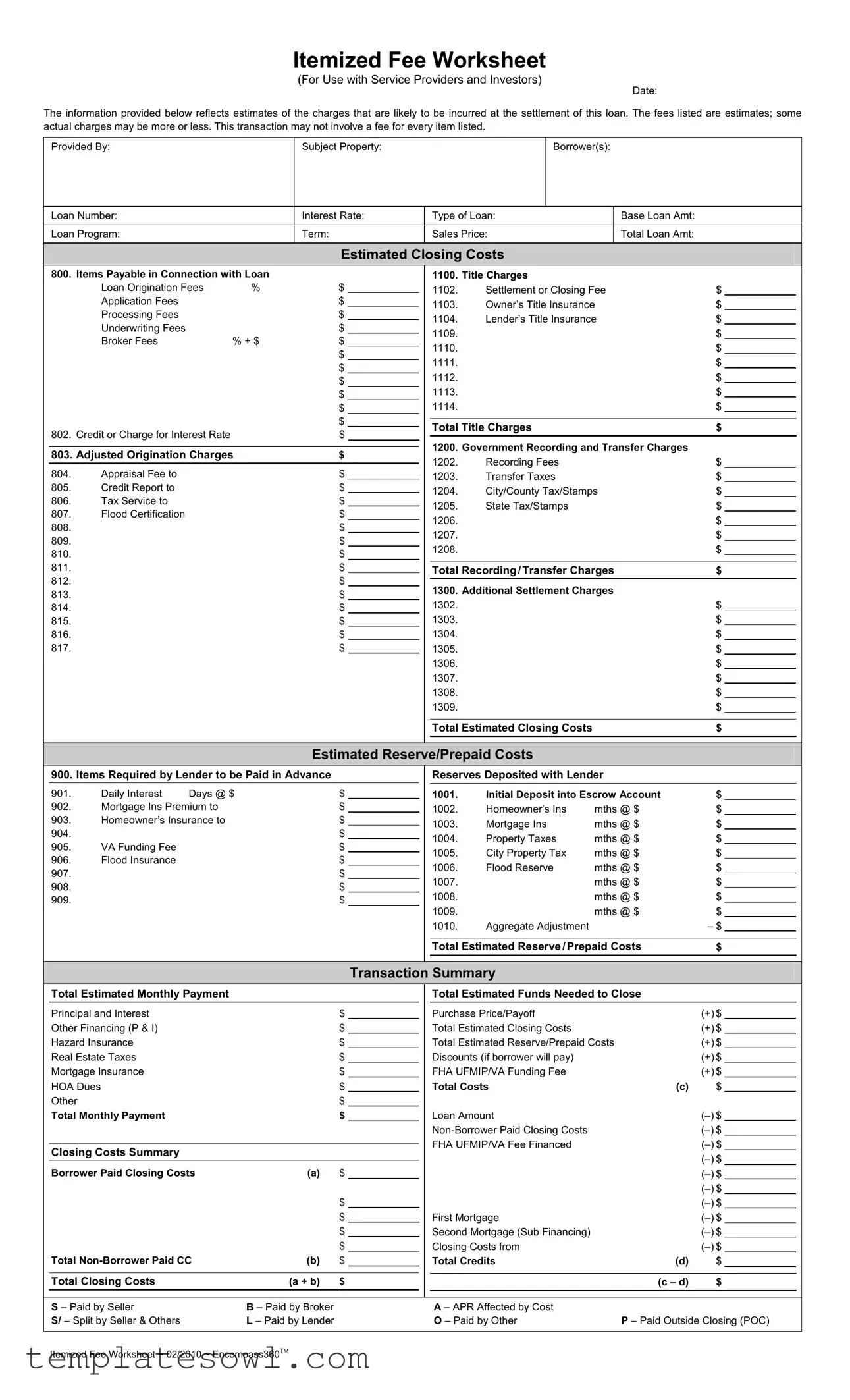

The Fee Worksheet form, specifically designed for service providers and investors, is a crucial tool in real estate transactions. This form captures a comprehensive breakdown of the estimated charges that borrowers can expect to incur during the loan settlement process. It not only outlines the various fees associated with the loan, such as title charges, origination fees, and processing fees but also highlights any additional costs required by lenders, like prepaid items and reserves. The form includes space for essential details like the date, borrower's information, loan number, and property specifics, ensuring all parties have a clear understanding of the financial obligations involved. With sections dedicated to itemizing costs related to government recording and transfer, as well as estimates of closing costs, the Fee Worksheet serves as an organized documentation tool, making the complex process of closing simpler and more transparent for everyone involved. It is important to remember, however, that the fees listed are merely estimates, and actual charges may vary, offering flexibility and consideration to both borrowers and lenders alike.

Fee Worksheet Example

Itemized Fee Worksheet

(For Use with Service Providers and Investors)

Date:

The information provided below reflects estimates of the charges that are likely to be incurred at the settlement of this loan. The fees listed are estimates; some actual charges may be more or less. This transaction may not involve a fee for every item listed.

|

Provided By: |

|

|

Subject Property: |

|

|

|

Borrower(s): |

|

|

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

Loan Number: |

|

|

Interest Rate: |

|

Type of Loan: |

|

Base Loan Amt: |

|

|

|

||||||

|

Loan Program: |

|

|

Term: |

|

|

|

|

Sales Price: |

|

Total Loan Amt: |

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

Estimated Closing Costs |

|

|

|

|

|

||||||

800. |

Items Payable in Connection with Loan |

|

|

|

1100. |

Title Charges |

|

|

|

|

|

||||||

|

|

Loan Origination Fees |

% |

|

$ |

|

|

1102. |

Settlement or Closing Fee |

$ |

|

|

|||||

|

|

|

|

|

|||||||||||||

|

|

Application Fees |

|

|

|

$ |

|

|

1103. |

Owner’s Title Insurance |

$ |

|

|

||||

|

|

|

|

|

|

|

|||||||||||

|

|

Processing Fees |

|

|

|

$ |

|

|

1104. |

Lender’s Title Insurance |

$ |

|

|

||||

|

|

Underwriting Fees |

|

|

|

$ |

|

|

|

|

|||||||

|

|

|

|

|

|

|

1109. |

|

|

|

|

$ |

|

|

|||

|

|

Broker Fees |

|

% + $ |

|

$ |

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

1110. |

|

|

|

|

$ |

|

|

||||

|

|

|

|

|

|

$ |

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

1111. |

|

|

|

|

$ |

|

|

||

|

|

|

|

|

|

$ |

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

1112. |

|

|

|

|

$ |

|

|

||

|

|

|

|

|

|

$ |

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

1113. |

|

|

|

|

$ |

|

|

||

|

|

|

|

|

|

$ |

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

$ |

|

|

1114. |

|

|

|

|

$ |

|

|

|

|

|

|

|

|

|

$ |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total Title Charges |

|

|

$ |

|

|

|||

802. |

Credit or Charge for Interest Rate |

|

|

$ |

|

|

|

|

|

|

|

||||||

|

|

|

|

1200. |

Government Recording and Transfer Charges |

|

|

|

|||||||||

|

|

|

|

|

|

|

|

|

|

|

|

||||||

|

803. Adjusted Origination Charges |

$ |

|

|

|

|

|

||||||||||

|

|

|

1202. |

Recording Fees |

|

|

$ |

|

|

||||||||

804. |

Appraisal Fee to |

|

|

|

$ |

|

|

|

|

|

|

||||||

|

|

|

|

|

1203. |

Transfer Taxes |

|

|

$ |

|

|

||||||

|

|

|

|

|

|

|

|||||||||||

805. |

Credit Report to |

|

|

|

$ |

|

|

1204. |

City/County Tax/Stamps |

$ |

|

|

|||||

806. |

Tax Service to |

|

|

|

$ |

|

|

|

|

||||||||

|

|

|

|

|

1205. |

State Tax/Stamps |

|

|

$ |

|

|

||||||

807. |

Flood Certification |

|

|

|

$ |

|

|

|

|

|

|

||||||

|

|

|

|

|

1206. |

|

|

|

|

$ |

|

|

|||||

808. |

|

|

|

|

$ |

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

1207. |

|

|

|

|

$ |

|

|

||||

809. |

|

|

|

|

$ |

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

1208. |

|

|

|

|

$ |

|

|

||||

810. |

|

|

|

|

$ |

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

811. |

|

|

|

|

$ |

|

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

Total Recording/Transfer Charges |

$ |

|

|

|||||||

|

|

|

|

|

|

||||||||||||

812. |

|

|

|

|

$ |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

1300. |

Additional Settlement Charges |

|

|

|

|||||||

813. |

|

|

|

|

$ |

|

|

|

|

|

|||||||

814. |

|

|

|

|

$ |

|

|

1302. |

|

|

|

|

$ |

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

||||||

815. |

|

|

|

|

$ |

|

|

1303. |

|

|

|

|

$ |

|

|

||

816. |

|

|

|

|

$ |

|

|

1304. |

|

|

|

|

$ |

|

|

||

817. |

|

|

|

|

$ |

|

|

1305. |

|

|

|

|

$ |

|

|

||

|

|

|

|

|

|

|

|

|

1306. |

|

|

|

|

$ |

|

|

|

|

|

|

|

|

|

|

|

|

1307. |

|

|

|

|

$ |

|

|

|

|

|

|

|

|

|

|

|

|

1308. |

|

|

|

|

$ |

|

|

|

|

|

|

|

|

|

|

|

|

1309. |

|

|

|

|

$ |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

Total Estimated Closing Costs |

|

|

$ |

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

||||||

|

|

|

|

|

Estimated Reserve/Prepaid Costs |

|

|

|

|

|

|||||||

|

900. Items Required by Lender to be Paid in Advance |

|

|

|

|

Reserves Deposited with Lender |

|

|

|

||||||||

901. |

Daily Interest |

Days @ $ |

$ |

|

|

1001. |

Initial Deposit into Escrow Account |

$ |

|

|

|||||||

902. |

Mortgage Ins Premium to |

|

|

$ |

|

|

1002. |

Homeowner’s Ins |

mths @ $ |

$ |

|

|

|||||

|

|

|

|

|

|

||||||||||||

903. |

Homeowner’s Insurance to |

|

|

$ |

|

|

1003. |

Mortgage Ins |

mths @ $ |

$ |

|

|

|||||

904. |

|

|

|

|

$ |

|

|

|

|

||||||||

|

|

|

|

|

|

1004. |

Property Taxes |

mths @ $ |

$ |

|

|

||||||

905. |

VA Funding Fee |

|

|

|

$ |

|

|

|

|

||||||||

|

|

|

|

|

1005. |

City Property Tax |

mths @ $ |

$ |

|

|

|||||||

906. |

Flood Insurance |

|

|

|

$ |

|

|

|

|

||||||||

|

|

|

|

|

1006. |

Flood Reserve |

mths @ $ |

$ |

|

|

|||||||

907. |

|

|

|

|

$ |

|

|

|

|

||||||||

|

|

|

|

|

|

1007. |

|

|

mths @ $ |

$ |

|

|

|||||

908. |

|

|

|

|

$ |

|

|

|

|

|

|

||||||

|

|

|

|

|

|

1008. |

|

|

mths @ $ |

$ |

|

|

|||||

909. |

|

|

|

|

$ |

|

|

|

|

|

|

||||||

|

|

|

|

|

|

1009. |

|

|

mths @ $ |

$ |

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

1010. |

Aggregate Adjustment |

|

|

– $ |

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

Total Estimated Reserve/Prepaid Costs |

$ |

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

Transaction Summary |

|

|

|

|

|

|||||

|

Total Estimated Monthly Payment |

|

|

|

|

|

|

Total Estimated Funds Needed to Close |

|

|

|

||||||

|

Principal and Interest |

|

|

|

$ |

|

|

|

Purchase Price/Payoff |

|

|

(+) $ |

|

|

|||

|

Other Financing (P & I) |

|

|

|

$ |

|

|

|

Total Estimated Closing Costs |

|

|

(+) $ |

|

|

|||

|

Hazard Insurance |

|

|

|

$ |

|

|

|

Total Estimated Reserve/Prepaid Costs |

(+) $ |

|

|

|||||

|

Real Estate Taxes |

|

|

|

$ |

|

|

|

Discounts (if borrower will pay) |

|

|

(+) $ |

|

|

|||

|

Mortgage Insurance |

|

|

|

$ |

|

|

|

FHA UFMIP/VA Funding Fee |

|

|

(+) $ |

|

|

|||

|

HOA Dues |

|

|

|

$ |

|

|

|

Total Costs |

|

(c) |

$ |

|

|

|||

|

Other |

|

|

|

$ |

|

|

|

|

|

|

|

|

|

|

|

|

|

Total Monthly Payment |

|

|

|

$ |

|

|

|

Loan Amount |

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

FHA UFMIP/VA Fee Financed |

|

|

|

|

|||

|

Closing Costs Summary |

|

|

|

|

|

|

|

|

|

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

Borrower Paid Closing Costs |

|

(a) |

$ |

|

|

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

$ |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

$ |

|

|

|

First Mortgage |

|

|

|

|

|||

|

|

|

|

|

|

$ |

|

|

|

Second Mortgage (Sub Financing) |

|

|

|

|

|||

|

Total |

|

(b) |

$ |

|

|

|

Closing Costs from |

|

|

|||||||

|

|

$ |

|

|

|

Total Credits |

|

(d) |

$ |

|

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

Total Closing Costs |

|

(a + b) |

$ |

|

|

|

|

|

|

|

(c – d) |

$ |

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

S – Paid by Seller |

|

B – Paid by Broker |

|

|

|

|

A – APR Affected by Cost |

|

|

|

|

|

||||

|

S/ – Split by Seller & Others |

|

L – Paid by Lender |

|

|

|

|

O – Paid by Other |

|

P – Paid Outside Closing (POC) |

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Itemized Fee Worksheet ~ 02/2010 ~ Encompass360TM

Form Characteristics

| Fact Name | Description |

|---|---|

| Purpose | The Fee Worksheet is designed to provide an itemized estimate of closing costs for borrowers and investors involved in a loan settlement. |

| Content Type | It includes various categories of fees such as title charges, loan origination fees, and recording fees that are likely to be incurred during the settlement process. |

| Date of Issue | The current version of the form is dated February 2010, indicating when the most recent updates were made to its content. |

| Legal Compliance | The use of this form is governed by federal regulations, including RESPA (Real Estate Settlement Procedures Act), which mandates certain disclosures during the settlement process. |

| Estimates vs. Actual Costs | The fees listed on the worksheet are estimates. Actual closing costs may vary, and not every fee may apply to every transaction. |

Guidelines on Utilizing Fee Worksheet

Filling out the Fee Worksheet is essential for understanding the anticipated costs associated with your loan settlement. By following these steps, you can ensure that all necessary information is accurately recorded. This form requires several key pieces of data, including details about the transaction, estimated costs, and expected payments.

- Fill in the date: Write the current date at the top of the form.

- Provide your personal details: Input the name of the service provider and the subject property.

- List borrower information: Include the names of the borrower(s) and the loan number.

- Specify loan details: Fill in the interest rate, type of loan, base loan amount, loan program, and term of the loan.

- Enter sales price: Write down the sales price of the property and the total loan amount.

- Detail estimated closing costs: Fill out the section on estimated closing costs by entering relevant fees such as loan origination fees, settlement fees, title insurance, and appraisal fees.

- Record additional costs: Complete the section for estimated reserve/prepaid costs, including mortgage insurance, homeowner’s insurance, and property taxes.

- Complete the transaction summary: Calculate and fill in the total estimated monthly payment, total estimated funds needed to close, and detail any applicable discounts.

- Fill in closing costs summary: Sum up the total closing costs, non-borrower paid closing costs, and any credits.

- Review: Double-check all entries for accuracy and completeness before submission.

What You Should Know About This Form

What is the purpose of the Fee Worksheet form?

The Fee Worksheet serves as a detailed breakdown of estimated costs associated with a loan settlement. It specifies charges that borrowers might incur and provides a transparent way to understand potential fees. By itemizing these charges, borrowers can better prepare for the financial aspects of their transaction, helping them to create a budget and anticipate necessary funds needed at closing. This clarity assists in making informed decisions throughout the loan process.

How can I use the Fee Worksheet to estimate my closing costs?

To use the Fee Worksheet effectively, start by filling in the relevant details about your loan, such as the loan number, interest rate, and property information. Next, take a closer look at each section of the worksheet. It includes line items for various charges like title fees, appraisal fees, and other settlement costs. Add up the estimates for each category to see a summary of your total closing costs. This can help both you and your lender to assess the expected expenses and manage your finances accordingly.

Can the estimates provided in the Fee Worksheet change?

Yes, the estimates on the Fee Worksheet are subject to change. They reflect initial estimates based on typical charges, but the actual fees at closing may vary. Some costs might be higher, while others could be lower. It’s important to communicate with your lender throughout the process to receive updates on any changes to your estimated costs. Keeping in touch ensures you are not caught off guard and can plan your finances accordingly.

What information do I need to gather before completing the Fee Worksheet?

Before completing the Fee Worksheet, it’s helpful to gather specific information about your loan and property. This includes the loan number, total loan amount, interest rate, and type of loan. Additionally, information on anticipated charges, such as loan origination fees, appraisal fees, and other service provider costs, will be necessary. Having this data ready will streamline the completion of the worksheet and enhance the accuracy of your estimated closing costs.

Common mistakes

When filling out the Fee Worksheet form, individuals often make errors that can lead to confusion or incorrect estimates of closing costs. These mistakes can affect not only the clarity of the document but also the borrower’s financial planning. Here are some common pitfalls to avoid.

One prevalent mistake is the incorrect estimation of fees. Many borrowers inadvertently under or overestimate various costs, such as title insurance or appraisal fees. Since these expenses can vary greatly based on local practices and the specifics of the transaction, it’s crucial to gather accurate estimates. Relying solely on previous experiences without current data can lead to substantial discrepancies.

Another frequent error occurs when leaving blank fields. Specific parts of the form must be filled out fully, including all applicable fees and reserves. Omitting a fee could create a misleading picture of total costs, potentially leaving borrowers unprepared for what they will actually owe at closing. Always ensure that every section that applies to the transaction is completed comprehensively.

Some individuals also fail to review the loan program details closely. Each loan program may have unique requirements regarding fees and necessary disclosures. Neglecting this aspect can result in mismatched expectations about what closing costs will be associated with a particular loan type. Understanding the specifics of one’s loan can help align estimated closing costs with reality.

Additionally, a common oversight involves miscalculating totals. It’s essential to double-check all calculations related to the estimated closing costs and prepaid costs. Simple mathematical errors can significantly alter the total estimated costs. Regularly reviewing each line item for accuracy ensures that the total figures reflect the true financial obligations.

Lastly, individuals often forget to clarify who is responsible for various fees. Notating whether costs are borrower-paid, seller-paid, or paid by others can prevent confusion later in the process. Being explicit about these responsibilities on the Fee Worksheet helps all parties understand their financial obligations, making the closing process smoother and more transparent.

Documents used along the form

Understanding the various forms and documents associated with real estate transactions can simplify the process for buyers and sellers alike. One such document often relevant to loan settlements is the Fee Worksheet form. Along with it, other forms play vital roles in ensuring that all parties are aware of the costs involved and the obligations that come with the transaction.

- Loan Estimate: This document provides borrowers with essential information about the mortgage they are applying for, including estimated monthly payments, interest rates, and closing costs. It serves to inform borrowers of the terms of their loan in a clear and concise manner.

- Closing Disclosure: Issued to the borrower at least three days before closing, this form outlines the final details of the mortgage loan, including all loan costs and the cash needed to close. It acts as a summary of the Loan Estimate to help borrowers compare the initial estimate with the final terms.

- Title Commitment: This document is issued by a title insurance company and details the terms under which the title insurance will be issued. It highlights any liens, easements, or other factors that may affect the property’s title.

- Purchase Agreement: Also known as the sales contract, this crucial document outlines the terms of the sale between the buyer and seller. It specifies the sale price, closing date, and any contingencies related to the transaction.

- Escrow Disclosure: This form contains information about the escrow account that will hold funds during the closing process. It explains how funds will be managed, including the payment of property taxes and insurance premiums.

Each of these documents complements the Fee Worksheet, providing clarity and organization to the intricate process of real estate transactions. By familiarizing yourself with them, you can navigate the closing process more efficiently and with greater confidence.

Similar forms

- Loan Estimate Form: Similar to the Fee Worksheet, this form outlines estimated costs associated with a mortgage loan within the first three days of application. Both documents provide crucial cost estimates for borrowers to understand before closing.

- Closing Disclosure: This document is received three days before closing and includes final costs. Like the Fee Worksheet, it breaks down individual charges and is meant to ensure transparency in the loan process.

- Good Faith Estimate (GFE): This form was used prior to the Loan Estimate. It provides borrowers with estimated costs of obtaining a mortgage, similar to the Fee Worksheet in its purpose of ensuring borrowers know potential charges early in the process.

- Title Cost Estimate: This document details title-related charges during the closing process. It is similar because it gives an itemized look at fees that will affect the total cost of acquiring property.

- HUD-1 Settlement Statement: Used in transactions before October 2015, this statement itemized all final closing fees. The Fee Worksheet serves a similar purpose by detailing estimated costs that can impact the settlement amount.

- Estimate of Charges: This document lists anticipated fees for settlement and closing. Like the Fee Worksheet, it outlines the costs borrowers can expect to incur during the loan process.

- Pre-Closing Disclosure: Some lenders provide this document to disclose estimated closing costs before the formal Closing Disclosure. It shares similarities with the Fee Worksheet in presenting costs prior to final agreement.

- Loan Application Disclosure: This summary helps borrowers understand their financial obligations. It is akin to the Fee Worksheet in terms of offering insight into the fees associated with the loan process early on.

Dos and Don'ts

When filling out the Fee Worksheet form, there are several important actions to consider. Here are some dos and don'ts that will help ensure accuracy and efficiency:

- Do provide detailed and accurate information for each section.

- Do verify all estimates against previous documentation to ensure consistency.

- Do break down fee categories clearly to avoid confusion at the closing.

- Don't omit any fees that might apply to the transaction.

- Don't use vague terms when describing fees; specificity is important.

- Don't forget to double-check the totals to ensure they add up correctly.

By adhering to these guidelines, the Fee Worksheet can be completed accurately, facilitating a smoother closing process.

Misconceptions

Misconceptions about the Fee Worksheet form can lead to confusion during the loan process. Here are ten common misunderstandings:

- It includes final costs. The Fee Worksheet provides estimates, not final charges. Actual costs may vary at the time of closing.

- All fees are mandatory. Not every item listed requires a fee. Some charges may apply only to specific transactions.

- It represents all possible charges. The worksheet identifies common fees, but it does not list every potential expense.

- It shows net costs. The worksheet focuses on total estimated costs before any credits or adjustments are applied.

- The amounts are fixed. Fees can be negotiable. Borrowers can discuss charges with their lenders or service providers.

- It’s the same for every loan. Each Fee Worksheet is tailored to the individual transaction, reflecting specific charges related to that loan.

- All fees are paid upfront. Some fees are not due until closing, while others may be incorporated into the loan amount.

- It indicates loan approval. The worksheet only estimates costs. Approval depends on many factors, including creditworthiness.

- Borrowers must understand every item. While it's beneficial to know the fees, borrowers can ask lenders for clarification on anything unclear.

- It’s a binding contract. The Fee Worksheet is informational and not a legal agreement. The final terms will be outlined in other loan documents.

Understanding these misconceptions can help borrowers navigate their loan transactions with more clarity and confidence.

Key takeaways

When filling out and using the Fee Worksheet form, several key points can ensure a smooth process. Understanding these elements can help you navigate the complexities of loan settlements effectively.

- Estimates Only: The fees listed on the worksheet are estimates. Actual charges may vary, so be prepared for some items to cost more or less than what is indicated.

- Specific Information Required: Fill in all the pertinent details about the transaction, including the subject property, loan number, and personal information. This clarity is crucial for accurate estimates.

- Itemized Listing: The worksheet provides a breakdown of various charges, including title fees, application fees, and recording fees. Utilize this itemization to understand where your funds will go.

- Verify Charges: Review each fee carefully. Some charges may not apply to your transaction, so it’s important to confirm what is relevant.

- Risk of Additional Costs: Be aware that beyond the listed estimates, you may incur other costs related to your loan that aren't included in the worksheet. Asking your lender for more information can help mitigate surprises.

- Reserve/Prepaid Costs: The worksheet also includes sections for reserve and prepaid costs, which are crucial to understanding your upfront financial requirements.

- Closing Costs Summary: The closing costs summary provides a comprehensive view of all expected expenses. Make sure to review this for a complete understanding of what you will owe at closing.

- Adjusting for Final Figures: Total amounts, both credit and costs, may change before closing. Keep lines of communication open with your lender for the most current figures.

By keeping these points in mind, borrowers can use the Fee Worksheet form as a helpful tool in managing their loan process effectively.

Browse Other Templates

Dd Form 365-4 - Understanding the disclosure rules is critical for applicants.

Handicap Placard Sc - Application status can be monitored through the SCDMV once submitted.