Fill Out Your Uia 1772 Form

The UIA 1772 form serves a crucial role in Michigan’s unemployment insurance framework, specifically when businesses undergo changes that affect their employment status. This form is essential for employers, ensuring compliance with the Michigan Employment Security Act. It requires detailed reporting of business ownership information, including the employer's name, address, and federal employer identification number. Additionally, employers must describe the circumstances surrounding any discontinuance or transfer of payroll or assets, such as mergers, sales, or bankruptcies. Notably, the form seeks clarification on whether the employer has entirely stopped operations within Michigan or retained employees post-transfer. If a business is sold or transferred, the new owners must also be identified, and their responsibilities regarding payroll must be thoroughly outlined. Moreover, the UIA 1772 includes sections to capture acquisition specifics and certification statements, ensuring that all provided information is accurate. This form not only helps determine the liabilities of the involved parties but also outlines penalties for non-compliance, thereby underscoring its importance in the landscape of unemployment insurance management.

Uia 1772 Example

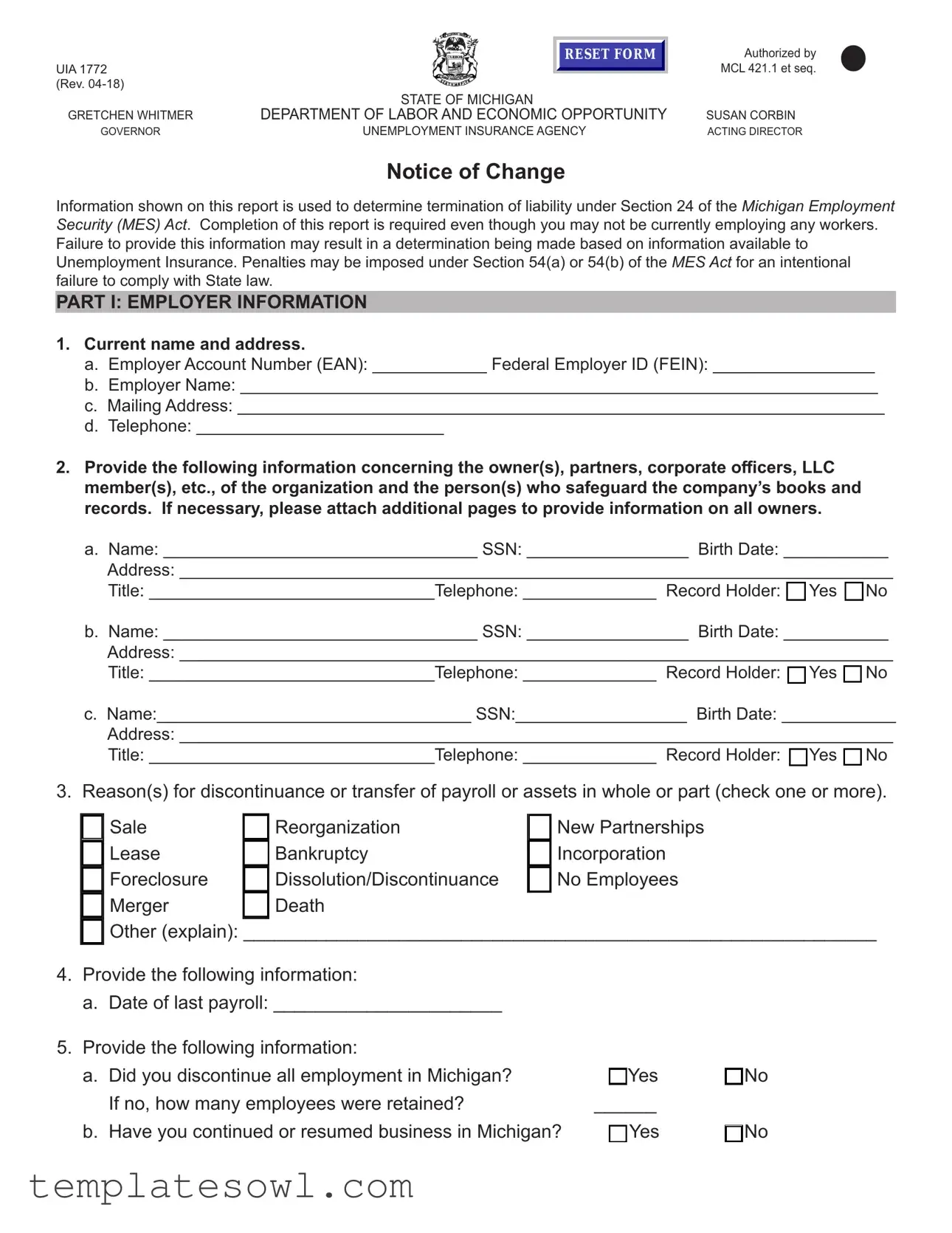

UIA 1772 |

|

RESET FORM |

|

|

|

(Rev. |

STATE OF MICHIGAN |

|

|

||

GRETCHEN WHITMER |

DEPARTMENT OF LABOR AND ECONOMIC OPPORTUNITY |

|

GOVERNOR |

UNEMPLOYMENT INSURANCE AGENCY |

|

Authorized by |

• |

MCL 421.1 et seq. |

|

SUSAN CORBIN |

|

ACTING DIRECTOR |

|

Notice of Change

Information shown on this report is used to determine termination of liability under Section 24 of the Michigan Employment Security (MES) Act. Completion of this report is required even though you may not be currently employing any workers. Failure to provide this information may result in a determination being made based on information available to Unemployment Insurance. Penalties may be imposed under Section 54(a) or 54(b) of the MES Act for an intentional failure to comply with State law.

PART I: EMPLOYER INFORMATION

1.Current name and address.

a.Employer Account Number (EAN): ____________ Federal Employer ID (FEIN): _________________

b.Employer Name: ___________________________________________________________________

c.Mailing Address: ____________________________________________________________________

d.Telephone: __________________________

2.Provide the following information concerning the owner(s), partners, corporate officers, LLC member(s), etc., of the organization and the person(s) who safeguard the company’s books and records. If necessary, please attach additional pages to provide information on all owners.

a.Name: _________________________________ SSN: _________________ Birth Date: ___________

Address: ___________________________________________________________________________

Title: ______________________________Telephone: ______________ Record Holder:  Yes

Yes  No

No

b.Name: _________________________________ SSN: _________________ Birth Date: ___________

Address: ___________________________________________________________________________

Title: ______________________________Telephone: ______________ Record Holder:  Yes

Yes  No

No

c.Name:_________________________________ SSN:__________________ Birth Date: ____________

Address: ___________________________________________________________________________

Title: ______________________________Telephone: ______________ Record Holder:  Yes

Yes  No

No

3.Reason(s) for discontinuance or transfer of payroll or assets in whole or part (check one or more).

Sale |

|

Reorganization |

|

New Partnerships |

Lease |

|

Bankruptcy |

|

Incorporation |

Foreclosure |

|

Dissolution/Discontinuance |

|

No Employees |

Merger |

|

Death |

|

|

Other (explain): _____________________________________________________________

4. |

Provide the following information: |

|

|

|

a. Date of last payroll: ______________________ |

|

|

5. |

Provide the following information: |

|

|

|

a. Did you discontinue all employment in Michigan? |

Yes |

No |

|

If no, how many employees were retained? |

______ |

|

|

b. Have you continued or resumed business in Michigan? |

Yes |

No |

UIA 1772 (Rev. 04

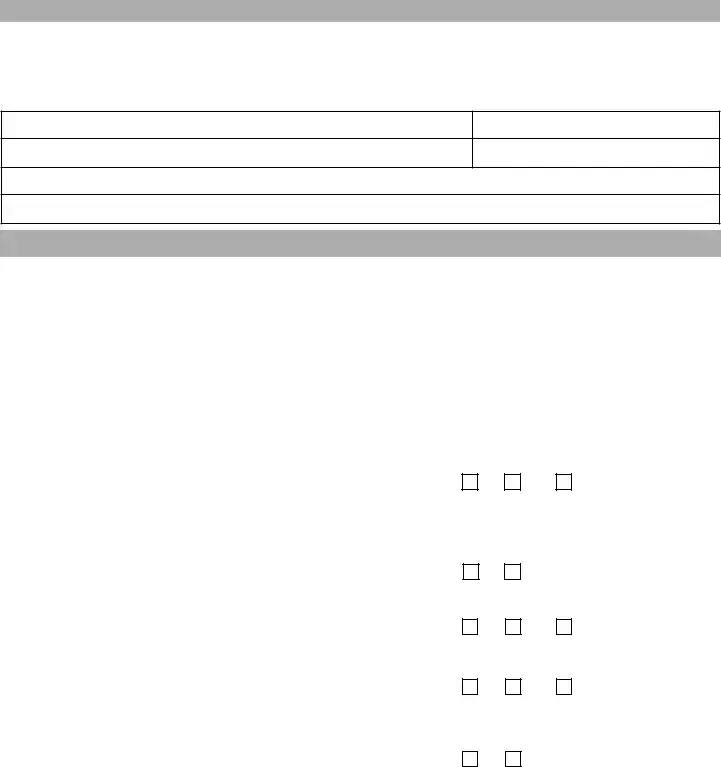

If you answered yes to question #5b, complete the section below if the information differs from what

was provided in question #1. |

|

___________________________________ |

__________________________________________ |

Legal Name of Business |

Address |

___________________________________ |

__________________________________________ |

Nature of Business |

Date(s) Resumed Business |

Complete Part II and Part III only if your business was sold or transferred.

PART II: NEW OWNER INFORMATION

Please provide the name(s) of the person(s)who acquired the Michigan assets, Michigan organization, Michigan trade, or Michigan business. “Acquired” refers not only to assets purchased, but also assets acquired by rental, lease, use, inheritance, merger, mortgage, foreclosure, gift, or other transfer. If more than one individual or organization is involved, answer all parts of this question for each purchaser, using separate sheets. If preferred, additional forms will be supplied upon request.

New Owner’s Name

New Corporation Name or DBA

Current Street Address (No PO Box)

City, State, Zip Code

New Owner’s UI Account Number or FEIN, if known.

Area Code & Telephone Number

PART III: ACQUISITION INFORMATION:

Complete this section carefully. It might be necessary to consult your accountant, attorney, or financial advisor for a complete valuation of your entire business to accurately determine the percentage of transfer for each item below.

1.Did the above acquire all, part, or none of the assets of any former business?

a.Number of business location in Michigan:

b.Number of business location in Michigan that have been discontinued:

2.Did the above acquire all, part, or none of the organization (employees/payroll/personnel) of any former business?

a.If all or part, indicate the percent and date acquired

b.Did the above acquire all or part of the employees/payroll/personnel of any former business by leasing any of those employee/payroll/personnel?

|

All |

Part |

None |

What |

Date |

|||||

|

|

|

|

|

|

|

|

|

Percentage |

Acquired |

|

|

|

|

|

|

|

|

|

________% |

_______ |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

All |

Part |

None |

|

|

|

What |

Date |

|

|

Percentage |

Acquired |

|

|

________% |

________ |

Yes |

No |

If yes, provide a copy of your |

|

|

|

lease agreement. |

|

3.Did the above acquire all, part, or none of the trade (customers/accounts/clients) of any former business?

4.Did the above acquire all, part, or none of the former owner’s Michigan business (products/services) of any former business?

5.Was your Michigan business described in

All |

Part |

None |

What |

Date |

|

|

|

percentage |

Acquired |

|

|

|

_______% |

________ |

All |

Part |

None |

What |

Date |

percentage |

Acquired |

|||

|

|

|

_______% |

________ |

Yes |

No |

Date operation ended |

||

|

|

__________________ |

|

|

UIA 1772 |

|

|

(Rev. |

|

|

Page 3 |

|

|

6. Is the above conducting/operating the Michigan business |

Yes |

No |

acquired from you? |

|

|

7.Is the above substantially owned, merged, or controlled in any way by the same interests who owned or controlled the organization, business or assets of your business?

8.Did the above hold any secured interest in any of the Michigan assets acquired from you?

9.Enter the reasonable value of the Michigan organization, trade, business or assets sold or transferred.

Yes |

No |

If Yes, complete this Form |

and fill out Schedule B of |

||

|

|

Form 518. |

Yes |

No |

If Yes, enter balance owed |

|

|

$______________ |

$______________

CERTIFICATION

I certify that the information contained in this report is accurate and complete to the best of my knowledge and belief. I understand that if I fail to provide accurate and complete information on this form, I may be subject to penalties of up to four times the amount of resulting unpaid unemployment taxes and imprisonment for up to five years.

____________________________________ |

______________________ |

Name |

Date |

____________________________________ |

_______________________ |

Title |

Telephone Number |

When a complete transfer of a Michigan business is involved:

•Your final Quarterly Wage/Tax Report must be filed and paid within 15 days,

•Your coverage will be terminated as of the transfer date,

•If you have persons in your employ after the transfer date of your business, you need to notify Unemployment Insurance immediately to determine if you are liable for taxes on that payroll.

When a partial transfer of a Michigan business is involved:

•You need to continue to report and pay taxes if you have Michigan workers in your employ or until your coverage is terminated.

All documents, agreements or records describing the transactions indicated in Part I Item 4, Part

IIand Part III above, should be kept available for examination by Unemployment Insurance for six years.

You may submit this Form through your Michigan Web Account Manager (MiWAM) account or via fax to

If your address changes it is important to update it with Unemployment Insurance.

If you have any questions, contact the Office of Employer Ombudsman (OEO) through your MiWAM account or at

LEO is an equal opportunity employer/program.

Form Characteristics

| Fact Name | Details |

|---|---|

| Form Title | UIA 1772 Reset Form |

| Jurisdiction | State of Michigan |

| Authorized By | MCL 421.1 et seq. |

| Legal Authority | Michigan Employment Security (MES) Act, Section 24 |

| Penalties | Penalties may apply under Sections 54(a) or 54(b) of the MES Act for failure to comply. |

| Submission Options | Submit via MiWAM account, fax, or mail to Tax Office, PO Box 8068, Royal Oak, MI. |

Guidelines on Utilizing Uia 1772

Completing the UIA 1772 form is an essential step for employers in Michigan who are updating their business information with the Unemployment Insurance Agency. After filling out this form, you may need to follow additional instructions regarding the submission process and what to do next depending on the nature of your business changes. Here is how you can accurately fill out the form.

- Start by providing your current name and address in Part I. Include your Employer Account Number (EAN) and Federal Employer ID (FEIN).

- Next, fill in your employer name, mailing address, and telephone number.

- List the owners, partners, or corporate officers of the business. For each individual, write down their name, Social Security Number (SSN), birth date, address, title, telephone number, and mark whether they are the record holder.

- Select the reasons for the discontinuance or transfer of payroll or assets. This could include sale, bankruptcy, merger, or other options. Check all that apply.

- Indicate the date of your last payroll in the provided space.

- Answer whether you have discontinued all employment in Michigan. If not, specify how many employees were retained.

- State if you have continued or resumed business in Michigan. If yes, provide the legal name of the business and any address changes.

- If applicable, complete Part II for new owner information, providing names and addresses for any individuals involved in the acquisition.

- Fill out Part III by indicating what was acquired in terms of business assets and payroll. Provide details about business locations and any organization transfers.

- Ensure to certify the information by signing and dating the document, including your title and telephone number.

After completing the form, you may submit it through your Michigan Web Account Manager account or send it via fax. If mailing is preferred, ensure you send it to the appropriate address provided in the form instructions. Keeping the records and relevant documents for six years is advisable for any potential future inquiries.

What You Should Know About This Form

What is the UIA 1772 form?

The UIA 1772 form, also known as the Unemployment Insurance Agency Reset Form, is a document used in Michigan. Employers file this form to inform the state of changes to their business operations, particularly regarding employment and payroll. It is used to determine liability under the Michigan Employment Security Act.

Who needs to fill out the UIA 1772 form?

Any employer in Michigan who is discontinuing or transferring their payroll or business assets must complete the UIA 1772 form. This applies even if the employer currently has no employees or is not actively using the business name.

What information is required on the UIA 1772 form?

The form requests a variety of information, including the employer's name and address, the reason for discontinuation or transfer, information about the owners or officers, and details regarding any new owners if the business has been sold or transferred. The user must provide accurate and complete information to avoid penalties.

What are the potential consequences of not filing the UIA 1772 form?

Failure to submit the UIA 1772 form can result in a determination made by the Unemployment Insurance Agency based on available information. This may lead to penalties under the Michigan Employment Security Act, which can be significant if it is found that an employer intentionally did not comply.

How do I submit the UIA 1772 form?

The UIA 1772 form can be submitted through the Michigan Web Account Manager (MiWAM) account. Alternatively, it can be sent via fax or mail. If mailing, the form should be addressed to the Unemployment Insurance, Tax Office, at the specified address in Royal Oak, Michigan.

What happens after I submit the UIA 1772 form?

Once submitted, the information provided will be reviewed by the Unemployment Insurance Agency. If the form indicates a change in the status of the business, the agency will determine if any action is necessary, including potential adjustments to liability for unemployment taxes.

Do I need to keep records regarding the information provided on the UIA 1772 form?

Yes, it is essential to keep all documents related to the transactions described on the UIA 1772 form for six years. This includes any agreements, leases, or records of the business's operations and changes. These may be requested for review by the Unemployment Insurance Agency.

What should I do if my business changes again after submitting the UIA 1772 form?

If there are further changes to your business after the submission of the UIA 1772 form, it is important to notify the Unemployment Insurance Agency. This will help ensure that your records are up-to-date and that you remain compliant with state laws.

Can I get assistance with completing the UIA 1772 form?

Yes, if you need help with the form, consulting an accountant, attorney, or financial advisor may be beneficial. These professionals can assist you in accurately reporting the necessary information and guide you through the implications of the changes in your business.

Where can I find the UIA 1772 form?

The UIA 1772 form can typically be accessed online through the Michigan Unemployment Insurance Agency's website. Additionally, employers can request physical copies of the form if needed.

Common mistakes

Filling out the UIA 1772 form can be a straightforward process, but many individuals make common mistakes that can lead to complications. One frequent error occurs when providing the Employer Account Number (EAN) and Federal Employer ID Number (FEIN). It's essential to ensure these numbers are accurate and match what is on official documents. A simple transposition of digits can lead to delays or miscommunication with the Unemployment Insurance Agency.

Another significant mistake is failing to include all necessary information about the business owners or partners. Omitting details such as Social Security Numbers (SSN) or birthdates can raise red flags. Everyone listed must be current and account for their roles within the organization. Any discrepancies could result in the denial of the form.

Some individuals neglect to indicate the reason for discontinuance or transfer of payroll or assets correctly. This section requires careful attention as it directly affects the processing of the form. Check all applicable reasons rather than leaving the section blank or making unclear selections.

Inaccurate reporting of the date of the last payroll is also common. This date is pivotal, as it helps determine liability for unemployment insurance. Double-check that this information is up-to-date to avoid potential legal ramifications.

Many applicants make the mistake of indicating "No" to the question about whether they have discontinued all employment in Michigan without realizing that this may not truly reflect their situation. Providing incorrect answers can lead to serious consequences, including penalties or investigations.

Additionally, not fully completing Part II, which requests information on new owners, can impede the review process. This form requires thorough documentation of all new owners involved in asset transfer. If omitted, it creates gaps that the agency may interpret as incomplete information.

Another oversight occurs with the certification section at the end of the form. Failing to sign or date it can render the entire document void. Always ensure that all parts of the form are not just filled out, but also properly certified by an authorized individual.

Lastly, many overlook the importance of keeping copies of all submitted documents. This habit is crucial for maintaining records and can be invaluable should any discrepancies arise later. Proper documentation ensures that you have a clear path for reference and can touch base on any matters that may occur down the line.

Documents used along the form

The UIA 1772 form is used by businesses to report changes related to unemployment insurance. When submitting this form, businesses may also need to include additional documents to provide comprehensive information. Below is a list of commonly used forms and documents that complement the UIA 1772 form.

- Quarterly Wage/Tax Report: This report provides details about employee wages and tax contributions for unemployment insurance. It is essential for tracking compliance with tax obligations.

- Form 518: This form is required if there has been a sale or transfer of business. It reports information regarding the business and must include a Schedule B for details on the assets transferred.

- Business License: A copy of the current business license demonstrates legal authorization to operate. It serves as proof of compliance with local ordinances.

- Lease Agreement: If the transfer involves leased assets, providing a copy of the lease agreement is necessary. It outlines the terms and conditions related to business premises.

- Sales Agreement: This document details the terms of the sale for any business assets. It includes information on the buyer, seller, and the assets being transferred.

- Asset Purchase Agreement: In case of a partial business transfer, this agreement specifies which assets are being sold and the responsibilities of both parties regarding liability.

- Corporate Resolutions: If the business is a corporation, resolutions documenting any decisions regarding changes in ownership or business structure may be required.

- Tax Identification Number (TIN) Verification: Providing verification for the Federal Employer Identification Number or state tax IDs helps confirm the business's tax obligations and compliance.

Inclusion of these documents can assist in providing clarity and thoroughness in the reporting process. Ensuring all necessary forms and agreements are attached will help prevent delays and facilitate smoother communication with the Unemployment Insurance Agency.

Similar forms

The UIA 1772 form serves specific functions for reporting changes regarding unemployment insurance in Michigan. Several other documents are similar in purpose, as they also involve reporting, maintaining compliance, and providing information about business operations or changes. Below is a list of eight documents that share similarities with the UIA 1772 form:

- Form 940 - Employer's Annual Federal Unemployment (FUTA) Tax Return: This form is used to report annual unemployment taxes and provide information about the employer's liability, similar to how the UIA 1772 reports changes in liability.

- Form 941 - Employer's Quarterly Federal Tax Return: This document details quarterly federal tax withholdings and payroll, reflecting changes or continuations of employee status like the UIA 1772 with employment status updates.

- Form W-2 - Wage and Tax Statement: Employers use this form to report wages and taxes withheld for employees. The necessity to report employee information parallels the UIA 1772's requirement to provide details about current business operations.

- Form 1099-MISC - Miscellaneous Income: When businesses report income paid to non-employees, this form captures the necessary information, akin to how the UIA 1772 outlines payroll changes and transfers.

- DBA Registration Form: This form is filed when a business intends to operate under a fictitious name. It is similar in that it notifies authorities about significant changes to a business’s operational structure.

- Articles of Incorporation: This legal document officially establishes a corporation. The need to inform state agencies of structural changes is akin to what the UIA 1772 requires regarding employment and business changes.

- Form 990 - Return of Organization Exempt from Income Tax: Non-profit organizations use this form to report financial information. As with the UIA 1772, it serves to keep government entities informed of significant changes in operations.

- State Business Registration Form: Similar to the UIA 1772, this form updates state authorities about a business's current status, including ownership and operational changes.

Understanding these forms can help businesses stay compliant and manage their reporting requirements effectively.

Dos and Don'ts

Filling out the UIA 1772 form can be straightforward if you keep a few things in mind. Here’s a helpful list of what to do and what to avoid.

- Do: Make sure all information is accurate and complete.

- Do: Use blue or black ink to fill out the form.

- Do: Review the form carefully before submitting it.

- Do: Keep a copy of the completed form for your records.

- Don't: Leave any sections blank unless instructed.

- Don't: Use abbreviations or shorthand that might confuse the reader.

- Don't: Forget to sign and date the form at the end.

- Don't: Submit the form late; make sure to send it on time.

Misconceptions

The UIA 1772 form is an important document used for reporting changes to an employer’s unemployment insurance status. However, there are several misconceptions surrounding its purpose and requirements. Addressing these misconceptions can help ensure that employers comply with state laws and maintain good standing.

- Misconception 1: The UIA 1772 form is only required if I have employees.

- Misconception 2: Providing incomplete information will not have consequences.

- Misconception 3: The form is not relevant unless I am transferring my business.

- Misconception 4: Filing the UIA 1772 form is a one-time process.

Many believe that this form is unnecessary unless they are actively employing workers. In reality, the form must be completed even if no employees are currently being hired. This requirement helps the state maintain accurate records regarding unemployment insurance liability.

Some individuals may think that submitting the UIA 1772 form with missing information is acceptable. This is not the case. Inaccuracies or omissions could lead to penalties under the Michigan Employment Security Act. It is essential to provide comprehensive and truthful information.

This form is often seen as only applicable during a business sale or transfer. However, it is necessary during any discontinuance of payroll or changes in business structure. Understanding when to use this form can prevent unwanted complications down the line.

Some people mistakenly believe that submitting the form is a one-time action. In truth, it may need to be filed multiple times as circumstances change. Regularly updating information ensures that the state's records are accurate and up to date, which ultimately helps in maintaining compliance.

Key takeaways

When filling out the UIA 1772 form, understanding the requirements and implications is crucial. Here are some key takeaways:

- Comprehensive Information Required: The form requires detailed employer information, including your Employer Account Number, Federal Employer ID, and owner details. Providing complete information is essential to avoid penalties.

- Mandatory Reporting: Regardless of whether you currently employ workers, you must complete the form. Failing to do so can lead to determinations made without your input, potentially affecting your unemployment tax liabilities.

- Documentation: Keep records of all documents related to your business's sale, transfer, or discontinuation. You must retain these records for a minimum of six years for review by the Unemployment Insurance Agency.

- Timely Submission: If there is a full transfer of your business, file your final Quarterly Wage/Tax Report within 15 days and notify the Unemployment Insurance Agency about any retained employees post-transfer.

- Consult Professionals: If needed, seek help from an accountant, attorney, or financial advisor to ensure accurate completion of the acquisition section, which can be complex and requires detailed assessments.

Browse Other Templates

Csa Dental - Include clear and concise descriptions of all dental services provided.

Emotional Distress Filing Form,Sensitivity Report Sheet,Whiner's Documentation Form,Feelings Impact Log,Tears & Whines Submission,Crybaby Complaint Form,Pansy Feelings Assessment,Fragile Ego Report,SSensitivity Assessment Form,Woe Is Me Report - This report invites you to take your feelings seriously.