Fill Out Your Fifth Third Bank Direct Deposit Form

The Fifth Third Bank Direct Deposit form is an essential tool for those wishing to streamline the way they receive their funds. It offers a simple solution for setting up direct deposit arrangements with various organizations, such as employers or government agencies. This form can be filled out for every company that will be making deposits into your Fifth Third Bank account. For payroll deposits, it's important to submit the completed form to your Human Resources department to ensure timely processing. If you're looking to establish direct deposit for Social Security or other government benefits, visiting a Fifth Third Banking Center will get you set up effectively. The form itself requires key details including your name, address, Social Security number, and specific banking information such as account numbers and routing numbers. You can also specify the type of account—checking or savings—where you would like your funds deposited. Additionally, you have options to authorize a new direct deposit, modify an existing one, or shift automatic payments from a previous bank account. With clear instructions and signature lines for both employee and employer, this form makes it easy to manage your finances with precision and efficiency.

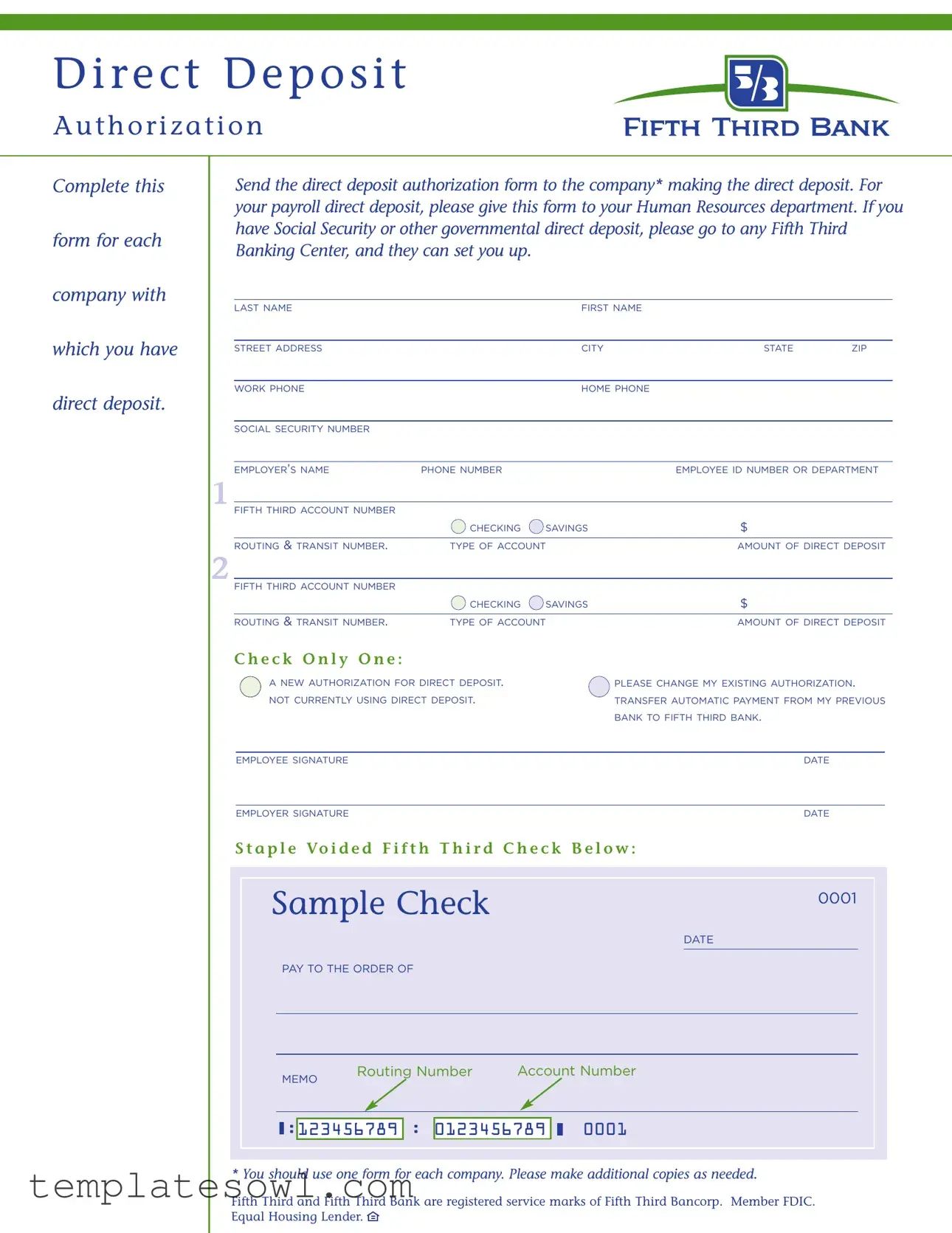

Fifth Third Bank Direct Deposit Example

D i r e c t D e p o s i t

A u t h o r i z a t i o n

Complete this

form for each

company with

which you have

direct deposit.

Send the direct deposit authorization form to the company* making the direct deposit. For your payroll direct deposit, please give this form to your Human Resources department. If you have Social Security or other governmental direct deposit, please go to any Fifth Third Banking Center, and they can set you up.

|

LAST NAME |

|

FIRST NAME |

|

|

|

|

|

|

|

|

|

STREET ADDRESS |

|

CITY |

STATE |

ZIP |

|

|

|

|

|

|

|

WORK PHONE |

|

HOME PHONE |

|

|

|

|

|

|

|

|

|

SOCIAL SECURITY NUMBER |

|

|

|

|

|

|

|

|

|

|

|

EMPLOYER’S NAME |

PHONE NUMBER |

|

EMPLOYEE ID NUMBER OR DEPARTMENT |

|

1 |

|

|

|

|

|

FIFTH THIRD ACCOUNT NUMBER |

|

|

|

|

|

|

|

|

|

|

|

|

|

CHECKING |

SAVINGS |

$ |

|

|

|

|

|

||

|

ROUTING & TRANSIT NUMBER. |

TYPE OF ACCOUNT |

AMOUNT OF DIRECT DEPOSIT |

||

2 |

|

|

|

|

|

FIFTH THIRD ACCOUNT NUMBER |

|

|

|

|

|

|

|

|

|

|

|

|

|

CHECKING |

SAVINGS |

$ |

|

|

|

|

|

||

|

ROUTING & TRANSIT NUMBER. |

TYPE OF ACCOUNT |

AMOUNT OF DIRECT DEPOSIT |

||

C h e c k O n l y O n e :

A NEW AUTHORIZATION FOR DIRECT DEPOSIT. |

PLEASE CHANGE MY EXISTING AUTHORIZATION. |

NOT CURRENTLY USING DIRECT DEPOSIT. |

TRANSFER AUTOMATIC PAYMENT FROM MY PREVIOUS |

|

BANK TO FIFTH THIRD BANK. |

|

|

EMPLOYEE SIGNATURE |

DATE |

|

|

EMPLOYER SIGNATURE |

DATE |

S t a p l e V o i d e d F i f t h T h i r d C h e c k B e l o w :

Sample Check |

0001 |

||

|

|

||

|

|

DATE |

|

|

PAY TO THE ORDER OF |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

MEMO |

Routing Number |

Account Number |

||||||

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|||

|

: |

123456789 |

: |

0123456789 |

|

|

0001 |

||

|

|

|

|

|

|

|

|

|

|

* You should use one form for each company. Please make additional copies as needed.

Fifth Third and Fifth Third Bank are registered service marks of Fifth Third Bancorp. Member FDIC. Equal Housing Lender.

Form Characteristics

| Fact Name | Details |

|---|---|

| Purpose of the Form | This form is used to set up direct deposit with various companies. |

| Submission | It must be sent to the company that will be making the direct deposit. |

| For Payroll Deposits | Employees should provide this form to their Human Resources department. |

| Government Payments | To set up Social Security deposits, individuals should visit a Fifth Third Banking Center. |

| Account Information | Multiple Fifth Third account details can be included for direct deposits. |

| Legal Compliance | This form adheres to federal regulations concerning direct deposit (e.g., NACHA guidelines). |

Guidelines on Utilizing Fifth Third Bank Direct Deposit

Getting ready to set up your direct deposit with Fifth Third Bank is an important step for you to easily receive payments. By completing the necessary form, you’re making it simpler for your employer or associated companies to deposit your earnings directly into your bank account. Here’s how to fill out the Direct Deposit Authorization form.

- Start by filling in your last name and first name at the top of the form.

- Next, provide your street address, city, state, and ZIP code.

- Include your work phone and home phone numbers.

- Enter your Social Security number in the designated field.

- Specify your employer’s name and their phone number.

- Fill in your employee ID number or department.

- Indicate your Fifth Third account number (either for checking or savings).

- Write down the routing & transit number for your account.

- Let the bank know the type of account (checking or savings).

- Indicate the amount of direct deposit you wish to receive in that account.

- If you have a second account, repeat steps 6-10 for that account.

- Choose one option from the section provided: a new authorization, change an existing one, not currently using direct deposit, or transfer an automatic payment.

- Don’t forget to sign and date the form where indicated, both for you and for your employer.

- Finally, if necessary, staple a voided Fifth Third check below the form sample.

Once you finish filling out the form, ensure it is submitted to the appropriate entity — usually, your employer’s payroll department if it's for your salary. This ensures that your direct deposit will be set up efficiently and without delays.

What You Should Know About This Form

What is the purpose of the Fifth Third Bank Direct Deposit form?

This form allows you to authorize your employer or any other entity to deposit funds directly into your Fifth Third Bank account. By using this form, you can streamline your paycheck or payment into your account, avoiding the need for paper checks and ensuring that your money is available more quickly and securely.

How do I complete the Direct Deposit Authorization form?

Begin by filling out your personal information, including your name, address, and Social Security number. You will also need to provide information about your employer or the organization making the direct deposit. Be sure to include your Fifth Third account number and the routing number, which is essential for directing your funds to the correct account. Don’t forget to specify the type of account—checking or savings—and enter the amount you’d like to deposit, if applicable.

Where do I send the completed form?

Once you have completed the form, send it directly to your employer’s Human Resources department for payroll deposits. If you are setting up a government payment, like Social Security, visit any Fifth Third Banking Center for assistance in processing your request.

Can I use one form for multiple accounts?

No, you should complete a separate Direct Deposit Authorization form for each company or account you wish to set up for direct deposit. If you need to set up direct deposits for more than one source or account, you will need additional copies of the form, which you can easily make as needed.

What if I want to change my existing direct deposit information?

If you want to change your existing authorization, simply select the option for changing your direct deposit on the form and provide the updated information. An employee signature is required, along with a date, to validate the changes you wish to make. Make sure to communicate with your employer to ensure they are aware of these updates.

How can I verify the status of my direct deposit?

To verify your direct deposit status, check your bank account statements or online banking portal after the expected deposit date. If your funds have not appeared as anticipated, contact your payroll department or the organization responsible for the deposit to investigate any potential issues. Regularly reviewing your statements can help you stay informed about your direct deposits.

Common mistakes

Filling out the Fifth Third Bank Direct Deposit form is a straightforward process, but several common mistakes can lead to delays or errors in setting up your direct deposit. First, individuals often forget to include their Social Security Number. This number is a critical piece of information that verifies identity and facilitates the direct deposit process. Omitting it can result in a rejection of the application, necessitating additional paperwork.

Another frequent oversight is incorrect routing or account numbers. Many people fail to double-check these numbers before submission. Because even a single digit entered incorrectly can direct funds to an unintended account, it is essential to pay close attention. It is advisable to refer to a recent bank statement or a check to ensure accuracy.

Many applicants also neglect to sign the form. An unsigned form is equivalent to an incomplete form and cannot be processed. Both the employee and employer signatures are typically required. Without these, the request for direct deposit will be stalled.

Some individuals mistakenly believe they can submit a single form for multiple employers. Each employer requires a separate authorization form. Sending a single form can lead to confusion and potentially disrupt the direct deposit process for all parties involved.

In addition, people sometimes fail to specify the type of account for their deposit. The form includes options for both checking and savings accounts. Not indicating the type can complicate the setup and lead to misrouting of funds. Clarity is crucial.

An often overlooked mistake is indicating the wrong amount for the direct deposit. Whether setting up a new deposit or modifying an existing authorization, it is vital to communicate the correct amount. Mistakes here can result in underpayment or overpayment.

Another common error arises when individuals neglect to check the status of their authorization after submission. It is prudent to follow up with the Human Resources department or the financial institution after submitting the form. This ensures that the information has been processed and that deposits will indeed occur as scheduled.

Finally, many forget to keep a copy of the completed form for their records. This can be problematic if questions arise later. Keeping a copy ensures there is evidence of what was submitted, which can be invaluable for tracking purposes.

By avoiding these mistakes, individuals can streamline the process of setting up direct deposit with Fifth Third Bank, ultimately ensuring timely access to their funds.

Documents used along the form

When completing the Fifth Third Bank Direct Deposit form, it's often helpful to be aware of other related documents that may be required for payroll, financial transactions, or other banking activities. Below is a list of forms and documents that individuals commonly use alongside the Direct Deposit form.

- W-4 Form: This form, titled "Employee's Withholding Certificate," informs an employer of the employee's tax situation. It determines the amount of federal income tax withholding from paychecks.

- Paycheck Stub: Often referred to as a pay stub, this document provides detailed information about an employee’s earnings, deductions, and year-to-date totals. It's useful for tracking income and tax withholdings.

- Bank Statement: A record provided by the bank showing transactions within a specific period, including deposits, withdrawals, and account balances. This is essential for managing finances and verifying account details.

- Direct Deposit Change Request: This document is submitted when an employee wishes to change their existing direct deposit information, such as account numbers or amounts being deposited.

- Employer’s Authorization Letter: A document written by the employer that confirms the employee's authorization for direct deposit. It may be required by the bank for processing the request.

- Social Security Administration (SSA) Notice: For individuals setting up direct deposit for Social Security benefits, a notice from the SSA may be required to confirm eligibility and account details.

- ID Verification Document: This could be a government-issued ID, such as a driver’s license or passport. It may be needed to verify the identity of the account holder when opening or managing accounts.

- Financial Institution Letter: A letter from the bank detailing account information. This document can help facilitate the direct deposit setup process and ensure the correct account details are used.

- Authorization Form for Electronic Payments: This form gives permission to a company or service provider to deposit or withdraw funds electronically from a bank account. It's similar to the Direct Deposit form but used for different types of electronic transactions.

Having these documents available can streamline the process of setting up or managing direct deposit arrangements with Fifth Third Bank. Each document plays a unique role, ensuring that banking activities proceed smoothly and accurately. Being organized can help individuals better navigate their banking needs with clarity.

Similar forms

The Fifth Third Bank Direct Deposit form shares similarities with various other financial and employment-related documents. Here is a list of nine such documents:

- W-4 Form: This IRS form allows employees to provide personal information to their employer for tax withholding purposes, similar to how the direct deposit form provides banking details for payroll deposits.

- Payroll Authorization Form: This document authorizes the employer to process payroll, just as the direct deposit form authorizes the bank to deposit funds directly into an employee’s account.

- Social Security Application: While applying for Social Security benefits, one provides banking information to facilitate direct deposit, akin to the method in the Fifth Third form.

- Automatic Payment Authorization Form: This form authorizes recurring payments from a bank account, similar to how the direct deposit form facilitates ongoing payroll deposits.

- Change of Address Form: This form updates the recipient's address for correspondence, paralleling how the direct deposit form updates banking information for deposits.

- Employee Onboarding Form: New hires often fill out this document, which includes banking information for direct deposits, resembling the requirements of the Fifth Third form.

- Bank Account Opening Application: This application requires providing personal and banking details, much like the direct deposit form needs account information for correct fund transfers.

- Vendor Registration Form: Vendors provide banking details for payment processing, similar to how employees provide information for direct payroll deposits.

- Financial Aid Direct Deposit Form: Students fill out this form to authorize their school to directly deposit financial aid, akin to how employees authorize their payroll deposits via the Fifth Third form.

Dos and Don'ts

When filling out the Fifth Third Bank Direct Deposit form, be cautious and thorough. Here are key points to consider:

- Ensure accuracy: Double-check all information, including your Social Security number and account details.

- Use one form per employer: Submit a separate form for each company or agency that will make direct deposits.

- Provide required signatures: Both your signature and your employer's signature are necessary for processing.

- Submit promptly: Send the completed form to your Human Resources department as soon as possible.

Conversely, here are things to avoid:

- Do not use vague language: Specify the amount and type of accounts clearly.

- Avoid incomplete forms: Failing to fill out all necessary fields can delay the setup process.

- Do not forget to indicate changes: If you're changing an existing authorization, make sure to select that option.

- Avoid submitting copies: Each submission must be an original form; do not send photocopies.

Misconceptions

Many people have misconceptions about the Fifth Third Bank Direct Deposit form. Understanding these can help avoid confusion and ensure that your direct deposits are set up smoothly. Below are some common misconceptions:

- One form is enough for all deposits. Each company requires a separate direct deposit authorization form.

- Direct deposit can be set up without employer involvement. You must give the form to your employer, or the appropriate department, to initiate payroll deposits.

- Only payroll can be direct deposited. Social Security and other government payments can also be set up for direct deposit through this form.

- You can submit the form online. The form must typically be sent or given to your employer or the company responsible for the direct deposit.

- The routing number is optional. You must include the routing number for your bank so that your funds can be directed correctly.

- Changes to direct deposit are instantaneous. Changes may take one or two pay cycles to take effect, so be sure to plan accordingly.

- Any bank’s account can be used. The account specified for the deposit must be a Fifth Third Bank account.

- You need a check to fill out the form. Although completing the form requires some information from your check, it is possible to fill out the form without having a physical check on hand.

- The form can be modified after submission. Any changes after submission require a new form to be filled out and submitted again.

Key takeaways

When filling out and using the Fifth Third Bank Direct Deposit form, it’s essential to ensure accuracy and completeness. Here are some key takeaways to consider:

- Form Submission: Each company that you have direct deposit with requires a separate form. Be sure to send the completed authorization form to the appropriate company paying you.

- Human Resources Contact: For payroll deposits, deliver the completed form directly to your Human Resources department. They will handle the process from there.

- Government Payments: If you are setting up a direct deposit for Social Security or other government payments, visit any Fifth Third Banking Center for assistance in getting it established.

- Account Information: Carefully fill in your Fifth Third account numbers, routing numbers, and specify the type of account (checking or savings) to ensure that your funds are deposited correctly.

By following these guidelines, you can streamline the process of setting up your direct deposits with Fifth Third Bank.

Browse Other Templates

Shipping Declaration,International Shipping Invoice,Export Documentation,Commercial Shipping Statement,Trade Invoice,Customs Declaration Form,Delivery Invoice,Freight Invoice,Import/Export Summary,Logistics Invoice - The individual's email address is captured for communication purposes.

Incorporate in Georgia - Filing should be done promptly to avoid potential complications with business identity.

What Alarms - Implement a 60-second arming delay to mitigate accidental triggers.