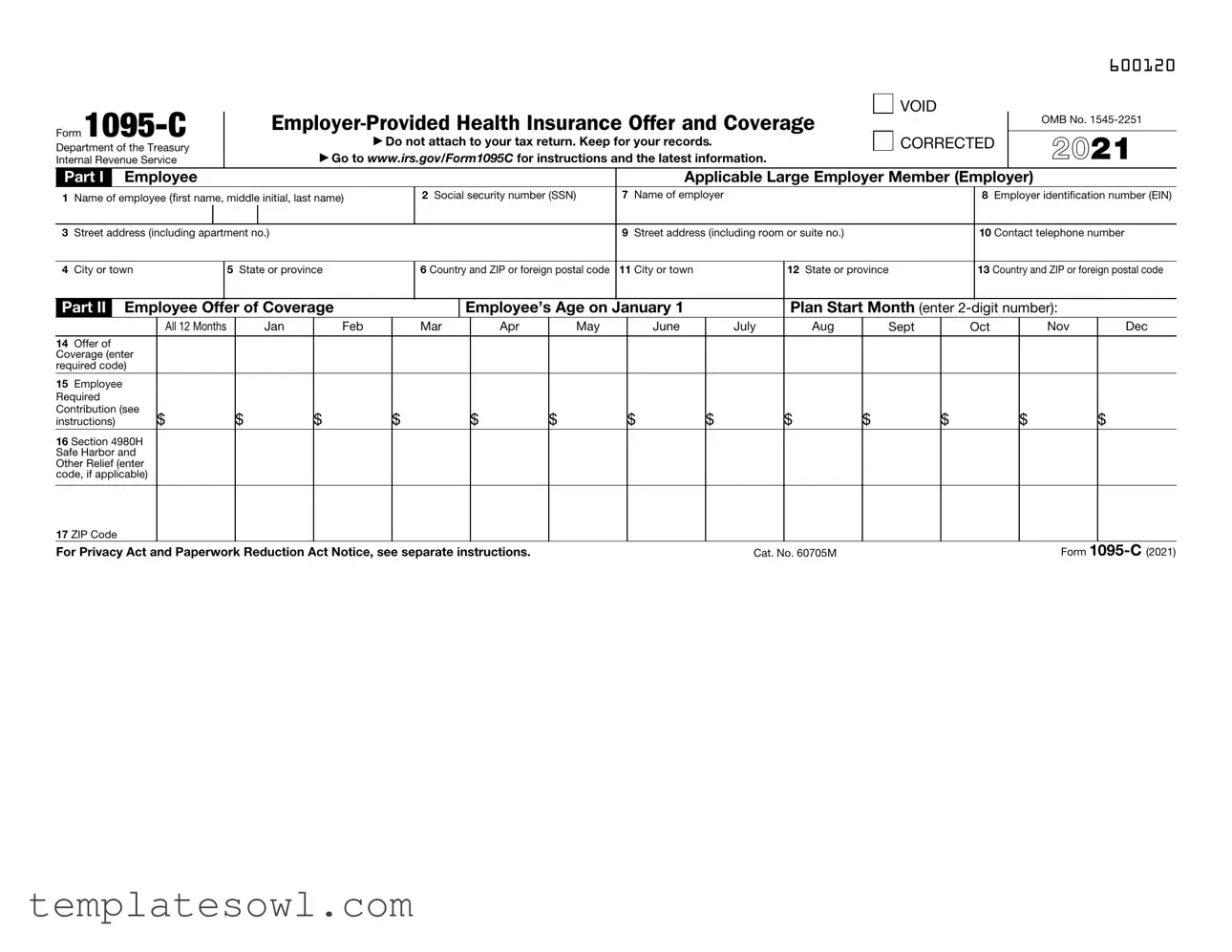

Fill Out Your 1095 C Form

The 1095-C form plays a critical role in understanding employer-provided health insurance under the Affordable Care Act (ACA). It is primarily issued by Applicable Large Employers (ALEs) to their employees, detailing the health coverage offered during the previous tax year. This form is divided into three parts; Part I provides information about the employee and the employer, including names and identification numbers. Part II focuses on the health insurance coverage that was available, specifying the offer made to the employee, spouse, and dependents, along with any contributions the employee was required to make. Part III is crucial for those who received self-insured health coverage, as it lists covered individuals and the months they were insured. Receiving a 1095-C indicates that the employer has met its reporting obligations, and it can also influence an employee’s eligibility for premium tax credits when seeking insurance coverage through the Health Insurance Marketplace. As such, familiarizing oneself with the key components of this form can be beneficial, particularly at tax time.

1095 C Example

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

600120 |

Form |

|

|

|

|

▶ |

|

|

|

|

|

|

|

|

VOID |

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

OMB No. |

|||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

Department of the Treasury |

|

|

|

|

|

Do not attach to your tax return. Keep for your records. |

|

|

CORRECTED |

|

2021 |

|||||||||||||

Internal Revenue Service |

|

|

|

▶ Go to www.irs.gov/Form1095C for instructions and the latest information. |

|

|

|

|

|

|

||||||||||||||

Part I |

|

Employee |

|

|

|

|

|

|

|

|

|

|

Applicable Large Employer Member (Employer) |

|

|

|||||||||

1 |

Name of employee (first name, middle initial, last name) |

|

|

2 Social security number (SSN) |

7 Name of employer |

|

|

|

|

8 Employer identification number (EIN) |

||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||

3 |

Street address (including apartment no.) |

|

|

|

|

|

|

9 Street address (including room or suite no.) |

|

|

|

10 Contact telephone number |

||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

4 |

City or town |

|

|

|

5 State or province |

|

|

6 Country and ZIP or foreign postal code |

11 City or town |

12 State or province |

|

13 Country and ZIP or foreign postal code |

||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||

Part II |

Employee Offer of Coverage |

|

|

|

Employee’s Age on January 1 |

|

Plan Start Month (enter |

|

||||||||||||||||

|

|

|

|

All 12 Months |

|

Jan |

Feb |

|

|

Mar |

Apr |

May |

June |

July |

Aug |

|

Sept |

Oct |

Nov |

Dec |

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

14 |

Offer of |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Coverage (enter |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

required code) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

15 |

Employee |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Required |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

Contribution (see |

$ |

|

|

$ |

|

$ |

|

$ |

|

$ |

$ |

$ |

$ |

$ |

$ |

$ |

$ |

|

$ |

|||||

instructions) |

|

|

|

|

|

|

|

|||||||||||||||||

16 Section 4980H Safe Harbor and Other Relief (enter code, if applicable)

17 ZIP Code |

|

Form |

For Privacy Act and Paperwork Reduction Act Notice, see separate instructions. |

Cat. No. 60705M |

600220

Form |

Page 2 |

Instructions for Recipient

You are receiving this Form

In addition, if you, or any other individual who is offered health coverage because of their relationship to you (referred to here as family members), enrolled in your employer’s health plan and that plan is a type of plan referred to as a

If your employer provided you or a family member health coverage through an insured health plan or in another manner, you may receive information about the coverage separately on Form

Employers are required to furnish Form

Additional information. For additional information about the tax provisions of the Affordable Care Act (ACA), including the individual shared responsibility provisions, the premium tax credit, and the employer shared responsibility provisions, visit www.irs.gov/ACA or call the IRS Healthcare Hotline for ACA questions

Part I. Employee

Lines

Line 2. This is your social security number (SSN). For your protection, this form may show only the last four digits of your SSN. However, the employer is required to report your complete SSN to the IRS.

Part I. Applicable Large Employer Member (Employer)

Lines

Line 10. This line includes a telephone number for the person whom you may call if you have questions about the information reported on the form or to report errors in the information on the form and ask that they be corrected.

Part II. Employer Offer of Coverage, Lines

Line 14. The codes listed below for line 14 describe the coverage that your employer offered to you and your spouse and dependent(s), if any. (If you received an offer of coverage through a multiemployer plan due to your membership in a union, that offer may not be shown on line 14.) The information on line 14 relates to eligibility for coverage subsidized by the premium tax credit for you, your spouse, and dependent(s). For more information about the premium tax credit, see Pub. 974.

1A. Minimum essential coverage providing minimum value offered to you with an employee required contribution for

1B. Minimum essential coverage providing minimum value offered to you and minimum essential coverage NOT offered to your spouse or dependent(s).

1C. Minimum essential coverage providing minimum value offered to you and minimum essential coverage offered to your dependent(s) but NOT your spouse.

1D. Minimum essential coverage providing minimum value offered to you and minimum essential coverage offered to your spouse but NOT your dependent(s).

1E. Minimum essential coverage providing minimum value offered to you and minimum essential coverage offered to your dependent(s) and spouse.

1F. Minimum essential coverage NOT providing minimum value offered to you, or you and your spouse or dependent(s), or you, your spouse, and dependent(s).

1G. You were NOT a

1H. No offer of coverage (you were NOT offered any health coverage or you were offered coverage that is NOT minimum essential coverage).

1I. Reserved for future use.

1J. Minimum essential coverage providing minimum value offered to you; minimum essential coverage conditionally offered to your spouse; and minimum essential coverage NOT offered to your dependent(s).

1K. Minimum essential coverage providing minimum value offered to you; minimum essential coverage conditionally offered to your spouse; and minimum essential coverage offered to your dependent(s).

1L. Individual coverage health reimbursement arrangement (HRA) offered to you only with affordability determined by using employee’s primary residence ZIP code.

1M. Individual coverage HRA offered to you and dependent(s) (not spouse) with affordability determined by using employee’s primary residence ZIP code.

1N. Individual coverage HRA offered to you, spouse, and dependent(s) with affordability determined by using employee’s primary residence ZIP code.

1O. Individual coverage HRA offered to you only using the employee’s primary employment site ZIP code affordability safe harbor.

1P. Individual coverage HRA offered to you and dependent(s) (not spouse) using the employee’s primary employment site ZIP code affordability safe harbor.

1Q. Individual coverage HRA offered to you, spouse, and dependent(s) using the employee’s primary employment site ZIP code affordability safe harbor.

1R. Individual coverage HRA that is NOT affordable offered to you; employee and spouse or dependent(s); or employee, spouse, and dependents.

1S. Individual coverage HRA offered to an individual who was not a

1T. Individual coverage HRA offered to employee and spouse (no dependents) with affordability determined using employee’s primary residence ZIP code.

1U. Individual coverage HRA offered to employee and spouse (no dependents) using employee’s primary employment site ZIP code affordability safe harbor.

1V. Reserved for future use.

1W. Reserved for future use.

1X. Reserved for future use.

1Y. Reserved for future use.

1Z. Reserved for future use.

(Continued on page 4)

600320

Form |

Page 3 |

Part III Covered Individuals

If Employer provided

18

19

20

21

22

23

24

25

26

27

28

29

30

(a) Name of covered individual(s) |

(b) SSN or other TIN (c) DOB (if SSN or other |

(d) Covered |

|

|

|

|

|

|

|

|

(e) Months of coverage |

|

|

|

|

|

|

||||||||||||

First name, middle initial, last name |

TIN is not available) |

all 12 months |

|

Jan |

Feb |

Mar |

Apr |

May June July |

Aug Sept |

Oct |

Nov |

Dec |

|||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Form

600420

Form |

Page 4 |

Instructions for Recipient (continued)

Line 15. This line reports the employee required contribution, which is the monthly cost to you for the lowest cost

Line 16. This code provides the IRS information to administer the employer shared responsibility provisions. Other than a code 2C, which reflects your enrollment in your employer’s coverage, none of this information affects your eligibility for the premium tax credit. For more information about the employer shared responsibility provisions, visit IRS.gov.

Line 17. This line reports the applicable ZIP code your employer used for determining affordability if you were offered an individual coverage HRA. If code 1L, 1M, 1N, or 1T was used on line 14, this will be your primary residence location. If code 1O, 1P, 1Q, or 1U was used on line 14, this will be your primary employment site. For more information about individual coverage HRAs, visit IRS.gov.

Part III. Covered Individuals, Lines

Part III reports the name, SSN (or TIN for covered individuals other than the employee listed in Part I), and coverage information about each individual (including any

Form Characteristics

| Fact Name | Description |

|---|---|

| Purpose | The 1095-C form provides information about health insurance coverage offered by employers to their employees. |

| Applicable Employers | This form is required for employers classified as Applicable Large Employers (ALEs) under the Affordable Care Act (ACA). |

| Reporting Requirements | Employers must furnish Form 1095-C to each employee, detailing health coverage offered and enrollment information. |

| Tax Implications | The information on this form helps employees determine eligibility for the Premium Tax Credit when filing their taxes. |

| State-Specific Forms | Some states have additional requirements for health coverage reporting, including Massachusetts and New Jersey, which have their own reporting laws. |

Guidelines on Utilizing 1095 C

After completing the 1095-C form, retain a copy for your personal records. This form provides essential information regarding health coverage offered by your employer, which may be useful for your tax return and insurance eligibility.

- Gather necessary information: Before starting, collect your personal details, including your name, address, and Social Security number, along with your employer's information like their name and Employer Identification Number (EIN).

- Complete Part I: Fill in your name, Social Security number, address, and employer’s details in the appropriate spaces.

- Fill in Part II: Record your age on January 1 and select the plan start month. Enter the required code for the type of coverage offered to you in line 14.

- Calculate the Employee Required Contribution: Enter the monthly amount you would pay for the lowest cost self-only coverage in line 15.

- Provide Safe Harbor Code (if applicable): If applicable, enter a code in line 16 that reflects the safe harbor or other relief available under the employer shared responsibility provisions.

- Indicate ZIP Code: In line 17, enter the ZIP code that your employer used to determine coverage affordability.

- Complete Part III: If your employer provided self-insured coverage, check the box and fill in the required details for each covered individual, including their name and SSN.

- Review and save: Double-check all information for accuracy. Then, keep the form for your records.

What You Should Know About This Form

What is Form 1095-C?

Form 1095-C is a document provided by your employer if they qualify as an Applicable Large Employer under the Affordable Care Act (ACA). It details the health coverage offered to you during the previous calendar year. This form helps both you and the IRS understand whether you were offered adequate health coverage and if you qualify for premium tax credits when filing your taxes.

Who receives Form 1095-C?

Only employees of Applicable Large Employers will receive Form 1095-C. If you worked for multiple Applicable Large Employers during the year, you might receive more than one form. Each form will contain information specific to your employment with that employer. If your employer is not classified as an Applicable Large Employer, they are not required to issue you this form.

Why do I need Form 1095-C?

Form 1095-C is essential for your tax filing. It informs you whether you were offered health insurance, the type of coverage, and its affordability. If you purchased health insurance through the Health Insurance Marketplace and wish to claim the premium tax credit, this form contains relevant information to determine your eligibility.

What information is provided on Form 1095-C?

The form contains several parts. Part I includes your personal information as the employee, while Part II details the coverage options offered to you, including the type and cost. Part III, if applicable, lists covered individuals under your employer's self-insured health plan, which includes family members and dependents. Each part provides crucial data for tax reporting and understanding your health care options.

What should I do if I find errors on my Form 1095-C?

If you notice discrepancies in the information on your Form 1095-C, such as incorrect personal details or coverage information, contact your employer directly. They are responsible for correcting any mistakes and providing you with an updated form. It's important to address these errors promptly to avoid issues when filing taxes.

Do I need to attach Form 1095-C to my tax return?

No, you do not need to attach Form 1095-C to your tax return. Instead, keep it for your records. However, you should review it carefully as the information can help you complete your tax return accurately, especially if you are applying for tax credits related to your health coverage.

Where can I find more information about Form 1095-C?

For more detailed information regarding Form 1095-C, visit the IRS website at www.irs.gov/Form1095C. This resource offers instructions, updates, and details related to the form and the ACA provisions. Additionally, for specific questions, the IRS Healthcare Hotline can be contacted at 800-919-0452.

Common mistakes

Filling out the 1095-C form can seem straightforward, but common mistakes can lead to issues. One major error people often make is incorrectly entering their personal information. For instance, a wrong social security number (SSN) can create significant problems later. If the IRS can't match the SSN on the form with their records, it may lead to delays or complications with your tax return.

Another mistake involves not understanding the codes required in the coverage section of the form. Each code in Line 14 tells the IRS what type of health coverage was offered. Selecting the wrong code can lead to misunderstandings about your eligibility for health coverage or tax credits. Make sure to review the definitions of each code carefully before filling it in.

People sometimes also forget to report the correct months of coverage in Part III. This is crucial if you were covered by a self-insured plan. Failing to accurately list coverage can lead to penalties. If the IRS looks into your case and finds discrepancies, it could result in unexpected tax issues.

Lastly, some individuals neglect to keep a copy of their completed form for their records. It’s essential to save this form, as you may need it when filing your tax return or if you have questions in the future. Having a personal copy ensures you have access to all the necessary information at any time.

Documents used along the form

The 1095-C form is an essential document for employees, as it outlines the health coverage offered by an employer under the Affordable Care Act (ACA). Employers who are considered Applicable Large Employers must provide this form to their employees. Nevertheless, several other forms and documents often accompany the 1095-C, as they serve different purposes related to health coverage and tax implications. Understanding these documents can help employees navigate their health insurance options and tax benefits more effectively.

- Form 1095-A: This form, known as the Health Insurance Marketplace Statement, is issued by the Health Insurance Marketplace to individuals who purchase health insurance through the exchange. It provides detailed information about the coverage, premiums, and any premium tax credits that may apply.

- Form 1095-B: This form provides information about minimum essential health coverage offered to an individual. It is typically issued by health insurance providers or government programs and verifies that a person had health coverage for at least part of the year.

- Form 1040: The U.S. Individual Income Tax Return is the standard form used by individuals to report their income and calculate their tax liability. Information from forms like 1095-C, 1095-A, and 1095-B may be used in completing this form, especially when claiming premium tax credits.

- Form 8962: This form is used to calculate the Premium Tax Credit and reconcile it with any advance payments received. Taxpayers who received premium tax credits from the Health Insurance Marketplace must provide details from Form 1095-A to correctly fill out Form 8962.

- Form 8941: The Credit for Small Employer Health Insurance Premiums form is used by small businesses to claim a tax credit for providing health insurance to employees. Employers eligible for this credit may find it useful in conjunction with Form 1095-C.

- Form W-2: The Wage and Tax Statement is issued by employers to report an employee's annual wages and the taxes withheld from their paycheck. The W-2 form may include information about health insurance premiums deducted from the employee’s pay, which can be relevant for tax calculations.

In summary, the 1095-C form works in conjunction with several other important documents that help individuals and families navigate their health care coverage choices and tax situations. Familiarizing oneself with these forms can lead to more informed decisions and ensure compliance with tax obligations under the ACA.

Similar forms

- Form 1095-A: This form reports health coverage obtained through the Health Insurance Marketplace. Like the 1095-C, it details coverage information and can help determine eligibility for premium tax credits. Both forms serve to verify health coverage during the tax year.

- Form 1095-B: This is used to report health coverage offered by small employers or insurance providers. Similar to the 1095-C, it provides information about the coverage received, which helps taxpayers understand their compliance with health coverage requirements.

- W-2 Form: While the W-2 indicates wages and tax withholdings, it may also provide information on health insurance coverage. The 1095-C accompanies it to give a more detailed picture of health insurance offers from employers.

- Form 1040: This is the individual tax return form. It requires information on health insurance status, similar to how the 1095-C does. Both forms are integral in determining eligibility for various tax credits and penalties concerning health coverage.

- Employee Handbook: This document often outlines benefits, including health insurance options. It complements the 1095-C by providing a deeper understanding of the coverage available and the employer's offerings in detail.

- Summary of Benefits and Coverage (SBC): Issued by health insurers, the SBC provides details on what a health plan covers. Like the 1095-C, this document helps individuals evaluate their coverage options and confirm the details of what was provided.

Dos and Don'ts

When filling out the 1095-C form, consider the following guidelines:

- Ensure accuracy: Double-check all entries for correct spelling, accurate social security numbers, and proper codes.

- Consult the instructions: Refer to the official IRS instructions for Form 1095-C to clarify any uncertainties regarding specific sections.

- Keep a copy: Retain a copy of the completed form for your personal records, as it may be useful for tax filing.

- Provide necessary details: Include all requested information in Part I about yourself, and make sure to cover all individuals under your health plan if applicable.

Additionally, avoid these common mistakes:

- Don’t skip sections: Every part of the form must be addressed, even if some information does not apply.

- Refrain from using incorrect codes: Using the wrong codes for the coverage offered can lead to complications with the IRS.

- Avoid leaving information blank: Incomplete forms may delay processing or lead to incorrect assessments.

- Don’t forget to check deadlines: Be aware of submission deadlines to avoid penalties or missed opportunities for tax credits.

Misconceptions

Understanding Form 1095-C can be quite tricky, leading to several common misconceptions. Here’s a breakdown of nine of those misconceptions along with clear explanations.

- My employer is required to give me a Form 1095-C. Not all employers are required to provide this form. Only Applicable Large Employers, which typically have 50 or more full-time employees, must provide it. If your employer doesn’t meet this threshold, they are not obligated to issue you a Form 1095-C.

- I need to submit Form 1095-C with my tax return. This is a misunderstanding. You do not attach Form 1095-C to your tax return. It is meant for your records, helping you understand the health coverage offered to you by your employer.

- Form 1095-C applies only to full-time employees. While many full-time employees receive this form, it can also be relevant to part-time employees. If you worked for multiple employers that qualify as Applicable Large Employers during the year, you might receive more than one Form 1095-C.

- If I don’t get a Form 1095-C, I was not offered health insurance. This isn’t always true. If your employer is not classified as an Applicable Large Employer, they are not required to provide this form. You might still have been offered health coverage.

- Form 1095-C contains detailed coverage information for all family members. Although the form does provide some coverage details, it primarily focuses on the employee. If you’re on a self-insured plan, a different section will list information for covered family members.

- I must have the lowest-cost health plan to qualify for the premium tax credit. Many think this way, but that’s not necessarily the case. You might still qualify for a premium tax credit even if your employer offers lowest cost coverage that meets the minimum standards.

- Form 1095-C only reports whether I accepted my employer's health plan. This is incorrect. The form includes information about the coverage your employer offered, regardless of whether you accepted it or enrolled. You can review this information to check if you’re might be eligible for other tax credits.

- Only health insurance through my employer is reported on Form 1095-C. Form 1095-C only pertains to the employer's health plans. If you have coverage from other sources, like a government program or a marketplace plan, that information will be reported on different forms, such as Form 1095-A or 1095-B.

- Receiving Form 1095-C means I must take action with the IRS. Not quite. Receiving this form is informational only. While it helps you understand your health coverage options, there are no immediate actions required regarding the IRS unless you have specific questions about your health care reporting or premium tax credits.

Ensuring you have accurate information about Form 1095-C helps clear up these misconceptions, making tax season a little less daunting.

Key takeaways

Here are some key points to keep in mind about filling out and using Form 1095-C:

- Purpose of the Form: Form 1095-C provides information about the health coverage offered by your employer. If your employer is an Applicable Large Employer, you will receive this form.

- Employee Information: Ensure that your details, such as your name and Social Security Number, are accurate in Part I of the form. This information must match your records.

- Coverage Details: In Part II, the form indicates the type of health coverage offered to you. Codes in line 14 describe whether minimum essential coverage was provided.

- Employee Contribution: Line 15 shows your required monthly contribution for the lowest-cost self-only minimum essential coverage. This may differ from what you actually pay.

- Multiple Forms: If you had more than one employer that qualifies as an Applicable Large Employer during the year, you may receive multiple 1095-C forms, each detailing coverage from a different employer.

- Records Keeping: Although you do not attach this form to your tax return, keep it for your records. You may need it for tax credits or health coverage reporting.

For more information about the Affordable Care Act and tax provisions related to health coverage, visit the IRS website or consult with a tax professional.

Browse Other Templates

Form 35 Income Tax - A prompt response from the registering authority is expected once submitted.

How Much Is a Resale License - The certificate should be filed securely as part of a business's tax documentation.