Fill Out Your Fl Dr 312 Form

The Affidavit of No Florida Estate Tax Due, commonly known as Form DR-312, serves as a crucial document for personal representatives managing estates that are exempt from Florida estate taxes. This form is specifically designed for situations where neither a Florida estate tax nor a federal estate tax return is required, offering an efficient way to confirm the absence of tax liability. By completing this affidavit, the personal representative acknowledges their role and responsibilities regarding the estate of a decedent who has passed away, providing essential details such as the decedent’s name, date of death, and domicile status. The form also gives personal representatives a means to certify that the estate does not owe any Florida estate tax, thereby facilitating the release of any potential tax liens associated with the estate. It emphasizes the importance of accuracy, as the personal representative must affirm the veracity of the facts stated. Notably, the DR-312 must be filed with the appropriate circuit court clerk and should never be sent to the Florida Department of Revenue. Steps for filing are straightforward, and the guidelines underscore that this affidavit is not applicable for those estates required to file federal Form 706 or 706-NA. Understanding the use and requirements of Form DR-312 can greatly ease the administrative process for personal representatives during what is often a difficult time, providing clarity and alleviating potential concerns regarding estate tax obligations.

Fl Dr 312 Example

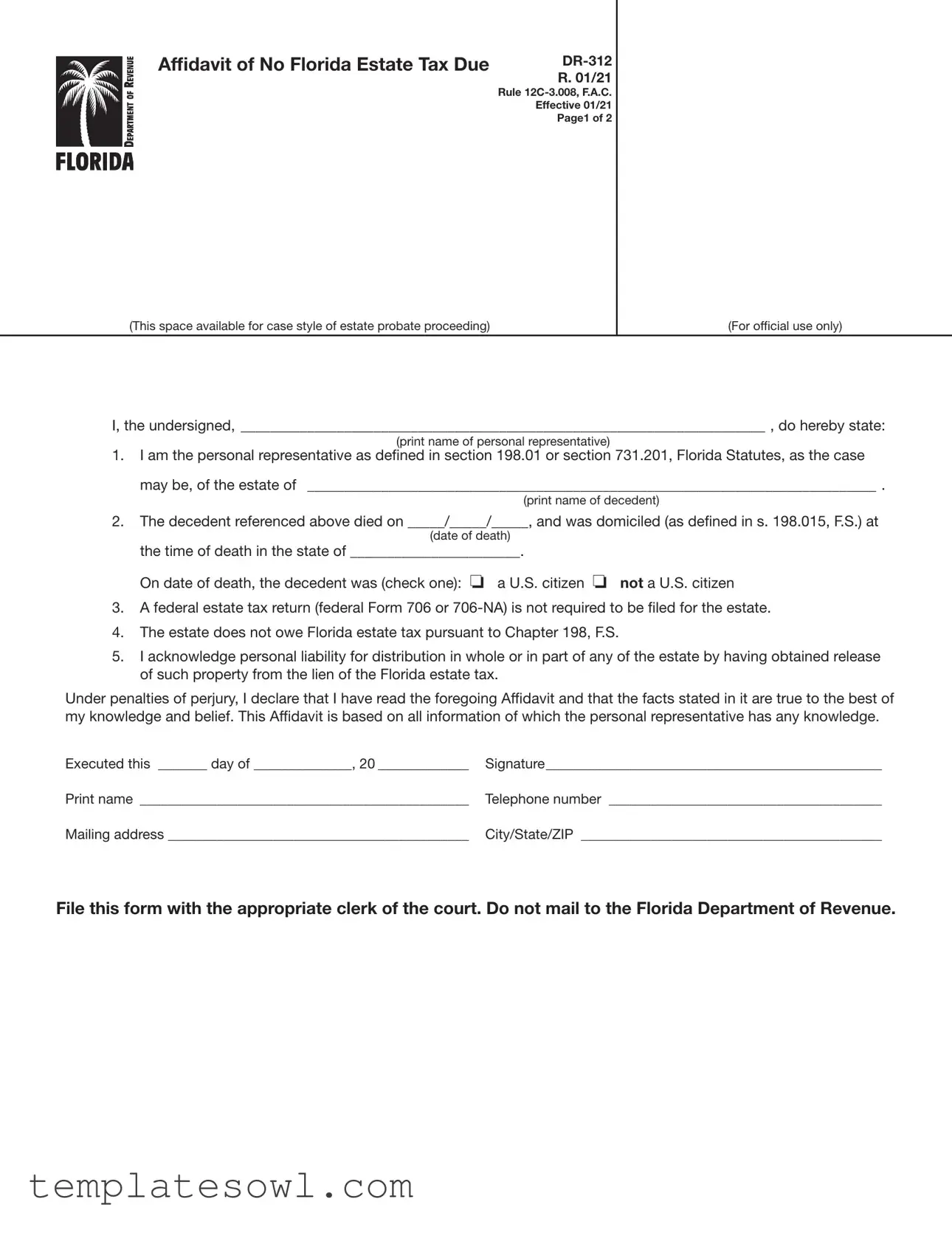

Affidavit of No Florida Estate Tax Due

Rule

Effective 01/21

Page1 of 2

(This space available for case style of estate probate proceeding) |

(For official use only) |

I, the undersigned, _______________________________________________________________________ , do hereby state:

(print name of personal representative)

1.I am the personal representative as defined in section 198.01 or section 731.201, Florida Statutes, as the case may be, of the estate of _____________________________________________________________________________ .

(print name of decedent)

2.The decedent referenced above died on _____/_____/_____, and was domiciled (as defined in s. 198.015, F.S.) at

(date of death)

the time of death in the state of _______________________.

On date of death, the decedent was (check one): o a U.S. citizen o not a U.S. citizen

3.A federal estate tax return (federal Form 706 or

4.The estate does not owe Florida estate tax pursuant to Chapter 198, F.S.

5.I acknowledge personal liability for distribution in whole or in part of any of the estate by having obtained release of such property from the lien of the Florida estate tax.

Under penalties of perjury, I declare that I have read the foregoing Affidavit and that the facts stated in it are true to the best of my knowledge and belief. This Affidavit is based on all information of which the personal representative has any knowledge.

Executed this _______ day of ______________, 20 _____________ |

Signature________________________________________________ |

Print name _______________________________________________ |

Telephone number _______________________________________ |

Mailing address ___________________________________________ |

City/State/ZIP ___________________________________________ |

File this form with the appropriate clerk of the court. Do not mail to the Florida Department of Revenue.

R. 01/21

Page 2 of 2

Instructions for Completing Form

File this form with the appropriate clerk of the court. Do not mail to the Florida Department of Revenue.

General Information

If Florida estate tax is not due and a federal estate tax return (federal Form 706 or

Form

The

Where to File Form

Form

When to Use Form

Form

and a federal estate tax return (federal Form 706 or

Federal thresholds for filing federal Form 706 only: (For informational purposes only. Please confirm with Form 706 instructions.)

Date of Death |

Dollar Threshold |

(year) |

for Filing Form 706 |

|

(value of gross estate) |

|

|

2000 and 2001 |

$675,000 |

|

|

2002 and 2003 |

$1,000,000 |

|

|

2004 and 2005 |

$1,500,000 |

|

|

For 2006 and forward |

|

go to the IRS website at |

|

www.irs.gov to obtain |

|

thresholds. |

|

|

|

For thresholds for filing federal Form

If an administration proceeding is pending for an estate, Form

To Contact Us

Information, forms, and tutorials are available on the Department’s website floridarevenue.com

If you have any questions, or need assistance, call Taxpayer Services at

To find a taxpayer service center near you, go to: floridarevenue.com/taxes/servicecenters

For written replies to tax questions, write to: Taxpayer Services - Mail Stop

5050 W Tennessee St Tallahassee FL

Subscribe to Receive Email Alerts from the Department.

Subscribe to receive an email when Tax Information Publications and proposed rules are posted to the Department’s website. Subscribe today at floridarevenue.com/dor/subscribe.

Reference Material

Rule Chapter

Form Characteristics

| Fact Name | Description |

|---|---|

| Form Purpose | The FL Dr 312 form serves as an Affidavit of No Florida Estate Tax Due. It is used by personal representatives to declare that no estate tax is owed for the deceased individual. |

| Governing Laws | The form is governed by Chapter 198 of the Florida Statutes and Rule 12C-3.008 of the Florida Administrative Code. These laws outline the definitions and procedures related to estate tax in Florida. |

| Filing Requirements | This form must be filed directly with the clerk of the circuit court in the county where the decedent owned property. It is important not to send the form to the Florida Department of Revenue. |

| Eligibility Criteria | The FL Dr 312 form may be used only when an estate is not subject to Florida estate tax, and a federal estate tax return is not required. Estates that must file a federal Form 706 cannot use this affidavit. |

Guidelines on Utilizing Fl Dr 312

Filling out the Florida Form DR-312 is a straightforward process that requires submitting it to the appropriate clerk of the court. The steps below will guide you through the necessary information to report on the form.

- Print your name in the space provided for the personal representative.

- Enter the decedent's name in the designated section.

- Provide the decedent's date of death in the format of MM/DD/YYYY.

- Indicate the state where the decedent was domiciled at the time of death.

- Check the box to confirm whether the decedent was a U.S. citizen or not.

- Assert that a federal estate tax return (federal Form 706 or 706-NA) is not required by stating “not required” in the appropriate section.

- Confirm that there is no Florida estate tax owed according to Chapter 198, F.S.

- Acknowledge your personal liability for any distributions made from the estate by signing your name.

- Print your name again below your signature.

- Provide your telephone number, mailing address, and city, state, and ZIP code.

- Do not mark or write in the space at the top right corner reserved for official use.

- Submit the completed form to the clerk of the circuit court in the county where the decedent owned property.

What You Should Know About This Form

What is the purpose of the Fl Dr 312 form?

The Fl Dr 312 form, officially known as the Affidavit of No Florida Estate Tax Due, serves to declare that the estate of a deceased individual does not owe any Florida estate tax. It provides assurance to the personal representative and beneficiaries that no federal estate tax return is required, and thus, they can proceed with distributing the estate without defaulting on tax obligations.

Who can complete and file the Fl Dr 312 form?

Only the personal representative of the estate can complete and file the Fl Dr 312 form. This representative is defined under Florida Statutes as an individual who holds actual or constructive possession of the estate's assets. Additionally, possessors of any property belonging to the decedent’s estate may also utilize this form to affirm that no Florida estate tax is due.

When should I use the Fl Dr 312 form?

This form should be used when an estate is not required to pay Florida estate tax and a federal estate tax return (federal Form 706 or 706-NA) is not necessary. It is essential to confirm that your estate meets these criteria before filing the form. If you are unsure whether your estate meets these requirements, consulting a professional can help clarify your obligations.

Where do I file the Fl Dr 312 form?

The completed Fl Dr 312 form must be filed directly with the clerk of the circuit court in the counties where the decedent owned property. Do remember, you should not send this form to the Florida Department of Revenue. It’s important for it to be duly recorded in the public records to validate the claims made in the affidavit.

What happens after I file the Fl Dr 312 form?

Once the Fl Dr 312 form is filed, it is accepted as evidence that the estate is not liable for Florida estate tax. This filing will also remove any estate tax lien imposed by the Florida Department of Revenue. However, make sure that all information provided in the form is accurate to avoid any legal complications later.

Common mistakes

Filling out the Florida Form DR-312 can be daunting, and mistakes can lead to delays or issues. One common error is failing to properly complete the personal representative's name. This form relies on accurate identification of the individual representing the estate. If the name is misspelled or written inaccurately, it may raise questions about the validity of the affidavit. It's crucial to print the name clearly and ensure it matches the official documentation.

An additional mistake often made involves the selection of the decedent's citizenship status. The form requires that you check the appropriate box indicating whether the decedent was a U.S. citizen or not. Neglecting to do this may lead to a rejection of the form, as the information is vital in determining the estate’s tax obligations. Always double-check that you have marked one of the options to avoid complications.

Many people overlook the importance of including the correct date of death. This date serves as a reference point for determining eligibility and tax requirements. If this information is incorrect or absent, it can create confusion about when the estate is assessed for tax purposes. Thus, writing this date accurately is paramount and should be double-checked against official records.

Finally, failing to file the DR-312 form with the correct clerk of the court is a frequent issue. It is essential to ensure that the form is submitted in the appropriate jurisdiction, aligning with where the decedent owned property. Sending the form to the Florida Department of Revenue instead of the circuit court can delay the processing, which might result in unwarranted tax claims against the estate. Always confirm the filing location to ensure compliance.

Documents used along the form

The Fl DR 312 form, Affidavit of No Florida Estate Tax Due, is commonly used in probate proceedings to confirm that no Florida estate tax is owed for a decedent's estate. Several other documents complement the use of the DR-312 form. Below is a brief description of these associated forms and documents.

- Federal Form 706: This is the United States Estate (and Generation-Skipping Transfer) Tax Return. It is filed by the estate of a deceased person if the gross estate exceeds a certain threshold. It provides a comprehensive accounting of the estate's assets and liabilities.

- Federal Form 706-NA: This form is specifically for the estates of nonresident aliens. It is used to report the transfer of the taxable estate and determine any estate tax that may apply under U.S. law.

- Nontaxable Certificate: Previously issued by the Florida Department of Revenue, this certificate confirmed that an estate did not owe estate taxes. However, this practice has changed following the adoption of Form DR-312.

- Will or Testament: This legal document outlines the testator’s wishes regarding the distribution of their property upon death. A will may affect tax liabilities and should be submitted alongside any tax affidavits to clarify the intended distribution of the estate.

Each of these documents serves a specific purpose in the administration of an estate. They promote clarity and ensure compliance with tax obligations, ultimately benefiting the estate's beneficiaries.

Similar forms

- Affidavit of Domicile: Similar to the FL DR 312 form, the Affidavit of Domicile is used to declare the legal residence of a decedent at the time of death. This document helps determine the jurisdiction for probate proceedings, similar to how the DR 312 form asserts that no Florida estate tax is owed.

- Federal Form 706: This form is the federal estate tax return that must be filed when the decedent's estate exceeds certain thresholds. It is different from the DR 312 in that it is required under specific conditions, while the DR 312 is for cases where no tax is due.

- Notice of Administration: This document serves to inform interested parties of the initiation of probate proceedings. Like the DR 312, it plays a crucial role in the probate process, although the DR 312 specifically addresses estate tax status.

- Inventory of Estate Assets: This document lists all assets belonging to the decedent’s estate. Unlike the DR 312, which focuses on tax liability, the inventory establishes what the estate consists of for distribution purposes.

- Waiver of Notice: This allows beneficiaries to waive their right to receive formal notice about probate proceedings. Both the Waiver of Notice and the DR 312 facilitate the probate process, but the latter deals explicitly with tax issues.

- Closing Statement: This document outlines the distribution of the estate’s assets after debts and taxes have been settled. Similar to the DR 312, it represents a finality in the probate process, yet it clarifies the outcome of asset distribution and obligations.

Dos and Don'ts

When filling out the Fl Dr 312 form, attention to detail is crucial. Here are eight important things you should and shouldn't do:

- Do read the instructions carefully before starting the form.

- Don't leave any required fields blank; all necessary information must be provided.

- Do ensure that the name of the personal representative is printed clearly.

- Don't forget to include the decedent's date of death; this is a critical detail.

- Do check the appropriate box regarding the decedent's U.S. citizenship status.

- Don't use the administrative space in the upper right corner; it is reserved for the court clerk's use only.

- Do file the form with the appropriate clerk of the court in the correct county.

- Don't mail the form to the Florida Department of Revenue; doing so will cause delays.

By following these guidelines, you can help ensure a smoother process in completing the Fl Dr 312 form.

Misconceptions

- Misconception 1: The form is only for wealthy estates.

- Misconception 2: It's unnecessary if there’s no Florida estate tax.

- Misconception 3: I should send the form to the Florida Department of Revenue.

- Misconception 4: Anyone can file this affidavit.

- Misconception 5: It's only relevant for estates in probate.

- Misconception 6: Filing the form is the last step in settling an estate.

Many people believe that the DR-312 form is only relevant for estates with significant assets. However, this form is applicable to any estate that does not owe Florida estate tax, regardless of its size.

Some individuals think that the DR-312 is not needed if there’s no Florida estate tax. This is not true. Filing the affidavit helps to formally declare that no tax is owed, which can prevent potential legal and financial complications later.

It is a common mistake to believe that the DR-312 should be mailed to the Florida Department of Revenue. The correct procedure is to file the form with the clerk of the circuit court instead.

While it may seem simple, only a personal representative as defined in Florida Statutes may complete and file this form. It's essential to ensure that the individual filing is eligible.

Some might think DR-312 applies solely to estates undergoing probate. However, it can also be filed for estates where no administration proceeding is pending, as long as the conditions for use are met.

After filing the DR-312, it doesn’t complete the estate's administration process. Other necessary steps may still exist, depending on the estate's unique circumstances.

Key takeaways

Understanding the Fl Dr 312 form, also known as the Affidavit of No Florida Estate Tax Due, is crucial for personal representatives handling an estate. Here are five key takeaways to keep in mind:

- Eligibility Criteria: This form should be used only when an estate is not liable for Florida estate tax and a federal estate tax return is not required. Confirm eligibility before proceeding.

- Important Filing Locations: File the Fl Dr 312 form directly with the clerk of the circuit court in the county where the decedent owned property. Do not send it to the Florida Department of Revenue.

- Liability Acknowledgment: By signing the form, the personal representative acknowledges personal liability for any distribution of the estate. This highlights the importance of accurate information when completing the form.

- Public Record: Once filed, this form is recorded in the public records, serving as official evidence that no Florida estate tax is due and helps release the estate from the tax lien.

- No Mailing Requirements: Do not mail the Fl Dr 312 to the Florida Department of Revenue, as it is meant for local clerk filing only.

By following these guidelines, personal representatives can ensure they handle the process effectively and within the legal requirements, minimizing potential complications down the line.

Browse Other Templates

Rebny Statement - The total assets section helps to calculate your net worth.

Wildlife Removal Hammond La - The scoring process for the test is efficient and aims to notify applicants promptly.