Fill Out Your Insolvency Irs Form

The Insolvency Worksheet serves as a crucial tool for individuals facing significant financial challenges, particularly when it comes to canceled debts. This form guides users through a comprehensive assessment of their financial situation by requiring them to detail their total liabilities, including credit card debt, mortgages, vehicle loans, medical bills, and more. In the first part of the worksheet, individuals must list all outstanding debts categorized accordingly, ensuring that no debt is counted more than once. This thorough cataloging sets the stage for understanding one’s financial obligations precisely. Following the liabilities section, the form prompts individuals to evaluate the fair market value of their assets. Assets range from cash in bank accounts to real estate holdings and other personal property like vehicles and jewelry. The final section of the worksheet facilitates the critical calculation of insolvency by subtracting total assets from total liabilities. This step is vital—it clarifies financial standing and determines whether a person is insolvent. Navigating this form not only provides necessary insights but also lays the foundation for potential tax implications resulting from forgiven debts, making it imperative for anyone in such financial straits to complete this worksheet with accuracy and diligence.

Insolvency Irs Example

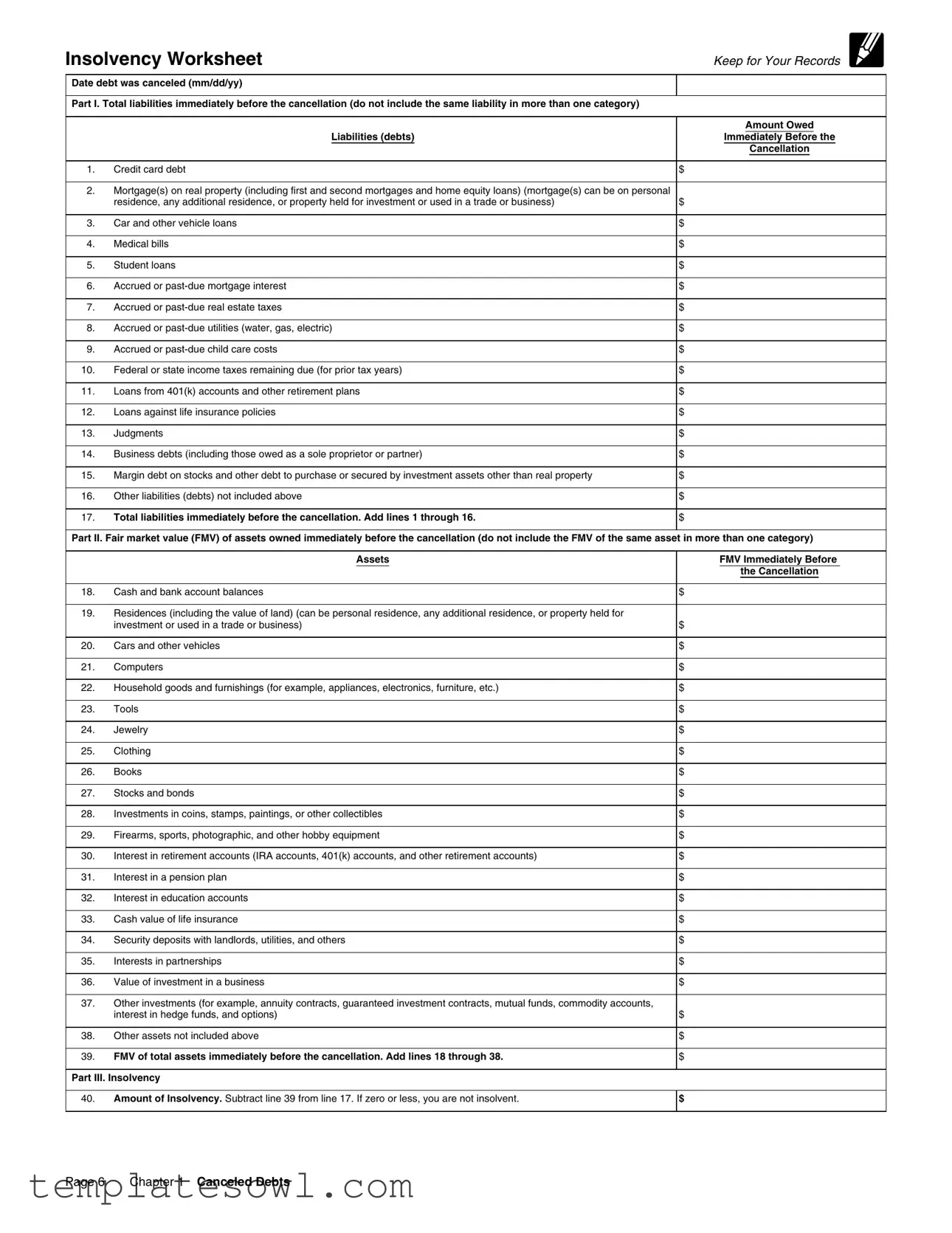

Insolvency Worksheet

Keep for Your Records

Date debt was canceled (mm/dd/yy)

Part I. Total liabilities immediately before the cancellation (do not include the same liability in more than one category)

|

Amount Owed |

Liabilities (debts) |

Immediately Before the |

|

Cancellation |

|

|

1. Credit card debt |

$ |

2.Mortgage(s) on real property (including first and second mortgages and home equity loans) (mortgage(s) can be on personal

|

residence, any additional residence, or property held for investment or used in a trade or business) |

$ |

|

|

|

3. |

Car and other vehicle loans |

$ |

|

|

|

4. |

Medical bills |

$ |

|

|

|

5. |

Student loans |

$ |

|

|

|

6. |

Accrued or |

$ |

|

|

|

7. |

Accrued or |

$ |

|

|

|

8. |

Accrued or |

$ |

|

|

|

9. |

Accrued or |

$ |

|

|

|

10. |

Federal or state income taxes remaining due (for prior tax years) |

$ |

|

|

|

11. |

Loans from 401(k) accounts and other retirement plans |

$ |

|

|

|

12. |

Loans against life insurance policies |

$ |

|

|

|

13. |

Judgments |

$ |

|

|

|

14. |

Business debts (including those owed as a sole proprietor or partner) |

$ |

|

|

|

15. |

Margin debt on stocks and other debt to purchase or secured by investment assets other than real property |

$ |

|

|

|

16. |

Other liabilities (debts) not included above |

$ |

|

|

|

17. |

Total liabilities immediately before the cancellation. Add lines 1 through 16. |

$ |

Part II. Fair market value (FMV) of assets owned immediately before the cancellation (do not include the FMV of the same asset in more than one category)

|

Assets |

FMV Immediately Before |

|

|

the Cancellation |

|

|

|

18. |

Cash and bank account balances |

$ |

19.Residences (including the value of land) (can be personal residence, any additional residence, or property held for

|

investment or used in a trade or business) |

$ |

|

|

|

20. |

Cars and other vehicles |

$ |

|

|

|

21. |

Computers |

$ |

|

|

|

22. |

Household goods and furnishings (for example, appliances, electronics, furniture, etc.) |

$ |

|

|

|

23. |

Tools |

$ |

|

|

|

24. |

Jewelry |

$ |

|

|

|

25. |

Clothing |

$ |

|

|

|

26. |

Books |

$ |

|

|

|

27. |

Stocks and bonds |

$ |

|

|

|

28. |

Investments in coins, stamps, paintings, or other collectibles |

$ |

|

|

|

29. |

Firearms, sports, photographic, and other hobby equipment |

$ |

|

|

|

30. |

Interest in retirement accounts (IRA accounts, 401(k) accounts, and other retirement accounts) |

$ |

|

|

|

31. |

Interest in a pension plan |

$ |

|

|

|

32. |

Interest in education accounts |

$ |

|

|

|

33. |

Cash value of life insurance |

$ |

|

|

|

34. |

Security deposits with landlords, utilities, and others |

$ |

|

|

|

35. |

Interests in partnerships |

$ |

|

|

|

36. |

Value of investment in a business |

$ |

37.Other investments (for example, annuity contracts, guaranteed investment contracts, mutual funds, commodity accounts,

|

interest in hedge funds, and options) |

$ |

|

|

|

38. |

Other assets not included above |

$ |

|

|

|

39. |

FMV of total assets immediately before the cancellation. Add lines 18 through 38. |

$ |

Part III. Insolvency

40.Amount of Insolvency. Subtract line 39 from line 17. If zero or less, you are not insolvent.

$

Page 6 |

Chapter 1 Canceled Debts |

Form Characteristics

| Fact Name | Description |

|---|---|

| Date of Debt Cancellation | Record the date when the debt was canceled in the format mm/dd/yy. |

| Total Liabilities | List all debts owed before cancellation, including credit cards and mortgages. |

| Fair Market Value of Assets | Determine the FMV of assets owned immediately prior to cancellation. |

| Insolvency Calculation | Subtract the total FMV of assets from total liabilities to find insolvency amount. |

| Types of Liabilities | Various debts may include student loans, medical bills, and business debts. |

| Asset Categories | Assets are categorized and valued, including vehicles, homes, and collectibles. |

| Zero Insolvency Threshold | If the insolvency amount is zero or less, the individual is not considered insolvent. |

| IRS Reporting | This worksheet assists individuals in determining insolvency for tax reporting purposes. |

| Record Keeping | Keep this worksheet for personal records and potential IRS inquiries. |

Guidelines on Utilizing Insolvency Irs

Completing the Insolvency IRS form involves a series of steps that require careful attention to detail. Providing accurate information is essential for determining your financial status leading up to the cancellation of debts. Follow these steps to ensure the form is filled out correctly.

- Gather all financial documents related to your debts and assets, including bank statements, property valuations, and any outstanding invoices.

- Start with Part I. List all your liabilities immediately before the cancellation. Fill in the amounts owed for each category, ensuring you do not duplicate any debts in multiple categories.

- Add the amounts from lines 1 to 16 in Part I to find the total liabilities immediately before the cancellation. Enter the total on line 17.

- Move on to Part II. List the fair market value (FMV) of each asset you own immediately before the cancellation. Be thorough and avoid duplication of the same asset in different categories.

- Calculate the total FMV of your assets by adding the amounts from lines 18 to 38 in Part II. Record the total on line 39.

- Proceed to Part III. Calculate your total insolvency by subtracting line 39 from line 17. Enter the result on line 40. If the amount is zero or less, it indicates that you are not insolvent.

- Review the completed form for accuracy. Ensure all entries are correct, and make adjustments if needed.

- Keep a copy of the completed form for your records before submitting it.

What You Should Know About This Form

What is the Insolvency IRS form?

The Insolvency IRS form is a worksheet used to determine if an individual is insolvent at the time debts are canceled. When liabilities exceed assets, one may be eligible to exclude some canceled debts from taxable income. This form facilitates the calculation, ensuring accurate reporting to the IRS.

Who needs to fill out this form?

This form is typically necessary for individuals who have had their debts canceled, which might include credit card debt, mortgages, or student loans. If one's total liabilities exceed total assets, filing this form can help in managing tax implications from canceled debts.

How do I calculate my total liabilities?

To calculate total liabilities, list all debts immediately before the debt cancellation. This includes credit card debts, mortgage balances, vehicle loans, medical bills, and any other relevant liabilities. Next, sum these amounts to achieve the total liability figure.

What should I include in my asset calculation?

When calculating assets, consider various categories such as cash, property, vehicles, and personal items. Fair market value is vital, meaning you should estimate what these assets would sell for in the current market. Ensure not to double-count any assets in multiple categories.

What does it mean to be insolvent?

Being insolvent means that your total liabilities exceed your total assets. If the value of what you owe is greater than what you own, you are considered insolvent. This status can be significant for understanding tax responsibilities related to canceled debts.

What should I do if my insolvency amount is zero or less?

If the insolvency amount, calculated by subtracting total assets from total liabilities, is zero or below, you are not considered insolvent. Thus, any canceled debt may be taxable. In such cases, it’s advisable to speak with a tax professional to understand your options.

Can I keep a copy of my completed form?

Yes, it’s essential to keep a copy of the completed Insolvency IRS form for your records. This documentation may be useful in future tax filings or if the IRS requires additional information regarding your financial situation.

Common mistakes

When filling out the Insolvency IRS form, it’s essential to pay close attention to details. Unfortunately, many people make common mistakes that can lead to complications. One such mistake is double-counting liabilities. When listing debts, each liability should only be entered in one category. Failing to do this can result in an inflated total, compromising the accuracy of your information.

Another frequent error involves underestimating asset values. It might be tempting to undervalue certain assets to appear more insolvent, but this is not advisable. The form requires a fair market value (FMV), which should reflect what you could realistically sell the asset for. Misrepresenting values can raise red flags with the IRS.

People often overlook including all relevant debts. It’s important to list every type of liability you hold, from credit card debt to loans against retirement accounts. Missing even one category can skew your insolvency calculations and potentially lead to issues with your tax obligations.

A mistake many make is not updating records before filling out the form. The debts and assets should reflect your circumstances at the time of cancellation. If you haven't accurately tracked your financial status, you may end up submitting incorrect information.

Another pitfall is neglecting to keep supporting documents. After completing the form, it's crucial to maintain records, including details of all debts and assets. If the IRS has questions or audits your filings, you will need to provide evidence to support your stated values.

In addition, some individuals fail to seek professional advice if they're unsure about any aspect of the form. Consulting a tax professional or financial advisor can help clarify the process and ensure everything is completed correctly. This guidance can be invaluable in preventing costly mistakes.

Finally, many people rush through the form, leading to careless errors in calculations. Always take your time to double-check each figure. A small mistake in addition could lead to significant discrepancies, putting your insolvency claim at risk. A thorough review can save you from future complications.

Documents used along the form

When navigating the complexities of insolvency, several forms and documents may accompany the Insolvency IRS form. These materials provide important context or support for your financial situation. Below is a list of commonly utilized documents that are essential for a comprehensive understanding of your insolvency status.

- Schedule D: This form lists all your debts, including secured and unsecured debts, providing a complete picture of what you owe.

- Form 1040: Your individual income tax return is necessary to determine the overall tax implications of any canceled debt.

- Form 982: This form is used to report the exclusion of canceled debt from income. It specifies the circumstances under which the debt can be excluded.

- Bank Statements: Recent bank statements can verify asset values and provide insight into your financial position before the cancellation.

- Loan Statements: These documents detail outstanding balances on loans, including terms and conditions, which are vital for assessing liabilities.

- Asset Valuations: Appraisals for property or other significant assets help establish fair market value, critical for accurate insolvency calculations.

- Budget Statements: A current and projected budget can illustrate your financial situation post-cancellation and may be needed for financial counseling.

- Credit Reports: Accessing your credit report provides an overview of your credit history, including debts and any potentially discharged amounts.

- Correspondence with Creditors: Any communication regarding debt validation or settlement terms from creditors can serve as important documentation.

- Tax Returns from Previous Years: Recent tax returns may be necessary to assess income levels and any relevant deductions or liabilities.

Gathering these documents can ease the process of filing and improve accuracy. Being organized allows for a clearer view of your financial landscape, enabling you to make informed choices moving forward.

Similar forms

- Bankruptcy Petition: Similar to the Insolvency IRS form, a bankruptcy petition details an individual's debts, assets, income, and expenses. Both documents require comprehensive disclosure of financial information to assess the individual's financial situation.

- Financial Disclosure Statement: This document outlines a person's financial condition, similar to the insolvency form. It requires details on liabilities, assets, and income, helping creditors understand repayment capacity.

- Debt Relief Agreement: Like the Insolvency IRS form, a debt relief agreement requires documentation of current debts and income. Both aim to present a clear picture of a person's financial difficulties and propose solutions for alleviating those issues.

- Loan Modification Application: This application is similar because it involves detailed information about debts and income in order to negotiate terms with lenders. Both documents utilize financial data to support requests for relief.

- Tax Return Forms: Tax returns and the Insolvency IRS form both require full disclosure of liabilities and financial activities. Understanding previous year’s debts and income can provide insight into the person's current financial state.

- Statement of Financial Affairs: This document is similar as it requires a detailed report of an individual's financial history, including debts and assets. Both help assess the insolvency status and inform creditors about the individual's financial situation.

Dos and Don'ts

When filling out the Insolvency IRS form, careful attention to detail is crucial. Here are some guidelines to help you avoid common pitfalls and ensure accuracy.

- Do include all liabilities immediately before the cancellation. Make sure to document credit card debt, mortgages, and any loans accurately.

- Do assess the fair market value of your assets. This should encompass everything from cash balances to real estate and investments.

- Do report the correct amounts. Double-check calculations for liabilities and assets to prevent discrepancies.

- Do keep thorough records. Maintain copies of the form and any supporting documents for your records.

- Don't underestimate the value of your assets. Accurate valuation is essential, as it affects your insolvency status.

- Don't omit any liabilities or assets. Failing to list all relevant items can lead to an inaccurate representation of your financial situation.

By following these steps, you can complete the Insolvency IRS form with greater confidence and clarity, minimizing the chances of errors that could complicate your situation.

Misconceptions

Misconceptions about the Insolvency IRS form can lead to misunderstandings regarding debt cancellation and tax liabilities. Below are eight common misconceptions explained succinctly.

- Anyone can use the insolvency worksheet. Not everyone qualifies to use the insolvency worksheet. It is primarily applicable to individuals whose debts exceed their total assets immediately before debt cancellation.

- The form is only for business debts. Many believe this form is only for business debts. In reality, it applies to individual debts such as credit cards, mortgages, and personal loans.

- All debts are considered in the calculation. Some think that all debts count towards insolvency. However, only liabilities that meet specific criteria should be included in the calculation.

- Assets can be overvalued without consequence. There's a misconception that overestimating asset values won’t affect the outcome. Accurate fair market valuations are essential, as inflating values can lead to incorrect insolvency results.

- You don't need to report certain debts. Some people believe they can ignore specific debts, like overdue utilities or child care costs. All relevant debts must be accounted for to ensure accurate insolvency status.

- You can ignore excluded asset categories. Another misconception is that omitting certain asset types is permissible. All owned assets must be included where applicable, or it may skew results negatively.

- Insolvency status is permanent. There’s a belief that once deemed insolvent, individuals remain so indefinitely. Insolvency is a snapshot in time, and individuals can improve their financial situation over time.

- Filing the form guarantees the cancellation of debts. Lastly, many think completing this form will automatically result in debt cancellation. In truth, while the form calculates insolvency, it does not itself cancel any debts.

Understanding these misconceptions can help individuals better assess their financial situation and navigate the complexities of debt cancellation.

Key takeaways

Filling out the Insolvency IRS form can be a crucial step for individuals dealing with canceled debts. Here are some key takeaways to consider:

- Accurate Documentation: Ensure all debts and assets are recorded accurately on the form. Self-reporting can lead to discrepancies, so a thorough review of financial records is essential.

- Categorization of Debts: Organize debts into specified categories. The form requires debts to be listed without duplication, which guarantees clarity when calculating total liabilities.

- Fair Market Value Consideration: Assess the fair market value (FMV) of assets carefully. This valuation impacts the insolvency determination, as it measures the individual’s net worth before debt cancellation.

- Insolvency Calculation: Understand the insolvency calculation process. Subtract the total asset value from the total liabilities, as this figure determines if an individual is deemed insolvent.

- Record Retention: Keep a copy of the completed form and any supporting documents. Retaining these records will be beneficial for future reference or in case of an audit.

By following these takeaways and remaining attentive to detail, individuals can effectively navigate the complexities of the Insolvency IRS form.

Browse Other Templates

Register Business in Georgia - The proportion of food to alcohol sales must meet established county benchmarks.

Certificate of Authenticity,Origin Declaration Form,Goods Origin Certificate,Shipping Origin Statement,Product Origin Documentation,Export Origin Certificate,Certificate of Goods Origin,Origin Certification Document,Cargo Origin Statement,Manufacture - It serves as proof of a product's country of origin for regulatory purposes.