Fill Out Your Fidelity Self Employed 401 K Form

Managing retirement savings while being self-employed requires careful planning, and the Fidelity Self-Employed 401(k) contribution remittance form is a crucial tool in this process. This form allows individuals who run their own businesses to submit contribution deposits to their Fidelity Self-Employed 401(k) accounts. It includes several sections that capture essential information about both the employer and the contributions made on behalf of employees. The form guides users on how to allocate contributions correctly, whether they are employee contributions or employer profit-sharing deposits, ensuring compliance with applicable limits. It is also important for users to understand their responsibilities, including the necessity of clearly designating contribution types to avoid potential delays or returns of funds. The clear instructions provided facilitate the completion of the form, while contact information for Fidelity's support ensures that help is readily available. Additionally, a signature section affirms that the plan administrator acknowledges the rules and understands the implications of the information submitted. By following the guidelines outlined in this form, self-employed individuals can better manage their retirement contributions and plan for their financial futures.

Fidelity Self Employed 401 K Example

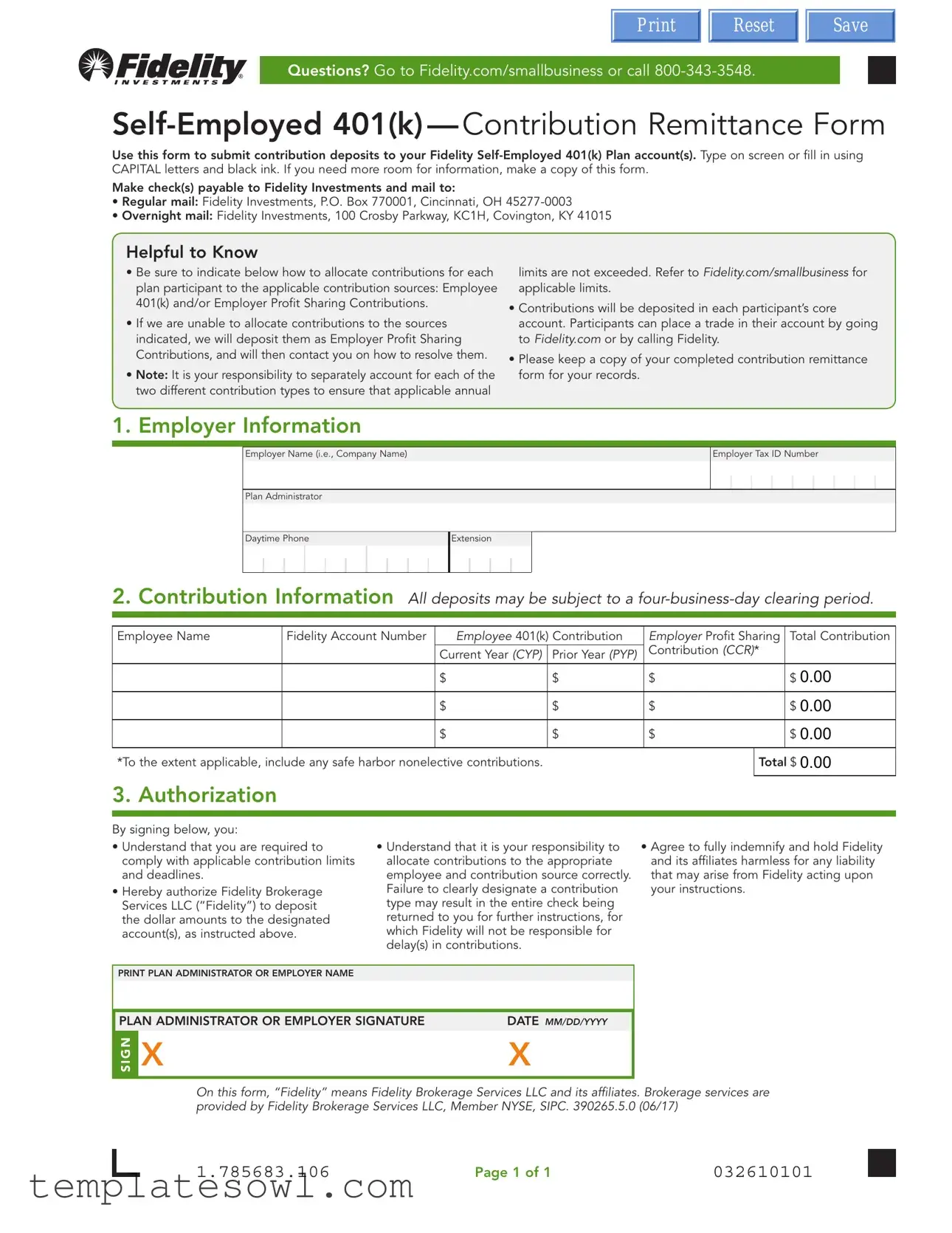

Print Reset Save

Questions? Go to Fidelity.com/smallbusiness or call

Use this form to submit contribution deposits to your Fidelity

Make check(s) payable to Fidelity Investments and mail to:

•Regular mail: Fidelity Investments, P.O. Box 770001, Cincinnati, OH

•Overnight mail: Fidelity Investments, 100 Crosby Parkway, KC1H, Covington, KY 41015

Helpful to Know

• Be sure to indicate below how to allocate contributions for each |

limits are not exceeded. Refer to Fidelity.com/smallbusiness for |

plan participant to the applicable contribution sources: Employee |

applicable limits. |

401(k) and/or Employer Profit Sharing Contributions. |

• Contributions will be deposited in each participant’s core |

|

|

• If we are unable to allocate contributions to the sources |

account. Participants can place a trade in their account by going |

indicated, we will deposit them as Employer Profit Sharing |

to Fidelity.com or by calling Fidelity. |

Contributions, and will then contact you on how to resolve them. |

• Please keep a copy of your completed contribution remittance |

|

|

• Note: It is your responsibility to separately account for each of the |

form for your records. |

two different contribution types to ensure that applicable annual |

|

1. Employer Information

Employer Name (i.e., Company Name)

Employer Tax ID Number

Plan Administrator

Daytime Phone

Extension

2.Contribution Information All deposits may be subject to a

Employee Name |

Fidelity Account Number |

Employee 401(k) Contribution |

Employer Profit Sharing |

Total Contribution |

||

|

|

|

|

Contribution (CCR)* |

|

|

|

|

Current Year (CYP) |

Prior Year (PYP) |

|

||

|

|

$ |

$ |

$ |

|

$ 0.00 |

|

|

|

|

|

|

|

|

|

$ |

$ |

$ |

|

$ 0.00 |

|

|

|

|

|

|

|

|

|

$ |

$ |

$ |

|

$ 0.00 |

|

|

|

|

|

|

|

*To the extent applicable, include any safe harbor nonelective contributions. |

|

|

Total $ 0.00 |

|||

|

|

|

|

|

|

|

3. Authorization

By signing below, you:

•Understand that you are required to comply with applicable contribution limits and deadlines.

•Hereby authorize Fidelity Brokerage Services LLC (“Fidelity”) to deposit the dollar amounts to the designated account(s), as instructed above.

•Understand that it is your responsibility to allocate contributions to the appropriate employee and contribution source correctly. Failure to clearly designate a contribution type may result in the entire check being returned to you for further instructions, for which Fidelity will not be responsible for delay(s) in contributions.

•Agree to fully indemnify and hold Fidelity and its affiliates harmless for any liability that may arise from Fidelity acting upon your instructions.

PRINT PLAN ADMINISTRATOR OR EMPLOYER NAME

PLAN ADMINISTRATOR OR EMPLOYER SIGNATURE

SIGN |

X |

|

|

DATE MM/DD/YYYY

X

On this form, “Fidelity” means Fidelity Brokerage Services LLC and its affiliates. Brokerage services are provided by Fidelity Brokerage Services LLC, Member NYSE, SIPC. 390265.5.0 (06/17)

1.785683.106 |

Page 1 of 1 |

032610101 |

|

Form Characteristics

| Fact Name | Details |

|---|---|

| Form Purpose | This form is used by self-employed individuals to submit contribution deposits to their Fidelity Self-Employed 401(k) Plan accounts. |

| Submission Guidelines | Contributions can be submitted either via regular mail or overnight mail, to specific addresses provided in the form. |

| Contribution Types | There are two primary types of contributions: Employee 401(k) contributions and Employer Profit Sharing contributions. |

| Allocation of Contributions | Users must clearly indicate how to allocate contributions to ensure that applicable limits are not exceeded. |

| Clearing Period | All deposits are subject to a four-business-day clearing period before they are available in the account. |

| Authorization Requirement | By signing the form, the employer or plan administrator authorizes Fidelity to deposit the specified dollar amounts into designated accounts. |

| Record Keeping | It is advised to keep a copy of the completed contribution remittance form for personal records. |

| Responsibility for Accuracy | It is the responsibility of the employer or plan administrator to correctly allocate contributions; failure to do so may result in processing delays. |

| Indemnification Clause | Signers agree to indemnify Fidelity for any liabilities that may arise from actions taken upon their instructions regarding contributions. |

Guidelines on Utilizing Fidelity Self Employed 401 K

Filling out the Fidelity Self-Employed 401(k) form is a straightforward process that helps ensure your contributions are properly allocated to your retirement plan. Following the right steps can save you time and frustration later on. Begin by gathering the necessary information before you get to work on the form.

- Fill Out Employer Information:

- Write your company name under "Employer Name."

- Enter your Employer Tax ID Number.

- List the name of the Plan Administrator.

- Provide a daytime phone number and extension.

- Complete Contribution Information:

- For each employee, enter their name and Fidelity account number.

- Specify the Employee 401(k) Contribution, distinguishing between Current Year and Prior Year as needed.

- Document the Employer Profit Sharing amounts for both Current Year and Prior Year.

- Calculate the total contribution and ensure all amounts are accurate.

- Authorization:

- Sign the form to confirm you understand the requirements regarding contribution limits and deadlines.

- Print the name of the Plan Administrator or Employer next to the signature line.

- Include the date, ensuring it is in the MM/DD/YYYY format.

Once you've completed the form, make sure to keep a copy for your records. Mail the originals to Fidelity using the designated addresses provided, either for regular or overnight delivery. This careful preparation helps ensure that your retirement contributions are processed smoothly.

What You Should Know About This Form

What is the Fidelity Self Employed 401(k) Contribution Remittance Form?

The Fidelity Self Employed 401(k) Contribution Remittance Form is used to submit contribution deposits to your Fidelity Self-Employed 401(k) Plan account. This form ensures that your contributions are allocated correctly across different sources, such as employee contributions and employer profit sharing.

How do I fill out the form?

You can fill out the form by typing on screen or by using capital letters and black ink. Be sure to clearly indicate the allocation of your contributions to avoid issues with processing. If you need extra space, feel free to make copies of the form.

Where do I send my contributions?

You should make checks payable to Fidelity Investments. For regular mail, send them to Fidelity Investments, P.O. Box 770001, Cincinnati, OH 45277-0003. For overnight mail, use Fidelity Investments, 100 Crosby Parkway, KC1H, Covington, KY 41015.

What are the contribution limits?

Contribution limits can vary. It is essential to refer to Fidelity.com/smallbusiness for the current limits applicable to your contributions. You must ensure that you comply with these limits to avoid any penalties.

What happens if I don’t clearly designate my contribution type?

If you fail to clearly indicate the contribution type, Fidelity will deposit the funds as Employer Profit Sharing Contributions. They will then reach out to you on how to resolve any discrepancies, but note that this may delay your contributions.

Can I trade in my account after making a contribution?

Yes, once contributions are deposited into your core account, you can place trades. You can do this either by visiting Fidelity.com or by calling Fidelity directly for assistance.

How long does it take for contributions to clear?

All deposits may be subject to a four-business-day clearing period. It's important to account for this timeframe when planning your contributions and any potential trades.

What should I do with the completed form?

Once you have filled out the form, keep a copy for your records. This will help you track your contributions and ensure you have documentation in case any issues arise.

What should I include in the contribution amounts?

In your contribution amounts, be sure to include all relevant contributions. This entails current year contributions, prior year contributions, and any applicable safe harbor nonelective contributions. Make sure to calculate the total accurately.

What is the authorization section for?

The authorization section of the form requires your signature to confirm that you understand your responsibilities regarding contribution limits and allocation. By signing, you grant Fidelity the authority to process your deposits as instructed and agree to indemnify them against any liabilities related to your instructions.

Common mistakes

Filling out the Fidelity Self-Employed 401(k) form can be a straightforward process, but several common mistakes can lead to delays or complications. It is crucial to be aware of these pitfalls to ensure a smooth experience. One significant error is failing to follow the instructions regarding the use of capital letters and black ink. Submission forms that do not adhere to these guidelines may be viewed as invalid, resulting in processing delays.

Another frequent mistake involves incorrectly allocating contributions. Participants must specify the distribution between Employee 401(k) contributions and Employer Profit Sharing contributions. If contributions are not properly designated, Fidelity may automatically classify them as Employer Profit Sharing, which may not align with the individual's intent. This lack of clear allocation can confuse processing and affect contribution limits.

Many individuals neglect to keep a copy of the completed contribution remittance form. This oversight can create issues for record-keeping, especially if disputes arise or if there is a need to track previous contributions. Maintaining personal records ensures accurate reporting and compliance with IRS rules.

Providing inaccurate information is another common error. Entering the wrong employer name or Tax ID Number can result in significant issues. Fidelity relies on this data to verify accounts and allocate contributions correctly. Therefore, double-checking this essential information before submission is crucial.

Participants often overlook the need to comply with contribution limits and deadlines. Misunderstanding these limits can lead to exceeding the allowed amounts, resulting in penalties or delays. Reviewing the latest guidelines and requirements from Fidelity is essential for compliance.

Finally, the signature section is sometimes mishandled. Failing to sign or date the form correctly can halt processing. It is imperative to ensure that the form is signed in the correct location and that the date is formatted correctly.

Avoiding these mistakes will facilitate a smoother process when submitting contributions to the Fidelity Self-Employed 401(k). It is in every participant's best interest to carefully fill out the form, review it thoroughly, and seek assistance if needed.

Documents used along the form

When setting up and managing a Fidelity Self-Employed 401(k) plan, several other forms and documents are often required. Understanding each of these items can help streamline the process and ensure compliance with retirement plan regulations. Here is a list of commonly used forms and documents along with brief descriptions for each:

- Form 5500: This is an annual report that provides information about the plan's financial condition, investments, and operations. It must be filed with the Employee Benefits Security Administration (EBSA) to ensure the plan complies with federal regulations.

- Plan Adoption Agreement: This document outlines the specific provisions of the 401(k) plan adopted by the employer. It serves as a formal agreement and establishes the rules governing the plan's operation.

- Summary Plan Description (SPD): The SPD is a detailed document that communicates the plan’s features, benefits, and participant rights. This document must be provided to all plan participants to inform them about their choices and obligations.

- Contribution Allocation Form: This form is used to specify how contributions should be divided among different employees and contribution types. It is essential to ensure accurate reporting and compliance with contribution limits.

- Employee Enrollment Forms: These forms are filled out by employees to join the 401(k) plan. They capture personal and financial information necessary for managing individual accounts and determining eligibility.

- Withholding Agreement: This document allows employees to specify the percentage of their salary they wish to contribute to the 401(k) plan. It is important for managing payroll deductions effectively.

- Distribution Request Form: Participants use this form to request a distribution from their 401(k) account, whether due to retirement, termination of employment, or other qualifying events. This document is vital for processing withdrawals efficiently.

Each of these forms and documents plays a crucial role in managing a self-employed 401(k) plan effectively. By understanding their functions, individuals can navigate the complexities of their retirement plans with greater ease, ensuring compliance and maximizing their retirement benefits.

Similar forms

The Fidelity Self Employed 401(k) form shares similarities with several other financial documents designed for retirement and contribution management. Here are eight documents that serve related functions:

- 401(k) Plan Adoption Agreement: This document establishes the terms of a 401(k) plan and reflects the choices made by the employer. Like the Fidelity Self Employed 401(k), it outlines contribution limits and necessary plan details.

- Contribution Allocation Form: This form specifies how contributions should be divided among various accounts. It mirrors the Fidelity form by requiring detailed information about contribution types and amounts.

- Individual Retirement Account (IRA) Contribution Form: This document is used for making contributions to an IRA. It has a similar purpose in tracking and managing retirement contributions, much like the Fidelity form does for 401(k) plans.

- Plan Summary Description (PSD): The PSD provides extensive information about the retirement plan, including how contributions will be handled. This document works in tandem with the Fidelity form by ensuring participants understand their options and responsibilities.

- Form 5500: This form is used to report on the financial conditions and operations of retirement plans to the federal government. It shares similarities with the Fidelity Self Employed 401(k) in its focus on compliance and record-keeping.

- Employer Contribution Remittance Form: This document serves to submit employer contributions to retirement accounts. It functions similarly by detailing how funds are allocated within respective accounts.

- Safe Harbor 401(k) Election Form: This form is for making elections regarding safe harbor contributions, much like how the Fidelity form allows for the election of specific contribution types.

- Retirement Plan Beneficiary Designation Form: This document identifies the beneficiaries of a retirement plan. While its primary purpose differs, both forms emphasize the importance of clear and accurate information for effective management of retirement funds.

Dos and Don'ts

Here are some important dos and don'ts to keep in mind when filling out the Fidelity Self-Employed 401(k) form:

- Do fill out the form in capital letters using black ink.

- Do provide accurate information, including your employer name and tax ID number.

- Do keep a copy of the completed form for your records.

- Do clearly indicate how to allocate your contributions to avoid confusion.

- Do ensure that your contributions do not exceed applicable limits.

- Don't leave any sections blank; provide all required information.

- Don't forget to sign and date the form before submitting it.

- Don't assume Fidelity knows how to allocate your contributions; you must specify this.

- Don't use incorrect mailing addresses; double-check before sending.

Misconceptions

There are several misconceptions regarding the Fidelity Self Employed 401(k) contribution remittance form. Understanding these can help individuals navigate the process more smoothly.

- Misconception 1: You must submit a separate form for each employee.

- Misconception 2: Contributions must be made immediately upon receiving the form.

- Misconception 3: Fidelity is responsible for ensuring contributions are allocated correctly.

- Misconception 4: You can ignore previous year contributions.

Many believe that submitting different forms for every employee is necessary. In reality, one form can accommodate multiple employees, provided all relevant sections are filled out correctly.

Some think that contributions should be deposited right after the form is filled out. However, there is a four-business-day clearing period to consider. So, timing can be flexible as long as you adhere to the contribution limits.

This is a common misunderstanding. It is the responsibility of the plan administrator to allocate contributions accurately. If allocations are unclear, Fidelity may return the entire check for further instructions.

Some may overlook the importance of prior year contributions. The form allows you to dedicate funds to both current and prior year contributions. Keeping track of these is crucial for compliance with applicable limits.

Key takeaways

When filling out the Fidelity Self Employed 401(k) form, it is important to understand a few key points to ensure smooth processing and compliance. Here are essential takeaways to guide you:

- Accurate Information is Essential: Fill out the form using CAPITAL letters and black ink to avoid any processing errors.

- Allocate Contributions Correctly: Clearly indicate how to allocate contributions between Employee 401(k) and Employer Profit Sharing to stay within limits.

- Mailing Instructions: Submit checks made out to Fidelity Investments either via regular or overnight mail, with each option having a specific address.

- Keep Copies: Always retain a copy of the completed remittance form for your personal records.

- Contribution Limits: Familiarize yourself with applicable contribution limits for both current and prior years to ensure compliance.

- Clearing Period: Be aware that all deposits may take up to four business days to clear, which may affect your planning.

- Responsibility for Allocation: It is your responsibility to allocate contributions correctly; failure to do so may lead to processing delays.

- Indemnification Agreement: By signing the form, you agree to indemnify Fidelity for any liabilities that may arise from following your instructions.

- Contact Information: If you have questions, refer to Fidelity's website or customer service for assistance.

Understanding these points will help you navigate the contribution process more effectively, ensuring a smoother experience with your Fidelity Self Employed 401(k) account.

Browse Other Templates

Processor Certification - It verifies that copies of documents are true and correct.

Estate Tax Ny - Information about the decedent's assets such as real property and bank deposits must be detailed.

Md Unemployment - There are multiple filing options, including complete contribution and employment reports or just contribution reports.