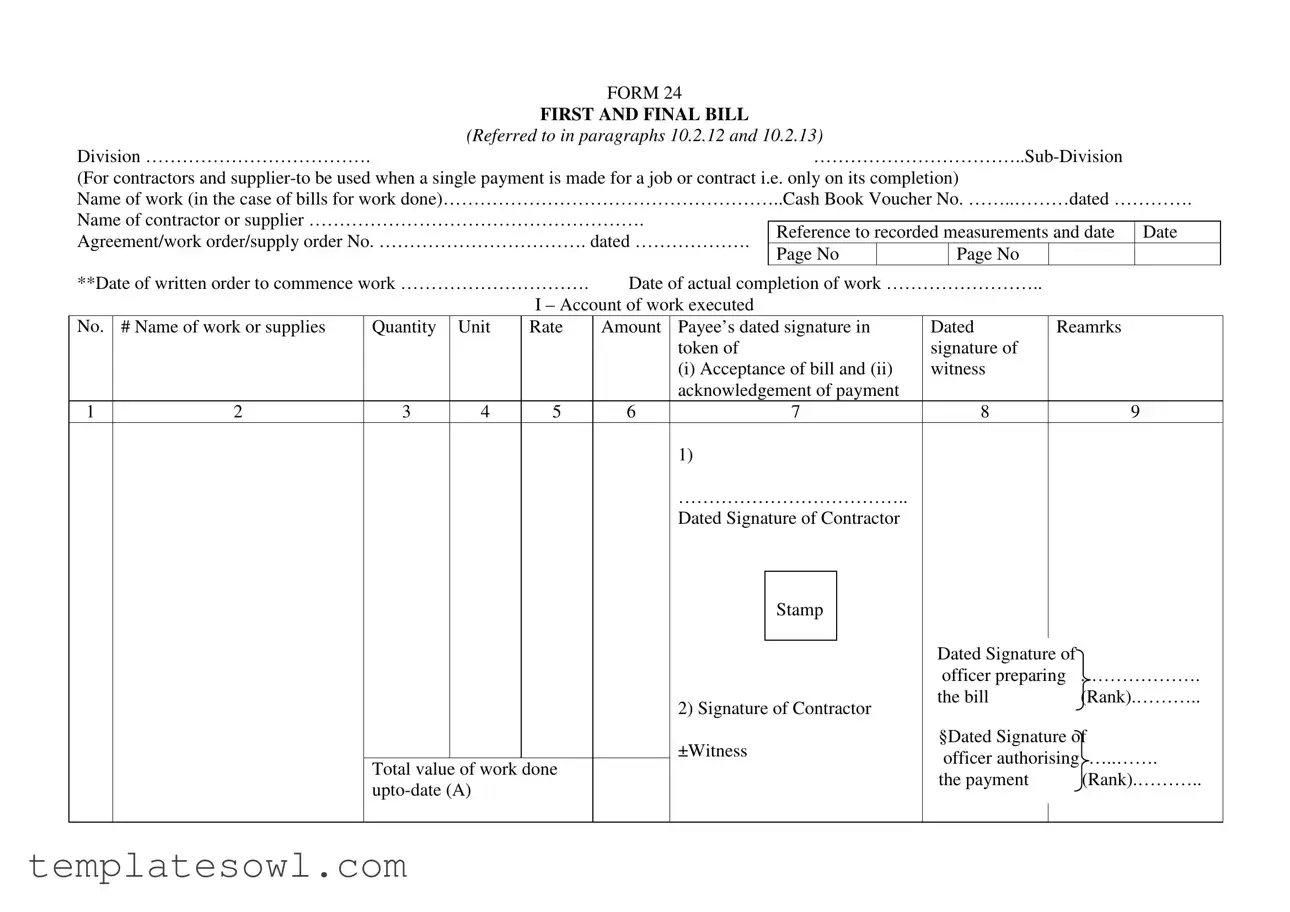

Fill Out Your Final Bill Form

The Final Bill form serves as a crucial document in the payment process for contractors and suppliers, particularly when a single payment is made upon the completion of a job or contract. It is typically referred to as FORM 24 FIRST AND FINAL BILL and is designed for use in specific divisions and sub-divisions of the organization. Key elements of this form include the identification of the work completed, a cash book voucher number for tracking, and reference to the original agreement or work order. Dates play a pivotal role, capturing the formal order to commence work and the actual completion date, ensuring accurate timeline documentation. In detailing the execution of work, the form includes a comprehensive account section, listing the quantity, unit, rate, and total amount for each task undertaken. Payee signatures and accompanying remarks provide acknowledgment of the payment, enhancing accountability. The memorandum of payments section further itemizes the financial transactions, highlighting amounts due, payments made by cheque, and recoveries from other accounts. These features collectively ensure clarity and transparency throughout the payment process, safeguarding the interests of both contractors and the organization. Various protocols, such as indicating stock purchases or requiring witness acknowledgement, facilitate compliance and proper record-keeping.

Final Bill Example

|

FORM 24 |

|

FIRST AND FINAL BILL |

|

(Referred to in paragraphs 10.2.12 and 10.2.13) |

Division ………………………………. |

(For contractors and

Name of work (in the case of bills for work done)………………………………………………..Cash Book Voucher No. ……..………dated ………….

Name of contractor or supplier ………………………………………………. |

|

|

|

|

|

|

|

|

|||||

|

Reference to recorded measurements and date |

|

Date |

||||||||||

Agreement/work order/supply order No. ……………………………. dated ………………. |

|

||||||||||||

Page No |

|

|

Page No |

|

|

|

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

||

**Date of written order to commence work …………………………. |

Date of actual completion of work …………………….. |

|

|

|

|||||||||

|

|

|

|

I – Account of work executed |

|

|

|

|

|

|

|

||

No. |

# Name of work or supplies |

Quantity |

Unit |

Rate |

Amount |

Payee’s dated signature in |

Dated |

Reamrks |

|

|

|||

|

|

|

|

|

|

token of |

|

|

signature of |

|

|

|

|

|

|

|

|

|

|

(i) Acceptance of bill and (ii) |

witness |

|

|

|

|||

|

|

|

|

|

|

acknowledgement of payment |

|

|

|

|

|

||

1 |

2 |

3 |

4 |

5 |

6 |

|

7 |

|

8 |

|

9 |

||

|

|

|

|

|

|

1) |

|

|

|

|

|

|

|

|

|

|

|

|

|

……………………………….. |

|

|

|

|

|

||

|

|

|

|

|

|

Dated Signature of Contractor |

|

|

|

|

|

||

|

|

|

Stamp |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Dated Signature of |

|

|

|

|

|

|

|

|

officer preparing |

.………………. |

|

|

|

|

2) Signature of Contractor |

the bill |

(Rank).……….. |

|

|||

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

±Witness |

§Dated Signature of |

|

||||

|

|

officer authorising …..……. |

|

|||||

|

Total value of work done |

|

|

|

|

|||

|

|

|

|

the payment |

(Rank).……….. |

|

||

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

II – Memorandum of Payments

|

|

|

Rs. |

|

|

1. Total Value as per Account I Col 6 Entry (A)……………………… |

…………………….. |

* Pay Rs…………………………………………. |

|||

2. Payments now to be made as detailed below :- |

|

|

………………………………… (by cheque) |

||

By recovery of amounts credited to this work- |

|

|

|

|

|

(a) ……………………………………...……… |

(a) ………….….. |

…………………….. |

|

|

|

……………………………………...……… |

|

|

Dated initials of disbursing officer |

||

Total 2 (a) ………………….. |

Total 1- 2(a) ………………….(c) |

…………………….. |

§Paid by me vide cheque No………….. |

||

|

|

|

|

dt……….. |

|

By recovery of amounts credited to other work |

|

|

|

||

or head of accounts- |

|

|

|

|

|

(b) |

Rs…… |

|

|

Dated initials of person actually making the |

|

Rs.…… |

(b)………….….. |

|

payment |

|

|

Security Deposit…….. |

Rs.….. |

|

|

For use in Divisional Office |

|

Other recoveries |

Rs…… |

|

|

Checked |

|

Total 2 (b) ………………….. |

|

|

|

Accounts Clerk |

Divisional Accountant |

|

|

|

|

|

|

(c) By Cheque ……………………………………………………. |

|

For use in Pay & Accounts Office |

|||

|

Audited |

Reviewed |

|||

|

|

|

|

||

|

Total 2(b) +(c) …………….(G) |

………………………. |

Acctt./Jr.A.O./A.A.O |

Pay & Accounts Officer |

|

|

|

|

|

||

|

|

|

|

|

|

#In the case of payments to suppliers a red ink entry should be made across the page, above the entries relating thereto, in one of the following forms, applicable to the case : (1) “Stock”, (2) “Purchases for Stock”, (3) Purchases for direct issue to work ………….” (4) “Purchase for the work ……….. for issue to contractor ……………….”.

**Not required in the case of works done or supplies made under a

±Payment should be attested by some known person when the payee’s acknowledgement is given by a mark, seal or thumb impression. §The person actually making the payment should initial (and date) in this column against each payment.

(This signature is necessary only when the officer authorizing payment is not the officer who prepares the bill.)

* This figures should be tested to see that it agrees with the total of items

Form Characteristics

| Fact Name | Details |

|---|---|

| Form Purpose | The Final Bill form is used for a one-time payment to contractors and suppliers after the completion of work or services. |

| Governing Law | State-specific regulations may govern the use of this form. Check local laws regarding final billing practices. |

| Payment Acknowledgment | It requires the payee's signature to acknowledge receipt of payment, ensuring accountability and transparency. |

| Work Completion Dates | The form must specify both the date work commenced and the actual completion date, outlining the project timeline. |

| Itemized Account | Section I provides a detailed account of executed work, itemizing the quantity, unit rate, and total amount for clarity. |

| Signature Requirements | Multiple signatures are necessary: contractor’s acknowledgment, officer preparing the bill, and the officer authorizing payment. |

| Payment Methodology | Payments can be made through various methods including cheque or recovery from amounts credited to the work, ensuring flexibility. |

Guidelines on Utilizing Final Bill

Once you have gathered all necessary information, filling out the Final Bill form will be a straightforward process. This form is essential for documenting the completion of work or the delivery of goods and must be filled out accurately to ensure timely payments. Below is a clear guide to help you complete the form step by step.

- Begin by filling out the **Division** and **Sub-Division** at the top. Indicate where the work was executed.

- In the section labeled **Name of work**, briefly describe the project or service completed.

- Enter the **Cash Book Voucher No.** along with the date it was issued.

- Write the **Name of contractor or supplier** responsible for the work or supplies.

- For reference, input the **date of recorded measurements** and the relevant **work order/supply order No.** along with its date.

- Fill in the **Date of written order to commence work** and the **Date of actual completion of work**.

- Move on to **Account of work executed**, and fill in the details such as **No.**, **Name of work or supplies**, **Quantity**, **Unit**, **Rate**, and **Amount** in the respective columns.

- Secure the **dated signature** of the payee in the designated area as an acknowledgment of receipt and acceptance of the bill.

- Include a **signature of the Contractor** along with the date and ensure the stamp of the contractor is affixed.

- Complete the signature of the officer preparing the bill, indicating their rank and the date.

- Next, provide the **Memorandum of Payments** section, where you must input the total value from **Account I** under **Total Value**.

- List payments to be made, specifying amounts and any relevant details, ensuring to record initials of disbursing officers against payments made.

- Ensure that all totals add up correctly in the space provided, confirming agreements across the various amounts.

- Lastly, include relevant signatures for authorization from the officer responsible for approving the payment, alongside indicated ranks and the date signed.

What You Should Know About This Form

What is the purpose of the Final Bill form?

The Final Bill form is used to document the completion of work done by a contractor or supplier. This form is specifically designed for situations where a single payment is made upon the completion of a job or contract. It serves as an official record of the work completed and the payment authorized for that work.

Who should use the Final Bill form?

This form should be utilized by contractors or suppliers who are completing a project or providing goods and services that require a final payment. It is intended for use in scenarios where all work has been satisfactorily finished, and all relevant agreements have been fulfilled.

What information needs to be included in the Final Bill form?

Several details should be filled out on the form. This includes the name of the work performed, cash book voucher number, agreement or work order number, recorded measurements, completion dates, the account of work executed with quantities, rates, and amounts, as well as signatures from contractors and relevant officers. Each section collects important data to ensure transparency and accuracy in the billing process.

Is there a specific date when the Final Bill should be submitted?

While there is no fixed submission date for the Final Bill form, it is typically submitted immediately after the completion of the work. The fine details, such as the date of actual completion, should be accurately filled out on the form. Timeliness is essential to ensure payment is processed as soon as possible.

What is the significance of the signatures required on the Final Bill?

Signatures on the Final Bill are crucial for authenticating the document. They indicate acceptance of the bill by the contractor and acknowledgment of payment by a witness. Having these signatures helps in preventing disputes and ensures that all parties involved agree on the work completed and the payment due.

Are there any payment methods specified in the Final Bill form?

Yes, the form allows for payments to be made by cheque or through recoveries of amounts credited to the work. Different methods for transaction processing can be used, but all payment details must be clearly documented within the form for accurate financial records.

What happens if there are discrepancies in the amounts listed on the Final Bill?

If discrepancies arise, they should be addressed before the submission of the Final Bill form. The total value of work done and the various payments must reconcile. It's encouraged to verify all figures and make adjustments as necessary before finalizing the bill to prevent any complications during the payment authorization process.

Is there a requirement for a witness to sign the Final Bill?

A witness is needed if the payee provides acknowledgment through a mark, seal, or thumb impression. In such cases, having a known person sign as a witness helps to validate the transaction and provides additional assurance that the payment process is legitimate and transparent.

What should be done after completing the Final Bill form?

Once the Final Bill form is completed, it should be submitted to the appropriate officer for authorization and payment processing. It is important for all involved parties to retain copies of the bill for their records to ensure proper documentation of the financial transaction.

Common mistakes

When completing the Final Bill form, individuals often encounter several pitfalls that can lead to complications and delays. One common mistake is failing to accurately fill in the Name of work. If this section is left vague or improperly filled, it may result in confusion about the services rendered or products supplied. Clarity is key. Each submission should clearly outline the work done.

Another frequent error involves the Date of actual completion of work. This date must match the timeline of when tasks were genuinely completed. If a discrepancy arises, it could bring about skepticism during the approval process. Submitting incorrect dates can lead to disputes that delay payments unnecessarily.

People also often overlook the importance of highlighting the Cash Book Voucher No.. This number is vital as it ties the bill to financial records. Omitting or inaccurately entering this detail may disassociate the bill from its corresponding payment documentation.

Next, many individuals neglect to ensure that all quantities and rates are filled in correctly under the Account of work executed section. Missing details in this area can misrepresent the financial situation and lead to disputes over quantities or payment amounts. Verifying these figures is indispensable before submission.

Additionally, the Signature of Contractor section is often misconstrued. Individuals may overlook the need for an official signature or fail to date their signature properly, raising questions of authenticity. A neglected signature can halt the entire process, as it denotes the contractor's approval of the bill.

Many forget about the Remarks section. This area is crucial for providing context or additional notes about the work completed or any exceptional circumstances. Failure to use it appropriately may leave decision-makers in the dark about important aspects of the bill.

Finally, individuals sometimes miss the need for initials of the relevant officers throughout the document. Each initial indicates approval at various stages and validates the payment process. Without these, the bill may face unnecessary scrutiny and, in some cases, outright rejection.

Documents used along the form

The Final Bill form serves as a crucial document for initiating payment upon the completion of work or a contract. It details the amounts owed to contractors or suppliers, ensuring transparency and accountability in financial transactions. Along with the Final Bill form, several other documents are commonly required to streamline the payment process and maintain accurate records.

- Contract Agreement: This document outlines the terms of the agreement between the parties involved, including scope, payment terms, and timelines. It serves as the foundation for the Final Bill, confirming that the work meets the contractual obligations.

- Work Completion Certificate: Issued by the project manager or engineer, this certificate verifies that the work has been completed to satisfaction. It provides an official acknowledgment necessary for processing the Final Bill.

- Invoice: A detailed statement issued by the contractor or supplier that lists the services rendered or goods supplied, including costs. The invoice is often provided alongside the Final Bill for clarity on charges.

- Measurement Sheet: This document records the measurements of work completed, which is essential for verifying quantities and ensuring accuracy in the amounts billed. It directly supports the entries made in the Final Bill.

- Payment Receipt: Upon processing the payment, this receipt serves as proof of transaction. It confirms that the contractor or supplier has received the agreed-upon payment as stated in the Final Bill.

- Change Order Document: This form records any changes made to the original contract or scope of work. It is important when modifications affect the overall payment and must be referenced in the Final Bill.

Collectively, these documents create a comprehensive framework that supports the integrity of the payment process. They help safeguard the interest of all parties involved, ensuring that payments are accurate, timely, and justifiable.

Similar forms

- Invoice: Like the Final Bill form, an invoice details the work performed or goods supplied, the quantities, rates, and total amount due for payment. Both documents serve as proof of transaction completion.

- Receipt: A receipt is proof of payment received, similar to how the Final Bill form records payment details, including dates and amounts, before a final settlement is made.

- Purchase Order: A purchase order outlines specific details of goods or work to be done, much like the Final Bill form references agreements and work orders, ensuring both parties agree before payment occurs.

- Contractor's Certificate: This document serves as confirmation that work was completed satisfactorily. Similarly, the Final Bill form requires signatures for acceptance of the bill and acknowledgment of payment.

- Payment Voucher: A payment voucher is an internal document that spells out payments made to vendors, similar to how the Final Bill form summarizes payments to contractors based on completed work.

- Statement of Work: This outlines the tasks completed for a project, akin to the Final Bill form that provides a detailed account of work executed which is necessary for final billing.

Dos and Don'ts

When filling out the Final Bill form, attention to detail is crucial. A few straightforward guidelines can help ensure the process runs smoothly. Below are ten actions to take and avoid:

- Do ensure accurate completion of all sections. Review each entry for correctness.

- Do use clear and legible handwriting to avoid misinterpretation.

- Do attach any required supporting documentation, such as work orders and payment acknowledgments.

- Do date the form properly, including the dates of order and completion.

- Do check that the totals in the memorandum of payments match the individual entries.

- Don't leave any fields blank. If an item doesn't apply, indicate that with "N/A".

- Don't forget to include the signatures of all necessary parties. This includes the contractor and the payment authorizing officer.

- Don't use abbreviations or unclear terms that may confuse the reviewer.

- Don't ignore the requirement for initials and dates next to each payment made.

- Don't rush the process. Take the time to verify the accuracy and completeness of the information provided.

Following these guidelines will help facilitate a smooth and efficient review of the Final Bill form, minimizing delays and potential issues.

Misconceptions

There are several misconceptions regarding the Final Bill form that can lead to confusion. It is important to understand the purpose and requirements of this document to ensure smooth processing. Here are six common misconceptions:

- The Final Bill form is only for contractors. Many people believe this form is exclusively for contractors. However, it is also applicable to suppliers who are providing goods or services for a completed job.

- All information can be filled out after the work is completed. Some individuals think they can complete the form at their convenience. In reality, certain details must be filled out during the work process, such as the date of the written order and the actual completion date.

- Signature of the contractor is optional. There is a misconception that the contractor’s signature is not necessary. This is not true; the contractor’s acceptance and signature are essential for validating the bill.

- All payments can be made through a single method. Some believe that only one method of payment is acceptable. The Final Bill form allows for multiple payment options, including checks and recoveries through other accounts.

- Payments are only verified at the time of disbursement. It is often thought that payment validation occurs solely at the time funds are released. In actuality, verification occurs throughout the process, ensuring that all entries are checked against totals.

- The form does not require supporting documentation. Many may think that submitting the form alone is sufficient. However, it is crucial to attach any necessary documentation, such as work orders or receipts, to support the entries listed in the bill.

Understanding these misconceptions can aid in the correct usage of the Final Bill form and lead to a more efficient payment process. Ensuring accuracy and clarity in the form will help all parties involved in their respective roles.

Key takeaways

Here are five key takeaways regarding the Final Bill form:

- Ensure all fields are completed: Items such as the name of the work, contractor details, and payment information must be correctly filled out for the bill to be valid.

- Document dates accurately: Key dates, including the date of the written order to commence work and the date of actual completion, are vital for tracking and auditing purposes.

- Include appropriate signatures: The contractor must sign and date the bill. Additionally, have the necessary witnesses and officers sign as required to authenticate the document.

- Verify payment totals: Double-check that the total values in the account section match with the sum of all payments detailed to ensure accuracy and avoid disputes.

- Follow the payment process carefully: If payments are made by cheque or recovery of amounts, ensure proper initials and dates are documented to maintain a clear record of transactions.

Browse Other Templates

Ngb22 - The State Adjutant General plays a key role in processing the NGB 62E submissions.

Florida Accident Report - Offers space for the owner’s information if different from the driver.

When Can You No Longer Claim a Child as a Dependent - The guide breaks down information on income from various sources, helping taxpayers understand what should be included in gross income reporting.