Fill Out Your Fl Dr 1 Form

The FL DR 1 form is an essential document for businesses operating in Florida, particularly when it comes to registering for the state's business tax. With a sleek and secure online registration process available at floridarevenue.com/taxes/registration, applicants can quickly and easily submit their information. This form covers vital aspects of a business entity, including necessary identification numbers such as the Federal Employer Identification Number (FEIN), Social Security Numbers (SSNs), and Florida Business Partner Numbers. It also requires details about the business's location, ownership structure, and reasons for applying, whether that’s starting a new business, adding a new location, or changing ownership. Confidentiality is a key point, as the information provided remains protected under Florida law. Additional sections are dedicated to business activities, allowing applicants to specify the primary nature of their enterprise alongside any necessary tax account numbers. Understanding the form’s requirements is crucial for compliance and for the seamless operation of businesses within the state.

Fl Dr 1 Example

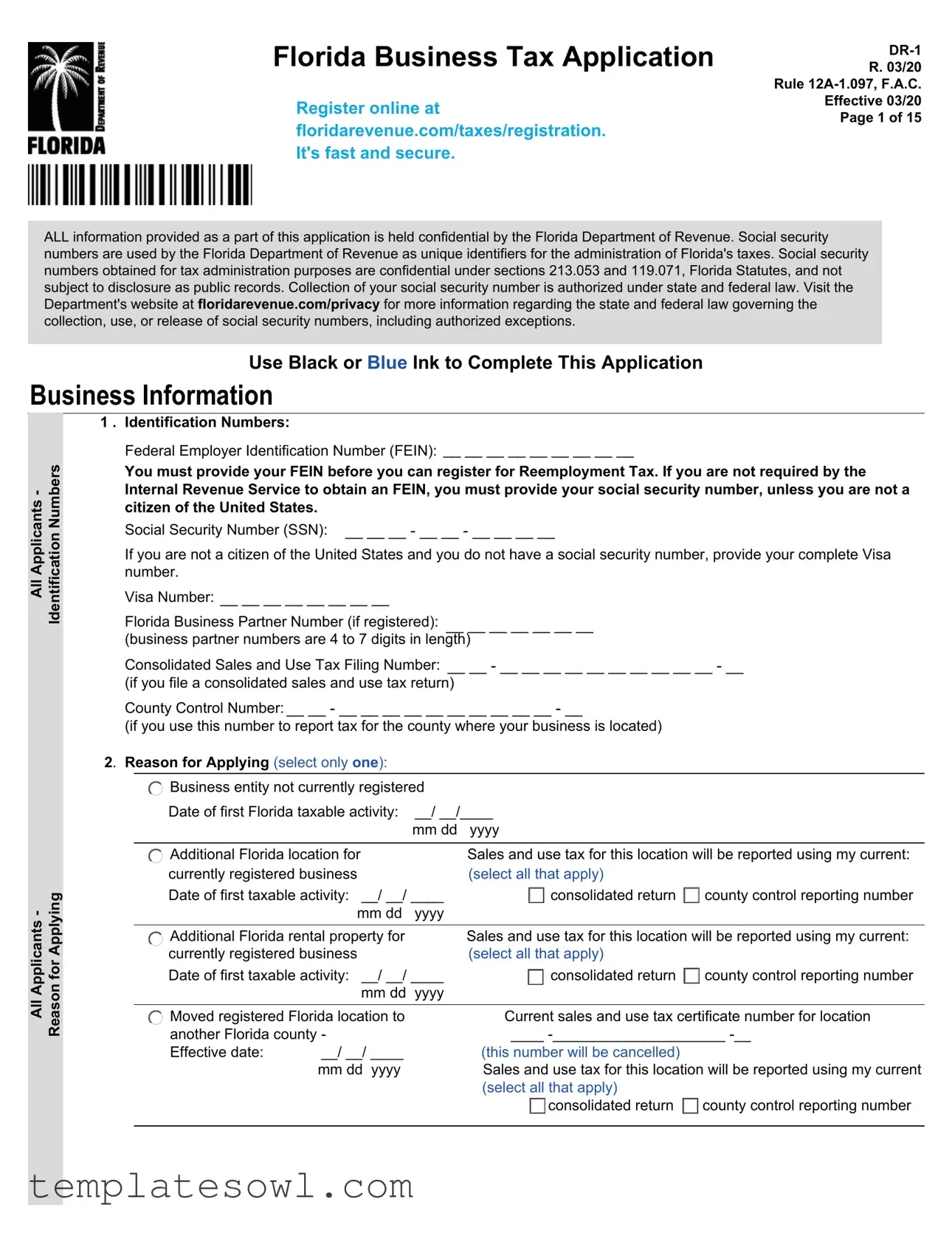

Florida Business Tax Application

Register online at floridarevenue.com/taxes/registration. It's fast and secure.

R. 03/20

Rule

Effective 03/20

Page 1 of 15

ALL information provided as a part of this application is held confidential by the Florida Department of Revenue. Social security numbers are used by the Florida Department of Revenue as unique identifiers for the administration of Florida's taxes. Social security numbers obtained for tax administration purposes are confidential under sections 213.053 and 119.071, Florida Statutes, and not subject to disclosure as public records. Collection of your social security number is authorized under state and federal law. Visit the Department's website at floridarevenue.com/privacy for more information regarding the state and federal law governing the collection, use, or release of social security numbers, including authorized exceptions.

Use Black or Blue Ink to Complete This Application

Business Information

All Applicants - Identification Numbers

1 . Identification Numbers:

Federal Employer Identification Number (FEIN): __ __ __ __ __ __ __ __ __

You must provide your FEIN before you can register for Reemployment Tax. If you are not required by the Internal Revenue Service to obtain an FEIN, you must provide your social security number, unless you are not a citizen of the United States.

Social Security Number (SSN): __ __ __ - __ __ - __ __ __ __

If you are not a citizen of the United States and you do not have a social security number, provide your complete Visa number.

Visa Number: __ __ __ __ __ __ __ __

Florida Business Partner Number (if registered): __ __ __ __ __ __ __

(business partner numbers are 4 to 7 digits in length)

Consolidated Sales and Use Tax Filing Number: __ __ - __ __ __ __ __ __ __ __ __ __ - __ (if you file a consolidated sales and use tax return)

County Control Number: __ __ - __ __ __ __ __ __ __ __ __ __ - __

(if you use this number to report tax for the county where your business is located)

2. Reason for Applying (select only one):

Business entity not currently registered

Business entity not currently registered

Date of first Florida taxable activity: __/ __/____

mm dd yyyy

All Applicants - Reason for Applying

Additional Florida location for |

Sales and use tax for this location will be reported using my current: |

||

currently registered business |

(select all that apply) |

|

|

Date of first taxable activity: __/ __/ ____ |

consolidated return |

county control reporting number |

|

|

mm dd yyyy |

|

|

Additional Florida rental property for |

Sales and use tax for this location will be reported using my current: |

||

currently registered business |

(select all that apply) |

|

|

Date of first taxable activity: __/ __/ ____ |

consolidated return |

county control reporting number |

|

|

mm dd yyyy |

|

|

Moved registered Florida location to |

Current sales and use tax certificate number for location |

||

another Florida county - |

____ |

||

Effective date: |

__/ __/ ____ |

(this number will be cancelled) |

|

|

mm dd yyyy |

Sales and use tax for this location will be reported using my current |

|

|

|

(select all that apply) |

|

|

|

consolidated return |

county control reporting number |

|

|

|

|

All Applicants - Reason for Applying

Seasonal All Applicants - Business Ownership Business

R. 03/20

Page 2 of 15

Starting a new taxable activity at a |

|

|

registered location - |

|

Current sales and use tax certificate number for location |

Effective date: |

__/ __/____ |

__ __ - __ __ __ __ __ __ __ __ __ __ - __ |

mmdd yyyy

Change the form of business ownership - Effective date: __/ __/ ____

Change the form of business ownership - Effective date: __/ __/ ____

mm dd yyyy

|

Acquired existing business - |

|

|

|

Effective date: |

__/ __/ ____ |

|

|

|

mm dd yyyy |

|

|

|

|

|

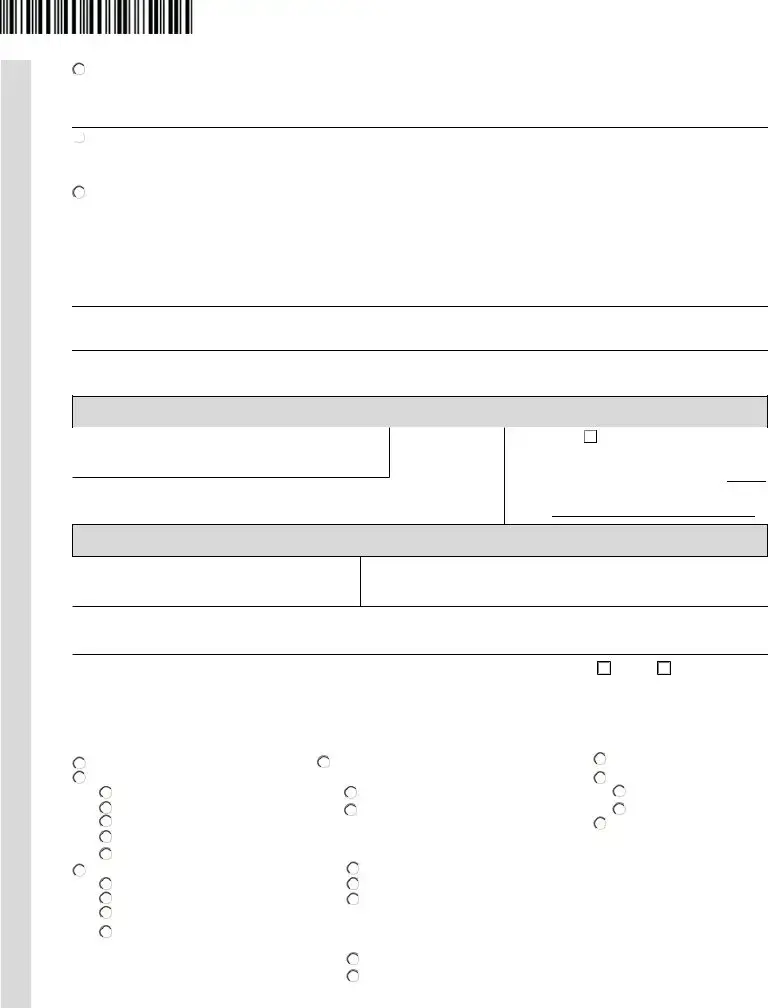

3. Business Name, Location, and Mailing Address: |

Others - Use name filed with the Florida Department of State or |

||

Sole proprietors - Use last name, first name, middle initial |

similar agency in another state |

||

Partnerships - Use partnership name or last name of general partners

Legal name of business:

Business trade name "doing business as" if you have one:

Physical Address: Provide the street address of the business location or Florida rental property - Do not use PO Box or Rural Route Numbers.

|

|

|

|

Street address: |

Florida County: |

Telephone #: |

Check if # is outside U.S. |

#:ext:

City / State / ZIP:

Fax #:

Fax #:

Mailing Address: Provide the name and mailing address where tax returns and other correspondence for your business are to be mailed.

Mail to: |

Mailing Address (if different than business location address): |

City / State / ZIP:

4. Is this business location only open during a portion of a calendar year? |

Yes |

No |

|||

If yes, provide the: |

|

|

|

|

|

First calendar month this business location is open: |

|

; and the |

|

|

|

Last calendar month this business location is open: |

|

. |

|

|

|

5. Form of Business Ownership: (select only one form of ownership) |

|

|

|||

Sole Proprietor (individual owner) |

Limited liability company (LLC) |

Estate |

|

||

Partnership (select one below): |

(select one below): |

Trust |

|

||

Married couple |

|

Single member |

Business |

||

General partnership |

|

Other |

|

||

Limited liability partnership (LLP) |

If single member,select the box that |

Governmental agency |

|||

Limited partnership (LP) |

applies to how your LLC is treated for |

|

|

||

Joint venture |

federal income tax. |

|

|

||

Corporation (select one below): |

|

C Corporation |

|

|

|

C Corporation |

|

S Corporation |

|

|

|

S Corporation |

|

Disregarded (reported by single member) |

|

|

|

If |

|

|

|||

Foreign corporation |

to how your LLC is treated for federal |

|

|

||

|

income tax. |

|

|

||

|

|

Partnership |

|

|

|

C Corporation

S Corporation

S Corporation

R. 03/20

Page 3 of 15

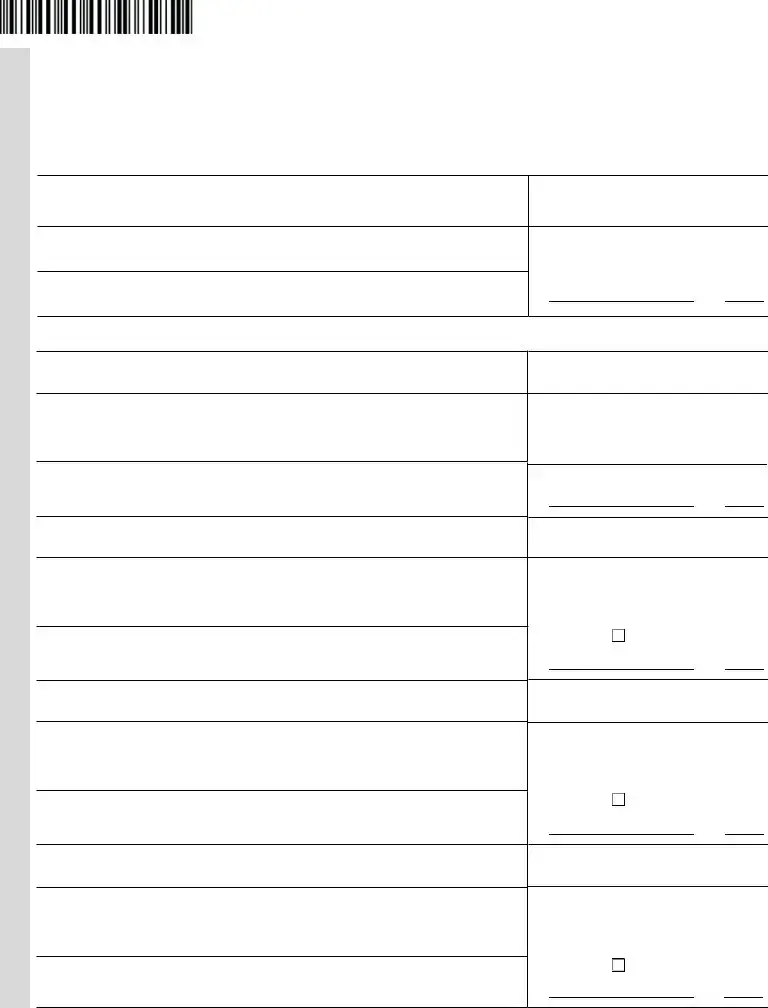

6. If your business is a partnership, corporation, limited liability company, or trust, provide the following information:

Date of Florida incorporation or organization,

or date of authorization to conduct business at this location in Florida: __ /__/ ____

mm dd yyyy

Fiscal year ending date (This date is generally "12/31"; however

a business may elect a different fiscal year):___/___

7. If you are a sole proprietor, provide the following information:

mm dd

Sole Proprietors

Legal Name (first name, middle initial, last name):

Home address:

City / State / ZIP:

SSN: __ __ __ - __ __ - __ __ __ __

or Visa #:__ __ __ __ __ __ __ __

Telephone #:  Check if # is outside U.S.

Check if # is outside U.S.

#:ext:

8.If your business is a partnership (including married couples), provide the following information for each general partner: (Attach additional pages, if needed.)

Business Owners and Managers

Name:

Home address:

City / State / ZIP:

Name:

Home address:

City / State / ZIP:

Name:

Home address:

City / State / ZIP:

Name:

Home address:

City / State / ZIP:

Title:

SSN: __ __ __ - __ __ - __ __ __ __

or Visa #:__ __ __ __ __ __ __ __

or FEIN: __ __

Telephone #:  Check if # is outside U.S.

Check if # is outside U.S.

#:ext: Title:

SSN: __ __ __ - __ __ - __ __ __ __

or Visa #:__ __ __ __ __ __ __ __

or FEIN: |

__ __ |

|

|

Telephone #: |

Check if # is outside U.S. |

#:ext:

Title:

SSN: __ __ __ - __ __ - __ __ __ __

or Visa #:__ __ __ __ __ __ __ __

or FEIN: |

__ __ |

|

|

Telephone #: |

Check if # is outside U.S. |

#:ext:

Title:

SSN: __ __ __ - __ __ - __ __ __ __

or Visa #:__ __ __ __ __ __ __ __

or FEIN: |

__ __ |

|

|

Telephone #: |

Check if # is outside U.S. |

#:ext:

R. 03/20

Page 4 of 15

9.If your business is a corporation, limited liability company, or trust, provide the following information for each director, officer, managing member, grantor, personal representative, or trustee of the business entity:

(Attach additional pages, if needed.)

Name:

Home address:

City / State / ZIP:

Title:

Last 4 Digits of Social Security Number: __ __ __ __

or Visa #:__ __ __ __ __ __ __ __

or FEIN: |

__ __ |

|||

Telephone #: |

Check if # is outside U.S. |

|||

#: |

|

|

ext: |

|

Business Owners and Managers

- |

Name:

Home address:

City / State / ZIP:

Name:

Home address:

City / State / ZIP:

Name:

Home address:

City / State / ZIP:

10. Background:

Title:

Last 4 Digits of Social Security Number: __ __ __ __

or Visa #:__ __ __ __ __ __ __ __

or FEIN: |

__ __ |

|

|||

Telephone #: |

Check if # is outside U.S. |

||||

#: |

|

|

ext: |

||

|

|

|

|

|

|

Title: |

|

|

|

|

|

Last 4 Digits of Social Security Number: __ __ __ __

or Visa #:__ __ |

__ __ __ __ __ __ |

|

|

|||

or FEIN: |

__ __ |

|

|

|||

Telephone #: |

Check if # is outside U.S. |

|

||||

#: |

|

|

ext: |

|||

|

|

|

|

|

|

|

Title: |

|

|

|

|

|

|

Last 4 Digits of Social Security Number: __ __ __ __

or Visa #:__ __ |

__ __ __ __ __ __ |

|

|

|||

or FEIN: |

__ __ |

|

|

|||

Telephone #: |

Check if # is outside U.S. |

|

||||

#: |

|

|

ext: |

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Applicants |

Background |

All Applicants - |

Business Activities |

|

Has your business ever been known |

|

|

Name: |

|

|

|

by another name? |

Yes |

No |

|

|

|

|

|

|

|

|

|

|

|

Was that business issued a Florida certificate |

|

|

Number: |

|

|

|

of registration or tax account number? |

Yes |

No |

|

|

|

|

|

|

|

|

|

|

|

11. Business Activities: |

|

|

Primary code |

|

|

|

Enter the |

|

|

|||

|

System (NAICS) code(s) that best describes your |

__ __ __ __ __ __ |

__ __ __ __ __ __ |

|

||

|

business activities at this location. Enter your primary |

__ __ __ __ __ __ |

__ __ __ __ __ __ |

|

||

|

code first. (Enter at least one.) |

|

|

|||

|

|

|

__ __ __ __ __ __ |

__ __ __ __ __ __ |

|

|

If you do not know your NAICS code(s), go to http://www.census.gov/eos/www/naics/index.html. Enter a keyword to search the most recent NAICS list.

All Applicants - Business Activities

R. 03/20

Page 5 of 15

Describe the primary nature of your business and type(s) of products or services to be sold.

Business Changes and Acquisitions

12.Change in Form of Business Ownership or Acquired Business

If your form of business ownership has changed (e.g., sole proprietorship to a corporation or partnership to a limited liability company), or you acquired an existing business, provide the following for your prior form of ownership or for the acquired business:

Name: |

|

|

|

FEIN: |

|

|

|

|

|

|

|

||

Address: |

|

|

|

Florida certificate or tax account number: |

||

|

|

|

|

|

|

|

City / State / ZIP: |

|

|

|

If acquired, portion acquired: |

|

|

|

|

|

|

All |

Part |

Unknown |

|

|

|

|

|||

Did your business share any common ownership, management, or |

|

Did the previous legal entity or acquired business have employees |

||||

control with the acquired business at the time of acquisition? |

|

at the time of the change or acquisition? |

|

|||

Yes |

No |

|

Yes |

No |

|

|

|

|

|

|

|

|

|

Were employees transferred to the new legal entity or new |

Date transferred: |

|

|

|

||

business? |

|

__ /__ /____ |

|

|

|

|

Yes |

No |

|

|

|

||

|

|

|

mm dd yyyy |

|

|

|

|

|

|

|

|

|

|

You must also submit a completed Report to Determine Succession and Application for Transfer of Experience Rating Records

(Form

You acquired an existing business in whole or in part, and

There was no common ownership, management or control between your business and the acquired business at the time of transfer.

Sales and Use Tax

Sales and Use Tax

13.For each of the business activities below, select all that apply to this location:

Sales, Rentals, or Repairs of Products

Sell products at retail (to consumers)

Sell products at retail (to consumers)

Sell products at wholesale (to registered dealers who will sell to consumers)

Sell products at wholesale (to registered dealers who will sell to consumers)

Sell products or goods from nonpermanent locations (such as flea markets or craft shows)

Sell products or goods from nonpermanent locations (such as flea markets or craft shows)

Sell products or goods by mail using catalogs or the internet

Sell, serve, or prepare food products or drinks for immediate consumption on your premises, or that you package or wrap for

Repair or alter consumer products or equipment

Rent equipment or other property or goods to individuals or businesses Charge admissions or membership fees

Property Rentals, Leases, or Licenses

Rent or lease commercial real property to individuals or businesses

Manage commercial real property for individuals or businesses

Rent or lease living or sleeping accommodations to others for periods of six months or less

Manage the rental or leasing of living or sleeping accommodations belonging to others

Rent or lease parking or storage spaces for motor vehicles in parking lots or garages

Rent or lease docking or storage spaces for boats in boat docks or marinas

Rent or lease

R. 03/20

Page 6 of 15

Sales and Use Tax (continued)

Sales and Use Tax

Real Property Contractors

Improve real property as a contractor

Sell products at retail (to consumers)

Construct, assemble, or fabricate building components at your plant or shop away from a project site that are used in your real property improvement projects

Purchase products or supplies from vendors located outside Florida for use in Florida real property improvement projects

Services

Pest control services for nonresidential buildings

Interior cleaning services for nonresidential buildings

Detective services

Protection services

Security alarm system monitoring services

Fuel

Sell tax paid gasoline, diesel fuel, or aviation fuel to retail dealers or end users in Florida (select all that apply below):

Gas station only

Gas station and convenience store

Truck stop

Marine fueling

Aircraft fueling

Reseller of fuel in bulk quantities Purchase dyed diesel fuel for

Reseller of fuel in bulk quantities Purchase dyed diesel fuel for

Secondhand Goods or Scrap Metal

Purchase, consign, trade, or sell secondhand goods

Purchase, gather, obtain, or sell salvage or scrap metal to be recycled or convert ferrous or nonferrous metals into raw material products

If you select either of these activities, you must also submit a Registration Application for Secondhand Dealers and Secondary Metals Recyclers (Form

Place and operate

Have entered into a written agreement with the following person or business to operate some or all the machines at this location.

Name:

Mailing address:

City / State / ZIP:

Telephone #:  Check if # is outside U.S.

Check if # is outside U.S.

#:ext:

If you operate amusement machines at your location or at locations belonging to others, you must also submit an Application for Amusement Machine Certificate (Form

Vending Machines (select all that apply below)

Place and operate vending machines at locations belonging to others: (Select the type or types of vending machines you operate.)

Place and operate vending machines at locations belonging to others: (Select the type or types of vending machines you operate.)

Food or beverage vending machines

Food or beverage vending machines

Nonfood or nonbeverage vending machines

Nonfood or nonbeverage vending machines

Operate vending machines at this location:

Operate vending machines at this location:

(Select the type or types of vending machines you operate.)

Food or beverage vending machines

Food or beverage vending machines  Nonfood or nonbeverage vending machines

Nonfood or nonbeverage vending machines

Sales and Use Tax (continued)

R.03/20 Page 7 of 15

|

Purchases |

||

|

|

Purchase items to use in my business without paying Florida sales tax to the seller at the time of purchase (such |

|

Tax |

|

as from a seller located outside Florida) |

|

|

Applying for a direct pay permit to |

||

Use |

|

||

|

To apply for a permit, submit an Application for |

||

|

|

||

and |

|

(Form |

|

|

Applying for authority to remit sales tax to the Department for independent sellers or distributors (see Rule |

||

Sales |

|

||

|

|||

|

|

||

|

|

|

|

|

|

This business does not conduct activities at this location subject to Florida sales and use tax |

|

Prepaid Wireless E911 Fee

E911 Fee

14. Do you sell prepaid phones, phone cards, or calling arrangements at this location? |

Yes |

No |

If yes, select the box that describes your sales:

Domestic or international long distance calling or phone cards

Domestic or international long distance calling or phone cards

Prepaid wireless services (cards, plans, devices) that provide access to wireless networks and interaction with 911 emergency services

Prepaid wireless services (cards, plans, devices) that provide access to wireless networks and interaction with 911 emergency services

Solid Waste - New Tire Fee,

WasteSolidFees Surchargeand |

15. |

Do you sell (at retail) new tires for motorized vehicles at this location that are sold separately or as |

Yes |

|

part of a vehicle? |

|

|

16. |

Do you sell (at retail) new or remanufactured |

|

|

|

|

||

|

|

or as a component part of another product such as new automobiles, golf carts, or boats? |

Yes |

|

17. |

Do you rent, lease, or sell |

|

|

|

that transport fewer than nine passengers? |

Yes |

Gross Receipts Tax on

No

No

No

No

No

No

Cleaning |

18. |

Do you own or operate a |

Yes |

No |

Tax |

Registration Package |

|

|

|

|

|

If yes, and you import or produce perchloroethylene or other |

|

|

Dry- |

|

|

|

|

Reemployment Tax |

|

|

||

Reemployment Tax

For purposes of reemployment tax, employees include officers of a corporation and members of a limited liability company classified as a corporation for federal tax purposes who perform services for the corporation or limited liability company and receive payment for such services (salary or distributions).

In addition to registering for Reemployment Tax:

New Florida employers must register with the Florida New Hire Reporting Center to report newly hired and

Florida employers are required to obtain appropriate workers' compensation insurance coverage for their employees. Visit www.myfloridacfo.com/division/wc/.

19. |

Do you have or will you have, employees in Florida? |

|

|

Yes |

No |

|||

20. |

Do you, or will you, lease workers from an employee leasing company to work in Florida? |

Yes |

No |

|||||

|

If yes, provide the following: |

|

|

|

|

|

|

|

|

Name of leasing company: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

FEIN: |

|

Department of Business and Professional Regulation license number: |

|||||

|

|

|

|

|

|

|

|

|

|

Portion of workforce that is leased: |

|

Date of leasing agreement for workers in Florida: |

|

|

|

|

|

|

All |

Part |

__ / __ |

/____ |

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

||

|

|

|

mm dd |

yyyy |

|

|

|

|

|

|

|

|

|

|

|

|

|

Reemployment Tax (continued)

R.03/20 Page 8 of 15

21. Do you use the services of persons in Florida whom you consider to be |

|

|

than those engaged in a distinct business, occupation, or profession that serves the general public (e.g., plumber, |

|

|

general contractor, or certified public accountant)? |

Yes |

No |

If yes, you must also submit a completed Independent Contractor Analysis (Form

If you answered No to questions 19, 20, and 21, proceed to the Communications Services Tax section. If you answered Yes, continue to the next question.

22. Is your business registered for reemployment tax? |

Yes |

No |

If yes, provide your RT account number: __ __ __ __ __ __ __ |

|

|

Are you currently reporting wages to the Florida Department of Revenue? |

Yes |

No |

Are you reactivating your reemployment tax account? |

Yes |

No |

23. On what date did you, or will you, first have an employee in Florida? __ / __ |

/____ |

|

mm dd |

yyyy |

|

24. Employment Type (select only one employment type):

Reemployment Tax

Regular employer

Nonprofit organization [must hold a 501(c)(3) determination letter from the Internal Revenue Service]

25.Select one category for your employment:

Domestic employer [employer of persons performing only domestic (household) services (e.g., maid or cook)]

Domestic employer [employer of persons performing only domestic (household) services (e.g., maid or cook)]

Indian tribe or Tribal unit

Indian tribe or Tribal unit

Governmental entity

Governmental entity

Agricultural (noncitrus) employer

Agricultural (noncitrus) employer

Agricultural (citrus) employer

Agricultural (citrus) employer  Agricultural crew chief

Agricultural crew chief

Regular, Indian tribe or Tribal unit, or Governmental employer

Have you or will you pay gross wages of at least $1,500 within a calendar quarter? |

|

Yes |

No |

If yes, provide the date you reached or will reach $1,500 gross wages. |

__ / __ |

/____ |

|

|

mm dd |

yyyy |

|

Have you or will you have one or more employees for a day (or portion of a day) during 20 or more |

|

|

|

weeks in a calendar year? |

|

Yes |

No |

If yes, provide the last day of the 20th week. |

__ / __ |

/____ |

|

|

mm dd |

yyyy |

|

Nonprofit organization

Have you or will you employ four or more workers for a day (or portion of a day) during 20 or more |

|

Yes |

No |

weeks in a calendar year? |

|

|

|

If yes, provide the last day of the 20th week. |

__ / __ |

/____ |

|

mm dd |

yyyy |

|

|

|

|

Domestic employer (Employer whose employees only perform domestic services.)

Have you or will you pay gross wages of at least $1,000 within a calendar quarter? |

|

Yes |

No |

If yes, provide the date you reached or will reach $1,000 gross wages. |

__ / __ |

/____ |

|

|

mm dd |

yyyy |

|

Reemployment Tax (continued)

R.03/20 Page 9 of 15

|

|

|

Agricultural (noncitrus, citrus, or crew chief) employer |

|

|

Have you or will you pay gross wages of at least $10,000 within a calendar quarter? |

Yes |

No |

If yes, provide the date you reached or will reach $10,000 gross wages. |

__ / __ |

/____ |

|

mm dd |

yyyy |

Have you or will you have five or more employees for a day (or portion of a day) during 20 or more |

|

|

weeks in a calendar year? |

Yes |

No |

If yes, provide the last day of the 20th week. |

__ / __ |

/____ |

|

mm dd |

yyyy |

26.List all Florida locations where you have employees. (Attach a separate sheet, if needed.)

Address:

Reemployment Tax

City / State / ZIP: |

|

|

|

Number of employees: |

|

|

|

|

|

Principal products or services: |

If services, indicate if: |

|

|

|

|

Administrative |

Research |

Other |

|

|

|

|

|

|

|

|

|

|

|

Address: |

|

|

|

|

|

|

|

|

|

City / State / ZIP: |

|

|

|

Number of employees: |

|

|

|

|

|

Principal products or services: |

If services, indicate if: |

|

|

|

|

Administrative |

Research |

Other |

|

|

|

|

|

|

|

|

|

|

|

Address: |

|

|

|

|

|

|

|

|

|

City / State / ZIP: |

|

|

|

Number of employees: |

|

|

|

|

|

Principal products or services: |

If services, indicate if: |

|

|

|

|

Administrative |

Research |

Other |

|

|

|

|

|

|

|

|

|

|

|

Address: |

|

|

|

|

|

|

|

|

|

City / State / ZIP: |

|

|

|

Number of employees: |

|

|

|

|

|

Principal products or services: |

If services, indicate if: |

|

|

|

|

Administrative |

Research |

Other |

|

|

|

|

|

|

|

|

|

|

|

27.Payroll Agent Information. If you will use a payroll agent (such as an accountant or bookkeeper) or firm that will maintain your payroll information, provide the following:

Name of payroll agent or firm:

Mailing address:

City / State / ZIP:

Reemployment Tax (continued)

R.03/20 Page 10 of 15

Reemployment Tax

28.Mailing Addresses for Reemployment Tax. To receive correspondence about reemployment tax reporting, tax rates, and benefits paid, select the appropriate mailing address for each type of correspondence below.

Reporting Forms and Information |

Tax Rate Information |

Benefits Paid Information |

Employer's Quarterly Reports, Certifications, |

Tax Rate Notices |

Notice of Benefits Paid |

Related Correspondence: |

Related Correspondence: |

|

Business Information (address in the |

Business Information (address |

Business Information (address in the |

the first section of this application) |

in the first section of this application) |

first section of this application) |

Payroll Agent Information (address |

Payroll Agent Information |

Payroll Agent Information (address |

in Question 27) |

(address in Question 27) |

in Question 27) |

Other (enter below) |

Other (enter below) |

Other (enter below) |

Other Address for Reporting Forms and Information

Name: |

|

Telephone #: |

Ext: |

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Mailing address: |

|

|

|

|

|

|

|

|

|

|

|

|

|

||

City / State / ZIP: |

Email address: |

|

|

|

|

||

|

|

|

|

|

|

|

|

Other Address for Tax Rate Information |

|

|

|

|

|

|

|

Name: |

|

Telephone #: |

Ext: |

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Mailing address:

City / State / ZIP:

Email address:

Other Address for Benefits Paid Information

Name: |

|

Telephone #: |

Ext: |

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Mailing address: |

|

|

|

|

|

|

|

|

|

|

|

|

|

||

City / State / ZIP: |

Email address: |

|

|

|

|

||

Communications Services Tax

Communications Services Tax

29. Do you sell communications services; purchase communications services to integrate into prepaid calling arrangements;

or are you applying for a direct pay permit for communications services tax? |

Yes |

No |

If yes, select each service you sell.

Telephone service (e.g., local, long distance, wireless, or VOIP) |

Video service (e.g., television programming or streaming) |

||

Paging service |

|||

Facsimile (fax) service (not when providing advertising or |

Pay telephone service |

||

professional services) |

Purchase services to integrate into prepaid calling arrangements |

||

Reseller (only sales for resale; no sales to retail customers) |

|

|

|

Other services; please describe: |

|

|

|

30. Are you applying for a direct pay permit for communications services tax? |

Yes |

No |

If yes, you must also submit an Application for

Form Characteristics

| Fact Name | Details |

|---|---|

| Application Purpose | The Florida Business Tax Application (Form DR-1) is used to register a business for the collection and remittance of taxes. |

| Confidential Information | All information in the application is confidential. The Florida Department of Revenue protects social security numbers under specific Florida Statutes. |

| Filing Requirements | Before registering for Reemployment Tax, applicants must provide a Federal Employer Identification Number (FEIN) or a social security number. |

| Governing Law | The application is governed by Rule 12A-1.097, F.A.C., and provisions in sections 213.053 and 119.071 of the Florida Statutes. |

| Online Registration | Businesses can complete the registration process online via floridarevenue.com/taxes/registration. It is a quick and secure method. |

Guidelines on Utilizing Fl Dr 1

Filling out the Florida Business Tax Application involves a series of detailed steps that ensure you provide necessary information to the Florida Department of Revenue. It’s important to have all your data ready to avoid any delays in your application process. This form is crucial for registering your business and establishing your tax obligations. Once completed, submit it online or as instructed in the guidelines.

- Visit the Florida Department of Revenue website at floridarevenue.com/taxes/registration to access the form.

- Use black or blue ink to fill out the application. Avoid pencil or other colors.

- In the “Identification Numbers” section, provide your Federal Employer Identification Number (FEIN). If you do not have one, enter your Social Security Number (SSN) or your complete Visa number if you are not a U.S. citizen.

- Indicate the reason for applying by selecting only one option from the provided options.

- Enter your business name, physical address, and mailing address accurately. Make sure to provide the complete street addresses and avoid using P.O. Box or Rural Route Numbers.

- Specify if your business operates only during part of the year. If yes, include the first and last calendar months of operation.

- Choose the form of business ownership and provide necessary details based on your selection.

- If applicable, fill in the information regarding the incorporation or organization date for corporations, LLCs or trusts.

- As a sole proprietor, provide your legal name, home address, and Social Security Number or Visa number.

- List information for all business owners, partners, or managers as required, attaching pages if necessary.

- If your business is a partnership, corporation, LLC, or trust, provide details for each officer or director.

- Input your primary North American Industry Classification System (NAICS) code that best matches your business activities. The primary code should be entered first.

- Describe the primary nature of your business and types of products or services you will offer.

- If there has been a change in ownership or if you have acquired a business, provide the necessary prior ownership information.

- Detail the sales and use tax activities that apply to your business location by selecting all applicable options related to sales, rentals, or repairs.

What You Should Know About This Form

What is the purpose of the FL DR 1 form?

The FL DR 1 form is the Florida Business Tax Application. This form is required for businesses to register and report their tax obligations in Florida. It allows for various tax registrations including sales and use tax, reemployment tax, and local business taxes. Completing this form is essential for anyone looking to operate a business in the state.

Who needs to fill out the FL DR 1 form?

Any individual or entity planning to conduct business activities in Florida is required to fill out the FL DR 1 form. This includes sole proprietors, partnerships, corporations, limited liability companies, and not-for-profits. Anyone who is establishing a new business, moving an existing business to Florida, or making changes to their business structure must complete this form.

What identification numbers are needed to complete the form?

Applicants must provide several identification numbers, including the Federal Employer Identification Number (FEIN) and Social Security Number (SSN). If the applicant does not require an FEIN, they must include their SSN unless they are not a U.S. citizen. In addition, those applying for a business partner number or a county control number should have these numbers available as well.

How is confidential information handled on the FL DR 1 form?

All information provided in the FL DR 1 form is treated as confidential by the Florida Department of Revenue. Particularly sensitive items such as Social Security Numbers are protected under Florida Statutes, making them exempt from public records disclosure. Security measures are in place to ensure that any confidential information is used solely for tax administration purposes.

Can the FL DR 1 form be submitted online?

Yes, the FL DR 1 form can be registered online at floridarevenue.com/taxes/registration. The online registration process is designed to be fast and secure, ensuring that applicants can conveniently complete their registration without the need for paper forms.

What if I need to change my business information after submitting the form?

If changes to business information occur after the submission of the FL DR 1 form, such as changes in ownership, business location, or business structure, the applicant must notify the Florida Department of Revenue. Depending on the nature of the change, a new or amended form may need to be submitted.

How can I determine my primary NAICS code for the application?

To find the appropriate NAICS (North American Industry Classification System) code for your business activities, you can visit the Census Bureau's website. By entering keywords related to your business, you can identify the accurate six-digit code that best describes your primary business activities.

What additional documentation may be required with the FL DR 1 form?

In certain cases, additional forms may be necessary. For example, if acquiring an existing business or changing business ownership forms, an applicant must submit Form RTS-1S to report specific details about the transfer. Applicants should be prepared to provide additional pages if there are multiple owners or managers involved.

Common mistakes

When filling out the Florida Business Tax Application (Form DR-1), applicants often make several common mistakes. One frequent error involves the identification numbers section. Applicants might forget to provide their Federal Employer Identification Number (FEIN) or Social Security Number (SSN), which can delay the registration process. It's essential to double-check that all required identification numbers are included and formatted correctly.

Another common mistake is related to the reason for applying. People may select more than one option instead of sticking to the instructions to choose only one. This can lead to confusion and result in their application being processed incorrectly. Applicants should carefully read the section and ensure they are selecting the appropriate reason for their application.

Completing the business name, location, and mailing address section can also present challenges. Applicants sometimes enter a PO Box or Rural Route Number instead of a physical address. The application requires a valid street address, as this information is crucial for tax purposes. Ensuring that the business’s location is accurately reported is necessary to avoid complications.

Furthermore, in the leadership section for partnerships or corporations, individuals may omit critical information about partners or members. This includes details such as home addresses and social security numbers or forgetting to provide it for all relevant parties. It's important to include complete information for all individuals involved in the business to ensure transparency.

Finally, applicants often overlook the NAICS code section. Providing an incorrect or invalid code can lead to classification problems later on. Before submitting the application, it’s advisable to verify that the entered NAICS code accurately reflects the primary activities of the business. Taking these steps can increase the chances of a smooth registration process.

Documents used along the form

When applying for business registration in Florida using the FL DR 1 form, there are several other forms and documents that are often used in conjunction. Each of these documents serves a specific purpose in ensuring that your business complies with local regulations and can operate effectively.

- Form RTS-1S: This form is necessary when there is a change in business ownership or when acquiring an existing business. It helps determine the proper transfer of experience rating records, which can affect future unemployment tax obligations. A completed RTS-1S must be submitted within 90 days of the transfer.

- Sales Tax Certificate: Often referred to as a Florida Sales Tax Number, this certificate allows businesses to collect sales tax on taxable sales. To obtain this certificate, businesses need to register with the Florida Department of Revenue, typically alongside the FL DR 1 form.

- Operating Agreement (for LLCs): This internal document outlines the management structure and operating procedures of a Limited Liability Company (LLC). While not mandatory, it's highly recommended to define roles and responsibilities clearly among members and protect personal assets.

- Partnership Agreement: For those creating a partnership, this document is crucial. It outlines the terms of the business relationship, including profit sharing, responsibilities, and procedures for adding or removing partners. This agreement helps prevent disputes by clearly defining roles.

- Employer Identification Number (EIN) Application (Form SS-4): Required for most businesses, the EIN is used for tax purposes and identification. This application is submitted to the Internal Revenue Service (IRS) and often needs to be completed before filing the FL DR 1 form, especially for businesses that plan to hire employees.

Understanding these additional forms is essential for successfully navigating the registration process for your business in Florida. Each document plays a vital role in ensuring compliance with state regulations, protecting your business interests, and facilitating smooth operations.

Similar forms

The Florida Business Tax Application (Form FL DR 1) is similar to several other important tax-related forms. Here’s a list of nine documents that share similarities with the FL DR 1 form:

- IRS Form SS-4: This form is used to apply for an Employer Identification Number (EIN), similar to how the FL DR 1 requests a Federal Employer Identification Number for Florida tax purposes.

- Florida Corporate Registration Application: This document is used to register a corporation in Florida, paralleling how the FL DR 1 assists in registering taxable activities in the state.

- Application for Florida Sales Tax Certificate (DR-1S): This document is directly related as it applies specifically to sales tax registration, an integral part of the FL DR 1 process.

- Form DR-840: This is the Florida Business Records Application form, both being part of the process to maintain compliance with state regulations.

- Federal Form 1040 Schedule C: This form is utilized by sole proprietors to report income and expenses, similar to how the FL DR 1 captures business ownership details for tax identification.

- IRS Form 1065: Partnerships use this form to report income, akin to FL DR 1’s request for partnership details and tax responsibilities.

- Form UCT-1 (Florida Unemployment Tax Registration): This form registers employers for unemployment tax in Florida, much like the FL DR 1 ensures business compliance with tax registrations.

- Florida Limited Liability Company (LLC) Application: This document registers an LLC in Florida and is similar to the FL DR 1 in its role in establishing business entities.

- Florida Department of Revenue’s Annual Resale Certificate for Sales Tax (DR-13): This certificate allows businesses to make tax-exempt purchases for resale, connecting back to the taxation aspects covered in the FL DR 1.

Dos and Don'ts

Things You Should Do When Filling Out the FL DR-1 Form:

- Use black or blue ink to fill out the application.

- Provide your Federal Employer Identification Number (FEIN) if applicable.

- Ensure your social security number (SSN) is accurate if you don’t have an FEIN.

- Double-check that all information matches official documents.

- Indicate the correct reason for applying from the given options.

- Provide a valid physical address, avoiding PO Boxes.

- Include contact information, such as telephone and fax numbers.

- Review the completed form before submission for errors or omissions.

Things You Shouldn't Do When Filling Out the FL DR-1 Form:

- Do not leave any required fields blank.

- Avoid using pencil or any other colors of ink.

- Do not submit without signing the form.

- Don’t provide incomplete or inaccurate identification numbers.

- Refrain from using an incorrect mailing address.

- Do not rush and skip the review process before sending the form.

- Don’t forget to update the form if your business structure changes.

- Do not use abbreviations for geographic locations or descriptors.

Misconceptions

The following is a list of six common misconceptions about the Florida Business Tax Application, also known as the Fl Dr 1 form, along with explanations to clarify each point:

- Misconception 1: The Fl Dr 1 form is only for new businesses.

- Misconception 2: Social security numbers are publicly accessible.

- Misconception 3: Completing the Fl Dr 1 form takes a long time.

- Misconception 4: You can use a PO Box for business addresses.

- Misconception 5: The Fl Dr 1 form is only necessary for sales and use tax.

- Misconception 6: The information on the Fl Dr 1 form is available to the public.

This form is used not only by new businesses but also by existing businesses that may need to update their registration or add additional locations. It is essential for any Florida business engaging in taxable activities to complete the form when necessary.

In reality, social security numbers collected as part of the Fl Dr 1 application are confidential. The Florida Department of Revenue maintains the confidentiality of these numbers, and they are protected by law from public disclosure.

Many applicants find that registering can be a quick and straightforward process. The Florida Department of Revenue offers an online registration system that is both fast and secure, making it easier for applicants to complete the process efficiently.

The application specifically requires a physical business address. PO Boxes or Rural Route Numbers are not acceptable as a primary address for the business. This helps ensure accurate records and correspondence.

This form serves multiple purposes beyond sales and use tax registration. It also applies to various business activities including rentals, repairs, and any taxable activities in Florida, making it a crucial document for a wide scope of businesses.

The information provided on this application is confidential and protected by the Florida Department of Revenue. Only authorized personnel may access this information, helping to ensure that sensitive business information remains secure.

Key takeaways

When completing the Florida Business Tax Application, also known as the FL DR-1 form, there are several important points to keep in mind. Here are key takeaways:

- Confidentiality of Information: All information submitted with this application is confidential. This means that sensitive details, such as Social Security numbers, are protected and not disclosed as public records.

- Using the Correct Ink: Always use black or blue ink when filling out the application. This ensures that the information is clear and readable for processing.

- Identification Numbers Required: You must provide your Federal Employer Identification Number (FEIN) or, if you do not have one, your Social Security Number (SSN). These numbers identify your business for tax purposes.

- Reason for Application: Clearly indicate why you are applying. You might be starting a new business, moving to a different county, or adding a new business location within Florida.

- Provide Complete Business Information: It is crucial to list your legal business name, trade name (if applicable), and accurate addresses. Do not use a P.O. Box for your business location.

- Code for Business Activities: Enter the relevant six-digit North American Industry Classification System (NAICS) code that best describes your business activities. This helps in categorizing your business type.

By keeping these key points in mind, you can ensure that your application process is smooth and efficient. Understanding the specifics of what is needed will help avoid delays or issues with your registration.

Browse Other Templates

Wisconsin Criminal Background Check Form,Multi-Name Criminal Record Inquiry,Wisconsin Criminal History Request Form,Crime Information Bureau Record Request,DJ-LE Multi-Name Inquiry,Wisconsin Criminal Record Check Application,DJ-LE-250A Multiple Name - The form allows users to check multiple names for criminal records in Wisconsin.

Bank of America Transfer - This transfer form facilitates smooth transitions between financial institutions.

Remistart - Rebate cards are issued by MetaBank and should be treated securely.