Fill Out Your Financial Assistance Application Form

The Financial Assistance Application Form is a crucial document designed to help individuals and families access much-needed assistance for medical expenses. It serves as a comprehensive record that gathers important personal and financial information, allowing health care providers to assess eligibility for aid. The form begins by collecting basic details such as the patient’s name, social security number, and relationship to the guarantor, which helps establish account ownership. Further sections inquire about the patient's income, employment status, and any other sources of income, such as social security or rental income. The application also requests details on dependents within the household, along with monthly expenses like rent or mortgage, utility bills, and insurance payments. Notably, applicants are guided to provide income verification documents, including tax returns or pay stubs, to support their claims. Should a household member have applied for Medicaid or state assistance, specific guidelines are included regarding further action. Overall, this application not only seeks to understand the financial situation of the applicant but also emphasizes transparency and thoroughness in documenting the pathway to securing financial assistance for healthcare needs.

Financial Assistance Application Example

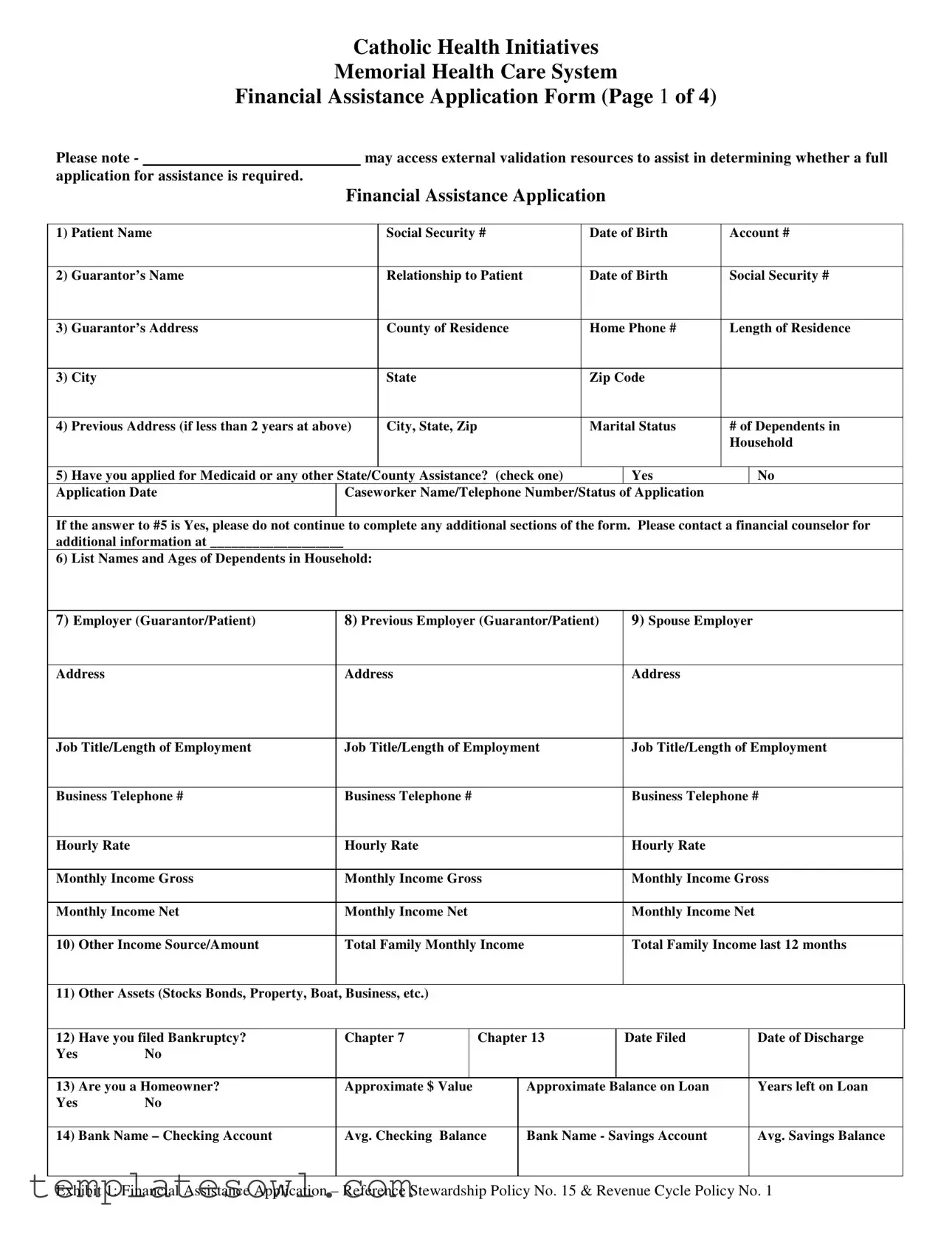

Catholic Health Initiatives

Memorial Health Care System

Financial Assistance Application Form (Page 1 of 4)

Please note - |

|

|

may access external validation resources to assist in determining whether a full |

||||||

application for assistance is required. |

|

|

|

|

|

|

|

||

|

|

|

Financial Assistance Application |

|

|

||||

|

|

|

|

|

|

|

|

|

|

1) |

Patient Name |

|

|

Social Security # |

Date of Birth |

Account # |

|||

|

|

|

|

|

|

|

|

|

|

2) |

Guarantor’s Name |

|

|

Relationship to Patient |

Date of Birth |

Social Security # |

|||

|

|

|

|

|

|

|

|

|

|

3) |

Guarantor’s Address |

|

|

County of Residence |

Home Phone # |

Length of Residence |

|||

|

|

|

|

|

|

|

|

|

|

3) |

City |

|

|

State |

Zip Code |

|

|

||

|

|

|

|

|

|

|

|

|

|

4) |

Previous Address (if less than 2 years at above) |

|

City, State, Zip |

Marital Status |

# of Dependents in |

||||

|

|

|

|

|

|

|

|

Household |

|

|

|

|

|

|

|

|

|

||

5) |

Have you applied for Medicaid or any other State/County Assistance? (check one) |

|

Yes |

|

No |

||||

Application Date |

Caseworker Name/Telephone Number/Status of Application |

|

|

||||||

|

|

|

|

|

|

|

|

|

|

If the answer to #5 is Yes, please do not continue to complete any additional sections of the form. Please contact a financial counselor for additional information at ___________________

6) List Names and Ages of Dependents in Household:

7) Employer (Guarantor/Patient) |

8) Previous Employer (Guarantor/Patient) |

9) Spouse Employer |

|

|||||||

|

|

|

|

|

|

|

|

|

|

|

Address |

Address |

|

|

|

|

Address |

|

|||

|

|

|

|

|

|

|

||||

Job Title/Length of Employment |

Job Title/Length of Employment |

Job Title/Length of Employment |

||||||||

|

|

|

|

|

|

|

|

|

||

Business Telephone # |

Business Telephone # |

|

|

|

|

Business Telephone # |

||||

|

|

|

|

|

|

|

|

|

|

|

Hourly Rate |

Hourly Rate |

|

|

|

|

Hourly Rate |

|

|||

|

|

|

|

|

|

|

|

|||

Monthly Income Gross |

Monthly Income Gross |

|

|

Monthly Income Gross |

||||||

|

|

|

|

|

|

|

|

|

|

|

Monthly Income Net |

Monthly Income Net |

|

|

|

|

Monthly Income Net |

|

|||

|

|

|

|

|

|

|

|

|

||

10) |

Other Income Source/Amount |

Total Family Monthly Income |

|

|

Total Family Income last 12 months |

|||||

|

|

|

|

|

|

|

|

|

|

|

11) |

Other Assets (Stocks Bonds, Property, Boat, Business, etc.) |

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

12) |

Have you filed Bankruptcy? |

Chapter 7 |

|

Chapter 13 |

|

Date Filed |

|

Date of Discharge |

||

Yes |

No |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

13) Are you a Homeowner? |

Approximate $ Value |

|

|

Approximate Balance on Loan |

|

Years left on Loan |

||||

Yes |

No |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

14) Bank Name – Checking Account |

Avg. Checking Balance |

|

Bank Name - Savings Account |

|

Avg. Savings Balance |

|||||

|

|

|

|

|

|

|

|

|

|

|

Exhibit 1: Financial Assistance Application – Reference Stewardship Policy No. 15 & Revenue Cycle Policy No. 1

Catholic Health Initiatives

Memorial Health Care System

Financial Assistance Application Form (Page 2 of 4)

15) AUTOMOBILE(S) |

|

|

|

|

|

|

|

|

|

1. Make: |

|

Model: |

|

Year: |

Pymt Amount: |

Balance Due: |

|||

|

|

|

|

|

|

|

|

|

|

2. Make: |

|

Model: |

|

Year: |

Pymt Amount: |

Balance Due: |

|||

|

|

|

|

|

|

|

|

|

|

3. Make: |

|

Model: |

|

Year: |

Pymt Amount: |

Balance Due: |

|||

|

|

|

|

|

|

|

|

|

|

4. Make: |

|

Model: |

|

Year: |

Pymt Amount: |

Balance Due: |

|||

|

|

|

|

|

|

|

|

|

|

Monthly Expenses: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

Description |

|

Monthly Payment |

Payment To |

|

Balance Due |

|

Limit |

||

Rent/Mortgage |

|

$ |

|

|

|

|

$ |

|

$ |

Charge Cards |

|

$ |

|

|

|

|

$ |

|

$ |

|

|

$ |

|

|

|

|

$ |

|

$ |

|

|

$ |

|

|

|

|

$ |

|

$ |

|

|

$ |

|

|

|

|

$ |

|

$ |

|

|

$ |

|

|

|

|

$ |

|

$ |

|

|

$ |

|

|

|

|

$ |

|

$ |

|

|

$ |

|

|

|

|

$ |

|

$ |

Bank Loans |

|

$ |

|

|

|

|

$ |

|

$ |

|

|

$ |

|

|

|

|

$ |

|

$ |

|

|

$ |

|

|

|

|

$ |

|

$ |

|

|

$ |

|

|

|

|

$ |

|

$ |

School Loans |

|

$ |

|

|

|

|

$ |

|

$ |

List Other Expenses Below:

|

Monthly Payment |

|

Monthly Payment |

|

Monthly Payment |

|

FOOD |

$ |

|

MEDICATION |

$ |

AUTO INS |

$ |

UTILITIES |

$ |

|

LIFE INSURANCE |

$ |

OTHER |

$ |

GAS (CAR) |

$ |

|

MEDICAL BILLS |

$ |

OTHER |

$ |

TOTAL MONTHLY EXPENSE |

$ |

|

|

|

|

|

Note: Attach additional sheet if necessary. Important: income verification must be attached – W2, Pay Stub, Tax Return with schedules, etc.

PLEASE READ THE FOLLOWING BEFORE SIGNING AND DATING THE APPLICATION

Please be advised that your signature indicates you have agreed to attach all income verification. In addition to the items requested by this application, you may attach bank statements, copies of social security checks (or letters). If there is no income, please verify how expenses are being met. It is important to explain a lack of income completely so that full consideration of your application can be made. If the guarantor/patient or the spouse is

CERTIFICATION

1.I, the undersigned, certify that the completed information in this document is true and accurate to the best of my knowledge.

2.I will apply for any and all assistance that may be available to help pay this bill.

3.I understand the information submitted is subject to verification; therefore, I grant permission and authorize any bank, insurance co., real estate co., financial institution and credit grantors of any kind to disclose to any authorized agent of

________________ information as to my past and present accounts, policies, experiences and all pertinent information related thereto. I authorize _____________________ to perform a credit check for both guarantor/patient and spouse.

Signature (Guarantor/Patient)

Date

Signature (Spouse)

Date

Please complete and mail your Financial Assistance Application to: Attn: Business Office - Financial Assistance Request, Memorial Health Care System, 2525 de Sales Avenue, Chattanooga, TN 37404

Exhibit 1: Financial Assistance Application – Reference Stewardship Policy No. 15 & Revenue Cycle Policy No. 1

Catholic Health Initiatives

Memorial Health Care System

Financial Assistance Application Form (Page 3 of 4)

DIRECTIONS FOR COMPLETING FINANCIAL ASSISTANCE APPLICATION

1: Complete the patient name, patient’s social security number, patient’s date of birth, and the hospital account number(s) if known.

2: Complete the guarantor name, relationship to patient, guarantor’s date of birth, and guarantor’s social security number. If the guarantor is the same as the patient, note “Same” in this field.

3: Complete the guarantor’s address, home telephone number and length of residence at this address.

4: Complete the guarantor’s previous address (if current residence is less than two years), guarantor’s marital status, and number of dependents living in household. If there are no dependents, please mark

5: Complete the questions regarding Medicaid and other State/County assistance. Please advise if you have applied for assistance (and on what date). Provide the assigned Caseworker’s name, telephone number and the status of the application. You may attach a separate sheet if needed. If your response is “Yes”, please do not proceed to complete any additional sections of the form. Please contact a financial counselor for additional information. If this section does not apply to you, please indicate this by marking it with N/A.

6: List the names and ages of dependents.

7: Complete the employer information for the guarantor or patient, depending upon who has responsibility for the balance. Please complete the name of the employer, the employer’s address, the guarantor/patient’s job title and length of employment. Please also include the guarantor/patient’s business telephone number, hourly (or salary) rate, and the monthly income (both gross and net). If there is no employment, please note how expenses are being met.

8: Complete the previous employer information for the guarantor/patient. This includes the employer’s name and address, the guarantor/patient’s job title and length of employment, business telephone number, hourly rate, and monthly income (both gross and net). If there is no prior employment, mark “N/A”.

9: Complete the income information for the guarantor/patient’s spouse. Include the name of the employer, the employer’s address, job title/length of employment, business telephone number, hourly rate, and monthly income (both gross and net). If the spouse is unemployed, or there is no spouse, mark “N/A”.

10: Complete the other income source/amount. This is for child support, social security, bonus amounts from employers, etc. This also includes rental income, alimony, pension income, welfare and VA benefits. Complete the total family income (add the guarantor/patient net income), then complete the total family income from the last 12 months. If there has been no income, please note how expenses are being met.

11:Please complete the section listing other assets you may have. This includes stocks, bonds, property, boats and businesses you may own. Use additional paper if needed to give complete details. If there are no additional assets, please mark “N/A”.

12: Please indicate if you have ever filed bankruptcy. If you have not filed bankruptcy, please mark “No”. Please verify that all questions have been completed. Attach additional paper if needed for any explanations.

13: Please complete the homeowner information. If you are a homeowner, please note the approximate dollar value, the approximate balance on the loan, and the number of years left on the loan. If you are not a homeowner, please mark “No”.

14: Please complete the banking information as requested and list the bank name. Complete the checking account number and provide the average checking account balance. Please do the same for the savings account field. If there is no savings account, please place “N/A” in the savings field.

15: For automobile information, please list the make, model and year of your vehicle. Please list the monthly payment amount and the current balance. Attach additional documentation for more than four autos.

Exhibit 1: Financial Assistance Application – Reference Stewardship Policy No. 15 & Revenue Cycle Policy No. 1

Catholic Health Initiatives

Memorial Health Care System

Financial Assistance Application Form (Page 4 of 4)

HOW TO COMPLETE THE MONTHLY EXPENSE SECTION (copies of monthly bills/statements may be requested):

RENT/MORTGAGE: Please verify the amount you are paying in rent or by mortgage. Indicate to whom the payment is made, the account number and the current balance due. If you do not pay rent or mortgage, please note why you have no payment or if you live with relatives or others. Use additional paper if needed.

CHARGE CARDS: Please indicate any charge card payments you are currently making. Please indicate the monthly payment amount, to whom the payment is made, the account number and the current balance due. Please indicate the credit limit for each card. Use additional paper if you needed to complete this field. If you have no charge cards please note “N/A”.

BANK LOANS: Please indicate any bank loans you may be paying. Indicate the monthly payment amount, to whom the payment is made, the account number and the current balance due. Use additional paper if needed to completely explain this field. If you have no bank loans, please mark “N/A”.

SCHOOL LOANS: Please list any educational loans you may be paying. This can include, but not be limited to, college loans, private school loans (or tuition),

LIST OTHER MONTHLY EXPENSES:

FOOD: Please list the amount paid for food on a monthly basis.

UTILITIES: Please list the amount paid on a monthly basis for electricity, gas, water, trash and any other utility you may pay. Please add these and place the total (for all of them) in the utilities section. If there are no monthly utilities paid, please mark “N/A” in this section and explain. Use a separate sheet of paper if needed.

GAS (CAR): Please list the amount paid on a monthly basis for transportation needs related to your vehicle. If there is no payment made on a monthly basis for gas, please mark the field “N/A”.

MEDICATION: Please add the amounts you pay on a monthly basis for medication needs. If there are several prescriptions or medications you take, please add them together and place the total amount in this section. If there are no monthly medication payments, please place “NA” in this section.

LIFE INSURANCE: If you have a life insurance policy, please indicate the monthly amount you pay. If there is no payment, please place “N/A” in this section.

MEDICAL BILLS: Please add any medical bills you may be paying on a monthly basis. This may include, but not be limited to, physician bills, insurance

AUTO INSURANCE: Please place the total amount you pay on a monthly basis for auto insurance. If you pay on a quarterly basis, please divide the quarterly payment by three and place the amount in this section. If you pay every six months, please divide the total amount you pay by six and place the amount in this section. If there is no monthly payment being made, please mark N/A in this section.

OTHER: This includes any monthly payments you currently are making that are not listed in the previous sections. Please provide details of what you are paying, to whom, and the balances due. Please use a separate sheet of paper if needed. If this section does not apply to you, mark “N/A”.

TOTAL MONTHLY EXPENSES: Please estimate your monthly expenses and place this amount in this section.

Exhibit 1: Financial Assistance Application – Reference Stewardship Policy No. 15 & Revenue Cycle Policy No. 1

Form Characteristics

| Fact Name | Fact Description |

|---|---|

| Application Purpose | The Financial Assistance Application is designed to help patients request financial assistance for medical bills if they cannot pay their balance due. |

| Eligibility Criteria | Applicants must provide financial information, which includes income sources, expenses, and assets. This information aids in determining eligibility for assistance programs. |

| Medicaid Notification | If applicants have applied for Medicaid or any state/county assistance, they are instructed not to fill out any additional sections of the form until further consultation with a financial counselor. |

| Required Documentation | Income verification documents, such as W2s and pay stubs, must be attached to ensure that the application can be fully considered. |

| State Laws | This application is governed by state-specific laws, including those related to patient financial assistance under the Tennessee Code Annotated Title 68, Chapter 11. |

Guidelines on Utilizing Financial Assistance Application

Your Financial Assistance Application form is an important document for obtaining assistance. Carefully filling it out ensures that all necessary information is provided for your request to be reviewed. Make sure to gather all required documents, such as proof of income and any other relevant financial statements, before you begin.

- Enter the patient’s name, social security number, date of birth, and account number if available.

- Complete the guarantor’s details: name, relationship to patient, date of birth, and social security number. If the guarantor is the same as the patient, write “Same.”

- Provide the guarantor’s address, county of residence, home phone number, and length of residence.

- If the guarantor has lived at their current address for less than two years, include the previous address, marital status, and number of dependents. Use “-0-” if there are no dependents.

- Answer the Medicaid and other assistance questions accurately. If assistance has already been applied for, provide the application date, caseworker name, and telephone number. If “Yes,” do not complete further sections. Contact a financial counselor for help.

- List the names and ages of all dependents living in the household.

- Fill in employer details for either the guarantor or the patient, including job title, length of employment, business telephone number, and income details.

- Provide information for previous employers—if applicable—similarly as outlined in the previous step. If there is no previous employer, mark “N/A.”

- If applicable, complete the spouse’s employer information, including all required details. Mark “N/A” for unemployed spouses or if there is no spouse.

- List any other income sources, including amounts from social security, child support, and rental income. Calculate total family monthly income.

- Disclose other assets you have, such as property or stocks. Mark “N/A” if there are none.

- Indicate if you have ever filed for bankruptcy and add any relevant details.

- Include homeowner information, providing approximate value and loan balance. If you do not own a home, mark “No.”

- Fill in your bank details for checking and savings accounts. Provide average balances or mark “N/A” as needed.

- Complete the automobile information, detailing make, model, year, payment amounts, and balances for each vehicle you own. List a maximum of four vehicles, and use additional sheets if necessary.

- Detail all monthly expenses, including rent/mortgage, charge cards, bank loans, and school loans. Include other expenses such as food, utilities, transportation costs, and medical bills. Ensure to add up totals accurately.

- Read the certification section carefully, then sign and date the application. This indicates that all provided information is true and complete.

- Mail your completed application to the address provided at the end of the form.

What You Should Know About This Form

What is the purpose of the Financial Assistance Application form?

The Financial Assistance Application form is designed for patients who may need help covering their medical expenses. By filling out this form, individuals can provide details about their financial situation, which can assist the healthcare provider in determining eligibility for financial support programs.

Who should fill out the Financial Assistance Application?

The application should be filled out by the patient or the guarantor responsible for the patient's healthcare expenses. A guarantor is someone who takes responsibility for paying the bill and is typically a parent, spouse, or other legal representative.

What information is required to complete the application?

The application requires personal details such as the patient's name, social security number, date of birth, and account number. Information about the guarantor, employment details, income sources, monthly expenses, and assets will also need to be provided. It is crucial to provide income verification, like pay stubs or tax returns, to support the application.

What do I do if I have applied for Medicaid or other state assistance?

If you have applied for Medicaid or any other state assistance, you should indicate this on the application. Do not complete any additional sections. Instead, contact a financial counselor who can guide you on the next steps and ensure you receive the assistance you may qualify for.

What should I do if certain sections of the application do not apply to me?

If certain sections of the application do not apply to you, simply mark them as "N/A" (Not Applicable). This helps clarify that you didn't overlook any questions and allows the reviewers to focus on the relevant information.

How should I account for my monthly expenses?

You should document all your monthly expenses, including rent or mortgage, charge cards, bank and school loans, and any other regular payments like utilities or insurance. Be as specific as possible. If documentation is requested, it’s wise to have copies of bills or statements ready to support your reported expenses.

What if I have no income or am currently unemployed?

If you have no income, clearly explain how you are managing your living expenses in the application. It’s essential to provide a complete picture so that your application can be considered fairly. If someone in your household is supporting you, include their information as well.

Can I include assets when applying for financial assistance?

Yes, you can include assets in your application. This includes any stocks, bonds, properties, or vehicles you own. Providing this information helps the financial counselors fully assess your financial situation. If you have no assets, simply indicate that on the form.

Is my information kept confidential?

Yes, any information you provide is handled with strict confidentiality. The data collected on the application is used solely for the purpose of evaluating your eligibility for financial assistance. It is important to provide accurate information to ensure the process works smoothly.

Where do I send my completed Financial Assistance Application?

Your completed application should be mailed to the Business Office at the Memorial Health Care System. The exact address is listed in the application instructions. Be sure to send it in time to avoid any interruptions in your assistance request process.

Common mistakes

Filling out the Financial Assistance Application form is a crucial step for those seeking financial help. However, many people make common mistakes that can delay or complicate their applications. It is important to be careful and thorough while completing the form.

One common mistake is not providing accurate or complete information in the patient details section. This includes the patient's name, Social Security number, and date of birth. Incomplete or incorrect entries can lead to processing delays. Ensure every detail is entered clearly and correctly.

Another frequent error involves failing to answer questions about Medicaid or state assistance. If someone has applied for these programs, they should stop completing the form and contact a financial counselor. Ignoring this instruction can result in an incomplete application, leading to the need for re-submission.

Omitting information about dependents is also a significant mistake. It is essential to list all dependents and their ages accurately. This information impacts the financial assessment and can affect the level of assistance received.

Many applicants do not provide sufficient income verification. Attaching pay stubs, tax returns, or W-2s is crucial. Without proper documentation proving income, the application may not be considered. Make sure to gather all necessary paperwork before submitting the application.

In the section where assets are listed, people often leave information blank or mark "N/A" without explanation. A complete inventory of assets can be critical in determining eligibility for assistance. Provide as many details as possible about any assets, rather than skipping this part.

Finally, failing to read and sign the certification statement can lead to an application being returned. A signature verifies the information provided is accurate and that all necessary documentation is attached. Take the time to review the entire application carefully and ensure all signatures are included before submission.

By being mindful of these common mistakes, applicants can strengthen their Financial Assistance Application and enhance their chances of receiving the help they need.

Documents used along the form

The Financial Assistance Application is an important step for those seeking help to cover medical expenses. Along with this form, several other documents may be required to complete your application. Below is a list of common documents you might need to submit.

- Proof of Income: Documents such as pay stubs, W-2 forms, or tax returns that verify your income for the past year.

- Bank Statements: Recent statements from your checking and savings accounts to show your financial status and verify assets.

- Medicaid Application: If you have applied for Medicaid or similar assistance, include any documentation regarding your application, including caseworker details.

- Expense Documentation: Copies of your monthly bills such as rent, utilities, and loans to illustrate your financial obligations.

- Bankruptcy Documents: If applicable, provide court documents related to any bankruptcy filings, including dates and status.

- Credit Report: A recent credit report may be requested to assess your overall financial health and credit history.

- Identification Documents: Copies of identification, such as a driver’s license or Social Security card, to verify your identity and residency.

Preparing these documents in advance will help ensure a smoother application process. If you have questions about any specific requirements, don’t hesitate to reach out for assistance.

Similar forms

- Medicaid Application Form: Like the Financial Assistance Application, this form collects personal and financial information to determine eligibility for state aid. Both require details about income, assets, and household members to assess financial need.

- Food Assistance Application (SNAP): Similar in purpose, this application assesses a family's financial status to provide food aid. It asks for income verification and household size, paralleling the inquiries in the Financial Assistance Application.

- Housing Assistance Application: This form also requires extensive information about income and expenses to evaluate eligibility for housing aid. Both documents focus on verifying resources and financial obligations, aiming to support those in need.

- Disability Benefits Application: This document assesses qualifications for disability benefits by obtaining detailed personal and financial information. Like the Financial Assistance Application, it requires verification of income and assets to confirm eligibility for support.

Dos and Don'ts

When filling out the Financial Assistance Application form, it's essential to approach the process with care and consideration. Here are eight key guidelines to follow:

- Do: Ensure all personal information is accurate.

- Do: Include all sources of income, even if it's minimal.

- Do: Attach all required documentation, such as W2s and pay stubs.

- Do: Provide details about dependents accurately.

- Don't: Leave any sections blank; if it doesn’t apply, indicate "N/A."

- Don't: Rush the application; take time to double-check your entries.

- Don't: Forget to sign and date the application.

- Don't: Assume that incomplete applications will still be considered; ensure thoroughness.

Following these guidelines ensures you present the most accurate and complete information, facilitating a smoother review process. Remember, seeking assistance is a step towards securing support; take your time and do it right.

Misconceptions

- Misconception: The application is overly complicated. Many people believe the Financial Assistance Application is too complex. However, it is designed to gather necessary information in a straightforward manner. By following the directions provided, applicants can complete it efficiently.

- Misconception: You must be without any income to qualify. Some assume that only those with zero income can receive assistance. In reality, the application considers total family income, including any minor income sources, and evaluates financial need based on monthly expenses and financial obligations.

- Misconception: Previous application attempts prevent future consideration. There is a worry that if someone has applied in the past and was denied, they cannot apply again. In fact, applicants are encouraged to reapply or provide new information that may change their eligibility status.

- Misconception: Only homeowners can apply for financial assistance. It's assumed that only those who own homes are eligible for aid. People who rent or live with relatives can also apply. The focus is on financial need, not home ownership.

- Misconception: The application must be filled out perfectly the first time. Many fear making mistakes on the application will lead to automatic rejection. While completeness is important, applicants are often given guidance on how to correct any inaccuracies or omissions.

- Misconception: All assets need to be disclosed upfront. Some believe they must provide extensive details of all assets immediately. However, the application allows for additional documentation to be submitted later if needed, focusing initially on key information.

- Misconception: There is no support available for completing the application. Many applicants think they are on their own. In reality, financial counselors are available to assist them, providing clarity and guidance throughout the process.

- Misconception: The application will certainly take a long time to process. While the processing time can vary based on individual cases, many applications are reviewed promptly. Applicants are advised to submit complete forms along with the required documentation to help expedite the process.

Key takeaways

When filling out the Financial Assistance Application form, consider the following key takeaways:

- Complete All Required Sections: Ensure you fill in all necessary fields, including patient and guarantor details, and income information.

- Income Verification is Essential: Attach required documentation such as W-2 forms, pay stubs, or tax returns to support your financial claims.

- Clarify Your Financial Situation: If there is no income, detail how expenses are managed to provide a complete picture of your circumstances.

- Be Honest and Accurate: Complete all sections truthfully. Any discrepancies may delay the processing of your application or result in denial.

- Follow Up on Assistance Applications: If you have applied for Medicaid or other assistance, contact the appropriate agency for details instead of completing the form.

- Sign and Date the Application: Remember to certify that the information provided is accurate and to acknowledge consent for verification checks.

Browse Other Templates

Authorization Form - Action must be taken to regularly update this information to reflect any changes.

Service of Process in Florida - The form requires the Respondent’s mailing address to ensure proper communication.

St 108 Form - Previous vehicle purchases made outside Indiana may be exempt if the buyer is now a resident of Indiana.