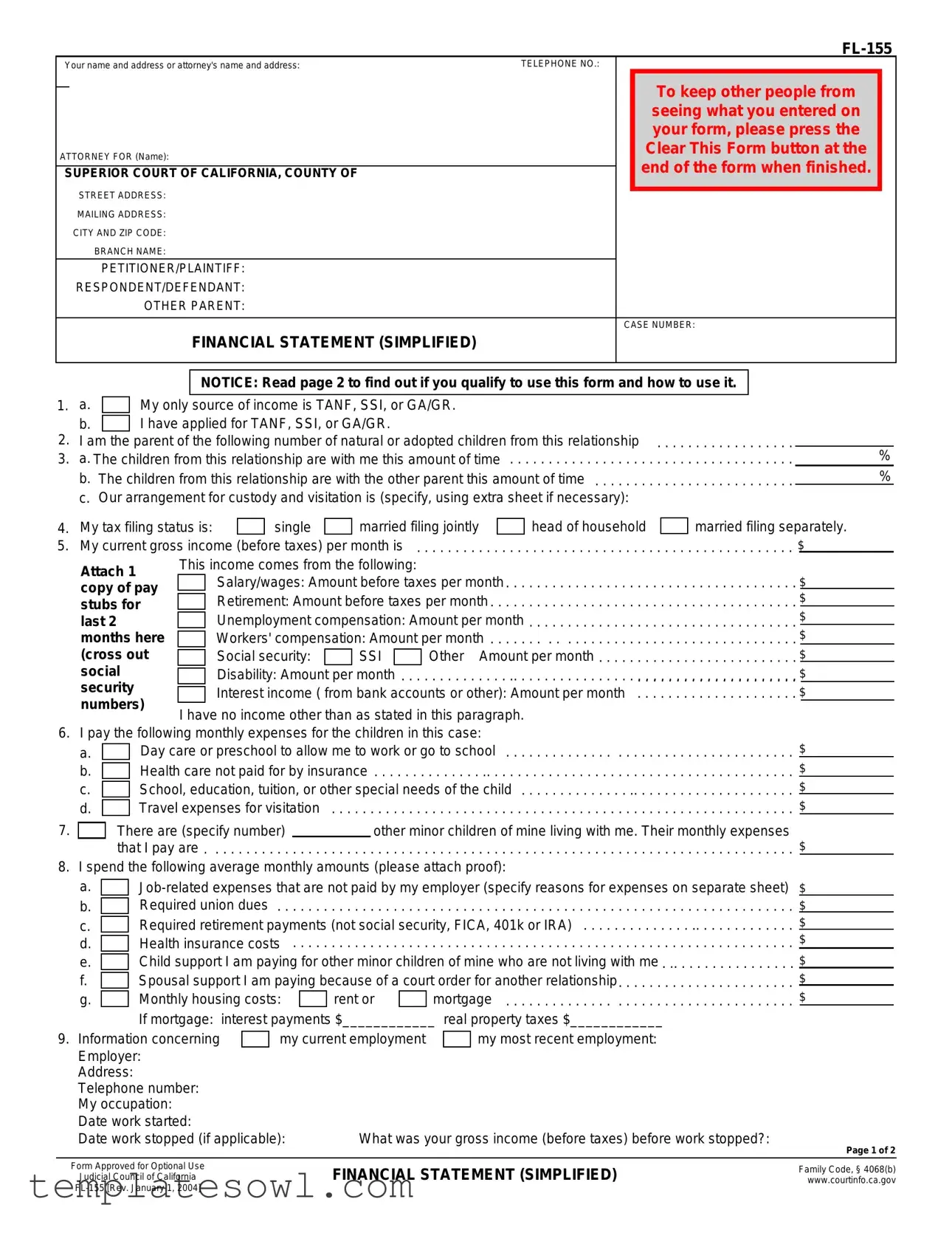

Fill Out Your Fl 155 Form

The FL 155 form serves as a vital tool within the California family law framework, aimed at simplifying the financial documentation process for individuals navigating child support and custody arrangements. This form is officially recognized as a Financial Statement (Simplified) and is primarily used by parties with relatively uncomplicated financial situations. It allows parents to present their income, expenses, and other relevant financial information clearly and concisely, facilitating a more efficient review by the court. The form prompts users to disclose essential details such as income sources, custody arrangements, and monthly expenditures related to children. Additionally, filling out this form properly ensures compliance with legal standards while preserving the privacy of sensitive information. It serves both parents, helping to construct fair financial arrangements that reflect each party’s economic reality. However, to use the FL 155 form, individuals must first meet specific eligibility criteria; for instance, applicants receiving certain types of public assistance, such as TANF, SSI, or GA/GR, may find this form particularly applicable. The simplicity of the FL 155 form is intended to alleviate some of the complexities associated with the legal process and provides a straightforward path for fulfilling obligations to the court regarding financial disclosures.

Fl 155 Example

Your name and address or attorney's name and address: |

TELEPHONE NO.: |

FOR COURT USE ONLY |

|

|

|

To keep other people from |

|

|

|

|

||||

|

|

|

seeing what you entered on |

|

|

|

|

|

your form, please press the |

|

|

ATTORNEY FOR (Name): |

|

Clear This Form button at the |

|

||

|

end of the form when finished. |

|

|||

|

|

|

|

||

SUPERIOR COURT OF CALIFORNIA, COUNTY OF |

|||||

|

|

|

|||

|

STREET ADDRESS: |

|

|

|

|

|

|

|

|

||

|

MAILING ADDRESS: |

|

|

|

|

|

CITY AND ZIP CODE: |

|

|

|

|

|

BRANCH NAME: |

|

|

|

|

|

PETITIONER/PLAINTIFF: |

|

|

|

|

|

RESPONDENT/DEFENDANT: |

|

|

|

|

|

OTHER PARENT: |

|

|

|

|

|

|

|

|

|

|

|

|

CASE NUMBER: |

|||

|

FINANCIAL STATEMENT (SIMPLIFIED) |

|

|

|

|

NOTICE: Read page 2 to find out if you qualify to use this form and how to use it.

1. |

a. |

|

|

My only source of income is TANF, SSI, or GA/GR. |

|

|

|

|

|

|

|

|||||||||||||||||||||||

|

|

|

|

|

|

I have applied for TANF, SSI, or GA/GR. |

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||

|

b. |

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||

2. |

I am the parent of the following number of natural or adopted children from this relationship |

|

||||||||||||||||||||||||||||||||

3. a. The children from this relationship are with me this amount of time |

. . |

. . . . . . . . . . . . . . . . . . |

|

. . . |

|

. . . . . . . . . . . . . . |

|

|||||||||||||||||||||||||||

|

b. The children from this relationship are with the other parent this amount of time |

|

||||||||||||||||||||||||||||||||

|

c. Our arrangement for custody and visitation is (specify, using extra sheet if necessary): |

|

|

|||||||||||||||||||||||||||||||

4. My tax filing status is: |

|

|

|

|

single |

|

|

married filing jointly |

|

|

head of household |

|

|

|

married filing separately. |

|||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||

5. |

My current gross income (before taxes) per month is . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ |

|||||||||||||||||||||||||||||||||

|

Attach 1 |

|

This income comes from the following: |

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||

|

|

|

|

Salary/wages: Amount before taxes per month |

|

|

|

|

|

|

$ |

|||||||||||||||||||||||

|

copy of pay |

|

|

. . . . . . . . . . . . . . . . . |

. |

. . . |

|

. . . . . . . . . . . . . . |

||||||||||||||||||||||||||

|

|

|

Retirement: Amount before taxes per month |

|

|

|

|

|

|

$ |

||||||||||||||||||||||||

|

stubs for |

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||

|

|

|

. . . . . . . . . . . . . . . . . |

. |

. . . |

|

. . . . . . . . . . . . . . |

$ |

||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||||

|

last 2 |

|

|

|

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .Unemployment compensation: Amount per month |

|||||||||||||||||||||||||||||

|

months here |

|

|

Workers' compensation: Amount per month |

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ |

|||||||||||||||||||||||||||||

|

|

|

||||||||||||||||||||||||||||||||

|

(cross out |

|

|

Social security: |

|

|

|

SSI |

|

|

|

Other Amount per month |

|

$ |

||||||||||||||||||||

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||||

|

social |

|

|

|

Disability: Amount per month . . . . . . . . . . . . . . .. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ |

|||||||||||||||||||||||||||||

|

|

|

|

|||||||||||||||||||||||||||||||

|

security |

|

|

|

Interest income ( from bank accounts or other): Amount per month |

|

$ |

|||||||||||||||||||||||||||

|

|

|

|

|

||||||||||||||||||||||||||||||

|

numbers) |

|

|

|||||||||||||||||||||||||||||||

|

I have no income other than as stated in this paragraph. |

|

|

|||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||||

6. I pay the following monthly expenses for the children in this case: |

|

|

|

|

|

|

|

|||||||||||||||||||||||||||

|

a. |

|

|

|

Day care or preschool to allow me to work or go to school |

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ |

||||||||||||||||||||||||||||

|

|

|

|

|||||||||||||||||||||||||||||||

|

|

|

|

|

Health care not paid for by insurance |

|

|

|

|

|

|

|

|

|

|

$ |

||||||||||||||||||

|

b. |

|

|

|

. . . . |

. .. . |

. . . |

. . . . . . . . . . . . . . . . . . |

|

. . . |

|

. . . . . . . . . . . . . . |

||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

$ |

|||||||||||||||

|

c. |

|

|

|

. . . . . . . . . . . . . . .. . . . . . . . . . . . . . . . . . . . .School, education, tuition, or other special needs of the child |

|||||||||||||||||||||||||||||

|

|

|

|

|

Travel expenses for visitation |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

$ |

|||||||||||

|

d. |

|

|

|

|

. . . |

. . . |

. . . |

|

. . . |

. |

. . |

. . . |

. . . . |

. . . |

. . . . . . . . . . . . . . . . . . |

|

. . . |

|

. . . . . . . . . . . . . . |

||||||||||||||

7. |

|

|

|

There are (specify number) |

|

|

|

|

other minor children of mine living with me. Their monthly expenses |

|

||||||||||||||||||||||||

|

|

|

|

|

|

|

||||||||||||||||||||||||||||

|

|

|

|

that I pay are |

$ |

|||||||||||||||||||||||||||||

|

|

|

|

|||||||||||||||||||||||||||||||

8. I spend the following average monthly amounts (please attach proof): |

|

|

|

|

|

|

|

|||||||||||||||||||||||||||

|

a. |

|

|

$ |

||||||||||||||||||||||||||||||

|

|

|

|

|

||||||||||||||||||||||||||||||

|

|

Required union dues |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||

|

b. |

|

|

|

|

. . |

. |

. . . . |

|

|

. . . |

. . . |

. . . |

|

. . . |

. |

. . |

. . . |

. . . . |

. . . |

. . . . . . . . . . . . . . . . . . |

|

. . . |

|

. . . . . . . . . . . . . . |

$ |

||||||||

|

|

Required retirement payments (not social security, FICA, 401k or IRA) |

|

$ |

||||||||||||||||||||||||||||||

|

c. |

|

|

|

|

|||||||||||||||||||||||||||||

|

d. |

|

|

|

|

. . . . .Health insurance costs |

|

. . . |

. . . |

. . . |

|

. . . |

. |

. . |

. . . |

. . . . |

. |

. . |

. . . . . . . . . . . . . . . . . . |

|

. . . |

. |

. . . . . . . . . . . . . |

$ |

||||||||||

|

|

Child support I am paying for other minor children of mine who are not living with me |

|

$ |

||||||||||||||||||||||||||||||

|

e. |

|

|

|

|

. . . . . . . . . . . . . . |

||||||||||||||||||||||||||||

|

f. |

|

|

|

|

Spousal support I am paying because of a court order for another relationship. . . . . . . . . . . . . . . . . . . . . . . $ |

||||||||||||||||||||||||||||

|

|

Monthly housing costs: |

|

|

rent or |

|

mortgage |

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ |

||||||||||||||||||||||||||

|

g. |

|

|

|

|

|

|

|||||||||||||||||||||||||||

|

|

|

|

|

|

If mortgage: interest payments $____________ real property taxes $____________ |

|

|

||||||||||||||||||||||||||

9. |

Information concerning |

|

my current employment |

|

|

my most recent employment: |

|

|

||||||||||||||||||||||||||

|

|

|

|

|

||||||||||||||||||||||||||||||

|

Employer: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

|

Address: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

Telephone number: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

|

My occupation: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

|

Date work started: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

|

Date work stopped (if applicable): |

|

|

What was your gross income (before taxes) before work stopped?: |

|

|||||||||||||||||||||||||||||

%

%

Page 1 of 2

Form Approved for Optional Use

Judicial Council of California

FINANCIAL STATEMENT (SIMPLIFIED)

Family Code, § 4068(b)

www.courtinfo.ca.gov

PETITIONER/PLAINTIFF: |

CASE NUMBER: |

RESPONDENT/DEFENDANT:

OTHER PARENT:

10. My estimate of the other party's gross monthly income(before taxes) is . . . . . . . . . . . . . . .. . . . . . . . . . . . . . . . . . . . $ 11. My current spouse's monthly income(before taxes) is . . . . . . . . . . . . . . . . . . . . . . . . . . . . .. . . . . . . . . . . . . . . . . . . . $ 12. Other information I want the court to know concerning child support in my case (attach extra sheet with the information).

13.

I am attaching a copy of page 3 of form

I declare under penalty of perjury under the laws of the State of California that the information contained on all pages of this form and any attachments is true and correct.

Date:

(TYPE OR PRINT NAME) |

(SIGNATURE OF DECLARANT) |

PETITIONER/PLAINTIFF

RESPONDENT/DEFENDANT

INSTRUCTIONS

Step 1: Are you eligible to use this form? If your answer is YES to any of the following questions, you may NOT use this form:

•Are you asking for spousal support (alimony) or a change in spousal support?

•Is your spouse or former spouse asking for spousal support (alimony) or a change in spousal support?

•Are you asking the other party to pay your attorney fees?

•Is the other party asking you to pay his or her attorney fees?

•Do you receive money (income) from any source other than the following?

• Welfare (such as TANF, GR, or GA)

• Salary or wages

• Disability

• Unemployment

• Are you

If you are eligible to use this form and choose to do so, you do not need to complete the Income and Expense Declaration (form

Step 2: Make 2 copies of each of your pay stubs for the last two months. If you received money from other than wages or salary, include copies of the pay stub received with that money.

Privacy notice: If you wish, you may cross out your social security number if it appears on the pay stub, other payment notice or your tax return

Step 3: Make 2 copies of your most recent federal income tax form.

Step 4: Complete this form with the required information. Type the form if possible or complete it neatly and clearly in black ink. If you need additional room, please use plain or lined paper,

Step 5: Make 2 copies of each side of this completed form and any attached pages.

Step 6: Serve a copy on the other party. Have someone other than yourself mail to the attorney for the other party, the other party, and the local child support agency, if they are handling the case, 1 copy of this form, 1 copy of each of your stubs for the last two months, and 1 copy of your most recent federal income tax return.

Step 7: File the original with the court. Staple this form with 1 copy of each of your pay stubs for the last two months. Take this document and give it to the clerk of the court. Check with your local court about how to submit your return.

Step 8: Keep the remaining copies of the documents for your file.

Step 9: Take the copy of your latest federal income tax return to the court hearing.

It is very important that you attend the hearings scheduled for this case. If you do not attend a hearing, the court may make an order without considering the information you want the court to consider.

FINANCIAL STATEMENT (SIMPLIFIED) |

|||

|

|||

|

|

|

|

For your protection and privacy, please press the Clear This Form |

|

|

|

|

Save This Form |

||

button after you have printed the form. |

|

||

|

|

|

|

Print This Form

Page 2 of 2

Clear This Form

Form Characteristics

| Fact Name | Description |

|---|---|

| Purpose | The FL-155 form is used to provide a simplified financial statement for family law cases, such as child support and custody determinations. |

| Governing Law | This form is governed by California Family Code, § 4068(b). |

| Eligibility | Not everyone can use this form. Individuals must not be seeking spousal support or have other complex financial situations. |

| Income Reporting | Users must report all sources of income, including TANF, SSI, and wages, clearly detailing each source. |

| Monthly Expenses | Monthly expenses for children, job-related costs, and housing should be listed, along with any documented proof. |

| Attachments | It is important to attach copies of pay stubs and recent tax returns when submitting the form. |

| Filing Instructions | After completing the form, file it with the court and serve copies to the other party and applicable agencies. |

Guidelines on Utilizing Fl 155

Filling out the FL-155 form is an essential step in the process of presenting your financial situation to the court. After you complete the form, you'll need to ensure that copies are served to the other party and filed with the court properly. Following the outlined steps will help you submit your information correctly and promptly, minimizing any potential delays in your case.

- Determine your eligibility to use this form. If you are requesting spousal support or have other income sources besides welfare, salary, or disability, you may not be eligible.

- Make two copies of each of your pay stubs from the last two months. If you received any other income, include those documents too.

- Make two copies of your latest federal income tax form.

- Fill out the FL-155 form with accurate information. It is preferable to type the form, but if you write it, do so neatly and clearly using black ink. If additional space is needed, attach plain or lined paper.

- Prepare two copies of the completed form and any attachments.

- Serve a copy of the form to the other party. Have someone other than you mail copies to the attorney representing the other party and the local child support agency, if applicable.

- File the original form with the court, along with one copy of each of your pay stubs. Consult your local court about filing procedures.

- Keep the remaining copies for your records.

- Bring a copy of your latest federal income tax return to the court hearing. Attendance at hearings is critical, as the court may make decisions without considering your information if you do not appear.

What You Should Know About This Form

What is the FL-155 form used for?

The FL-155 form is a Financial Statement (Simplified) used in family law cases. It helps the court assess a party's financial situation, particularly in matters related to child support. This form is specifically designed for those with simpler financial circumstances, allowing them to provide essential information without overwhelming detail.

Who qualifies to use the FL-155 form?

To qualify for the FL-155, you must answer "no" to specific questions regarding spousal support, attorney fees, or other complex income sources. If your only income comes from certain public assistance programs, salary, wages, or unemployment benefits, you may qualify. If your financial situation is more complex, consider using the longer Income and Expense Declaration (form FL-150).

What information is required on the FL-155 form?

The FL-155 form requires details about your income, monthly expenses, and custody arrangements for any children from the relationship. You'll need to provide your gross monthly income, your tax filing status, and any additional financial responsibilities you have, like child support for other children or spousal support from a previous relationship.

How do I file the FL-155 form?

After completing the FL-155 form, make two copies for your records. You must serve a copy to the other party involved in the case and file the original with the court. Make sure to include copies of your most recent pay stubs and tax return when you file. It’s crucial to attend any scheduled hearings, as failure to do so may result in the court making decisions without your input.

What should I do if my financial situation changes after completing the FL-155 form?

If your financial circumstances change after submitting the FL-155 form, you should inform the court as soon as possible. You may need to file an updated form to reflect your new financial situation. Keeping the court informed ensures that child support obligations are based on accurate and current information.

Common mistakes

Filling out the FL-155 form, also known as the Financial Statement (Simplified), can be a detailed process that often leads to errors. One common mistake is not providing complete personal information. It is crucial to include your name, address, and contact details accurately. Missing or incorrect details can delay your case or result in the return of the form.

Another frequent issue arises from misunderstanding the eligibility requirements. People sometimes complete this form even when they do not qualify based on the criteria listed, such as in cases involving spousal support. Ensure you read and comprehend the eligibility questions thoroughly to avoid this pitfall.

A third mistake involves underestimating reported income. Many individuals may inaccurately state their gross monthly income by either omitting sources of income or providing outdated figures. It's important to gather all necessary documentation and state your income truthfully to present an accurate financial snapshot.

Neglecting to account for tax implications can also lead to significant discrepancies. Some applicants do not calculate their gross income before taxes correctly. This oversight may lead to undervaluation or misrepresentation of financial obligations. Accurate figures are essential for the court to assess your circumstances.

Individuals frequently overlook the requirement to attach proof of income and expenses. Failing to include copies of pay stubs, tax returns, or other relevant documentation can weaken your case. These attachments provide necessary support for the statements made in the form.

Many people also make the mistake of not updating their information. Seasons change, and so do financial situations. If there have been changes in employment, child custody, or expenses since the last submission, those changes must be reflected on the current form.

Providing incomplete or incorrect expense details is another common error. Not listing all monthly expenses related to children or neglecting to describe job-related costs can lead to misunderstanding your financial obligations. All relevant expenses should be specified to present a complete picture.

Some individuals fail to sign and date the form. It seems straightforward, yet a missing signature can render the form invalid. Always double-check the final details before submission to avoid unnecessary delays.

Lastly, many applicants do not keep copies of the completed form and all attachments for their records. Retaining a personal copy can be beneficial for future reference or if questions arise about your financial disclosure.

By being aware of these common mistakes when filling out the FL-155 form, individuals can improve their chances of a smoother process. Ensuring accuracy and completeness in each section will help facilitate a fair assessment by the court.

Documents used along the form

When completing the FL-155 form, several other documents may also be required to support your financial disclosures. These documents provide further details relevant to your financial situation and are often necessary for a complete assessment by the court.

- FL-150: Income and Expense Declaration - This form provides a detailed overview of your income, expenses, and financial obligations. It is used for cases where spousal support is requested or if there has been a change in support payments.

- FL-142: Declaration of Disclosure - This document discloses your financial status and is typically involved in divorce proceedings. It is essential for outlining assets, debts, and other financial interests.

- FL-140: Spousal or Partner Support Declaration - This form is used to request spousal or domestic partner support. It includes income information and outlines proposed support arrangements.

- Pay Stubs and Tax Returns - Recent pay stubs and copies of tax returns are usually required to substantiate your income claims. They provide evidence of earnings and are important for financial evaluations.

These documents collectively ensure a comprehensive view of your financial circumstances, aiding the court in making informed decisions regarding support and custody. Prepare these forms carefully to reflect accurate information throughout your case.

Similar forms

FL-150 Income and Expense Declaration: This form provides a comprehensive account of an individual's financial situation, including detailed income and expenses. While FL-155 is a simplified version, FL-150 asks for more extensive documentation and elaboration on financial circumstances.

FL-145 Request for Order: This document is used to formally request the court to order a specific action, such as child support or spousal support. Similar to FL-155, it may require disclosure of financial information but tends to focus more on the request rather than detailed financial reporting.

FL-160 Spousal or Partner Support Declaration: This form is specifically meant for outlining financial situations related to spousal support, similar to how FL-155 deals with child-related financial disclosures. Both require the disclosure of income and financial obligations.

FL-120 Summons: While primarily used to notify parties of a legal action, this form can also hint at the need for financial documentation in certain cases, making it similar in purpose to FL-155 concerning the disclosure expectations in family law cases.

FL-140 Declaration of Disclosure: This document requires parties to provide financial information and ensures transparency in financial matters in family law cases. It shares the objective of FL-155 in emphasizing the importance of complete and honest financial representation.

FL-130 Declaration of Disclosure (Preliminary): This form is often required early in family law proceedings, mirroring FL-155 in gathering essential financial data. Both emphasize the importance of sharing accurate financial details for fair resolution.

FL-145 Child Support Case Registry Form: Similar in function, this form registers child support cases and may inquire about financial situations. It collaborates with FL-155 to ensure that the court has necessary financial information related to child support obligations.

Dos and Don'ts

When completing the FL-155 form, it is essential to be mindful of certain practices that can help ensure accuracy and compliance. Here is a list of recommended actions and mistakes to avoid:

- Do ensure all information is filled out completely. Missing details can lead to delays or complications.

- Do carefully review eligibility criteria to confirm you qualify to use this form.

- Do maintain copies of all documents submitted. Keeping records is crucial for future reference.

- Do use clear and legible handwriting or type your responses to avoid confusion.

- Do include any necessary supporting documentation, such as pay stubs and tax forms.

- Don’t leave any sections blank. If a section does not apply, indicate that with "N/A."

- Don’t use red or colored ink; black ink or typed responses are preferred for clarity.

- Don’t forget to sign and date the form before submission. Without your signature, the form is incomplete.

- Don’t submit the form without keeping copies for yourself. You will need them for your records.

- Don’t share the completed form with unauthorized individuals to protect your personal information.

Misconceptions

Misconceptions surrounding the FL 155 form can lead to confusion and misinformation about its purpose and use. Here are five common misconceptions, clarified for better understanding.

- All Parents Must Use the FL 155 Form. This form is specifically designated for individuals who do not have significant financial complexity. If one is asking for spousal support or has income beyond certain sources, other forms may be required.

- The FL 155 Form Eliminates the Need for Other Documentation. While the FL 155 is a simplified financial statement, users still must provide additional documentation, such as pay stubs and income tax returns, to substantiate the claims made on the form.

- Filing the FL 155 Form Alone Resolves Child Support Issues. Submitting the FL 155 does not automatically settle child support matters. The information must be reviewed by the court, and attendance at hearings is necessary for obtaining a final decision.

- All Information on the FL 155 Is Publicly Accessible. There are privacy measures in place, enabling users to protect sensitive information. Reportedly, individuals can cross out personal identifiers like Social Security numbers on certain attached documents.

- Once Filed, the FL 155 Form Cannot Be Change. Users retain the ability to amend the information provided on the form if circumstances change. Inconsistencies may arise, and it’s crucial to keep the court informed of any updates to financial status.

Understanding these misconceptions empowers individuals to approach the FL 155 form with clarity, ensuring they fully comply with legal requirements and protect their rights within the family court system.

Key takeaways

Understanding the FL-155 Form is crucial for anyone navigating financial disclosures in court related to child support and custody issues. Here are key takeaways to consider:

- Eligibility is essential. Before filling out the FL-155, ensure you qualify. If you are seeking spousal support or have other income sources, this form may not be for you.

- Use clear language. Type your answers if possible or write neatly in black ink to avoid any confusion.

- Gather necessary documents. Have your recent pay stubs, tax returns, and proof of additional income ready.

- Financial details matter. Be prepared to detail your income, expenses, and child care costs accurately. This includes mandatory fields like monthly gross income and child-related expenses.

- Keep it private. After completing the form, press the “Clear This Form” button to protect your information from unauthorized viewing.

- Follow the right steps. Make copies of everything — the form, your pay stubs, and tax returns. File the original with the court and serve copies to all parties involved.

- Attend all hearings. Your presence is vital. If you miss a hearing, the court may issue orders without considering your input.

- Use attachments wisely. If you need to provide additional information, do so on separate sheets. Make sure to reference them appropriately in the main form.

- Review before submission. Double-check your entries to ensure they are accurate. Errors or omissions could affect your case adversely.

By following these guidelines, you can effectively use the FL-155 form to convey your financial situation to the court. Proper preparation is key to advocating successfully for your and your children's needs.

Browse Other Templates

Cinetopia Job Application,Cinetopia Employment Request,Cinetopia Candidate Submission,Cinetopia Hiring Form,Cinetopia Employment Inquiry,Cinetopia Position Application,Cinetopia Job Inquiry Form,Cinetopia Career Application,Cinetopia Recruitment Form - Confirm if you graduated from high school.

SNHU Educational Record Release Form,Authorization for Privacy Waiver,Student Information Disclosure Authorization,SNHU FERPA Rights Waiver,Confidential Information Consent Form,Academic Records Release Agreement,Information Release Authorization For - Include your full name as it appears in university records.

How to Make Fake Abortion Papers - Documenting informed consent is essential for legal protection.