Fill Out Your Fha Amendatory Clause Form

The FHA Amendatory Clause form plays a crucial role in real estate transactions involving Federal Housing Administration (FHA) financing. This form protects buyers by stipulating that they are not obligated to complete the purchase unless they receive a written statement from the Federal Housing Commissioner or an authorized lender, confirming that the appraised value of the property meets or exceeds the sales price. The primary focus of the clause is to ensure that buyers can verify the property's value before making a financial commitment, thereby preventing them from incurring penalties, such as forfeiture of earnest money deposits, if the property appraises for less than expected. Additionally, this form emphasizes that while the Department of Housing and Urban Development (HUD) insures the mortgage up to the appraised value, it does not guarantee the property's condition or sale price. Understanding this clause is vital for buyers as it reinforces their rights throughout the purchasing process, allowing them to proceed with confidence knowing they are protected from financial discrepancies related to property appraisals. Furthermore, the real estate certification section of the form holds all parties accountable, ensuring that the information provided is accurate and truthful. This acknowledgment safeguards the integrity of the transaction while also underscoring the serious ramifications of providing false information under federal law.

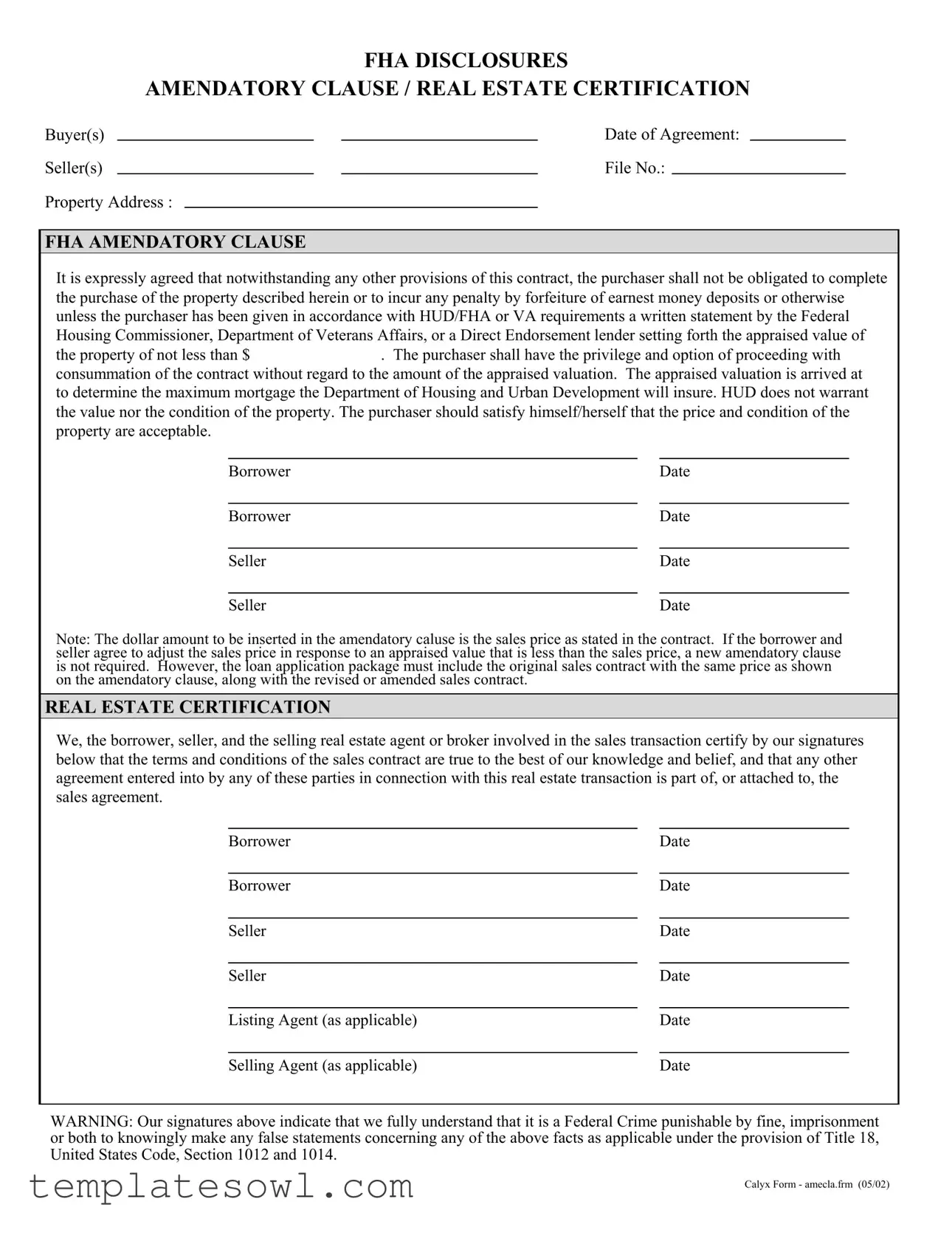

Fha Amendatory Clause Example

FHA DISCLOSURES

AMENDATORY CLAUSE / REAL ESTATE CERTIFICATION

Buyer(s) |

|

|

|

|

Date of Agreement: |

|

|

Seller(s) |

|

|

|

|

File No.: |

|

|

Property Address : |

|

|

|

|

|

|

|

FHA AMENDATORY CLAUSE

It is expressly agreed that notwithstanding any other provisions of this contract, the purchaser shall not be obligated to complete the purchase of the property described herein or to incur any penalty by forfeiture of earnest money deposits or otherwise unless the purchaser has been given in accordance with HUD/FHA or VA requirements a written statement by the Federal Housing Commissioner, Department of Veterans Affairs, or a Direct Endorsement lender setting forth the appraised value of

the property of not less than $. The purchaser shall have the privilege and option of proceeding with consummation of the contract without regard to the amount of the appraised valuation. The appraised valuation is arrived at to determine the maximum mortgage the Department of Housing and Urban Development will insure. HUD does not warrant the value nor the condition of the property. The purchaser should satisfy himself/herself that the price and condition of the property are acceptable.

Borrower |

Date |

|

|

|

|

Borrower |

Date |

|

|

|

|

Seller |

|

Date |

|

|

|

Seller |

|

Date |

Note: The dollar amount to be inserted in the amendatory caluse is the sales price as stated in the contract. If the borrower and seller agree to adjust the sales price in response to an appraised value that is less than the sales price, a new amendatory clause is not required. However, the loan application package must include the original sales contract with the same price as shown on the amendatory clause, along with the revised or amended sales contract.

REAL ESTATE CERTIFICATION

We, the borrower, seller, and the selling real estate agent or broker involved in the sales transaction certify by our signatures below that the terms and conditions of the sales contract are true to the best of our knowledge and belief, and that any other agreement entered into by any of these parties in connection with this real estate transaction is part of, or attached to, the sales agreement.

Borrower |

Date |

|

|

|

|

Borrower |

Date |

|

|

|

|

Seller |

|

Date |

|

|

|

Seller |

|

Date |

|

|

|

Listing Agent (as applicable) |

|

Date |

|

|

|

Selling Agent (as applicable) |

|

Date |

WARNING: Our signatures above indicate that we fully understand that it is a Federal Crime punishable by fine, imprisonment or both to knowingly make any false statements concerning any of the above facts as applicable under the provision of Title 18, United States Code, Section 1012 and 1014.

Calyx Form - amecla.frm (05/02)

Form Characteristics

| Fact Name | Fact Details |

|---|---|

| Purpose | The FHA Amendatory Clause protects buyers by ensuring they are not obligated to complete the purchase unless the property appraises for a certain amount. |

| Governing Laws | This clause operates under federal regulations set forth by the Department of Housing and Urban Development (HUD) and the Department of Veterans Affairs (VA). |

| Appraised Value | The appraised value serves as the minimum threshold to avoid penalties, ensuring the buyer can walk away if the property appraises for less than the agreed sales price. |

| Buyer Privilege | Buyers have the option to proceed with the purchase regardless of the appraised value, giving them flexibility in their decision. |

| Signature Requirement | All parties involved, including buyers, sellers, and real estate agents, must provide their signatures on the form to confirm their understanding and agreement. |

| Legal Consequences | Providing false information on the form can lead to severe legal ramifications, including fines and imprisonment as outlined in Title 18, United States Code. |

Guidelines on Utilizing Fha Amendatory Clause

Completing the FHA Amendatory Clause form is a critical step in your property transaction process. This form outlines the conditions under which a buyer is obligated to proceed with a purchase. It ensures that both parties understand the implications of the property’s appraised value. Be prepared to gather the necessary details before you begin filling out the form.

- Fill in the Buyer(s) Information: Enter the names of the buyers in the designated area.

- Date of Agreement: Write the date the purchase agreement was executed.

- Seller(s) Information: Enter the names of the sellers.

- File Number: Include the file number associated with the transaction, if applicable.

- Property Address: Clearly state the full address of the property being purchased.

- Appraised Value Statement: Insert the agreed-upon sales price as stated in the contract where indicated.

- Borrower Signatures: Both buyers need to sign and date the form.

- Seller Signatures: Both sellers need to sign and date the form.

- Complete Real Estate Certification: All parties involved, including real estate agents, should sign and date this section to certify the accuracy of the transaction details.

After filling out the form, ensure that you retain copies for your records. This documentation will be important as you move forward with the purchase process, especially in your dealings with lenders and other involved parties. Be sure to double-check all entries for accuracy before finalizing the document.

What You Should Know About This Form

What is the FHA Amendatory Clause?

The FHA Amendatory Clause is a provision that protects buyers in a real estate transaction that involves FHA financing. It allows buyers to back out of the purchase if the property's appraised value is less than the agreed purchase price. This clause ensures that the buyer is not obligated to proceed with the purchase if the appraisal does not meet the required standards.

Why is the FHA Amendatory Clause important?

This clause is crucial because it provides buyers with an added layer of financial protection. It prevents them from overpaying for a property and allows them to reconsider their purchase based on the appraised value. The goal is to help buyers make informed decisions and protect their investment.

Who needs to sign the FHA Amendatory Clause?

All parties involved in the transaction must sign the FHA Amendatory Clause. This includes the buyer(s), seller(s), and any real estate agents or brokers. By signing, they all confirm their understanding and acceptance of the terms outlined in the clause.

What happens if the appraised value is lower than the purchase price?

If the appraised value is lower than the agreed sales price, the buyer has the right to cancel the contract without incurring any penalties, such as losing their earnest money deposit. However, buyers may choose to proceed if they agree with the seller on a new purchase price.

Is it necessary to create a new FHA Amendatory Clause if the sales price is adjusted?

No, a new FHA Amendatory Clause is not needed if the borrower and seller agree to lower the sales price following a low appraisal. You must include the original sales contract with the same price as indicated in the amendment, along with any revised agreement.

What is the role of HUD in the FHA Amendatory Clause?

The Department of Housing and Urban Development (HUD) is responsible for establishing the requirements that guide the FHA Amendatory Clause. HUD evaluates the appraised value of properties to determine the maximum mortgage they will insure. However, they do not guarantee the value or condition of the property.

What should buyers do if they disagree with the appraised value?

If buyers disagree with the appraised value, they might consider negotiating with the seller to adjust the sales price or request a second appraisal. It’s important to have open communication with the seller and to document any changes or agreements reached.

Are there any penalties for not signing the FHA Amendatory Clause?

Not signing the FHA Amendatory Clause may place buyers at risk. Without this clause, they could become obligated to finalize the purchase regardless of the appraised value. This could lead to financial strain or potential loss of earnest money deposits if they decide to back out later.

What are the legal implications of the FHA Amendatory Clause?

Legally, the FHA Amendatory Clause provides a framework that outlines the rights and responsibilities of both buyers and sellers in a transaction involving FHA financing. It is important to understand that making false statements on this clause can have serious legal consequences, including fines and imprisonment.

Can a buyer still proceed with the purchase even if the appraisal is low?

Yes, the buyer retains the option to proceed with the purchase despite a low appraisal. They can choose to go forward by accepting the risk of paying more than the appraised value. It is advisable for buyers to carefully consider all factors before making such a decision.

Common mistakes

Filling out the FHA Amendatory Clause form can feel daunting, and small mistakes can lead to significant consequences. One common mistake is failing to insert the correct appraised value according to the contract. When filling out this form, the appraised value must match the sales price stated in the agreement. Omitting or misrepresenting this figure can cause delays and may even jeopardize the loan approval.

Another frequent error occurs when buyers neglect to sign the form. All parties involved—both buyers and sellers—need to provide their signatures. Without these, the form holds no validity, leading to complications down the line. Remember, it takes just one signature missing to potentially invalidate the agreement.

A third mistake involves misunderstanding the purpose of the amendatory clause. Some individuals mistakenly assume that it guarantees the purchase of the property. In reality, this clause protects buyers by allowing them to withdraw if the appraised value falls below the stated sales price. Recognizing this distinction is vital for making informed decisions.

Many people forget to keep copies of the original sales contract. When revisions occur—like adjusting sales price based on appraised value—it's essential to include both the original and the amended contracts in the loan application package. Failing to do so can lead to unnecessary confusion and may complicate the closing process.

Moreover, one must be careful with the wording on the form. Ambiguities or unclear language can lead to misunderstandings. The FHA wants to ensure that all terms are unequivocal, so clear, straightforward language is preferable. Lack of clarity might result in disputes between buyers and sellers later on.

Inadequate attention to the involvement of real estate agents is another common pitfall. If agents or brokers are part of the transaction, their involvement must be documented properly. This includes signatures where applicable. Missing this step can lead to claims of non-compliance with regulations.

Additionally, some individuals overlook the warning about false statements. The form contains a clear caution regarding the consequences of providing misleading information. Ignoring this can lead to serious legal repercussions, so it’s essential to comprehend the gravity of this warning fully.

An often-ignored detail is the date on the agreement. The contract must reflect an accurate and current date to be valid. If the date is incorrect or missing, it could create discrepancies that hinder the processing of the loan.

Lastly, buyers sometimes fail to seek clarification about the HUD/FHA or VA requirements. Understanding these guidelines is crucial for successfully navigating the amendatory clause. Not doing so may result in misinterpretations and unnecessary delays.

Documents used along the form

When engaging in transactions involving Federal Housing Administration (FHA) financing, several key documents accompany the FHA Amendatory Clause. Understanding these forms not only helps simplify the process but also ensures compliance with FHA requirements. Below are four commonly used documents in conjunction with the FHA Amendatory Clause.

- Sales Contract: This document outlines the terms of the sale between the buyer and the seller. It includes the sale price, contingencies, and any specific conditions that must be met before closing. The sale contract serves as the primary agreement and must be referenced in association with the FHA Amendatory Clause.

- FHA Loan Application: Also known as the Uniform Residential Loan Application (URLA), this form gathers personal and financial information from the borrower to assess eligibility for an FHA loan. It is a critical part of the underwriting process and must be completed accurately to facilitate the financing of the home purchase.

- Appraisal Report: Conducted by a licensed appraiser, this report estimates the value of the property being purchased. The appraisal is essential for FHA loans, as it determines whether the property meets the required value for the loan amount being requested. This document secures compliance with FHA guidelines related to property value.

- Closing Disclosure: This document provides a detailed account of the final terms of the loan, including costs associated with the transaction. Provided to the borrower at least three days before closing, it ensures that all financial aspects are transparent and understood by the buyer, thereby helping to prevent any surprises on the closing day.

Accompanying the FHA Amendatory Clause with these documents helps streamline the purchasing process and assures adherence to FHA regulations. Buyers should carefully review each document to ensure clarity and understanding, which enhances the overall experience of purchasing a home using FHA financing.

Similar forms

- Loan Estimate (LE): Similar to the FHA Amendatory Clause, the Loan Estimate provides essential information about loan terms and estimated costs. Both documents aim to protect the buyer by ensuring they are informed of the financial implications of their agreement before proceeding with a property transaction.

- Closing Disclosure (CD): Like the FHA Amendatory Clause, the Closing Disclosure outlines the final details of the mortgage loan, including the loan amount and related fees. This document emphasizes the importance of transparency in the transaction process, ensuring that buyers are fully aware of the financial aspects before closing.

- Appraisal Report: The FHA Amendatory Clause relies on an appraisal to determine the property's value. Similarly, the Appraisal Report provides an unbiased assessment of the property's worth, which is crucial for both buyers and lenders in ensuring that the property's sale aligns with its market value.

- Sales Agreement (Purchase Agreement): The FHA Amendatory Clause is often included within a Sales Agreement. Both documents outline the terms and conditions of the property sale, protecting the interests of both parties. They ensure that buyers understand their rights and obligations in relation to the property being sold.

Dos and Don'ts

When completing the FHA Amendatory Clause form, following the right steps can help ensure a smooth and compliant process. Here are nine essential dos and don'ts to keep in mind.

- Do: Ensure you have the correct property address listed on the form.

- Do: Include the sales price as specified in your sales contract.

- Do: Obtain a written statement from the Federal Housing Commissioner or Direct Endorsement lender regarding the appraised value.

- Do: Keep a copy of the original sales contract along with any amendments for your records.

- Do: Review the completed form carefully to confirm all details are accurate before signing.

- Don't: Insert an appraised value that is lower than the agreed sales price without adjusting the contract.

- Don't: Forget to gather all necessary signatures, including those of sellers and brokers.

- Don't: Delay in submitting the necessary documentation after completion; timely submission is crucial.

- Don't: Make assumptions; if in doubt, consult with a professional for clarification.

By adhering to these guidelines, you can navigate the FHA Amendatory Clause process with confidence and ensure compliance with relevant regulations.

Misconceptions

Understanding the FHA Amendatory Clause can sometimes be challenging, leading to various misconceptions. Below are ten common misconceptions, clarified for better comprehension.

- The FHA Amendatory Clause guarantees a specific appraised value. Many believe the clause ensures a specific appraised value of the property, but it actually states that the buyer is not obligated to complete the purchase unless the appraised value meets or exceeds the sales price.

- This clause applies only to FHA loans. Some think the FHA Amendatory Clause is exclusive to FHA loans, but it can also apply in cases involving VA loans when stated in the agreement.

- Buyers must automatically forfeit their earnest money. A common misconception is that if the property appraises for less than the sales price, the buyer loses their earnest money. In reality, the buyer has the option to back out without penalty, as stated in the clause.

- The appraised value is a guarantee of the property's worth. Many assume that the appraised value reflects the true market value; however, it merely indicates the maximum amount the FHA will insure, without guaranteeing the property’s value or condition.

- Adjustments to the sales price require a new clause. Some believe that if the sales price is renegotiated after an appraisal, a new FHA Amendatory Clause must be created. This is not the case; the original clause remains valid as long as the revised sales contract reflects the new price.

- Only the buyer can benefit from this clause. There is a misconception that only buyers benefit from the FHA Amendatory Clause. However, it also protects sellers by setting clear expectations about the transaction process in relation to appraisals.

- All parties must sign a separate document for the clause to be valid. It is often thought that separate documentation is required for the clause. In fact, the signatures included in the main sales agreement suffice to validate the clause.

- The FHA Amendatory Clause is optional. Some people believe this clause can be excluded without consequences. However, it is a necessary component of FHA-insured home purchases designed to protect all parties involved.

- The FHA Amendatory Clause does not have to be included in the loan application. A common error is assuming this clause is irrelevant for the loan application. In truth, it must be part of the application package to maintain compliance.

- This clause delays the closing process. Many fear that incorporating the FHA Amendatory Clause will lengthen the closing procedure. While it does require appraisal evaluation, it is a standard part of the FHA process designed to facilitate proper funding and agreements.

Understanding these misconceptions can help buyers and sellers navigate their real estate transactions with clarity and confidence.

Key takeaways

Here are some key takeaways to keep in mind when filling out and using the FHA Amendatory Clause form:

- Understand the Purpose: The FHA Amendatory Clause protects buyers by ensuring they are not obligated to proceed with the purchase if the appraised value of the property is less than the agreed sales price.

- Include the Correct Dollar Amount: Remember to insert the sales price as stated in your contract into the amendatory clause. Accurate information is essential for compliance.

- Know Your Rights: If the appraised value comes in lower than the sales price, you and the seller can negotiate a new price without needing to create a new amendatory clause.

- Certify Validity: All parties involved must sign to certify the accuracy of the information provided. Misrepresentation can lead to serious legal consequences under federal law.

Browse Other Templates

Weis Markets - Applicants are reminded to save their application correctly if submitted electronically.

Nyc Corp Tax Rate - All corporations operating in New York State should be aware of the CT-5.4 form and its implications.

Certificate of Membership - This ledger provides clarity on the amount paid for membership transactions.