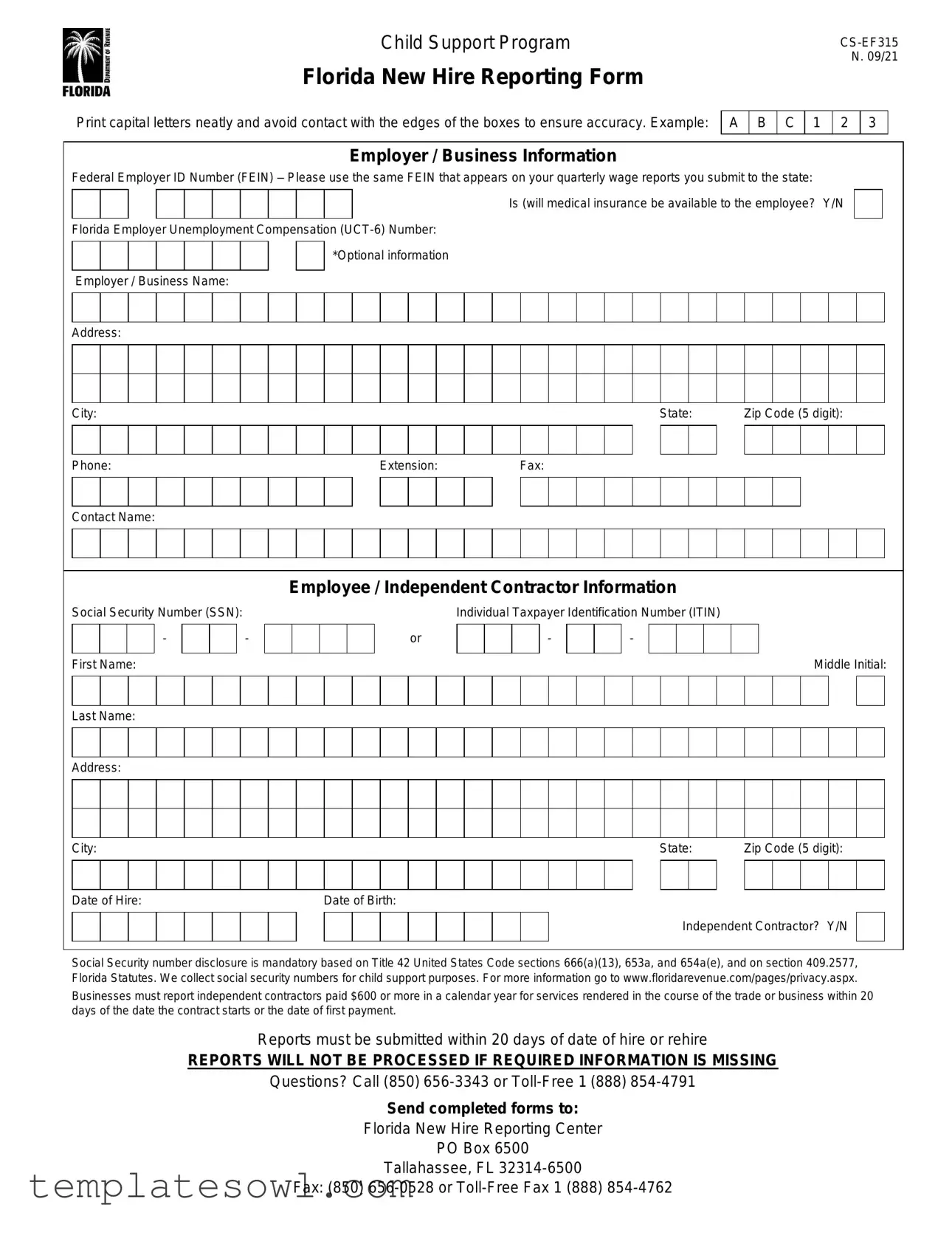

Fill Out Your Fl New Hire Form

When hiring new employees in Florida, it is essential to complete the Florida New Hire Reporting Form accurately and promptly. This form serves a crucial role in the Child Support Program by facilitating the reporting of new hires to the state. Completing the form requires careful attention to detail, so it's recommended to print in capital letters and avoid touching the edges of the boxes to ensure all information is clear. Each section of the form captures important employer and employee details. Employers must provide their Federal Employer ID Number (FEIN), business name, and contact information. Additionally, they need to indicate if medical insurance is available to the new hire. Meanwhile, employees must supply their social security number, name, address, date of hire, and, if applicable, identify themselves as independent contractors. Disclosure of the social security number is mandatory to comply with federal and state regulations. Timeliness is paramount, as businesses must report new hires within 20 days or face processing delays. For questions or assistance, help is available through dedicated phone lines, ensuring that both employers and employees can navigate this necessary process effectively.

Fl New Hire Example

Child Support Program

Florida New Hire Reporting Form

Print capital letters neatly and avoid contact with the edges of the boxes to ensure accuracy. Example:

N. 09/21

A B C 1 2 3

Employer / Business Information

Federal Employer ID Number (FEIN) – Please use the same FEIN that appears on your quarterly wage reports you submit to the state:

Is (will medical insurance be available to the employee? Y/N Florida Employer Unemployment Compensation

Is (will medical insurance be available to the employee? Y/N Florida Employer Unemployment Compensation

*Optional information

Employer / Business Name:

Address:

City: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

State: |

|

Zip Code (5 digit): |

||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Phone: |

|

|

|

|

|

|

|

Extension: |

|

|

Fax: |

|

|

|

|

|

|

|||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Contact Name: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Employee / Independent Contractor Information

Social Security Number (SSN): |

|

||||||

|

|

|

|

|

|

|

- |

|

|

|

- |

|

|

|

|

|

|

|

|

|

|

|

|

First Name: |

|

||||||

|

Individual Taxpayer Identification Number (ITIN) |

||||||||||

or |

|

|

|

|

|

|

- |

|

|

|

|

|

|

|

- |

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

Middle Initial:

Last Name:

Address:

City: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

State: |

|

Zip Code (5 digit): |

||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Date of Hire: |

|

|

|

|

|

Date of Birth: |

|

|

|

|

|

|

||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Independent Contractor? Y/N |

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Social Security number disclosure is mandatory based on Title 42 United States Code sections 666(a)(13), 653a, and 654a(e), and on section 409.2577, Florida Statutes. We collect social security numbers for child support purposes. For more information go to www.floridarevenue.com/pages/privacy.aspx.

Businesses must report independent contractors paid $600 or more in a calendar year for services rendered in the course of the trade or business within 20 days of the date the contract starts or the date of first payment.

Reports must be submitted within 20 days of date of hire or rehire

REPORTS WILL NOT BE PROCESSED IF REQUIRED INFORMATION IS MISSING

Questions? Call (850)

Send completed forms to:

Florida New Hire Reporting Center

PO Box 6500

Tallahassee, FL

Fax: (850)

Form Characteristics

| Fact Name | Description |

|---|---|

| Purpose | The Florida New Hire Reporting Form is used to report newly hired or rehired employees to the state's Child Support Program. |

| Mandatory Information | The form requires the employer's Federal Employer ID Number (FEIN), employee's Social Security Number (SSN), and relevant personal details. |

| Submission Timeline | Employers must submit the form within 20 days of the employee's date of hire or rehire. |

| Independent Contractors | Businesses must also report independent contractors paid $600 or more within 20 days of the contract start date or first payment. |

| Compliance Requirements | The collection of SSNs is mandated by federal laws and Florida Statutes, ensuring compliance with child support regulations. |

| Contact Information | For questions, employers can call (850) 656-3343 or toll-free at 1 (888) 854-4791 for assistance. |

| Submission Details | Completed forms should be mailed to the Florida New Hire Reporting Center or sent via fax to the appropriate numbers provided. |

Guidelines on Utilizing Fl New Hire

Once you've gathered all relevant information about your new hire, you’re ready to fill out the Florida New Hire Reporting Form. This form plays a crucial role in ensuring compliance with state requirements. Completing it accurately and promptly is essential, so let's dive into the steps you need to follow.

- Start by using the form provided. Remember to print in capital letters and avoid touching the edges of the boxes.

- In the Employer / Business Information section, fill in the following details:

- Federal Employer ID Number (FEIN): Use the same FEIN that appears on your quarterly wage reports.

- Will medical insurance be available to the employee? Indicate ‘Y’ for Yes or ‘N’ for No.

- Florida Employer Unemployment Compensation (UCT-6) Number: This is optional but helpful.

- Employer / Business Name: Enter the official name of your company.

- Address: Provide the complete address of your business.

- City: Indicate the city where your business is located.

- State: Fill in the state.

- Zip Code: Include the 5-digit zip code.

- Phone: Enter a contact number.

- Extension: Provide an extension, if applicable.

- Fax: Fill in the fax number, if you have one.

- Contact Name: Specify the name of the person to reach for questions.

- Next, move on to the Employee / Independent Contractor Information section:

- Social Security Number (SSN): Enter the employee’s SSN.

- First Name: Fill in the first name.

- Middle Initial: Include the middle initial.

- Last Name: Enter the last name.

- Address: Provide the address of the employee or independent contractor.

- City: Indicate the city of residence.

- State: Fill in the state.

- Zip Code: Include the 5-digit zip code.

- Date of Hire: Write the date the employee was hired.

- Date of Birth: Fill in the employee's date of birth.

- Independent Contractor? Indicate ‘Y’ for Yes or ‘N’ for No.

- Double-check all information to ensure accuracy. Missing information can lead to processing delays.

- Submit the completed form as soon as possible. Reports should be submitted within 20 days of hire or rehire.

Once you complete these steps, submit the form by mailing or faxing it to the appropriate address provided on the form. Remember, prompt submission is critical to remain compliant.

What You Should Know About This Form

What is the purpose of the Florida New Hire Reporting Form?

The Florida New Hire Reporting Form is designed to assist in the enforcement of child support obligations. By reporting new hires, employers provide crucial information that helps state agencies locate parents who owe child support, ensuring that payment obligations are met. This form is an essential tool in promoting the financial support of children across the state.

Who is required to submit this form?

All employers in Florida, including businesses and government entities, are required to report newly hired employees and independent contractors. If you’re paying independent contractors $600 or more in a calendar year, you must also report their details. This requirement helps maintain the integrity of child support systems and ensures accountability regarding payments.

When should the form be submitted?

The form must be reported within 20 days of the date of hire or rehire. Timely submission is crucial to ensure that the information is processed efficiently and that child support obligations can be monitored appropriately. Delays in reporting can lead to complications in managing child support cases.

What information is needed to complete the form?

Employers need to provide various pieces of information, such as the Federal Employer ID Number (FEIN), business name and address, employee's Social Security Number (SSN), name, address, date of hire, and date of birth. It’s important to ensure that this information is accurately filled out, as the form will not be processed if any required information is missing.

Why is the Social Security Number necessary?

Disclosure of the Social Security Number is mandated by federal and state laws for child support enforcement purposes. This requirement helps authorities identify individuals who have child support obligations and ensures that those obligations are tracked and enforced. It's important for employers to take this seriously and safeguard this sensitive information.

What should I do if I face technical issues when submitting the form?

If you encounter difficulties while completing or submitting the form, you can reach out for assistance. You can call the Florida New Hire Reporting Center at (850) 656-3343 or the toll-free number at 1 (888) 854-4791. Helpful staff can guide you through the process and resolve any technical problems you might face.

How can the completed form be submitted?

Once completed, the Florida New Hire Reporting Form can be submitted via mail or fax. You can send the form to the Florida New Hire Reporting Center at PO Box 6500, Tallahassee, FL 32314-6500. Alternatively, you can fax it to (850) 656-0528 or use the toll-free fax number at 1 (888) 854-4762. Be sure to keep a copy for your records.

What happens if I don’t submit the form?

Failure to submit the Florida New Hire Reporting Form can result in penalties for employers, including potential fines. More importantly, not submitting the form can affect child support enforcement efforts, leaving children without the financial support they need. Compliance is not just a legal obligation; it is a commitment to supporting families in your community.

Where can I find additional resources or information?

For more detailed information, including privacy practices regarding Social Security numbers, please visit the Florida Department of Revenue’s website. They provide comprehensive resources and guidance on child support enforcement and new hire reporting, ensuring that both employers and employees are well-informed.

Common mistakes

Completing the Florida New Hire Reporting Form requires careful attention to detail. Mistakes can lead to delays in processing and potential penalties. One common error is the improper completion of the Federal Employer ID Number (FEIN). This number must match exactly with what appears on quarterly wage reports; any discrepancy can lead to complications down the line.

Another frequent issue is related to the employee's social security number (SSN). It's crucial to ensure that this number is entered accurately. A single typo could result in significant administrative headaches and may delay benefits. Additionally, neglecting to report the date of hire properly can lead to problems with compliance, as all necessary information must be submitted within specified timeframes.

Furthermore, many individuals forget to check the box indicating whether medical insurance is available to the employee. This detail is not just a formality; it is essential for compliance with both state and federal regulations. Additionally, omitting the contact information for the business can hinder communication if any issues arise during the review process.

Another critical mistake involves failing to provide complete and accurate information about the employee’s address. The form explicitly states that the city, state, and zip code must be clearly filled in. Incomplete addresses can lead to complications in processing that could have been easily avoided.

Finally, neglecting to review the form thoroughly before submission is a mistake that many make. It’s vital to check each section, ensuring that all requisite fields are filled out clearly and completely. Missing information can result in delays or even rejection of the submitted form. Time is of the essence here; ensure everything is filled out correctly to facilitate speedy processing.

Documents used along the form

When hiring new employees in Florida, businesses must complete various forms to ensure compliance with state laws and regulations. The Florida New Hire Reporting Form is an essential document, but it is often accompanied by several other forms. Each of these documents serves a specific purpose and helps facilitate the onboarding process. Below is a list of some common forms used alongside the Florida New Hire Reporting Form.

- Form W-4: This form allows employees to indicate their tax withholding preferences. Employees provide information about their filing status and allowances, which helps employers calculate the correct amount of federal income tax to withhold from each paycheck.

- Form I-9: Required for verifying the identity and employment authorization of individuals hired in the United States. Employers must ensure that employees provide proper identification and complete this form within three days of their start date.

- Direct Deposit Authorization Form: This document enables employees to authorize their employer to deposit their paychecks directly into their bank accounts. Providing this form increases convenience and ensures timely payment.

- Employee Handbook Acknowledgment: New employees often need to sign a document acknowledging that they have received, read, and understood the company’s employee handbook. This helps ensure that employees are aware of company policies and procedures.

- Health Insurance Enrollment Form: If the company offers medical insurance, this form allows employees to enroll in the plan. It typically requires personal information and chosen coverage options.

- State Tax Withholding Form: Employees may need to fill out this form to inform employers about state income tax withholding. This document varies by state and helps employers manage local tax requirements.

- Emergency Contact Form: Employers often request this form to gather essential information about whom to contact in case of an emergency involving an employee. It is vital for ensuring employee safety and communication.

- Non-Disclosure Agreement (NDA): In some instances, businesses require new hires to sign an NDA. This agreement protects sensitive information and ensures that employees do not disclose proprietary data.

- Informational Tax Document (Form 1099 or W-2): Depending on whether the worker is an employee or an independent contractor, businesses must prepare the appropriate tax document for reporting annual earnings to the IRS.

Completing these documents correctly is crucial for establishing a smooth working relationship and adhering to legal requirements. A well-organized onboarding process not only fosters a positive experience for new employees but also protects the interests of the business. Ensuring compliance with these forms helps to avoid potential penalties and cultivates a professional workplace environment.

Similar forms

The Florida New Hire form is not an isolated document. It shares similarities with several other key forms utilized in employment and compliance processes. Here’s how it aligns with each of these documents:

- I-9 Employment Eligibility Verification: Like the Florida New Hire form, the I-9 is essential for verifying the identity and employment authorization of individuals. Both forms require personal information from the employee and serve as crucial instruments for compliance with federal regulations.

- W-4 Employee's Withholding Certificate: The W-4 is used to determine how much federal income tax should be withheld from an employee's paycheck. Similar to the Florida New Hire form, it collects personal data and needs to be completed shortly after employment begins.

- Form 1099-MISC: For independent contractors, the 1099-MISC serves as a means to report income. The Florida New Hire form is relevant for reporting contractors and their earnings, emphasizing the necessity of timely submissions within a defined period.

- State Unemployment Insurance (SUI) Registration Forms: Registering for state unemployment insurance requires similar employer and employee information as the Florida New Hire form. Both are vital for compliance with state labor laws and require accurate reporting of employment status.

- Child Support Income Withholding Order: This document requires the employer to gather and report specific employee data for child support enforcement. Like the Florida New Hire form, it places a strong emphasis on the need for accurate information to ensure compliance with child support obligations.

- Employee Handbook Acknowledgment Form: While not a government form, this document captures employee understanding and acceptance of workplace policies and practices. It parallels the Florida New Hire form in that both establish a foundational understanding of employment terms and responsibilities.

- Offer Letter or Employment Contract: This document outlines the terms of employment, akin to how the Florida New Hire form records essential details about the employee’s start date and position. Both facilitate clear communication between employer and employee, helping to set expectations from the outset.

In conclusion, while each of these documents serves its unique purpose, they collectively contribute to a comprehensive framework for managing employment relationships and compliance with regulatory requirements.

Dos and Don'ts

When filling out the Florida New Hire Reporting Form, there are a few important guidelines to follow. Here’s a handy list of things you should and shouldn’t do.

- Do: Print in capital letters clearly.

- Do: Ensure your writing does not touch the edges of the boxes.

- Do: Use the same Federal Employer ID Number (FEIN) that appears on your quarterly wage reports.

- Do: Include the employee's Social Security Number (SSN) as it is mandatory.

- Do: Report any independent contractors paid $600 or more within the required timeline.

- Don't: Leave any required information blank; missing information will cause delays.

- Don't: Use informal or unclear handwriting; clarity is key for processing.

- Don't: Forget to include the date of hire and the employee's date of birth.

- Don't: Ignore the privacy notices related to Social Security number disclosure.

By adhering to these tips, you can help ensure that your forms are processed quickly and accurately.

Misconceptions

Understanding the Florida New Hire Reporting Form is crucial for employers, yet there are several misconceptions surrounding it. Here are five common misunderstandings:

- The Social Security Number (SSN) is optional. Many assume that providing an SSN is not mandatory, but it is actually required under federal and state law. The form states that disclosure of the SSN is required for child support purposes.

- Independent contractors do not need to be reported. Some believe that independent contractors are exempt from reporting. This isn’t true. Businesses must report any independent contractors paid $600 or more for services within a calendar year.

- There’s no deadline for submitting the form. A common misconception is that there is flexibility in submission time. In reality, reports must be filed within 20 days of the employee’s hire or rehire date. Delays can result in processing difficulties.

- All information on the form is optional. While some fields may not be strictly mandatory, providing complete information ensures accuracy and prevents processing issues. Missing required information can halt the processing of reports.

- Only full-time employees need to be reported. There's a belief that only full-time employees require reporting, which is incorrect. All employees, regardless of hours worked or employment type, must be reported in accordance with state requirements.

Addressing these misconceptions is vital to ensure compliance and avoid potential penalties. Act promptly to stay fully informed about the requirements of the Florida New Hire Reporting Form.

Key takeaways

Here are some important points to remember about the Florida New Hire Reporting Form:

- Fill Out Clearly: Use capital letters and avoid touching the edges of the boxes to ensure that all information is clear and readable.

- Include All Required Information: Make sure to provide the necessary details, such as the Federal Employer ID Number and the employee's Social Security Number. Missing information can lead to delays or rejection of your report.

- Timely Submission: Reports must be submitted within 20 days of the employee's hire or rehire date. For independent contractors, the same timeline applies if they earn $600 or more for services.

- Contact for Help: If you have any questions while filling out the form, you can reach out for assistance via phone. The numbers provided are (850) 656-3343 and toll-free at 1 (888) 854-4791.

Browse Other Templates

Roof Warranty Template - Contract compliance is monitored under the terms of this warranty.

Third Party Release Authorization,Loan Information Consent Form,Third Party Loan Access Form,Seterus Loan Authorization Agreement,Loan Release Authorization Document,Borrower Authorization Form,Loan Information Disclosure Authorization,Third Party Ne - This document aids in expediting communication regarding your loan with external parties.

Student Banner - Attach certified copies of required supporting documents.