Fill Out Your Fl 435 Form

The FL-435 form is an important legal document used in California to facilitate spousal or partner support through an earnings assignment order. This form is primarily aimed at ensuring that the person obligated to pay support, often referred to as the obligor, has a portion of their earnings withheld directly from their paycheck and routed to the recipient of the support, known as the obligee. The FL-435 outlines detailed instructions for payors, which include employers, detailing how much should be withheld based on various support obligations. The form specifies not only the amounts owed for current support but also any arrears, ensuring compliance with the court's directive. It is essential for both the obligor and the payor to understand their responsibilities under this order, which comes into effect as soon as it is received and must be acted upon within a strict timeframe. The FL-435 form also provides the obligor with options for contesting or modifying the support order, thus highlighting the legal recourse available to those who may be affected by it. This document is crucial in promoting fairness and ensuring the timely payment of support while also safeguarding the rights of all parties involved.

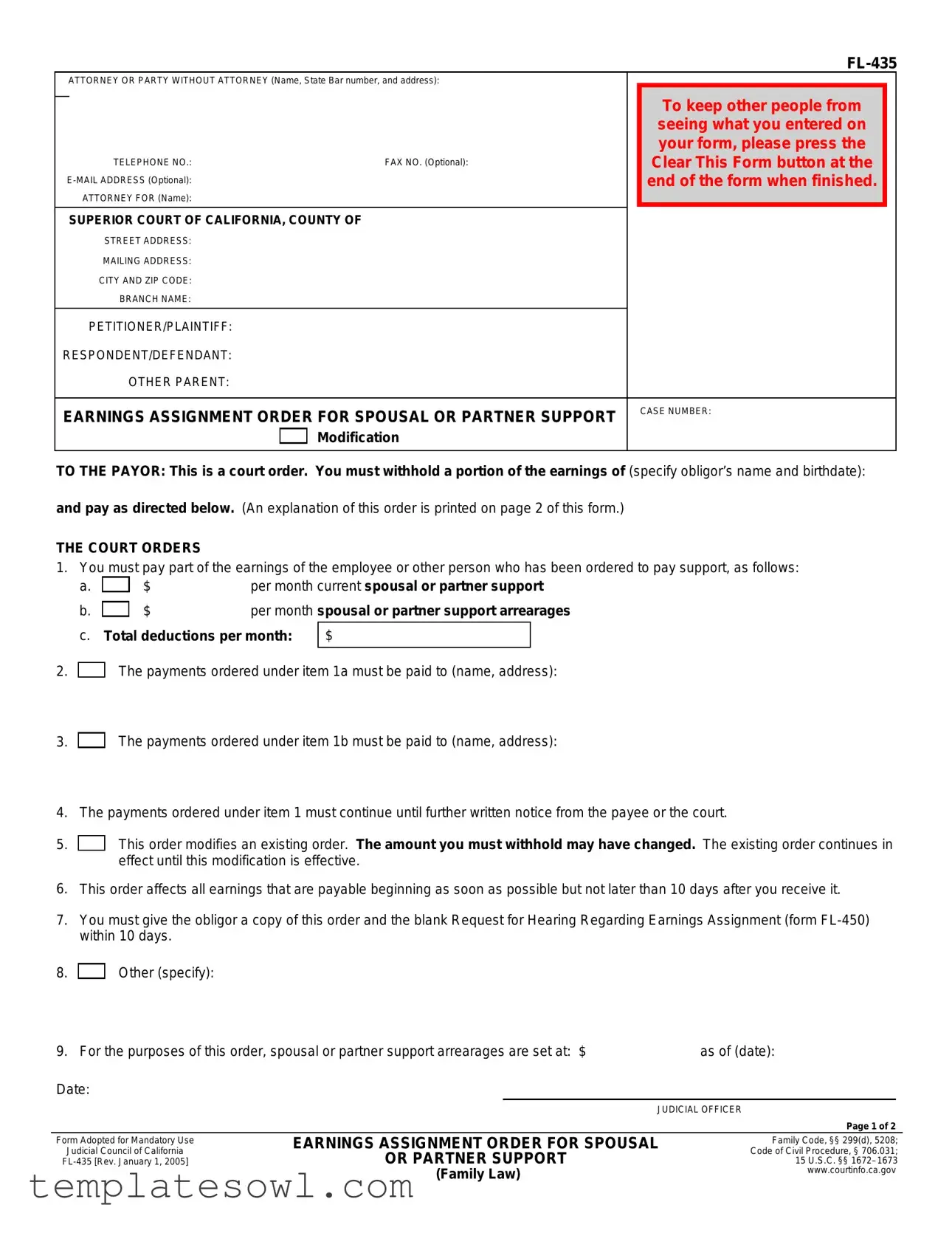

Fl 435 Example

|

|

|

|

|

||

ATTORNEY OR PARTY WITHOUT ATTORNEY (Name, State Bar number, and address): |

|

FOR COURT USE ONLY |

|

|||

|

|

|

|

|

To keep other people from |

|

|

|

|

|

|

|

|

|

|

|

|

|

seeing what you entered on |

|

|

|

|

|

|

your form, please press the |

|

|

TELEPHONE NO.: |

|

FAX NO. (Optional): |

|

Clear This Form button at the |

|

|

|

|

end of the form when finished. |

|

||

|

ATTORNEY FOR (Name): |

|

|

|

|

|

|

SUPERIOR COURT OF CALIFORNIA, COUNTY OF |

|

|

|

||

|

STREET ADDRESS: |

|

|

|

|

|

|

MAILING ADDRESS: |

|

|

|

|

|

|

CITY AND ZIP CODE: |

|

|

|

|

|

|

BRANCH NAME: |

|

|

|

|

|

|

PETITIONER/PLAINTIFF: |

|

|

|

|

|

RESPONDENT/DEFENDANT: |

|

|

|

|

|

|

|

OTHER PARENT: |

|

|

|

|

|

|

|

|

|

|

|

|

EARNINGS ASSIGNMENT ORDER FOR SPOUSAL OR PARTNER SUPPORT |

|

CASE NUMBER: |

||||

|

|

|

||||

|

|

|

Modification |

|

|

|

|

|

|

|

|

|

|

TO THE PAYOR: This is a court order. You must withhold a portion of the earnings of (specify obligor’s name and birthdate):

and pay as directed below. (An explanation of this order is printed on page 2 of this form.)

THE COURT ORDERS

1. You must pay part of the earnings of the employee or other person who has been ordered to pay support, as follows:

a. |

|

$ |

per month current spousal or partner support |

b.

$ |

per month spousal or partner support arrearages |

c. Total deductions per month: |

$ |

2.

3.

4.

5.

6.

The payments ordered under item 1a must be paid to (name, address):

The payments ordered under item 1b must be paid to (name, address):

The payments ordered under item 1 must continue until further written notice from the payee or the court.

This order modifies an existing order. The amount you must withhold may have changed. The existing order continues in effect until this modification is effective.

This order affects all earnings that are payable beginning as soon as possible but not later than 10 days after you receive it.

7.You must give the obligor a copy of this order and the blank Request for Hearing Regarding Earnings Assignment (form

8.

Other (specify):

9. For the purposes of this order, spousal or partner support arrearages are set at: $ |

as of (date): |

Date:

JUDICIAL OFFICER

Page 1 of 2

Form Adopted for Mandatory Use

Judicial Council of California

EARNINGS ASSIGNMENT ORDER FOR SPOUSAL

OR PARTNER SUPPORT

(Family Law)

Family Code, §§ 299(d), 5208; Code of Civil Procedure, § 706.031;

15 U.S.C. §§

INSTRUCTIONS FOR EARNINGS ASSIGNMENT ORDER

1.DEFINITION OF IMPORTANT WORDS IN THE EARNINGS ASSIGNMENT ORDER

a.Earnings:

(1)Wages, salary, bonuses, vacation pay, retirement pay, and commissions paid by an employer;

(2)Payments for services of independent contractors;

(3)Dividends, interest, rents, royalties, and residuals;

(4)Patent rights and mineral or other natural resource rights;

(5)Any payments due as a result of written or oral contracts for services or sales, regardless of title;

(6)Payments due for workers’ compensation temporary benefits, or payments from a disability or health insurance policy or program; and

(7)Any other payments or credits due, regardless of source.

b.Earnings assignment order: a court order issued in every court case in which one person is ordered to pay for the support of another person. This order has priority over any other orders such as garnishments or earnings withholding orders.

Earnings should not be withheld for any other order until the amounts necessary to satisfy this order have been withheld in full. However, an OrderlNotice to Withhold Income for Child Support for child support or family support has priority over this order for spousal or partner support.

c.Obligor: any person ordered by a court to pay support. The obligor is named before item 1 in the order.

d.Obligee: the person or governmental agency to whom the support is to be paid.

e.Payor: the person or entity, including an employer, that pays earnings to an obligor.

2.INFORMATION FOR ALL PAYORS. Withhold money from the earnings payable to the obligor as soon as possible but no later than 10 days after you receive the Earnings Assignment Order for Spousal or Partner Support. Send the withheld money to the payee(s) named in items 2 and 3 of the order within 10 days of the pay date. You may deduct $1 from the obligor’s earnings for each payment you make.

When sending the withheld earnings to the payee, state the date on which the earnings were withheld. You may combine amounts withheld for two or more obligors in a single payment to each payee, and identify what portion of that payment is for each obligor.

You will be liable for any amount you fail to withhold and can be cited for contempt of court.

3.SPECIAL INSTRUCTIONS FOR PAYORS WHO ARE EMPLOYERS

a.State and federal laws limit the amount you can withhold and pay as directed by this order. This limitation applies only to earnings defined above in item 1a(1) and are usually half the obligor’s disposable earnings.

Disposable earnings are different from gross pay or

security, (3) state income tax, (4) state disability insurance, and (5) payments to public employees’ retirement systems.

After the obligor’s disposable earnings are known, withhold the amount required by the order, but never withhold more than 50 percent of the disposable earnings unless the court order specifies a higher percentage. Federal law prohibits withholding more than 65 percent of disposable earnings of an employee in any case.

If the obligor has more than one assignment for

support, add together the amounts of support due for all the assignments. If 50 percent of the obligor’s net disposable earnings will not pay in full all of the assignments for support, prorate it first among all of the current support assignments in the same proportion that each assignment bears to the total current support owed. Apply any remainder to the assignments for arrearage support in the same proportion that each assignment bears to the total arrearage owed. If you have any questions, please contact the office or person who sent this form to you. This office or person's name appears in the upper

b.If the employee's pay period differs from the period specified in the order, prorate the amount ordered withheld so that part of it is withheld from each of the obligor’s paychecks.

c.If the obligor stops working for you, notify the office that sent you this form of that, no later than the date of the next payment, by

d.California law prohibits you from firing, refusing to hire, or taking any disciplinary action against any employee ordered to pay support through an earnings assignment. Such action can lead to a $500 civil penalty per employee.

4.INFORMATION FOR ALL OBLIGORS. You should have received a Request for Hearing Regarding Earnings Assignment (form

If you think your support order is wrong, you can ask for a modification of the order or, in some cases, you can have the order set aside and have a new order issued. You can talk to an attorney or get information from the family law facilitator about this.

5.SPECIAL INFORMATION FOR THE OBLIGOR WHO IS AN EMPLOYEE. State law requires you to notify the payees named in items 2 and 3 of the order if you change your employment. You must provide the name and address of your new employer.

EARNINGS ASSIGNMENT ORDER FOR SPOUSAL

OR PARTNER SUPPORT

(Family Law)

Page 2 of 2

For your protection and privacy, please press the Clear This Form

button after you have printed the form.

Save This Form

Print This Form

Clear This Form

Form Characteristics

| Fact Name | Details |

|---|---|

| Purpose | The FL-435 form is used to issue an Earnings Assignment Order for spousal or partner support, allowing the court to direct an employer to withhold earnings from an obligor’s pay to meet support obligations. |

| Governing Law | This form is governed by the California Family Code, specifically sections 299(d) and 5208, as well as California Code of Civil Procedure, section 706.031. |

| Modification | The FL-435 is used to modify an existing support order. Changes in the amount to be withheld from the obligor’s earnings can occur due to this modification. |

| Obligor Responsibilities | The obligor must receive a copy of the order within 10 days and inform the payees of any changes in employment. Non-compliance can result in legal consequences. |

Guidelines on Utilizing Fl 435

Filling out the FL 435 form is an important step in the processes surrounding spousal or partner support. Once you have completed the form, it will need to be submitted to the appropriate court. Be sure to carefully follow each step to ensure all necessary information is included and accurate.

- Header Section: In the top left section, fill in your name, State Bar number, telephone number (if applicable), address, and email address (optional). If an attorney is representing you, include their information under “ATTORNEY FOR.”

- Court Information: Complete the section for “SUPERIOR COURT OF CALIFORNIA,” including the county name, street address, city, mailing address, and branch name.

- Petitioners and Respondents: Enter the names of the petitioner/plaintiff, respondent/defendant, and any other parent involved in the case.

- Case Number: Include the relevant case number at the designated spot on the form.

- Payor Information: Specify the name and birthdate of the obligor, who is the individual whose earnings will be assigned for support payments.

- Support Payments: Fill in the required amounts for current spousal or partner support, arrearages, and total deductions per month as applicable.

- Payment Instructions: Detail where the payments for both current support and arrearages should be sent, including the name and address of the payees.

- Court Orders: Note that the order is modifying an existing order and state the amount for arrearages as of a specified date.

- Signature: At the bottom of the form, sign and date the document where indicated.

Once you have filled out the FL 435 form, review it for any errors or missing information. After verifying everything is correct, submit the form to the court as directed. Don't forget to print a copy for your records!

What You Should Know About This Form

What is the FL 435 form?

The FL 435 form is an Earnings Assignment Order for Spousal or Partner Support. It is used in the state of California when a court orders one party (known as the obligor) to pay support to another party (the obligee). The form directs the obligor's employer or payor to withhold a specified amount from the obligor's earnings and send it to the obligee. This form helps to ensure that support payments are made consistently and that the financial responsibilities are met as ordered by the court.

Who is responsible for filling out the FL 435 form?

How quickly must payment start after the FL 435 form is served?

What types of earnings are subject to withholding under the FL 435 form?

Can the FL 435 form be modified once it has been issued?

What protections are in place for obligors regarding employment?

What happens if an obligor changes jobs?

Common mistakes

When filling out the FL-435 form, some common mistakes can occur. One frequently seen error is not providing the obligor's complete and correct name. It is crucial to ensure that the obligor's name is correctly spelled and matches the legal documents. A simple mistake in the name can lead to delays in processing the order.

Another mistake involves incorrectly entering the amount of support to be withheld. It is important to accurately calculate and report the monthly amounts for both current support and arrearages. Misunderstanding these amounts can cause complications down the line.

Some individuals forget to list the correct names and addresses of the payees receiving the support payments. Each payee must be clearly identified to avoid any confusion about where the payments should be directed. This step is essential for ensuring that all parties receive the funds they are entitled to.

Failing to complete the modification section of the form is another common error. If the order modifies a previous one, this needs to be explicitly stated. Ignoring this detail can lead to misunderstandings regarding the obligations expected of the obligor.

Another frequent oversight is not providing timely notice to the obligor about the order. The form requires that a copy of the order be given to the obligor within ten days. Neglecting this step can result in compliance issues later on.

People also sometimes overlook reading the instructions provided with the form. The guidelines clarify how to fill out the form correctly and should be followed closely. Ignoring these instructions can result in submitting an incorrect or incomplete application.

Lastly, individuals may forget to sign and date the form before submission. An unsigned form is not valid and will not be processed. Ensuring that all necessary signatures are obtained is the final step to completing the FL-435 form appropriately.

Documents used along the form

The FL-435 form is an Earnings Assignment Order for Spousal or Partner Support issued by the California Superior Court. This document is often accompanied by various forms and documents necessary for effective processing and understanding of the earnings assignment. Below are ten commonly used documents that may accompany the FL-435 form:

- FL-450: Request for Hearing Regarding Earnings Assignment - This form allows an obligor to formally request a court hearing to contest or modify the earnings assignment order.

- FL-431: Earnings Assignment Order for Child Support - Similar to the FL-435 but specifically for child support payments. It outlines how much should be withheld from an obligor's earnings for child support obligations.

- FL-430: Notice of Rights and Responsibilities - This document informs both obligors and obligees of their rights and responsibilities under the earnings assignment order.

- FL-420: Declaration of Disclosure - Used in family law cases to ensure that both parties disclose their financial information, which may impact support orders.

- FL-325: Spousal Support Order - This form establishes the amount and terms of spousal support ordered by the court, often considered in conjunction with the FL-435.

- FL-310: Petition for Dissolution of Marriage - This document initiates divorce proceedings and may include requests for spousal support to be addressed within the FL-435.

- FL-960: Child Support Change Form - Used to request a modification to existing child support orders, which can relate to changes in spousal support as well.

- FL-200: Response to Petition - A document filed by the responding party in a family law case, which may address issues related to spousal or partner support.

- FL-250: Notice of Change of Address - This form notifies the court and involved parties of any address changes, which is essential for communication regarding support orders.

- FL-140: Income and Expense Declaration - A critical document used to declare income and expenses, helping determine support obligations in family law cases.

Having these forms readily available will streamline the process surrounding spousal or partner support. It is crucial to consult with a legal professional or family law facilitator if any questions arise regarding the use of these documents.

Similar forms

The FL-435 form, titled "Earnings Assignment Order for Spousal or Partner Support," shares similarities with several other legal documents. Each of these documents serves unique but related purposes in the context of support and earnings assignments. Below are four documents that resemble the FL-435:

- FL-450: Request for Hearing Regarding Earnings Assignment - This document allows the obligor to request a hearing if they wish to contest or modify the earnings assignment order. Similar to the FL-435, it is concerned with the legal obligations surrounding support payments.

- FL-144: Spousal Support Order - The FL-144 establishes the terms of spousal support, much like the FL-435 specifies the earnings assignment for such support. Both documents outline the financial responsibilities of the obligor toward the obligee.

- FL-330: Child Support Order - This document outlines the obligations for child support payments. Similar to the FL-435, the FL-330 is a court order that mandates financial support, but it focuses specifically on the needs of children rather than spousal or partner support.

- Garnishment Order - A garnishment order is used in various legal contexts to direct a third party to withhold a portion of a debtor's earnings for the payment of debts. Like the FL-435, it involves the withholding of wages, although it may not specifically pertain to support obligations.

Dos and Don'ts

When completing the FL-435 form, it is important to follow certain guidelines to ensure that the process goes smoothly. Here are seven recommendations that can help you avoid common pitfalls:

- Do carefully read all instructions. Understanding the requirements before filling out the form will prevent errors.

- Do provide accurate personal information. Double-check names, addresses, and contact details to ensure they are correct.

- Do keep a copy of the form. Retain a copy for your records after submission, as it may be needed later.

- Don’t rush through the completion. Take your time to avoid mistakes that could delay the process.

- Don’t leave any required fields blank. Ensure you fill in all necessary information; incomplete forms may be rejected.

- Don’t forget to sign and date the form. An unsigned form is invalid and will not be processed.

- Don’t forget to clear sensitive information. Use the "Clear This Form" button at the end to protect your privacy.

Following these practices will facilitate a smoother experience when filling out the FL-435 form. Attention to detail can make all the difference.

Misconceptions

- Misconception: The FL-435 form is only for employers.

- Misconception: The FL-435 form can wait for several weeks before it needs to be addressed.

- Misconception: The FL-435 only pertains to spousal support, not partner support.

- Misconception: Once the FL-435 form is submitted, there is no further need for action from the obligor.

- Misconception: The amount withheld under the FL-435 form is fixed and cannot change.

- Misconception: An employer can fire an employee for having an earnings assignment order.

- Misconception: The FL-435 form needs legal representation to complete.

This form is applicable to both employers and obligors (the individuals required to pay support). While it contains guidelines for employers, obligors must also understand their rights and responsibilities outlined in the document.

The earnings assignment order requires immediate action. Payors must begin withholding earnings within 10 days of receiving the FL-435 form. Delaying this can result in legal complications.

The form applies to both spousal and partner support. Its terminology encompasses various forms of relationship support as defined in family law.

Obligors must stay informed and act if they wish to contest or modify the order. This includes filing a Request for Hearing (form FL-450) if they believe there are issues with the support order.

The ordered amount can vary, especially if there is a modification of a previous support agreement. The current order continues to enforce the previous support obligations unless officially changed.

California law protects employees from termination or disciplinary actions due to an earnings assignment order. Violating this law can result in financial penalties for the employer.

While legal assistance can be helpful for understanding details, individuals can fill out the FL-435 form themselves. Resources are available from court clerks and family law facilitators to assist in this process.

Key takeaways

Understanding the FL-435 form is essential for those involved in spousal or partner support cases. Here are some key takeaways:

- Ensure accurate completion of the form. Provide relevant personal information, including names and addresses.

- The form initiates a court order to withhold earnings directly from an obligor’s paycheck.

- Payments are divided into current support and any arrears owed. Clearly outline these amounts on the form.

- Submit the form promptly. The order must be effective within 10 days of receipt.

- Obligors have the right to contest the order. A Request for Hearing form (FL-450) must be filed within 10 days.

- Employers must notify the issuing office if the obligor ceases to be employed.

- Withholding limits apply. Employers must adhere to state and federal regulations on how much can be withheld from salaries.

- After completing the form, prioritize confidentiality. Use the “Clear This Form” option after printing.

Browse Other Templates

Colorado Garnishment Order,Continuing Garnishment Writ,Garnishment Enforcement Form,Writ for Earnings Withholding,Judgment Collection Writ,Earnings Garnishment Notice,Writ of Garnishment for Debts,Debt Recovery Writ,Writ of Payment Interception,Garni - Service by the sheriff or a designated process server is among the legal options for delivering the writ.

How to Make Fake Abortion Papers - The form ensures compliance with updated state health regulations.

Michigan Bar Exam Results - Employers are responsible for maintaining proper payroll records as required by the insurer.