Fill Out Your 15G Form

The 15G form serves as an essential document for individuals seeking to declare certain types of income without the imposition of tax deductions at source. It is utilized primarily by individuals, excluding companies or firms, who expect their total income for the financial year to fall below the taxable threshold set by the Income Tax Act. This form encompasses crucial details, including personal identification information, such as the individual's name, PAN, and contact details, as well as specifics relating to various income sources like dividends, interest on securities, and mutual fund units. Each of these income categories is delineated in separate schedules, allowing for a clear overview of the declarant's financial landscape. The form also asks for estimates of total income and prior assessments to ensure accurate declarations. Notably, the signature at the end signifies the individual's verification of the information provided, emphasizing the importance of accuracy and honesty in the process. Additionally, the second part of the form, aimed at the person responsible for income payments, requires details regarding the income itself, further solidifying the framework for tax reporting and compliance. By utilizing the 15G form, individuals can effectively navigate their tax responsibilities while ensuring that their rights and obligations under the Income Tax Act are met with clarity and rigor.

15G Example

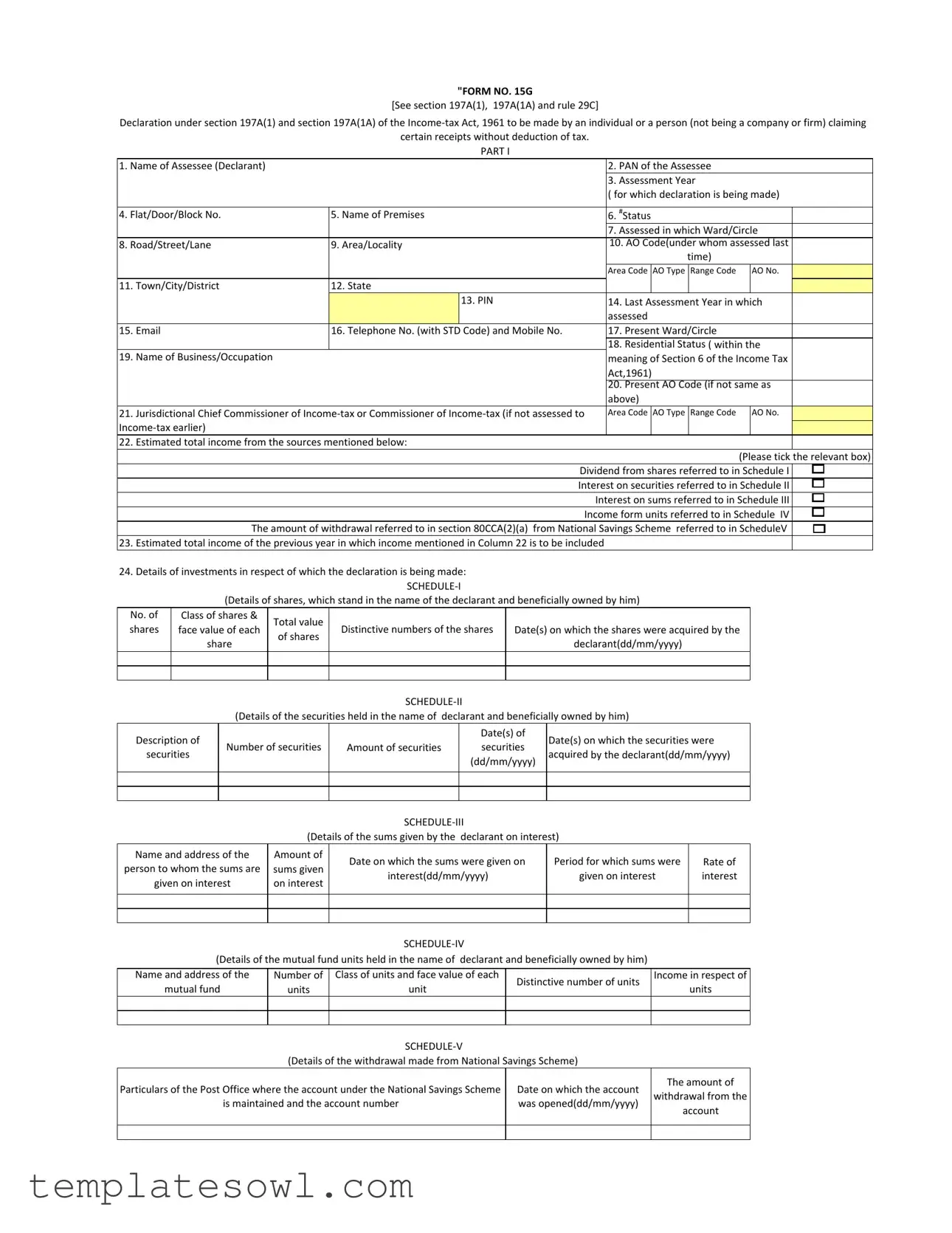

"FORM NO. 15G

[See section 197A(1), 197A(1A) and rule 29C]

Declaration under section 197A(1) and section 197A(1A) of the Income‐tax Act, 1961 to be made by an individual or a person (not being a company or firm) claiming

certain receipts without deduction of tax.

PART I

1. Name of Assessee (Declarant) |

|

|

|

2. PAN of the Assessee |

|

|

|

||

|

|

|

|

3. Assessment Year |

|

|

|

||

|

|

|

|

( for which declaration is being made) |

|||||

|

|

|

|

|

|

|

|

||

4. Flat/Door/Block No. |

5. Name of Premises |

|

6. #Status |

|

|

|

|||

|

|

|

|

7. Assessed in which Ward/Circle |

|

||||

8. Road/Street/Lane |

9. Area/Locality |

|

10. AO Code(under whom assessed last |

|

|||||

|

|

|

|

|

time) |

|

|

|

|

|

|

|

|

Area Code |

AO Type |

Range Code |

|

AO No. |

|

11. Town/City/District |

12. State |

|

|

|

|

|

|

|

|

|

|

13. PIN |

|

14. Last Assessment Year in which |

|

||||

|

|

|

|

assessed |

|

|

|

||

15. Email |

16. Telephone No. (with STD Code) and Mobile No. |

|

17. Present Ward/Circle |

|

|

|

|||

|

|

|

|

18. Residential Status ( within the |

|

||||

19. Name of Business/Occupation |

|

|

|

meaning of Section 6 of the Income Tax |

|

||||

|

|

|

|

Act,1961) |

|

|

|

||

|

|

|

|

20. Present AO Code (if not same as |

|

||||

|

|

|

|

above) |

|

|

|

||

21. Jurisdictional Chief Commissioner of Income‐tax or Commissioner of Income‐tax (if not assessed to |

|

Area Code |

AO Type |

Range Code |

|

AO No. |

|

||

Income‐tax earlier) |

|

|

|

|

|

|

|

|

|

22. Estimated total income from the sources mentioned below: |

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

(Please tick the relevant box) |

||

|

|

Dividend from shares referred to in Schedule I |

|

||||||

|

|

Interest on securities referred to in Schedule II |

|

||||||

|

|

|

Interest on sums referred to in Schedule III |

|

|||||

|

|

Income form units referred to in Schedule IV |

|

||||||

The amount of withdrawal referred to in section 80CCA(2)(a) from National Savings Scheme referred to in ScheduleV |

|

||||||||

23. Estimated total income of the previous year in which income mentioned in Column 22 is to be included |

|

|

|

||||||

24.Details of investments in respect of which the declaration is being made:

SCHEDULE‐I

(Details of shares, which stand in the name of the declarant and beneficially owned by him)

No. of |

Class of shares & |

Total value |

|

|

|

|

|

|||

shares |

face value of each |

Distinctive numbers of the shares |

Date(s) on which the shares were acquired by the |

|||||||

of shares |

||||||||||

|

|

share |

|

|

|

|

declarant(dd/mm/yyyy) |

|||

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

SCHEDULE‐II |

|

|

|

||

|

|

|

(Details of the securities held in the name of declarant and beneficially owned by him) |

|||||||

Description of |

|

|

|

|

|

Date(s) of |

Date(s) on which the securities were |

|||

|

Number of securities |

Amount of securities |

|

securities |

||||||

securities |

|

|

acquired by the declarant(dd/mm/yyyy) |

|||||||

|

|

|

|

|

(dd/mm/yyyy) |

|||||

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

SCHEDULE‐III |

|

|

(Details of the sums given by the declarant on interest) |

||

Name and address of the |

Amount of |

Date on which the sums were given on |

|

person to whom the sums are |

sums given |

|

|

interest(dd/mm/yyyy) |

|

||

given on interest |

on interest |

|

|

|

|

||

|

|

|

|

Rate of interest

SCHEDULE‐IV

(Details of the mutual fund units held in the name of declarant and beneficially owned by him)

Name and address of the |

Number of |

Class of units and face value of each |

Distinctive number of units |

Income in respect of |

|

mutual fund |

units |

unit |

units |

||

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

SCHEDULE‐V |

|

|

|

|

(Details of the withdrawal made from National Savings Scheme) |

|

|||

Particulars of the Post Office where the account under the National Savings Scheme |

Date on which the account |

The amount of |

|||

withdrawal from the |

|||||

is maintained and the account number |

was opened(dd/mm/yyyy) |

||||

account |

|||||

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

……………………………………….

**Signature of the Declarant

DECLARATION/VERIFICATION

*I/We………………………………do hereby declare that to the best of *my/our knowledge and belief what is stated above is correct, complete and is truly stated. *I/We

declare that the incomes referred to in this form are not includible in the total income of any other person u/s 60 to 64 of the Income‐tax Act, 1961. *I/We further, declare that the tax *on my/our estimated total income, including *income/incomes referred to in Column 22 above, computed in accordance with the provisions of the Income‐tax Act, 1961, for the previous year ending on .................... relevant to the assessment year ..................will be nil. *I/We also, declare that *my/our

*income/incomes referred to in Column 22 for the previous year ending on .................... relevant to the assessment year .................. will not exceed the maximum

amount which is not chargeable to income‐tax.

Place: |

……………………………………………….. |

|

|

……………………………………………………………. |

||

Date: |

……………………………………………….. |

|

|

Signature of the Declarant |

||

|

|

PART II |

|

|

|

|

|

|

[For use by the person to whom the declaration is furnished] |

||||

1. Name of the person responsible for paying the income referred to in Column 22 of Part I |

2. |

PAN of the person indicated in Column 1 of Part II |

||||

|

|

|

|

|

|

|

3. Complete Address |

|

|

|

|

|

|

|

|

|

4. |

TAN of the person indicated in Column 1 of Part II |

||

|

|

|

|

|

|

|

5. Email |

|

6. Telephone No. (with STD Code) and Mobile No. |

|

|

|

|

|

|

|

7. |

Status |

|

|

8. Date on which Declaration is Furnished |

9. Period in respect of which the dividend has been |

10. Amount of income paid |

11. Date on which the income |

|||

(dd/mm/yyyy) |

declared or the income has been paid/credited |

|

|

has been paid/ |

||

|

|

|

|

|||

|

|

|

|

|

credited(dd/mm/yyyy) |

|

|

|

|

|

|

|

|

12. Date of declaration, distribution or payment of dividend/withdrawal under the |

13. Account Number of National Saving Scheme from which withdrawal has |

|

National Savings Scheme(dd/mm/yyyy) |

been made |

|

|

||

Forwarded to the Chief Commissioner or Commissioner of Income‐tax………………………………………………………… |

||

Place: |

……………………………………………….. |

………………………………………………… |

Date: |

………………………………………………. |

|

Signature of the person responsible for paying the income referred to in Column 22 of Part I

NOTES:

1.The declaration should be furnished in duplicate.

2.*Delete whichever is not applicable.

3.#Declaration can be furnished by an individual under section 197A(1) and a person (other than a company or a firm) under section 197A(1A).

4.**Indicate the capacity in which the declaration is furnished on behalf of a HUF, AOP, etc.

5.Before signing the declaration/verification , the declarant should satisfy himself that the information furnished in this form is true, correct and complete in all respects. Any person making a false statement in the declaration shall be liable to prosecution under 277 of the Income‐tax Act, 1961 and on conviction be punishable‐

i)In a case where tax sought to be evaded exceeds twenty‐five lakh rupees, with rigorous imprisonment which shall not be less than 6 months but which may extend to seven years and with fine;

ii)In any other case, with rigorous imprisonment which shall not be less than 3 months but which may extend to two years and with fine.

6.The person responsible for paying the income referred to in column 22 of Part I shall not accept the declaration where the amount of income of the nature referred to in sub‐section (1) or sub‐section (1A) of section 197A or the aggregate of the amounts of such income credited or paid or likely to be credited or paid during the

previous year in which such income is to be included exceeds the maximum amount which is not chargeable to tax.";

Form Characteristics

| Fact Name | Description |

|---|---|

| Form Purpose | Form 15G allows individuals or specific entities to declare income received without tax deduction at source. |

| Governing Law | This form is governed by the Income Tax Act of 1961, specifically sections 197A(1) and 197A(1A). |

| Eligibility | The declaration can be made by an individual or a person other than a company or firm. |

| Submission Requirement | The form must be furnished in duplicate to the person responsible for paying the income before the income is credited or paid. |

| Declaration Consequences | Providing false information can lead to severe legal penalties under Section 277 of the Income Tax Act. |

| Income Cap | The total income under declaration should not exceed the maximum amount not chargeable to tax in the relevant assessment year. |

Guidelines on Utilizing 15G

Filling out the 15G form involves providing personal details and estimates of income to ensure that no tax is deducted at source from your income. Once the form is completed properly, it can be submitted to the relevant authorities to maintain compliance.

- Start with Part I of the form.

- Enter your name in the space provided for the Assessee (Declarant).

- Provide your Permanent Account Number (PAN).

- Indicate the Assessment Year for which you are making the declaration.

- Fill in your Flat/Door/Block No.

- Provide the Name of the Premises.

- Select your Status from the options given.

- Specify the Ward/Circle where you were last assessed.

- Fill in your Road/Street/Lane.

- Provide your Area/Locality information.

- Enter the AO Code under which you were last assessed.

- Complete the Town/City/District section.

- Specify your State and enter the PIN code.

- Indicate the Last Assessment Year in which you were assessed.

- Provide your Email address.

- Fill in your Telephone No. with STD Code and Mobile No.

- Specify your Present Ward/Circle.

- State your Residential Status as defined in Section 6 of the Income Tax Act.

- Provide your Present AO Code if it is different from the previous one.

- Fill in the details for the Jurisdictional Chief Commissioner of Income-tax.

- In Column 22, tick the relevant box for your estimated total income sources, like Dividend or Interest.

- Enter your Estimated total income for the previous year.

- Complete the details of investments in Schedules I to V as applicable, providing descriptions, amounts, dates, and any other required information.

- Complete the Signature section, confirming that all details are accurate and true.

After filling out Part I, proceed to Part II, if applicable. This section is intended for the person responsible for paying the income mentioned. Ensure that all information is correct before submission. Maintaining accuracy in your entries is essential for compliance with tax regulations.

What You Should Know About This Form

What is the 15G form?

The 15G form is a declaration that individuals or certain non-corporate entities can use to ensure that no tax is deducted at source for specific income types. Individuals can claim this benefit when their total income is below the taxable limit. It often applies to interest income from banks, dividends, and certain securities.

Who can submit the 15G form?

Any individual or person (not being a company or firm) can submit the 15G form if their estimated total income for the financial year is below the taxable threshold. This includes individuals who earn interest on savings accounts, fixed deposits, and various securities.

What information is required on the 15G form?

The form requires personal details such as name, PAN (Permanent Account Number), contact information, and details regarding the income to be received. Additionally, it asks for specifics about the sources of income, including types of investments, their values, and the period for which tax exemption is sought.

What is the purpose of filing a 15G form?

The primary purpose of filing the 15G form is to avoid tax deduction at source on income that is below the taxable limit. When accepted by the income payer, it allows individuals to receive their interest or any other applicable income in full, without deductions.

Can a 15G form be submitted multiple times in a financial year?

Yes, a 15G form can be submitted for different income sources within the same financial year. However, the total amount of income from all sources must still remain below the taxable limit for the exemption to apply. It is essential to keep track of total income to avoid any issues with tax compliance.

How do I submit the 15G form?

The 15G form can typically be submitted directly to the person or institution that is liable to pay you the income. This could be your bank, a corporate entity, or other financial institutions. Ensure to provide a duplicate copy to retain for your records.

What happens if I submit a 15G form and my total income exceeds the tax limit?

If you submit a 15G form but later find that your total income exceeds the taxable limit, you must rectify the situation. Depending on the circumstances, it may lead to penalties under the Income Tax Act. Always keep accurate records of your income and inform the authorities promptly if your financial situation changes.

Is there a deadline for submitting the 15G form?

While there is no strict deadline to submit the 15G form, it must be provided to the payer before they disburse the income. It is always advisable to submit it well in advance of receiving income to ensure no tax is deducted at source.

What are the consequences of submitting false information in the 15G form?

Submitting false information in the 15G form can lead to severe repercussions, including prosecution under the Income Tax Act. Penalties may include rigorous imprisonment and fines. It is crucial to ensure that the information is accurate and complete to avoid legal complications.

Common mistakes

Filling out the 15G form can be straightforward if done correctly, but many individuals make mistakes that can lead to complications. One common error is failing to provide accurate personal information. Every section, from the name of the taxpayer to the Permanent Account Number (PAN), must be filled in with precision. An incorrect PAN can delay the processing of the form or result in tax deduction errors. When entering personal details, double-check spellings and numbers to ensure everything aligns with government records.

Another frequent mistake involves miscalculating the estimated total income. Individuals often rush through this section, leading to either underreporting or overreporting their income. The estimated total income in column 22 must be accurate, reflecting all relevant sources. Since this affects whether tax will be deducted or not, it's crucial to tally all income accurately before submitting the form.

Not indicating the correct assessment year is also a common error. The assessment year must match the income for which the declaration is made. Failing to do so can lead to the tax authorities considering the submission invalid. This mistake can be easily avoided by reviewing the current tax year guidelines and ensuring the year matches the income being declared.

Moreover, many people overlook the requirement to include all relevant details in the attached schedules. Each schedule in the 15G form asks for specific information about shares, securities, and other income sources. Skipping these details can result in a form that is incomplete. All required fields in the schedules must be filled out accurately; this ensures that the declaration is valid and complete.

Improper signatures or verification can lead to delays or rejection of the application. The form must be signed by the appropriate person, and verifications must be filled out as required. This includes declaring that the income is not subject to taxation under other provisions. Omitting a signature or failing to declare certain information can be perceived as an attempt to mislead tax authorities.

Finally, not submitting the declaration in duplicate is another commonly made oversight. The law requires that individuals provide two copies of the 15G form, ensuring that one copy can be retained by the payer of the income. This requirement is often missed, leading to unnecessary complications in documentation. Always prepare two copies to comply with this regulation.

Documents used along the form

The 15G form is primarily used by individuals or non-corporate entities to declare their income, ensuring no tax is deducted at source given that their total income falls below the taxable limit. Alongside the 15G form, several other forms and documents may be necessary or beneficial for tax declaration purposes. Below are key forms often associated with the 15G form, which help streamline the income declaration process.

- Form 15H: Similar to Form 15G, this document is utilized by senior citizens to declare that their total income is below the taxable limit. By submitting Form 15H, senior citizens can prevent tax deductions at source from their interest income.

- Form 26AS: This is a tax credit statement that reflects all the income on which tax has been deducted and deposited with the government. It is crucial for taxpayers to cross-check their income details with Form 26AS to ensure accurate reporting.

- Form ITR: The Income Tax Return is the comprehensive document used by individuals to report their annual income, taxes paid, and details of any deductions claimed. Filing ITR becomes essential to claim any tax refund or carry forward losses.

- Form 13: This is a request for no deduction of tax at source on certain types of income. Taxpayers can submit Form 13 to the Deductor, establishing their justification for no deduction based on their expected income levels.

These additional forms complement the 15G form, facilitating a smoother tax experience for individuals by ensuring that their income is appropriately declared, and tax obligations are met. Understanding the purpose and importance of these documents can aid taxpayers in optimizing their financial responsibilities.

Similar forms

- Form W-4: This form is used by employees to inform their employer about the amount of federal income tax to withhold from their paycheck. Similar to Form 15G, it allows individuals to declare their tax situation to prevent excess tax withholding.

- Form 1040: This is the standard individual income tax return form used in the U.S. While Form 1040 reports total income, Form 15G helps declare expected income below the taxable threshold to avoid unnecessary tax deductions.

- Form 1099: This form is issued to report various types of income other than wages. Like Form 15G, it pertains to income exemptions but operates from the payer's perspective rather than the recipient's.

- Form 8962: Used to calculate premium tax credits for individuals who meet certain income thresholds. It serves a similar purpose by allowing individuals to report income levels relevant for tax benefits, mirroring the goal of Form 15G in income declaration.

- Schedule C: This form reports income or loss from a business operated by a sole proprietor. Like Form 15G, it requires detailed income information to determine tax obligations, although it focuses specifically on business income.

- Form 8832: This allows entities to choose how they are classified for federal tax purposes. Both forms facilitate income classification but cater to different taxpayer categories—individuals for Form 15G and entities for Form 8832.

- Form 4868: This application for an automatic extension of time to file a U.S. Individual Income Tax Return allows taxpayers additional time to report income. It relates to Form 15G in the context of tax liabilities and income reporting timelines.

Dos and Don'ts

When filling out the 15G form, consider the following dos and don'ts to ensure accurate submission.

- Do provide your full name as stated in official documents.

- Do include your Permanent Account Number (PAN) to avoid processing delays.

- Do indicate the correct assessment year for which the declaration is being made.

- Do ensure that all provided information is accurate and complete.

- Don't leave any mandatory fields empty; incomplete submissions may be rejected.

- Don't provide false information, as this can lead to legal consequences.

- Don't submit without reviewing all details for accuracy, especially your financial data.

Misconceptions

- Misconception 1: The 15G form can be submitted by anyone.

- Misconception 2: Filing the 15G form guarantees no tax will be deducted.

- Misconception 3: You can file multiple 15G forms for different income sources in one go.

- Misconception 4: Only interest income requires a 15G form.

- Misconception 5: The 15G form is only for residents of India.

- Misconception 6: Once you submit a 15G form, you don’t need to file income tax returns.

- Misconception 7: The 15G form must be filed every financial year without exception.

- Misconception 8: You can get refunds if tax has been deducted after filing the 15G.

- Misconception 9: The information provided in the 15G form does not need to be accurate.

- Misconception 10: The 15G form is valid for all types of income.

This is not true. Only individuals or certain categories of persons who are not companies or firms can submit the 15G form.

Submitting the 15G form does not guarantee that no tax will be deducted. It is based on the estimated total income and if it exceeds the non-taxable limit, tax may still be levied.

You must submit separate 15G forms for each income source as the details vary. Each form must clearly reflect the income pertaining to a specific category.

This is incorrect. The 15G form can be used for several types of income, including dividends, certain investments, and withdrawals from savings schemes.

While it primarily applies to residents, certain non-residents may also claim benefits if eligible, depending on the specifics of the income.

Filing the 15G form does not exempt you from filing income tax returns. You still need to report your income during the filing season.

While it is true you must file the form if applicable, if your income does not change and remains below the taxable limit, you may not need to submit it each year.

If tax is deducted despite your submission of the 15G form, you must claim a refund through your income tax return. The form itself does not guarantee a refund.

This is a serious misconception. The information must be truthful and complete. Providing false information can lead to penalties.

The form is specifically designed for certain types of income, like interest and dividends. You cannot use it for all income types indiscriminately.

Key takeaways

Filling out the 15G form can seem daunting, but understanding its key elements will simplify the process. Here are some essential takeaways:

- The 15G form is used to declare your intention not to have tax deducted from certain income because your taxable income is below the taxable limit.

- You can use the form if you are an individual or a person who is not a company or a firm.

- It is necessary to provide your Permanent Account Number (PAN) on the form; this identifies you to the tax authorities.

- Include the assessment year for which you are claiming the non-deduction of tax. This is vital for accurate processing.

- Fill in all personal details correctly, including your address, contact information, and residential status.

- Schedule-wise details about investments and income sources must be accurately filled out—this includes shares, securities, and mutual funds.

- It is important to estimate your total income carefully; accurate estimations help in avoiding penalties.

- Ensure you provide a declaration of your past income to avoid double taxation on your earnings.

- Submit the form in duplicate to the person responsible for paying the income, as this is a requirement.

- Remember, any false declaration can lead to penalties, including imprisonment or fines, so double-check your information.

By keeping these points in mind, you can navigate the 15G form with greater confidence and clarity.

Browse Other Templates

Emergency Contact Record,Beneficiary Designation Form,Casualty Notification Document,Military Emergency Data Form,Service Member Beneficiary Form,DoD Emergency Information Sheet,Record of Beneficiaries,Emergency Data and Beneficiary Form,Notification - It is recommended to document any changes in personal circumstances promptly.

Homeschool Letter of Intent Template - Parents or guardians must sign the form to indicate their intention to provide home schooling for their children.