Fill Out Your Financial Planning Worksheet For Career Form

The Financial Planning Worksheet for Career Transition serves as a comprehensive tool designed to aid individuals in navigating their financial landscape during a career change. This worksheet requires users to gather essential documents, including current pay stubs, credit reports, and living expense details. These items help in capturing a clear picture of one's financial obligations and assets. The worksheet includes sections for assessing monthly income from various sources, such as base pay, allowances, and deductions. It facilitates an understanding of total income against existing liabilities, which encompass loans, credit card debts, and other financial responsibilities. Users can evaluate their net worth by comparing total assets, like savings accounts and real estate, to liabilities. Additionally, the worksheet promotes planning for future financial stability through sections that allow for tracking savings and living expenses while also setting goals for income increases and debt reduction. By completing this form, individuals can create actionable strategies to optimize their financial situation as they transition in their careers.

Financial Planning Worksheet For Career Example

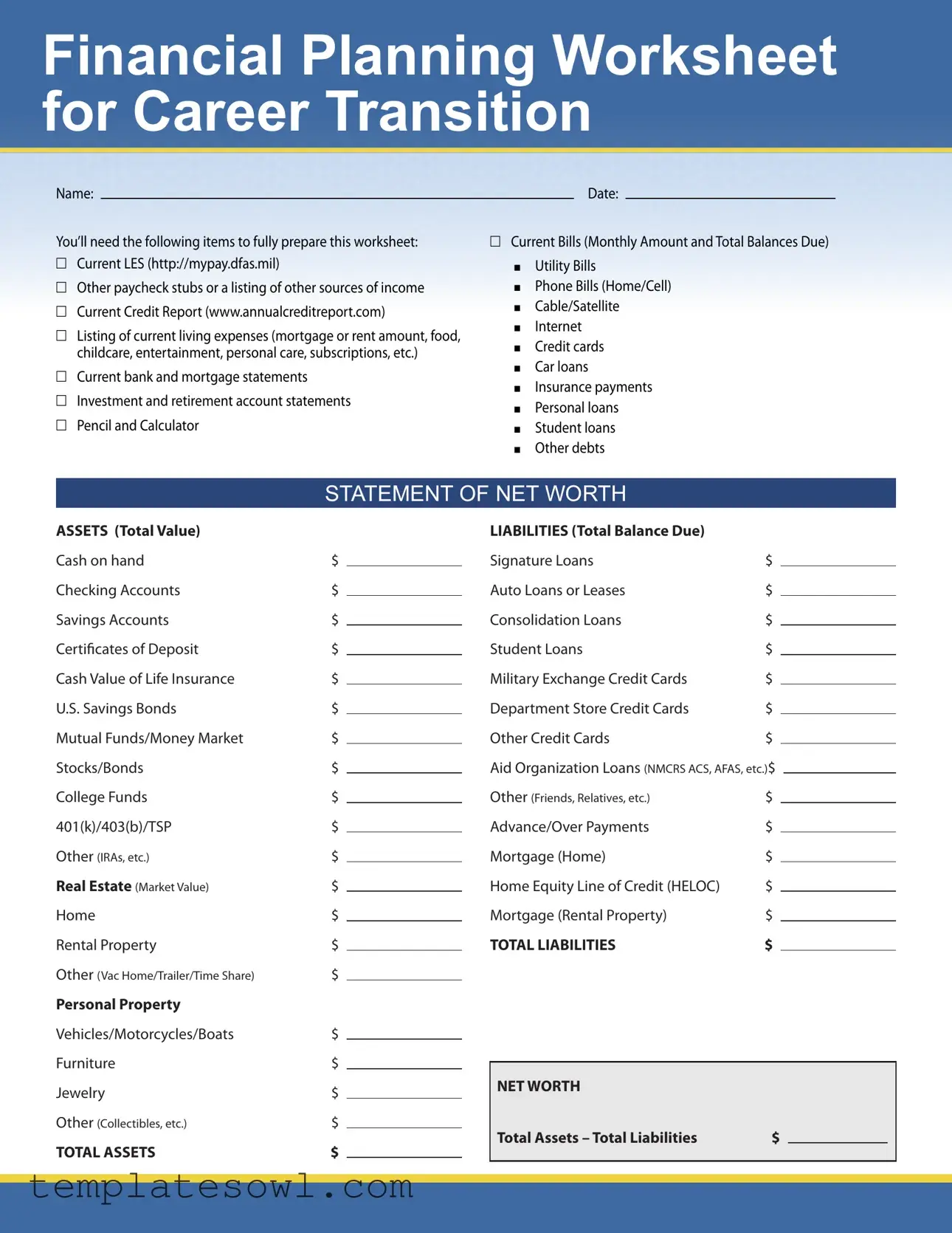

Financial Planning Worksheet for Career Transition

Name:

You’ll need the following items to fully prepare this worksheet: PP Current LES (http://mypay.dfas.mil)

PP Other paycheck stubs or a listing of other sources of income PP Current Credit Report (www.annualcreditreport.com)

PP Listing of current living expenses (mortgage or rent amount, food, childcare, entertainment, personal care, subscriptions, etc.)

PP Current bank and mortgage statements

PP Investment and retirement account statements PP Pencil and Calculator

Date:

PP Current Bills (Monthly Amount and Total Balances Due)

OO Utility Bills

OO Phone Bills (Home/Cell) OO Cable/Satellite

OO Internet

OO Credit cards OO Car loans

OO Insurance payments OO Personal loans

OO Student loans OO Other debts

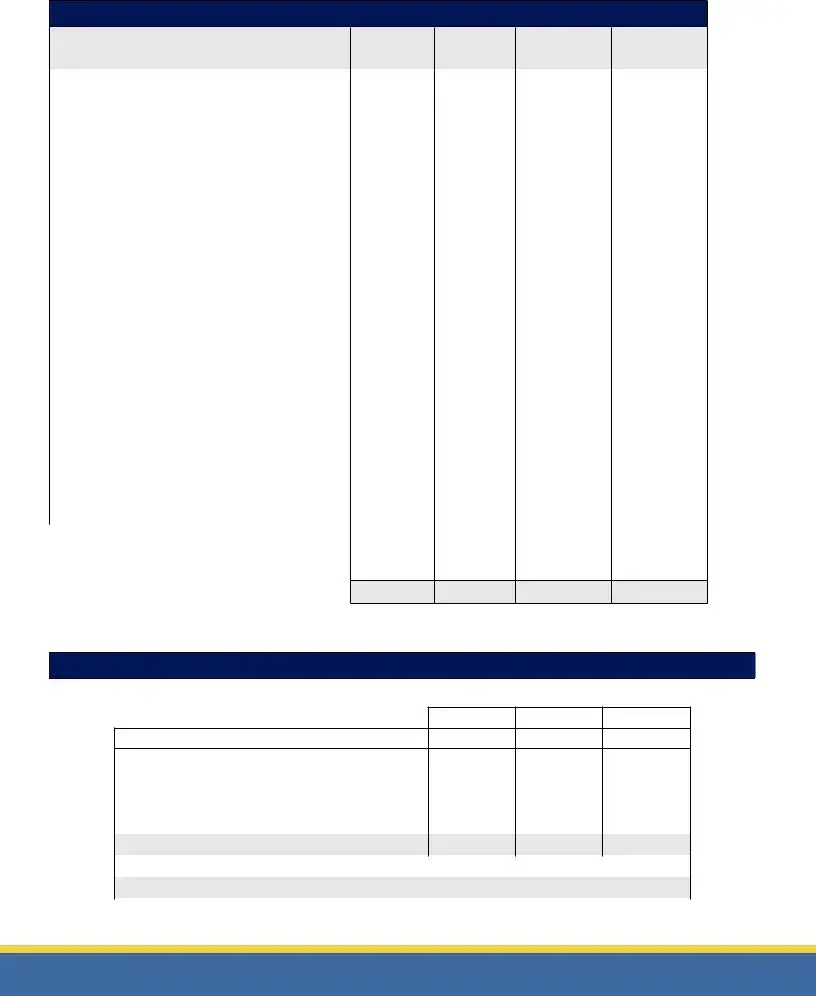

STATEMENT OF NET WORTH

ASSETS (Total Value) |

|

Cash on hand |

$ |

Checking Accounts |

$ |

Savings Accounts |

$ |

Certificates of Deposit |

$ |

Cash Value of Life Insurance |

$ |

U.S. Savings Bonds |

$ |

Mutual Funds/Money Market |

$ |

Stocks/Bonds |

$ |

College Funds |

$ |

401(k)/403(b)/TSP |

$ |

Other (IRAs, etc.) |

$ |

Real Estate (Market Value) |

$ |

Home |

$ |

Rental Property |

$ |

Other (Vac Home/Trailer/Time Share) |

$ |

Personal Property |

|

Vehicles/Motorcycles/Boats |

$ |

Furniture |

$ |

Jewelry |

$ |

Other (Collectibles, etc.) |

$ |

TOTAL ASSETS |

$ |

LIABILITIES (Total Balance Due) |

|

Signature Loans |

$ |

Auto Loans or Leases |

$ |

Consolidation Loans |

$ |

Student Loans |

$ |

Military Exchange Credit Cards |

$ |

Department Store Credit Cards |

$ |

Other Credit Cards |

$ |

Aid Organization Loans (NMCRS ACS, AFAS, etc.)$

Other (Friends, Relatives, etc.) |

$ |

Advance/Over Payments |

$ |

Mortgage (Home) |

$ |

Home Equity Line of Credit (HELOC) |

$ |

Mortgage (Rental Property) |

$ |

TOTAL LIABILITIES |

$ |

NET WORTH |

|

Total Assets – Total Liabilities |

$ |

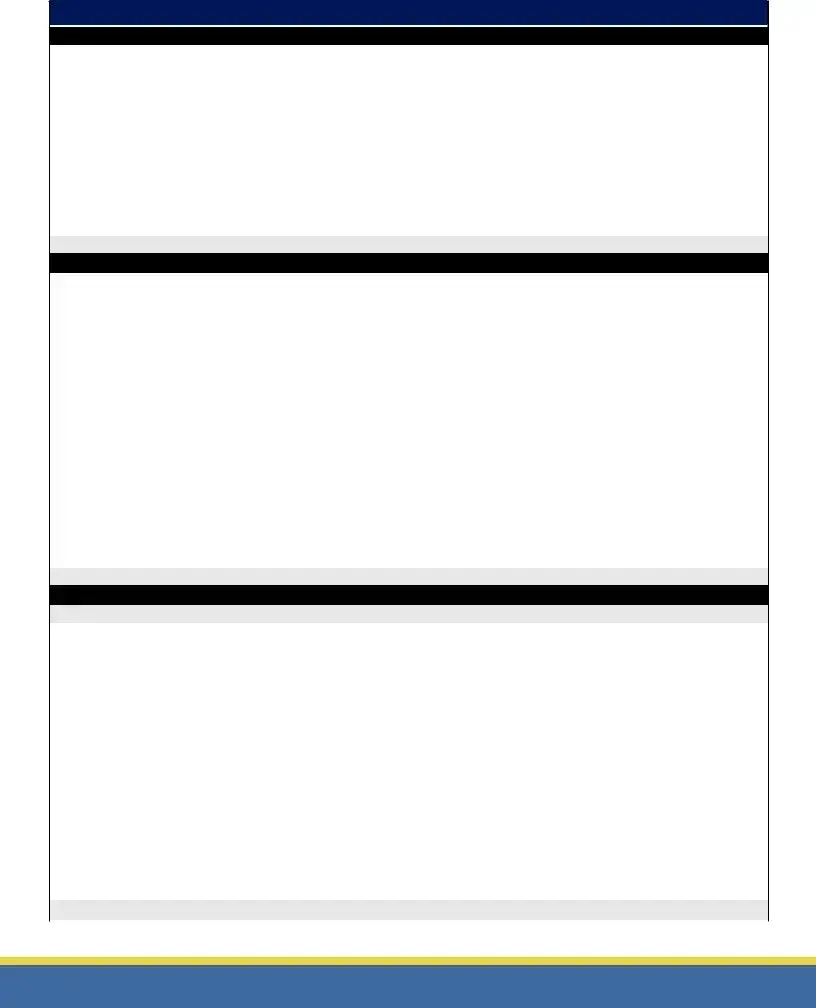

MONTHLY INCOME

ENTITLEMENTS |

|

ACTUAL |

PROJECTED 1 |

PROJECTED 2 |

|

|

|

|

|

|

|

* |

Base Pay |

|

|

|

|

|

Basic Allowance for Housing |

|

|

|

|

|

|

|

|

|

|

|

Overseas Housing Allowance |

|

|

|

|

|

|

|

|

|

|

|

Basic Allowance for Subsistence (BAS) |

|

|

|

|

|

|

|

|

|

|

|

Family Separation Allowance (FSA) |

|

|

|

|

|

|

|

|

|

|

* |

Special Pay |

|

|

|

|

* |

Special Pay |

|

|

|

|

* |

Special Pay |

|

|

|

|

* |

Special Pay |

|

|

|

|

|

*Other Taxable Pay |

|

|

|

|

|

|

|

|

|

|

|

Other |

|

|

|

|

|

|

|

|

|

|

|

TOTAL MILITARY COMPENSATION |

(A) |

|

|

|

|

|

|

|

|

|

DEDUCTIONS |

|

ACTUAL |

PROJECTED 1 |

PROJECTED 2 |

|

|

|

|

|

|

|

|

ALLOTMENT |

|

|

|

|

|

|

|

|

|

|

|

ALLOTMENT |

|

|

|

|

|

|

|

|

|

|

|

ALLOTMENT |

|

|

|

|

|

|

|

|

|

|

|

ALLOTMENT |

|

|

|

|

|

|

|

|

|

|

|

ALLOTMENT |

|

|

|

|

|

|

|

|

|

|

|

Family SGLI (For Spouses) |

|

|

|

|

|

|

|

|

|

|

|

Servicemembers’ Group Life Insurance (SGLI) |

|

|

|

|

|

|

|

|

|

|

|

Uniform Services TSP |

|

|

|

|

|

|

|

|

|

|

|

MGIB |

|

|

|

|

|

|

|

|

|

|

|

FITW Filing Status Actual |

|

|

|

|

|

|

|

|

|

|

|

FICA (Social Security) |

|

|

|

|

|

|

|

|

|

|

|

FICA (Medicare) |

|

|

|

|

|

|

|

|

|

|

|

State Income Tax |

|

|

|

|

|

|

|

|

|

|

|

AFRH (Armed Forces Retirement Home) |

|

|

|

|

|

|

|

|

|

|

|

TRICARE Dental Plan (TDP) |

|

|

|

|

|

|

|

|

|

|

|

Advance Payments |

|

|

|

|

|

|

|

|

|

|

|

Overpayments |

|

|

|

|

|

|

|

|

|

|

|

TOTAL DEDUCTIONS |

(B) |

$ |

$ |

|

|

|

|

|

|

|

CALCULATE NET INCOME |

|

ACTUAL |

PROJECTED 2 |

PROJECTED 2 |

|

|

|

|

|

|

|

|

Service Member’s Take Home Pay |

$ |

$ |

|

|

|

|

|

|

|

|

|

Service Member’s Other Earnings (less taxes) |

|

|

|

|

|

|

|

|

|

|

|

Spouse’s Earnings (less taxes) |

|

|

|

|

|

|

|

|

|

|

|

Child Support/Alimony (Received/Income) |

|

|

|

|

|

|

|

|

|

|

|

Other Income (e.g., SSI, Rental Income) |

|

|

|

|

|

|

|

|

|

|

|

ALLOTMENT |

|

|

|

|

|

|

|

|

|

|

|

ALLOTMENT |

|

|

|

|

|

|

|

|

|

|

|

ALLOTMENT |

|

|

|

|

|

|

|

|

|

|

|

ALLOTMENT |

|

|

|

|

|

|

|

|

|

|

|

ALLOTMENT |

|

|

|

|

|

|

|

|

|

|

|

Family SGLI (For Spouses) |

|

|

|

|

|

|

|

|

|

|

|

Servicemembers' Group Life Insurance (SGLI) |

|

|

|

|

|

|

|

|

|

|

|

Uniform Services TSP |

|

|

|

|

|

|

|

|

|

|

|

MGIB |

|

|

|

|

|

|

|

|

|

|

|

TRICARE Dental Plan (TDP) |

|

|

|

|

|

|

|

|

|

|

|

Advance Payments |

|

|

|

|

|

|

|

|

|

|

|

Overpayments |

|

|

|

|

|

|

|

|

|

|

|

MONTHLY NET INCOME |

|

$ |

$ |

$ |

*Note: Pay Entitlements are taxable. Allowance Entitlements are

MONTHLY SAVINGS AND LIVING EXPENSES

SAVINGS |

|

ACTUAL |

PROJECTED 1 |

PROJECTED 2 |

|

|

|

|

|

|

|

|

Emergency Fund |

|

|

|

|

|

Reserve Fund |

|

|

|

|

|

|

|

|

|

|

|

Investments/IRAs/TSP/etc. |

|

|

|

|

TOTAL SAVINGS AND |

INVESTMENTS |

$ |

|

$ |

|

|

LIVING EXPENSES |

|

ACTUAL |

PROJECTED 1 |

PROJECTED 2 |

|

|

|

|

|

|

|

|

|

HOUSING |

Furnishings |

|

|

|

|

|

|

Maintenance/Repairs |

|

|

|

|

|

|

Mortgage/Rent |

|

|

|

|

|

|

Taxes/Fees |

|

|

|

|

|

FOOD |

Dining Out |

|

|

|

|

|

|

Groceries |

|

|

|

|

|

|

Lunches |

|

|

|

|

|

|

Vending Machines |

|

|

|

|

|

|

Meal Deductions from military pay |

|

|

|

|

|

UTILITIES |

Cable/Satellite TV |

|

|

|

|

|

|

Cellular/Pagers/Phone Cards |

|

|

|

|

|

|

Electricity |

|

|

|

|

|

|

Internet Service |

|

|

|

|

|

|

Natural Gas/Propane |

|

|

|

|

|

|

Telephone |

|

|

|

|

|

|

Water/Garbage/Sewage |

|

|

|

|

|

CHILD CARE |

Allowances |

|

|

|

|

|

|

Daycare |

|

|

|

|

|

|

Child Support/Other Dependent Care |

|

|

|

|

|

AUTOMOBILE |

Gasoline |

|

|

|

|

|

|

Maintenance/Repairs |

|

|

|

|

|

|

Other |

|

|

|

|

|

CLOTHING |

Laundry/Dry Cleaning |

|

|

|

|

|

|

Purchases ($50 monthly per person) |

|

|

|

|

|

INSURANCE |

Automobile |

|

|

|

|

|

|

Health |

|

|

|

|

|

|

Life |

|

|

|

|

|

|

Homeowners/Renters |

|

|

|

|

|

|

SGLI/FSGLI |

|

|

|

|

|

|

Dental Insurance |

|

|

|

|

|

HEALTHCARE |

Dental Expenses |

|

|

|

|

|

|

Eye Care |

|

|

|

|

|

|

Hospital/Physician |

|

|

|

|

|

|

Prescriptions |

|

|

|

|

|

EDUCATION |

Books |

|

|

|

|

|

|

Fees (Other/Room & Board) |

|

|

|

|

|

|

Tuition |

|

|

|

|

|

|

MGIB |

|

|

|

|

|

CONTRIBUTIONS |

Charities |

|

|

|

|

|

|

Club Dues/Association Fees |

|

|

|

|

|

|

Religious |

|

|

|

|

|

LEISURE |

Athletic Events/Sporting Goods |

|

|

|

|

|

|

Books/Magazines |

|

|

|

|

|

|

Computer Products (Software/Hardware) |

|

|

|

|

|

|

DVD/VHS & Video Games Rentals |

|

|

|

|

|

|

DVD’s & CD’s |

|

|

|

|

|

|

Entertainment |

|

|

|

|

|

|

Lessons |

|

|

|

|

|

|

Toys & Games |

|

|

|

|

|

|

Travel/Lodging |

|

|

|

|

|

PERSONAL |

Beauty Shop/Nails |

|

|

|

|

|

|

Barber Shop |

|

|

|

|

|

|

Cigarettes/Other Tobacco |

|

|

|

|

|

|

Vending Machines |

|

|

|

|

|

|

Liquor/Beer/Wine |

|

|

|

|

|

|

Other (Toiletries, Supplements, etc.) |

|

|

|

|

|

GIFTS |

Holidays |

|

|

|

|

|

|

Birthdays/Anniversaries |

|

|

|

|

|

PET CARE |

Food/Supplies |

|

|

|

|

|

|

Veterinarian/Service (Boarding/Grooming) |

|

|

|

|

|

MISCELLANEOUS |

ATM Fees/Stamps/etc. |

|

|

|

|

|

|

Other |

|

|

|

|

|

TOTAL MONTHLY LIVING EXPENSES |

$ |

$ |

$ |

|

|

|

|

|

|

|

|

|

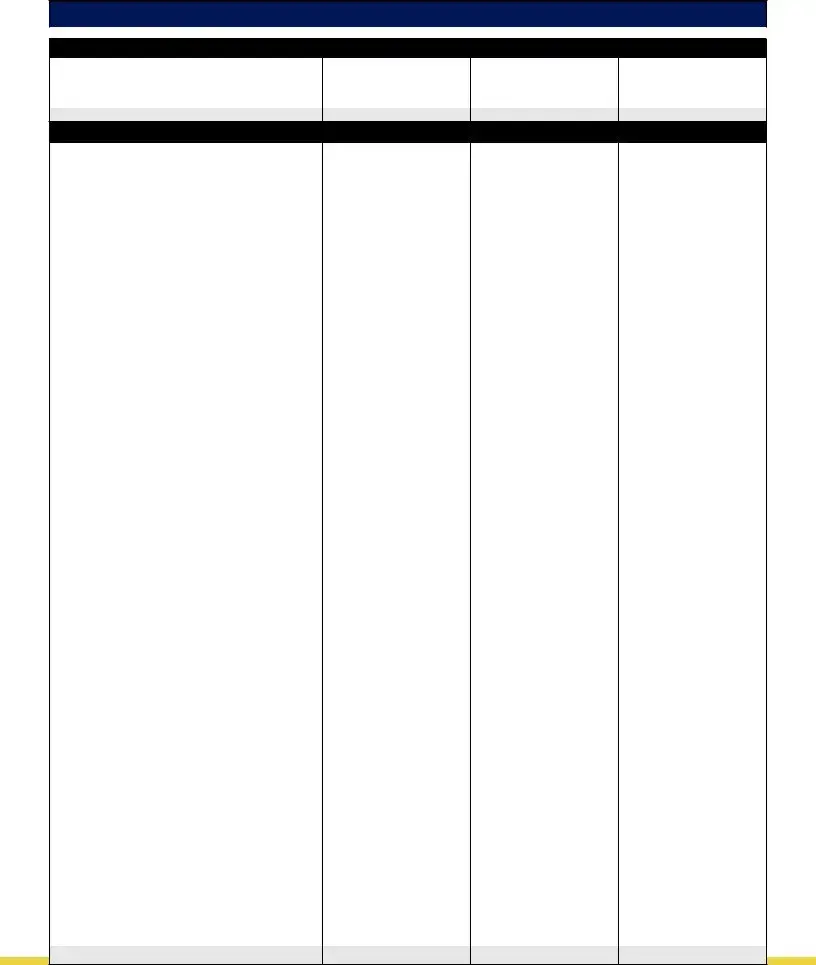

INDEBTEDNESS

|

|

|

BALANCE |

CURRENT |

|

|

CREDITOR |

PURPOSE |

APR % |

(From Page |

MONTHLY |

PROJECTED 1 |

PROJECTED 2 |

|

|

|

One) |

PAYMENT |

|

|

1. US Govt. |

Advance Pay |

|

|

|

|

|

|

|

|

|

|

|

|

2. US Govt. |

Over Payments |

|

|

|

|

|

|

|

|

|

|

|

|

3. |

|

|

|

|

|

|

|

|

|

|

|

|

|

4. |

|

|

|

|

|

|

|

|

|

|

|

|

|

5. |

|

|

|

|

|

|

|

|

|

|

|

|

|

6. |

|

|

|

|

|

|

|

|

|

|

|

|

|

7. |

|

|

|

|

|

|

|

|

|

|

|

|

|

8. |

|

|

|

|

|

|

|

|

|

|

|

|

|

8. |

|

|

|

|

|

|

|

|

|

|

|

|

|

10. |

|

|

|

|

|

|

|

|

|

|

|

|

|

11. |

|

|

|

|

|

|

|

|

|

|

|

|

|

12. |

|

|

|

|

|

|

|

|

|

|

|

|

|

13. |

|

|

|

|

|

|

|

|

|

|

|

|

|

14. |

|

|

|

|

|

|

|

|

|

|

|

|

|

15. |

|

|

|

|

|

|

|

|

|

|

|

|

|

16. |

|

|

|

|

|

|

|

|

|

|

|

|

|

17. |

|

|

|

|

|

|

|

|

|

|

|

|

|

18. |

|

|

|

|

|

|

|

|

|

|

|

|

|

19. |

|

|

|

|

|

|

|

|

|

|

|

|

|

20. |

|

|

|

|

|

|

|

|

|

|

|

|

|

21. |

|

|

|

|

|

|

|

|

|

|

|

|

|

22. |

|

|

|

|

|

|

|

|

|

|

|

|

|

23. |

|

|

|

|

|

|

|

|

|

|

|

|

|

24. |

|

|

|

|

|

|

|

|

|

|

|

|

|

25. |

|

|

|

|

|

|

|

|

|

|

|

|

|

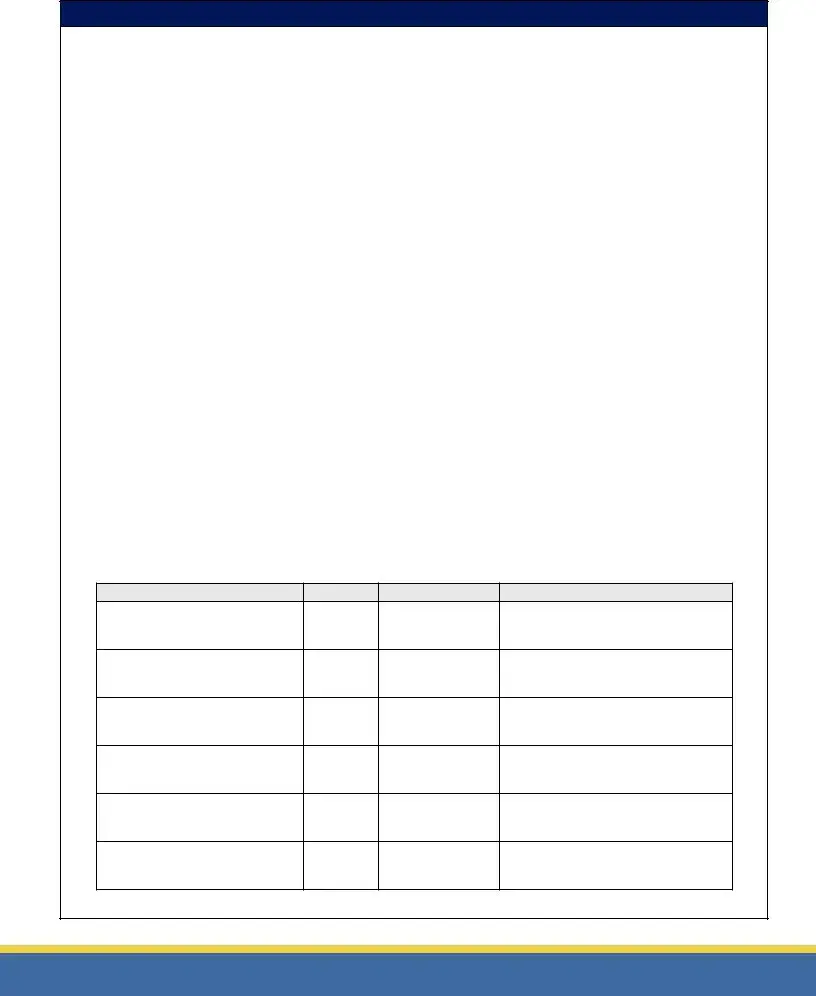

TOTAL

SUMMARY

ACTUAL |

PROJECTED 1 |

PROJECTED 2 |

NET INCOME (Bottom of Page 2)

SAVINGS & INVESTMENTS (Page 3) |

– |

|||

|

|

|

|

|

LIVING EXPENSES (Page 3) |

– |

|||

|

|

|

|

|

AMOUNT LEFT TO PAY DEBTS |

= |

|

|

|

|

|

|

|

|

TOTAL MONTHLY DEBT PAYMENTS (Page 4) |

– |

|||

|

|

|

|

|

SURPLUS OR DEFICIT |

= |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(Total Monthly Debt Payments ÷ Net Income x 100 =

ACTION PLAN

INCREASE INCOME

1. �����������������������������������������������������������������������

2. �����������������������������������������������������������������������

3. �����������������������������������������������������������������������

4. �����������������������������������������������������������������������

DECREASE LIVING EXPENSES

1. �����������������������������������������������������������������������

2. �����������������������������������������������������������������������

3. �����������������������������������������������������������������������

4. �����������������������������������������������������������������������

DECREASE INDEBTEDNESS

1. �����������������������������������������������������������������������

2. �����������������������������������������������������������������������

3. �����������������������������������������������������������������������

4. �����������������������������������������������������������������������

ADDITIONAL INFORMATION NEEDED

1. �����������������������������������������������������������������������

2. �����������������������������������������������������������������������

3. �����������������������������������������������������������������������

4. �����������������������������������������������������������������������

TRANSITION GOALS

GOAL |

COST |

DATE WANTED |

MONTHLY SAVINGS TO REACH GOAL |

1.

2.

3.

4.

5.

6.

Form Characteristics

| Fact Name | Details |

|---|---|

| Purpose | The Financial Planning Worksheet for Career Transition assists individuals in evaluating their financial situation as they prepare for a career change or transition. |

| Required Items | To complete the worksheet, a user must gather various documents, including pay stubs, credit reports, and lists of current living expenses. |

| Net Worth Calculation | This form includes a section for calculating net worth, highlighting the importance of comparing total assets to total liabilities. |

| Monthly Income and Expenses | Users can detail their actual and projected monthly income alongside living expenses, allowing for a comprehensive view of their financial health. |

| Debt Management | A section for listing current debts helps individuals recognize their total indebtedness, guiding efforts toward debt reduction. |

| State-Specific Considerations | For individuals in certain states, local laws regarding financial planning may require adherence to additional regulations or guidelines. |

Guidelines on Utilizing Financial Planning Worksheet For Career

Filling out the Financial Planning Worksheet for Career can seem daunting at first, but taking it step by step can simplify the process. This worksheet will help you assess your finances, plan for your future, and prepare for any career transitions. With your materials in hand, you’ll be ready to break down your financial situation clearly.

- Gather Necessary Materials: Collect your current LES, paycheck stubs, recent credit report, living expenses list, bank statements, mortgage statements, and investment account statements. Don’t forget a pencil and calculator!

- Fill Out Personal Information: Enter your name and the date at the top of the form.

- List Current Bills: Write down the monthly amounts and total balances due for bills like utilities, phone, internet, credit cards, and any other debts.

- Assess Assets: Complete the “Statement of Net Worth” section by listing all your assets, like cash, checking and savings accounts, real estate, personal property, and their total value.

- Account for Liabilities: Detail all your debts in the “Liabilities” section, including loans, credit cards, and mortgages, and calculate the total balance due.

- Calculate Net Worth: Subtract your total liabilities from your total assets to find your net worth.

- Determine Monthly Income: In the “Monthly Income” section, note your actual income and project future income based on various entitlements, including special pays and allowances.

- List Deductions: Include your deductions to find out your total deductions, which will help you assess your actual take-home pay.

- Calculate Net Income: Subtract total deductions from total income to figure out your monthly net income.

- Outline Monthly Savings and Living Expenses: List your current savings and living expenses, writing down what you pay now and your projections for the future.

- Assess Indebtedness: Document your current debts, creditors, annual percentage rate (APR), and monthly payments for a clear picture of your obligations.

- Complete Summary and Action Plan: Sum up your net income, savings, living expenses, and total monthly debt payments. Fill out your action plan to identify ways to increase income, decrease expenses, and reduce debts.

- Set Transition Goals: Finally, list your financial goals, their costs, desired completion dates, and a plan for how to reach them.

Once you've completed this worksheet, you'll have a clearer view of your financial landscape, which can guide your next steps in career planning and personal finance management.

What You Should Know About This Form

What is the purpose of the Financial Planning Worksheet for Career Transition?

This worksheet is designed to help individuals assess their current financial situation when considering a career transition. By gathering information on income, expenses, assets, and liabilities, it enables users to create a clear financial picture. This can assist in making informed decisions about their career path and financial planning, helping to set realistic goals and manage potential financial impacts during the transition period.

What documents are needed to complete the Financial Planning Worksheet?

To fully prepare the worksheet, you will need several documents. These include your current Leave and Earnings Statement (LES), paycheck stubs or records of other income sources, and your latest credit report. Additionally, listing your living expenses is crucial. This involves details such as rent or mortgage payments, childcare costs, and utility bills. You'll also require statements from your bank accounts, credit accounts, investment accounts, and retirement plans to provide a comprehensive view of your financial status.

How do I calculate my net worth using the worksheet?

Your net worth is calculated by subtracting your total liabilities from your total assets. First, sum up all your assets, which can include cash, real estate, and investment accounts. Next, total all your liabilities, such as loans and credit card debts. The formula is simple: Net Worth = Total Assets - Total Liabilities. This figure will give you a snapshot of your financial health and is important for long-term financial planning.

Can the worksheet help in managing debt during my career transition?

Yes, the Financial Planning Worksheet is an excellent tool for managing debt. It encourages users to track their monthly debts and compare them against their income. By identifying total monthly debt payments and assessing your income situation, you can create an action plan to reduce expenses, increase earnings, or pay down debts. The worksheet also allows you to set specific goals for decreasing indebtedness, helping you stay organized and focused on achieving financial stability during your transition.

Common mistakes

People often make common mistakes when filling out the Financial Planning Worksheet for Career Transition. One significant error is not gathering all necessary documents beforehand. Many individuals dive right into the form without their current LES, paycheck stubs, or credit reports. This can lead to incomplete information, causing discrepancies that may affect financial decisions later.

Another frequent misstep is underestimating living expenses. It’s easy to overlook certain costs like subscriptions or occasional splurges on entertainment. Those small amounts can accumulate, ultimately painting a misleading picture of one’s financial situation. Properly detailing all living expenses will provide a clearer understanding of monthly needs.

Inaccuracies in reporting income also present a challenge. Some individuals might accidentally omit additional income sources, such as freelance jobs or side gigs. This results in a lower perceived net income, which can skew budgeting and savings plans. Always cross-check all income streams for accuracy.

Many also forget to account for liabilities thoroughly. Underreporting debts, like credit card balances or student loans, can lead to an inflated view of net worth. It is crucial to include every outstanding balance to see a true picture of financial health.

Another prevalent mistake is not projecting future expenses or income accurately. People often assume that current figures will remain consistent, ignoring potential changes like promotions, relocations, or changing family dynamics. By failing to forecast, one may make ill-informed financial decisions.

Some individuals neglect the action plan section, losing out on valuable goal-setting. Outlining clear steps for increasing income or reducing debt fosters accountability. It's important to write down specific actions rather than leaving this section blank.

Lastly, miscalculating totals is common. Whether summing expenses or balancing monthly income, errors can easily happen. Double-checking calculations helps to avoid mistakes that could drastically affect financial forecasts. By paying attention to detail, you safeguard your financial future.

Documents used along the form

When you're diving into your financial planning, there are several key documents and forms that can help you gather the necessary information. Here’s a list of materials that you might find useful alongside the Financial Planning Worksheet for Career. Each one plays a vital role in achieving a clear picture of your financial status and future goals.

- Budgeting Worksheet: This tool helps you track your income against your expenses, ensuring you know exactly where your money goes each month.

- Debt Repayment Plan: Create a structured approach to eliminate debts by listing them, their total amounts, and a priority repayment order.

- Income Statement: This summary shows your total income over a specific period, making it easier to plan your finances moving forward.

- Credit Report: A detailed account of your credit history, providing insights into your creditworthiness and how to improve your score.

- Net Worth Statement: This document summarizes what you own versus what you owe, helping you see your overall financial health.

- Retirement Planning Calculator: Use this tool to estimate how much you'll need for retirement, based on your desired lifestyle and current savings.

- Investment Portfolio Summary: This provides an overview of your current investments, helping you assess performance and make necessary adjustments.

- Insurance Coverage Overview: A list of your current insurance policies, including coverage limits, premiums, and beneficiaries, ensuring you’re adequately protected.

- Goal-Setting Worksheet: This helps you outline financial goals, breaking them down into achievable steps along with timelines for completion.

Organizing these documents can simplify the financial planning process and prepare you for any career transition. With everything in front of you, decision-making becomes much more manageable. Be confident in your planning.

Similar forms

The Financial Planning Worksheet for Career form is similar to several other financial planning documents. Below is a list of these documents and how they relate:

- BUDGET WORKSHEET: Like the Financial Planning Worksheet, a budget worksheet helps track income and expenses, providing a clear overview of financial health and allowing for better financial decisions.

- NET WORTH STATEMENT: Both documents require a detailed listing of assets and liabilities. A net worth statement summarizes the financial position by calculating the difference between total assets and total liabilities.

- DEBT REPAYMENT PLAN: Similar to the Financial Planning Worksheet, a debt repayment plan outlines existing debts and sets a strategy for repayment over time, emphasizing the importance of managing liabilities.

- RETIREMENT PLANNING CHECKLIST: This checklist, like the Financial Planning Worksheet, focuses on anticipated income streams in retirement and expenses, aiding in long-term financial forecasting.

- INCOME EXPENSE ANALYSIS: This document analyzes cash flows, comparing income sources to expenses. It serves a similar purpose in budgeting and financial planning.

- ASSET ALLOCATION STRATEGY: Both documents examine assets. The asset allocation strategy focuses on investment distribution while the worksheet ensures a comprehensive view of overall financial health.

- SPENDING TRACKER: Like the Financial Planning Worksheet, a spending tracker records all expenditures over time, helping identify areas for potential savings.

- FINANCIAL GOALS WORKSHEET: This worksheet outlines personal financial objectives, similar to the action plan section in the Financial Planning Worksheet, focusing on strategic planning for finances.

- MONTHLY FINANCIAL REPORT: Both reports track and summarize finances over the month, offering a snapshot of financial activities and trends that inform future decision-making.

Dos and Don'ts

When filling out the Financial Planning Worksheet for Career, adhering to specific guidelines can streamline the process. Below is a list of five things you should do and five things you shouldn't do.

- Gather all necessary documents such as your current LES, credit report, and living expenses.

- Be accurate and honest when entering your income and expenses. This will provide a clearer picture of your financial situation.

- Use a calculator to double-check your figures, ensuring you avoid simple mistakes.

- Update your information regularly to reflect any changes in income or expenses.

- Set realistic financial goals as part of your action plan to make progress feel achievable.

- Do not rush through the form. Taking your time can help prevent errors.

- Avoid guessing at numbers. If you don’t know, either find the exact amounts or leave the fields blank.

- Do not use estimates for your expenses. This can lead to an inaccurate portrayal of your financial situation.

- Steer clear of overly ambitious goals that could lead to disappointment if not met.

- Do not neglect to include all debts as overlooking any can result in an incomplete financial picture.

Misconceptions

- Financial Planning Worksheets are only for the wealthy. Many believe that financial planning is only for those with significant wealth. In reality, anyone can benefit from a financial planning worksheet, regardless of income level. This tool can help individuals of any financial background make informed decisions.

- It's just for military personnel. While the worksheet is tailored for military transitions, anyone can use it. This form is a valuable asset for anyone looking to budget, plan for major life changes, or manage financial responsibilities.

- You only need to fill it out once. A common misconception is that this worksheet requires only a one-time effort. However, financial planning is an ongoing process. Regularly updating the worksheet ensures that it accurately reflects one's current situation and goals.

- Documentation is optional. Some may think that gathering financial documents is not essential. In truth, accurate and comprehensive data provides a clearer picture of one's finances. Documents like bank statements and credit reports are critical for effective planning.

- The worksheet is only for planning future income. While it helps with projecting future earnings, it also assists in tracking current spending and savings. This comprehensive approach allows for a balanced understanding of both income and expenses.

- It's only about reducing expenses. Many believe that financial planning focuses solely on cutting back. In reality, it also emphasizes increasing income, managing debts, and making strategic investments. A well-rounded financial plan includes multiple pathways to achieving financial health.

Key takeaways

- The Financial Planning Worksheet For Career is essential for assessing your financial status during a career transition.

- Gather all necessary documentation before starting. You will need recent pay stubs, a current credit report, and living expenses.

- Clearly list all assets and liabilities. Understanding your total net worth is crucial.

- Record monthly income accurately. Include all sources, from military compensation to potential spousal earnings.

- Track your deductions meticulously. Awareness of taxes, allowances, and insurance will clarify your financial landscape.

- Create a detailed savings plan. Set specific goals for emergency funds and investments that align with your future aspirations.

- Itemize living expenses thoughtfully. This should encompass all monthly bills, including utilities, groceries, and personal care.

- Assess your indebtedness. Keeping track of creditor balances and monthly payments can help in effective financial management.

- Calculate your debt-to-income ratio. This figure is vital for understanding your financial health and potential borrowing power.

- Develop an action plan. Identify actionable steps to increase your income, decrease expenses, and reduce debt.

Taking these steps with urgency can set you on a path toward a more secure financial future. This worksheet serves as a valuable tool in navigating your career transition effectively.

Browse Other Templates

Strayer Transcripts - Alumni must provide verification of their identity through the requested information.

Form Cms-40b - Adherence to federal regulations while completing the form is essential for successful enrollment.