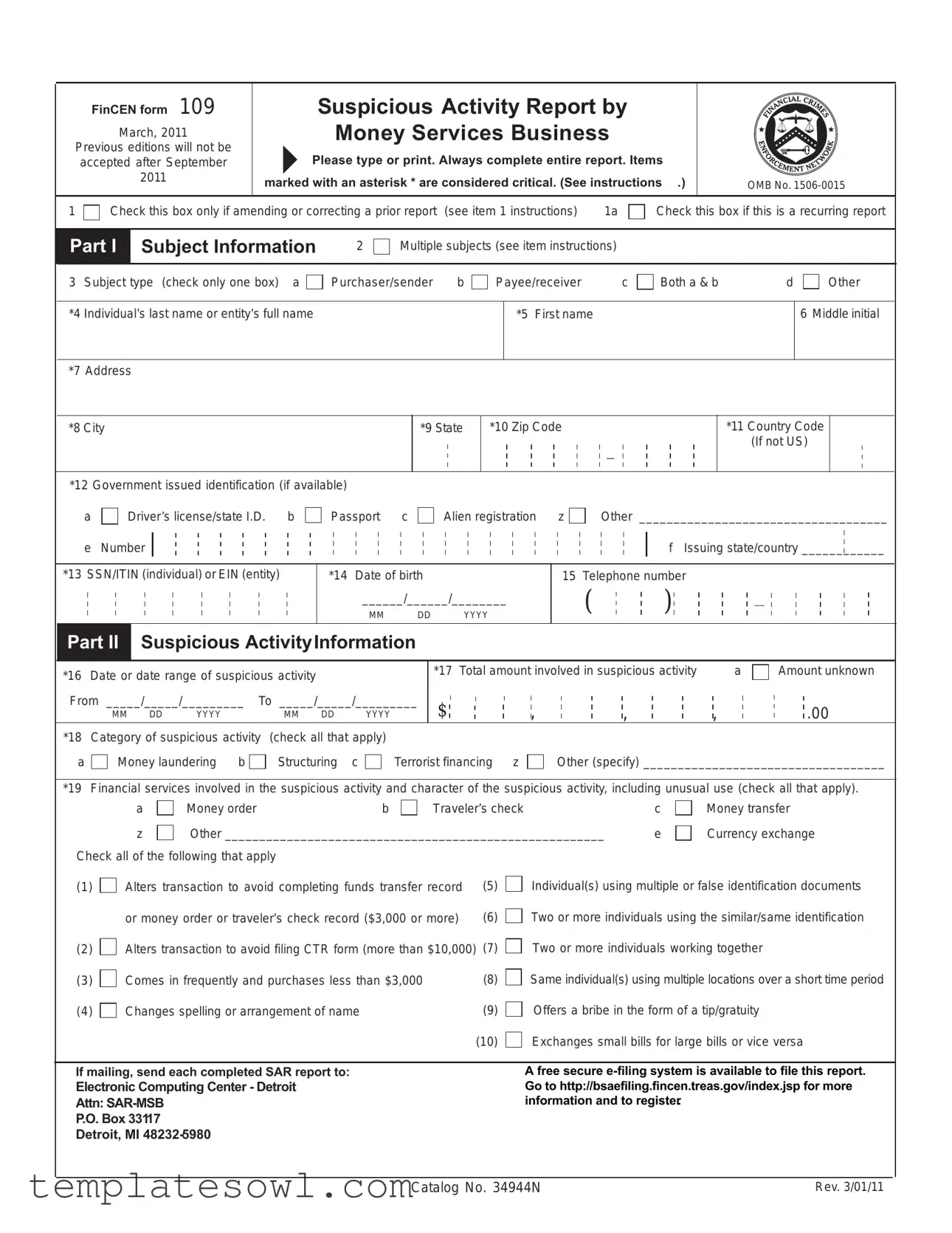

Fill Out Your Fincen 109 Form

The FinCEN Form 109, also known as the Suspicious Activity Report by Money Services Business, is an essential tool used to help combat money laundering and other financial crimes within the United States. This report is specifically designed for money services businesses (MSBs) to disclose any suspicious activities they encounter while conducting transactions. It’s crucial for an MSB to complete the entire form accurately, as each item carries specific significance; those marked with an asterisk are especially important. The form requires detailed information about the individual or entity involved, the type of suspicious activity observed, the amount of money involved, and the nature of the financial services used. Additionally, businesses must file this report electronically through a secure e-filing system, which provides a simple and efficient way to alert authorities about potential illegal activities. Understanding the requirements for this form, including proper completion and submission timelines, can significantly impact the investigation and resolution of suspicious transactions. For convenience, the form is user-friendly, with clear sections that guide users on providing necessary information, from subject identification details to the specifics of the suspicious activity itself. Filing a FinCEN Form 109 is not just about compliance; it is about actively participating in safeguarding the financial system from illicit activities.

Fincen 109 Example

FinCEN form 109

March, 2011

Previous editions will not be accepted after September 2011

Suspicious Activity Report by

Money Services Business

Please type or print. Always complete entire report. Items marked with an asterisk * are considered critical. (See instructions .)

Please type or print. Always complete entire report. Items marked with an asterisk * are considered critical. (See instructions .)

OMB No.

1

Check this box only if amending or correcting a prior report (see item 1 instructions) |

1a |

Check this box if this is a recurring report

|

Part I |

Subject Information |

2 |

|

|||

|

|

|

|

|

|

|

|

Multiple subjects (see item instructions)

3 Subject type (check only one box) a |

Purchaser/sender |

b |

Payee/receiver |

c |

Both a & b |

d |

Other |

|

|

|

|

|

|

|

|

|

|

*4 Individual’s last name or entity’s full name |

|

|

|

*5 First name |

|

|

|

6 Middle initial |

|

|

|

|

|

|

|

|

|

*7 Address

*8 City

*9 State

*10 Zip Code

_

*11 Country Code

(If not US)

*12 Government issued identification (if available)

|

a |

|

Driver’s license/state I.D. |

b |

Passport |

|

c |

Alien registration |

|

|

z |

Other ____________________________________ |

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

e |

Number |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

f Issuing state/country ____________ |

|

||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

*13 SSN/ITIN (individual) or EIN (entity) |

|

|

|

*14 Date of birth |

|

|

|

|

|

|

|

|

|

|

|

|

15 Telephone number |

|

||||||||||||||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

______/______/________ |

|

|

|

|

( |

|

|

|

|

|

) |

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

MM |

|

DD |

|

YYYY |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Part II Suspicious ActivityInformation

*16 Date or date range of suspicious activity |

|

|

|||

From _____/_____/_________ |

To _____/_____/_________ |

||||

MM |

DD |

YYYY |

MM |

DD |

YYYY |

*17 |

Total amount involved in suspicious activity |

a |

|

|||||||||

$ |

|

|

|

|

, |

|

|

, |

|

|

, |

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

||||

Amount unknown

.00

.00

*18 |

Category of suspicious activity |

(check all that apply) |

|

|

|

|

|

|||

a |

|

Money laundering |

b |

Structuring c |

Terrorist financing z |

Other (specify) ___________________________________ |

||||

|

|

|||||||||

*19 |

Financial services involved in the suspicious activity and character of the suspicious activity, including unusual use (check all that apply). |

|||||||||

|

|

a |

Money order |

b |

Traveler’s check |

|

c |

Money transfer |

||

|

|

z |

Other _______________________________________________________ |

e |

Currency exchange |

|||||

Check all of the following that apply |

|

|

|

|

|

|||||

(1) |

Alters transaction to avoid completing funds transfer record |

(5) |

Individual(s) using multiple or false identification documents |

|||||||

|

|

or money order or traveler’s check record ($3,000 or more) |

(6) |

Two or more individuals using the similar/same identification |

||||||

(2) |

Alters transaction to avoid filing CTR form (more than $10,000) (7) |

Two or more individuals working together |

||||||||

(3) |

Comes in frequently and purchases less than $3,000 |

(8) |

Same individual(s) using multiple locations over a short time period |

|||||||

(4) |

Changes spelling or arrangement of name |

|

(9) |

Offers a bribe in the form of a tip/gratuity |

||||||

|

|

|

|

|

|

|

(10) |

Exchanges small bills for large bills or vice versa |

||

If mailing, send each completed SAR report to:

Electronic Computing Center - Detroit

Attn:

P.O. Box 33117

Detroit, MI

Catalog No. 34944N |

Rev. 3/01/11 |

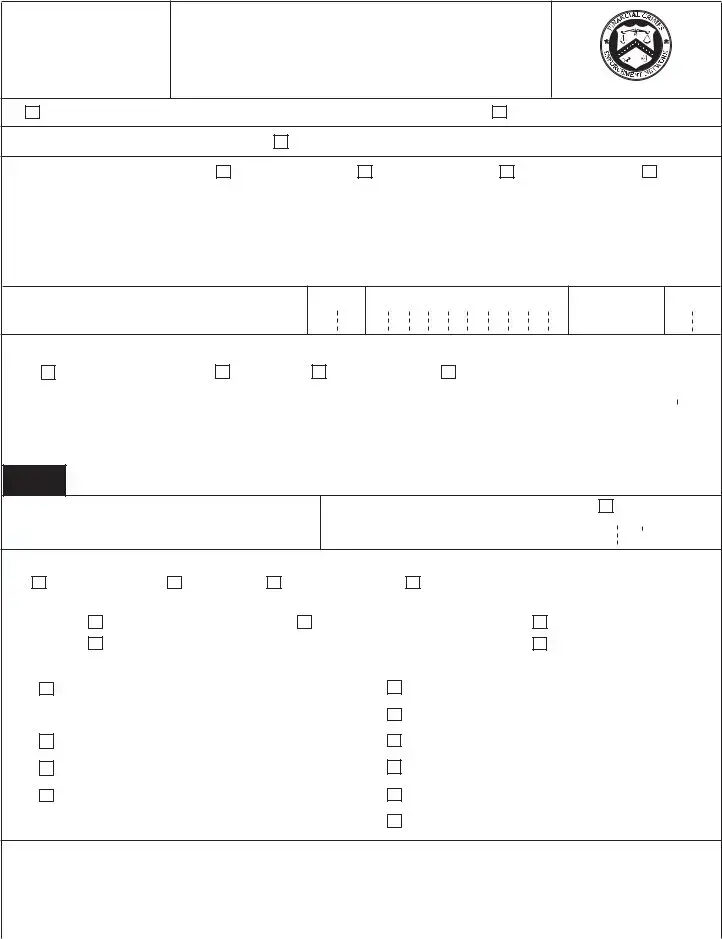

Part II Suspicious Activity Information, Continued

2

*20 Purchases |

and redemptions (check box “P” for purchase or box “R” for redemption) |

|

|

||

Instrument |

P |

R |

Issuers |

Total Instruments |

Total Amount (US Dollars) |

Money Orders: |

|

|

______________________________________________ |

______ |

$__________________.00 |

|

|

|

______________________________________________ |

______ |

$__________________.00 |

|

|

|

______________________________________________ |

______ |

$__________________.00 |

Traveler’s Checks: |

|

______________________________________________ |

______ |

$__________________.00 |

|

|

|

|

______________________________________________ |

______ |

$__________________.00 |

|

|

|

______________________________________________ |

______ |

$__________________.00 |

Money Transfers |

|

______________________________________________ |

______ |

$__________________.00 |

|

|

|

|

______________________________________________ |

______ |

$__________________.00 |

|

|

|

______________________________________________ |

______ |

$__________________.00 |

*21 Currency Exchanges: |

Tendered Currency/Instrument |

Country |

Received currency |

Country |

Amount (US Dollars) |

If bulk small currency |

__________________________ |

______ |

__________________ |

______ |

$__________________.00 |

If bulk small currency |

__________________________ |

______ |

__________________ |

______ |

$__________________.00 |

Part III |

Transaction Location |

22 |

|

|

|

Multiple transaction locations

23 |

|

Type of business location (check only one) |

a |

Selling location |

|

|

|

b |

Paying location |

|

|

c |

Both |

||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

*24 |

|

Legal name of business |

|

|

|

|

|

|

|

|

|

|

|

25 |

Doing business as |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

*26 |

|

Permanent address (number, street, and suite no.) |

*27 City |

|

|

|

|

|

|

|

|

*28 State |

|

*29 Zip Code |

|||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

*30 EIN (entity) or SSN/ITIN (individual) |

*31 Business telephone number |

|

|

|

|

|

|

|

32 Country |

|

|

33 |

Internal control/file number |

|||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

( |

|

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Code |

|

|

|

|

|

|

|

(If available) |

|||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(If not US) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

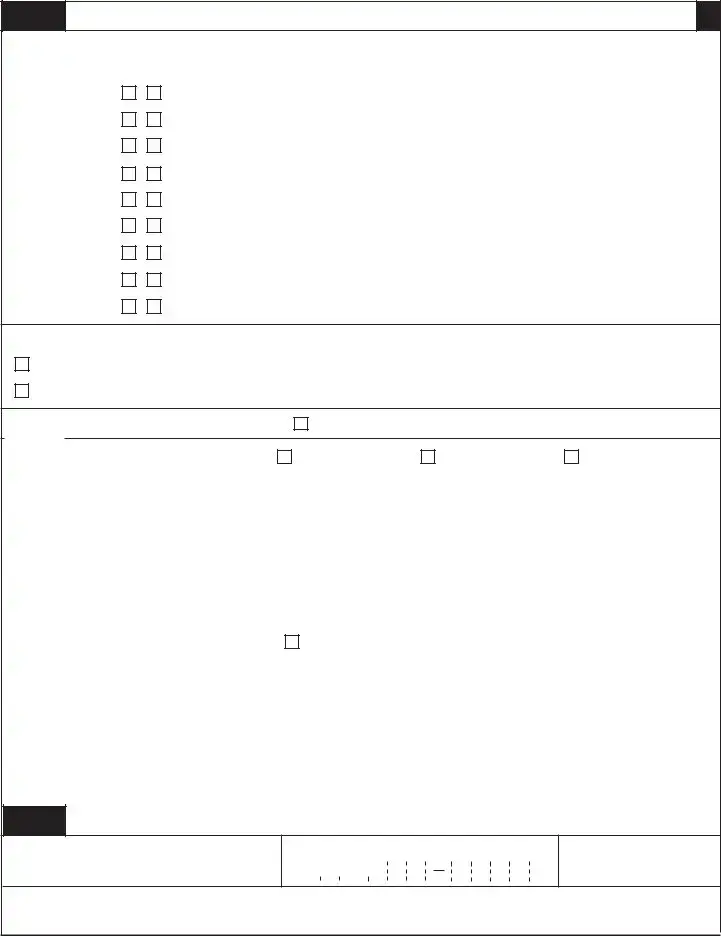

Part IV |

Reporting Business |

34 |

|

The Reporting Business is the same as the Transaction Location (go to Part V) |

||||||||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

*35 |

Legal name of business |

|

|

|

|

|

|

|

|

|

|

|

36 |

Doing business as |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

*37 |

Permanent address (number, street, and suite no.) |

*38 City |

|

|

|

|

|

|

|

|

*39 State |

|

*40 Zip Code |

||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

*41 EIN (entity) or SSN/ITIN (individual) |

*42 Business phone number (include area code) |

|

43 Country |

|

|

|

44 |

Internal control/file number |

||||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

( |

|

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Code |

|

|

|

|

|

|

|

(If available) |

|||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(If not US) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Part V Contact for Assistance

*45 Designated contact office

*46 Designated phone number (Include area code)

(

)

)

47 Date filed (See instructions)

______/______/________

MM DD YYYY

48 Agency (If not filed by a Money Services Business)

Part VI

Suspicious Activity Information - Narrative*

3

Explanation/description of suspicious activity(ies).This section of the report is critical. The care with which it is completed may determine whether or not the described activity and its possible criminal nature are clearly understood by investigators. Provide a clear, complete and chronological description of the activity, including what is unusual, irregular or suspicious about the transaction(s). Use the checklist below, as a guide, as you prepare your description. The description should cover the material indicated in Parts I, II and III, but the money services business (MSB) should describe any other information that it believes is necessary to better enable investigators to understand the suspicious activity being reported.

a.Describe conduct that raised suspicion.

b.Explain whether the transaction(s) was completed or only attempted.

c.Describe supporting documentation and retain such documentation for your file for five years.

d.Indicate a time period, if it was a factor in the suspicious transaction(s). For example, specify the time and whether it occurred during AM or PM. If the activity covers more than one day, identify the time of day when such activity occurred most frequently.

e.Retain any admission or explanation of the transaction(s) provided by the subject(s) or other persons. Indicate when and to whom it was given.

f.Retain any evidence of

g.Indicate where the possible violation of law(s) took place (e.g., main office, branch, agent location, etc.).

h.Indicate whether the suspicious activity is an isolated incident or relates to another transaction.

i.Indicate for a foreign national any available information on subject’s passport(s), visa(s), and/or identification card(s). Include date, country, city of issue, issuing authority, and nationality.

j.Indicate whether any information has been excluded from this report; if so, state reasons.

k.Indicate whether any U.S. or foreign instrument(s) were involved.

If so, provide the amount, name of currency, and country of origin.

l.Indicate whether any transfer of money to or from a foreign country,

or any exchanges of a foreign currency were involved. If so, identify the currency, country, and sources and destinations of money.

m.Indicate any additional account number(s), and any foreign bank(s) account numbers which may be involved in transfer of money.

n.Identify any employee or other individual or entity (e.g., agent) suspected of improper involvement in the transaction(s).

o.For issuers, indicateif the endorser of money order(s) and/or traveler’s check(s) is different than payee. If so, provide the individual or entity name; bank’s name, city, state and country; ABA routing number; endorser’s bank account number; foreign

p.For selling or paying locations, indicateif there is a video recording medium or surveillance photograph of the customer.

q.For selling or paying locations,if you do not have a record of a government issued identification document, describe the type, issuer and number of any alternate identification that is available (e.g., for a credit card specify the name of the customer and credit card number.)

r.For selling or paying locations,describe the subject(s) if you do not have the identifying information in Part I or if multiple individuals use the same identification. Use descriptors such as male, female, age, etc.

s.If amending a prior report, complete the form in its entirety and note the changes here in Part VI.

t.If a law enforcement agency has been contacted, list the name of the agency and the name of any person contacted, their title, their telephone number, and when they were contacted.

Supporting documentation should not be filed with this report. Maintain the information for your files.

Enter the explanation/description narrative in the space below. If necessary, continue the narrative on a duplicate of this page or a blank page. Tips on SAR form preparation and filing are available in the SAR Activity Reviews at w ww.fincen.gov/pub_reports.html.

Legal disclaimers will not be included in this narrative.

FinCEN Form 109a Suspicious Activity Report by Money Services Business |

1 |

|

||||

Safe Harbor |

i. The transaction involves funds derived |

4. SSN |

|

|

||

|

|

from illegal activity or is intended or conducted |

5. Instruments |

|||

Federal law (31 U.S.C. 5318(g)(3)) provides |

in order to hide or disguise funds or assets derived |

and/or Traveler’s Check(s) |

|

|

||

complete protection from civil liability for all |

from illegal activity (including, without limitation, |

6. Redeemer |

||||

reports of suspicious transactions made to |

the nature, source, location, ownership or control |

|||||

appropriate authorities, including supporting |

of such funds or assets) as part of a plan to violate |

instruments in exchange for currency or other |

||||

documentation, regardless of whether such |

or evade any Federal law or regulation or to avoid |

instruments for which it is not the issuer is a |

||||

reports are filed pursuant to this report’s |

any transaction reporting requirement under |

redeemer. The MSB definition in 31 CFR |

||||

instructions or are filed on a voluntary basis. |

Federal law or regulation; |

1010.100(ff)(4) extends to “redeemers” of |

||||

Specifically, the law provides that a financial |

|

money orders and traveler’s checks only insofar |

||||

institution, and its directors, officers, employees |

ii. The transaction is designed, whether |

as the |

|

|

||

and agents, that make a disclosure of any possible |

through structuring or other means, to evade any |

instruments involved are redeemed for monetary |

||||

violation of law or regulation, including in |

regulations promulgated under the Bank Secrecy |

value — that is, for currency or monetary or other |

||||

connection with the preparation of suspicious |

Act; or |

negotiable or other instruments. The taking of the |

||||

activity reports, “shall not be liable to any person |

|

instruments in exchange for goods or general ser- |

||||

under any law or regulation of the United States, |

iii. The transaction has no business or |

vices is not redemption under BSA regulations. |

||||

any constitution, law, or regulation of any State or |

apparent lawful purpose and the money services |

C. General Instructions |

|

|

||

political subdivision of any State, or under any |

business knows of no reasonable explanation for |

|

|

|||

contract or other legally enforceable agreement |

the transaction after examining the available facts, |

|

|

|

||

(including any arbitration agreement), for such |

including the background and possible purpose |

1. This form should be |

||||

disclosure or for any failure to provide notice of |

of the transaction. |

Bank Secrecy Act |

||||

such disclosure to the person who is the subject |

iv. The transaction involves the use of the |

http://bsaefiling.fincen.treas.gov/index.jsp |

||||

of such disclosure or any other person identified |

to register. This form is also available for down- |

|||||

in the disclosure”. |

money services business to facilitate criminal |

load on the Financial Crimes Enforcement |

||||

|

|

activity. |

Network’s Web site at www.fincen.gov, or may |

|||

Notification Prohibited |

b. To the extent that the identification of |

be ordered by calling the IRS Forms Distribution |

||||

Center at (800) |

|

|

||||

|

|

transactions required to be reported is derived |

|

|

|

|

Federal law (31 U.S.C. 5318(g)(2)) provides that |

from a review of clearance records or other similar |

2. If not filed electronically or through magnetic |

||||

a financial institution, and its directors, officers, |

records of money orders or traveler’s checks that |

media, send each completed suspicious activity |

||||

employees, and agents, who report suspicious |

have been sold or processed, an issuer of money |

report to: |

|

|

||

transactions to the government voluntarily or as |

orders or traveler’s checks shall only be required |

|

|

|

||

required by 31 CFR 1022.320, may not notify |

to report a transaction or a pattern of transactions |

Electronic Computing |

|

|

||

any person involved in the transaction that the |

that involves or aggregates funds or other assets of |

ATTN: |

|

|

||

transaction has been reported. |

at least $5,000. |

P.O. Box 33117 |

|

|

||

|

|

2. File a |

Detroit, MI |

|

|

|

|

|

|

|

|

||

Notification Required |

days after the date of initial detection of facts that |

3. While all items should be completed fully |

||||

|

|

constitute a basis for filing the report. |

and accurately, items marked with an asterisk (*) |

|||

In situations involving suspicious transactions |

3. The Bank Secrecy Act requires that each |

must be completed according to the provisions of |

||||

requiring immediate attention, such as ongoing |

paragraph 4 below. |

|

|

|||

money laundering schemes, a money transmitter; |

financial institution (including a money services |

|

|

|

||

a currency dealer or exchanger; or an issuer, seller, |

business) file currency transaction reports (CTRs) |

4. If the information for a item marked with a |

||||

or redeemer of money orders and/or traveler’s |

in accordance with the Department of the Treasury |

asterisk (*) is not known or not applicable, enter |

||||

checks shall immediately notify, by telephone, |

implementing regulations (31 CFR Chapter X). |

special response “XX” to complete the item. To |

||||

an appropriate law enforcement authority. In |

These regulations require a financial institution |

indicate “Total amount” as unknown, check the |

||||

addition, a timely |

to file a CTR (FinCEN Form 104) whenever a |

box provided. |

||||

including recording any such notification in Part |

currency transaction exceeds $10,000. If a |

blank if the information is unknown or not |

|

|

||

VI on the form. |

currency transaction exceeds $10,000 and is |

applicable. |

|

|

||

|

|

suspicious, a money transmitter, or issuer, seller |

5. Complete each suspicious activity report by |

|||

|

|

or redeemer of money orders and/or traveler’s |

||||

A. When To FileA Report: |

checks or currency dealer or exchanger must |

providing as much information as possible on initial |

||||

and amended or corrected reports. |

|

|

||||

|

|

file two forms, a CTR to report the currency |

|

|

||

1. Money transmitters; currency dealers and |

transaction and a |

6. Do not include supporting documents when |

||||

suspicious aspects of the transaction. If the |

||||||

exchangers; and issuers, sellers and redeemers |

||||||

suspicious activity involves a currency |

filing the suspicious activity report . Retain a copy |

|||||

of money orders and/or traveler’s checks that are |

||||||

transaction that is $10,000 or less, the institution |

of the suspicious activity report and all supporting |

|||||

subject to the requirements of the Bank Secrecy |

||||||

is only required to file a |

documentation or business record equivalent in |

|||||

Act and its implementing regulations (31 CFR |

||||||

records must be maintained in each case. See |

your files for five (5) years from the date of the |

|||||

Chapter X are required to file a suspicious |

||||||

31 CFR Chapter X. |

report. All supporting documentation (such as |

|||||

activity report |

||||||

|

copies of instruments; receipts; sale, transaction |

|||||

|

|

|

||||

a. Any transaction conducted or attempted |

B. Abbreviations and Definitions |

or clearing records; photographs, surveillance |

||||

by, at, or through a money services business |

|

audio and/or video recording medium) must be |

||||

1. EIN |

made available to appropriate authorities upon |

|||||

involving or aggregating funds or other assets of |

||||||

request. |

|

|

||||

at least $2,000 (except as described in section |

2. IRS |

|

|

|||

|

|

|

||||

“b” below) when the money services business |

3. ITIN |

|

|

|

||

knows, suspects, or has reason to suspect that: |

Number |

|

|

|

||

|

|

Catalog No. 35084Y |

Rev. 3/1/11 |

|||

|

|

|

|

2 |

|

7. Type or complete the report using block |

even if the entire address is not known. If the |

document used. In box “e” list the number of the |

|

||

written letters. |

street address, city, or ZIP Code is unknown, |

identifying document. In box “f” list the issuing |

|||

|

enter “NA” in the item. If a state or country is |

state or country. If more space is required, enter |

|||

8. If more than one subject is being reported, |

unknown, enter “XX” in the item. |

the additional information in Part VI. If the subject |

|||

use as many copies of the Part I Subject |

|

is an entity or an individual’s identification was |

|||

Information page as necessary to record the |

D. Item Preparation Instructions |

not available, check box “z” and enter “XX” in |

|||

additional subjects. Attach the additional page(s) |

|

“Other.” |

|

|

|

behind page 1. If more than one transaction |

Item 1. Check the box if this report amends |

Item 13 |

*SSN/ITIN (individual) or EIN |

||

location is being reported, use as many copies of |

(adds missing data) or corrects errors in the prior |

||||

the Part III Transaction Location Information page |

report. (See Part V, item “s”). |

(entity). |

See General Instruction 12 and |

||

as necessary to record the additional locations. |

|

definitions. If the subject named in Items 4 |

|||

Attach the additional page(s) behind page 2. If |

Item |

through 6 is a U.S. Citizen or an alien with a SSN, |

|||

more space is needed for the Part VI Narrative, |

report filed on continuing activity. |

enter his or her SSN in Item 13. If that person is |

|||

add as many blank continuation pages as |

|

an alien who has an ITIN, enter that number. For |

|||

necessary to complete the narrative. Attach the |

Part I Subject Information |

an entity, enter the EIN. If the SSN, ITIN, or EIN |

|||

additional pages behind page 3. |

|

was unknown or not applicable, enter “XX” in this |

|||

If more space is needed to complete any other |

Item 2 Multiple subjects. Check this box if |

item. |

|

|

|

multiple subjects are involved. Attach Part I |

Item 14 |

*Date of birth. See General |

|||

item, identify that item in Part VI by “item |

Subject continuation pages behind page 1 to |

||||

number” and provide the additional information. |

account for all additional subjects involved in the |

Instruction 9. If the subject is an individual, enter |

|||

|

suspicious activity. |

the date of birth. If the month and/or day is not |

|||

9. Enter all dates in MM/DD/YYYY format |

|

available or unknown, fill in with zeros (e.g., “01/ |

|||

where MM = month, DD = day, and YYYY = |

Item 3 Subject type. Check box “a” if the |

00/1969” indicates an unknown date in January, |

|||

year. Precede any single number with a zero, |

subject purchased a money order(s) or traveler’s |

1969). |

|

|

|

i.e., 01, 02, etc. |

check(s) or sent a money transfer(s). Check box |

Item 15 Telephone number. See General |

|||

|

“b” if the subject cashed a money order(s) or |

||||

10. Enter all telephone numberswith (area |

traveler’s check(s) or received payment of a money |

Instruction 10. Enter the U.S. home or business |

|||

code) first and then the seven numbers, using |

transfer(s). Check box “c” if both “a” and “b” |

number for individual or entity. List foreign |

|||

the format (XXX) |

apply. If the transaction is a currency exchange |

telephone numbers and any additional U.S. |

|||

international telephone numbers in Part VI. |

check box “c.” Check box “d” Other and describe |

numbers (e.g., hotel, etc.) in Part VI. |

|||

|

in Part VI if the subject is an individual other than |

Part II Suspicious Activity Information |

|||

11. Always enter an individual’s name by |

a customer. Examples are MSB employees and |

||||

entering the last name, first name, and middle |

agents. |

Item 16 *Date or date rangeof suspicious |

|||

initial (if known). If a legal entity is listed, enter |

|

||||

its legal name in the last name item and trade |

Items 4, 5, and 6 *Name of subject. See |

activity. See General Instruction 9. Enter the |

|||

name in the first name item. |

General Instruction 11. Enter the name of the |

date of the reported suspicious activity in the |

|||

|

subject individual in Items 4 through 6. If the |

“From” field. If more than one day is involved, |

|||

12. Enter all identifying numbers (alien |

MSB knows that the individual has an “also known |

indicate the duration of the activity by entering |

|||

registration, driver’s license/state ID, EIN, ITIN, |

as” (AKA) or “doing business as” (DBA) name, enter |

the first date in the “From” field and the last date |

|||

Foreign National ID, passport, SSN, vehicle |

that name in Part VI. If the subject is an entity, |

in the “To” field. |

|||

license number, etc.) starting from left to right. |

enter the legal name in Item 4 and the trade or |

|

|

|

|

Do not include spaces or other punctuation. |

DBA name in item 5. If the legal name is not |

Item 17 *Total dollar amount. See General |

|||

|

known, enter the DBA name in Item 4. If there is |

Instruction 14. If unknown, check box 17a.If the |

|||

13. Enter all ZIP Codeswith at least the first |

more than one subject, use as many Part I Subject |

suspicious activity only involved purchases, or |

|||

five numbers (ZIP+4, if known). |

Information continuation pages as necessary to |

redemptions, or currency exchanges, enter the |

|||

|

provide the information about each subject. |

total U.S. Dollar value involved in the reported |

|||

14. Enter all monetary amounts in U.S. |

Attach the additional copies behind page 1. When |

activity. For instance, if multiple money orders |

|||

Dollars. Use whole dollar amounts rounded up |

there is more than one purchaser and/or payee |

from more than one issuer were redeemed, enter |

|||

when necessary. Use this format: $000,000,000. |

(e.g., two or more transactions), indicate in Part VI |

the total of all money orders redeemed. If |

|||

If foreign currency is involved, record the |

whether each subject is a purchaser or payee and |

multiple activities are involved, such as a |

|||

currency amount in U.S. Dollars, name, and |

identify the instrument or money transfer |

redemption of money orders combined with |

|||

country of origin in the Part VI narrative. |

information associated with each subject. If part |

purchase of a money transfer, enter the largest |

|||

|

of an individual’s name is unknown, enter “XX” in |

activity amount in Item 17. For instance, if the |

|||

15. Addresses, general. Enter the permanent |

the appropriate name item. If the subject is an |

transaction involved redeeming $5,000 in money |

|||

street address, city, two letter state/territory |

entity, enter “XX” in Item 5 (if the trade or legal |

orders and purchase of a $3,500 money transfer , |

|||

abbreviation used by the U.S. Postal Service, and |

name is not known) and in Item 6. |

the Item 17 amount would be $5,000. |

|||

ZIP code (ZIP+4, if known) of the individual or |

Items 7 - 11 *Permanent address. See |

Item 18 |

*Category of suspicious activity. |

||

entity. A post office box number should not be |

|||||

used for an individual, unless no other address is |

General Instructions 13 and 15. Enter “XX” if the |

Check the box(es) which best identifies the |

|||

available. For an individual also enter any |

street address, city, and ZIP Code items are |

suspicious activity. Check box “b Structuring” |

|||

apartment number or suite number and road or |

unknown or not applicable. Enter “XX” if the |

when it appears that a person (acting alone, in |

|||

route number. If a P.O. Box is used for an entity, |

state or country is not known. |

conjunction with, or on behalf of other persons) |

|||

enter the street name, suite number, and road or |

Item 12 *Government issued identification (if |

conducts or attempts to conduct activity designed |

|||

route number. If the address is in a foreign |

to evade any record keeping or reporting |

||||

country, enter the city, province or state if Canada |

available). See General Instruction 12. Check |

requirement of the Bank Secrecy Act. If box “d” |

|||

or Mexico, and the name of the country. |

the box showing the type of document used to |

is checked, specify the type of suspicious activity |

|||

Complete any part of the address that is known, |

verify subject identity. If you check box |

which occurred. Describe the character of such |

|||

|

“z Other”, be sure to specify the type of |

activity in Part VI. Box “z” should only be used if |

|||

|

|

|

3 |

|

|

|

|

|

|

|

|

no other type of suspicious activity box |

Item 24 *Legal name of business. Enter |

aid if contact is required. |

|

|

|

adequately categorizes the transaction. |

the legal name of the business where the |

Part V Contact for Assistance |

|||

Item 19 *Financial services involved. |

transactions took place. |

||||

|

Item |

||||

Check any of boxes “a” through “e” that apply to |

Item 25 Doing business as.Enter the trade |

||||

identify the services involved in the suspicious |

name by which the business is commonly known. |

the name of the office that the financial institution |

|||

activity. If box “z” is checked, briefly explain the |

|

has designated to receive request for assistance |

|||

service on the following line. If “unusual use” is |

Items |

with this report. This office must have an individual |

|||

involved, check the appropriate service box(s) |

address. Enter the transaction location address |

knowledgeable of this report available during |

|||

and box “z” and note “unusual use” and explain |

by following General Instructions 13 and 15. |

regular business hours. |

|||

|

|

|

|||

in Part VI. Check all of boxes “1” through “10” |

|

Item * |

|||

that apply to describe the character of the |

Item 30 *EIN (entity) or SSN/ITIN |

||||

Instruction B10. Enter the work telephone number |

|||||

suspicious activity. |

(individual). See General Instruction 12 and |

||||

of the contact office. |

|||||

Item 20 *Purchases and redemptions |

definitions. If the business identified in Item 24 |

|

|

|

|

has an EIN, enter that number in Item 30. If not, |

Item |

||||

(See definition 6 on page 1 of the instructions). |

enter individual owner’s SSN or ITIN. |

B9. Enter the date this report was filed. For |

|||

Enter information about purchases or |

|

electronic filing, it is the date that the report was |

|||

redemptions of money orders, traveler’s checks, |

Item 31 *Business telephone number. See |

||||

or money transfers. Check the appropriate box |

General Instruction 10. Enter the telephone |

filing, it is the date the magnetic media was |

|||

in column “P” or “R” to identify the entry as a |

number of the business listed in Item 24. |

forwarded to DCC. For all other filers, it is the |

|||

purchase or redemption. Enter the name of the |

|

date the financial institution completed the final |

|||

issuers, the total number of instruments |

Item 32 Country code. Enter the |

review and mailed/submitted the report to DCC. |

|||

purchased or redeemed, and the total amount of |

country code if not US. |

Item |

|||

the instruments. You can enter up to three |

|

||||

|

agency other than an MSB, such as a federal or state |

||||

issuers in each instrument category. If more than |

Item 33 Internal control/file number (If |

||||

examiner, enter the name of the reporting agency in |

|||||

three issuers are involved, enter the information |

available). Enter any internal file or report number |

||||

Item 48. |

|||||

on the additional issuers in Part VI. |

assigned by the reporting institution to track this |

||||

|

|

|

|||

Item 21 *Currency Exchanges. Record up |

report. This information will act as an identification |

Part VI Suspicious Activity Information |

|||

aid if contact is required. |

|||||

to two currency exchanges made by the subject(s). |

Part IV Reporting Business Information |

Narrative* |

|||

Check the box “If bulk small currency” if a large |

|

|

|

||

number of small bills was used to pay for the |

|

Enter a narrative describing all aspects of the |

|||

currency exchange. Enter the name of the |

Item 34 Check this box and go to Part V if the |

suspicious activity not covered by form data items. |

|||

currency or type of monetary instrument used to |

reporting business is the same as the Part III |

See page 3 of the form for instructions on |

|||

pay for the exchange, and the |

Transaction Location. If the reporting business is |

completing the narrative. If the initial Part VI |

|||

the country that issued the currency. An example |

different, complete Part IV. |

narrative page is not sufficient, use as many Part |

|||

of this would be “Pesos” for the name of the |

|

VI Narrative continuation pages as necessary to |

|||

currency and “MX” representing Mexico as issuer |

Item 35 *Legal name of business.Enter the |

complete the narrative. Attach the continuation |

|||

of the currency. Enter the name of the currency |

legal name of the reporting business. |

pages behind the initial narrative page. Legal |

|||

received in exchange and the |

|

disclaimers will not be included in this narrative. |

|||

the country that issued the currency. Enter the |

Item 36 Doing business as.Enter the trade |

||||

Paperwork Reduction Act Notice |

|||||

value of the exchange in U.S. Dollars. If there |

name by which the reporting business is commonly |

||||

were more than two currency exchanges, enter |

known (if other than the legal name). |

|

|

|

|

the information about the additional exchanges |

|

The purpose of this form is to provide an effective |

|||

in Part VI. |

Items |

means for a money services business (MSB) to notify |

|||

|

address. Enter the reporting business address by |

appropriate law enforcement agencies of suspicious |

|||

Part III Transaction Location Information |

following General Instructions 13 and 15. |

transactions and activities that occur by, through, or at an |

|||

|

|

MSB. This report is authorized by law, pursuant to |

|||

Item 22 Multiple selling and/or paying |

Item 40 *EIN (entity) or SSN/ITIN |

authority contained in 31 U.S.C. 5318(g). Information |

|||

collected on this report is confidential (31 U.S.C. 5318(g)). |

|||||

business locations. Check the box if the reported |

(individual). See General Instruction 12 and |

||||

Federal regulatory agencies, State law enforcement |

|||||

activity occurred at multiple selling and/or paying |

definitions. If the business identified in Item 35 |

||||

agencies, the U.S. Departments of Justice and Treasury, |

|||||

business locations. Fill out as many Part III |

has an EIN, enter that number in Item 41. If not, |

||||

and other authorized authorities may use and share this |

|||||

Transaction Location Information sections as |

enter individual owner’s SSN or ITIN. |

information. Public reporting and record keeping burden |

|||

necessary to record all locations. Attach the |

Item 42 *Business phone number. Enter the |

for this form is estimated to average 60 minutes per |

|||

additional sections behind page 2 of the SAR- |

response, and includes time to gather and maintain |

||||

MSB. |

telephone number of the reporting business. If |

information for the required report, review the instructions, |

|||

|

the reporting business telephone number is a |

and complete the information collection. Send comments |

|||

Item 23 Type of business location(s).Check |

foreign telephone number, leave Item 44 blank |

regarding this burden estimate, including suggestions for |

|||

box “a” if this is the selling location where the |

and enter the number in the Part VI Narrative. |

reducing the burden, to the Office of Management and the |

|||

customer purchases a money order(s) or traveler’s |

See General Instruction 10. |

Budget, Paperwork Reduction Project, Washington, DC |

|||

20503 and to the Financial Crimes Enforcement Network, |

|||||

check(s), or initiated a money transfer(s), or |

|

||||

|

Attn.: Paperwork Reduction Act. P.O. Box 39, Vienna |

||||

exchanged currency. Check box “b” if this is the |

Item 43 Country code.Enter the |

||||

VA |

|||||

paying location where the customer cashed a |

code if not US. |

and an organization (or a person) is not required to respond |

|||

money order(s) or traveler’s check(s) or received |

Item 44 Internal control/file number (If |

to, a collection of information unless it displays a currently |

|||

payment of a money transfer(s). Check box “c” if |

valid OMB control number. |

||||

multiple transactions are reported and the business |

available). Enter any internal file or report number |

|

|

|

|

was both a selling and paying location for one or |

assigned by the reporting institution to track this |

|

|

|

|

more transactions. |

report. This information will act as an identification |

|

|

|

|

Form Characteristics

| Fact Name | Details |

|---|---|

| Filing Method | A free secure e-filing system is available for submitting the FinCEN Form 109. Filers can go to the official website for more information and to register. |

| Version Acceptance | The current version of the FinCEN Form 109 was released in March 2011. Be aware, earlier editions will not be accepted after September 2011. |

| Purpose of the Form | This form is specifically designed to report suspicious activity by Money Services Businesses (MSBs), highlighting any potential illicit acts. |

| Critical Information | Items marked with an asterisk (*) are considered critical and must always be completed. Failing to provide this information may hinder the report's effectiveness. |

| Mailing Address for Completed Reports | If not e-filing, completed reports should be mailed to: Electronic Computing Center - Detroit, Attn: SAR-MSB, P.O. Box 33117, Detroit, MI 48232-5980. |

Guidelines on Utilizing Fincen 109

Effectively filling out the FinCEN Form 109, also known as the Suspicious Activity Report by Money Services Business, is crucial for reporting suspicious activities related to money services businesses. It’s important to act promptly and ensure clarity in every step, as this report can be instrumental in preventing various financial crimes. The following steps outline how to complete this report accurately.

- Visit the FinCEN website to e-file the form: http://bsaefiling.fincen.treas.gov/index.jsp. If you prefer to file by mail, ensure you have the necessary information ready.

- Start with identifying whether you are amending a previous report by checking the appropriate box at the top of the form.

- Fill out Part I for Subject Information. Provide the full legal name, address, and identification information of the individual or entity involved. Ensure you mark any critical fields, as indicated by an asterisk (*).

- In Part II, enter relevant details about the suspicious activity. This includes the date of activity and the total amount involved. Be sure to check all applicable categories of suspicious activity.

- Check the financial services involved in the suspicious activity. This includes types of transactions, such as money orders or currency exchange.

- Detail the transaction location in Part III. Include the legal business name and the address. Verify your entries are complete and accurate.

- Complete Part IV with details about the reporting business. It should match the transaction location unless otherwise specified.

- Provide contact information in Part V. This should include a designated contact office and phone number for any follow-up inquiries.

- In Part VI, describe the suspicious activity in detail, ensuring you cover all necessary aspects indicated in the instructions. This narrative section is vital for investigators’ understanding.

- Before submission, review the entire report for accuracy and completeness. If filing by mail, send the report to:

- Electronic Computing Center - Detroit

- Attn: SAR-MSB

- P.O. Box 33117

- Detroit, MI 48232-5980

- Retain a copy of the completed report and all supporting documentation for a minimum of five years.

By following these steps diligently, you can ensure that the FinCEN Form 109 is filed accurately and effectively, aiding in the detection and prevention of suspicious financial activities.

What You Should Know About This Form

What is the purpose of the FinCEN Form 109?

The FinCEN Form 109, also known as the Suspicious Activity Report by Money Services Business (SAR-MSB), is used by money services businesses to report suspicious activities that may involve money laundering, terrorist financing, or other illegal activities. This report assists law enforcement agencies in their investigations by providing necessary details about suspicious transactions.

Who is required to file Form 109?

Money services businesses, including money transmitters, currency dealers or exchangers, and issuers, sellers, or redeemers of money orders and traveler's checks, must file Form 109. If they conduct or suspect a suspicious transaction involving funds of at least $2,000, they are required to submit this report.

What kinds of activities should trigger a Form 109 filing?

Specific activities that might necessitate filing include, but are not limited to, transactions that appear to be structured to evade reporting requirements, involve funds with unknown sources, or are inconsistent with the customary behavior of the client or the business operations. Any unusual patterns or suspicious activity should be reported.

How can I file Form 109?

You can file Form 109 electronically through the Financial Crimes Enforcement Network’s (FinCEN) e-filing system. Go to BSA e-filing System to register and file your report securely.

What information is required on Form 109?

Form 109 requires detailed information, including the identity of the subject(s) involved (such as names, addresses, and identification numbers), details of suspicious activity, the amount of money involved, and a narrative explaining the situation. Each field marked with an asterisk (*) is essential and must be completed accurately.

What should be included in the narrative section of Form 109?

The narrative section should provide a clear and chronological description of the suspicious activity, including what raised suspicion, whether transactions were completed or attempted, relevant supporting documentation, and any unusual factors. This information is crucial for investigators to understand the context and nature of the reported activity.

What should I do if I cannot complete a certain field on Form 109?

If information for an asterisk-marked item is not known or unique to the situation, enter "XX" in the field. Non-asterisk fields may be left blank if the information is unknown or not applicable. Accuracy is vital, and attempts should be made to provide as much detail as possible.

How long must I keep records related to Form 109?

Retain a copy of the completed Form 109 and any supporting documentation for at least five years from the date of filing. These records must be available for potential review by law enforcement or regulatory agencies.

Is there any liability protection for filing a Form 109?

Yes, federal law provides a safe harbor protection for individuals or businesses that report suspicious transactions to the authorities. This means that those who file Form 109 in good faith will not be liable for civil lawsuits or regulatory penalties related to their disclosures.

What happens after I file Form 109?

After filing Form 109, financial institutions must not disclose to any involved party that the report was filed. The information contained within the report will be reviewed by FinCEN and other law enforcement agencies for potential follow-up investigations. It is important to maintain confidentiality regarding the filing of the report.

Common mistakes

Filing the FinCEN Form 109 is a critical process for reporting suspicious activities related to money services businesses. Many individuals make mistakes that can lead to complications or even legal repercussions. One common mistake is failing to complete the entire report. Items marked with an asterisk (*) are deemed critical. Omitting any of these required fields may result in the report being rejected. Always ensure that each necessary item is accurately filled out to avoid delays.

Another error often encountered is the use of incorrect date formats. The form instructs filers to enter dates as MM/DD/YYYY. Using any other format, such as DD/MM/YYYY, can lead to confusion and inaccuracies. This seemingly small detail is vital, as investigators rely heavily on precise information to analyze suspicious activity effectively.

Many also overlook the significance of the narrative section in Part VI of the form, where detailed descriptions of suspicious activity are required. Skimping on detail or providing vague information can hinder the ability of authorities to understand the nature of the transaction. Be specific about the circumstances surrounding the activity, including timelines and any unusual aspects that raised suspicion.

Inadequate identification of the subjects involved is another prevalent issue. The form asks for governmental identification numbers, such as a Social Security Number (SSN), Individual Taxpayer Identification Number (ITIN), or Employer Identification Number (EIN). Failing to provide this information, or incorrectly entering "XX" when the number is available, weakens the report’s effectiveness.

Furthermore, some filers do not check the correct boxes for the categories of suspicious activity. For instance, if both money laundering and structuring apply, both should be marked. Missing important categories could signal a gap in the understanding of the transaction, which may ultimately lead to oversight by investigators.

Another common mistake is insufficient supporting documentation. While the report itself should not have supporting documents attached, filers must maintain these records for five years. Neglecting to retain relevant documents can create challenges if authorities require further analysis in the future.

Finally, ensuring clarity in the description and avoiding confusing language is vital. The narrative should be straightforward, focusing on facts rather than assumptions. Avoid using ambiguous phrases and instead provide strong, clear details that investigators can easily understand. A thorough and clear report maximizes the chances of effective investigation into suspicious activities.

Documents used along the form

The FinCEN Form 109 is an essential document used for reporting suspicious activities in money services businesses. Along with this form, several other documents may also be needed to provide additional information or to ensure compliance with financial regulations. Here is a list of commonly used forms and documents associated with FinCEN Form 109.

- FinCEN Form 104: This form is used to report currency transactions that exceed $10,000. It must be filed alongside Form 109 when applicable to document both the transaction and its suspicious aspects.

- FinCEN Form 105: This form is specifically for reporting suspicious activities related to international transportation of currency or monetary instruments. It is important for transactions involving cross-border activities.

- FinCEN Form 111: This is the form used to report suspicious transactions involving financial institutions. While Form 109 focuses on money services businesses, Form 111 is broader in its application.

- Currency Transaction Log: A detailed record of transactions that involves cash payments or transfers. This log helps the business keep track of daily operations and provides a basis for reporting under the Bank Secrecy Act.

- Sales Receipts: Documents that record the sale or redemption of money orders and traveler’s checks. These receipts can serve as evidence of transactions that are being reported as suspicious.

- Client Identification Records: These records require businesses to maintain documentation regarding the identity of their clients. They are crucial for verifying customer identity during transactions.

- Narrative Statements: A narrative description detailing the suspicious activity. This information is essential for investigators to understand the unusual actions that prompted the filing of Form 109.

- Internal Control Documents: Inspections, procedures, and audits that help ensure compliance with anti-money laundering regulations. Companies need to keep these up to date to support any reports made.

- Transaction Monitoring Reports: Reports generated from monitoring systems that analyze transaction patterns and flag suspicious activities. These reports are vital for backing up a Form 109 filing.

In summary, various forms and supporting documents play a crucial role in the responsible and effective reporting of suspicious activities in the financial system. Keeping accurate records ensures a streamlined process for financial institutions and compliance with regulatory requirements.

Similar forms

- FinCEN Form 104 (Currency Transaction Report): Similar to Form 109, this form reports currency transactions exceeding $10,000. It collects detailed information about individuals involved and the nature of the transaction, serving to flag potentially illicit financial activity.

- FinCEN Form 105 (Report of International Transportation of Currency or Monetary Instruments): This form is used to report the physical transportation of currency or monetary instruments equal to or greater than $10,000. Like Form 109, it requires information on subjects and amounts, making it essential for tracking suspicious movements of cash.

- IRS Form 8300 (Report of Cash Payments Over $10,000 Received in a Trade or Business): This form must be filed by businesses receiving more than $10,000 in cash. Similar to Form 109, it aims to prevent money laundering by maintaining records of large cash transactions.

- FinCEN Form 111 (Unregistered Investment Company Form): This form identifies certain investment transactions that may not involve a licensed entity. Although its focus differs, both forms share a goal of highlighting unusual financial activities and require detailed declarations about involved parties.

- FinCEN Form 112 (Larger Transactions Report): This form details transactions greater than specific thresholds as defined by the agency. The intention aligns with that of Form 109—to enhance tracking and reporting mechanisms for suspicious financial activities.

Dos and Don'ts

- Do use the e-filing system for submitting the report. Go to FinCEN's e-filing site for registration.

- Do ensure all critical items marked with an asterisk (*) are completed accurately.

- Do provide a clear and detailed narrative in Part VI describing the suspicious activity.

- Do file the report within 30 days of detecting suspicious activity.

- Do enter dates in the correct MM/DD/YYYY format.

- Do not include supporting documents with the SAR-MSB report. Keep them for your records.

- Do not leave non-critical fields blank if the information is unknown or not applicable; enter "XX" or "NA" as appropriate.

- Do not use a post office box as the only address for an individual unless no other address is available.

- Do not contact the person involved in the transaction to inform them that a report has been filed.

Misconceptions

Misconception 1: The FinCEN Form 109 does not require e-filing.

Many believe that paper filing is acceptable. However, this form must be filed electronically. A secure system is available for this purpose.

Misconception 2: I can use old versions of FinCEN Form 109.

It is crucial to know that only the most current edition of the form is accepted. Previous editions were no longer accepted after September 2011.

Misconception 3: Only large transactions need reporting.

Common assumptions wrongly state that only significant transactions are suspicious. A SAR-MSB must be filed for any transaction that involves or aggregates funds of at least $2,000.

Misconception 4: The report does not need to be completed in detail.

Completing the entire report is vital. Items marked with an asterisk (*) are critical and must be filled out accurately.

Misconception 5: It's okay to include supporting documents with the report.

Do not include additional documentation when filing. Keep these documents for your records, as they must be maintained for five years.

Misconception 6: I'm allowed to notify the subject of the suspicious activity report.

Legally, you cannot inform anyone involved that a report has been filed. It’s considered a serious violation.

Misconception 7: Filing the form can happen at any time after detecting suspicious activity.

The report must be filed within 30 days of detecting any suspicious activity. Timeliness is essential to ensure compliance.

Misconception 8: I don’t need to keep records of the suspicious activity report.

Keeping a copy of the SAR-MSB and all supporting documentation for five years is required. This is critical for regulatory compliance.

Key takeaways

Understanding the process of filling out and using the FinCEN Form 109 can greatly streamline your reporting of suspicious activities. Here are some essential points to keep in mind:

- Electronic Filing is Required: To submit the FinCEN Form 109, utilize the secure e-filing system available at FinCEN's website. This not only ensures compliance but also safeguards your information.

- Critical Information Needs Attention: Make sure to complete all sections of the form, especially those marked with an asterisk (*). These fields contain vital information that the authorities need to assess the suspicious activity effectively.

- Document the Suspicious Activity Clearly: The narrative section is essential. Provide a detailed and chronological account of the suspicious incident, including any unusual behaviors you observed—this can be critical for investigations.

- Retain Supporting Documentation: It is important to keep all supporting documentation for five years. While you should not send these documents with the filing, they must be available for law enforcement if requested.

By following these guidelines, you can ensure that the process of reporting suspicious activities is thorough and compliant with federal requirements.

Browse Other Templates

What Is the Highest Income to Qualify for Snap? - Users are encouraged to review the instructions carefully before completing the form.

Consent to Release - The boundary between Proof of Representation and Consent to Release is crucial to understand.