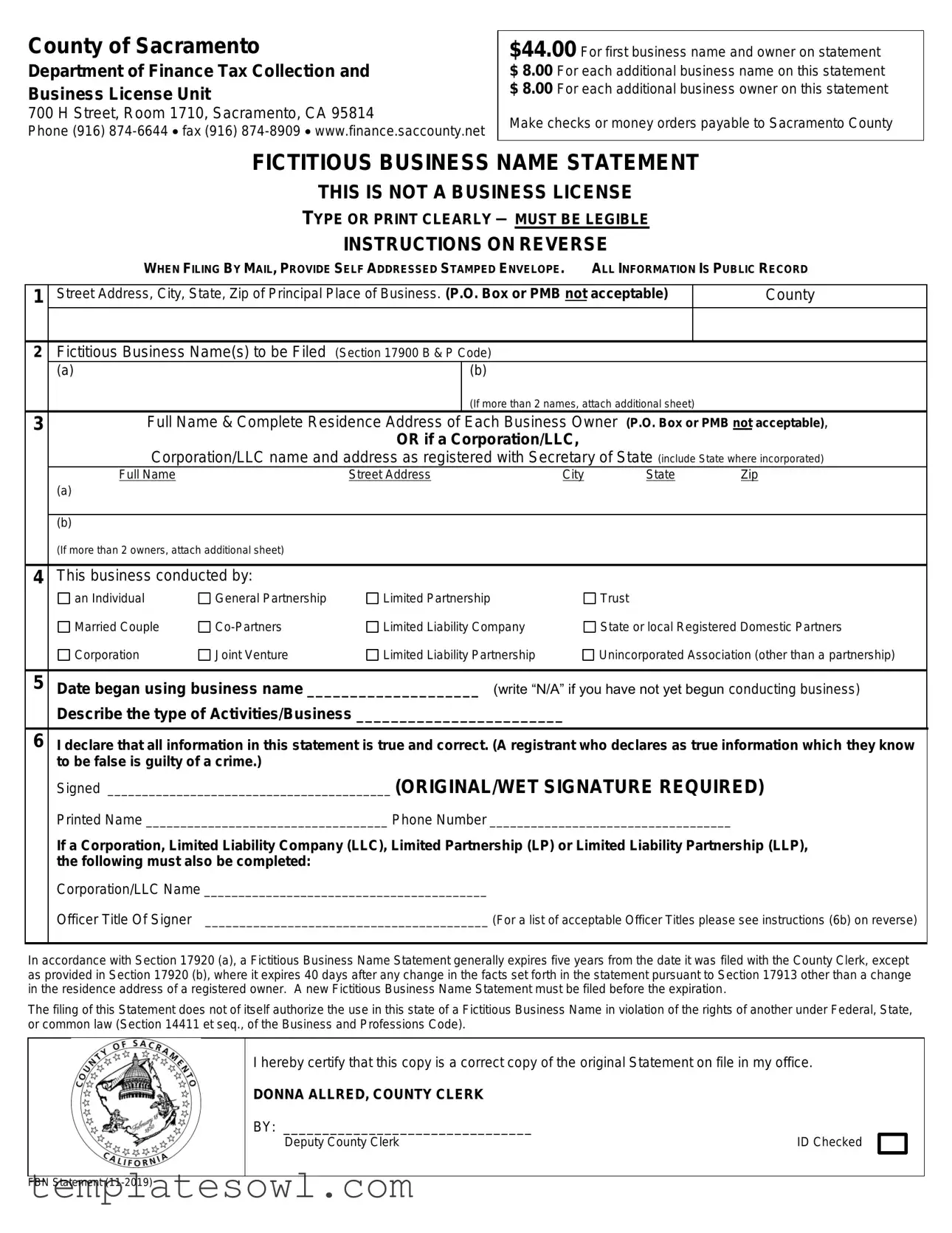

Fill Out Your Fictitious Business Name Statement Form

When starting a business in Sacramento County, understanding the Fictitious Business Name Statement form is essential. This document is necessary for those who wish to conduct business under a name that differs from their personal name or the registered name of their corporation or LLC. The process involves completing a straightforward form that requires key information, including the principal business address, the fictitious business names being used, and details about the business owners. There are associated fees, with an initial cost of $44 for the first name and owner, and $8 for each additional name or owner listed. It's important to note that the information provided in this statement becomes public record. Additionally, once filed, the Fictitious Business Name Statement is valid for five years, although it must be renewed or updated if any significant changes occur. Moreover, after filing, the registrant must publish the statement in a local newspaper weekly for four weeks for it to be considered legally effective. The seriousness of this filing process is underscored by the penalties for providing false information—this includes potential misdemeanor charges. Understanding these requirements aids entrepreneurs in ensuring compliance and helps protect their business interests.

Fictitious Business Name Statement Example

County of Sacramento

Department of Finance Tax Collection and Business License Unit

700 H Street, Room 1710, Sacramento, CA 95814

Phone (916)

$44.00 For first business name and owner on statement $ 8.00 For each additional business name on this statement $ 8.00 For each additional business owner on this statement

Make checks or money orders payable to Sacramento County

FICTITIOUS BUSINESS NAME STATEMENT

THIS IS NOT A BUSINESS LICENSE

TYPE OR PRINT CLEARLY – MUST BE LEGIBLE

INSTRUCTIONS ON REVERSE

|

WHEN FILING BY MAIL, PROVIDE SELF ADDRESSED STAMPED ENVELOPE. |

ALL INFORMATION IS PUBLIC RECORD |

||||||

|

|

|

|

|

||||

1 |

Street Address, City, State, Zip of Principal Place of Business. (P.O. Box or PMB not acceptable) |

|

County |

|||||

|

|

|

|

|

|

|

|

|

2 |

Fictitious Business Name(s) to be Filed |

(Section 17900 B & P Code) |

|

|

|

|

||

|

(a) |

|

|

(b) |

|

|

|

|

|

|

|

|

(If more than 2 names, attach additional sheet) |

|

|||

3 |

Full Name & Complete Residence Address of Each Business Owner (P.O. Box or PMB not acceptable), |

|||||||

|

|

|

OR if a Corporation/LLC, |

|

|

|

||

|

Corporation/LLC name and address as registered with Secretary of State (include State where incorporated) |

|||||||

|

Full Name |

|

Street Address |

City |

State |

Zip |

||

|

(a) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(b) |

|

|

|

|

|

|

|

|

(If more than 2 owners, attach additional sheet) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

4 |

This business conducted by: |

|

|

|

|

|

|

|

|

an Individual |

General Partnership |

Limited Partnership |

|

Trust |

|

||

|

Married Couple |

Limited Liability Company |

State or local Registered Domestic Partners |

|||||

|

Corporation |

Joint Venture |

Limited Liability Partnership |

Unincorporated Association (other than a partnership) |

||||

|

|

|

||||||

5 |

Date began using business name ____________________ |

(write “N/A” if you have not yet begun conducting business) |

||||||

|

Describe the type of Activities/Business ________________________ |

|

|

|

||||

|

|

|

|

|

|

|

|

|

6I declare that all information in this statement is true and correct. (A registrant who declares as true information which they know to be false is guilty of a crime.)

Signed _________________________________________ (ORIGINAL/WET SIGNATURE REQUIRED) Printed Name ___________________________________ Phone Number ___________________________________

If a Corporation, Limited Liability Company (LLC), Limited Partnership (LP) or Limited Liability Partnership (LLP), the following must also be completed:

Corporation/LLC Name _________________________________________

Officer Title Of Signer _________________________________________ (For a list of acceptable Officer Titles please see instructions (6b) on reverse)

In accordance with Section 17920 (a), a Fictitious Business Name Statement generally expires five years from the date it was filed with the County Clerk, except as provided in Section 17920 (b), where it expires 40 days after any change in the facts set forth in the statement pursuant to Section 17913 other than a change in the residence address of a registered owner. A new Fictitious Business Name Statement must be filed before the expiration.

The filing of this Statement does not of itself authorize the use in this state of a Fictitious Business Name in violation of the rights of another under Federal, State, or common law (Section 14411 et seq., of the Business and Professions Code).

I hereby certify that this copy is a correct copy of the original Statement on file in my office.

DONNA ALLRED, COUNTY CLERK

BY: ________________________________

Deputy County Clerk |

ID Checked |

FBN Statement

NOTICE TO REGISTRANT PURSUANT TO SECTION 17924 BUSINESS & PROFESSIONS CODE (B & P Code)

Within 30 days after the fictitious business name statement has been filed with the County Clerk, the statement must be published in a newspaper of general circulation in the county where the fictitious business name was filed. The statement must be published once a week for four successive weeks with at least five days between each date of publication. An affidavit of publication must be filed with the county clerk within 30 days after the completion of the publication. If the registrant has no place of business in this state, the notice shall be published in a newspaper of general circulation in Sacramento County. (Section 17917 B & P Code, Section 6064 Government Code).

If refiling is required because the prior statement has expired, the refiling need not be published unless there has been a change in the information in the expired statement, provided the refiling is filed within 40 days of the date the statement expired. (Section 17917 B & P Code). Any person who executes, files, or publishes any fictitious business name statement, knowing that such statement is false, in whole or in part, is guilty of a misdemeanor and upon conviction thereof shall be fined not to exceed one thousand dollars ($1,000.00). (Section 17930 B & P Code).

According to Section 17900 B & P Code, “Fictitious Business Name” Means:

“(1) In the case of an individual, a name that does not include the surname of the individual”

INSTRUCTIONS FOR COMPLETION OF STATEMENT (Sec. 17913, 17914, 17915 B & P Code)

Type or print legibly. (P.O. Box, postal drop box, mailing suite and c/o addresses are not acceptable for either the business or residence address.)

1.Insert the street address and county of the principal place of business in California. The fictitious business name statement shall be filed with the clerk of the county in which the registrant has his principal place of business or if the registrant has no place of business in California, the Fictitious Business Name Statement shall be filed with the Clerk of Sacramento County.

2.Insert the fictitious business name or names if more than one name. Only those businesses operated at the same address may be listed on one statement.

3.Individual: insert full name and residence address of the individual.

Married Couple: insert full name and residence address of both spouses.

Partnership,

Trust: insert the full name and residence address of each trustee.

Corporation: insert the name and address of the corporation as set out in its articles of incorporation, and the state of incorporation.

Limited Liability Company (LLC): insert the name and address of the LLC as set out in its articles of organization, and the state of organization.

State or local Registered Domestic Partnership: insert full name and residence address of each domestic partner.

4.Indicate which of the terms best describes the ownership of the business.

5.Insert the date on which the registrant first began using business name(s) or expected date to begin. If the registrant has not yet begun transacting business and the expected date is unknown, insert “N/A”.

Describe the type activities/business that is occurring at address in section 1

6a. If the registrant is an individual, the statement must be signed by the individual; if a partnership or other association of other persons, by a general partner; if a trust, by a trustee; if a corporation, by an officer (title must be indicated); if a limited liability company, by an officer or a manager (title must be indicated). (Signature of an agent is not acceptable)

6b. If the registrant is a Corporation, acceptable officer titles include President, Vice President, Secretary, Treasurer, CEO, CFO, COO.

If the registrant is an LLC, acceptable officer titles include President, Vice President, Secretary, Treasurer, CEO, CFO, COO, Member, Managing Member, and Manager

IF YOU ARE FILING YOUR STATEMENT BY MAIL, PLEASE INCLUDE A

TRADE NAME REGISTRATION (Sec. 14411, 14412, 14415, 14416 B&P Code)

The filing of articles of incorporation with the state and/or a fictitious business name statement in the county establishes a rebuttable presumption within that county that the registrant or corporation has the exclusive right to use that business name, as well as any confusingly similar name, if the registrant or corporation is the first to register such name and is actively engaged in a business utilizing the name. The rebuttable presumption shall be applicable until the statement is abandoned or otherwise expires and no new statement has been filed by the registrant.

EXPIRATION OF FICTITIOUS BUSINESS NAME STATEMENT (Sec. 17920 B&P Code)

(a)In accordance with Section 17920 (a), a Fictitious Business Name Statement generally expires five years from the date it was filed with the County Clerk, unless the statement expires earlier under (b) or (c) below. A NEW FICTITIOUS BUSINESS NAME STATEMENT MUST BE FILED BEFORE THE EXPIRATION.

(b)A fictitious business name statement expires 40 days after any change in the facts as set forth in the statement, except (1) a change in the residence address of an individual, general partner, or trustee does not cause the statement to expire, and (2) the filing of a statement of withdrawal from partnership by a withdrawing partner does not cause the statement to expire. A NEW STATEMENT MUST BE FILED WITHIN 40 DAYS AFTER A CHANGE IN THE INFORMATION REQUIRED ON THIS STATEMENT.

(c)A fictitious business name statement expires when the registrant files a statement of abandonment of use of the fictitious business name statement.

ONCE FILED, ALL INFORMATION ON THE FICTITIOUS BUSINESS NAME STATEMENT IS PUBLIC RECORD

For additional information on fictitious business names, refer to our Website at www.finance.saccounty.net

Form Characteristics

| Fact Name | Details |

|---|---|

| Governing Law | The Fictitious Business Name Statement is governed by Sections 17900–17930 of the California Business and Professions Code. |

| Initial Filing Fee | The fee for filing the first business name and owner is $44.00. |

| Additional Names and Owners | Each additional business name or owner incurs a fee of $8.00. |

| Public Record Status | All information submitted in this statement is considered public record and accessible to the public. |

| Expiration Period | A Fictitious Business Name Statement generally expires five years after filing but may expire sooner due to changes in the information provided. |

| Publication Requirement | The statement must be published in a local newspaper for four successive weeks within 30 days of filing. |

| Signature Requirement | An original signature is required on the statement, which must be provided by the registrant or an authorized representative. |

| Filing Locations | The statement should be filed with the clerk of the county where the principal place of business is located. |

Guidelines on Utilizing Fictitious Business Name Statement

Filling out a Fictitious Business Name Statement requires attention to detail and accuracy. Gather the necessary information before you start to ensure a smooth completion process. Once completed, the form must be submitted to the Sacramento County Clerk's office along with payment. Subsequently, you will need to publish the statement in a local newspaper, so keep that in mind as you prepare your documents.

- Enter the Street Address, City, State, and Zip Code of your principal place of business. Note that a P.O. Box is not acceptable.

- List the Fictitious Business Name(s) you wish to file. Use section 17900 B & P Code. If you have more than two names, attach an additional sheet.

- Provide the Full Name and Complete Residence Address of each business owner. If the business is a Corporation or LLC, include the name and address as registered with the Secretary of State.

- Indicate the type of ownership by selecting one of the options provided. Options may include Individual, General Partnership, Corporation, etc.

- Write the Date you began using the business name. If you have not started conducting business, write “N/A”.

- Describe the type of Activities/Business you will conduct.

- Declare the truthfulness of your information and include your Original Signature, printed name, and phone number. If applicable, include the title of the signer for corporations or LLCs.

- Complete any additional requirements if your business is a Corporation, LLC, LP, or LLP, specifically filling in the name and officer title.

Remember to include a self-addressed, stamped envelope if you are filing by mail. If you are filing in person or through an agent, present valid identification. The completion of this form sets the foundation for legally using your chosen business name.

What You Should Know About This Form

What is a Fictitious Business Name Statement?

A Fictitious Business Name Statement is a document that allows individuals or businesses to register a name under which they will operate that is different from their personal name or the officially registered name of their corporation or LLC. This statement serves to inform the public about who is behind a business name and is a requirement in California and many other states. It is crucial for transparency and facilitates the identification of business owners.

What are the costs associated with filing a Fictitious Business Name Statement?

The initial fee for filing the Fictitious Business Name Statement is $44. This fee covers the registration of the first business name and the owner listed on the statement. If you have additional business names or owners, it will cost $8 for each name or owner. Payment can be made through checks or money orders made out to Sacramento County. It is important to ensure that all fees are submitted to avoid processing delays.

How long is a Fictitious Business Name Statement valid?

A Fictitious Business Name Statement is generally valid for five years from the date of filing. It will, however, expire earlier if there is a change in the information provided, except for changes in a registered owner's residence address. Should any changes occur, a new statement must be filed within 40 days from when the change takes place. It is essential to keep your business name registration updated to maintain compliance.

What are the publication requirements after filing a Fictitious Business Name Statement?

After filing your Fictitious Business Name Statement, you must publish it in a newspaper of general circulation within the county where the statement was filed. This publication should occur once a week for four consecutive weeks, with at least five days between each publication. An affidavit confirming this publication must be submitted to the county clerk within 30 days following the completion of the publication period. Compliance with these requirements is important to ensure that the registration is fully recognized.

Common mistakes

Filling out the Fictitious Business Name Statement form can seem straightforward, but many people make common mistakes that can delay their registration process. One such mistake is using a P.O. Box or PMB for the principal place of business. The form specifically requires a physical street address. Skipping this detail often results in the application being returned for correction.

Another frequent error involves the fictitious business name section. Applicants sometimes attempt to list more names than allowed. The form permits only two names on the statement itself; if additional names are necessary, applicants must attach an extra sheet. Failing to adhere to this guideline could lead to rejection.

Incomplete or incorrectly formatted information is also a common pitfall. Respondents might forget to include critical information such as the business ownership type. This can cause confusion and prolong the review process. Clearly marking the ownership structure, whether it’s a corporation, LLC, or partnership, is essential.

Addressing the section for business owners poses its own challenges. Some individuals neglect to provide complete residence addresses for all owners. This information must be precise and cannot use a P.O. Box. Not providing full names and addresses can delay approval and lead to additional requests for information.

Lack of attention to the signature requirements presents another hurdle. Many people forget that an original signature is necessary; electronic or stamped signatures will not suffice. Filing without a proper signature can result in the form being deemed invalid.

Many applicants miscalculate the filing fees, which vary based on the number of business names and owners included. Understanding the fee structure is important to avoid delays caused by pending payments.

Another oversight occurs when registrants fail to include a self-addressed, stamped envelope for mail filings. This simple requirement ensures that applicants receive their endorsed copies promptly. Without it, processing could take longer than expected.

Providing insufficient information about the business activities is yet another mistake. Describing the type of activities or business is critical for proper classification, and vague answers can lead to follow-up questions and delays.

Finally, misunderstanding the expiration policies can cause problems down the line. Many forget that a Fictitious Business Name Statement generally expires five years from the filing date. Staying informed about renewal requirements is crucial to maintaining good standing.

Documents used along the form

When registering a fictitious business name, certain other forms and documents may also be necessary. These forms facilitate compliance with local and state regulations and help ensure that your business operates within legal guidelines. Below is a list of documents commonly paired with the Fictitious Business Name Statement.

- Business License Application: This form is required to legally operate a business within a specific locality. It usually requires information about the nature of your business, location, and sometimes details about ownership.

- Partnership Agreement: If your business has more than one owner, a partnership agreement outlines the roles, responsibilities, and rights of each partner. This document can prevent disputes and clarify expectations.

- Tax Registration Form: To comply with federal and state tax regulations, businesses must often fill out a tax registration form. This form ensures that your business is registered for proper tax identification and obligations.

- Sales Tax Permit: If your business sells taxable goods or services, you will need a sales tax permit. This document allows you to collect sales tax from customers and remit it to the state.

- Employer Identification Number (EIN): Obtaining an EIN from the IRS is essential for businesses that have employees or operate as a corporation or partnership. This number is used for tax purposes.

- Articles of Incorporation: For businesses structured as corporations, submitting Articles of Incorporation is necessary. This document outlines the corporation's purpose, structure, and other essential details.

- Operating Agreement: If your business is a Limited Liability Company (LLC), this agreement details the responsibilities of members and management structure, supporting smooth operations.

- Affidavit of Publication: After filing your Fictitious Business Name Statement, you must publish it in a local newspaper. An affidavit is then filed to confirm that this publication requirement has been fulfilled.

Each of these forms plays a crucial role in business operations. Proper completion and submission of these documents help ensure compliance with legal standards, enabling businesses to focus on their growth and success.

Similar forms

The Fictitious Business Name Statement form shares similarities with various other business-related documents. Here are five documents that resemble it in function or purpose:

- Business License Application: Like the Fictitious Business Name Statement, a Business License Application is essential for legally operating a business. Both documents require details about the business owner and the business itself, including the name and address.

- Partnership Agreement: This document outlines the relationship between business partners, similar to how the Fictitious Business Name Statement records the owners. Both documents need clear identification of the individuals involved and their roles or contributions.

- Operating Agreement for LLCs: An Operating Agreement establishes the internal workings of a Limited Liability Company. Like the Fictitious Business Name Statement, it details the names and addresses of members and outlines the company's structure, ensuring all parties are on the same page.

- Trademark Registration Application: When applying for a trademark, businesses provide information about their name and its use. This is similar to the Fictitious Business Name Statement, which legally registers a business name, protecting it from use by others.

- DBA Registration Form: A "Doing Business As" registration allows a business to operate under a name different from its legal name. Like the Fictitious Business Name Statement, it enables transparency in business identities, requiring disclosure of the name and owner's information.

Dos and Don'ts

When filling out the Fictitious Business Name Statement form, it’s essential to pay attention to certain details. The accuracy and clarity of your submission can prevent delays or complications down the road. Here’s a helpful list of things you should and shouldn’t do:

- Do: Type or print your information clearly.

- Do: Provide the proper physical address for your principal place of business, not a P.O. Box.

- Do: Include the full name and complete residence address of each business owner.

- Do: Sign the form with an original wet signature, as electronic signatures may not be accepted.

- Do: Submit a self-addressed stamped envelope if you are filing by mail to receive your endorsed copies.

- Don’t: Use a mailing address such as a P.O. Box for your business or owner's address.

- Don’t: Omit any required information, as incomplete forms may be rejected.

- Don’t: Forget to publish your statement in a local newspaper within 30 days after filing.

- Don’t: Provide false information, as doing so can lead to serious legal consequences.

- Don’t: Delayed filing of a new statement if there are changes in your business details.

By following these guidelines, you can navigate the process more easily and ensure that your Fictitious Business Name Statement is filed correctly. Always double-check your entries for accuracy before submitting, which will help you avoid unnecessary complications.

Misconceptions

Understanding the Fictitious Business Name Statement form can be tricky. Here are seven common misconceptions and explanations to help clarify any confusion.

- Filing the statement gives exclusive rights to a business name. Many believe that once they file a fictitious business name statement, they automatically have exclusive rights to that name. In reality, this filing does not prevent others from using similar names. It merely establishes a presumption of use within the county.

- You don’t have to renew the statement. A common belief is that once filed, the statement remains valid indefinitely. However, the statement typically expires after five years unless renewed. It's essential to keep track of this timeline.

- A P.O. Box address is acceptable. Some people think using a P.O. Box is sufficient for listing a business address. In fact, the form specifically requires a physical street address; P.O. Boxes are not allowed.

- Anyone can file the statement on behalf of the business owner. There’s a misconception that any person can submit the fictitious business name statement. However, it must be signed by the actual business owner or an authorized representative; signatures of agents are not acceptable.

- Posting the statement online replaces the newspaper requirement. While some may think that publishing the statement online suffices, the law requires that it be published in a local newspaper for four consecutive weeks. This ensures proper public notice.

- A fictitious business name equals a business license. People often confuse filing a fictitious business name statement with obtaining a business license. They are two distinct processes; the statement does not grant permission to operate a business.

- Changes to owner information do not require a new statement. Some individuals assume that minor changes, such as a change of address, don’t need a new filing. However, significant changes in ownership or business structure necessitate filing a new statement within 40 days.

Being informed about these misconceptions can save time and prevent potential legal issues. For further guidance, consulting with a legal professional is always advisable.

Key takeaways

Filling out and utilizing the Fictitious Business Name Statement form is an essential step for many business owners in California. Here are some key takeaways to keep in mind:

- Understand the Purpose: This form allows you to register a business name that is different from your personal name or your legal business name. It’s mostly used to ensure transparency in business operations.

- Accuracy is Key: All information you provide must be accurate and complete. Any false statements can lead to legal issues.

- Required Fees: Expect to pay $44 for the first business name and owner listed, $8 for each additional business name, and $8 for any additional business owners. These fees help process your applications.

- Public Record: Once filed, all details from your statement become public information. Anyone can access these records.

- Publication Requirement: Within 30 days of filing, you must publish your business name in a local newspaper for four consecutive weeks. Keep in mind this is a legal requirement that cannot be skipped.

- New Filings for Changes: If your business information changes, such as ownership or address, a new Fictitious Business Name Statement must be filed. This needs to happen within 40 days of the change.

- Expiration: The statement is valid for five years. After that, you must file a new one to continue using your business name legally.

Being thorough and understanding these takeaways can significantly ease the process of registering and using your fictitious business name.

Browse Other Templates

Maryland Offer in Compromise - The form reflects the compliance requirements expected by the Maryland Comptroller’s office.

Chabot College Transcript - Students can specify if the transcript should be processed immediately.

Eyemed Submit Claim - If unsure about any section, reach out for assistance before completing the claim form.