Fill Out Your Fl 421 Form

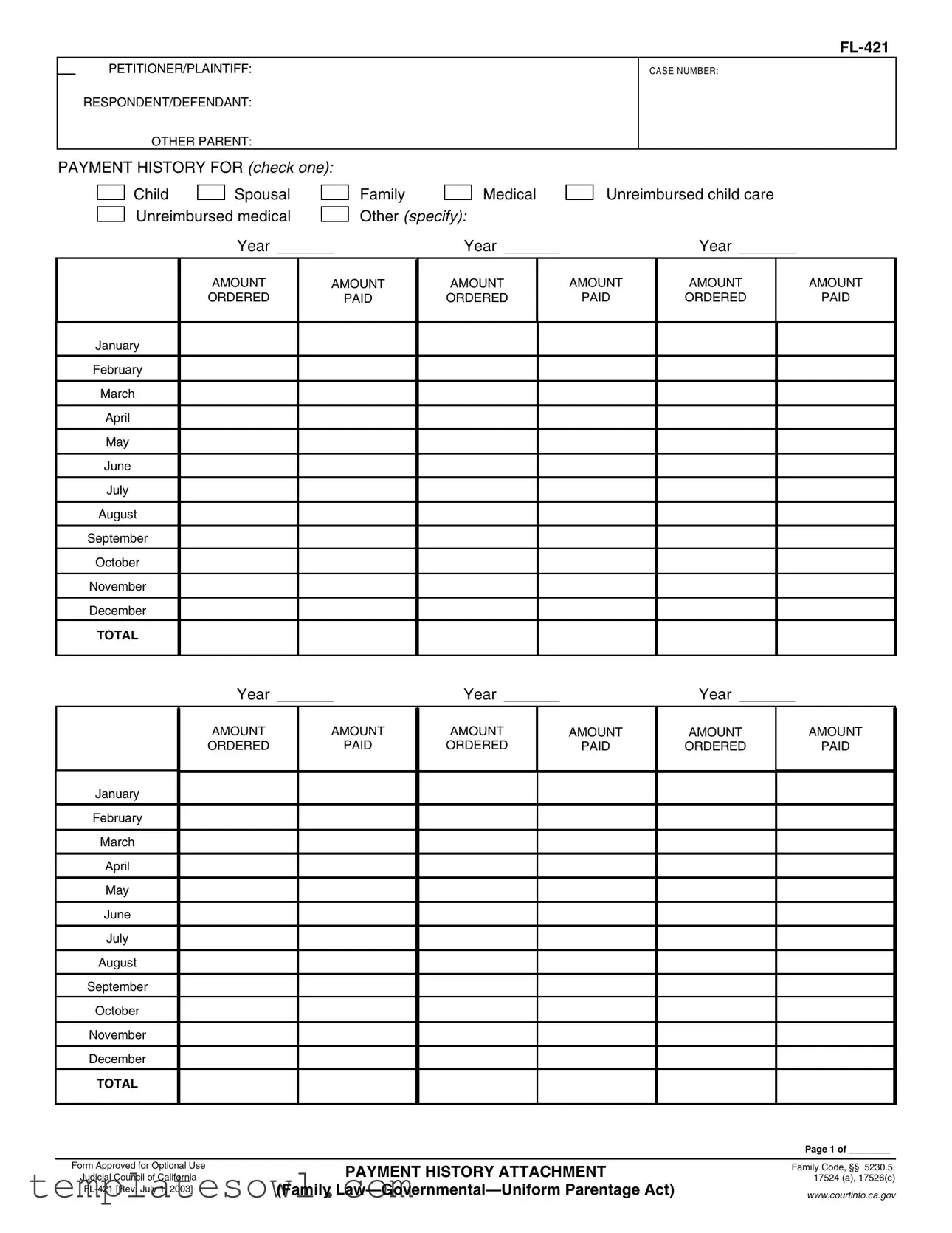

The FL 421 form, commonly known as the Payment History Attachment, plays a significant role in family law cases involving child or spousal support. Its primary purpose is to provide a detailed account of payments made or required over a specified period. It requires users to indicate crucial information such as the case number, names of the petitioner and respondent, and the type of payment history being documented, whether for child support, spousal support, or unreimbursed medical expenses. Each year must be clearly listed alongside the amounts ordered and paid on a monthly basis. The form includes a structured format for submitting payment records, encouraging the attachment of necessary supporting documents, such as bills or receipts, to substantiate the claims. Accurately completing this form can help ensure that all financial obligations are transparent and acknowledged by the relevant parties and the court. Additionally, users must follow specific instructions, such as itemizing expenses and ensuring that each entry is correctly documented. These requirements encourage organization and clarity, facilitating a smoother process during any hearings or discussions related to support payments.

Fl 421 Example

PETITIONER/PLAINTIFF:

RESPONDENT/DEFENDANT:

OTHER PARENT:

CASE NUMBER:

PAYMENT HISTORY FOR (check one):

Child  Spousal Unreimbursed medical

Spousal Unreimbursed medical

Year

FamilyMedical

Other (specify):

Year

Unreimbursed child care

Year

|

AMOUNT |

AMOUNT |

AMOUNT |

AMOUNT |

AMOUNT |

AMOUNT |

|

ORDERED |

PAID |

ORDERED |

PAID |

ORDERED |

PAID |

|

|

|

|

|

|

|

January

February

March

April

May

June

July

August

September

October

November

December

TOTAL

|

Year |

|

|

Year |

|

|

Year |

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

AMOUNT |

AMOUNT |

AMOUNT |

|

AMOUNT |

AMOUNT |

|

AMOUNT |

||||

|

ORDERED |

|

PAID |

ORDERED |

|

PAID |

ORDERED |

|

PAID |

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

January

February

March

April

May

June

July

August

September

October

November

December

TOTAL

Page 1 of ________

Form Approved for Optional Use

Judicial Council of California

PAYMENT HISTORY ATTACHMENT

(Family

Family Code, §§ 5230.5, 17524 (a), 17526(c)

www.courtinfo.ca.gov

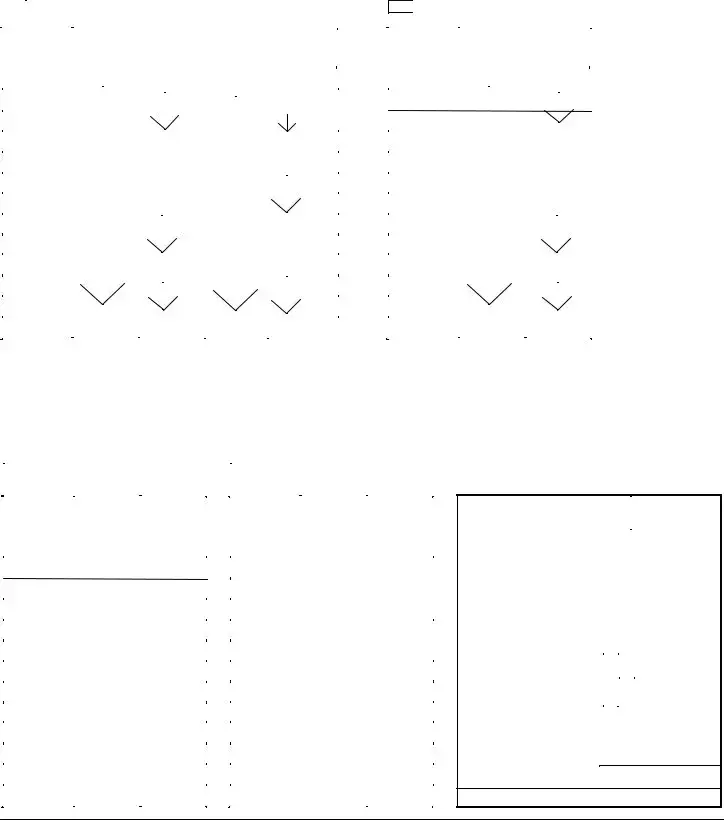

INSTRUCTIONS FOR COMPLETING PAYMENT RECORD

You must complete a separate Payment History Attachment form for each type of support paid. Enter the year, list the amount ordered, and the amount paid for each month during that year. If the amounts repeat in a column, you can use an arrow as shown in the example below. Add the amounts in each column to get the yearly totals. Enter the totals at the bottom.

Attach additional sheets and supporting documents (bills, receipts, and other proof of expense) as necessary.

|

x |

|

Child |

Year |

2000 |

|

|

Year |

2001 |

|

|||

|

|

|

|

|

|

||||||||

|

|

|

|

|

|

|

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

AMOUNT |

|

AMOUNT |

AMOUNT |

AMOUNT |

|||||

|

|

|

|

ORDERED |

|

PAID |

ORDERED |

|

PAID |

||||

|

|

|

|

|

|

|

|

|

|

||||

|

January |

100 |

|

0 |

100 |

100 |

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|||

|

February |

|

|

|

|

|

|

|

0 |

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

March |

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

April |

|

|

|

100 |

|

|

100 |

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

May |

|

|

|

100 |

|

|

0 |

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

June |

|

|

|

100 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

July |

|

|

|

0 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

August |

|

|

|

|

|

|

|

100 |

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

September |

|

|

|

|

|

|

|

100 |

|

|||

|

October |

|

|

|

100 |

|

|

0 |

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

November |

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

December |

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

TOTAL |

1,200 |

|

600 |

1,200 |

400 |

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

x

Spousal

Spousal

|

AMOUNT |

AMOUNT |

||

|

ORDERED |

PAID |

||

|

|

|

||

January |

100 |

0 |

||

|

|

|

|

|

February |

|

|

|

|

March |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

April |

|

|

100 |

|

|

|

|

|

|

May |

|

|

100 |

|

|

|

|

|

|

June |

|

|

100 |

|

|

|

|

|

|

July |

|

|

0 |

|

|

|

|

|

|

August |

|

|

|

|

|

|

|

|

|

September |

|

|

|

|

October |

|

|

100 |

|

|

|

|

|

|

November |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

December |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

TOTAL |

1,200 |

600 |

||

|

|

|

|

|

UNREIMBURSED CHILD CARE, MEDICAL, OR OTHER EXPENSES:

You must complete a separate Payment History Attachment form for each type of unreimbursed expense. If you have more than one bill, receipt, and other proof of expense per month use an additional declaration page (form

other proof of expense in chronological order for each month; and 5.) enter the total bills, receipts, and other proof of expense for each month. If your court order did not state a specific due date for reimbursement, then include that amount in the month that the expense was incurred.

|

|

Unreimbursed child care expenses |

|

Unreimbursed medical expenses |

||||||||||

|

x |

x |

||||||||||||

|

|

|

Year |

2001 |

|

|

|

|

|

Year |

2001 |

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

AMOUNT |

|

AMOUNT |

|

|

|

|

AMOUNT |

|

AMOUNT |

||

|

|

|

ORDERED |

|

PAID |

|

|

|

ORDERED |

|

PAID |

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

January |

50% ($200) |

|

0 |

|

|

January |

50% ($200) |

|

0 |

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

February |

50% ($200) |

|

100 |

|

|

February |

|

|

|

|

|||

|

|

50% ($200) |

|

|

|

|

|

|

|

|

|

|||

|

March |

|

0 |

|

|

March |

50% ($200) |

|

0 |

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

April |

50% ($200) |

|

50 |

|

|

|

April |

50% ($75) |

|

0 |

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

May |

|

|

|

|

|

|

|

May |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

June |

|

|

|

|

|

|

|

June |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

July |

|

|

|

|

|

|

|

July |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

August |

|

|

|

|

|

|

August |

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

September |

|

|

|

|

|

|

September |

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

October |

|

|

|

|

|

|

October |

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

November |

|

|

|

|

|

|

November |

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

December |

|

|

|

|

|

|

December |

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

TOTAL |

$400 |

|

150 |

|

|

TOTAL |

$237.50 |

|

0 |

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Form

Petitioner/Plaintiff |

CASE NUMBER |

|

|

Defendant/Respondent |

|

I request reimbursement for 50% of these expenses, which are supported by copies of bills, receipts, and other proof of expense.

01/04/01 |

Dr. Adams |

$45.00 |

Exhibit A |

||||

01/08/01 |

Dr. Lee, D.D.S. |

$155.00 |

Exhibit B |

||||

02/15/01 |

AB |

$200.00 |

Exhibit C |

||||

04/26/01 |

Kids Therapy |

$75.00 |

Exhibit D |

||||

Child care expenses: |

|

|

|

|

|

|

|

01/02 |

ABC School |

50% ($200) |

|

|

|

|

|

02/02 |

ABC School |

50% ($200) |

|

|

Exhibit E |

|

|

03/02 |

ABC School |

50% ($200) |

|

|

|

||

|

|

|

|

||||

04/02 |

ABC School |

50% ($200) |

|

|

|

|

|

|

|

|

|

|

|

|

|

I declare under penalty of perjury under the laws of the State of California that the foregoing is true and correct.

. . . . . . . . . . . . . . . . . . . . . . . . . . . |

|

(TYPE OR PRINT NAME) |

(SIGNATURE OF DECLARANT) |

Form

PAYMENT HISTORY ATTACHMENT

(Family

Form Characteristics

| Fact Name | Description |

|---|---|

| Purpose | The FL-421 form serves as a record of payment history for child support, spousal support, and other related expenses, ensuring transparency and accountability in financial obligations. |

| Governing Laws | This form is governed by California Family Code sections 5230.5, 17524(a), and 17526(c), which dictate the requirements for reporting financial support obligations. |

| Sections | The form includes multiple sections for detailing amounts ordered and paid across various months. It requires separate entries for each type of payment, such as child support or unreimbursed medical expenses. |

| Yearly Totals | Yearly totals are calculated at the end of each section based on the monthly payments documented in the form, allowing for clear visibility into overall payment patterns. |

| Documentation | Participants must attach supporting documents for every claimed expense. Receipts, bills, and proof of payments need to be included and properly annotated for reference. |

| Filing Instructions | A completed FL-421 form must be submitted as part of any family law case involving financial obligations. Additionally, individuals are encouraged to seek guidance if unsure about any specific requirements related to the form. |

Guidelines on Utilizing Fl 421

Filling out the FL-421 form is an essential task that requires attention to detail. After gathering all necessary information regarding payments and expenses, you will be ready to proceed with completing this form. Ensure you have documents like bills and receipts available, as these will help support your entries. It's crucial to maintain accurate records for each type of support paid or owed, as this will assist you in both understanding your obligations and presenting your case effectively.

- Identify the type of support: Check the appropriate box for Child, Spousal, Unreimbursed medical, Unreimbursed child care, or Other.

- Fill in the year: Write the year for which you are providing the payment history.

- Detail monthly amounts: For each month from January to December, enter the amount that was ordered and the amount that was paid. If the same amount applies for multiple months, you can use an arrow to indicate this.

- Calculate totals: At the end of each year’s section, add up the total amounts for the ordered and paid columns, and write these totals in the designated spots.

- Attach supporting documentation: Gather all relevant documents evidencing the payments, such as receipts and bills. Attach them to the FL-421 form.

- Fill in the case information: Clearly write the names of the Petitioner/Plaintiff, Respondent/Defendant, Other Parent, and the Case Number at the top of the form.

- Sign and date the form: Finally, ensure to sign and date the form to make it official and complete.

Those steps will guide you through the process of filling out the FL-421 form accurately and efficiently. Being thorough and organized during this process is key to presenting a clear account of your payment history.

What You Should Know About This Form

What is the purpose of the FL 421 form?

The FL 421 form, also known as the Payment History Attachment, is designed to track and document payments made for various types of support obligations, including child support, spousal support, and unreimbursed expenses related to medical or childcare. This form assists courts in reviewing payment history and ensuring compliance with support orders.

How do I complete the FL 421 form?

To complete the FL 421 form, you need to provide a year-by-year account of amounts ordered and amounts actually paid for the support type you are documenting. You should enter the amounts for each month, calculating and entering total amounts for the year at the bottom of the form. If there are recurring amounts, you may use an arrow to indicate this for simplicity. Make sure to attach any supporting documents, such as receipts or bills, to substantiate the payment history.

Do I need to submit multiple FL 421 forms?

Yes, you must submit a separate FL 421 form for each type of support or unreimbursed expense. For instance, if you are documenting both child support and spousal support payments, you will need to complete two distinct forms. This separation helps the court clearly understand each distinct payment history.

What happens if I have more than one bill for a month?

If you have multiple bills or receipts for a particular month, you should list each expense itemized on an additional declaration page (Form MC-031) or a separate page. Attach these documents to the FL 421 form, marking each with an exhibit number for clear reference. This approach provides the court with comprehensive information on each expense incurred.

What if my court order does not specify due dates for reimbursements?

In cases where the court order does not specify a reimbursement due date, you should include the expenses in the month they were actually incurred. This means you will document the costs in the month they appear on your invoices or receipts, ensuring that all expenses are accurately represented on the FL 421 form.

Is it necessary to declare under penalty of perjury?

Yes, when you complete the FL 421 form, you must declare under penalty of perjury that the information provided is true and correct. This statement, which includes your printed name and signature, affirms to the court the accuracy of the financial details you have reported, contributing to the overall integrity of the legal process.

Common mistakes

Completing the FL-421 form can be straightforward, yet many people make mistakes that can lead to delays or complications in processing. One common error is failing to include all required amounts in the payment history section. When listing the ordered and paid amounts for each month, individuals often overlook adding the total amounts at the end of each section. This oversight can create confusion and might result in administrative issues.

Another frequent mistake is not using separate Payment History Attachment forms for different types of support and expenses. It’s crucial to categorize child support, spousal support, and unreimbursed medical and child care expenses on distinct forms. This helps ensure clarity and facilitates a straightforward review process.

People sometimes neglect to attach supporting documents when submitting their payment history. Bills, receipts, and other proof of expenses should be included to support the amounts entered on the FL-421. Failing to provide adequate documentation can lead to a denial of reimbursement requests.

Many individuals also fail to mark each attached bill or payment with an Exhibit number. This numbering system is not just a suggestion; it helps the court easily reference the evidence provided. Without proper numbering, it may result in confusion, causing the payer to lose potential reimbursements.

Additionally, users often mix up the months and the amounts due or paid. Careful attention is necessary when entering data, as mistakes in month identification can skew the overall totals. A simple transposition error can lead to significant discrepancies in reported payments.

Finally, it’s essential to sign the declaration at the bottom of the form. Some people forget to do so, rendering their submission invalid. A signed declaration confirms the accuracy of the information provided, making it a critical final step in the filing process.

Documents used along the form

The FL-421 form, which tracks payment histories for child support, spousal support, and other expenses, often requires additional documents to provide a complete picture of financial responsibilities. Below is a list of related forms and documents that commonly accompany the FL-421 in family law cases.

- FL-427: Income and Expense Declaration - This form outlines an individual’s income, monthly expenses, and assets. It helps the court assess a party’s financial situation for determining support obligations.

- FL-150: Income and Expense Declaration - Similar to FL-427, this form is used to declare income and expenses for support calculations. It is often required to ensure accurate assessments for both parties.

- MC-031: Declaration - This declaration form is used to provide additional evidence or explanations supporting claims made in other court documents. It can accompany expenses listed in the FL-421 form.

- FL-180: Judgment - This is the final order from the court that outlines all decisions, including support payments. It provides the legal framework for obligations summarized in the FL-421.

- FL-300: Request for Order - This form allows a party to request a change in support obligations. It’s essential if there’s a need to alter the payments noted on the FL-421.

- FL-391: Notice of Motion - This document notifies the other party about upcoming court hearings regarding support. It's crucial for ensuring both parties are aware of proceedings linked to the FL-421.

- FL-403: Response to Request for Order - This is the form used by the responding party to address requests made in FL-300. It provides an opportunity to discuss specific details related to the amounts listed in the FL-421.

In family law matters, collaboration and clarity are key. Using these additional forms can help ensure that all financial aspects of support are thoroughly documented and easily understood by everyone involved. Be sure to keep copies of all documents for your records, as they are important components of your case.

Similar forms

-

FL-420 Payment History for Child Support - This form is used to document payments made toward child support, detailing the amounts ordered and paid over specific months, much like the FL-421 in its structure for recording payment histories.

-

FL-430 Spousal Support Payment History - Similar to FL-421, this document tracks spousal support payments, highlighting the ordered and paid amounts at monthly intervals.

-

FL-431 Child Care Expense Declaration - Reflecting the same focus on expenses, this form allows the payer to declare unreimbursed child care expenses, showing the total due and paid, akin to the unreimbursed sections in FL-421.

-

FL-430 Attachment A - This attachment is used specifically for claiming additional spousal support details, maintaining a consistent format with payment history records like those in FL-421.

-

FL-432 Medical Expense Declaration - Capturing unreimbursed medical expenses, this form serves a similar purpose to FL-421's unreimbursed expense sections, detailing amounts incurred and paid over time.

-

MC-031 Declaration Page - This form can be attached to various declarations, allowing for additional details to support claims, much like the supporting document requests in FL-421.

-

FL-150 Income and Expense Declaration - While focusing more on income, this form provides a comprehensive overview of a person's financial situation, just as FL-421 outlines payment histories.

-

FL-394 Direct Deposit Authorization - This form is related in that it facilitates the direct deposit of support payments, sharing the common theme of managing financial support.

-

FL-410 Summary of Support - This document summarizes various support payments, resembling FL-421's goal of compiling a full payment history for clarity and record-keeping.

-

FL-415 Notice of Change of Support - Similar in its purpose of tracking changes in support payments, this form provides updates relevant to the ongoing records indicated in FL-421.

Dos and Don'ts

When filling out the FL 421 form, it is essential to follow specific guidelines to ensure accuracy and compliance. Below is a list of what to do and what not to do:

- Do: Complete a separate payment history attachment for each type of support paid.

- Do: Clearly indicate the year for which you are reporting and fill in the required amounts for both ordered and paid.

- Do: Use arrows to denote repeated amounts in a column to maintain clarity and conciseness.

- Do: Attach all necessary supporting documents, such as bills and receipts, to substantiate your claims.

- Don't: Leave any months blank. Each month should have a value, even if it is zero.

- Don't: Forget to total each column at the end of the year for a complete record.

- Don't: Provide incomplete information. Ensure that all required details are filled out accurately.

- Don't: Submit your form without reviewing it for errors and inconsistencies prior to filing.

Misconceptions

- Misconception 1: The FL-421 form is only for child support payments.

- Misconception 2: You do not need to keep supporting documents when submitting the FL-421 form.

- Misconception 3: The FL-421 form is a standalone document and does not require additional forms.

- Misconception 4: All amounts need to be reported monthly, even if no payments were made.

This form includes payment history not just for child support but also for spousal support and unreimbursed medical and child care expenses. Users must specify the type of payment being documented.

Individuals must attach supporting documents such as receipts and bills when filing the FL-421. This documentation provides evidence for the amounts listed and is crucial for the court's review.

In most cases, a separate Payment History Attachment form is necessary for each type of support or expense. Moreover, if there are multiple bills for a given expense, additional documentation using form MC-031 may be required.

While amounts should be listed for each month, if no payments were made during a specific month, it is acceptable to enter zero. The form allows users to clearly track periods of non-payment along with total calculations for the year.

Key takeaways

When dealing with the FL-421 form, understanding the nuances of its structure is crucial for accurate completion. Here are several key takeaways regarding its use:

- Separate Attachments for Each Support Type: You must fill out a distinct Payment History Attachment for each category of support, such as child or spousal support. This ensures clarity and organization in your records.

- Detail Monthly Amounts: For the year in question, you need to provide both the amount ordered and the amount paid for each month. This aids in tracking obligations and compliance accurately.

- Include Supporting Documentation: It's vital to attach relevant bills, receipts, and proof of payments. Each document should be labeled and grouped by month to streamline your submission.

- Consistent Yearly Totals: After entering monthly figures, calculate and record yearly totals at the end of each attachment. This summary helps in presenting a clear financial picture to the court.

Browse Other Templates

What Is a Driver Qualification File - Print or type your information clearly to ensure legibility.

Gc-310 - It is specifically for cases involving the conservatorship of individuals who may need assistance managing their personal or estate affairs.

Who Pays for the Bridesmaids Hair and Makeup - This contract serves as a formal agreement to protect both the client's and the artist's interests.