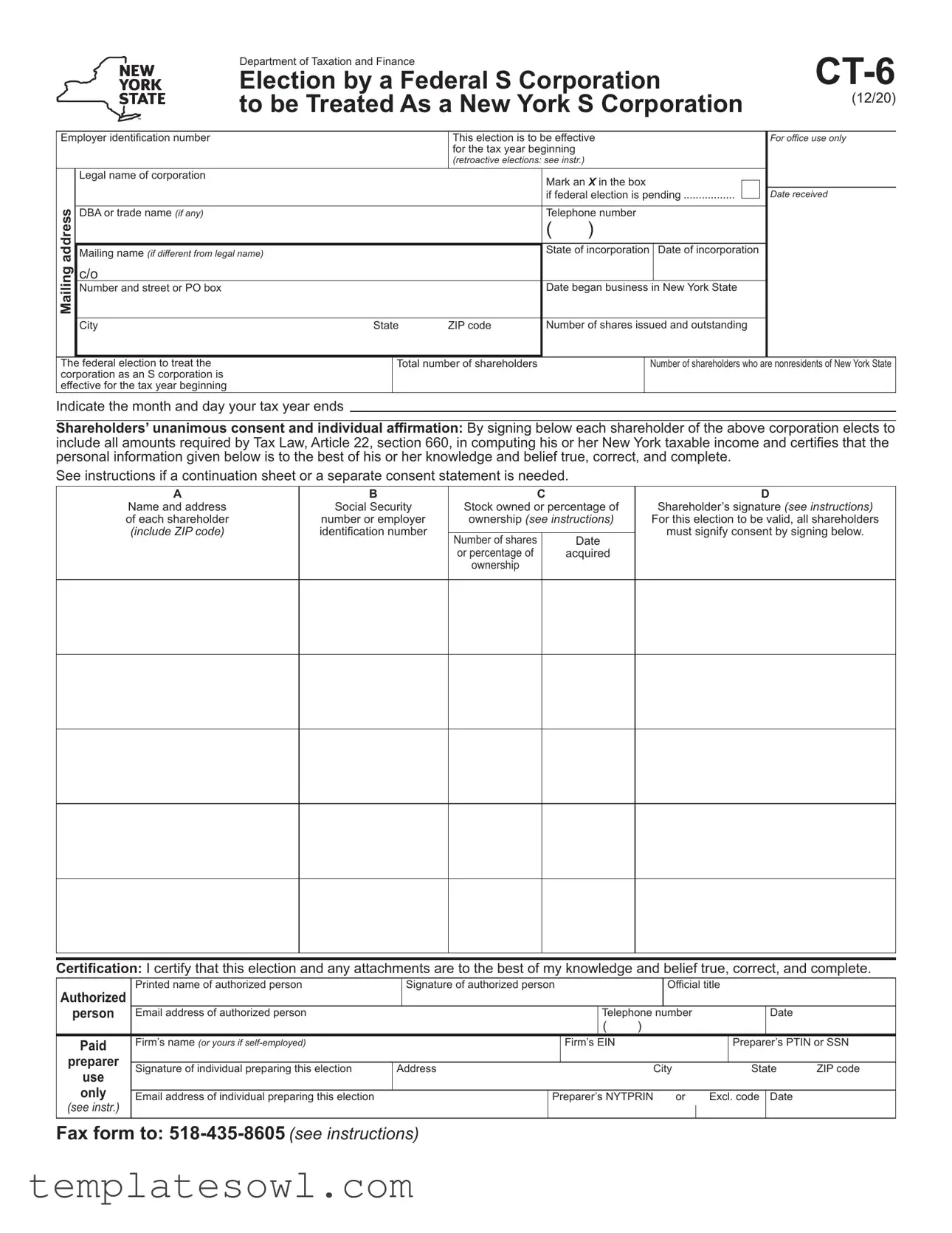

Fill Out Your Fill Out Ct 6 Form

The CT-6 form is a critical document for corporations looking to elect S corporation status in New York. This election allows a federally recognized S corporation to also be treated as an S corporation under New York tax law. To complete the form, a business must provide essential details such as its legal name, employer identification number, and address, including any trade name used. Key dates like incorporation and the start of business operations in New York must be included, alongside the total number of shares issued and the names of all shareholders. Each shareholder must agree to the election and provide their consent by signing the form, which affirms their agreement to include the specified amounts in their New York taxable income. Furthermore, the form requires the certification from an authorized representative of the corporation, ensuring the accuracy and completeness of the information submitted. With a straightforward process, the CT-6 form paves the way for corporations to benefit from S corporation status while complying with state regulations.

Fill Out Ct 6 Example

Department of Taxation and Finance |

|

Election by a Federal S Corporation |

|

to be Treated As a New York S Corporation |

(12/20) |

|

Employer identification number |

||

address |

|

Legal name of corporation |

|

||

|

DBA or trade name (if any) |

|

|

Mailing name (if different from legal name) |

|

|

||

|

|

|

Mailing |

|

c/o |

|

Number and street or PO box |

|

|

|

|

City

This election is to be effective for the tax year beginning

(retroactive elections: see instr.)

|

|

Mark an X in the box |

|

|

|

|

|

|

|

||

|

|

if federal election is pending |

|

|

|

|

|

|

|||

|

|

Telephone number |

|||

|

|

( ) |

|||

|

|

State of incorporation |

Date of incorporation |

||

|

|

Date began business |

|

|

|

|

|

in New York State |

|||

State |

ZIP code |

Number of shares issued and outstanding |

|||

For office use only

Date received

The federal election to treat the corporation as an S corporation is effective for the tax year beginning

Total number of shareholders |

Number of shareholders who are nonresidents of New York State |

Indicate the month and day your tax year ends

Shareholders’ unanimous consent and individual affirmation: By signing below each shareholder of the above corporation elects to include all amounts required by Tax Law, Article 22, section 660, in computing his or her New York taxable income and certifies that the personal information given below is to the best of his or her knowledge and belief true, correct, and complete.

See instructions if a continuation sheet or a separate consent statement is needed.

A |

B |

|

C |

D |

|

Name and address |

Social Security |

Stock owned or percentage of |

Shareholder’s signature (see instructions) |

||

of each shareholder |

number or employer |

ownership (see instructions) |

For this election to be valid, all shareholders |

||

(include ZIP code) |

identification number |

|

|

|

must signify consent by signing below. |

Number of shares |

|

Date |

|||

|

|

|

|

||

|

|

or percentage of |

|

acquired |

|

|

|

ownership |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Certification: I certify that this election and any attachments are to the best of my knowledge and belief true, correct, and complete.

Authorized |

Printed name of authorized person |

|

Signature of authorized person |

|

|

Official title |

|

||||||

person |

Email address of authorized person |

|

|

|

|

Telephone number |

|

|

Date |

|

|||

|

|

|

|

|

( |

) |

|

|

|

|

|

|

|

Paid |

Firm’s name (or yours if |

|

|

|

Firm’s |

EIN |

|

|

|

|

Preparer’s PTIN or SSN |

||

preparer |

|

|

|

|

|

|

|

|

|

||||

Signature of individual preparing this election |

Address |

|

City |

|

State |

ZIP code |

|||||||

use |

|

|

|

|

|

|

|

|

|

|

|

|

|

only |

|

|

|

|

|

|

|

|

|

|

|||

Email address of individual preparing this election |

|

|

Preparer’s NYTPRIN |

|

or |

Excl. code |

Date |

|

|||||

(see instr.) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Fax form to:

Form Characteristics

| Fact Name | Description |

|---|---|

| Purpose | The CT-6 form allows a federal S Corporation to elect to be treated as a New York S Corporation for tax purposes. |

| Governing Law | This form is governed by New York Tax Law, Article 22, Section 660. |

| Shareholder Consent | All shareholders must sign the form to indicate their consent for the corporation's S Corporation election. |

| Effective Date | The election can be retroactive, but must start with the tax year indicated on the form. |

| Preparer Information | A preparer's information, including their PTIN or SSN, needs to be included for validation of the election. |

Guidelines on Utilizing Fill Out Ct 6

After completing the Fill Out CT-6 form, the next steps involve ensuring all information is accurate and obtaining the necessary signatures from shareholders. When all parties have consented, the form should be submitted according to the instructions provided.

- Gather your company's information: This includes the employer identification number, legal name of the corporation, and any DBA or trade name.

- Provide mailing details: Include a mailing address if it differs from the legal name, and specify an individual c/o if necessary.

- Indicate the effective date: State the year when the election is intended to take effect.

- Mark the federal election status: If applicable, mark an X in the box indicating if a federal election is pending.

- Fill out the state information: Include the state of incorporation, date of incorporation, and the date your business began in New York State.

- List the number of shares: Record the number of shares issued and outstanding.

- Provide contact information: Input a telephone number and the total number of shareholders.

- Detail non-resident shareholders: Specify how many shareholders are non-residents of New York State.

- Indicate the tax year end date: Enter the month and day when your tax year concludes.

- Secure shareholder consent: Each shareholder must sign and provide their name, address, Social Security number or employer identification number, stock ownership percentage, and signature.

- Include certification: An authorized person must certify the election is complete and accurate, including their printed name, signature, official title, email address, and telephone number.

- Complete preparer’s information: If applicable, fill out the details of the individual preparing the form, including their name, EIN or SSN, NYTPRIN, and fax number, if necessary.

- Ensure accuracy: Review the entire form for correctness before submission.

- Submit the form: Fax the filled form to the designated number provided in the instructions.

What You Should Know About This Form

What is the CT-6 form?

The CT-6 form is a document used by a federal S corporation to elect to be treated as a New York S Corporation. This election is important for tax purposes, as it can affect how the corporation is taxed under New York state law.

Who needs to fill out the CT-6 form?

Any corporation that has federal S corporation status and wishes to receive the same treatment under New York State tax law must complete the CT-6 form. This is particularly relevant for corporations doing business in New York or with shareholders who reside in New York.

When should the CT-6 form be filed?

The CT-6 form should be filed for the tax year beginning on the date indicated in the form. If you are making a retroactive election, be sure to check the relevant instructions. This ensures your election takes effect in the correct tax year.

What information is required to complete the CT-6 form?

You will need to provide the corporation’s legal name, employer identification number, and address. Additionally, you must include details about the date of incorporation, the total number of shares issued, and the number of shareholders. Each shareholder must also sign and provide personal information, such as their Social Security number and the stock they own or the percentage of ownership.

Do all shareholders have to consent to the CT-6 election?

Yes, all shareholders must consent to the election for it to be valid. They do this by signing the form, confirming that they understand the tax implications and that the information they provided is accurate and complete.

What happens if a shareholder does not sign the CT-6 form?

If any shareholder does not provide their signature, the election will not be valid. All shareholders must indicate their consent to the election. This is crucial for maintaining compliance with New York tax requirements.

Can I retroactively elect S corporation status in New York?

Yes, retroactive elections are permitted, but specific conditions must be met. The instructions accompanying the form will provide guidance on how to proceed with a retroactive election, including any deadlines that must be observed.

What should I do if I made a mistake on the CT-6 form?

If you realize there is an error on your CT-6 form after submission, it is important to act quickly. Contact the New York Department of Taxation and Finance for guidance on how to correct your mistake. Depending on the nature of the error, you may need to submit a revised form or provide additional information.

How do I submit the CT-6 form?

The CT-6 form can be faxed to the New York Department of Taxation and Finance at 518-435-8605. Be sure to follow all instructions for submission carefully to ensure your election is processed without delay.

Common mistakes

When filling out the CT-6 form, many people encounter common mistakes that can lead to complications or delays in processing. One significant error is failing to provide complete and accurate information about the corporation. This includes not only the legal name but also the Employer Identification Number (EIN), which is essential for identification. Omitting or incorrectly entering these details can create confusion, prolonging the election's effective date.

An additional mistake often made is not ensuring that all shareholders sign the form. Each shareholder must provide their signature to affirm their consent for the S corporation election. Skipping this step means the election is considered invalid, and this can lead to considerable issues down the line. It’s crucial to double-check that all signatures are present and correctly dated.

Many also overlook the section regarding shareholder information. This part requires accurate details, including Social Security numbers and the percentage of ownership. Errors in this area can not only delay the processing of the CT-6 form but also affect each shareholder's tax obligations. It is vital to ensure all shareholders are aware of their shareholdings and the information provided is precise.

Lastly, individuals often forget to attach any necessary documentation or additional consent statements. If the instructions indicate that further information is needed, failing to include those documents may result in a rejection of the form. It’s important to read the instructions carefully and compile all required material. Paying close attention to these details can save time and help the election go smoothly.

Documents used along the form

The CT-6 form is essential for corporations electing to be treated as New York S Corporations. However, there are other documents usually required to complete the filing process effectively. Here’s a look at these forms, which can help ensure compliance and facilitate smooth processing.

- Form CT-3-S: This is the New York S Corporation Franchise Tax Return, which S Corporations must file annually. It summarizes the corporation’s income, deductions, and tax owed.

- Form CT-245: Used for the New York S Corporation Consent to Share Tax Benefits. This form allows shareholders to distribute tax benefits among themselves based on their ownership percentage.

- Form IT-201: This is the New York State Personal Income Tax Return. Shareholders must file this form to report their income, including earnings distributed from the S Corporation.

- Form CT-5: The Application for a Credit or Refund of the New York Franchise Tax. This form is necessary if shareholders believe they have overpaid their franchise taxes and wish to request a refund.

- Form CT-2: This form is an application for a brokerage tax. Some S Corporations may need to file this if they have a broker business in New York and seek to make special tax elections.

Completing the CT-6 form along with the associated documents correctly helps in meeting all regulatory requirements. Ensuring all forms are attached and properly signed can facilitate a smoother process and avoid potential penalties.

Similar forms

The CT-6 form is an election by a federal S corporation to be treated as a New York S corporation. Several other documents share similarities with the CT-6 form in terms of purpose and required information. Below are four such documents:

- Form CT-3: This is the General Business Corporation Franchise Tax Return. Like the CT-6, it requires specific financial information, including income and shareholder data, to determine the tax liability of a corporation operating in New York State.

- Form CT-4: Known as the Application for a New York S Corporation Election, this form is used by corporations to elect S corporation status for New York tax purposes. It also necessitates gathering consent from shareholders, similar to the consent requirements in the CT-6 form.

- Form 1120S: This federal tax return is filed by S corporations to report income, deductions, and credits. Both forms require comprehensive owner information, including shareholder details and their respective tax responsibilities.

- Form 2553: This IRS form is used to elect S corporation status at the federal level. Both this form and the CT-6 require shareholder consent and basic corporate details, reflecting the alignment in election processes for S corporation tax treatment.

Dos and Don'ts

When completing the CT-6 form, attention to detail is crucial. Here’s a list of nine key do’s and don’ts that can help ensure your submission is accurate and complete.

- Do: Provide the correct employer identification number. This is essential for accurate identification.

- Do: Use the legal name of the corporation. Avoid abbreviations or informal names unless specified.

- Do: Clearly indicate your corporation's mailing address. This ensures you receive important correspondence.

- Do: Mark the box if a federal election is pending; this informs the authorities about your status.

- Do: Ensure all shareholders consent by signing the form. Every signature is needed for the election to be valid.

- Don't: Omit the date your tax year ends. This information is necessary for processing your election correctly.

- Don't: Forget to provide a telephone number and email address for the authorized person. This helps facilitate communication.

- Don't: Submit the form without double-checking the accuracy of the information. Mistakes can delay processing.

- Don't: Use a P.O. box as the primary mailing address if the actual address is available. Clarity is important.

- Don't: Leave blank spaces in the shareholder section. Each shareholder's information must be fully completed.

By following these guidelines, you can increase the likelihood that your CT-6 form will be processed smoothly and without delay.

Misconceptions

When it comes to the Fill Out CT-6 form, there are several common misconceptions. Understanding the truth can help ease the application process.

- Myth 1: The CT-6 form is only for new corporations.

- Myth 2: You don’t need to notify shareholders.

- Myth 3: You can submit the CT-6 form anytime.

- Myth 4: The CT-6 form does not require an authorized signature.

- Myth 5: You can ignore the shareholder information section.

- Myth 6: The CT-6 form guarantees tax benefits.

- Myth 7: Changes to the form can be made after submission.

- Myth 8: You do not need a federal S corporation status before filing the CT-6.

- Myth 9: All forms can be faxed without concerns.

- Myth 10: You must hire a tax professional to file the CT-6.

This is not accurate. Existing federal S corporations can also use the form to elect New York S corporation status.

Actually, all shareholders must consent to the election by signing the form. Their unanimous consent is essential.

The form must be filed by a specific deadline, usually within two months and 15 days from the beginning of the tax year. Planning ahead is key.

This is incorrect. An authorized person must sign the form to certify its accuracy, and their contact information is also required.

The details of each shareholder, including their ownership and Social Security numbers, are crucial for the form's validity.

Filing the form does not automatically ensure tax advantages. It simply elects for the corporation to be treated as an S corporation under New York law.

Once submitted, changes require filing an amended form. It’s important to double-check all information before sending.

To elect as a New York S Corporation, the company must already have federal S corporation status.

While the CT-6 form can be faxed, make sure that all documents are complete and clear to avoid delays or rejections.

While many choose to do so for guidance, it’s not mandatory. Businesses can complete the form on their own if they understand the requirements.

Clarifying these misconceptions can help ensure a smoother experience with the CT-6 form and facilitate the election process effectively.

Key takeaways

Here are some key takeaways regarding the use of the CT-6 form:

- The CT-6 form is used by a federal S Corporation to elect to be treated as a New York S Corporation.

- All shareholders must provide their consent by signing the form; this ensures compliance with New York tax laws.

- Accurate information is crucial. Each shareholder must confirm that their details are true and complete.

- The form must include the corporation's legal name, address, and federal employer identification number (EIN).

- Fax the completed form to 518-435-8605, but review the instructions thoroughly for any additional guidance.

Browse Other Templates

Wisconsin Tax Simplified Form,WI 2017 Income Adjustment Form,Wisconsin Amended Tax Return,WI-Z Income Tax Return,Wisconsin Tax Reporting Form,WI Joint Filing Form,Wisconsin Easy Tax Return,WI-Z Simple Tax Submission,Wisconsin 2017 Tax Revision Form,W - Attach your W-2 forms with care to avoid any discrepancies in reported income.

Dd Form 2817 - This cross-reference form can enhance the overall effectiveness of office communication regarding documents.