Fill Out Your Fictitious Business Statement Form

The Fictitious Business Name Statement form serves as a crucial document for anyone operating a business under a name that is not their own. It is necessary for individuals and entities alike to officially register their fictitious business name within 40 days of starting operations. The form includes essential sections that require detailed information about the business name, address of the principal place of business, and the registered owner's details. Each registrant must provide accurate identification, ensuring that the information is verified. The statement must be filed with the county clerk where the business is located, and it must be published in a newspaper of general circulation for four consecutive weeks. It’s also important to note that this statement has a lifespan of five years, after which it must be renewed, and any changes in business structure or ownership require a new filing. Understanding the requirements and implications of the Fictitious Business Name Statement is essential for legal compliance and protecting business rights.

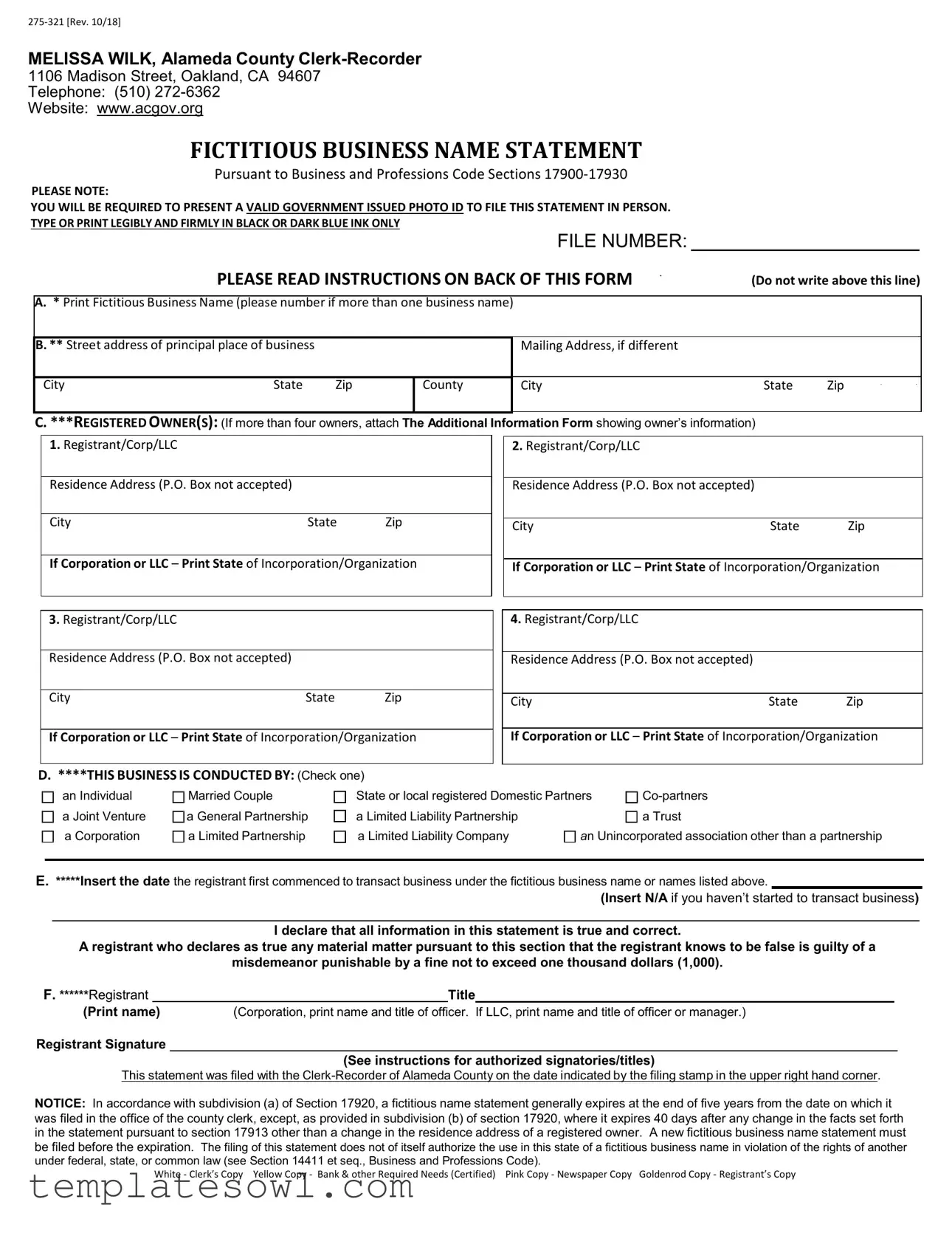

Fictitious Business Statement Example

275‐321 [Rev. 10/18]

MELISSA WILK, Alameda County

1106 Madison Street, Oakland, CA 94607

Telephone: (510)

Website: www.acgov.org

FICTITIOUS BUSINESS NAME STATEMENT

Pursuant to Business and Professions Code Sections 17900‐17930

PLEASE NOTE:

YOU WILL BE REQUIRED TO PRESENT A VALID GOVERNMENT ISSUED PHOTO ID TO FILE THIS STATEMENT IN PERSON.

TYPE OR PRINT LEGIBLY AND FIRMLY IN BLACK OR DARK BLUE INK ONLY

|

FILE NUMBER: |

|

|

PLEASE READ INSTRUCTIONS ON BACK OF THIS FORM |

(Do not write above this line) |

||

|

|

|

|

A. * Print Fictitious Business Name (please number if more than one business name) |

|

|

|

|

|

|

|

B. ** Street address of principal place of business

City |

State |

Zip |

County |

|

|

|

|

Mailing Address, if different

City |

State |

Zip |

C. ***REGISTERED OWNER(S): (If more than four owners, attach The Additional Information Form showing owner’s information)

1.Registrant/Corp/LLC

Residence Address (P.O. Box not accepted)

City |

State |

Zip |

If Corporation or LLC – Print State of Incorporation/Organization

3.Registrant/Corp/LLC

Residence Address (P.O. Box not accepted)

City |

State |

Zip |

If Corporation or LLC – Print State of Incorporation/Organization

2.Registrant/Corp/LLC

Residence Address (P.O. Box not accepted)

City |

State |

Zip |

If Corporation or LLC – Print State of Incorporation/Organization

4.Registrant/Corp/LLC

Residence Address (P.O. Box not accepted)

City |

State |

Zip |

If Corporation or LLC – Print State of Incorporation/Organization

D. ****THIS BUSINESS IS CONDUCTED BY: (Check one)

|

|

an Individual |

|

Married Couple |

|

State or local registered Domestic Partners |

|

|

|||

|

|

a Joint Venture |

|

a General Partnership |

|

a Limited Liability Partnership |

|

|

|

|

a Trust |

|

|

|

|

|

|

|

|

||||

|

|

a Corporation |

|

a Limited Partnership |

|

a Limited Liability Company |

|

An Unincorporated association other than a partnership |

|||

|

|

|

|

|

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

E.*****Insert the date the registrant first commenced to transact business under the fictitious business name or names listed above.

(Insert N/A if you haven’t started to transact business)

I declare that all information in this statement is true and correct.

A registrant who declares as true any material matter pursuant to this section that the registrant knows to be false is guilty of a

misdemeanor punishable by a fine not to exceed one thousand dollars (1,000).

F. ******Registrant |

|

Title |

|

||

(Print name) |

(Corporation, print name and title of officer. If LLC, print name and title of officer or manager.) |

|

|||

Registrant Signature |

|

|

|

|

|

|

|

(See instructions for authorized signatories/titles) |

|

||

This statement was filed with the

NOTICE: In accordance with subdivision (a) of Section 17920, a fictitious name statement generally expires at the end of five years from the date on which it was filed in the office of the county clerk, except, as provided in subdivision (b) of section 17920, where it expires 40 days after any change in the facts set forth in the statement pursuant to section 17913 other than a change in the residence address of a registered owner. A new fictitious business name statement must be filed before the expiration. The filing of this statement does not of itself authorize the use in this state of a fictitious business name in violation of the rights of another under federal, state, or common law (see Section 14411 et seq., Business and Professions Code).

White ‐ Clerk’s Copy Yellow Copy ‐ Bank & other Required Needs (Certified) Pink Copy ‐ Newspaper Copy Goldenrod Copy ‐ Registrant’s Copy

275‐321 [Rev. 10/18]

INSTRUCTIONS FOR COMPLETION OF FICTITIOUS BUSINESS NAME STATEMENT

THE INFORMATION BELOW IS NOT TO BE PUBLISHED (SEC. 17924, B&P)

REQUIREMENTS FOR FILING THE STATEMENT

Every person or entity who regularly transacts business in this state for profit using a fictitious business name shall file a fictitious business name (FBN) statement not later than 40 days from the date such business commences. The registrant shall file a new statement on or before the date of expiration of each FBN statement. The statement shall be filed in the county in which the principal place of business is located. If the principal place of business is outside this state, the statement shall be filed with the Clerk of Sacramento County.

CONTENTS OF THE STATEMENT (BUSINESS AND PROFESSIONS CODE SECTION 17913)

A. * Where one asterisk appears in the form:

(a)Insert the fictitious business name or names. (For additional business names use The Additional Information Form.)

(b)Only those businesses operated at the same address and under the same ownership may be listed on one statement.

(c)If the fictitious name includes Corporation, Corp, Incorporated, INC., PC, Limited Liability Company, LLP, or LLC, the registrant must also submit a state endorsed copy of the articles of incorporation or articles of organization for such name or for such registrant.

B.** Where two asterisks appear in the form:

(a)If the registrant has a place of business in this state, insert the street address and county of his or her principal place of business in this state.

(b)P.O. Box, postal drop box, mailing suite, or c/o addresses are not acceptable.

(c)If the registrant has no place of business in this state, insert the street address and county of his or her principal place of business outside this state and file with the Clerk of Sacramento County (B&P 17915).

PERSONS REQUIRED ON STATEMENT (BUSINESS AND PROFESSIONS CODE SECTION 17913)

C. *** Where three asterisks appear in the form:

(a)If the registrant is an individual, insert his or her full name and residence address.

(b)If the registrants are a married couple, insert the full name and residence address of both parties to the marriage.

(c)If the registrant is a general partnership,

(d)If the registrant is a limited partnership, insert the full name and residence address of each general partner.

(e)If the registrant is a limited liability company, insert the name and address of the limited liability company, as set out in its articles of organization on file with the CA Secretary of State, and the state of organization.

(f)If the registrant is a trust, insert the full name and residence address of each trustee

(g)If the registrant is a corporation, insert the name and address of the corporation, as set out in its articles of incorporation on file with the CA Secretary of State, and the state of incorporation.

(h)If the registrants are state or local registered domestic partners, insert the full name and residence address of each domestic partner.

D.**** Where four asterisks appear in the form:

(a)Check whichever of the terms listed on the front of the form best describes the nature of the business.

E.***** Where five asterisks appear in the form:

(a)Insert the date on which the registrant first commenced to transact business under the fictitious business name or names listed, if already transacting business under that name or names.

(b)Insert N/A if you have not yet commenced to transact business under the fictitious business name or names listed.

PERSONS REQUIRED TO SIGN STATEMENT (BUSINESS AND PROFESSIONS CODE SECTION 17914)

F. ****** Where six asterisk appears in the form:

The statement shall be signed as follows:

(a)If the registrant is an individual, by the individual.

(b)If the registrants are a married couple, by either party to the marriage.

(c)If the registrant is a general partnership, limited partnership, limited liability partnership,

(d)If the registrant is a limited liability company, by a manager or officer. (Ex: Managing Member, Member, or Principal)

(e)If the registrant is a trust, by a trustee.

(f)If the registrant is a corporation, by an officer. (Ex: CEO, President, Secretary, Treasurer, Vice President)

(g) If the registrant is a state or local registered domestic partnership, by one of the domestic partners.

PLACE OF FILING STATEMENT (BUSINESS AND PROFESSIONS CODE SECTION 17915)

The fictitious business name statement shall be filed with the clerk of the county in which the registrant has his or her principal place of business in this state or, if the registrant has no place of business in this state, with the Clerk of Sacramento County. Nothing in this chapter shall preclude a person from filing a fictitious business name statement in a county other than that where the principal place of business is located, as long as the requirements of this subdivision are also met.

PUBLICATION OF NOTICE (BUSINESS AND PROFESSIONS CODE SECTION 17917)

Publication for Original, New Filings (renewal with change in facts from previous filing), or Refile

(a)Within 30 days after a fictitious business name statement has been filed, the registrant shall cause it to be published in a newspaper of general circulation in the county where the fictitious business name statement was filed or, if there is no such newspaper in that county, in a newspaper of general circulation in an adjoining county. The publication must be once a week for four successive weeks and an affidavit of publication must be filed with the county clerk where the fictitious business name statement was filed within 30 days after the completion of the publication.

(b)If a refiling is required because the prior statement has expired, the refiling need not be published, unless there has been a change in the information required in the expired statement, provided the refiling is filed within 40 days of the date the statement expired.

EXPIRATION OF FICTITIOUS BUSINESS NAME STATEMENT (BUSINESS AND PROFESSIONS CODE SECTION 17920)

(a)Unless the statement expires earlier under (b) or (c) below, a fictitious business name statement expires five years from the date it was filed.

A NEW STATEMENT MUST BE FILED BEFORE THE EXPIRATION DATE.

(b)A fictitious business name statement expires 40 days after any change in the facts set forth in the statement, except (1) a change in the residence address of an individual, general partner, or trustee does not cause the statement to expire prior to the end of the five year term; and

(2)the filing of a statement of withdrawal from partnership by a withdrawing partner does not cause the statement to expire prior to the end of the five year term. A NEW STATEMENT MUST BE FILED WITHIN 40 DAYS AFTER A CHANGE IN THE FACTS.

(c)A fictitious business name statement expires when the registrant files a statement of abandonment of the fictitious business name described

in the statement.

PENALTY FOR EXECUTION, FILING OR PUBLICATION OF FALSE STATEMENT (BUSINESS AND PROFESSIONS CODE SECTION 17930)

Any person who executes, files, or publishes any statement under this chapter, knowing that such statement is false, in whole or in part, shall be guilty of a misdemeanor and upon conviction thereof shall be punished by a fine not to exceed one thousand dollars ($1,000).

Form Characteristics

| Fact Title | Description |

|---|---|

| Form Purpose | The Fictitious Business Name Statement allows individuals or entities to register a business name that differs from their legal name. It ensures transparency in business operations. |

| Governing Law | This form is governed by the Business and Professions Code Sections 17900‐17930 in California. |

| Filing Timeline | New businesses must file the statement within 40 days of commencing business to comply with state regulations. |

| Expiration Period | The Fictitious Business Name Statement typically expires five years after filing, unless there are changes in ownership or business structure requiring re-filing. |

| Identification Requirement | Individuals filing the statement in person must present a valid government-issued photo ID to verify identity and comply with local regulations. |

| Publication Obligation | After filing, registrants must publish the statement in a local newspaper of general circulation for four consecutive weeks within 30 days of filing. |

| Legal Consequences | Providing false information on this form can result in misdemeanor charges and a fine of up to $1,000, emphasizing the importance of accuracy. |

Guidelines on Utilizing Fictitious Business Statement

To complete the Fictitious Business Statement form, it's essential to follow the detailed instructions carefully. Gather all required information before starting. It’s important to ensure the accuracy of the details provided to avoid potential legal issues later on.

- Start by entering the Fictitious Business Name. If you have more than one name, number them accordingly.

- Provide the Street Address of your principal place of business, along with the City, State, Zip Code, and County. If your mailing address differs, include that as well.

- List the Registered Owner(s) of the business. If there are more than four owners, use The Additional Information Form. For each owner, include their residence address, avoiding P.O. Boxes, and specify the state of incorporation or organization if applicable.

- Select the option that best describes how the business is conducted. Options include individual, married couple, partnership types, corporation, and others. Check one box.

- Insert the date when you first started transacting business under the fictitious name. If you have not yet begun, input N/A.

- Complete the declaration statement, affirming that all provided information is truthful and correct.

- Sign the form. If the registrant is a corporation or LLC, print the name and title of the officer or manager who is signing.

- After completing the form, ensure it is presented along with a valid government-issued photo ID when filing in person.

What You Should Know About This Form

What is a Fictitious Business Name Statement?

A Fictitious Business Name Statement (FBN) is a legal document that allows an individual or business entity to operate under a name that is different from their legal name. In California, anyone who regularly transacts business for profit using a fictitious name is required to file this statement with the county where their primary business address is located. The purpose of this document is to inform the public of the true owner of the business and to prevent public deception.

How do I complete the Fictitious Business Name Statement form?

To complete the Fictitious Business Name Statement form, you'll need to provide specific information. This includes the fictitious business name that you plan to use, the principal place of business address, and details about the registered owner or owners. All addresses must be residential, as P.O. Boxes are not acceptable. If the business has more than one owner or name, you'll need to include additional information on a separate form. Make sure to print legibly using black or dark blue ink, and do not forget to sign the form.

What should I do after filing the Fictitious Business Name Statement?

Once you file the Fictitious Business Name Statement, you must publish a notice of your filing in a newspaper of general circulation within the county of filing. This publication needs to occur once a week for four consecutive weeks. After the publication is complete, you must submit an affidavit of publication to the county clerk's office. This step is critical because it helps ensure public awareness of your business operations under a fictitious name. If you do not comply with this requirement, your filing may not be considered valid.

What are the consequences of providing false information on the form?

Providing false information on the Fictitious Business Name Statement can lead to serious consequences. If it is found that any material information was declared false knowing it to be untrue, the individual could be charged with a misdemeanor. A conviction may result in a fine of up to one thousand dollars. It's essential to ensure that every item on the form is accurate and truthful to avoid these penalties.

How long is the Fictitious Business Name Statement valid?

The Fictitious Business Name Statement typically remains valid for five years from the filing date. However, it will expire 40 days after any change in the information provided, with the exception of certain residence address changes. It's important to note that if a new statement is not filed before the expiration date, you will need to file a fresh statement to continue using the fictitious name. Regularly check for any changes in your business that may affect your filing status.

Common mistakes

Filling out a Fictitious Business Name Statement can appear straightforward, but many common mistakes can lead to complications. Understanding these pitfalls can help ensure the process goes smoothly. Here are some common mistakes people make.

One frequent error is failing to provide complete business owner information. Registrants sometimes forget to include all owners' full names and addresses, especially if there are multiple owners. If there are more than four owners, it is necessary to attach the Additional Information Form. Omitting any information can result in delays or even rejection of the application.

Another common issue is using incomplete or incorrect addresses. Registrants are required to provide a street address for their principal place of business. P.O. Boxes and similar mailing addresses are not acceptable. Without an accurate physical address, the filing could be invalidated, leading to potential compliance issues.

Some individuals neglect to check the appropriate boxes that identify the nature of their business. This selection is crucial and guides the rest of the processing. Not marking this correctly could result in misclassification, which might lead to legal complications down the road.

Failing to indicate the date the business commenced can also create problems. This information is critical for determining the validity of the Fictitious Business Name Statement. If someone has not yet started transacting under the name, they should clearly indicate this by inserting "N/A." Misstating this date can lead to further inquiries from the clerks.

Signature requirements pose another challenge, especially for businesses with multiple owners or corporate structures. Each statement must be signed by the appropriate persons, depending on the business structure. Sometimes registrants forget to follow the signature instructions, which can result in a rejection.

Additionally, a common oversight is ignoring the filing deadlines. The form must be submitted within 40 days of starting to use the fictitious name. If this deadline is missed, individuals may be subjected to penalties or may need to start the process over.

Lastly, individuals often overlook the requirement for publication. After filing, the business name must be published in a local newspaper for four consecutive weeks. This step is mandatory, and failing to publish can lead to issues with compliance and may require re-filing.

Documents used along the form

When filing a Fictitious Business Name Statement, several additional forms and documents may be required. Each serves a specific purpose in ensuring compliance with local regulations and maintaining accurate business records.

- Additional Information Form: This form is used to provide details about additional owners if there are more than four owners associated with the fictitious business name. It ensures that all individuals involved are properly documented.

- Articles of Incorporation or Organization: If the business is a corporation or limited liability company (LLC), this document must be submitted along with the fictitious business name statement. It proves that the business entity is legally recognized and provides essential information regarding its structure.

- Proof of Publication: Once the fictitious business name is filed, there is a requirement to publish a notice in a local newspaper. An affidavit of publication needs to be submitted to confirm this process has been completed.

- Withdrawal Statement: If a partner decides to leave a partnership or if a business owner discontinues the use of a fictitious business name, this form is vital. It formally documents the withdrawal and helps revise the records accordingly.

Understanding these additional documents and their requirements can streamline the filing process and ensure compliance with local regulations. Proper documentation safeguards against potential legal issues that may arise from improper filings.

Similar forms

-

Business License Application: Like the Fictitious Business Statement, this document is required for anyone wishing to operate a business legally. It includes details about the business owner and the business operations, ensuring compliance with local regulations.

-

Sole Proprietorship Registration: This document identifies a business owned by one individual. It serves to inform the state about the owner’s identity and the business name, much like how a fictitious business name identifies an alternative operating name.

-

DBA Certificate (Doing Business As): Similar to a Fictitious Business Statement, a DBA certificate allows a business to operate under a name different from its legal name. It also provides transparency regarding the true owner of the business.

-

Partnership Agreement: This document outlines the roles and responsibilities of partners in a business venture. It is comparable in that both documents officially recognize the existence of a business entity and its operation under a specific name or structure.

-

Articles of Incorporation: When a business becomes a corporation, this document is filed with the state. Like the Fictitious Business Statement, it includes vital information about the business, such as its name and administrative structure.

-

Limited Liability Company (LLC) Formation Documents: Similar to the Fictitious Business Statement, these documents establish a business entity and outline its operation, ownership, and administration, ensuring legal compliance.

-

Trade Name Registration: This document is akin to a Fictitious Business Statement, as it allows a business to protect its trade name from being used by others and establishes a legal claim to that name.

-

Franchise Disclosure Document: For businesses operating under a franchise, this document outlines the responsibilities of both the franchisor and franchisee. Both documents serve to provide clarity and legality to business operations.

-

Nonprofit Organization Registration: Similar to the Fictitious Business Statement for profit businesses, this registration allows a nonprofit entity to operate legally while also identifying its governing structure and purpose.

-

Employer Identification Number (EIN) Application: While the EIN is primarily a tax identification number, it plays an essential role in legally recognizing the business. This application shares similarities with the Fictitious Business Statement in establishing a business’s identity with state and federal agencies.

Dos and Don'ts

Things You Should Do:

- Present a valid government-issued photo ID when filing in person.

- Type or print legibly in black or dark blue ink.

- Include all required information for each registered owner, ensuring no P.O. Box addresses are used.

- File the statement within 40 days of starting to use the fictitious business name.

- Ensure each fictitious business name is listed accurately and corresponds to the same address and ownership.

- Check off the appropriate description of your business type on the form.

Things You Shouldn't Do:

- Do not leave any required fields blank on the form.

- Avoid using P.O. Box or mailing addresses for the principal place of business.

- Do not assume a fictitious name statement is valid without proper filing and publication.

- Do not submit the form without the correct signatures from all registrants.

- Do not wait until the last minute; allow time for possible corrections or issues.

- Never file in a county where you do not have a principal place of business if you're within California.

Misconceptions

Misconceptions about the Fictitious Business Statement form can lead to confusion and potential legal issues. Here are six common misunderstandings:

- 1. Filing the form is optional. Many believe that submitting a fictitious business name statement is not necessary. However, anyone conducting business under a name other than their legal name must file this form within 40 days of starting operations.

- 2. A fictitious business name grants exclusive rights. Another misconception is that filing the statement provides exclusive rights to the business name. In reality, it does not prevent others from using the same or similar names, and the registrant must ensure their chosen name doesn't infringe on existing trademarks.

- 3. You can use a P.O. box for your business address. Some people think that they can list a P.O. box as their business address. This is incorrect. The form requires a physical address where the business operates, and P.O. boxes are not accepted.

- 4. The statement lasts indefinitely. Many individuals assume the fictitious business name statement does not expire once filed. This is false. The statement generally expires after five years unless a new statement is filed beforehand, especially if any facts change.

- 5. Only individuals need to file the statement. There’s a common belief that only individual proprietors must file this form. In fact, partnerships, corporations, and limited liability companies also need to submit a fictitious business name statement if they operate under a name that is different from their registered entity name.

- 6. The registration can be done anywhere. Some think they can file the statement wherever it's convenient. This is misleading. The fictitious business name statement must be filed in the county where the principal place of business is located. If outside California, filing should be done with Sacramento County.

Key takeaways

Filling out a Fictitious Business Name Statement is essential for anyone conducting business under a name other than their own. Here are key points to consider:

- Identification Requirement: You need to present a valid government-issued photo ID when filing this statement in person.

- Legibility Matters: Make sure to type or print clearly and use black or dark blue ink only.

- Time Limit for Filing: You must file the statement within 40 days of starting your business using a fictitious name.

- Expiration Awareness: The statement generally expires five years after filing unless changes occur that require a new filing.

- Accurate Information: Including all required details about the business and owners is crucial. Any false declaration can lead to legal penalties.

- Public Notice Requirement: After filing, publish your fictitious business name in a local newspaper for four consecutive weeks. An affidavit of this publication must be submitted to the county clerk.

- Change Notification: If any information changes, file a new statement within 40 days to ensure compliance.

- Multiple Names: If operating multiple businesses, each fictitious name must be numbered and listed separately.

- Filing Location: The filing must take place in the county where your principal business address is located. If applicable, out-of-state businesses must file with Sacramento County.

Be mindful of these points to ensure your filing process goes smoothly and complies with local regulations.

Browse Other Templates

Long Shoreman Jobs - This form lists names selected for processing toward Unidentified Casual status.

Basic College Math - Monitoring progress through the mastery tests encourages a proactive approach to learning.

Nurse Skills Checklist Template - Ensures nurses are familiar with protocols in critical care environments.