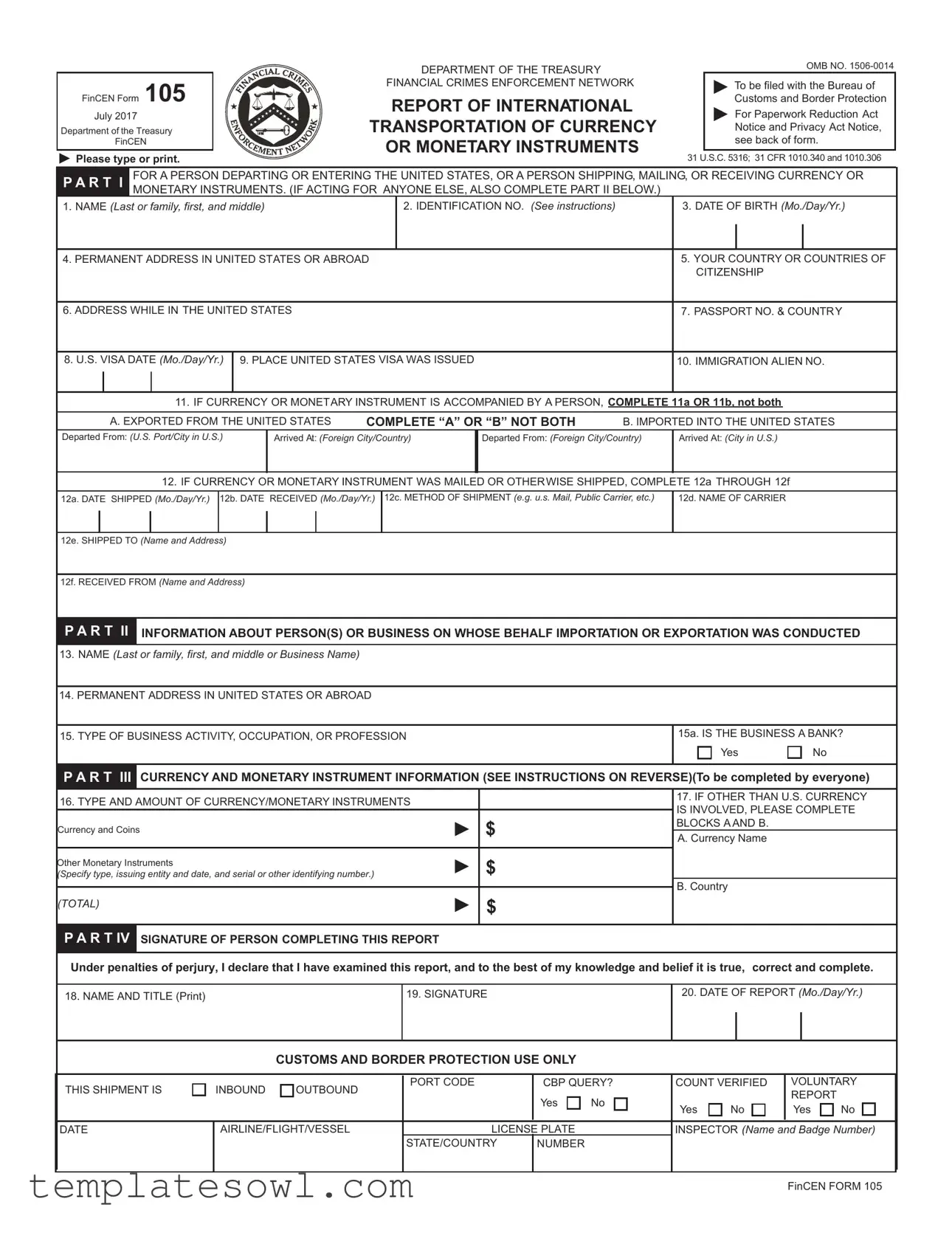

Fill Out Your Fincen 105 Form

The FinCEN Form 105 is a pivotal document required by those transporting currency or monetary instruments internationally. This form serves to report the international transportation of currency or monetary instruments exceeding $10,000 as dictated by U.S. law. The Financial Crimes Enforcement Network, part of the Department of the Treasury, mandates its submission to ensure compliance with regulations aimed at preventing money laundering and other financial crimes. Individuals or entities entering or exiting the U.S. or sending or receiving money must complete this form, providing key details such as their identification information, the nature and amount of the currency involved, and the specifics about the shipment or transport methods. Notably, exceptions to filing may apply to certain financial institutions and travelers, emphasizing the form's regulatory focus. Complete and accurate reporting is essential, as penalties can arise from incorrect submissions or omissions. Though the process might seem daunting, knowing the requirements and having the necessary information ready can facilitate a smoother filing experience.

Fincen 105 Example

FinCEN Form 105

July 2017

Department of the Treasury FinCEN

Please type or print.

Please type or print.

DEPARTMENT OF THE TREASURY

FINANCIAL CRIMES ENFORCEMENT NETWORK

REPORT OF INTERNATIONAL TRANSPORTATION OF CURRENCY OR MONETARY INSTRUMENTS

OMB NO.

To be filed with the Bureau of Customs and Border Protection

For Paperwork Reduction Act Notice and Privacy Act Notice, see back of form.

31 U.S.C. 5316; 31 CFR 1010.340 and 1010.306

P A R T I

FOR A PERSON DEPARTING OR ENTERING THE UNITED STATES, OR A PERSON SHIPPING, MAILING, OR RECEIVING CURRENCY OR MONETARY INSTRUMENTS. (IF ACTING FOR ANYONE ELSE, ALSO COMPLETE PART II BELOW.)

1. NAME (Last or family, first, and middle) |

2. IDENTIFICATION NO. (See instructions) |

3. DATE OF BIRTH (Mo./Day/Yr.) |

||

|

|

|

|

|

|

|

|

|

|

4. PERMANENT ADDRESS IN UNITED STATES OR ABROAD |

|

5. YOUR COUNTRY OR COUNTRIES OF |

||

|

|

CITIZENSHIP |

||

6. ADDRESS WHILE IN THE UNITED STATES

7. PASSPORT NO. & COUNTRY

8.U.S. VISA DATE (Mo./Day/Yr.)

9. PLACE UNITED STATES VISA WAS ISSUED

10. IMMIGRATION ALIEN NO.

11. IF CURRENCY OR MONETARY INSTRUMENT IS ACCOMPANIED BY A PERSON, COMPLETE 11a OR 11b, not both

A. EXPORTED FROM THE UNITED STATES |

COMPLETE “A” OR “B” NOT BOTH |

B. IMPORTED INTO THE UNITED STATES |

Departed From: (U.S. Port/City in U.S.)

Arrived At: (Foreign City/Country)

Departed From: (Foreign City/Country)

Arrived At: (City in U.S.)

12. IF CURRENCY OR MONETARY INSTRUMENT WAS MAILED OR OTHERWISE SHIPPED, COMPLETE 12a THROUGH 12f

12a. DATE SHIPPED (Mo./Day/Yr.) |

12b. DATE RECEIVED (Mo./Day/Yr.) |

12c. METHOD OF SHIPMENT (e.g. u.s. Mail, Public Carrier, etc.) |

12d. NAME OF CARRIER |

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

12e. SHIPPED TO (Name and Address) |

|

|

||||||

|

|

|

|

|

|

|

|

|

12f. RECEIVED FROM (Name and Address) |

|

|

||||||

P A R T II

INFORMATION ABOUT PERSON(S) OR BUSINESS ON WHOSE BEHALF IMPORTATION OR EXPORTATION WAS CONDUCTED

13.NAME (Last or family, first, and middle or Business Name)

14.PERMANENT ADDRESS IN UNITED STATES OR ABROAD

15. TYPE OF BUSINESS ACTIVITY, OCCUPATION, OR PROFESSION

15a. IS THE BUSINESS A BANK?

YesNo

P A R T III

CURRENCY AND MONETARY INSTRUMENT INFORMATION (SEE INSTRUCTIONS ON REVERSE)(To be completed by everyone)

16. TYPE AND AMOUNT OF CURRENCY/MONETARY INSTRUMENTS |

|

17. IF OTHER THAN U.S. CURRENCY |

||

|

IS INVOLVED, PLEASE COMPLETE |

|||

|

|

|

||

Currency and Coins |

$ |

BLOCKS A AND B. |

||

A. Currency Name |

||||

|

|

|||

Other Monetary Instruments |

$ |

|

||

(Specify type, issuing entity and date, and serial or other identifying number.) |

|

|||

|

|

|

B. Country |

|

(TOTAL) |

$ |

|||

|

||||

|

|

|||

|

|

|

|

|

P A R T IV |

SIGNATURE OF PERSON COMPLETING THIS REPORT |

|

|

|

|

|

|

|

|

Under penalties of perjury, I declare that I have examined this report, and to the best of my knowledge and belief it is true, correct and complete.

18. NAME AND TITLE (Print)

19. SIGNATURE

20.DATE OF REPORT (Mo./Day/Yr.)

CUSTOMS AND BORDER PROTECTION USE ONLY

THIS SHIPMENT IS |

INBOUND |

OUTBOUND |

PORT CODE |

|

CBP QUERY? |

COUNT VERIFIED |

VOLUNTARY |

|||

|

|

Yes |

No |

|

|

REPORT |

|

|||

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

Yes |

No |

Yes |

No |

||

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|||

DATE |

AIRLINE/FLIGHT/VESSEL |

|

LICENSE PLATE |

|

INSPECTOR (Name and Badge Number) |

|||||

|

|

|

STATE/COUNTRY |

NUMBER |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

FinCEN FORM 105

GENERAL INSTRUCTIONS

This report is required by 31 U.S.C. 5316 and Treasury Department regulations (31 CFR Chapter X).

WHO MUST FILE:

(1)Each person who physically transports, mails, or ships, or causes to be physically transported, mailed, or shipped currency or other monetary instruments in an aggregate amount exceeding $10,000 at one time from the United States to any place outside the United States or into the United States from any place outside the United States, and

(2)Each person who receives in the United States currency or other monetary instruments In an aggregate amount exceeding $10,000 at one time which have been transported, mailed, or shipped to the person from any place outside the United States.

A TRANSFER OF FUNDS THROUGH NORMAL BANKING PROCEDURES, WHICH DOES NOT INVOL VE THE PHYSICAL TRANSPORTATION OF CURRENCY OR MONETARY INSTRUMENTS, IS NOT REQUIRED TO BE REPORTED.

Exceptions: Reports are not required to be filed by:

(1)a Federal Reserve bank,

(2)a bank, a foreign bank, or a broker or dealer in securities in respect to currency or other monetary instruments mailed or shipped through the postal service or by common carrier,

(3)a commercial bank or trust company organized under the laws of any State or of the United States with respect to overland shipments of currency or monetary instruments shipped to or received from an established customer maintaining a deposit relationship with the bank, in amounts which the bank may reasonably conclude do not exceed amounts commensurate with the customary conduct of the business, industry, or profession of the customer concerned,

(4)a person who is not a citizen or resident of the United States in respect to currency or other monetary instruments mailed or shipped from abroad to a bank or broker or dealer in securities through the postal service or by common carrier,

(5)a common carrier of passengers in respect to currency or other monetary instruments in the possession of its passengers,

(6)a common carrier of goods in respect to shipments of currency or monetary instruments not declared to be such by the shipper,

(7)a travelers’ check issuer or its agent in respect to the transportation of travelers’ checks prior to their delivery to selling agents for eventual sale to the public,

(8)a person with a restrictively endorsed traveler’s check that is in the collection and reconciliation process after the traveler’s check has been negotiated, nor by

(9)a person engaged as a business in the transportation of currency, monetary instruments and other commercial papers with respect to the transportation of currency or other monetary instruments overland between established offices of banks or brokers or dealers in securities and foreign persons.

WHEN AND WHERE TO FILE:

A.

B. Shippers or Mailers— lf the currency or other monetary instrument does not accompany the person entering or departing the United States, FinCEN Form 105 may be filed by mail on or before the date of entry, departure, mailing, or shipping addressed to: Attn: CMIR, Passenger Systems Directorate #1256, CBP, 7375, Boston Blvd., DHS, VA

C. Travelers— Travelers carrying currency or other monetary instruments with them shall file FinCEN Form 105 at the time of entry into the United States or at the time of departure from the United States with the Customs officer in charge at any Customs port of entry or departure.

An additional report of a particular transportation, mailing, or shipping of currency or the monetary instruments is not required if a complete and truthful report has already been filed. However, no person otherwise required to file a report shall be excused from liability for failure to do so if, in fact, a complete and truthful report has not been filed. Forms may be obtained from any Bureau of Customs and Border Protection office.

PENALTIES: Civil and criminal penalties, including under certain circumstances a fine of not more than $500,000 and Imprisonment of not more than ten years, are provided for failure to file a report, filing a report containing a material omission or misstatement, or filing a false or fraudulent report. In addition, the currency or monetary instrument may be subject to seizure and forfeiture. See 31 U.S.C.5321 and 31 CFR 1010.820; 31 U.S.C. 5322 and 31 CFR 1010.840; 31 U.S.C. 5317 and 31 CFR 1010.830, and U.S.C. 5332.

DEFINITIONS:

association organized under the laws of any State or of the United States; (4) an insured institution as defined in section 401 of the National Housing Act; (5) a savings bank, industrial bank or other thrift institution; (6) a credit union organized under the laws of any State or of the United States; (7) any other organization chartered under the banking laws of any State and subject to the supervision of the bank supervisory authorities of a State other than a money service business; (8) a bank organized under foreign law; and (9) any national banking association or corporation acting under the provisions of section 25A of the Federal Reserve Act (12 U.S.C. Sections

Foreign

Broker or Dealer in Securities— A broker or dealer in securities, registered or required to be registered with the Securities and Exchange Commission under the Securities Exchange Act of 1934.

Currency: The coin and paper money of the United States or any other country that is (1) designated as legal tender and that (2) circulates and (3) is customarily accepted as a medium of exchange in the country of issuance.

Identification

Monetary Instruments— (1) Coin or currency of the United States or of any other country, (2) traveler’s checks in any form, (3) negotiable instruments (including checks, promissory notes, and money orders) in bearer form, endorsed without restriction, made out to a fictitious payee, or otherwise in such form that title thereto passes upon delivery, (4) incomplete instruments (including checks, promissory notes, and money orders) that are signed but on which the name of the payee has been omitted, and (5) securities or stock in bearer form or otherwise in such form that title thereto passes upon delivery. Monetary instruments do not include (i) checks or money orders made payable to the order of a named person which have not been endorsed or which bear restrictive endorsements, (ii) warehouse receipts, or (iii) bills of lading.

SPECIAL INSTRUCTIONS:

You should complete each line that applies to you.PART I. — Complete 11A or 11B, not both. Block 12A and 12B; enter the exact date you shipped or received currency or monetary instrument(s). PART II.

PRIVACY ACTAND PAPERWORK REDUCTION ACT NOTICE:

Pursuant to the requirements of Public law

The principal purpose for collecting the information is to assure maintenance of reports or records where such reports or records have a high degree of usefulness in criminal, tax, or regulatory investigations or proceedings. The information collected may be provided to those officers and employees of the Bureau of Customs and Border Protection and any other constituent unit of the Department of the Treasury who have a need for the records in the performance of their duties. The records may be referred to any other department or agency of the Federal Government upon the request of the head of such dep artment or agency. The information collected may also be provided to appropriate state, local, and foreign criminal law enforcement and regulatory personnel in the performance of their official duties.

Disclosure of this information is mandatory pursuant to 31 U.S.C. 5316 and 31 CFR Chapter X. Failure to provide all or any part of the requested information may subject the currency or monetary instruments to seizure and forfeiture, as well as subject the individual to civil and criminal liabilities.

Disclosure of the social security number is mandatory . The authority to collect this number is 31 U.S.C. 5316(b) and 31 CFR 1010.306(d). The social security number will be used as a means to identify the individual who files the record.

An agency may not conduct or sponsor, and a person is not required to respond to, a collection of information unless it displays a currently valid OMB control number. The collection of this information is mandatory pursuant to 31 U.S.C. 5316, of Title

IIof the Bank Secrecy Act, which is administered by Treasury’s Financial Crimes Enforcement Network (FINCEN).

Statement required by 5 CFR 1320.8(b)(3)(iii): The estimated average burden associated with this collection of information is 11 minutes per respondent or record keeper depending on individual circumstances. Comments concerning the accuracy of this burden estimate and suggestions for reducing this burden should be directed to the Department of the Treasury, Financial Crimes Enforcement Network, P.O. Box 39 Vienna, Virginia 22183. DO NOT send completed forms to this

FinCEN FORM 105

Form Characteristics

| Fact Name | Description |

|---|---|

| Purpose | The FinCEN Form 105 is used to report the international transportation of currency or monetary instruments exceeding $10,000 when entering or leaving the United States. |

| Filing Requirements | Individuals or entities must file this form if they physically transport, mail, or ship over $10,000 in currency or monetary instruments, or if they receive such amounts from abroad. |

| When to File | The form must be submitted within 15 days after the currency or instruments are received, or at the time of entry or departure if transporting them personally. |

| Legal Basis | The requirement to file is governed by 31 U.S.C. 5316 and 31 CFR Chapter X, which detail the reporting obligations under U.S. law. |

| Penalties | Failure to file this report may result in civil and criminal penalties, including fines up to $500,000 and possible imprisonment, along with the potential seizure of the currency involved. |

Guidelines on Utilizing Fincen 105

Completing the FinCEN Form 105 involves meticulously filling out various sections to ensure that all necessary information is accurately reported. This form needs to be filed when transporting significant amounts of currency or monetary instruments into or out of the United States. The following steps outline how to properly fill out this form.

- Print the form or open it in a word processing application. Ensure that you can type or clearly print your information.

- PART I: Provide your personal details:

- Write your full name (last, first, middle) in the first section.

- Input your identification number. This could be a Social Security number or passport number.

- Enter your date of birth in the specified format (Mo./Day/Yr.).

- Detail your permanent address, either in the U.S. or abroad.

- List your country or countries of citizenship.

- Specify your address while in the United States.

- Include your passport number and the country of issuance.

- Provide the date your U.S. visa was issued.

- Indicate where the U.S. visa was issued.

- Input your immigration alien number if applicable.

- For questions 11 and 12, determine if you are exporting or importing currency. Complete either section A or B under question 11 accordingly.

- If applicable, complete the shipping information in question 12, including the date shipped, received, method of shipment, and details of the carrier.

- PART II: If you are filling out the form on behalf of another person or business, complete sections 13 through 15, providing their full name, permanent address, and type of business or occupation.

- PART III: In sections 16 and 17, specify the type and amount of currency and monetary instruments being transported. If other than U.S. currency is involved, give details about the issuing entity and any relevant identifying information.

- PART IV: Sign and date the report, printing your name and title as required.

After completing the form, ensure that all entries are correct. Submit the form as outlined in the filing instructions to prevent penalties or complications. If filing by mail, address it to the specified Bureau of Customs and Border Protection location. Be mindful of deadlines, as timely submission is crucial.

What You Should Know About This Form

What is the purpose of the FinCEN Form 105?

The FinCEN Form 105 is used to report the international transportation of currency or monetary instruments. It is required by law for individuals who physically transport, mail, or ship currency or monetary instruments exceeding $10,000 into or out of the United States. This form helps the government monitor potential money laundering and other financial crimes, ensuring that funds are appropriately tracked as they cross borders.

Who needs to file the FinCEN Form 105?

Any person who transports, mails, or ships more than $10,000 in currency or monetary instruments must file this form. This requirement also applies to those who receive such amounts in the U.S. However, certain entities, such as banks and foreign financial institutions, are exempt under specific conditions. If you're unsure whether you need to file, it’s important to seek clarification as the penalties for non-compliance can be severe.

How do I file the FinCEN Form 105?

The filing process depends on your situation. If you are physically carrying currency or monetary instruments, you should submit the form at the time of entry or departure with a Customs officer at any U.S. port. If the funds do not accompany you, the form can be mailed to a designated address prior to your shipment or mailing. It's crucial to ensure that the form is submitted within the required timeframe to avoid penalties.

What happens if I fail to file the FinCEN Form 105?

Failure to file this form can lead to serious consequences, including civil and criminal penalties. Individuals may face fines up to $500,000 and a prison sentence of up to ten years for willful non-compliance. Additionally, any currency or monetary instruments transported without a valid report may be subject to seizure and forfeiture by the government.

What kinds of currencies or monetary instruments are covered by this form?

The FinCEN Form 105 covers various forms of currency and monetary instruments, including coins and paper money, negotiable instruments like checks and money orders, and travelers' checks. It does not, however, include certain items like endorsed checks that name a specific payee or warehouse receipts. It's crucial to accurately report all items involved in the transaction to comply with the law.

What are the consequences of providing false information on the FinCEN Form 105?

Providing false information on the FinCEN Form 105 is treated very seriously. Individuals who file fraudulent reports may face criminal charges, including hefty fines and potential imprisonment. The law emphasizes the importance of truthfulness, as the insights gained from these reports are vital for preventing financial crimes. Ensuring accuracy and completeness is not just a legal obligation; it is an ethical responsibility to uphold the integrity of financial transactions.

Common mistakes

Completing the FinCEN Form 105 can be straightforward, but there are common mistakes that people often make. One of the biggest errors is failing to provide accurate identification numbers. Each person filling out the form should include their social security number, passport number for non-citizens, or employer identification number. Neglecting this step or providing incorrect numbers can lead to delays or complications in the processing of the form. Always double-check this information before submitting.

Another frequent mistake is not clearly indicating whether the currency or monetary instruments are being exported or imported. It's crucial to fill out either Section 11A or 11B, but not both. If individuals are shipping or mailing currency, they should ensure they complete the relevant sections accurately. Incorrectly marking these fields can result in misunderstandings that delay review or raise flags with the authorities.

Many people also overlook the importance of listing the exact date of shipment or receipt in Section 12. Entering an estimated date or forgetting to fill this out completely is a common pitfall. This date is essential for tracking and regulatory purposes. Ensure that the date entered matches the actual shipment day to avoid any potential issues.

Finally, some individuals fail to sign and date the form in Part IV, declaring its accuracy and completeness. This step is necessary to validate the report and confirm the information provided is true. Without a signature or date, the form could be considered incomplete, leading to penalties or legal consequences. Always remember to review each section carefully before submitting the form.

Documents used along the form

The FinCEN Form 105 is often accompanied by several other documents to ensure compliance with regulations concerning the transportation of currency and monetary instruments. Below is a list of some common forms and documents used alongside the FinCEN Form 105.

- Form 8300: This form is used to report cash payments over $10,000 received in a trade or business. It collects information about the sender and the nature of the transaction.

- Customs Declaration Form (CBP Form 6059B): Travelers must complete this form when entering or leaving the United States if they are carrying currency or monetary instruments exceeding $10,000.

- Bank Statement: This document may be required to provide evidence of an individual’s financial standing, particularly in relation to transactions involving large sums of money.

- Wire Transfer Receipt: If currency is being transferred electronically, a receipt showing the transaction details is necessary for verification and compliance purposes.

- Identification Documents: Valid forms of ID, such as a passport or driver’s license, are often required to substantiate the identity of those involved in the exchange or transport of currency.

- Proof of Source of Funds: Individuals may need to provide documentation illustrating how the funds were acquired, which can include pay stubs, sale agreements, or loan documents.

- Power of Attorney (POA): If someone is acting on behalf of another person to transport currency, a POA may be necessary to authorize this action legally.

- Travel Itinerary: This document may be requested to confirm the traveler's route and duration of stay when carrying large sums of cash or instruments across borders.

These documents ensure that all transactions and movements involving significant amounts of currency are transparent and compliant with federal regulations. It is essential to have all relevant documentation ready when filing the FinCEN Form 105 or engaging in related transactions.

Similar forms

The FinCEN Form 105, which reports the international transportation of currency or monetary instruments, shares similarities with several other important documents. Understanding these parallels can assist individuals and businesses in navigating compliance requirements effectively. Here are eight documents that are comparable to the FinCEN Form 105:

- Form 1042-S: This document is used for reporting payments of income to foreign persons. Both forms require detailed reporting to ensure compliance with U.S. Treasury regulations regarding money flows.

- Form MLATS: The Mutual Legal Assistance Treaty (MLAT) requests prompt information sharing between countries investigating financial crimes. Similar to FinCEN Form 105, both documents aim to deter money laundering and ensure transparency in financial transactions.

- Form 8802: This form is used to apply for a U.S. residency certification. It requires details about foreign income, paralleling FinCEN Form 105, which collects information about large amounts of cash transported across borders.

- IRS Form 8938: The Statement of Specified Foreign Financial Assets is essential for individuals with foreign accounts. It complements the FinCEN Form 105, as both focus on reporting assets to mitigate tax evasion.

- Bank Secrecy Act Reporting (BSA) Forms: Various BSA forms mandate the reporting of suspicious activities. Like the FinCEN Form 105, they enhance the government’s capacity to track potentially illegal transactions.

- Currency Transaction Reports (CTR): These reports track currency transactions exceeding $10,000 in financial institutions. Similar to the FinCEN Form 105, they are crucial for identifying and preventing money laundering activities.

- Form TD F 90-22.1 (FBAR): Report of Foreign Bank and Financial Accounts (FBAR) pertains to foreign accounts with balances over $10,000. Like the FinCEN Form 105, it emphasizes transparent reporting of large financial movements.

- Form 1065: This is the U.S. Return of Partnership Income form. While primarily used in partnership taxation, it collects extensive financial data akin to the FinCEN Form 105's focus on large transactions.

Each of these forms contributes to the overall framework designed to promote transparency and compliance within financial systems. Familiarity with them can prove invaluable for accurate and timely reporting, ensuring adherence to regulations and minimizing risk.

Dos and Don'ts

When completing the FinCEN 105 form, it's crucial to adhere to certain guidelines to ensure accuracy and compliance. Below is a list of important dos and don'ts for your reference:

- Do: Provide accurate information for your name, identification number, and date of birth.

- Do: Complete either Part I, question 11a or 11b, depending on whether the currency was exported from or imported into the United States.

- Do: Include all necessary details in Part III about the currency and monetary instruments, specifying amounts and types clearly.

- Do: Review the information thoroughly before submission to ensure there are no errors or omissions.

- Don’t: Leave any applicable sections blank; all relevant sections should be filled in completely.

- Don’t: Misrepresent information or provide false details, as this could result in significant penalties.

Following these guidelines can help you to submit the form properly and avoid potential issues. It is always best to approach this process with care and thoroughness.

Misconceptions

- Misconception 1: The FinCEN 105 form is only for people leaving the U.S.

Many believe this form pertains solely to individuals departing the United States. In reality, it must be completed by anyone entering or exiting the country with more than $10,000 in currency or monetary instruments, as well as those mailing or shipping such amounts.

- Misconception 2: Only U.S. citizens need to file the form.

It is a common misunderstanding that only U.S. citizens are required to submit the FinCEN 105. Non-residents and foreign travelers must also file if they possess more than $10,000 in monetary instruments either coming into or leaving the United States.

- Misconception 3: The form is optional for amounts below $10,000.

Some people think that if the monetary amount is less than $10,000, reporting is optional. However, while the form may not be needed for amounts below that threshold, it is still wise to keep documentation of any currency transport to avoid future complications.

- Misconception 4: You can file the form anytime after you transport the currency.

This idea is misleading. The FinCEN 105 must be filed within a specific timeframe. Recipients must file within 15 days of receiving currency exceeding $10,000, while travelers are required to submit the form during their travel time.

- Misconception 5: Only banks need to worry about the FinCEN 105.

This misconception assumes that only banking institutions have to file this form. In truth, any individual or entity transporting over $10,000 in monetary instruments is subject to this requirement, including individuals traveling internationally.

- Misconception 6: Filing the form guarantees that your currency will not be seized.

While filing the FinCEN 105 form is essential for compliance, it does not offer immunity against the seizure of funds. If discrepancies or suspicions arise, law enforcement may take action regardless of the proper filings.

- Misconception 7: The form can be filled out informally or verbally.

Some think that informing customs verbally or filling out the form casually is acceptable. However, it is crucial to complete the legally specified form accurately and formally to ensure compliance with regulations.

- Misconception 8: Privacy concerns make it unsafe to disclose personal information.

While it is natural to be cautious about sharing personal data, this information is required by law for the FinCEN 105. Additionally, there are strict privacy regulations that govern how this information is handled to protect individuals.

Key takeaways

Understanding FinCEN Form 105 is essential for anyone transporting currency or monetary instruments. This form is mandated for amounts exceeding $10,000.

- Ensure to fill out all required sections completely. Missing information can lead to delays or penalties.

- File the form within 15 days of receiving or shipping currency. Timely filing is crucial to avoid penalties.

- Be aware of exceptions; certain entities like banks do not need to file this form under specific conditions.

- Failure to comply can result in severe penalties, including fines up to $500,000 and imprisonment.

Browse Other Templates

Leosa Restrictions - Potential delays can occur if applications are submitted with incomplete payment information.

Colorado Security License - Future employers must be specified on the form, including job duties.