Fill Out Your Fha Refinance Authorization Form

The FHA Refinance Authorization form plays a crucial role in the refinancing process for homeowners seeking to leverage the benefits offered by the Federal Housing Administration (FHA). This essential document requires the submission of multiple identifiers, including the loan number, as well as the Borrower Social Security Numbers for all individuals involved in the refinance. Accurate completion of the form ensures that the necessary checks are conducted for eligibility and potential issues. Particularly noteworthy is the inclusion of CAIVRS, which stands for Credit Alert Verification Reporting System. This system helps to identify any outstanding federal obligations the borrower may have, which can affect their ability to refinance. Additionally, the form requires relevant FHA Case Numbers—both for the new application and the mortgage being paid off—along with an expected closing month. By gathering this information, the form sets the stage for an efficient refinancing process, benefiting both lenders and borrowers alike.

Fha Refinance Authorization Example

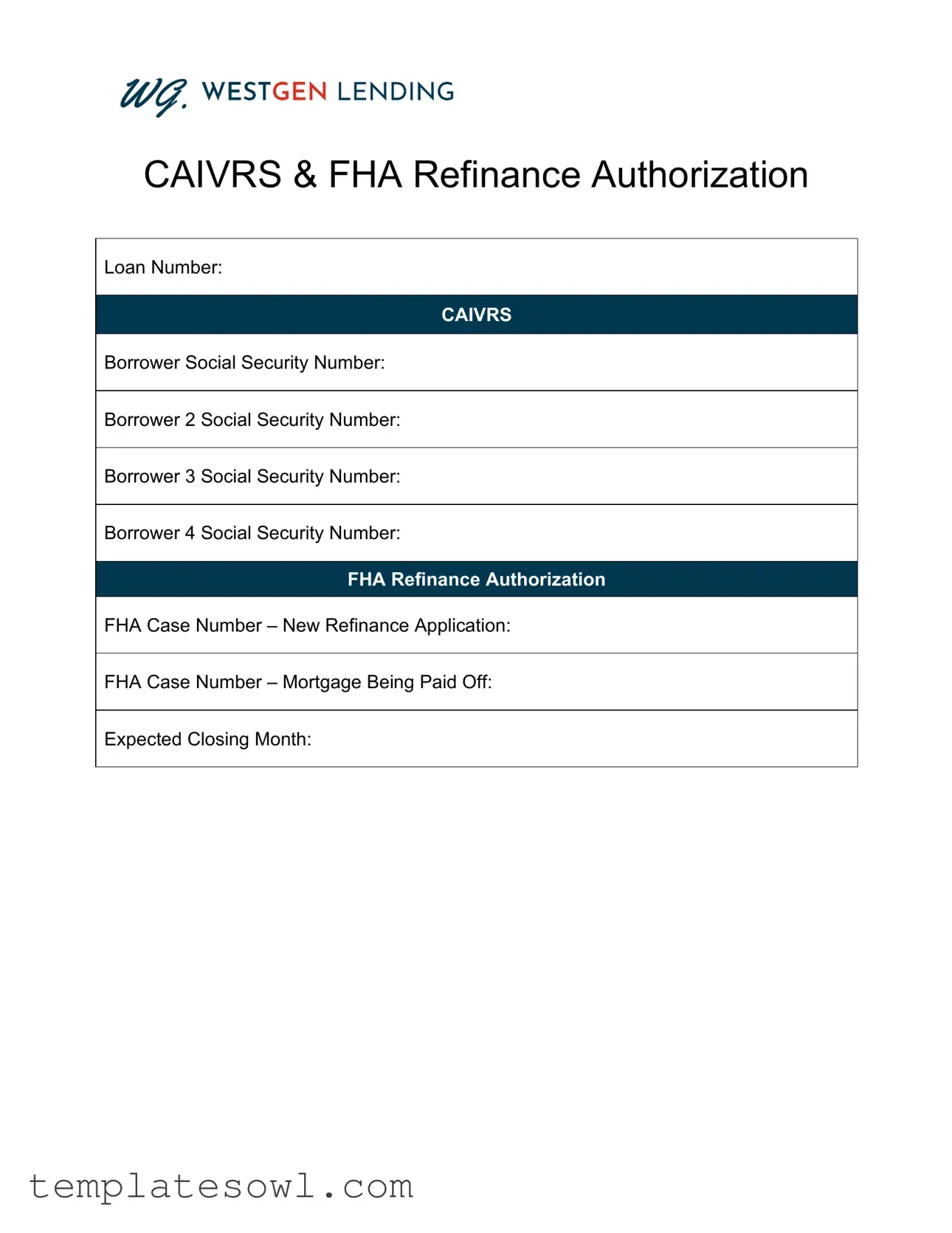

CAIVRS & FHA Refinance Authorization

Loan Number:

CAIVRS

Borrower Social Security Number:

Borrower 2 Social Security Number:

Borrower 3 Social Security Number:

Borrower 4 Social Security Number:

FHA Refinance Authorization

FHA Case Number – New Refinance Application:

FHA Case Number – Mortgage Being Paid Off:

Expected Closing Month:

Form Characteristics

| Fact Name | Details |

|---|---|

| Loan Number | This is a unique identifier assigned to each loan. It helps track the loan through the FHA system. |

| Social Security Numbers | The form requires Social Security Numbers for up to four borrowers, ensuring accurate identification and application processing. |

| FHA Case Number | Two FHA case numbers are needed. One is for the new refinance application, and the other is for the mortgage being paid off. |

| Expected Closing Month | Indicates when the borrower expects to close on the refinance, important for planning and scheduling the process. |

Guidelines on Utilizing Fha Refinance Authorization

Before beginning the process of filling out the FHA Refinance Authorization form, ensure that you have your personal information and loan details readily available. Each section of the form requires specific information, so careful attention is important for a smooth submission.

- Start with the Loan Number. Write down the loan number associated with your current mortgage.

- Next, enter your Social Security Number. If there are multiple borrowers, include the Social Security Numbers for Borrower 2, Borrower 3, and Borrower 4 in the designated spaces.

- Move on to the FHA Refinance Authorization section. Here, provide the FHA Case Number for your new refinance application.

- Then, fill in the FHA Case Number for the mortgage that is being paid off.

- Finally, indicate the Expected Closing Month. This is the month you anticipate closing on your refinance.

After completing these steps, review the form to ensure accuracy before submitting it. Having all information correctly filled out will help streamline the processing of your refinance application.

What You Should Know About This Form

What is the FHA Refinance Authorization form?

The FHA Refinance Authorization form is a document that authorizes the Federal Housing Administration (FHA) to gather information regarding a borrower's mortgage and credit status. This form is essential for individuals looking to refinance an existing FHA loan. It ensures that the lender can access necessary data to determine eligibility for refinancing options.

What information is required on the form?

The FHA Refinance Authorization form requires several key pieces of information, including the loan number, Social Security numbers of all borrowers involved, and FHA case numbers for both the new refinance application and the mortgage being paid off. An expected closing month is also requested to help manage the refinancing process effectively.

Who needs to sign the FHA Refinance Authorization form?

All borrowers listed on the refinance application must sign the FHA Refinance Authorization form. This includes anyone whose name is on the existing mortgage, as well as anyone seeking new financing under the refinance program. Their signatures indicate consent for the lender to access their financial information.

Is this form mandatory for FHA refinance applications?

Yes, submitting the FHA Refinance Authorization form is mandatory for all FHA refinance applications. Lenders will require this form to proceed with the application process. Without it, the loan request may be delayed or denied due to the inability to retrieve necessary credit and mortgage information.

How does the information on the form affect the refinancing process?

The information provided on the FHA Refinance Authorization form plays a crucial role in the refinancing process. Lenders use the detailed data to assess the borrower’s credit profile and determine the eligibility for favorable refinancing terms. Accurate and complete information can help expedite the approval process.

What happens if I do not provide accurate information on the form?

Providing inaccurate information on the FHA Refinance Authorization form can lead to complications during the refinancing process. It may result in delays, additional scrutiny by lenders, or even denial of the refinancing request. Therefore, it is essential for all borrowers to ensure that the form is completed accurately before submission.

Can the FHA Refinance Authorization form be revoked after submission?

Once the FHA Refinance Authorization form is submitted and processed, it is generally viewed as binding. However, borrowers do have the option to revoke their consent at any time before closing the loan. This may require notifying the lender formally, as well as withdrawing the refinance application if necessary.

How can I obtain the FHA Refinance Authorization form?

The FHA Refinance Authorization form can typically be obtained directly from your lender or through the FHA's official website. Many lenders provide this form as part of their refinancing package. It is advisable to consult with your lender for the most current version and any specific instructions required for completion.

Common mistakes

Filling out the FHA Refinance Authorization form can seem straightforward, but many people make mistakes that can delay their refinancing process. One common error is failing to provide a complete loan number. Each loan must have a unique identifier. If the loan number is incorrect or missing, it can lead to confusion and potential delays in processing.

Another frequent mistake involves the Social Security Numbers. Borrowers often forget to list all borrowers’ Social Security Numbers. In the case of a joint application, all parties must be included. This oversight can slow down the approval process as the necessary information is missing.

It's also essential to ensure that the FHA Case Number for both the new refinance application and the mortgage being paid off is accurately filled in. Some borrowers may inadvertently mix up these two numbers or fail to write them down altogether. This can create complications in tracking the transactions associated with the loans.

Many applicants overlook the expected closing month. This date helps the lender plan and allocate resources effectively. If this field is left blank or filled out with a vague timeline, it can lead to miscommunication and delays in finalizing the refinance.

Unclear handwriting can also snowball into serious issues. If the form is filled out by hand, any indecipherable text may lead to misunderstandings. Reviewers might misread critical information, resulting in processing delays while the lender seeks clarification.

Inaccurate contact information is another mistake that can hinder the refinancing process. Borrowers should provide current phone numbers and email addresses. Missing or outdated contact information can prevent the lender from reaching out when necessary.

Additionally, people may forget to sign the Authorization form. Without the required signatures, the entire application could be rendered invalid. Each borrower listed on the form needs to acknowledge and affirm their understanding of the authorization.

Moreover, not providing necessary documentation can be a significant setback. It's essential for borrowers to ensure that any required supporting documents are submitted alongside the form. Missing documentation may result in the need for additional requests from the lender, thus prolonging the approval process.

Finally, misunderstanding what the authorization entails can lead to confusion. Borrowers must be clear about the implications of their signatures. Lack of understanding can complicate the refinancing process and lead to undesirable outcomes for the borrowers.

Documents used along the form

The FHA Refinance Authorization form is a vital document in the refinancing process. It allows lenders to verify important borrower information and ensure compliance with FHA guidelines. Alongside this form, several other documents are commonly required to facilitate a smooth refinance experience.

- FHA Case Number Assignment: This document confirms the assignment of a new FHA case number for the refinance application, essential for tracking the loan.

- CAIVRS Verification: This is a report that checks if the borrower has any outstanding federal debts or delinquencies that could impact loan eligibility.

- Credit Report: Lenders will review the borrower's credit report to assess creditworthiness. This report details the borrower’s credit history and current credit score.

- Loan Application (Form 1003): Commonly known as the Uniform Residential Loan Application, this form collects detailed information about the borrower, employment, and assets.

- Debt-to-Income (DTI) Ratio Calculation: This calculation helps lenders determine the borrower’s financial capability by comparing monthly debt payments to monthly income.

- Property Appraisal Report: An appraisal assesses the property's market value and determines if it meets the FHA's standards for refinancing.

- Borrower Certification and Authorization: This document confirms that the borrower authorizes the lender to obtain and review necessary financial information for the loan process.

Understanding these supporting documents is crucial for borrowers initiating an FHA refinance. Proper preparation and accurate completion of each form streamline the refinancing process and help ensure a favorable outcome.

Similar forms

-

VA Loan Authorization Form: This form carries essential borrower information, including social security numbers, similar to the FHA Refinance Authorization form. It serves to verify eligibility for refinancing through VA loans.

-

Conventional Loan Application: Like the FHA Refinance Authorization, this application requires personal details of the borrower. It is used to assess the borrower’s creditworthiness and financial stability during the refinancing process.

-

Loan Estimate Form: This document outlines the estimated terms of the refinancing process. It similarly includes critical information such as the loan amount and the closing costs, providing clarity to the borrower.

-

Credit Authorization Form: This form is used to obtain the borrower's consent to access their credit history. Both this form and the FHA Refinance Authorization seek to ensure that the lender has the necessary information to make informed decisions.

-

Closing Disclosure: Issued before the closing of a loan, this document summarizes the final loan terms and settlement details. Similar to the FHA Refinance Authorization, it includes key information such as the loan number and borrower details.

Dos and Don'ts

When filling out the FHA Refinance Authorization form, pay attention to the details. Here are five important guidelines, including things you should and shouldn’t do:

- Do ensure all borrowers’ Social Security numbers are accurate and clearly written.

- Don’t leave any fields blank. Every section must be completed to avoid delays.

- Do double-check the FHA case numbers for both the new refinance application and the existing mortgage.

- Don’t submit the form without confirming the expected closing month aligns with your financial plans.

- Do keep a copy of the completed form for your records before submission.

Misconceptions

The FHA Refinance Authorization form is an important document in the mortgage refinancing process, particularly for those utilizing the Federal Housing Administration's programs. However, several misconceptions about this form might cause confusion for borrowers. Below are ten common misunderstandings explained.

-

The form is only needed for certain borrowers.

This is untrue. All borrowers participating in the FHA refinance process must complete the FHA Refinance Authorization form, regardless of their specific situation.

-

Completing the form guarantees refinancing approval.

While the form is necessary for application, it does not ensure that the borrower will receive approval for refinancing. Decision-making depends on various other criteria.

-

The form can be completed after submitting the loan application.

This misconception leads to delays. The FHA Refinance Authorization form should be completed concurrently with the loan application to ensure all pertinent information is available.

-

All Social Security Numbers listed must match the primary borrower.

This is not entirely correct. The form may require the Social Security Numbers of all parties involved, including co-borrowers or dependents, for proper identification during the refinancing process.

-

Borrowers must have a perfect credit history to use the form.

This belief is misleading. The FHA program does offer options for those with less than perfect credit. However, having a challenge in credit might affect terms and conditions.

-

The FHA Case Number is not relevant.

This is inaccurate. The FHA Case Number is essential for tracking the loan application throughout the approval process. It must be correctly filled out on the form.

-

Using the form costs a lot of money.

Completing the FHA Refinance Authorization form itself does not incur any fees. However, other costs may be associated with the refinancing process.

-

This form is the same as the original loan application.

This is a misconception. The FHA Refinance Authorization form specifically addresses refinancing and includes additional elements like the payoff mortgage details.

-

The information provided is kept private.

While efforts are made to protect borrower information, certain disclosures may be required by law. Thus, borrowers should always be informed about their privacy rights.

-

You cannot modify the form once submitted.

This is not entirely correct. If inaccuracies are found after submission, it may be possible to amend the information, but it’s best to do it prior to submission to avoid complications.

Understanding these misconceptions can lead to a smoother refinancing experience. For anyone navigating this process, being informed is key to making educated decisions.

Key takeaways

Here are some key takeaways about filling out and using the FHA Refinance Authorization form:

- Gather required information. Before starting, ensure you have all necessary details, including loan numbers and Social Security numbers for all borrowers.

- Complete all fields. Missing information can delay your application. Fill in every section of the form thoroughly, including FHA case numbers.

- Understand CAIVRS. CAIVRS stands for the Credit Alert Verification Reporting System. This identifies any federal debts owed, which may impact your refinancing process.

- Use accurate case numbers. Enter the correct FHA case numbers for both the new refinance application and the mortgage being paid off to avoid complications.

- Check expected closing month. Include your estimated closing month to provide a timeline for the refinancing process.

- Submit in a timely manner. Ensure you submit the form as soon as possible to keep your refinancing on track.

- Keep copies. Retain a copy of the completed form for your records. This can be helpful for future reference.

- Follow up. After submission, reach out to your lender for any updates or further information needed regarding your application.

Browse Other Templates

If I Get Fired From My Job Can I Collect Unemployment - Claimants must provide details about each contact, including employer information and the method of contact.

888-556-2128 - Specify the area and tooth numbers relevant to the procedure.

Ambetter Inpatient Prior Authorization Form - If the member is currently treated on the proposed medication, indicate the duration.