Fill Out Your Fl 825 Form

The FL 825 form, officially known as the Earnings Assignment Order for Spousal or Partner Support, serves a crucial role in family law within California. This form is primarily used to instruct an employer—or any payor—to withhold a specified amount from an employee's wages for the purpose of fulfilling a spousal or partner support obligation. It outlines the obligations of the payor, obligor, and obligee, detailing precisely how much must be deducted from the obligor's earnings each pay period. Key elements include not only the amounts owed for current support but also any past due support arrearages. The FL 825 also provides specific instructions regarding the timing of these withholdings and the necessity to communicate with the obligor about the process. In situations where modifications to an existing order are necessary, this form also addresses those changes. While its complexity may seem daunting, understanding the FL 825 is essential for compliance and ensuring that support payments are made timely and accurately. Ultimately, this form is instrumental in facilitating the financial support needed for spousal or partner obligations, thus aiding in the protection of rights and responsibilities within California’s family law framework.

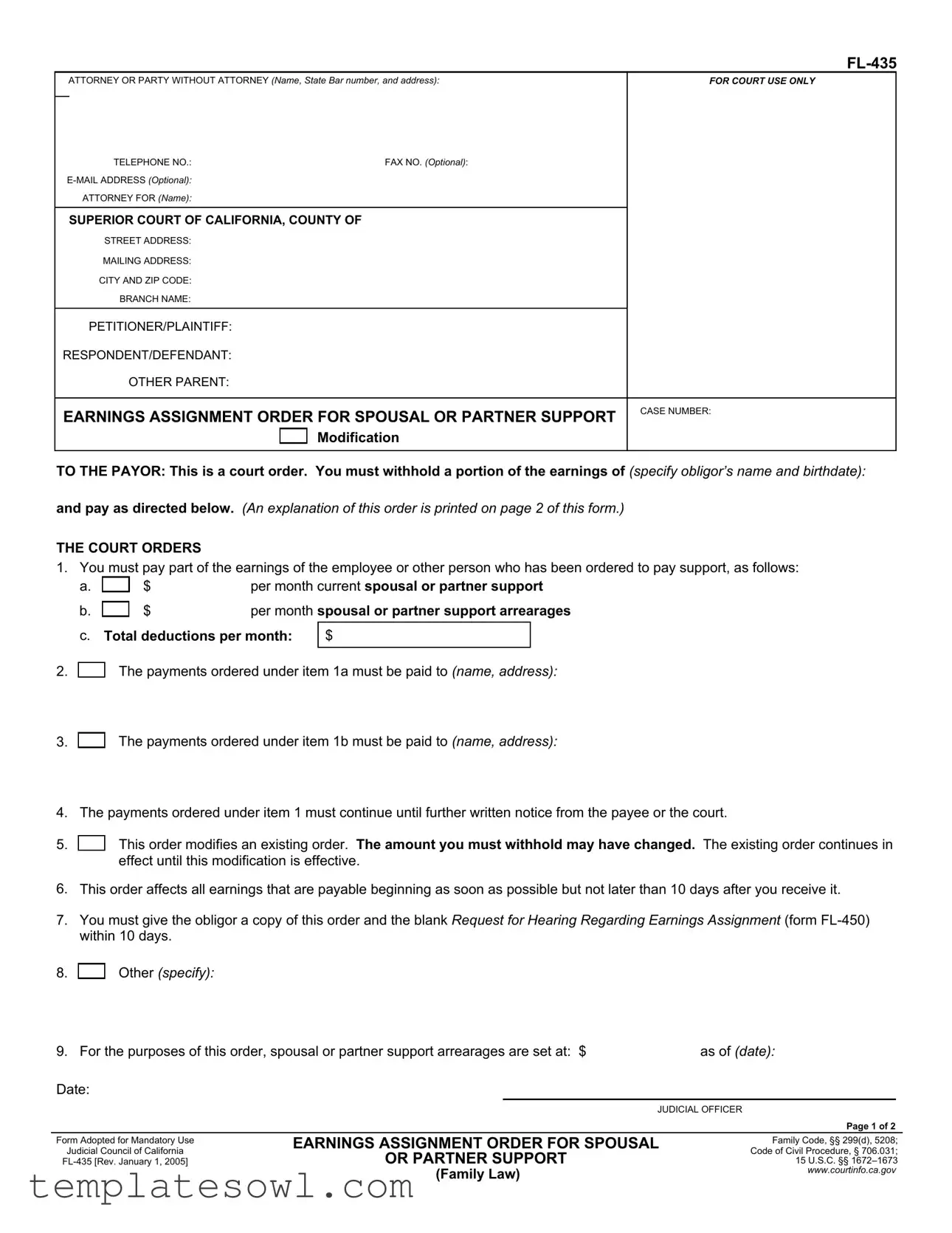

Fl 825 Example

ATTORNEY OR PARTY WITHOUT ATTORNEY (Name, State Bar number, and address): |

FOR COURT USE ONLY |

TELEPHONE NO.: |

FAX NO. (Optional): |

|

|

ATTORNEY FOR (Name): |

|

SUPERIOR COURT OF CALIFORNIA, COUNTY OF

STREET ADDRESS:

MAILING ADDRESS:

CITY AND ZIP CODE:

BRANCH NAME:

PETITIONER/PLAINTIFF:

RESPONDENT/DEFENDANT:

OTHER PARENT:

EARNINGS ASSIGNMENT ORDER FOR SPOUSAL OR PARTNER SUPPORT |

CASE NUMBER: |

|

Modification

TO THE PAYOR: This is a court order. You must withhold a portion of the earnings of (specify obligor’s name and birthdate):

and pay as directed below. (An explanation of this order is printed on page 2 of this form.)

THE COURT ORDERS

1.

2.

3.

4.

5.

6.

7.

8.

You must pay part of the earnings of the employee or other person who has been ordered to pay support, as follows:

a. |

|

$ |

per month current spousal or partner support |

|||

b. |

|

|

$ |

per month spousal or partner support arrearages |

||

|

|

|||||

c. |

|

|

|

|||

Total deductions per month: |

$ |

|

||||

|

|

|

|

|

|

|

The payments ordered under item 1a must be paid to (name, address):

The payments ordered under item 1b must be paid to (name, address):

The payments ordered under item 1 must continue until further written notice from the payee or the court.

This order modifies an existing order. The amount you must withhold may have changed. The existing order continues in effect until this modification is effective.

This order affects all earnings that are payable beginning as soon as possible but not later than 10 days after you receive it.

You must give the obligor a copy of this order and the blank Request for Hearing Regarding Earnings Assignment (form

Other (specify):

9. For the purposes of this order, spousal or partner support arrearages are set at: $ |

as of (date): |

|

Date: |

|

|

|

|

JUDICIAL OFFICER |

Page 1 of 2

Form Adopted for Mandatory Use

Judicial Council of California

EARNINGS ASSIGNMENT ORDER FOR SPOUSAL

OR PARTNER SUPPORT

(Family Law)

Family Code, §§ 299(d), 5208; Code of Civil Procedure, § 706.031; 15 U.S.C. §§

INSTRUCTIONS FOR EARNINGS ASSIGNMENT ORDER

1.DEFINITION OF IMPORTANT WORDS IN THE EARNINGS ASSIGNMENT ORDER

a.Earnings:

(1)Wages, salary, bonuses, vacation pay, retirement pay, and commissions paid by an employer;

(2)Payments for services of independent contractors;

(3)Dividends, interest, rents, royalties, and residuals;

(4)Patent rights and mineral or other natural resource rights;

(5)Any payments due as a result of written or oral contracts for services or sales, regardless of title;

(6)Payments due for workers’ compensation temporary benefits, or payments from a disability or health insurance policy or program; and

(7)Any other payments or credits due, regardless of source.

b.Earnings assignment order: a court order issued in every court case in which one person is ordered to pay for the support of another person. This order has priority over any other orders such as garnishments or earnings withholding orders.

Earnings should not be withheld for any other order until the amounts necessary to satisfy this order have been withheld in full. However, an OrderlNotice to Withhold Income for Child Support for child support or family support has priority over this order for spousal or partner support.

c.Obligor: any person ordered by a court to pay support. The obligor is named before item 1 in the order.

d.Obligee: the person or governmental agency to whom the support is to be paid.

e.Payor: the person or entity, including an employer, that pays earnings to an obligor.

2.INFORMATION FOR ALL PAYORS. Withhold money from the earnings payable to the obligor as soon as possible but no later than 10 days after you receive the Earnings Assignment Order for Spousal or Partner Support. Send the withheld money to the payee(s) named in items 2 and 3 of the order within 10 days of the pay date. You may deduct $1 from the obligor’s earnings for each payment you make.

When sending the withheld earnings to the payee, state the date on which the earnings were withheld. You may combine amounts withheld for two or more obligors in a single payment to each payee, and identify what portion of that payment is for each obligor.

You will be liable for any amount you fail to withhold and can be cited for contempt of court.

3.SPECIAL INSTRUCTIONS FOR PAYORS WHO ARE EMPLOYERS

a.State and federal laws limit the amount you can withhold and pay as directed by this order. This limitation applies only to earnings defined above in item 1a(1) and are usually half the obligor’s disposable earnings.

Disposable earnings are different from gross pay or

security, (3) state income tax, (4) state disability insurance, and (5) payments to public employees’ retirement systems.

After the obligor’s disposable earnings are known, withhold the amount required by the order, but never withhold more than 50 percent of the disposable earnings unless the court order specifies a higher percentage. Federal law prohibits withholding more than 65 percent of disposable earnings of an employee in any case.

If the obligor has more than one assignment for

support, add together the amounts of support due for all the assignments. If 50 percent of the obligor’s net disposable earnings will not pay in full all of the assignments for support, prorate it first among all of the current support assignments in the same proportion that each assignment bears to the total current support owed. Apply any remainder to the assignments for arrearage support in the same proportion that each assignment bears to the total arrearage owed. If you have any questions, please contact the office or person who sent this form to you. This office or person's name appears in the upper

b.If the employee's pay period differs from the period specified in the order, prorate the amount ordered withheld so that part of it is withheld from each of the obligor’s paychecks.

c.If the obligor stops working for you, notify the office that sent you this form of that, no later than the date of the next payment, by

d.California law prohibits you from firing, refusing to hire, or taking any disciplinary action against any employee ordered to pay support through an earnings assignment. Such action can lead to a $500 civil penalty per employee.

4.INFORMATION FOR ALL OBLIGORS. You should have received a Request for Hearing Regarding Earnings Assignment (form

If you think your support order is wrong, you can ask for a modification of the order or, in some cases, you can have the order set aside and have a new order issued. You can talk to an attorney or get information from the family law facilitator about this.

5.SPECIAL INFORMATION FOR THE OBLIGOR WHO IS AN EMPLOYEE. State law requires you to notify the payees named in items 2 and 3 of the order if you change your employment. You must provide the name and address of your new employer.

EARNINGS ASSIGNMENT ORDER FOR SPOUSAL

OR PARTNER SUPPORT

Page 2 of 2

(Family Law)

Form Characteristics

| Fact Name | Detail |

|---|---|

| Form Title | Earnings Assignment Order for Spousal or Partner Support |

| Governing Law | Family Code, §§ 299(d), 5208; Code of Civil Procedure, § 706.031; 15 U.S.C. §§ 1672–1673 |

| Purpose | This form is used to direct a payor to withhold earnings for spousal or partner support as ordered by the court. |

| Obligor Definition | An obligor is the person ordered by the court to make support payments. |

| Payor Responsibilities | The payor must begin withholding earnings as directed within 10 days of receiving the order. |

| Payment Deductions | Payors can withhold a maximum of 50% of the obligor's disposable earnings unless specified otherwise. |

| Automatic Continuation | The withholding for support will continue until further notice from the payee or the court. |

| Modification | This order can modify an existing support order, adjusting the amount to be withheld. |

| Copy Requirement | The obligor must receive a copy of the order and a blank Request for Hearing Regarding Earnings Assignment (form FL-450) within 10 days. |

Guidelines on Utilizing Fl 825

When preparing to fill out the FL-825 form, it's essential to ensure that all sections are completed accurately. This form is critical for your case and requires detailed personal information along with specific financial details. Follow these steps carefully to ensure a smooth submission process.

- Begin by entering the name and State Bar number of your attorney (if applicable), along with their contact information in the designated fields.

- Fill in the court’s details, including the street address, mailing address, city, and ZIP code. Provide the branch name where your case is filed.

- Clearly state the names of the petitioner/plaintiff, respondent/defendant, and other parent involved in the case.

- Input the case number accurately to avoid any confusion or delays.

- Next, specify the obligor's name and birthdate where prompted. This refers to the individual whose earnings are to be withheld.

- Complete the fields for current spousal or partner support by entering the monthly amount that must be withheld.

- If applicable, enter the amount for any spousal or partner support arrearages following the same format.

- Calculate the total deductions per month and input this figure in the designated section.

- Provide the name and address of the entity to which payments are to be sent for the current support amount.

- Similarly, enter the name and address for any arrearages to be paid.

- In the blank space provided, indicate any additional information relevant to the case or order.

- Fill out the amount of spousal or partner support arrearages as of the specified date.

- Finally, sign and date the form in accordance with the requirements.

Once you have filled out all sections of the form, double-check for accuracy. Ensure to make a copy for your records before submitting it to the appropriate court. This step is crucial because maintaining documentation of your submissions can help you track your case progress more efficiently.

What You Should Know About This Form

What is the FL-825 form and when do I need to use it?

The FL-825 form, formally known as the Earnings Assignment Order for Spousal or Partner Support, is used in California to direct a payor—typically an employer—to withhold a portion of an obligor's earnings. This order is appropriate in cases where one party is required by a court to pay spousal or partner support. The form outlines the amount owed and ensures that the payee receives the support they need consistently. You would use this form after a court has determined the support obligations for one party based on family law statutes.

Who is considered an obligor and an obligee?

The obligor is the person ordered by the court to pay support. This individual is the one whose earnings will be withheld as specified in the order. The obligee, on the other hand, is the person or agency entitled to receive the support payments. Understanding these roles is crucial, as it determines who is financially responsible and who benefits from the support amounts withheld.

What types of earnings are subject to withholding under this order?

The FL-825 form covers a wide range of earnings. This includes wages, salary, bonuses, commissions, retirement pay, and payments from independent contractors. Other sources of income, like dividends, rents, and payments due to contracts, are also affected. In essence, any compensation received for work or services rendered may be subject to withholding based on this court order.

How long does the payment obligation last?

The obligation to pay reflects on the FL-825 form and continues until the court receives a new order indicating changes or the party receiving support no longer requires it. This means that the withholdings will persist until there is further written notice from either the payee or the court, signifying that a modification or cessation of payments is warranted.

What should the payor do upon receiving the order?

Once a payor, typically the employer, receives the FL-825 form, they must act promptly. The payor should withhold the specified amounts from the obligor's pay no later than 10 days from receipt of the order. Additionally, they are required to send these withheld amounts to the designated payees within the specified timeframe. It's essential to keep accurate records when making these payments, as failure to do so could result in significant liabilities.

Can the obligations under this order change?

Yes, the amounts specified in the FL-825 form can change. If there is a modification to the existing support order, this must be reflected in a new FL-825 form. The existing support order remains in effect until the modification is formally recognized by the court. It is critical for both the obligor and the obligee to stay informed about any changes that may affect their financial responsibilities.

What happens if the obligor changes jobs?

If the obligor changes their employer, they have a responsibility to inform the payees listed in the FL-825 form. The obligor must provide the new employer's details to ensure that support payments continue seamlessly. This helps prevent interruptions in support and ensures compliance with the court’s order.

Are there restrictions on how much can be withheld from an obligor's wages?

Indeed, there are limits to how much money can be withheld. Generally, state and federal laws allow withholding of up to 50 percent of an obligor’s disposable earnings, which are earnings remaining after mandatory deductions like taxes and social security. However, federal law caps the maximum withholding at 65 percent of disposable earnings. It’s crucial for payors to be aware of these limits to avoid legal repercussions.

What steps can an obligor take if they believe the order is incorrect?

If an obligor believes that the Earnings Assignment Order is incorrect or unjust, they can request a hearing by submitting a Request for Hearing Regarding Earnings Assignment (form FL-450). It’s important to act quickly, as the request must be filed within 10 days of receiving the FL-825 form. Professional legal guidance is advisable in these cases to navigate the court system effectively.

Common mistakes

Filling out the FL-825 form can be a straightforward process, but mistakes can lead to delays or complications. One common error occurs when individuals forget to include complete contact information for both the attorney and the parties involved. It’s essential to provide accurate names, addresses, and phone numbers. Omissions or inaccuracies here can result in difficulties later in the process.

Another frequent mistake is failing to specify the correct amounts for spousal or partner support. Under item 1a and 1b, the amounts must be clearly stated. A vague entry such as “varies” will not suffice. Instead, exact dollar amounts are necessary. If these figures are missing or incorrect, it can lead to confusion and disputes.

Individuals also sometimes neglect to give a copy of the order to the obligor within the required timeframe. According to the instructions, this must happen within ten days of receiving the order. Not doing this can lead to issues with enforcement and compliance.

Additionally, many overlook the importance of ensuring the order's effective date is explicitly stated. This date is crucial as it determines when the obligations begin. If it is absent or improperly recorded, it can cause complications in enforcing the order.

Lastly, some individuals fail to account for existing orders when modifying the FL-825 form. It's important to remember that the new order must not conflict with any previous orders. Always clarify how the modifications interact with earlier court decisions to avoid potential legal complications. Taking the time to review these areas carefully can prevent significant challenges down the road.

Documents used along the form

When dealing with the FL-825 form, it's helpful to understand other related documents that may also be necessary. Below is a list of frequently used forms that accompany the FL-825. Reviewing these will ensure you are well-prepared for the process.

- FL-450 Request for Hearing Regarding Earnings Assignment: This form allows an obligor to request a hearing if they want to contest or modify the earnings assignment order. It should be filed within 10 days of receiving the order.

- FL-434 Notice of Motion to Modify Child or Spousal Support: Use this to request a change to existing support orders. It outlines why a modification is necessary and offers details about the requested changes.

- FL-428 Child Support Case Registry Form: This form collects essential details needed for the child support case. It's often required for properly documenting child support cases in court systems.

- FL-431 Income and Expense Declaration: This form helps both parties disclose income, expenses, and financial circumstances. Complete transparency is necessary when the court considers support adjustments.

- FL-485 Earnings Assignment Order for Child Support: Similar to FL-435, this document specifically focuses on child support payments rather than spousal or partner support.

- FL-300 General Family Law Petition: This form starts the legal process regarding family law matters, including divorce or child custody cases. It lays the foundation for any further court actions.

- FL-325 Support Declaration: This document is used to provide information specific to support obligations. It includes details on income and support calculations, which the court will review.

Being aware of these documents can save time and streamline the process. Make sure to gather everything you need and consult a knowledgeable professional if you're uncertain about any steps.

Similar forms

- Earnings Assignment Order for Child Support (FL-400): Like the FL-825, this document is also a court order that requires an employer to withhold a portion of an employee's earnings. The key difference is that it focuses specifically on child support instead of spousal or partner support. Both documents follow similar procedures for payment distribution and the timeline for compliance.

- Income Withholding Order (IWO): This federal form is issued to garnish wages for various types of support, including child support, spousal support, and other debts. The IWO outlines amounts to be withheld, mirroring the FL-825 in its goal of ensuring compliance with court-ordered financial obligations.

- Request for Hearing Regarding Earnings Assignment (FL-450): While not an order to withhold earnings itself, this document is often associated with the FL-825. It allows an obligor the opportunity to contest the order or request modifications, providing due process similar to challenges that may arise from earnings assignments.

- Notice of Wage Assignment (FL-440): This form is a notice usually sent to an employee’s employer indicating that wages must be garnished for support. Its purpose is closely related to the FL-825, as both serve to instruct payors on their responsibilities in relation to support payments.

- Child Support Order (FL-610): This document establishes a specific amount of child support to be paid. Similar to the FL-825, it details the obligations of the payer and coordinates with earnings assignments to ensure that payments are made from an obligor's income.

- Spousal Support Order (FL-320): This is a judicial decree that specifies the amount and duration of support one spouse must pay to another. It operates similarly to the FL-825 by specifying payment timelines and establishing clear expectations between parties.

- Judgment on Reserved Issues (FL-180): This document outlines ruling on final issues in a divorce proceeding, which can include spousal support. While it does not directly order earnings to be withheld, it may set the stage for subsequent earnings assignment orders, aligning with the objectives of the FL-825.

Dos and Don'ts

When filling out the FL 825 form, there are important actions to take and avoid. Here are some key points to help you through the process:

- Do: Review the form carefully before filling it out to ensure you understand each section.

- Do: Double-check all names, addresses, and case numbers for accuracy.

- Do: Keep a copy of the completed form for your records after submission.

- Do: Submit the form to the appropriate court by the required deadline.

- Don’t: Leave any sections blank; fill in all required information completely.

- Don’t: Use incorrect names or jurisdictions, which can cause delays.

- Don’t: Forget to sign and date the form where necessary.

- Don’t: Ignore any additional instructions provided with the form.

Misconceptions

Misinformation 1: The FL-825 form only pertains to child support.

This is incorrect. The FL-825 form, also known as the Earnings Assignment Order for Spousal or Partner Support, specifically addresses spousal or partner support payments. It does not cover child support, which has its own set of requirements and forms.

Misinformation 2: The employer can withhold any amount from the obligor's earnings.

This misunderstanding overlooks the legal limits on withholding. Employers can only withhold a maximum of 50% of an obligor's disposable earnings, unless a court order specifies otherwise. Federal law also sets limits, ensuring no more than 65% can be withheld.

Misinformation 3: The obligor does not need to be notified once the earnings assignment order is issued.

On the contrary, the payor must provide a copy of the order to the obligor within 10 days of receipt. This notification is essential for the obligor to understand their responsibilities and rights regarding the support payments.

Misinformation 4: Once the FL-825 form is issued, the obligor cannot contest the order.

This is a misconception. The obligor has the right to contest the order by filing a Request for Hearing Regarding Earnings Assignment (form FL-450) within 10 days of receiving the order. They can seek a modification of the order if necessary.

Key takeaways

Here are key takeaways regarding the FL-825 form:

- Purpose: The FL-825 form is designed to facilitate the garnishment of an obligor's earnings for spousal or partner support as specified by the court.

- Timeliness: Payors must withhold and remit a portion of the obligor’s earnings within 10 days after receiving the Earnings Assignment Order.

- Payment Breakdown: The form details current support payments, arrearages, and specifies where those payments should be sent.

- Legal Requirement: Copies of the order must be provided to the obligor and the Request for Hearing Regarding Earnings Assignment (form FL-450) must also be included.

- Modification Impact: When filling out the form, it is crucial to note that this order can modify an existing support order; the previous order remains effective until the modification is confirmed.

- Earnings Definition: Earnings include wages, bonuses, commissions, and other compensation types. Understanding what constitutes earnings is essential for compliance.

- Withholding Limits: Employers are limited on how much can be withheld from disposals earnings, typically no more than 50 percent of disposable earnings unless specified by the court.

- Employment Changes: Obligors must notify the court and payees of any changes in employment. This obligation ensures continued support enforcement.

- Punitive Measures: Employers are prohibited from retaliating against employees who are subject to earnings assignment orders, with penalties for violations.

Using the FL-825 form necessitates careful attention to detail and compliance with legal standards to ensure that both the rights of the obligor and the demands of the court are respected.

Browse Other Templates

Course Registration Form - Indicate whether you hold a bachelor’s degree and from which institution.

2407 - Communication regarding changes in coverage should be transparent and informed.

Emotional Distress Filing Form,Sensitivity Report Sheet,Whiner's Documentation Form,Feelings Impact Log,Tears & Whines Submission,Crybaby Complaint Form,Pansy Feelings Assessment,Fragile Ego Report,SSensitivity Assessment Form,Woe Is Me Report - Use this report as a tool to express your vulnerabilities.