Fill Out Your First Midwest Bank Direct Deposit Form

The First Midwest Bank Direct Deposit form serves as a critical tool for employees wishing to streamline their payroll processes. This document allows individuals to authorize their employers to deposit their salaries directly into their First Midwest Bank accounts, ensuring timely access to funds. Whether establishing direct deposit for the first time or changing an existing setup from another bank, this form guides users through the necessary steps. Key elements of the form include personal information such as the employee's name, social security number, and various contact details. Additionally, it requires account specifics, like the First Midwest Bank account number, routing number, and the desired deposit amount. For clarity, employees must sign and date the form to validate their authorization. Attaching a voided check helps verify account information accurately. It is important to note that this authorization remains effective until a written notification is submitted to the employer for termination, with a potential processing delay of up to two pay periods upon such changes. Overall, the form simplifies financial management for employees while offering a secure method for receiving their paychecks.

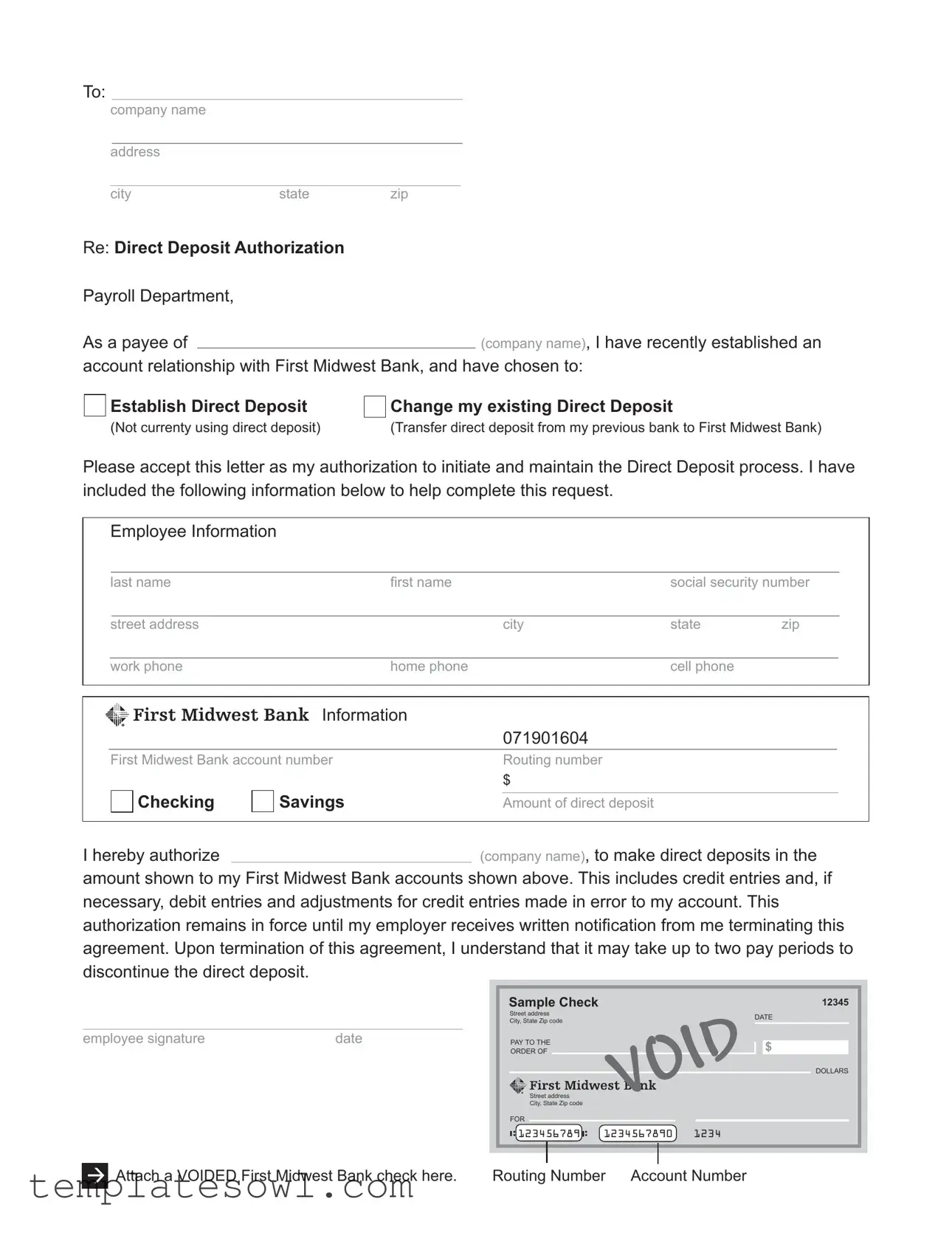

First Midwest Bank Direct Deposit Example

To:

company name

address

city |

state |

zip |

Re: Direct Deposit Authorization

Payroll Department,

As a payee of(company name), I have recently established an account relationship with First Midwest Bank, and have chosen to:

Establish Direct Deposit

(Not currenty using direct deposit)

Change my existing Direct Deposit

(Transfer direct deposit from my previous bank to First Midwest Bank)

Please accept this letter as my authorization to initiate and maintain the Direct Deposit process. I have included the following information below to help complete this request.

Employee Information

last name |

first name |

social security number |

|

|

|

|

|

street address |

city |

state |

zip |

|

|

|

|

work phone |

home phone |

cell phone |

|

Information

|

071901604 |

First Midwest Bank account number |

Routing number |

|

$ |

Checking

Savings |

Amount of direct deposit |

I hereby authorize(company name), to make direct deposits in the

amount shown to my First Midwest Bank accounts shown above. This includes credit entries and, if necessary, debit entries and adjustments for credit entries made in error to my account. This authorization remains in force until my employer receives written notification from me terminating this agreement. Upon termination of this agreement, I understand that it may take up to two pay periods to discontinue the direct deposit.

employee signature |

date |

Sample Check |

|

12345 |

Street address |

|

DATE |

City, State Zip code |

|

|

|

|

|

PAY TO THE |

|

$ |

ORDER OF |

|

|

|

|

DOLLARS |

Street address |

|

|

City, State Zip code |

|

|

FOR |

|

|

:123456789 : |

1234567890 |

1234 |

Attach a VOIDED First Midwest Bank check here. |

Routing Number Account Number |

Form Characteristics

| Fact Name | Fact Description |

|---|---|

| Account Relationship | This form is used by employees of a company to establish, change, or maintain a direct deposit relationship with First Midwest Bank. |

| Employee Information Requirement | Employees must provide their last name, first name, social security number, street address, city, state, zip, and various phone numbers. |

| Bank Details | To complete the form, employees need to provide their First Midwest Bank account number and routing number. |

| Direct Deposit Amount | The form requires specifying the amount of direct deposit, which may be set for checking or savings accounts. |

| Authorization Terms | By signing, employees authorize their employer to initiate and maintain direct deposits, including adjustments for errors. |

| Termination Notification | Employees must notify their employer in writing to terminate the direct deposit, with an understanding that it may take up to two pay periods to process this request. |

Guidelines on Utilizing First Midwest Bank Direct Deposit

Filling out the First Midwest Bank Direct Deposit form is an essential step toward simplifying the payroll deposit process. Completing this form accurately ensures that your deposits go directly into your bank account without delay. Follow these steps closely to ensure you provide all necessary information.

- Begin by entering the company name and its address. Include the city, state, and zip code where the company is located.

- Next, indicate whether you are establishing new direct deposit or changing your existing direct deposit and include the name of the payroll department.

- Fill out your employee information by providing your last name, first name, and social security number.

- Enter your street address. Be sure to include the city, state, and zip code where you reside.

- Provide your contact numbers: list your work, home, and cell phone numbers.

- Next, fill in your First Midwest Bank account number and the routing number. Make sure these numbers are correct, as they are essential for processing your deposits.

- Indicate whether you want to deposit into a checking or savings account, and specify the amount of direct deposit you would like to receive.

- Review the authorization statement closely. Ensure it matches your understanding of the terms, then sign and date the form at the bottom.

- Finally, attach a VOIDED check from your First Midwest Bank account to complete the process.

What You Should Know About This Form

What is the purpose of the First Midwest Bank Direct Deposit form?

The First Midwest Bank Direct Deposit form allows you to authorize your employer to deposit your paycheck directly into your First Midwest Bank account. This process makes receiving your pay more convenient and secure, eliminating the need for paper checks.

How do I fill out the Direct Deposit form?

To complete the form, provide your employer's name and address at the top. Next, state whether you are establishing a new direct deposit or changing an existing one. Fill in your personal information, including your name, social security number, address, and phone numbers. Then, indicate your First Midwest Bank account number, routing number, and the desired deposit amount. Don't forget to sign and date the form before submission.

Do I need to include any documents with the form?

When submitting the Direct Deposit form, you must attach a voided check from your First Midwest Bank account. This voided check helps your employer verify your account details and ensures correct processing of transactions.

Are there fees associated with setting up Direct Deposit?

No, First Midwest Bank does not charge fees for setting up direct deposit. This service is provided to make banking more efficient for customers. However, it's good to confirm with your employer if there are any fees associated with their payroll processing.

How long does it take for Direct Deposit to start?

Once your employer receives the completed Direct Deposit form, it typically takes one to two pay cycles for the changes to take effect. Check with your employer for specific timelines, as they may vary depending on their payroll schedule.

What if I want to cancel my Direct Deposit?

If you wish to terminate your Direct Deposit, you must provide written notification to your employer. Once your request is received, it may take up to two pay periods to discontinue the direct deposit. Make sure to allow for this timeframe to prevent any interruption in your payments.

Common mistakes

When filling out the First Midwest Bank Direct Deposit form, it's important to be as precise as possible. One of the most common mistakes individuals make is not including their correct account number. This number is crucial because it directs funds to your specific bank account. A simple typographical error can lead to delays or misdirected deposits.

Another frequent error is failing to provide accurate routing numbers. The routing number is unique to your bank and is essential for processing direct deposits. If this number is incorrect, it can cause significant issues with your payroll deposits, preventing your funds from reaching your account on time.

Additionally, many people overlook the need to double-check their personal information. This includes your name, address, and Social Security number. Any discrepancies between what is on the form and what is on file with your employer or bank can lead to complications. Always ensure that the information matches and is spelled correctly.

Another mistake to avoid is neglecting to indicate whether you are establishing a new direct deposit or changing an existing one. This distinction is critical. Labeling your request incorrectly may result in confusion at your employer's payroll department and could delay the initiation or transfer of your direct deposit.

It is also essential not to forget to attach a VOIDED check. This document is a simple but important step. Neglecting to include this can result in having to start the process over again, delaying your access to direct deposits.

Finally, many individuals underestimate the importance of signing and dating the form. An unsigned authorization will not be considered valid. Ensure that both your signature and the date are clearly marked before submitting the form to avoid any unnecessary delays.

Documents used along the form

When you initiate a direct deposit with First Midwest Bank, there are other important forms and documents you might need to complete. These documents work together to ensure that your direct deposit is set up smoothly and efficiently. Below are five documents that are commonly used alongside the First Midwest Bank Direct Deposit form.

- Employment Verification Form: This document confirms your employment status and may be required by the bank to validate your account information. It usually includes details such as your position, salary, and length of employment.

- Employer’s Direct Deposit Authorization Form: Some employers have their own forms for authorizing direct deposits. This document typically collects similar information as the First Midwest Bank form and may outline specific policies or requirements related to direct deposit.

- Voided Check: A voided check is needed to provide the bank with your account and routing numbers. It ensures accuracy in transferring your funds and minimizes mistakes. You simply write "VOID" across the check and attach it to your direct deposit form.

- Payroll Deduction Authorization Form: This form allows you to authorize deductions from your paycheck for specific purposes, such as contributions to retirement plans or health insurance. It's not always required for direct deposit but might be needed by your employer for payroll processing.

- Change of Address Form: If you've recently moved, this form is essential for updating your personal information with your employer. Keeping your address current ensures that you receive important documents related to your direct deposit and employment promptly.

Having these forms ready can facilitate a smoother transition to direct deposit at First Midwest Bank. They help ensure that all required information is in order, so you can receive your payments accurately and on time. It’s always best to check with your employer to see if they require any additional documentation before starting the direct deposit process.

Similar forms

- W-4 Form: This form is used by employees to indicate their tax situation to their employer. Like the Direct Deposit form, it contains personal information such as name and Social Security number, which is necessary for processing payroll correctly.

- Direct Deposit Authorization Form from Other Banks: Similar to the First Midwest Bank Direct Deposit form, this document allows employees to initiate or change their direct deposit preferences with their respective banks by providing account and routing information.

- Employee Information Form: This document collects various personal details about an employee, including contact information and Social Security number. It serves to set the foundation for payroll processes throughout different companies.

- Payroll Deduction Authorization Form: Employees use this to authorize specific deductions from their paycheck, much like how the Direct Deposit form authorizes deposits to a bank account. Both ensure clear communication between the employee and employer about financial transactions.

- New Hire Reporting Form: Employers fill out this form to register new employees with state agencies. It captures critical information similar to what is required for the Direct Deposit form—such as the employee's name and Social Security number.

- Change of Address Form: This document notifies employers about an employee’s change in address. It often accompanies forms like the Direct Deposit authorization when an employee’s information needs to be updated for payroll accuracy.

- Bank Account Closure or Transfer Form: This document is submitted when an employee closes or transfers an account. Similar to the Direct Deposit form, it involves managing where funds are deposited and ensuring the employer has the updated information.

- Tax Form 1099-MISC: Although mainly for independent contractors, this form reports payments made. Like the Direct Deposit form, it exchanges financial information between entities to ensure proper tax reporting and payments.

Dos and Don'ts

When filling out the First Midwest Bank Direct Deposit form, careful attention will ensure that your direct deposit setup goes smoothly. Below are some recommended practices and pitfalls to avoid.

- Do double-check your personal information for accuracy.

- Do include your account number and routing number correctly.

- Do specify whether you are establishing or changing a direct deposit.

- Do attach a voided First Midwest Bank check to the form.

- Don't forget to sign and date the form before submitting it.

- Don't leave any sections blank; complete all required fields.

- Don't assume your employer knows your change; inform them directly.

Following these guidelines will help facilitate a smooth direct deposit process. Ensure you keep a copy of the completed form for your records.

Misconceptions

- Misconception 1: Direct deposit is only for salaried employees.

- Misconception 2: You need a bank account to set up direct deposit.

- Misconception 3: Changing your direct deposit account is a lengthy process.

- Misconception 4: You cannot split direct deposit between multiple accounts.

- Misconception 5: Direct deposit means you can't get paper pay stubs.

- Misconception 6: Authorization for direct deposit is permanent.

- Misconception 7: If there’s an error in your deposit, it’s not fixable.

- Misconception 8: You can't access your funds immediately after direct deposit.

- Misconception 9: You must submit a new form each time you change your paycheck amount.

This is incorrect. Both hourly and salaried employees can use direct deposit. Any type of employee can choose to receive payments electronically.

While it is true that you need an account to receive funds, it does not have to be a First Midwest Bank account. You can authorize deposits to any bank account.

In fact, changing your account can often be done quickly. Once you submit the new direct deposit form, it usually takes a couple of pay cycles to process the change.

Many employers allow direct deposit to multiple bank accounts. You can specify how much goes into each account on your authorization form.

This is not true. Even with direct deposit, employers are still required to provide employees with pay stubs, whether in paper form or electronically.

Direct deposit does not last forever. You have the power to terminate or change your authorization at any time by notifying your employer.

This is incorrect. If an error occurs, you can have it corrected through adjustments. The direct deposit system allows for fixing mistakes.

Typically, funds from direct deposits become available on payday, allowing you instant access as soon as they are deposited into your account.

This misconception fails to recognize that you only need to submit a new form if you change the bank account where your paychecks are deposited. Adjustments to the amount can often be made without additional paperwork.

Key takeaways

The First Midwest Bank Direct Deposit form is an important document that streamlines the payment process for employees. Here are six key takeaways regarding its use and completion:

- Authorization Requirement: You must provide written authorization for your employer to initiate and maintain direct deposits into your First Midwest Bank account.

- Current Status: Indicate if you are establishing a new direct deposit or changing an existing one from another bank to First Midwest Bank.

- Complete Employee Information: Fill in all required fields accurately. This includes your last name, first name, social security number, addresses, and phone numbers.

- Bank Account Details: Clearly specify your First Midwest Bank account number, routing number, and the amount you wish to have deposited. You can opt for checking or savings accounts.

- Ongoing Authorization: The authorization continues until you provide your employer with a written notice to terminate the agreement. Be mindful that it may take up to two pay periods to process this termination.

- Voided Check: Include a voided check from your First Midwest Bank account as an attachment to ensure the accuracy of your banking information.

Properly completing this form enhances your payroll experience and ensures timely deposits into your bank account.

Browse Other Templates

Form 5329 - Users can track their distribution status by maintaining up-to-date contact information on the form.

Formal Request Form - The form can be faxed or mailed, providing flexibility for submission.

Palmetto Employee Remote Access Guide,Palmetto Health Networking Access Overview,MyAccess Remote Connection Manual,Palmetto Health Digital Gateway Instructions,Remote Work Access Overview for Palmetto Employees,Palmetto Health Telecommuting Access Gu - Maintaining updated software is vital for security purposes while using MyAccess.